Nationwide Car Insurance Review for 2024

Nationwide car insurance rates for minimum coverage average $44 per month while full coverage costs $115 per month. Nationwide insurance rating from A.M. Best is A+. In this Nationwide car insurance review, we'll delve into more details about factors that affect Nationwide car insurance quotes.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Nationwide A.M. Best rating is A+

- Nationwide’s monthly car insurance costs range from $44-$115

- Nationwide’s types of insurance include: aircraft, auto, commercial auto, earthquake, flood, and homeowners

| Coverage Type | Nationwide | U.S. Average |

|---|---|---|

| Full Coverage | $115 | $119 |

| Minimum Coverage | $44 | $45 |

Nationwide insurance boasts a staggering $150 billion in active policies, solidifying its position as one of the top-tier insurance companies in the United States. Established back in 1925 in the state of Ohio, Nationwide underwent a transformative shift in 1996 when it became a publicly traded entity. Since then, it has grown into a multifaceted financial and insurance powerhouse, offering a diverse array of services to meet your needs.

In this comprehensive Nationwide car insurance review, we will explore the critical aspects of Nationwide insurance, a prominent player in the insurance industry. Our review will cover everything you need to know, including coverage options, available discounts, customer feedback, and more.

Cost Factors of Nationwide Car Insurance

When it comes to choosing the right car insurance, understanding the cost is a critical factor. Nationwide insurance is known for offering a range of coverage options and discounts, but the actual cost can vary significantly based on several factors.

Nationwide car insurance rates can vary widely based on several key factors. Here are some of the primary elements that influence the cost of your Nationwide car insurance policy:

- Coverage Type: The type of coverage you choose plays a significant role in determining your insurance costs. Full coverage, which includes comprehensive and collision coverage, is typically more expensive than minimum coverage.

- Location: Where you live and drive can impact your insurance rates. Urban areas with higher traffic and more potential for accidents generally have higher premiums than rural areas.

- Driving Record: Your driving history, including accidents, speeding tickets, and other violations, can lead to higher rates. Safe drivers often enjoy lower premiums.

- Vehicle Make and Model: The car you drive can affect your insurance costs. More expensive or high-performance vehicles may come with higher premiums due to the cost of repairs or the likelihood of theft.

- Age and Gender: Young and inexperienced drivers often pay more for car insurance. Additionally, some states still consider gender as a rating factor.

- Credit History: Your credit score can influence your insurance rates. A good credit score can result in lower premiums, while poor credit may lead to higher costs.

- Commute Distance: The distance you regularly commute to work or other destinations can impact your insurance rates. Longer commutes may lead to higher costs.

- Coverage Level: The extent of coverage you choose, whether it’s minimum coverage or higher limits, affects your premiums. More extensive coverage typically comes with higher costs.

- Bundling: If you bundle your car insurance with other policies, such as homeowners or renters insurance, you may qualify for discounts.

- Discounts: Nationwide offers various discounts, such as safe driver discounts, multi-policy discounts, and more. These can significantly reduce your insurance costs.

The cost of Nationwide car insurance can vary based on numerous factors, including your coverage type, location, driving record, and personal details. To get an accurate estimate of your car insurance costs with Nationwide, it’s essential to request a personalized quote based on your specific circumstances and coverage needs.

By considering these factors and exploring available discounts, you can find the most suitable and cost-effective car insurance plan for your requirements.

| Nationwide Company Overview | Info |

|---|---|

| Year Founded | 1926 |

| Current Executives | Kurt Walker, CEO |

| Number of Employees | 34,000 |

| Total Sales/Assets | $230.6 billion |

| HQ Address | One Nationwide Plaza Columbus, Ohio 43215-2220 |

| Phone Number | 1-800-882-2822 |

| Company Website | https://www.nationwide.com |

| Premiums Written (Total Private Passenger Auto) | 3,003,035 |

| Loss Ratio | 0.61% |

| Best For | Auto Insurance Homeowners Insurance Life Insurance Specialty Insurance |

If you’re like most of us in the country today, there’s a pretty good chance you own and drive at least one vehicle. Whether it’s a four-door sedan, a monster pickup, or a 1957 vintage Harley-Davidson, insurance coverage is needed to keep you legal and on the road.

But which company do you choose? With so many car insurance companies to choose from, making such a critical decision can be difficult, at best.

In this comprehensive guide, we’re going to provide everything you need to know about Nationwide, including ratings, company history, coverage options, and more.

Would you like to start comparison shopping today? Take advantage of our FREE online tool to start comparing rates in your area.

Let’s get started.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Car Insurance Rates

In this next section, we partnered with Quadrant Data to bring you rates based on specific demographic factors. Here are two things to consider when shopping for car insurance:

- Many variables can affect what you pay. Your price may differ from what is listed below.

- Nationwide has discounts and options that may help offset the cost.

Nationwide’s Availability and Rates by State

Nationwide is available everywhere in the contiguous United States. Rates vary, sometimes above and sometimes below average, and can be further affected by factors like driving record, marital status, and credit history. In the table below, you can see the rates of Nationwide in all states compared to other leading car insurance companies.

| State | Average by State | Nationwide Average Annual Rate | Higher/Lower Than State Average | Higher/Lower Percent Than State Average |

|---|---|---|---|---|

| Alabama | $3,566.96 | $2,662.66 | -$904.30 | -25.35% |

| Arizona | $3,770.97 | $3,496.08 | -$274.89 | -7.29% |

| Arkansas | $4,124.98 | $3,861.79 | -$263.19 | -6.38% |

| California | $3,688.93 | $4,653.19 | $964.26 | 26.14% |

| Colorado | $3,876.39 | $3,739.47 | -$136.92 | -3.53% |

| Connecticut | $4,618.92 | $3,672.34 | -$946.58 | -20.49% |

| Delaware | $5,986.32 | $4,330.21 | -$1,656.11 | -27.66% |

| District of Columbia | $4,439.24 | $4,848.98 | $409.74 | 9.23% |

| Florida | $4,680.46 | $4,339.60 | -$340.86 | -7.28% |

| Georgia | $4,966.83 | $6,484.90 | $1,518.07 | 30.56% |

| Idaho | $2,979.09 | $3,032.19 | $53.10 | 1.78% |

| Illinois | $3,305.48 | $2,711.81 | -$593.67 | -17.96% |

| Indiana | $3,414.97 | Data Not Available | Data Not Available | Data Not Available |

| Iowa | $2,981.28 | $2,735.44 | -$245.84 | -8.25% |

| Kansas | $3,279.62 | $2,475.59 | -$804.03 | -24.52% |

| Kentucky | $5,195.40 | $5,503.23 | $307.83 | 5.92% |

| Louisiana | $5,711.34 | Data Not Available | Data Not Available | Data Not Available |

| Maine | $2,953.28 | Data Not Available | Data Not Available | Data Not Available |

