Expert Nevada Car Insurance Advice (Compare Costs & Companies)

Nevada car insurance laws require all drivers to carry minimum coverage of 25/50/20 for bodily injury and property damage liability. Nevada car insurance rates average $92 per month while some of the best car insurance companies in Nevada by market share include State Farm, Geico, and Progressive.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Nevada minimum car insurance requirements are 25/50/20 for bodily injury and property damage liability

- Nevada car insurance rates average $92 per month

- The largest car insurance companies in Nevada by market share are State Farm, Geico, and Progressive

| NEVADA STATISTIC SUMMARY | STATS |

|---|---|

| Road Miles | 43,900 |

| Registered Vehicles | 2,241,530 |

| State Population | 3,034,392 |

| Most Popular Vehicle | Toyota RAV 4 |

| Percentage of Uninsured Vehicles | 10.69% |

| Driving Deaths | Speeding: 95 Drunk Driving: 89 |

| Average Premiums Annually | Liability: $681.56 Collision: $303.86 Comprehensive: $117.63 |

| Cheapest Provider | USAA |

From the Vegas Strip to the Hoover Dam. Nevada really is a great place to live.

The Silver State also boasts nearly 43 million visitors a year. When you add this number to the over 3 million people who currently reside in Nevada its no wonder that driving around can sometimes be a hassle.

More people behind the wheel translates into more possibilities for an accident which could end up costing you way more than you bargained for if you have the wrong Nevada car insurance company.

How do you find affordable car insurance? We are here to help you figure that out. Just enter your information above and then keep scrolling to find out about all of the ways that you can save when purchasing your car insurance policy.

Nevada Car Insurance Coverage and Rates

Legal mandates for the minimum car insurance coverage amounts and types that drivers are required to carry are nothing new.

In fact, the Insurance Information Institute asserts that almost every state in the country has some type of compulsory law regarding these things.

Navigating some of the laws and regulations surrounding car insurance can be a difficult and often frustrating process though which is where we come in.

We are here to help you sort through everything from policy options to coverage types. We can also help you find discounts that you might qualify for along with other ways to save money. Keep reading to find all of the ways that we can help.

- Best Cheap Car Insurance Companies

Nevada Car Culture

As one of the least densely populated states in the country, it may seem as though residents of Nevada have little to worry about when they head out on the open road. Nothing could be further from the truth.

Given the fact that cities are so widely spaced apart with little more than desserts of mountains between them, car ownership in Nevada is actually a big deal.

In fact, car ownership is such a big deal that Nevada is host to both the National Automobile Museum in Reno and the International Car Forest of the Last Church.

There is no denying that residents of the Silver State love their cars.

The beauty and history of Nevada also attract nearly 43 million visitors annually which can make navigating the roads in the Silver State quite a challenge.

You can lower your stress level though by investing in the right car insurance policy that will protect you should you ever become involved in a car accident. Keep scrolling to see how we can help you make the best decision.

Nevada Minimum Coverage

If you live in the Silver State then you know that the cost of purchasing the minimum state requirements for car insurance just got higher.

According to the Nevada DMV, the Silver State requires that automobile liability insurance policies carry minimum coverage at the following levels:

- $25,000 for bodily injury or death of one person in any one accident

- $50,000 for bodily injury or death of two or more persons on any one accident

- And $20,000 for injury to or destruction of property of others in any one accident.

The State of Nevada also mandates that these coverage amounts must be maintained continuously as long as your vehicle is registered and AAA also notes that:

Nevada has no grace period for liability coverage. A one day lapse in your insurance coverage will result in a possible suspension of your registration. The minimum penalty is a $250 reinstatement fee.

Allowing your car insurance policy to lapse in the Silver State could also result in major losses if you are involved in a car accident as an uninsured motorist because according to Kiplinger, “state minimums don’t come close to covering the cost of a serious accident”

Kiplinger also suggests that:

You should carry bodily-injury coverage of at least $100,000 per person, and $300,000 per accident, and property-damage coverage of $50,000, or a minimum of $300,000 on a single-limit policy.

Kiplinger doesn’t make this suggestion lightly either.

The reality is that if you have an accident as an uninsured or underinsured motorist your house, retirement plan, and other personal property could become part of any settlement arrangement.

