Progressive Car Insurance Review for 2024

Progressive minimum coverage insurance rates average $39 per month while Progressive full coverage rates are $105 per month. Compared to competitors, Progressive is a great option for drivers with poor driving record, specifically DUI/DWI violations. Progressive insurance rating from A.M. Best is A+ (Superior).

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Dec 24, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Dec 24, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Progressive’s A.M. Best rating is A+ (superior)

- Progressive’s monthly car insurance range from $39-$105

- Progressive’s types of insurance include: aircraft, auto, commercial auto, earthquake, flood, and homeowners

At Progressive, we understand that the journey of life is full of unexpected twists and turns, and that’s why we’re here to help you navigate the road with confidence and peace of mind. Since our inception, we’ve been committed to providing more than just insurance – we’re your trusted partner on the road to protection, savings, and unparalleled convenience. Learn everything you need to know about Progressive car insurance below.

| Progressive Overview | Stats |

|---|---|

| Founded | March 10, 1937 |

| Current Executives | CEO, President - Tricia Griffith Claims President - Michael Sieger |

| Number of Employees | 10,000+ |

| Current Assets | $10+ billion (USD) per year |

| Headquarters Address | Campus I: 6300 Wilson Mills Road Mayfield Village, OH 44143 |

| Phone Number | 1-855-347-3939 |

| Website | https://www.progressive.com/ |

| Premiums Written | Total Private Passenger Auto: $27 billion |

| Loss Ratio (2018) | 61% |

| Best For | Auto Insurance |

Factors Influencing Progressive Car Insurance Costs

When considering car insurance, understanding the potential costs is essential. The cost of Progressive car insurance can vary significantly depending on multiple factors, including your location, driving history, coverage options, and more.

Here are the factors that impact the cost of car insurance and provide some general insights into their pricing. Keep in mind that the rates provided here are for reference and may not reflect your specific circumstances.

The cost of Progressive car insurance is influenced by several key factors, including:

- Location: The state and even the specific zip code where you reside can significantly impact your insurance rates. Some states have higher average premiums due to various factors, including population density, weather conditions, and local laws.

- Driving Record: Your driving history, including any accidents, violations, or claims, can have a substantial impact on your premiums. Safe drivers with a clean record typically receive lower rates.

- Coverage Levels: The type and amount of coverage you select will affect your premiums. More extensive coverage options, such as comprehensive coverage and collision coverage, will generally result in higher costs.

- Vehicle Type: The make and model of your car, as well as its age, can influence your insurance rates. Expensive or high-performance vehicles often come with higher premiums.

- Usage: How you use your car can affect costs. For example, using your vehicle for a daily commute may lead to higher premiums than using it for occasional leisure drives.

- Age and Gender: Younger and less experienced drivers, especially males, often face higher insurance rates due to statistical risk factors.

- Credit History: In some states, your credit history can be a factor in determining your insurance rates. A better credit score may lead to lower premiums.

The cost of Progressive car insurance is not one-size-fits-all. It depends on various individual factors, making it essential to obtain a personalized quote to get an accurate estimate. To find the most cost-effective coverage that meets your specific needs, it’s advisable to contact Progressive directly or use their online tools to request a customized quote based on your unique circumstances.

If you own and drive a car, you’ll have to find and purchase insurance to be able to operate it legally on the road. Car insurance companies have advertised for years about 15-minute phone calls, mayhem, and being in good hands, but when it comes down to it, most of us want to know what the bottom line is.

Car insurance is something most of us need, and we want to make sure that you’re not spending too much. Saving money is a language we all want to know more about. In this guide, we’re going to show you everything you need to know about Progressive, including ratings, company history, coverage options, and more.

Would you like to start comparison shopping today? Take advantage of our FREE online tool to start comparing rates in your area.

Let’s get started.

| Coverage Type | Progressive | U.S. Average |

|---|---|---|

| Full Coverage | $105 | $119 |

| Minimum Coverage | $39 | $45 |

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Progressive Car Insurance Coverage Options

Progressive understands that life’s journey can be full of unexpected twists and turns. That’s why we’re here to help you navigate every corner of the road with confidence and certainty. Progressive offers a wide range of insurance products. In the chart below, check out the different options available from Progressive.

| Coverage | Purpose | Example of Coverage Use |

|---|---|---|

| Bodily injury liability | This coverage pays for another driver's medical bills/loss of income in an accident you caused. | You glance down to check the GPS instructions and rear-end another car, injuring the driver. |

| Classic car | Covers classic cars for less than regular auto insurance policies. | Vintage cars used just for pleasure — driving around on a sunny day. |

| Collision | Pays for repairs to your vehicle in accidents with another vehicle or object. | You hydroplane and crash into a tree. |

| Commercial | Covers vehicles used for business. | You own a flower shop and have a delivery van used for your business. |

| Comprehensive | Pays for repairs in accidents not caused by another vehicle. These accidents include theft, natural disasters and animal collisions. | Your car is parked outside when heavy winds knock a tree onto your car. |

| Gap coverage | Pays the difference between your vehicle's actual value and what you still owe on your loan/lease. | You total your car. Your car is worth $10,000, but you still owe $15,000 on your car loan. |

| Medical payments | Pays for your and your passenger's medical costs in an accident. | An accident gave you a mild concussion, and you need to be treated at a hospital. |

| Personal injury protection | Pays for your medical bills and other accident costs (such as lost income). | Your concussion from an accident leaves you unable to work for a month, resulting in medical bills and lost income. |

| Property damage liability | Pays for damages to another person's vehicle/property in an accident you caused. | You accidentally scrape another person's car pulling into a tight parking spot. |

| Rental reimbursement | Provides access to a rental car if your car is in shop after a covered accident. | Your car will be in the repair shop for at least a few days, so you need another vehicle to get around. |

| Rideshare | Covers rideshare drivers. | You want to work for Uber or Lyft as a rideshare driver. |

| Umbrella | Provides extra liability coverage. | You were in an accident the other parties are suing you. |

| Underinsured motorist | Helps you if you are in an accident with an underinsured motorist. | A driver hits you, but has such poor insurance that the driver can't cover your medical and property damage bills. |

| Uninsured motorist | Helps in hit-and-run accidents or an accident with an uninsured motorist. | You come out of the store and someone has run into your car before fleeing the scene. |

Explore the following coverage options to discover how Progressive can be your co-pilot in ensuring your vehicle, your passengers, and your peace of mind are well-protected.

- Liability Coverage: Protects you if you’re at fault in an accident and covers bodily injury and property damage for others.

- Comprehensive and Collision: Safeguard your vehicle against a range of risks, including accidents, theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist: In case you’re involved in an accident with an uninsured or underinsured driver, this coverage ensures you’re not left with the financial burden.

- Medical Payments: Covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

- Personal Injury Protection (PIP): Provides a broader coverage for medical expenses, lost wages, and other costs related to an accident, regardless of fault.

- Roadside Assistance: Get peace of mind knowing you have help on the way if you face a breakdown, flat tire, or run out of gas.

- Rental Car Reimbursement: Keep your life moving smoothly by getting coverage for a rental car while yours is being repaired after an accident.

- Gap Insurance: If your car is totaled, this coverage bridges the gap between the car’s actual cash value and what you still owe on your loan or lease.

- Custom Parts and Equipment: Protect any customized additions to your vehicle, like high-end sound systems or rims.

At Progressive, we take pride in offering more than just insurance. We take pride in offering the peace of mind that comes from knowing you’re properly protected. Our coverage options are your ticket to safety, savings, and convenience. Whether it’s liability coverage, collision protection, comprehensive security, or any of our other options, we’ve got your back on the journey ahead.