| Maryland | $4,582.70 | $2,915.69 | -$1,667.01 | -36.38% |

| Massachusetts | $2,678.85 | Data Not Available | Data Not Available | Data Not Available |

| Median | $3,660.89 | $3,187.20 | -$473.69 | -12.94% |

| Michigan | $10,498.64 | $6,327.38 | -$4,171.26 | -39.73% |

| Minnesota | $4,403.25 | $2,926.49 | -$1,476.76 | -33.54% |

| Mississippi | $3,664.57 | $2,756.53 | -$908.04 | -24.78% |

| Missouri | $3,328.93 | $2,265.35 | -$1,063.58 | -31.95% |

| Montana | $3,220.84 | $3,478.26 | $257.42 | 7.99% |

| Nebraska | $3,283.68 | $2,603.94 | -$679.74 | -20.70% |

| Nevada | $4,861.70 | $3,477.14 | -$1,384.56 | -28.48% |

| New Hampshire | $3,151.77 | $2,491.10 | -$660.67 | -20.96% |

| New Jersey | $5,515.21 | Data Not Available | Data Not Available | Data Not Available |

| New Mexico | $3,463.64 | $3,514.38 | $50.74 | 1.46% |

| New York | $4,289.88 | $4,012.93 | -$276.95 | -6.46% |

| North Carolina | $3,393.11 | $2,848.03 | -$545.08 | -16.06% |

| North Dakota | $4,165.84 | $2,560.35 | -$1,605.49 | -38.54% |

| Ohio | $2,709.71 | $3,300.89 | $591.18 | 21.82% |

| Oklahoma | $4,142.33 | Data Not Available | Data Not Available | Data Not Available |

| Oregon | $3,467.77 | $3,176.83 | -$290.94 | -8.39% |

| Pennsylvania | $4,034.50 | $2,800.37 | -$1,234.13 | -30.59% |

| Rhode Island | $5,003.36 | $4,409.63 | -$593.73 | -11.87% |

| South Carolina | $3,781.14 | $3,625.49 | -$155.65 | -4.12% |

| South Dakota | $3,982.27 | $2,737.66 | -$1,244.61 | -31.25% |

| Tennessee | $3,660.89 | $3,424.96 | -$235.93 | -6.44% |

| Texas | $4,043.28 | $3,867.55 | -$175.73 | -4.35% |

| Utah | $3,611.89 | $2,986.57 | -$625.32 | -17.31% |

| Vermont | $3,234.13 | $2,128.21 | -$1,105.92 | -34.20% |

| Virginia | $2,357.87 | $2,073.00 | -$284.87 | -12.08% |

| Washington | $3,059.32 | $2,129.84 | -$929.48 | -30.38% |

| West Virginia | $2,595.36 | Data Not Available | Data Not Available | Data Not Available |

| Wisconsin | $3,606.06 | $5,224.99 | $1,618.93 | 44.89% |

| Wyoming | $3,200.08 | $3,187.20 | -$12.88 | -0.40% |

No matter what state you live in, if Nationwide is your insurance provider, there’s a good chance that your premiums are less than those who don’t have Nationwide. Nationwide’s average rate is nearly 13 percent below the median average.

Comparing the Top 10 Companies by Market Share

Saving money is always a great thing, and one way to do that is to shop around and get the best rates for you and your family. How does Nationwide compare to the other top providers in the country on price? The table below compares Nationwide to nine other top companies on a state-by-state basis.

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

When it comes to rate prices compared to the other top insurance companies in the country, Nationwide scores well, coming in fourth place behind USAA, State Farm, and Geico.

Average Nationwide Male Versus Female Car Insurance Rates

Who pays the most for car insurance? Surprisingly, some states allow gender as a factor when determining insurance rates. However, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, California, and parts of Michigan have banned this practice and no longer allow companies to use gender as a factor.

| Nationwide Demographic Rates | Average |

|---|---|

| Married 60-year-old female | $2,130.26 |

| Married 60-year-old male | $2,214.62 |

| Married 35-year-old female | $2,360.49 |

| Married 35-year-old male | $2,387.43 |

| Single 25-year-old female | $2,686.48 |

| Single 25-year-old male | $2,889.04 |

| Single 17-year-old female | $5,756.37 |

| Single 17-year-old male | $7,175.31 |

Age certainly has its benefits, as married, older drivers enjoy the cheapest car insurance rates. Male teen drivers are the most expensive group to insure. However, many companies offer discounts for teen drivers, so be sure and speak to speak with your agent.

Average Nationwide Rates by Make and Model

Considering a new car? One thing to consider when shopping for a new car is what kind of car you drive has a significant impact on the cost of your insurance. In the table below, we show rates for five specific vehicles, see how your rates compare.

| Nationwide | Make and Model |

|---|---|

| $3,571.01 | 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 |

| $3,547.84 | 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT |

| $3,517.03 | 2015 Toyota RAV4 XLE |

| $3,373.64 | 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 |

| $3,361.93 | 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT |

| $3,328.57 | 2018 Toyota RAV4 XLE |

Unlike rates with other companies, Nationwide rates differ only around $250 for the vehicles. Specifically, the Honda Civic usually costs hundreds more to insure with other companies.

Average Nationwide Commute Rates

How far you drive also impacts your car insurance rates. In the table below, we show data from Nationwide for two commutes based on distance.

| Commute/Mileage | Average Annual Rate |

|---|---|

| 10-Mile Commute/6,000 Annual Mileage | $3,437.33 |

| 25-Mile Commute/12,000 Annual Mileage | $3,462.67 |

Some companies charge hundreds more for a longer commute. The good news for Nationwide customers is only $25 separates the two commutes.

Average Nationwide Coverage Level Rates

You might think that having the lowest minimum coverage in your state is the best way to cover your insurance needs. But that’s not necessarily the case, because the difference in low to high coverage is often less than you think.

Check out how the table below to see coverage level rates from Nationwide.

| Coverage | Average Annual Rate |

|---|---|

| High | $3,505.37 |

| Medium | $3,449.80 |

| Low | $3,394.83 |

A little more than $100 separates low to high coverage with Nationwide. But what does this mean? Essentially, if you have an expensive car like a Porsche or Ferrari and only have state minimum requirements on it and have an accident, insurance won’t cover the replacement cost of the vehicle, potentially costing you thousands of dollars.

Average Nationwide Credit History Rates

Do you have bad credit? If so, it could cost you in ways you didn’t know. You may not be able to get a car loan or rent an apartment. Poor credit can also have an impact on how much you pay for car insurance.

The table below reflects what you’ll pay for car insurance based on your credit score.

| Credit Score | Average Annual Rate |

|---|---|

| Good | $2,925.94 |

| Fair | $3,254.83 |

| Poor | $4,083.29 |

The average credit score in the U.S. is 675. If your credit score is lower, you may face increased rates on car insurance. In some states, poor credit can raise your rates by thousands of dollars. On average, with Nationwide, poor credit can raise your rates by $1,150.