Forms of Finacial Responsibility

Nevada residents wishing to register their vehicle with the state must fill out and sign a Declaration of Responsibility form.

This form is a legal document that lays out the requirements for car insurance coverage and the penalties for allowing your coverage to lapse.

The Nevada DMV also asserts that evidence of Insurance can be presented to official offices and law enforcement in the following formats:

- A printed car insurance ID card

- Or in an electronic format displayed on a mobile electronic device

No matter how you choose to present your proof of insurance you must have it in the vehicle that you are driving at all times.

You should also note that if you are a new resident to the Silver State and your car insurance policy is not written for Nevada it is considered invalid.

You can verify whether your car insurance provider is licensed to do business in Nevada by visiting the Nevada Division of Insurance.

Premiums as a Percentage of Income

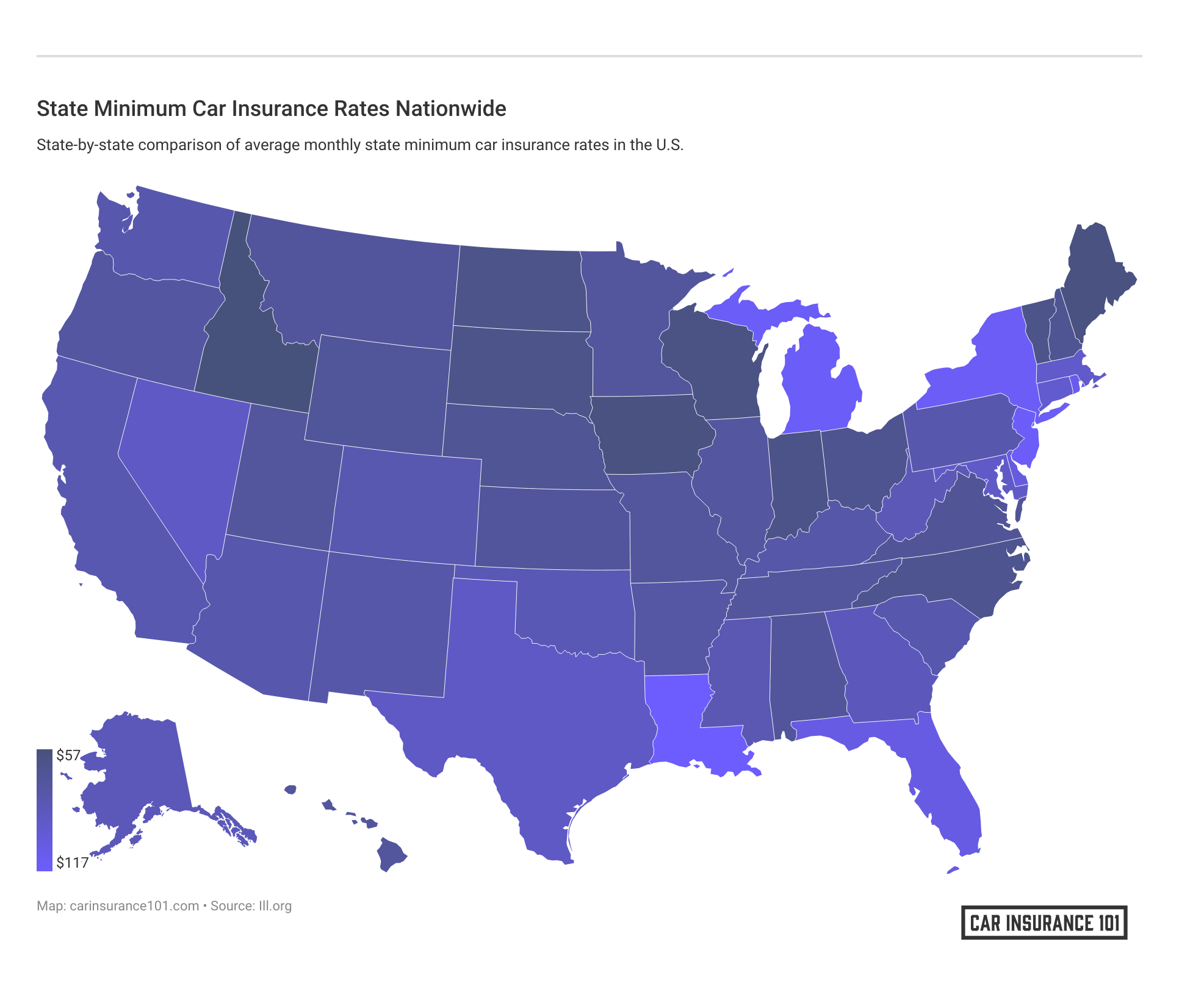

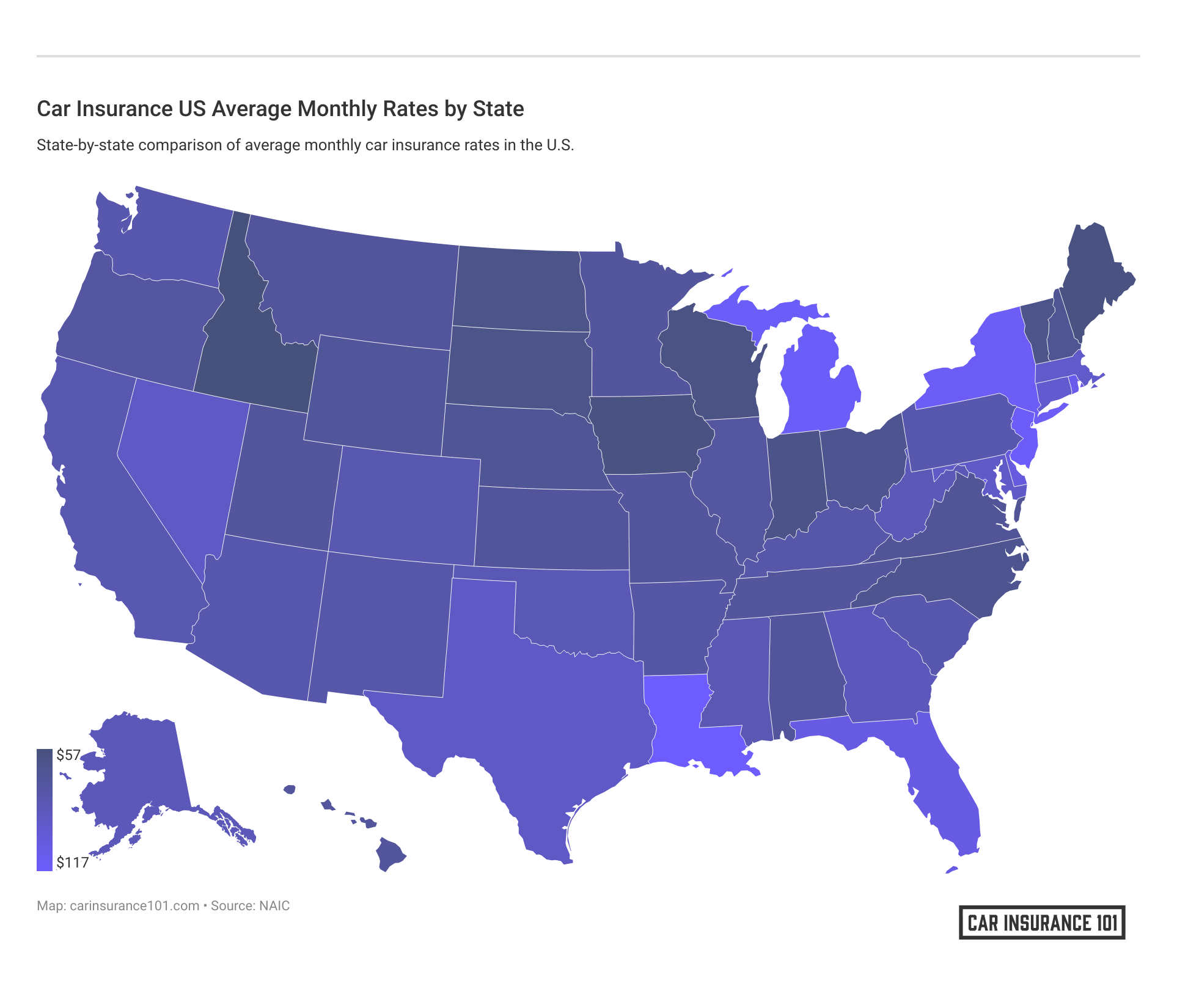

According to the Insurance Information Institute, Nevada ranked 12th in the nation for average expenditures for auto insurance between 2012 to 2016.