Cheap Car Insurance Rates

We partnered with Quadrant Data to bring you this information. Here are two things to consider when shopping for car insurance:

- Many variables can affect what you pay. Your rate may differ from what is listed below.

- Progressive has discounts and options that may help offset the cost.

Progressive Availability and Rates by State

Progressive’s rates vary by state, sometimes below and sometimes above average, and can be further affected by factors like driving record and credit history.

In the table below, you can see the rates of Progressive in all states compared to other leading insurers.

| State | Annual Premium | Higher/Lower than State Average | Percentage Change from State Average (+/-) |

|---|---|---|---|

| Alabama | $3,062.85 | -$358.66 | -10.48% |

| Alaska | $4,450.52 | $883.56 | 24.77% |

| Arizona | $5,312.09 | $1,187.11 | 28.78% |

| Arkansas | $3,577.50 | -$193.47 | -5.13% |

| California | $2,849.67 | -$839.26 | -22.75% |

| Colorado | $4,231.92 | $355.53 | 9.17% |

| Connecticut | $4,920.35 | $301.43 | 6.53% |

| Delaware | $4,970.26 | $531.02 | 11.96% |

| District of Columbia | $4,181.83 | -$1,804.49 | -30.14% |

| Florida | $5,583.30 | $902.84 | 19.29% |

| Georgia | $4,499.22 | -$467.61 | -9.41% |

| Hawaii | $2,177.93 | -$377.71 | -14.78% |

| Idaho | $2,395.50 | -$585.78 | -19.65% |

| Illinois | N/A | N/A | N/A |

| Indiana | $3,536.65 | $231.17 | 6.99% |

| Iowa | $3,898.00 | $483.03 | 14.14% |

| Kansas | $4,144.38 | $864.76 | 26.37% |

| Kentucky | $5,547.63 | $352.23 | 6.78% |

| Louisiana | $7,471.10 | $1,759.76 | 30.81% |

| Maine | $3,643.59 | $690.32 | 23.37% |

| Maryland | $4,094.86 | -$487.84 | -10.65% |

| Massachusetts | $3,835.11 | $1,156.26 | 43.16% |

| Michigan | $5,364.55 | -$5,134.09 | -48.90% |

| Minnesota | N/A | N/A | N/A |

| Mississippi | $3,419.14 | $90.21 | 2.71% |

| Missouri | $4,308.85 | $644.28 | 17.58% |

| Montana | $4,330.76 | $1,109.92 | 34.46% |

| Nebraska | $2,382.61 | -$1,010.50 | -29.78% |

| Nevada | $3,623.06 | -$542.78 | -13.03% |

| New Hampshire | $3,758.01 | $474.33 | 14.44% |

| New Jersey | $2,694.45 | -$457.32 | -14.51% |

| New Mexico | $3,972.72 | -$1,542.49 | -27.97% |

| New York | $3,119.18 | -$344.46 | -9.94% |

| North Carolina | $4,062.57 | -$799.13 | -16.44% |

| North Dakota | $3,771.15 | -$518.73 | -12.09% |

| Ohio | $3,436.96 | $727.25 | 26.84% |

| Oklahoma | $4,832.35 | $690.03 | 16.66% |

| Oregon | $3,629.13 | $161.36 | 4.65% |

| Pennsylvania | $4,451.00 | $416.51 | 10.32% |

| Rhode Island | $5,231.09 | $227.73 | 4.55% |

| South Carolina | $4,573.08 | $791.94 | 20.94% |

| South Dakota | $3,752.81 | -$229.46 | -5.76% |

| Tennessee | $3,656.91 | -$3.98 | -0.11% |

| Texas | $4,664.69 | $621.41 | 15.37% |

| Utah | $3,830.10 | $218.21 | 6.04% |

| Vermont | $2,498.58 | $140.71 | 5.97% |

| Virginia | $5,217.14 | $1,983.01 | 61.32% |

| Washington | $3,209.52 | $150.20 | 4.91% |

| West Virginia | N/A | N/A | N/A |

| Wisconsin | $3,128.91 | -$477.15 | -13.23% |

| Wyoming | $4,401.17 | $1,201.09 | 37.53% |

In most states, Progressive rates are lower than the state average. For example, rates in Massachusetts, Nebraska, and Louisiana are thousands less than the state average.

Additional Resources:

Comparing the Top 10 Companies by Market Share

Saving money is always a great thing, and one way to do that is to shop around and get the best rates for you and your family. Here’s a look at Progressive compared to nine other top companies on a state-by-state basis.

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | NA in State | $2,879.96 | $5,295.55 | NA in State | $3,062.85 | $2,228.12 | NA in State | $2,454.21 |

| Alabama | $3,566.96 | $3,311.52 | NA in State | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Arkansas | $4,124.98 | $5,150.03 | NA in State | $4,257.87 | $3,484.63 | NA in State | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| Arizona | $3,770.97 | $4,904.10 | NA in State | $5,000.08 | $2,264.71 | NA in State | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| California | $3,688.93 | $4,532.96 | NA in State | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | NA in State | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | NA in State | NA in State | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| District of Columbia | $4,439.24 | $6,468.92 | NA in State | NA in State | $3,692.81 | NA in State | $4,848.98 | $4,970.26 | $4,074.05 | NA in State | $2,580.44 |

| Delaware | $5,986.32 | $6,316.06 | NA in State | NA in State | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| Florida | $4,680.46 | $7,440.46 | NA in State | NA in State | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | NA in State | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | NA in State | NA in State | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | NA in State | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | NA in State | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | NA in State | $1,189.35 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | NA in State | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | NA in State | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | NA in State | NA in State | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | NA in State | NA in State | $6,154.60 | NA in State | NA in State | $7,471.10 | $4,579.12 | NA in State | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | NA in State | $2,770.15 | $2,823.05 | $4,331.39 | NA in State | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | NA in State | NA in State | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | NA in State | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | NA in State | NA in State | $1,510.17 | $4,339.35 | NA in State | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | NA in State | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | NA in State | $2,066.99 | NA in State | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | NA in State | $2,525.78 |

| Mississippi | $3,664.57 | $4,942.11 | NA in State | NA in State | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Montana | $3,220.84 | $4,672.10 | NA in State | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | NA in State | $2,031.89 |

| North Carolina | $3,393.11 | $7,190.43 | NA in State | NA in State | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | NA in State |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | NA in State | $2,006.80 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | NA in State | $2,330.78 |

| New Hampshire | $3,151.77 | $2,725.01 | NA in State | NA in State | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | NA in State | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | NA in State | $7,617.00 | $2,754.94 | $6,766.62 | NA in State | $3,972.72 | $7,527.16 | $4,254.49 | NA in State |

| New Mexico | $3,463.64 | $4,200.65 | NA in State | $4,315.53 | $4,458.30 | NA in State | $3,514.38 | $3,119.18 | $2,340.66 | NA in State | $2,296.77 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New York | $4,289.88 | $4,740.97 | NA in State | NA in State | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | NA in State | $4,142.40 | $3,437.34 | $6,874.62 | NA in State | $4,832.35 | $2,816.80 | NA in State | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | NA in State | NA in State | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | NA in State | NA in State | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | NA in State | $4,691.85 | $3,178.01 | NA in State | $3,625.49 | $4,573.08 | $3,071.34 | NA in State | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | NA in State | NA in State |

| Tennessee | $3,660.89 | $4,828.85 | NA in State | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | NA in State | $3,263.28 | NA in State | $3,867.55 | $4,664.69 | $2,879.94 | NA in State | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | NA in State | $2,491.10 |

| Virginia | $2,357.87 | $3,386.80 | NA in State | NA in State | $2,061.53 | NA in State | $2,073.00 | $2,498.58 | $2,268.95 | NA in State | $1,858.38 |

| Vermont | $3,234.13 | $3,190.38 | NA in State | NA in State | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | NA in State | $1,903.55 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | NA in State | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | NA in State | NA in State | $2,120.80 | $2,924.39 | NA in State | NA in State | $2,126.32 | NA in State | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | NA in State | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | NA in State | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | NA in State | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

Progressive doesn’t have the lowest rates in some states. However, they are not the most expensive, either. Based on your personal information, you may be able to take advantage of several discounts, which we’ll review later in this guide.