Average Nationwide Driving Record Rates

Got a leadfoot? Do you like to put the pedal to the medal? What about having a few and getting behind the wheel? We hope you never drink and drive, but there are times when you may get a speeding ticket or be involved in a car wreck. Not surprisingly, these events may cause your car insurance to go up.

The table below reflects what you’ll pay for car insurance based on your driving record.

| Driving Record | Average Annual Rate |

|---|---|

| Clean record | $2,746.18 |

| With one speeding violation | $3,113.68 |

| With one accident | $3,396.95 |

| With one DUI | $4,543.20 |

One accident with Nationwide can raise your rates by over $600. Our best advice is to obey posted speed limit signs and never drink and drive.

How Nationwide Compares Against Other Auto Insurance Providers

This table provides a swift comparison of Nationwide car insurance with various competitors such as AAA, Home State, Root, Kemper, Liberty Mutual, State Farm, and more. Gain quick insights into Nationwide’s standing in the insurance market to inform your coverage decisions.

Coverages Offered

Nationwide offers the same coverage as all of the other top 10 companies do and, in some cases, at a competitive rate. Let’s take a look at standard insurance terms and go into detail about what they mean.

| Coverage | Purpose | Example of Coverage Use |

|---|---|---|

| Bodily injury liability | This coverage pays for another driver's medical bills/loss of income in an accident you caused. | You glance down to check the GPS instructions and rear-end another car, injuring the driver. |

| Classic car | Covers classic cars for less than regular auto insurance policies. | Vintage cars used just for pleasure — driving around on a sunny day. |

| Collision | Pays for repairs to your vehicle in accidents with another vehicle or object. | You hydroplane and crash into a tree. |

| Commercial | Covers vehicles used for business. | You own a flower shop and have a delivery van used for your business. |

| Comprehensive | Pays for repairs in accidents not caused by another vehicle. These accidents include theft, natural disasters and animal collisions. | Your car is parked outside when heavy winds knock a tree onto your car. |

| Gap coverage | Pays the difference between your vehicle's actual value and what you still owe on your loan/lease. | You total your car. Your car is worth $10,000, but you still owe $15,000 on your car loan. |

| Medical payments | Pays for your and your passenger's medical costs in an accident. | An accident gave you a mild concussion, and you need to be treated at a hospital. |

| Personal injury protection | Pays for your medical bills and other accident costs (such as lost income). | Your concussion from an accident leaves you unable to work for a month, resulting in medical bills and lost income. |

| Property damage liability | Pays for damages to another person's vehicle/property in an accident you caused. | You accidentally scrape another person's car pulling into a tight parking spot. |

| Rental reimbursement | Provides access to a rental car if your car is in shop after a covered accident. | Your car will be in the repair shop for at least a few days, so you need another vehicle to get around. |

| Rideshare | Covers rideshare drivers. | You want to work for Uber or Lyft as a rideshare driver. |

| Umbrella | Provides extra liability coverage. | You were in an accident the other parties are suing you. |

| Underinsured motorist | Helps you if you are in an accident with an underinsured motorist. | A driver hits you, but has such poor insurance that the driver can't cover your medical and property damage bills. |

| Uninsured motorist | Helps in hit-and-run accidents or an accident with an uninsured motorist. | You come out of the store and someone has run into your car before fleeing the scene. |

Whatever your insurance needs, there’s a good chance that Nationwide covers it.

Nationwide’s Bundling Options

How can you save money on car insurance? One great way to save money on insurance is by bundling insurance products together. Here are the products available to be bundled from Nationwide.

By bundling insurance policies with Nationwide, you can save big through the company’s multi-policy discount.

Currently, the available policy combinations Nationwide offer include:

- Auto and home

- Auto and renters

- Motorcycle and renters

- Auto, home, and life

- Multi-car (if you insure multiple vehicles with Nationwide)

- Boat and auto

Now, let’s take a look at some of the other vital discounts offered by Nationwide.

Nationwide’s Discounts

Nationwide has many options and discounts available to its customers. Depending on the discount, you could save up to 40 percent. Check out the table below to learn more.

| Discount Type | Amount Saved |

|---|---|

| Adaptive Cruise Control | Not Listed |

| Adaptive Headlights | Not Listed |

| Anti-Lock Brakes | 5% |

| Anti-Theft | 25% |

| Claim Free | 10% |

| Daytime Running Lights | 5% |

| Defensive Driver | 5% |

| Distant Student | 10% |

| Driving Device/App | 40% |

| Early Signing | 8% |

| Electronic Stability Control | Not Listed |

| Family Plan | 25% |

| Forward Collision Warning | Not Listed |

| Further Education | 15% |

| Good Credit | Not Listed |

| Good Student | 10% |

| Homeowner | 5% |

| Lane Departure Warning | Not Listed |

| Life Insurance | Not Listed |

| Low Mileage | Only available in CA |

| Loyalty | 5% |

| Married | Not Listed |

| Membership/Group | 7% |

| Multiple Policies | 10% |

| Multiple Vehicles | 20% |

| Newer Vehicle | Not Listed |

| Occupation | 15% |

| Paperless Documents | 5% |

| Paperless/Auto Billing | $30 |

| Passive Restraint | 20% |

| Safe Driver | 35% |

| Stable Residence | Not Listed |

| Students and Alumni | 7% |

| Vehicle Recovery | 25% |

| VIN Etching | Not Listed |

One thing to remember is these discounts aren’t available in all areas and may not apply to you.

Customer Reviews for Nationwide Car Insurance

Nationwide Car Insurance has garnered favorable feedback from numerous policyholders, primarily commending the company’s commitment to outstanding customer service and efficiency in processing claims. Customers consistently highlight the ease of reaching out to Nationwide, a vital aspect in the insurance realm.

In cases of accidents and collisions, prompt communication is crucial for a smooth claims process and preventing potential financial complications.

Furthermore, Nationwide’s extensive range of coverage options and available discounts is frequently commended. These options provide customers with the flexibility to tailor their policies to match their unique needs and financial constraints, offering peace of mind and financial security.

Overall, Nationwide Car Insurance appears to maintain a strong reputation for its dedication to customer service and the accessibility of its claims reporting process, factors that resonate with policyholders seeking reliability and convenience in their insurance provider.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Nationwide Insurance History

The Farm Bureau Mutual Automobile Insurance Company was founded in the mid-1920s in the state of Ohio. The company sold insurance products exclusively in the Buckeye State until 1943, when expansion took it into 12 states, including Washington, D.C.

In 1955, the company changed its name to Nationwide with the idea of selling its products countrywide. In 1968, Nationwide became the first auto insurer to establish a 24-hour claim reporting service. With corporate offices still located in Ohio, the company has grown into the eighth largest insurance provider in the United States.

Why should you care about the history of Nationwide? Because looking at a company’s history provides crucial data about how successful the company is and what its future looks like.