Nevada residents also spend a higher percentage of their disposable income on car insurance than their neighbors in Arizona (2.8 percent), Utah (2.54 percent), or Oregon (2.45 percent).

On average, Nevada residents dedicate approximately 2.97 percent of their annual disposable income to paying for their car insurance policy. So what doe this mean in real numbers?

With a per capita disposable income of $36,477 per year earned by each Nevada resident, and $1,083 of that being spent to maintain car insurance coverage, this means that on average $90 is spent on car insurance from a monthly budget of $3,000.

This is a lot more money than residents off Oregon who pay approximately $894 annually for the same type of coverage.

With so much of your hard-earned money being spent on maintaining your car insurance policy, it’s definitely worth shoppo=ing around to get the best deal.

CalculatorPro

Average Monthly Car Insurance Rates in NV (Liability, Collision, Comprehensive)

Before you can get the best deal on car insurance you need to have a basic understanding of the core types of coverage that are available to you from the various car insurance providers in your area.

The three core coverage types are:

- Liability Coverage-This type of coverage helps to cover the cost of any damage that you do to another person’s property or any personal injuries that you might cause another person if you are found to be at-fault in an accident.

- Collision Coverage-This coverage type pays for damage to the policyholder’s car which has resulted from a collision with another car, object or as a result of flipping over

- Comprehensive Coverage-This coverage type can reimburse you for losses that result from theft or for damage caused by something other than a collision with another car or object, such as a natural disaster, animal strike, or vandalism.

Take a look at what each of these types of coverage cost on average in the Silver State.

| COVERAGE TYPE | ANNUAL COSTS (2015) |

|---|---|

| Liability | $681.56 |

| Collision | $303.86 |

| Comprehensive | $117.63 |

| Combined Total | $1,103.05 |

The rates above reflect the fiscal year of 2015 so premiums for 2019 could be a bit higher.

Being aware of the car insurance requirements for Nevada, which car insurance providers are available in your area, and then shopping around can help keep your costs down though.

Additional Liability

Liability, comprehensive, and collision are not the only policy options that can help protect you in the event of a car accident.

Some of the other options that you should consider are:

- MedPay insurance will cover the medical payments of all passengers in a vehicle who are injured during an accident; including the ambulance ride and treatment.

- Uninsured/Underinsured insurance protects you if you are in an accident with an at-fault driver who isn’t carrying liability insurance or whose limits are to low to cover the damages and medical expenses incurred by you or others during an accident.

- Property Damage Liability which pays for damage policyholders–or anyone driving the car with their permission of the policyholder–might cause to someone else’s property

As you think about the various types of additional liability coverage that you might need it is also a good idea to consider the loss ratio for each type of these coverage options.

Take a look at these ratios by coverage type according to the data collected by the National Association of Insurance Commissioners.

| LOSS RATIO | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 81.58 | 78.32 | 79 |

| Uninsured/Underinsured Motorist Coverage | 101.86 | 107.13 | 98.4 |

These loss ratio numbers are good news to you as a resident of Nevada because they indicate that companies in the Silver State are pretty willing to settle car insurance claims quickly.

They are a bit on the high side though which means that Nevada residents file a lot of claims.

How can you tell by looking at the loss ratio? That starts by understanding what the loss ratio means.

Specifically the loss ratio works as follow:

- A High Loss Ratio (over 100 percent) indicates that the companies are losing money because they are paying out to many claims which might cause them to face bankruptcy.

- A Low Loss Ratio indicates that companies are paying to few claims which might result in you having your claim rejected by such a company should ever need to file one with them.

When you consider that almost 11 percent of all drivers in Nevada are uninsured it might be a good idea to invest in additional liability coverage.

Choosing a company that has a low loss ratio can also help to ensure that your claim will be settled quickly should the worst ever happen.

Add-ons, Endorsements, and Riders

Core coverage and additional liability coverage are just two of the many ways that you can protect yourself and your property while you are on the roadways in Nevada.

Many car insurance providers also offer a variety of add-ons, endorsements, and riders meant to protect you and your car or to help you out if you should suffer from mechanical failure while on the road.

Some of these options include:

- Guaranteed Auto Protection (GAP)–If your car is ever totaled or stolen GAP will pay any money that is remains owed on the lease or loan.