Average Progressive Male vs. Female Car Insurance Rates

Who pays the most for car insurance? It may surprise you to know that some states allow gender to be used when determining insurance rates. However, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, California, and parts of Michigan have banned this practice and no longer allow companies to use gender as a factor.

| Progressive Demographic Rates | |

|---|---|

| Married 60-year-old female | $1,991.49 |

| Married 60-year-old male | $2,048.63 |

| Married 35-year-old female | $2,296.90 |

| Married 35-year-old male | $2,175.27 |

| Single 25-year-old female | $2,697.73 |

| Single 25-year-old male | $2,758.66 |

| Single 17-year-old female | $8,689.95 |

| Single 17-year-old male | $9,625.49 |

Age certainly has its benefits, as mature drivers enjoy the least expensive car insurance rates.

Conversely, male teen drivers, no matter their location, have the most expensive rates in the industry. Compare car insurance rates by age and gender here.

Average Progressive Rates by Make and Model

Considering a new car? One thing to consider before purchasing is that the kind of car you drive has a significant impact on your insurance premiums. In the table below, we show rates for five specific vehicles. See how your rates compare.

| Make and Model | Progressive |

|---|---|

| 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,914.05 |

| 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $4,429.56 |

| 2015 Toyota RAV4 XLE | $3,647.22 |

| 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,962.58 |

| 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $4,528.90 |

| 2018 Toyota RAV4 XLE | $3,730.78 |

It’s good news if you drive a Toyota RAV4 because they enjoy the least expensive rates. One surprising fact is the Honda Civic is one of the most expensive cars to drive. That’s because the Honda Civic is one of the most stolen vehicles in the country.

Average Progressive Commute Rates

How far you drive also impacts your car insurance rates. In the table below, we show data from Progressive for two commutes based on distance.

| Company | 10-Mile Commute / 6,000 Annual Miles | 25-Mile Commute / 12,000 Annual Miles |

|---|---|---|

| Progressive | $4,030.02 | $4,041.01 |

Some companies charge hundreds more for a longer commute. The good news for Progressive customers is that only $11 separates the two commutes.

Average Progressive Coverage Level Rates

You might think that having the lowest minimum coverage in your state is the best way to ensure that you and your family are protected. But that’s not necessarily the case. Sometimes the difference in low to high coverage is less than you think. Check out how the table below to see coverage level rates from Progressive.

| Company | Low | Medium | High |

|---|---|---|---|

| Progressive average rate | $3,737.13 | $4,018.46 | $4,350.96 |

If you drive a more expensive car, you may want more coverage. The good news is that there is only a $600 difference in price from low to high coverage.

Average Progressive Credit History Rates

Having bad credit can affect you in more ways than not being able to secure a car loan or rent an apartment. Poor credit can also have an impact on how much you pay for car insurance. The table below reflects what you’ll pay for car insurance based on your credit score.

| Company | Good | Fair | Poor |

|---|---|---|---|

| Progressive Average Rate | $3,628.85 | $3,956.31 | $4,737.64 |

The average credit score in the United States is 675. If yourf credit score is lower than this, you may face increased rates on car insurance. In some states, poor credit can raise your rates by thousands of dollars. On average, with Progressive, poor credit can raise your rates by $1,100.

Average Progressive Driving Record Rates

If you get a speeding ticket, have an accident, or get a DUI, your rates with Progressive will increase in most states. The table below shows rates with these three violations compared to the rate for a clean record.

| Company | Clean Record | With 1 Speeding Violation | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| Progressive average rate | $3,393.09 | $4,002.28 | $4,777.04 | $3,969.65 |

One speeding violation can raise your car insurance rates by over $600. Our best advice is to obey posted speed limit signs and never drink and drive.

Progressive’s Discounts

Progressive has numerous affordability options and discounts available to its consumers. Depending on the discount, you could save up to 40 percent. One thing to remember is these discounts aren’t available in all areas and may not apply to you.

| Discount Name | Average Discount | Details |

|---|---|---|

| Multi-policy | 5% | If you have two or more policies with Progressive (for example: if you were to have an auto and home-owners policy with Progressive) |

| Snapshot program | $130 | Their Snapshot program that personalizes your rate based on your driving. |

| Safe driver | 31% | If you have no accidents/traffic violations in the past three years |

| Multi-car | 10% | If you have more than one vehicle listed on your policy |

| Homeowner | nearly 10% | If you own a home (even if it is not insured through Progressive's network) |

| Sign online | nearly 8% | If you sign your documents online |

| Online quote | 7% | If you got your policy quote online (or if you start your quote online and a licensed Progressive representative finishes it for you over the phone |

| Paperless | Varies | If you opt to receive your documents via email (dependent on signing your documents online and is an addition to the sign online discount) |

| Continuous insurance | Varies | If you switch to Progressive from another insurer, you won't lose any longevity benefits (discount value will depend on how long you've been consistently insured with no gaps or cancellations) |

| Teen driver | Varies | If you're adding a teen driver to your policy |

| Good student | Varies | If you have a student who maintains a "B" average or better (discount also applies to college students, students more than 100 miles from your residence, or is 22 years or younger) |

| Pay in full | Varies | If you pay for your six month policy up front |

| Automatic payment | Varies | If you set up automatic payments from a checking account to pay (you cannot combine the automatic payment and pay in full discounts) |

From the table, you can see that the more policies you purchase, the lower your rates will be.

Progressive’s Programs

What else does Progressive offer customers? Check out the programs below to see if they may be beneficial to you.

- Car buying service — Progressive has partnered with TruCar to help customers shop for cars.

- Accident forgiveness — Progressive offers accident forgiveness to customers, which means rates won’t go up for a customer’s first accident.

- Custom parts and equipment value — This covers anything not installed by the original manufacturer, such as a new stereo.

- Roadside assistance — Helps customers with flat tires, lock-outs, gas refueling, and towing.

- Usage-based insurance — Progressive’s Snapshot app measures how well customers drive and adjust rates accordingly.

Another program from Progressive is the PerkShare program, which offers discounts and exclusive savings at select venues. Here are just a few of the options.

- Save on Marathon Fuel gift cards

- Get a special discount at Enterprise car rental

- Get discounts on an oil change at NTB

- Get a 20 percent discount on rentals at National Car Rental

- Along with everyday low prices, you get an extra discount at Alamo car rental

- Enjoy a 10 percent discount at Enterprise truck rental

Let’s review what we’ve learned so far by looking at what stands out about Progressive’s offerings and what’s missing.

- What Stands Out — Progressive has more discounts than other providers do. It also offers a variety of add-on coverages and programs that go beyond the basics.

- What’s Missing — Progressive doesn’t have a military discount, which is standard with most companies. It’s also more expensive than the other top four insurance companies. Also, customers gave mixed reviews for customer satisfaction and unresolved complaints.