But many factors make up a company, including how well it treats customers, its involvement in the community, and whether it’s financially stable enough to weather volatile economic situations.

In the following sections, we’re going to discuss everything from Nationwide’s market share to what employees think about working there.

Nationwide’s Programs

What else does Nationwide offer customers? Check out the programs below to see if they may be beneficial to you.

- Vanishing Deductible – Every year you remain accident-free, Nationwide will drop your deductible by $100.

- Smart Ride® – Smart Ride lets you plug a behavioral monitoring device into your car. This device will record your driving habits for between four and six months. After the review period, you’ll be awarded a discount based on how well you’ve driven. You also receive a discount for signing up for the program in the first place.

- BonusDrive – As long as you drive a vehicle that appears on Nationwide’s “approved vehicles” list, you will receive $500 upon signing up for the BonusDrive program.

- Auto Shopping Service – Whether searching for a new car or a used one, Nationwide will help you find the best ride for your lifestyle with help from TrueCar.

- On Your Side Repair Network – Nationwide also lists its preferred partner auto shops and will offer you a discount for visiting their garages.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Nationwide’s Ratings

All companies advertise how much better they are than the competition, and Nationwide is no exception. The company says they are on your side, but is that a good thing? Let’s see what multiple, independent agencies say about Nationwide and if they are the right car insurance company for your needs. Check out the scores in the table below.

| Agency | Rating |

|---|---|

| AM Best | A+ (Superior) |

| Better Business Bureau (Northbrook, IL) | A+ |

| Consumer Affairs | 1.9/5 |

| Consumer Reports | 88 out of 100 |

| J.D. Power | 3/5 stars |

| Moody's | A1 |

| NAIC Complaint Index Ratio | 1.16 |

| S&P | A+ |

Comparing the pros and cons is an important factor in choosing which auto insurance company is best for you.

AM Best

An AM Best rating measures the financial stability of a company, with A++ being the highest rating possible. Nationwide earned an impressive A+ rating, which means the company has a stable financial future.

Moody’s

A rating from Moody’s rating looks at how well a company can pay off its debts (its creditworthiness). Nationwide’s A1 rating falls into the P-2 category, meaning the company has a “strong ability to repay debts and has a predictable, stable future.”

This score is excellent because the last thing a customer needs is to file a claim and learn the company has filed for bankruptcy.

Better Business Bureau

This rating looks at multiple aspects of a business, although the most critical element is the company’s complaint history. A complaint history shows how satisfied customers are with the service they receive.

Since A+ is the highest rating the BBB gives, the Better Business Bureau views Nationwide’s A+ as exceptional and should be able to answer any questions quickly and to their best conclusion.

S&P Rating

What does a rating from S&P mean? This video explains more.

S&P awards Nationwide an A+, the highest score they can award. This excellent rating indicates that Nationwide is a credit-safe company that can protect investors and consumer finances with ease.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) measures the number of complaints a company receives. In 2018, the company’s complaint ratio was 0.41, and below the national average of 1.51. One thing to consider is that your experience may be better or worse than these ratings based on your insurance needs.

J.D. Power

Another rating to look at when researching an insurance company is customer satisfaction levels. J.D. Power rates companies solely on customer satisfaction levels. Nationwide received scores of 796 out of 1000 throughout the country in providing a satisfying purchase experience, ranking it 12th among auto insurers.

Consumer Reports

Consumer Reports is a non-profit and independent organization that’s working to bring transparency into the marketplace for consumers. The company works to help consumers with purchase decisions, drive fair competition, and improve the products that companies offer.

| Claims Process | Rating |

|---|---|

| Agent Courtesy | Excellent |

| Being Kept Well Informed of Claim Status | Very Good |

| Damage Amount | Very Good |

| Ease of Reaching an Agent | Very Good |

| Freedom to Select Repair Shop | Very Good |

| Promptness of Response | Very Good |

| Simplicity of the Process | Very Good |

| Timely Payment | Very Good |

Customers had very complimentary things to say about Nationwide. One score that received an “excellent” rating was agent courtesy.

Consumer Affairs

As for the Consumer Affairs’ rating of Nationwide, the company has received 1.9 out of 5 stars on 71 reviews. We should mention, however, that this rating reflects a small fraction of the total 1,025 car insurance customer reviews collected by Consumer Affairs in recent years. Consequently, this star rating may not present a complete picture of consumers’ satisfaction.

Not every customer reports their relationship regarding the companies they deal with, so we encourage you to do your research and determine if Nationwide checks all of the boxes when it comes to your insurance needs.

Nationwide’s Market Share

The market share of a car insurance company determines how strong the company has become in the industry. A higher market share also means that a provider is the preferred choice of consumers.

Let’s review the growth of Nationwide over the last several years.

| Year | Market Share |

|---|---|

| 2015 | 3.85% |

| 2016 | 3.56% |

| 2017 | 3.17% |

| 2018 | 2.73% |

Nationwide’s market share has slipped from 3.85 percent in 2015, down to 2.73 percent in 2018. This decline is based on many factors, which we’ll try to address as we continue through this guide.

Nationwide’s Position for the Future

Like other large insurance providers, Nationwide has dealt with higher claim settlements lately due to natural disasters. According to Bizjournal.com:

The company paid $16.6 billion in claims and benefits to policyholders in 2018.

The article goes on to say that, according to CFO Mark Thrasher, “We continue to grow in places we want to grow. If you take apart the two businesses, financial services had a strong sales year and earnings, and the (property and casualty insurance) business had some bottom-line challenges but good performance.”

Another way the company is working for the future was announcing a round of layoffs that would further decrease the number of employees at the corporate levels. Furthermore, the company is shifting its business model to independent agencies, meaning 2000 agents will need to become independent to maintain a relationship with the company.

With continued diversification and a new CEO taking the helm, Nationwide hopes to continue to maintain and grow its business by partnering with tech-giants to invest and expand in the years to come.

Nationwide’s Online Presence

Nationwide has several options if you want to access information or get in touch with someone about your car insurance needs.

- Online – You can find quotes and more online at the Nationwide website.

- Agents – You can talk to agents by calling 1-877-669-6877.

- Apps – Nationwide offers a mobile app through which you can access your policy information and contact agents.

No matter your preferred mode of communication, Nationwide does a great job of providing many different ways to keep in touch.

Nationwide’s Commercials

We all know the jingle. Nationwide has been on our side for decades. Let’s revisit some of the company’s best commercials.

Moving on from Peytonville, here’s Leslie Odom, Jr, and his jingle:

And here’s a version from Tori Kelly:

Whoever sings it best is a choice left for others to decide. What else is Nationwide doing besides being on our side? In the next section, we check out the company’s involvement in the community.

Nationwide in the Community

Community outreach shows a company cares, and Nationwide has developed several programs where the company and employees can give back to the community.