- Rental Reimbursement-This type of coverage will help you pay the costs of renting a car until your repairs are finished.

- Emergency Roadside Assistance-If your car breaks down or you have a flat emergency roadside assistance will be there for you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance–This type of coverage helps to pay for the cost of repairs to your car which did not result from an accident.

- Non-Owner Car Insurance–This type of coverage is perfect for you then because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage–If a basic model just isn’t your style then modified car insurance should be. This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Collector Car Insurance–If you own a collector or classic car you will probably want to have additional protection for your prized possession which is where this type of coverage in. This type of insurance typically costs less as well since these types of cars are generally not driven as much.

- Pay-As-You-Drive or Usage-Based Insurance–With this type of coverage the insurance provider provides you with some type of onboard device and then takes into account your speed, distance traveled, and other such factors and issues discounts based on that information.

The type of car you drive or how and when you drive are not the only things that can determine the type of coverage you may need or the price that you will pay for it. Keep reading to find out more.

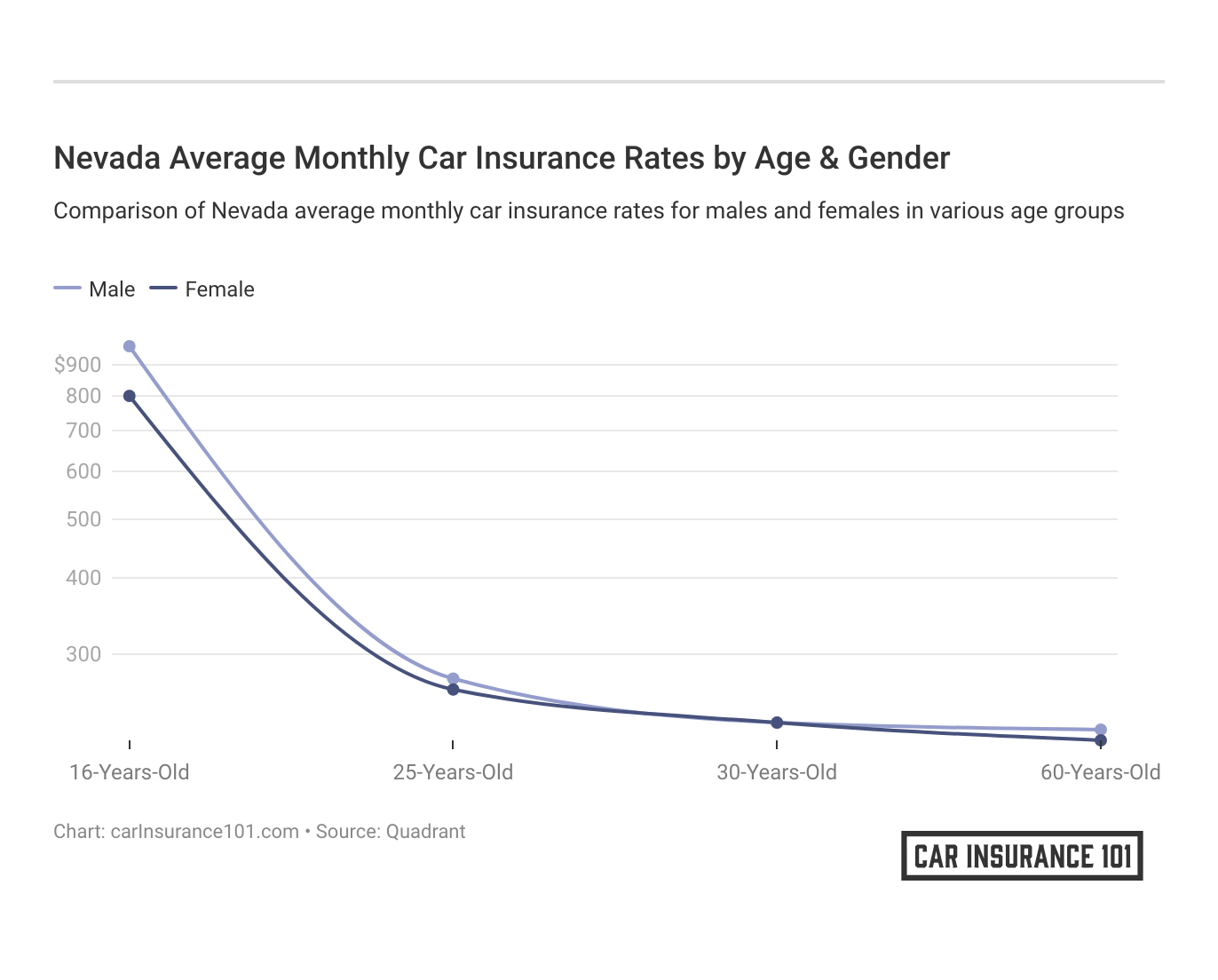

Average Monthly Car Insurance Rates by Age & Gender in NV

Consumer Federation of America conducted an interesting study in 2017 which revealed that:

Twice as many Americans think men pay higher premiums than think women pay more.

CFA’s study didn’t just reveal this common misconception; it also debunked the very idea by asserting that:

Testing found that women paid higher premiums more often than men, sometimes by significant amounts.

While seven states have placed an outright ban on the use of gender as a factor that car insurance companies can use to set your rate, Nevada is not among them.

Take a look at how just being who you are can result in significant price differences when it comes to purchasing your car insurance policy.