Progressive Financial Ratings

All companies advertise how much better they are than the competition. But let’s see what multiple independent agencies say about Progressive and if it’s the right company for your insurance needs. Comparing the pros and cons is an important factor in determining which auto insurance company is best for you.

| Agency | Rating |

|---|---|

| A.M. Best | A+ (Superior) |

| Better Business Bureau (Northbrook, IL) | A- (Very Good) |

| Moody's | A2 (Good) |

| S&P | AA (Very Strong) |

| NAIC Complaint Index Ratio | 0.0012 (2018) |

| J.D. Power | About Average |

| Consumer Reports | 87 out of 100 |

Let’s dig deeper into each of these ratings and examine what they mean to you as a customer.

A.M. Best

An A.M. Best rating measures the financial stability of a company, with A++ being the highest rating possible. Progressive has an impressive A+ rating, which means the company has a stable financial future.

Moody’s

Moody’s rating looks at how well a company can pay off its debts (its creditworthiness). Progressive’s A2 rating falls into the P-2 category, meaning the company has a “strong ability to repay debts and has a predictable, stable future.”

This is an excellent score because the last thing a customer needs is to try and file a claim and find the company has filed for bankruptcy.

Better Business Bureau

This rating looks at multiple aspects of a business, although the most critical element is the company’s complaint history. A complaint history shows how satisfied customers are with the service they receive.

Since A+ is the highest rating the BBB gives, the Better Business Bureau views Progressive’s B- as better than most, but it needs improvement.

S&P Rating

What does a rating from Standard & Poor’s mean? This video explains more.

S&P’s rating of Progressive is good, though the best grade is AAA. Their AA rating means that Progressive has a strong capacity to meet financial commitments. It differs from the highest-rated companies by only a small degree.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) measures the number of complaints a company receives. In 2018, the company’s complaint ratio was 0.0012, well below the national average of 1.51. One thing to consider is that your experience may be better or worse than these ratings based on your insurance needs.

| Private Passenger Policies | 2016 | 2017 | 2018 |

|---|---|---|---|

| Total complaints | 32 | 35 | 34 |

| Complaint index (Better or worse than national index) | 0.0011 (better) | 0.0000 (better) | 0.0012 (better) |

| National Complaint Index | 1.47 | 1.53 | 1.51 |

You can see from the table that complaints about Progressive were stable over the three years from 2016-2018.

J.D. Power

Another rating to look at when researching an insurance company is customer satisfaction levels. J.D. Power rates companies solely on customer satisfaction levels. Progressive received scores of 797 – 828 throughout the country in providing a satisfying purchase experience, ranking it ninth among auto insurers.

Consumer Reports

Consumer Reports is a non-profit and independent organization that’s working to bring transparency into the marketplace for consumers. The company works to help consumers with purchase decisions, drive fair competition, and improve the products that companies offer.

| Claims Handling | Score |

|---|---|

| Ease of reaching an agent | Very Good |

| Simplicity of the process | Very Good |

| Promptness of response - very good | Very Good |

| Damage amount | Very Good |

| Agent courtesy | Very Good |

| Timely payment | Excellent |

| Freedom to select repair shop | Very Good |

| Being kept informed of claim status | Very Good |

| Total | 87 |

Progressive scores well in many of the above categories, making them a favorite of customers.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Company History

Progressive was founded in Cleveland, Ohio, in 1937, and from the beginning, it has taken an innovative approach to car insurance. The company was the first car insurance provider to allow drive-in claims service, and also the first to enable customers to pay in installments instead of yearly.

Progressive has grown substantially over the past 75 years and has established itself as the third-largest insurer in the United States behind State Farm and Geico. In the 1990s, the company became the first car insurance company to develop a company website on the Internet.

But many factors make up a company, including how it treats its customers, how it works within the community, and whether it’s financially reliable enough to weather volatile economic situations.

Why should you care about the history of Progressive? Because looking at a company’s history provides essential data about how successful the company is and what its future looks like.

In the following sections, we’re going to dig into everything from Progressive’s market share to its awards and accolades.

Progressive’s Market Share

The market share of a car insurance company determines how strong the company has become in the industry. A higher market share also means that a provider is the preferred choice of consumers.

Let’s review how Progressive has grown over the years.

| Year | Direct Premiums Written | Loss Ratio | Market Share Percent |

|---|---|---|---|

| 2015 | $17,518,721 | 64% | 8.77 |

| 2016 | $19,611,981 | 66% | 9.15 |

| 2017 | $22,776,349 | 63% | 9.84 |

| 2018 | $27,058,768 | 62% | 10.97 |

It may be the advertising, or it could be customer satisfaction because Progressive has seen continuous growth over the last four years, increasing its market share by over two percentage points.

Progressive’s Position for the Future

Have you wondered what’s next for Progressive? Here’s an interview with CEO Trici Griffin, who explains.

Next, we’re going to discuss Progressive’s online presence and learn more about its commercials.

Progressive’s Online Presence

Progressive has several options if you want to access information or get in touch with someone about your car insurance policy.

- Online – You can find quotes and more online at the Progressive website.

- Agents – You can talk to agents by texting, calling, or emailing.

- Apps – Progressive offers a mobile app through which you can access your policy information and contact agents.

Progressive’s Commercials

Car insurance companies do whatever it takes to grab your attention through emotional bonding, humor, and what-if scenarios. Progressive is no exception.

In 2008, the company launched a new campaign featuring a character called Flo, played by actress Stephanie Courtney, who has changed the way we view car insurance.

Check out this video to learn more about the woman behind the famous character.

In recent years, additions have been added to the Progressive lineup.

Check out this commercial about Jamie, Flo’s assistant.

https://youtu.be/ISmVGMta-7I

Other recent television commercials feature Cleveland Browns quarterback Buster Mayfield and a half-bike, half-man character called Motaur.

While the lack of a catchphrase may make Progressive stick less in people’s minds, Progressive has done an incredible job of promoting its brand by developing commercials that people can relate to when searching for car insurance.

Progressive in the Community

Community outreach shows that a company cares, and Progressive has developed several programs in which the company and its employees can give back to the community.

- The Progressive Insurance Foundation — Progressive matches employees’ donations to eligible charities.

- Volunteer Website — Progressive has an internal website where employees can search and find volunteer opportunities.

- STEM Progress Program — Progressive has a program where employees visit schools and help teach skills using insurance concepts.

Another program that benefits communities is the Keys To Progress Program that helps veterans. This video explains more:

https://youtu.be/2_zjIQd2qfM

Progressive also makes corporate decisions to be more socially responsible in maintaining a sustainable environment, helping others, and ensuring a better future.

Progressive’s Employees

Have you wondered what it’s like working for a big insurance company? Let’s look at what employees think of Progressive.

How a company treats its employees gives us insight into the company’s values and employee satisfaction levels.

Let’s begin by looking at employees’ experience ratings according to Great Place to Work.

| Statement | Employee Percentage in Agreement |

|---|---|

| When you join the company, you are made to feel welcome. | 97% |

| Management is honest and ethical in business practices. | 93% |

| I am given the resources and equipment to do my job. | 93% |

| I am proud to tell others I work here. | 93% |

| People here are given a lot of responsibility. | 92% |

At Progressive, 92 percent of the company’s employees say that it’s a great place to work. Watch this video to learn more about the employees at Progressive.

We also checked employee reviews on Glassdoor to know about what they think of Progressive.

- In about 2,500 employee reviews, Progressive was rated 3.8 out of 5, with most of the reviews highlighting the great experience people have had working at the company.

- Almost 73 percent of the reviewers would recommend working at Progressive to their friends.

- Around 92 percent approve of the company’s current CEO.

Positive reviews about Progressive reflect a great work environment, great people, and excellent benefits. Some dissatisfied reviews say factors such as long hours, little work/life balance, and the difficulty of working in Progressive’s call center.