The Nationwide Foundation was established in 1959 and was created to provide non-profit sponsorships and grants to businesses or organizations in need. Some of Nationwide’s long-term partners include:

- The United Way

- The American Red Cross

- Feeding America

In addition to the widespread efforts of the Nationwide Foundation, the company’s Community Connect initiative provides volunteer opportunities for employees across the nation.

Employees have the opportunities to find opportunities, choose shifts, and log the hours they volunteer, for which they are rewarded with paid time off.

Nationwide’s Employees

Have you wondered what it’s like working for a big insurance company? Let’s look at what employees think of Nationwide. How a company treats its employees gives us insight into the company’s values and employee satisfaction levels.

Let’s begin by looking at employees’ experience ratings according to A Great Place to Work.

| Statement | Employee Percentage in Agreement |

|---|---|

| Employees say this is a great place to work | 82% |

| People care about each other here | 88% |

| When you join the company, you are made to feel welcome. | 91% |

| I feel good about the ways we contribute to the community. | 91% |

| Management is honest and ethical in business practices. | 92% |

| I am given the resources and equipment to do my job. | 93% |

Over 82 percent of employees say Nationwide is a great company to work for.

Another dedicated employee site, PayScale.com, has awarded the company an overall satisfaction rating of 3.7 stars. Respondents also rate the company’s outlook 3.9 stars, gave 3.8 stars for learning and development, and 3.5 stars for employee appreciation.

Additionally, A Great Place To Work goes on to say Nationwide has been awarded several awards and accolades, including the following:

-

- #21 in Best Workplaces in Financial Services & Insurance™ 2019 (Large Companies)

- #26 in Best Workplaces in Texas™ 2019 (Large Companies)

- #57 in 2019 Fortune 100 Best Companies to Work For®

- #34 in PEOPLE 2019 Companies that Care®

- #50 in Best Workplaces for Diversity™ 2019 | Fortune Profile

Are you interested in learning more about a career with Nationwide? Click here to learn more about possible opportunities.

Related Article: Geico vs. Nationwide — which is better?

Canceling Your Policy

Occasionally, a situation may arise when you need to modify or cancel your insurance policy with Nationwide. Here are four examples which may apply to you:

- Selling a car and not replacing it

- Storing a classic or antique vehicle

- A teen is heading to college and will no longer be driving the vehicle

- A vehicle has been paid off and no longer requires comprehensive coverage

But what if you want to cancel your policy for other reasons? Are you a dissatisfied customer? Are your rates too high? Maybe you’re just moving out of state and want a fresh start. In this next section, we’re going to show you the steps involved with canceling an insurance policy with Nationwide.

Cancellation Fee

Unlike some other top 10 insurance providers, Nationwide doesn’t assess a cancellation fee if you choose to cancel your policy.

Is there a refund?

For customers who do cancel their policy, they can expect to receive a prorated portion of their policy.

How to Cancel

You’ll need to pick up the phone and call 1-877-669-6877 or call your local agent if you want to cancel your policy. Nationwide’s website does allow you to modify or change some policies but doesn’t allow for canceling a policy.

Option Two – Cancel by Mail

If you wish to submit written notice, you can send your letter to this address: One Nationwide Plaza, 1 West Nationwide Boulevard, Columbus, OH 43215.

To allow time for your notice to process, mail your letter at least two to three weeks before the date you intend for the policy to end.

Option Three – Cancel in Person

With Nationwide’s availability throughout the country, you could also choose to meet with a local agent or your dedicated agent to cancel your policy in person.

If you’re unsure where to find a local agent, check your policy documents or the Find an Agent locator tool linked previously for a list of agents located in your ZIP code.

When can I cancel?

You can cancel your policy at any time. Additionally, if you are switching providers because of personal reasons and will still need to have coverage, make sure you have chosen another company. If you don’t take this step, you may have a lapse in coverage, which can result in fines from the state and higher rates from prospective insurers.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Make a Claim

Unfortunately, a time may arise when you’ve been involved in an accident and need to file a claim with your insurance company. We know in times of stress, you need a company that is fast and reliable and can help you through the process.

In the next section, we’re going to discuss how the claims process works and how many claims were paid out.

Let’s begin.

Ease of Making a Claim

Nationwide makes it easy to file a claim with them in the following ways:

- By phone, calling 1-800-421-3535

- Contacting your local agent

- Using the Nationwide cellular app

- Online Claim Form through Nationwide’s site

Once you’ve filed a claim, you can track the claim’s progress in your online account with, or call and talk to a representative with any additional questions.

But how does Nationwide payout claims to its customers?

Premiums Written

How do premiums written relate to claims? The answer to that question is, the higher the number of premiums written, the less customers have to pay. A company with lower written premiums will have to charge policyholders more to cover the cost of accident claims.

Let’s take a look at the NAIC’s data on Nationwide’s written premiums.

| Year | Premiums Written |

|---|---|

| 2015 | $7,337,880,000 |

| 2016 | $7,640,558,000 |

| 2017 | $7,341,476,000 |

| 2018 | $6,726,799,000 |

Nationwide has seen its premiums written go up and then decline in the next year. But in 2018, the company wrote 617 million premiums less than in 2017, which is a significant drop. Such a drop bears watching to see if it is a one-time event or related more to a volatile market.

Loss Ratio

What exactly is a loss ratio?

A loss ratio calculates the number of written premiums compared to the number of claims. A company with a 55 percent loss ratio is paying $55 on claims for every $100 earned from written premiums.

A high loss ratio may seem reasonable, but anything over 100 percent means a company is risking bankruptcy. Conversely, a low loss ratio means a company isn’t paying out a large number of claims.

| Year | Loss Ratio |

|---|---|

| 2015 | 64.68% |

| 2016 | 75.67% |

| 2017 | 66.16% |

| 2018 | 58% |

In each year for which loss ratio was measured, the numbers were all within the normal range. The consistent decline in loss ratio is also good news for Nationwide, considering its decrease in premiums written between 2017 and 2018.

How to Get a Quote Online

Ready to get a quote? In the next section, we show you the steps needed to get an online quote from Nationwide.