| COMPANY | MARRIED 35-YEAR OLD FEMALE | MARRIED 35-YEAR OLD MALE | MARRIED 60-YEAR OLD FEMALE | MARRIED 60-YEAR OLD MALE | SINGLE 17-YEAR OLD FEMALE | SINGLE 17-YEAR OLD MALE | SINGLE 25-YEAR OLD FEMALE | SINGLE 25-YEAR OLD MALE |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,213.12 | $3,187.35 | $2,980.43 | $3,148.67 | $10,608.38 | $12,771.99 | $3,436.69 | $3,631.01 |

| American Family Mutual | $3,166.61 | $3,166.61 | $2,821.83 | $2,821.83 | $10,708.72 | $14,014.29 | $3,166.61 | $3,653.13 |

| Mid-Century Ins Co | $3,309.54 | $3,398.72 | $3,017.95 | $3,407.39 | $11,011.64 | $11,728.64 | $4,410.53 | $4,434.89 |

| Geico Cas | $2,764.87 | $2,674.83 | $2,816.04 | $2,873.57 | $6,851.05 | $6,237.15 | $2,737.80 | $2,324.96 |

| Safeco Ins Co of IL | $3,084.15 | $3,335.64 | $3,041.79 | $3,434.95 | $14,026.77 | $15,639.03 | $3,477.93 | $3,637.13 |

| Depositors Insurance | $2,362.11 | $2,414.50 | $2,152.73 | $2,282.29 | $5,805.75 | $6,979.24 | $2,808.27 | $2,994.55 |

| Progressive Direct | $2,182.18 | $1,873.41 | $1,904.77 | $1,899.44 | $9,436.38 | $10,231.11 | $2,535.15 | $2,328.90 |

| State Farm Mutual Auto | $3,496.78 | $3,496.78 | $3,171.99 | $3,171.99 | $10,846.02 | $13,863.57 | $3,917.14 | $4,378.51 |

| Travelers Home & Marine Ins Co | $2,107.82 | $2,137.13 | $2,013.94 | $2,011.37 | $11,261.00 | $18,350.69 | $2,332.62 | $2,582.53 |

| USAA | $2,044.07 | $2,007.42 | $1,960.43 | $1,948.62 | $5,313.62 | $5,987.19 | $2,576.44 | $2,740.28 |

Looking at the data reveals that 25-year-old females in the Silver State are often charged between $200 to $400 more than their male counterparts.

That’s a lot of money to lose just because of your age or gender. Your age and gender are not the only things that car insurance providers in the Silver State are looking at either.

Cheapest Rates by ZIP Code

It comes as a surprise to a lot of people to discover that they might be paying a lot more money for their car insurance policy just because they live in a particular ZIP code.

It’s true though for a variety of reasons. Some of these reasons include higher rates of vehicle theft or traffic accidents.

Knowing where your ZIP code ranks among the ones that surround your neighborhood could go a long way towards helping you determine just which type of coverage you might need and who has the best deal.