The company has won numerous awards over the years for diversity, humanitarianism, and working women. In 2019, Fortune named Progressive as one of the 100 best companies to work for in the United States.

The company has a long history of valuing diversity and inclusion and continues to operate on those principles.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Canceling Your Policy

At some time, you may need to change or cancel your insurance policy with Progressive. Here are four examples which may apply to you:

- Selling a car and not replacing it

- Storing a classic or antique vehicle

- A teen is heading to college and will no longer be driving the vehicle

- A vehicle has been paid off and no longer requires comprehensive coverage

But what if you want to cancel your policy for other reasons such as customer dissatisfaction, rates that are too high, or you’re moving geographic locations? In this next section, we’re going to show you the steps involved with canceling an insurance policy with Progressive.

How to Cancel

You’ll need to pick up the phone and call 1 (800) 776-4737 or contact your local agent if you want to cancel your policy. Progressive’s website does allow you to modify or change some policies but doesn’t allow you to cancel a policy.

The same thing applies to the Progressive app. You can modify or manage your account, but you’ll need to speak with your agent to cancel a policy.

Additionally, if you’re switching providers because of personal reasons and will still need to have coverage, make sure you’ve decided on another company. If you don’t take this step, you may have a lapse in coverage, which can result in fines from the state and higher rates from prospective insurers.

When can I cancel?

You can cancel at any time. However, canceling before a renewal cycle may result in a cancellation fee. The cancellation will go into effect at midnight the following day after your policy expires or whatever day you have chosen to end the policy.

How to Make a Claim

No matter how hard you try, at some point, you may have to file a claim due to an accident, whether you’re at fault or not. In times of stress, you need a company that is fast and reliable to help you through the process.

In the next section, we’re going to discuss everything from how the claims process works to how many claims were paid out.

Let’s get started.

Ease of Making a Claim

Perhaps you’ve seen them around town, at disaster sites, or parked at home, Progressive mobile agents come to you to help you through the claims process.

This video explains more:

Besides working directly with your agent, there are other ways to file a claim with Progressive.

- Online — You can file a claim online at Progressive’s website. You’ll need to have your policy number, contact information, and accident/incident information.

- Mobile App — If you have Progressive’s mobile app, you can use it to file a claim.

- Phone — You can call 1 (800) 776-4737 at any time (it’s available 24/7, seven days a week).

But how does Progressive payout claims to its customers?

Premiums Written

How do premiums written relate to claims? The answer to that question is, the higher the number of premiums written, the less customers have to pay. A company with lower written premiums will have to charge policyholders more to cover the cost of accident claims.

Let’s take a look at the NAIC’s data on Progressive’s written premiums.

| 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|

| $16.56 billion | $19.63 billion | $22.78 billion | $27.05 billion |

The company has nearly doubled its premiums written in the period, which is great news for customers because it keeps rates low.

Loss Ratio

What exactly is a loss ratio?

A loss ratio calculates the number of written premiums compared to the number of claims. A company with a 65 percent loss ratio is paying $65 on claims for every $100 earned from written premiums.

A high loss ratio may seem reasonable, but anything over 100 percent means a company is risking bankruptcy. Conversely, a low loss ratio means a company isn’t paying out a good number of claims.

Let’s look at Progressive’s loss ratios to see how many claims the company pays out.

| 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|

| 64.23% | 66.74% | 63.32% | 62% |

The loss ratio dipped in 2017 but increased again in 2018. However, it is still above 60 percent, which is considered a good loss ratio

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Get a Quote Online

Ready to get a quote? In the next section, we show you the steps needed to get an online quote from Progressive.

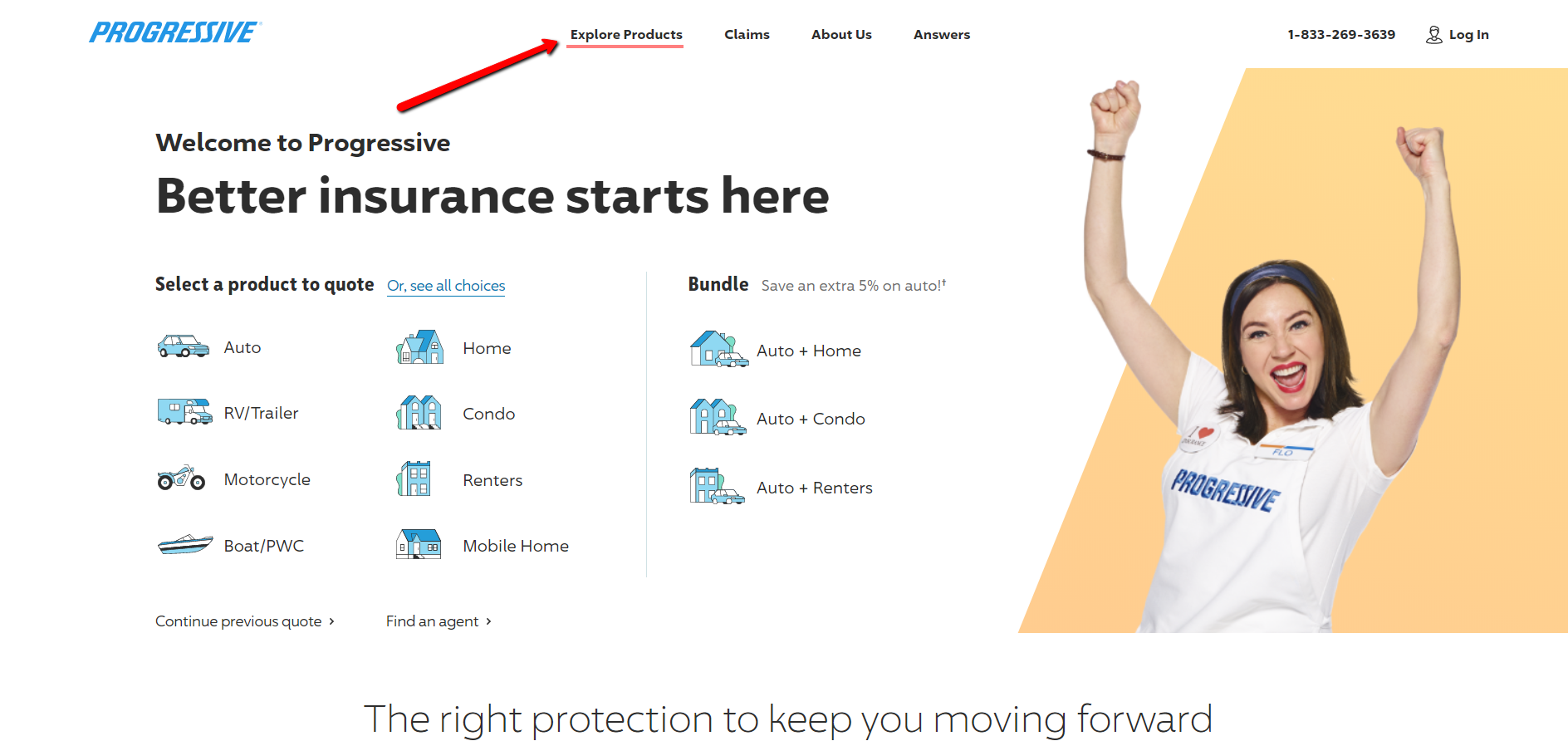

Step One: Visit Progressive’s website

There are many options on the auto insurance quote page of Progressive’s website. Select the product for which you need coverage, find bundling options, continue a previous quote, or find an agent near you.