Before you get started, be ready to provide the following items:

- Date of birth

- Contact information (name, phone number, address)

- Social Security number

- Vehicle information

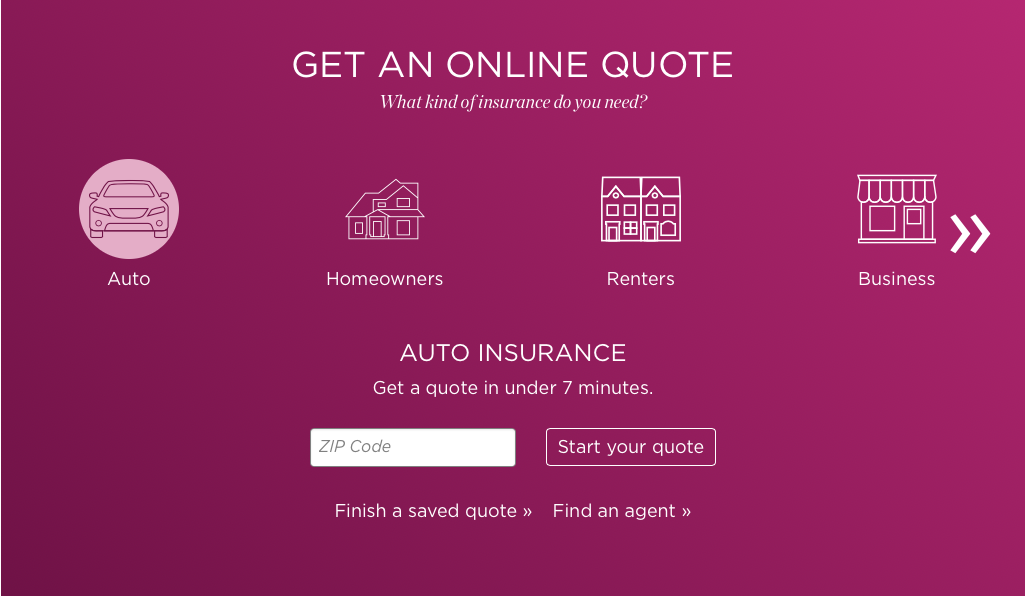

Step One – Go to the Nationwide Website

Open up a new webpage and navigate to the Nationwide website. Scroll down to the middle of the page, where you will see the following quote section. Click on the auto-icon.

Step Two – Enter Your ZIP Code

Enter your ZIP code in the box and hit “Start Your Quote.”

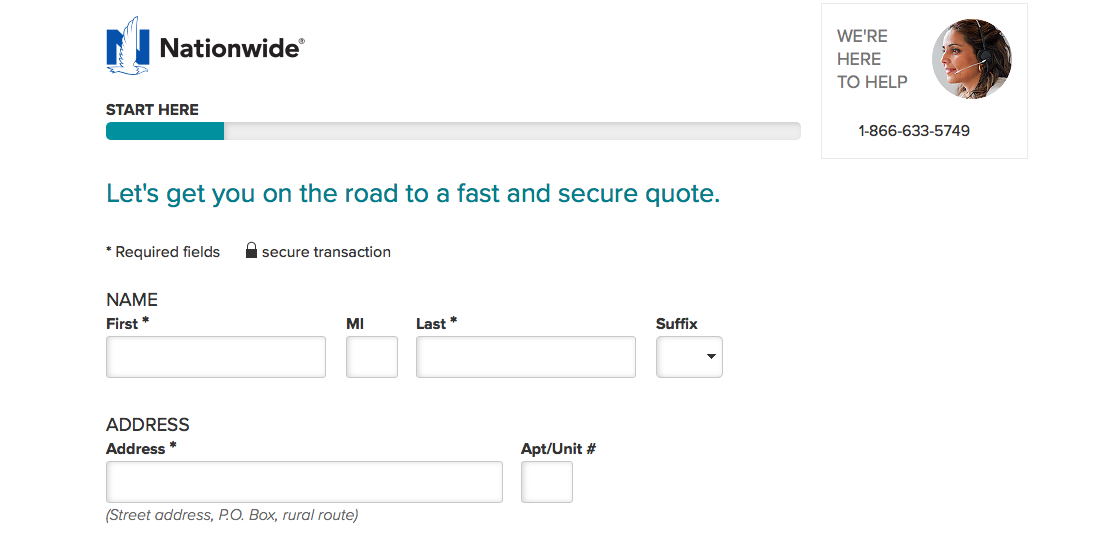

Step Three – Enter Your Personal Information

Enter your name, address, date of birth, email address, and phone number. Click “Continue.”

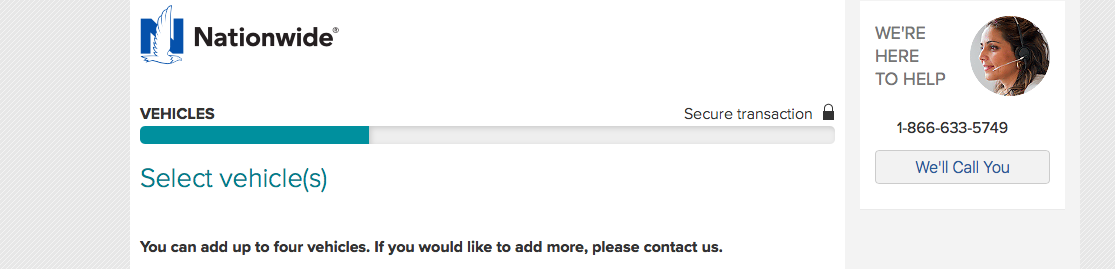

Step Four – Choose Vehicles to Be Included in the Quote

Based on the information you provide, you’ll be prompted to select from a list of possible vehicles for your new policy. You can also add vehicles. Choose the vehicle(s) you want to be included in the quote and hit “Continue.”

Step Five – Fill in the Vehicle Information

Next, you’ll need to complete the vehicle information for the cars you selected. Once done, select “Continue.”

Step Six – Fill in Driver Details

During this step, you’ll be prompted to confirm some of the personal information previously provided, along with other vital information, including marital status and previous accidents and violations, if applicable.

There’s also an option to add another driver to the quote if you missed it on the previous step.

Once finished, select “Continue” to proceed.

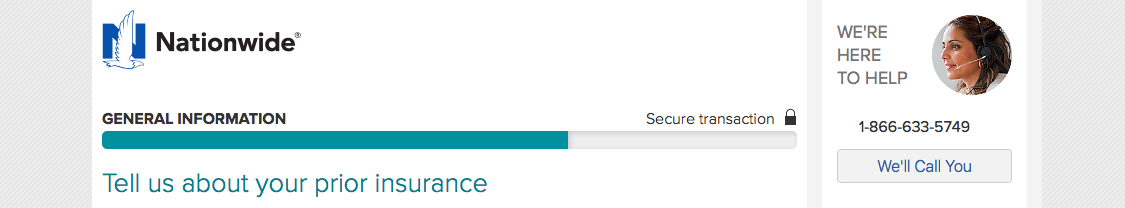

Step Seven – Provide Information Regarding Prior Insurance

Here, you’ll provide details about your current or previous insurance policy, including the date coverage ends, how long you’ve been with your current insurer, and your chosen coverage limits.

Select “Continue.”

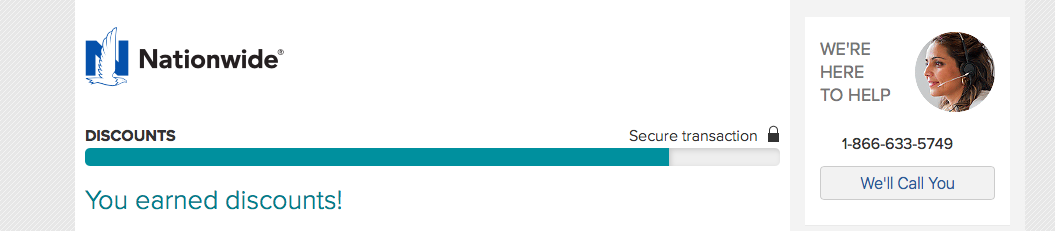

Step Eight – Select Discounts and Finish Your Quote

At this last step, any discounts triggered by the information you provided will be revealed. You’ll have the chance to select other discount opportunities.