Take a look at the tables below to find out where your neighbor stands in relation to the rest of them in the Silver State.

| Most Expensive Zip Codes in Nevada | City | Average by Zip Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 89101 | LAS VEGAS | $7,486.53 | Liberty Mutual | $9,883.38 | State Farm | $9,533.35 | USAA | $3,951.95 | Geico | $4,836.05 |

| 89102 | LAS VEGAS | $7,376.44 | Liberty Mutual | $9,545.82 | Farmers | $9,480.30 | USAA | $3,962.16 | Geico | $5,120.65 |

| 89106 | LAS VEGAS | $7,374.13 | Liberty Mutual | $10,172.89 | Farmers | $9,480.30 | USAA | $3,951.95 | Geico | $4,962.07 |

| 89104 | LAS VEGAS | $7,360.29 | Liberty Mutual | $9,617.41 | State Farm | $9,503.70 | USAA | $3,951.95 | Geico | $4,808.57 |

| 89030 | NORTH LAS VEGAS | $7,347.44 | Liberty Mutual | $9,883.38 | Farmers | $9,318.62 | USAA | $3,951.95 | Geico | $4,836.05 |

| 89107 | LAS VEGAS | $7,255.06 | Liberty Mutual | $9,638.95 | Farmers | $9,480.30 | USAA | $3,892.43 | Nationwide | $4,791.34 |

| 89109 | LAS VEGAS | $7,199.02 | Farmers | $9,480.30 | Travelers | $9,297.97 | USAA | $3,876.74 | Geico | $4,846.89 |

| 89110 | LAS VEGAS | $7,189.05 | Liberty Mutual | $9,325.59 | Farmers | $9,318.62 | USAA | $3,704.95 | Geico | $4,735.03 |

| 89169 | LAS VEGAS | $7,157.12 | Farmers | $9,480.30 | Travelers | $9,297.97 | USAA | $3,876.74 | Geico | $4,960.96 |

| 89146 | LAS VEGAS | $7,073.87 | Farmers | $9,480.30 | State Farm | $8,675.02 | USAA | $3,993.24 | Geico | $5,119.94 |

| 89103 | LAS VEGAS | $7,029.98 | State Farm | $8,928.35 | Farmers | $8,690.65 | USAA | $3,962.16 | Geico | $4,977.04 |

| 89121 | LAS VEGAS | $6,944.29 | Farmers | $9,480.30 | State Farm | $9,135.53 | USAA | $3,876.74 | Geico | $4,652.70 |

| 89119 | LAS VEGAS | $6,919.52 | Liberty Mutual | $9,183.10 | State Farm | $8,931.76 | USAA | $3,876.74 | Geico | $4,652.70 |

| 89156 | LAS VEGAS | $6,903.68 | Farmers | $9,318.62 | State Farm | $8,465.05 | USAA | $3,541.66 | Geico | $4,737.88 |

| 89147 | LAS VEGAS | $6,898.71 | Farmers | $9,160.06 | State Farm | $8,392.48 | USAA | $3,895.68 | Nationwide | $4,959.82 |

| 89032 | NORTH LAS VEGAS | $6,879.48 | Farmers | $9,318.62 | State Farm | $8,675.45 | USAA | $3,813.50 | Geico | $4,190.21 |

| 89142 | LAS VEGAS | $6,870.53 | Farmers | $9,318.62 | State Farm | $9,242.92 | USAA | $3,795.37 | Geico | $4,685.71 |

| 89117 | LAS VEGAS | $6,861.27 | State Farm | $8,493.85 | Farmers | $8,485.83 | USAA | $3,993.24 | Nationwide | $4,948.36 |

| 89120 | LAS VEGAS | $6,856.41 | Farmers | $9,480.30 | State Farm | $8,609.67 | USAA | $3,876.74 | Geico | $4,635.57 |

| 89108 | LAS VEGAS | $6,830.19 | Farmers | $9,318.62 | State Farm | $9,255.16 | USAA | $3,892.43 | Geico | $4,318.70 |

| 89122 | LAS VEGAS | $6,808.18 | Farmers | $9,318.62 | State Farm | $9,035.87 | USAA | $3,918.32 | Geico | $4,691.99 |

| 89118 | LAS VEGAS | $6,803.81 | Farmers | $8,690.65 | State Farm | $8,520.80 | USAA | $3,789.24 | Nationwide | $4,978.20 |

| 89148 | LAS VEGAS | $6,782.42 | Farmers | $9,160.06 | Liberty Mutual | $8,079.21 | USAA | $3,895.68 | Nationwide | $4,809.06 |

| 89115 | LAS VEGAS | $6,731.08 | Liberty Mutual | $9,570.04 | Farmers | $9,318.62 | USAA | $2,788.04 | Geico | $4,193.14 |

| 89139 | LAS VEGAS | $6,708.63 | Farmers | $8,602.85 | State Farm | $8,087.23 | USAA | $3,789.24 | Nationwide | $4,647.53 |