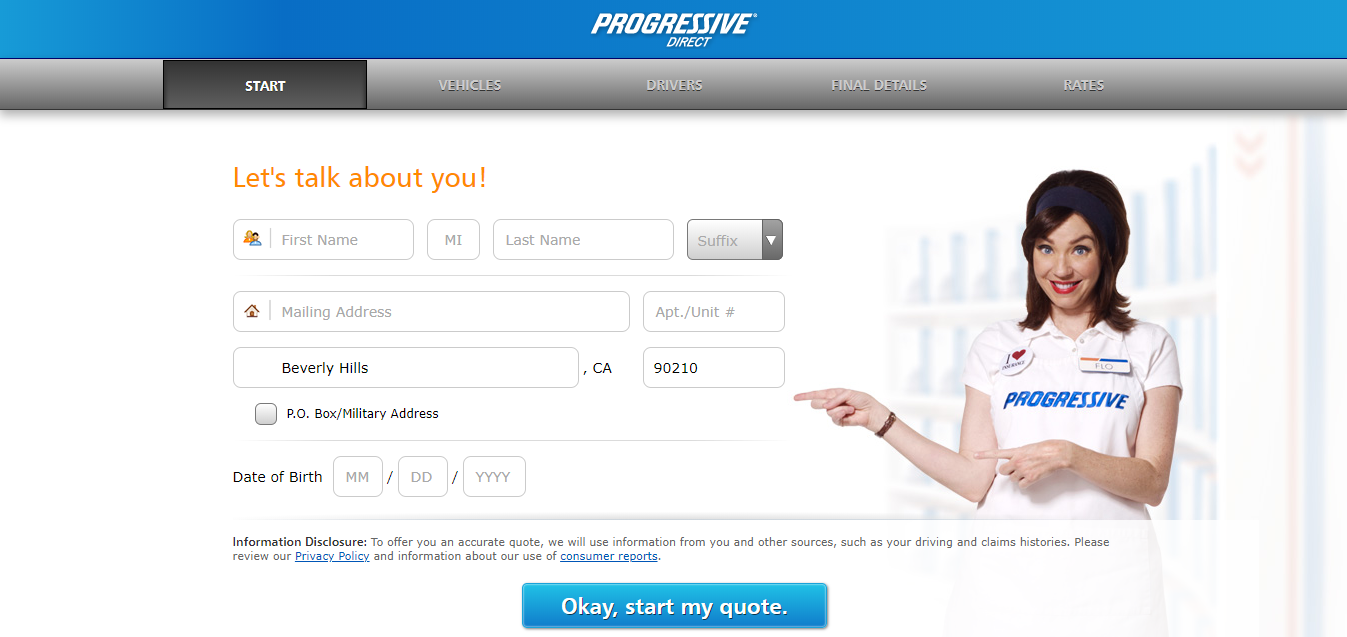

Step Two: Basic Information

Once you select a product and enter your ZIP code, you’ll be asked to enter basic information about yourself.

You’ll be asked for your name, address, and date of birth.

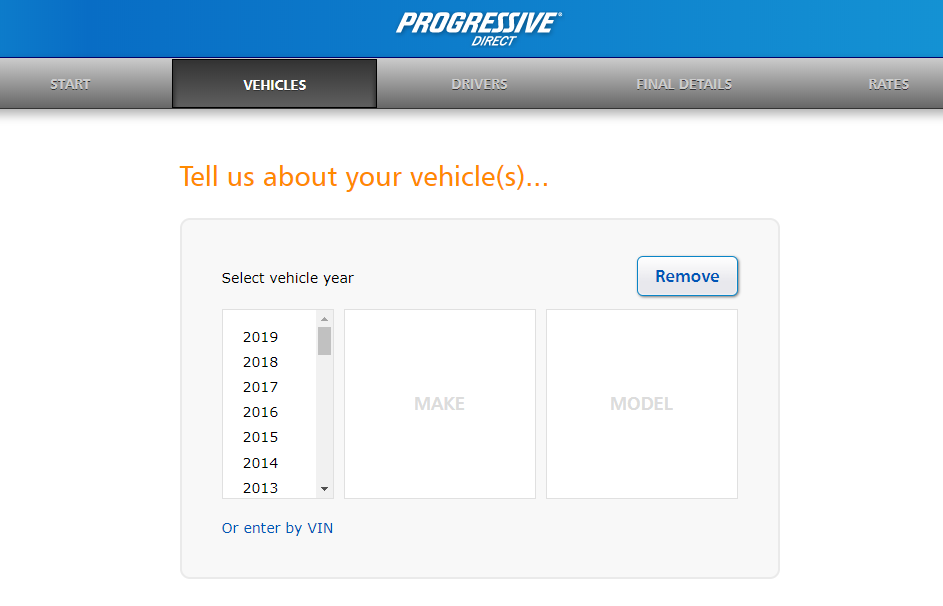

Step Three: Vehicle Information

Next, you’ll enter information for every vehicle you want to insure. You’ll be prompted to enter the year, make, and model of each car. You can also enter your car’s VIN and have the information generated for you.

You’ll also be asked about the use of your car, as this helps calculate commute distance rates.

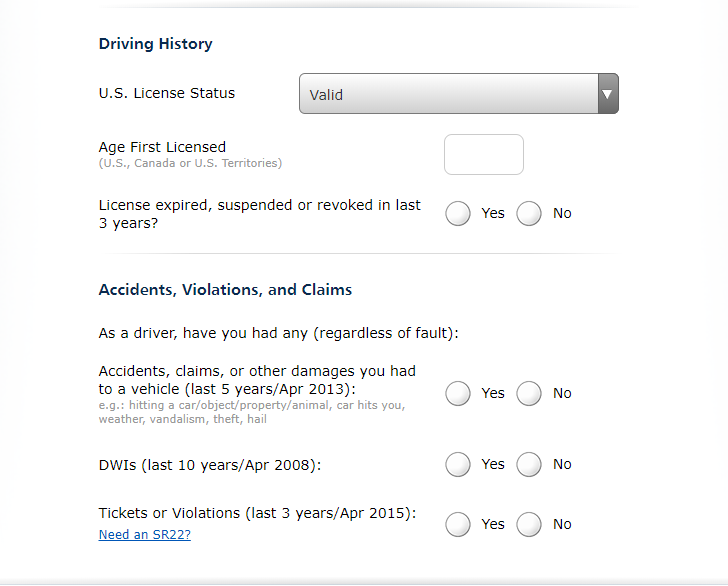

Step Four: Driver Information

One of the last pieces of information you will provide is driver history.

Here, you’ll provide driver information that gives Progressive an overview of your driver profile and history. You’ll also need to fill out basic details, such as your gender, prior license revocations, and primary residence.

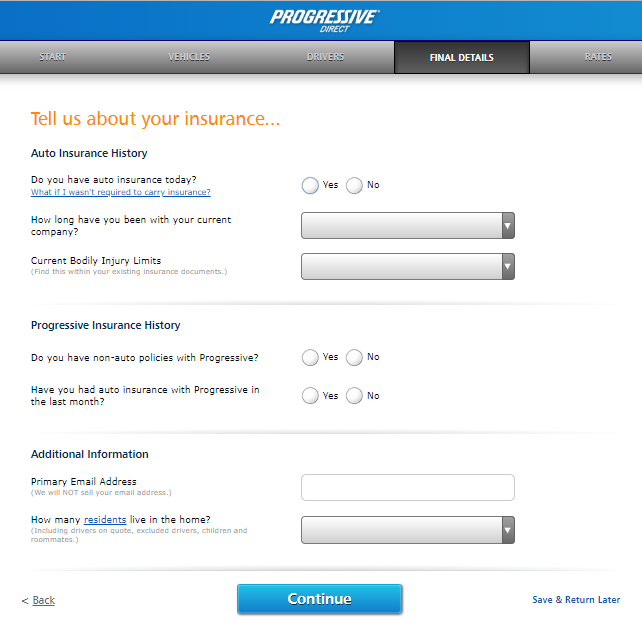

Step Five: Final Details

Finally, Progressive will ask for a few details about your insurance history.