Once you’re ready, select “Continue” to complete your quote. You’ll see a list of potential discounts and coverage options. If you’re prepared to purchase your policy right away, select your coverages and navigate to the “Purchase” button at the bottom to proceed.

Design of Website and App

While other car insurance company websites and apps may be difficult to navigate, Nationwide’s is easy to use. On the website, it is easy to find whatever information you’re searching for. Just click from any of the categories on the drop-down menu and go.

At the top of the page, you will see tabs that drop-down into menus with more choices. The tabs give a full breakdown of what the company offers and leads you to more information.

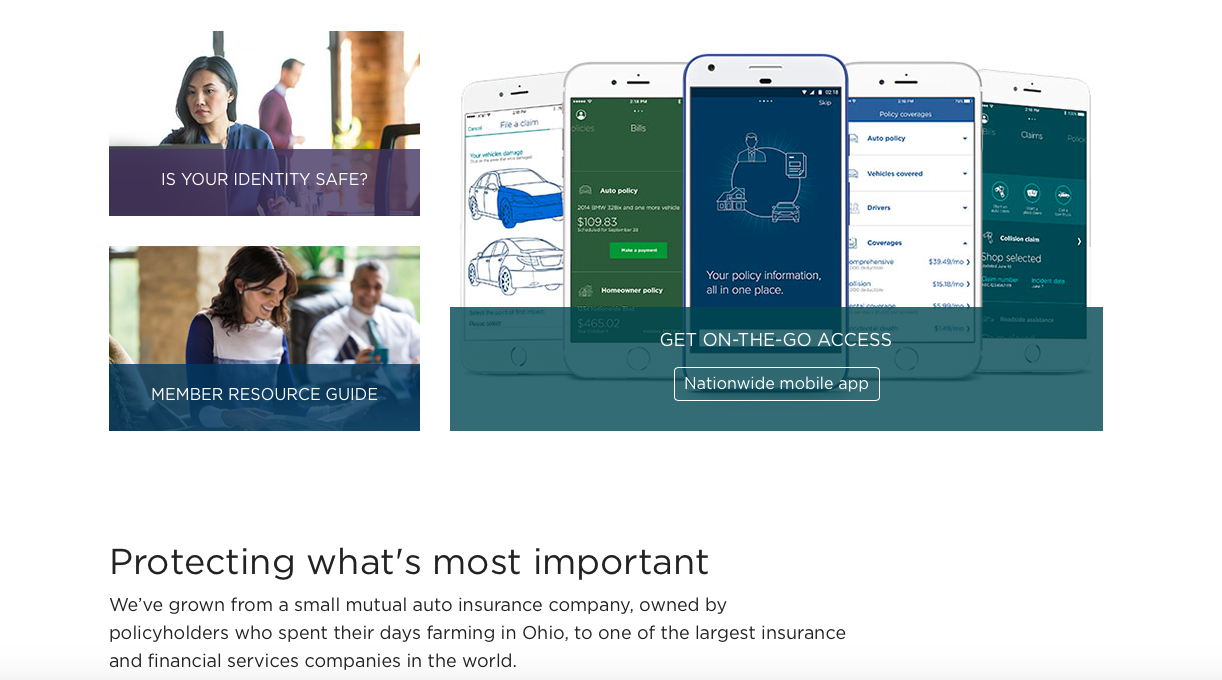

Keep scrolling toward the bottom of the homepage to learn more about Nationwide’s mobile app and access other helpful resources.

At the very bottom of the homepage, you can click through to Nationwide’s social pages, careers page, Contact Us page, About Us page, and other helpful links.

Finding answers is quick and effortless with Nationwide’s website. With a simple click or hovering your mouse over a dropdown menu, you can find the answers you need in moments.

The design is simple enough that it makes it easy to find what you need but still colorful and professional looking. They make it easy to find what you’re looking for.

Let’s move on and check out the app from Nationwide.

Mobile App

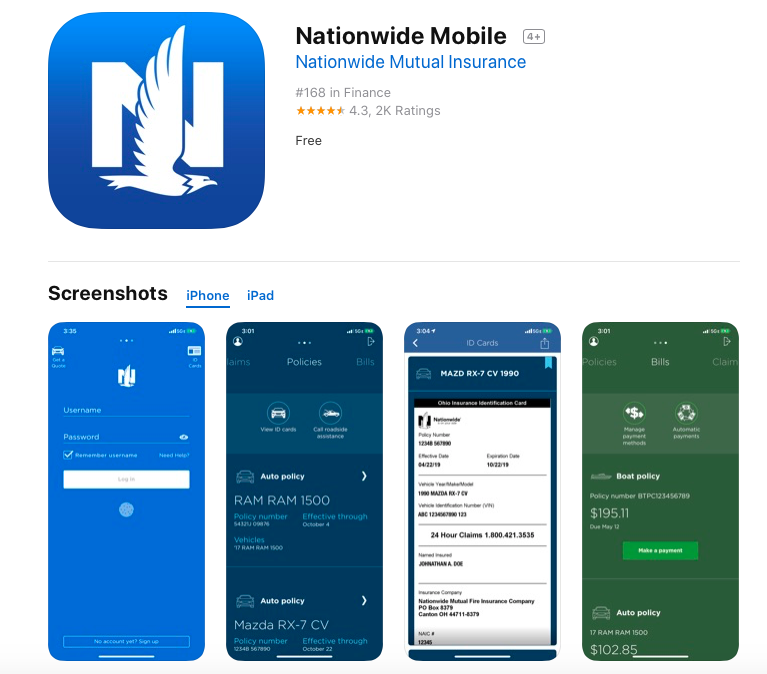

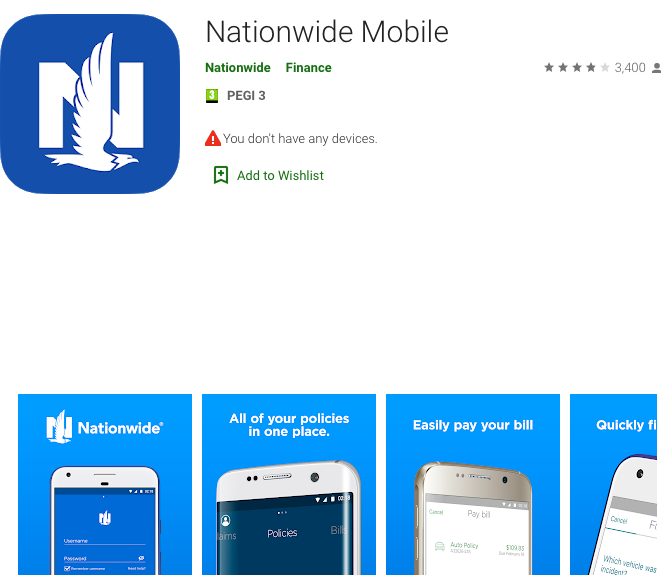

Nationwide’s mobile app is available on Android™, iPhone®, and iPad®. Through the app, you can make payments, manage your payment methods, file a claim, save ID cards, get claims status info, request roadside assistance, and more.

The App Store version has a 4.3-star rating based on over 2,000 ratings. The Google Play Store has 3,840+ reviews for a 4.2-star rating at the time of this review.

Multiple users have noted complaints with pages not loading and the app freezing on the login screen, but overall, most reviews are positive. Consumers have also reported that the app is fundamental and could offer more options.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons

Now that we have covered everything you need to know about Nationwide, let’s check out the biggest takeaways in terms of pros and cons.

| Pros | Cons |

|---|---|

| Affordable rates that are generally in the median range of competitor insurers' rates | Not available in all 50 states |

| Excellent long-term financial ratings | Recent decrease in written premiums |

| Good discount options | Mixed consumer reviews |

| Easy and efficient claims process | Some glitches with the mobile app |

Nationwide rates are mid-level compared to the other top 10 companies, and they offer many discounts to choose from that may lower the price. They’ve also been around a long time and are a well-known brand. A top concern may be the decline in premiums written, but according to company officials, they are streamlining and modifying its business model to keep up with economic changes.

Nationwide Car Insurance Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

Filing a claim with Nationwide is a user-friendly process designed to accommodate a variety of preferences. Customers can initiate a claim online through Nationwide’s website, providing essential details and documents electronically.

Alternatively, they can opt for the convenience of filing a claim over the phone by contacting Nationwide’s dedicated claims hotline. For those who prefer mobile solutions, Nationwide offers a mobile app that streamlines the claims process, allowing users to submit claims, upload photos, and track their progress from the convenience of their smartphones.

Average Claim Processing Time

Nationwide’s commitment to prompt claims processing is evident in their efficient handling of claims. On average, Nationwide boasts a relatively quick claim processing time, ensuring that customers receive the support they need when they need it most. The company’s goal is to minimize the disruption caused by accidents or unforeseen events, allowing policyholders to get back on the road with minimal hassle.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a pivotal role in assessing an insurance company’s performance in handling claims. Nationwide prides itself on its customer-centric approach to claim resolutions and payouts. The company consistently seeks input from policyholders to ensure their satisfaction with the claims process.

While individual experiences may vary, Nationwide’s commitment to addressing customer concerns and delivering fair and timely claim resolutions is a cornerstone of their service.

Explore the Digital and Technological Features of Nationwide Car Insurance

Mobile App Features and Functionality

Nationwide’s mobile app offers a range of features and functionalities designed to enhance the customer experience. With the app, policyholders can manage their insurance policies on the go, access digital ID cards, and even file claims directly from their smartphones.

The user-friendly interface and intuitive navigation make it easy for customers to stay connected with Nationwide and access vital information and services whenever and wherever they need them.

Online Account Management Capabilities

Nationwide’s online account management capabilities empower customers to take control of their insurance experience. Through their secure online accounts, policyholders can view policy details, make payments, request policy changes, and access important documents and forms. This digital convenience simplifies policy management, ensuring that customers have the information they need at their fingertips.

Digital Tools and Resources

Nationwide goes beyond traditional insurance by providing an array of digital tools and resources to assist policyholders. These resources include educational materials, calculators, and informative articles aimed at helping customers make informed decisions about their insurance coverage.

Nationwide’s commitment to digital innovation ensures that customers have access to valuable resources that enhance their understanding of insurance and financial planning.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Bottom Line

Knowledge is power, and that’s why we’ve shown you everything you need to know about Nationwide, so you can decide for yourself whether they are the right insurance company for you. Did we miss anything? What did you find most useful?

Nationwide has a long, storied history and has continued to grow and modify with changing times. Employees love working there, and the company gives back in many ways.

Multiple rating agencies give the company high marks for financial stability and customer satisfaction. One thing to consider is that everyone’s needs are different, and rates can vary significantly based on individual factors.

As comprehensive as this guide is, your rates will vary and depend on the information you provide.

Get quotes today to find out how much you could save on car insurance. Get started by simply entering your ZIP code in our FREE comparison tool.

Company Car Insurance FAQs

Have further questions about Nationwide? We’ve answered a few common questions about the company below.

What do you need to obtain a Nationwide quote?

To get a quote online, you’ll need to furnish your name, date of birth, address, phone, and email to get a quote. Also needed to complete an online quote are your vehicle information and any citations or accidents.

How do you qualify for the Good Student discount?

Drivers between the ages of 16 and 24 enrolled in high school or college full time may qualify for the Good Student discount. Students must maintain at least a B average academically.

Does Nationwide cover hail damage?

Comprehensive coverage covers damage from incidents other than a collision or rollover. Storm and hail damage can occur anywhere in the United States, so if you park your vehicles outside, purchasing comprehensive coverage might be a good option.

Does Nationwide car insurance include roadside assistance?

Roadside assistance coverage is available as an add-on to your Nationwide policy. With roadside assistance, there are a variety of service options, including battery jump-starts, gas delivery, lockout aid, towing up to 15 miles, and flat tire replacement.

Is Nationwide car insurance expensive?

The cost of coverage with Nationwide will vary depending on many of the factors mentioned above. To get the best protection at an affordable price, we encourage you to look at all discounts options available from Nationwide.

Frequently Asked Questions

What is Nationwide car insurance?

Nationwide car insurance is a type of auto insurance offered by the Nationwide Mutual Insurance Company, which provides coverage for damage or injury caused by car accidents, theft, vandalism, and other covered events.

What types of car insurance coverage does Nationwide offer?

Nationwide offers several types of car insurance coverage, including liability insurance, collision insurance, comprehensive insurance, personal injury protection (PIP), uninsured motorist coverage, and underinsured motorist coverage.

How much does Nationwide car insurance cost?

The cost of Nationwide car insurance varies depending on several factors, such as the driver’s age, location, driving record, and the type and amount of coverage selected. Drivers can get a quote online or through an agent to find out how much their insurance will cost.

How can I file a claim with Nationwide?

To file a claim with Nationwide, drivers can contact the company’s claims department by phone, online, or through their mobile app. They will need to provide information about the accident, such as the date, location, and other details, as well as information about their policy and any other parties involved.

Does Nationwide offer discounts on car insurance?

Yes, Nationwide offers several discounts on car insurance, such as safe driver discounts, multi-car discounts, anti-theft device discounts, and more. Drivers can contact an agent or check their website to find out what discounts they may be eligible for.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.