If you’re unsure if you want to continue with your application, you can always click the “Save & Return Later” when it’s more convenient for you.

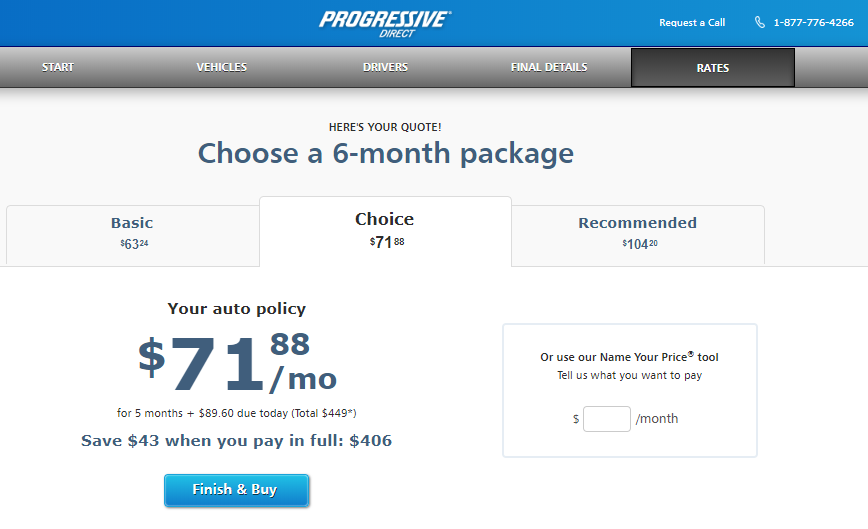

Step Six: Get Your Quote

Once you’re done filling out the information, you’ll immediately be given a quote.

While Progressive gives you the option to purchase a plan immediately, you’re not obligated to buy a policy at the end of the quote.

Design of Website and App

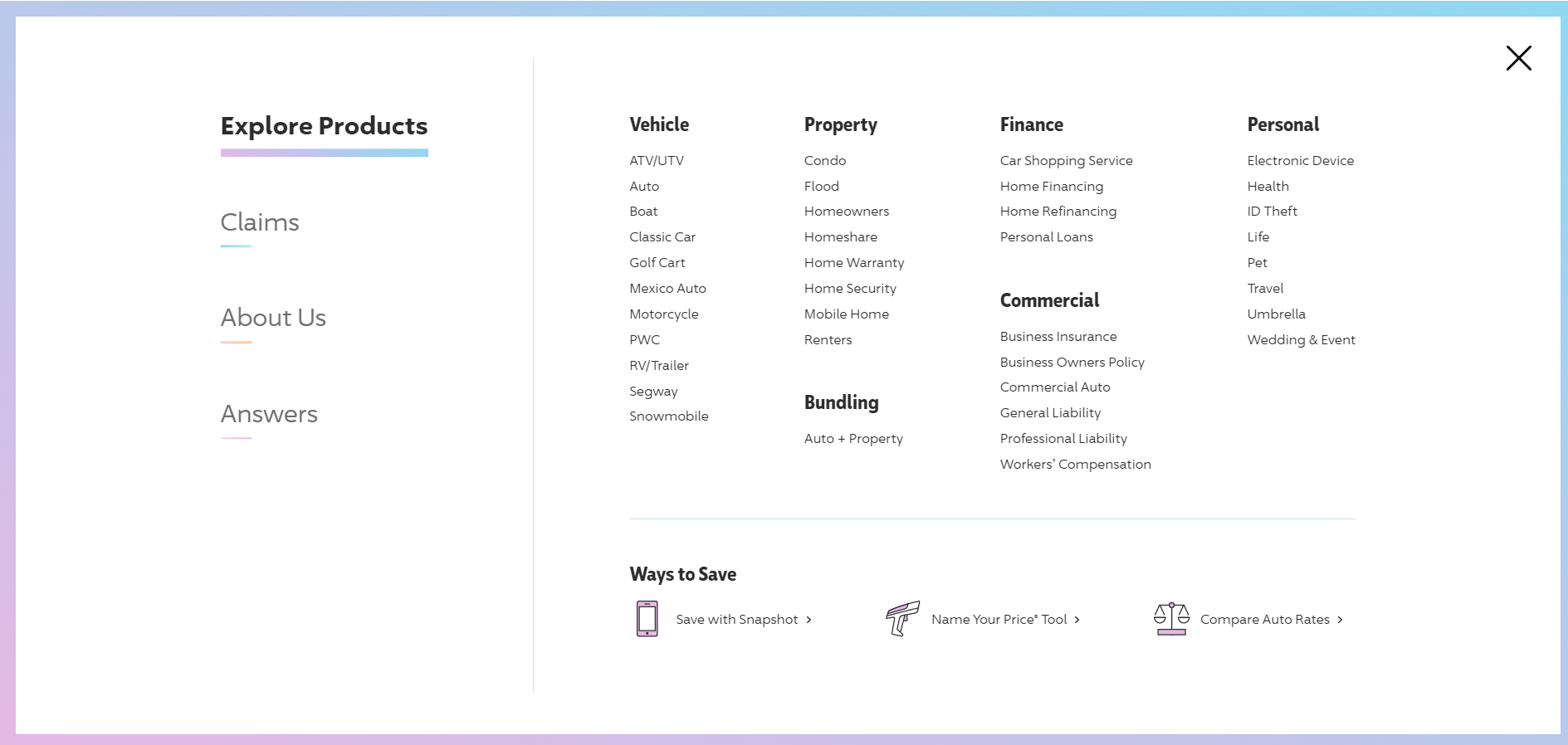

While other car insurance company websites and apps may be difficult to navigate, Progressive’s is uncluttered and easy to use. On the website, it is easy to find whatever information you’re searching for. Just click from any of the categories on the drop-down menu and go.

At the top of the page, you’ll see tabs that drop down into menus with more choices. The Explore Products tab gives a full breakdown of what the company offers and leads you to more information.

If you can’t find what you’re searching for in the drop-down menus, scrolling down to the bottom of Progressive’s webpage will show you a search bar.

Let’s move on and check out the app from Progressive.

The app received 3.4 stars out of five (based on 1,600+ ratings). Complaints about the app include the following.

- Can’t use debit cards for autopay

- Trouble signing in with passwords

So, what can you do with the app?

- View your coverages, discounts, ID cards, documents, and policy details

- Report a claim and add pictures

- Pay bills and view billing history

- See Snapshot progress

- Get a quote or make a policy change

- Request roadside assistance

- Contact your agent

One key component missing from the app is the inability to check the status of your claim.

Pros and Cons

Now that we have covered everything you need to know about Progressive, let’s check out the biggest takeaways in terms of pros and cons.

| Pros | Cons |

|---|---|

| 24/7/365 support | High rates for poor driving history |

| Numerous discounts to help drivers offset cost of insurance | High rates for poor credit history |

| Comparable rates despite commute distance in most states | Accident forgiveness program is a separate cost |

| Customer Satisfaction ratings higher than other insurers | Rates higher than state average in several states |

| Loss ratio is stable | Mobile app ratings spotty based on customer experience |

| One of the only insurers who offers pet protection | Financial strength ratings not as high as other insurers |

| "Name Your Price" option to cater your budget to the policy you can actually afford | Not as many discounts as other competitors |

| Snapshot program to personalize your rate your YOUR driving | Supplemental coverage options harder to find |

| Reputation of helping high-risk drivers | Teen driver rates higher than other insurers |

Rates from Progressive are higher than the norm, but with discount options readily available, there are ways to save money.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Guiding Through Claims Handling at Progressive Car Insurance

Ease of Filing a Claim

Progressive offers multiple convenient options for filing claims. You can file a claim online through their website or mobile app, providing a user-friendly and efficient experience. Additionally, you can initiate a claim over the phone by calling their dedicated claims hotline.

Average Claim Processing Time

The average claim processing time with Progressive can vary depending on the complexity of the claim and other factors. However, Progressive is known for its quick claims processing, and they strive to handle claims promptly to minimize disruptions for their policyholders.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback regarding claim resolutions and payouts with Progressive is generally positive. Many policyholders appreciate the company’s responsive claims handling and fair compensation for covered losses. Progressive’s commitment to customer satisfaction is reflected in their high ratings in customer satisfaction surveys.

Tech-Driven Solutions by Progressive Car Insurance: Digital Features

Mobile App Features and Functionality

Progressive’s mobile app offers a range of features and functionality to enhance the customer experience. Users can easily manage their policies, view digital insurance ID cards, pay bills, and report claims directly through the app. Additionally, the app provides access to useful resources and tools for tracking driving habits and potential discounts through programs like Snapshot.

Online Account Management Capabilities

Progressive’s online account management system allows policyholders to access and manage their insurance policies with ease. You can review policy details, make changes to coverage, update personal information, and view billing statements. The online portal provides a convenient and secure way to stay informed about your policy.

Digital Tools and Resources

Progressive offers a variety of digital tools and resources to help policyholders make informed decisions. These include online quote calculators, coverage comparison tools, and educational resources to help customers better understand their insurance options. Additionally, Progressive’s website features informative articles and guides on various insurance topics to assist customers in navigating the insurance landscape.

Customer Reviews of Progressive Car Insurance

Some policyholders express satisfaction with Progressive’s competitive rates, easy-to-use website and mobile app, and efficient claims processing. Progressive’s discounts and tech-driven solutions, such as the Snapshot program, receive positive feedback for potentially reducing premiums.

However, some customers report negative experiences, including concerns about rates increasing over time, particularly after participating in the Snapshot program. Additionally, while Progressive’s customer service garners both praise and criticism, it’s essential to recognize that the overall customer experience may vary based on individual circumstances and preferences.

As with any insurance provider, prospective customers are encouraged to research, obtain quotes, and compare options to determine if Progressive aligns with their specific needs and expectations.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

History and Mission of Progressive Car Insurance

Progressive Car Insurance, founded in 1937 in Cleveland, Ohio, has a rich history of innovation in the insurance industry. They were pioneers in introducing drive-in claims service and offering customers the option to pay premiums in installments. Over the decades, Progressive has grown to become the third-largest auto insurer in the United States, with a strong online presence as one of the first insurance companies to establish a website.

Their mission centers on providing accessible and affordable insurance solutions to a diverse range of customers. Progressive aims to simplify the insurance experience, offering easy-to-use digital tools and innovative programs like Snapshot to help customers save on their premiums.

This commitment to technological advancements and customer-focused solutions has become a hallmark of Progressive’s mission as they continue to adapt and evolve in the ever-changing insurance landscape.

The Bottom Line

Knowledge is power, and that’s why we’ve shown you everything you need to know about Progressive so you can decide for yourself whether they’re the right insurance company for you. Did we miss anything? What did you find most useful?

Progressive pushes bundling as a way to save on your insurance costs. But don’t focus too much on that bundle that you end up paying too much for car insurance. One thing to consider is that everyone’s needs are different, and rates can vary significantly based on individual factors.

As comprehensive as this guide is, your rates will vary and depend on the information you provide.

Progressive Insurance FAQs

Have further questions about Progressive? We’ve answered a few common questions about the company below.

What is accident forgiveness at Progressive?

There are two types of accident forgiveness at Progressive.

- Small accident forgiveness is a program that won’t raise your premiums if the total claim amount is less than $500.

- Large accident forgiveness ensures your premiums won’t increase after an accident regardless of cost; however, to qualify, you must be accident-free for three years, and a Progressive customer for five years.

Can I buy a Progressive policy online?

Progressive offers the option to buy a policy online. Simply complete the required forms and choose the option to purchase at the end of Progressive’s free quote form.

Will Progressive’s Snapshot App increase my rates?

There is a possibility it can raise premiums. If the app shows you to be a high-risk driver, the company can raise your premiums. Progressive reports only two out of every 10 drivers will see rates increase, but if you’re unsure of your driving skills, don’t get the app.

Can I cancel the Snapshot App?

It is possible to cancel the Snapshot App if your premiums are going up. You may cancel at any time, but in some states, a surcharge may apply if cancellation is within 45 days of getting the app.

What if I miss a Progressive payment?

While most of us pay our bills on time, occasions may arise when a payment is late or missed. The good news is that Progressive offers a short grace period. Depending on where you live, you’ll have 10-20 days after a missed payment before Progressive cancels your policy.

Are you worried about forgetting a payment? Progressive offers autopayment for its customers.

Get quotes today to find out how much you could save on car insurance. Get started by simply entering your ZIP code in our FREE comparison tool.

Frequently Asked Questions

What factors affect car insurance rates with Progressive?

Car insurance rates with Progressive are influenced by several factors, including your location, driving record, credit history, age, gender (in some states), the type of vehicle you drive, your commute distance, coverage level, credit history, and driving record.

How does Progressive’s car insurance rates vary by state?

Progressive’s rates vary by state and can be affected by local factors, driving conditions, and legal requirements. In many states, Progressive offers rates that are lower than the state average, making them a competitive option for car insurance.

Are there discounts available with Progressive car insurance?

Yes, Progressive offers various discounts that can help you save on your car insurance premiums. These discounts include multi-policy discounts, safe driver discounts, and many more. The availability of discounts may vary by location and individual circumstances.

What types of coverage does Progressive offer?

Progressive provides a wide range of coverage options, including liability insurance, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and more. They also offer add-on coverages like roadside assistance and custom parts and equipment coverage.

How can I cancel my Progressive car insurance policy?

To cancel your Progressive car insurance policy, you can call 1 (800) 776-4737 or contact your local agent. You can cancel at any time, but canceling before the renewal cycle may result in a cancellation fee.

How do I make a claim with Progressive?

You can file a claim with Progressive online through their website, using their mobile app, or by calling 1 (800) 776-4737. Progressive also offers mobile agents who can come to you to help with the claims process.

How does Progressive handle complaints and customer satisfaction?

Progressive’s customer satisfaction levels have received mixed reviews. While some customers have reported positive experiences, others have mentioned issues with long hours and work/life balance, particularly in call center positions. The Better Business Bureau (BBB) gave Progressive a B- rating, indicating that there is room for improvement in addressing customer complaints.

Does Progressive offer programs or initiatives to the community?

Yes, Progressive is involved in various community outreach programs, including the Progressive Insurance Foundation, volunteer opportunities for employees, and educational programs in schools. They also have programs like Keys To Progress, which helps veterans with transportation needs.

How can I get a car insurance quote from Progressive?

You can get a car insurance quote from Progressive by visiting their website, providing your basic information, vehicle details, driver information, and insurance history. Progressive will then generate a quote based on the information you provide.

Can I easily make changes to my Progressive policy online or through their app?

Progressive’s website and app make it relatively easy to make changes to your policy, manage your account, and access policy information. However, for certain actions like canceling a policy, you may need to contact your local agent or call their customer service number.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.