The most expensive zip codes are in Las Vegas.

| Least Expensive Zip Codes in Nevada | City | Average by Zip Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 89406 | FALLON | $3,411.08 | Liberty Mutual | $4,391.57 | American Family | $4,247.71 | USAA | $2,160.12 | Nationwide | $2,572.09 |

| 89832 | OWYHEE | $3,411.87 | Liberty Mutual | $4,505.15 | State Farm | $4,254.77 | Progressive | $2,522.37 | Nationwide | $2,535.31 |

| 89445 | WINNEMUCCA | $3,413.48 | Liberty Mutual | $4,359.85 | American Family | $4,247.71 | Nationwide | $2,453.46 | Progressive | $2,521.14 |

| 89419 | LOVELOCK | $3,428.28 | Liberty Mutual | $4,386.51 | American Family | $4,247.71 | Nationwide | $2,535.31 | Progressive | $2,586.28 |

| 89835 | WELLS | $3,430.06 | Liberty Mutual | $4,682.79 | American Family | $4,060.71 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89831 | MOUNTAIN CITY | $3,431.30 | Liberty Mutual | $4,505.15 | State Farm | $4,285.73 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89834 | TUSCARORA | $3,434.38 | Liberty Mutual | $4,564.00 | State Farm | $4,285.73 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89815 | SPRING CREEK | $3,434.84 | Liberty Mutual | $4,684.24 | State Farm | $4,334.73 | USAA | $2,573.74 | Nationwide | $2,631.58 |

| 89833 | RUBY VALLEY | $3,437.66 | Liberty Mutual | $4,602.12 | State Farm | $4,285.73 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89801 | ELKO | $3,451.43 | Liberty Mutual | $4,684.24 | State Farm | $4,230.11 | USAA | $2,573.74 | Nationwide | $2,631.58 |

| 89822 | CARLIN | $3,456.73 | Liberty Mutual | $4,580.09 | State Farm | $4,123.70 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89825 | JACKPOT | $3,463.16 | Liberty Mutual | $4,578.64 | State Farm | $4,424.85 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89823 | DEETH | $3,464.11 | Liberty Mutual | $4,727.26 | State Farm | $4,285.73 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89447 | YERINGTON | $3,465.95 | Liberty Mutual | $4,439.50 | Travelers | $4,109.98 | Nationwide | $2,535.31 | USAA | $2,693.93 |

| 89427 | SCHURZ | $3,468.42 | Liberty Mutual | $4,450.28 | State Farm | $4,285.73 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89426 | PARADISE VALLEY | $3,468.91 | Liberty Mutual | $4,335.52 | State Farm | $4,285.73 | Nationwide | $2,535.31 | Progressive | $2,596.03 |

| 89828 | LAMOILLE | $3,470.27 | Liberty Mutual | $4,684.24 | State Farm | $4,285.73 | USAA | $2,573.74 | Nationwide | $2,631.58 |

| 89425 | OROVADA | $3,470.37 | Liberty Mutual | $4,379.95 | American Family | $4,247.71 | Nationwide | $2,535.31 | Progressive | $2,596.03 |

| 89820 | BATTLE MOUNTAIN | $3,471.07 | Liberty Mutual | $4,519.53 | American Family | $4,247.71 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89404 | DENIO | $3,474.95 | Liberty Mutual | $4,372.72 | State Farm | $4,285.73 | Nationwide | $2,535.31 | Progressive | $2,586.28 |

| 89418 | IMLAY | $3,487.58 | Liberty Mutual | $4,775.11 | State Farm | $4,285.73 | Nationwide | $2,535.31 | Progressive | $2,586.28 |

| 89415 | HAWTHORNE | $3,497.60 | Liberty Mutual | $4,399.49 | American Family | $4,247.71 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89430 | SMITH | $3,502.58 | Liberty Mutual | $4,439.50 | Travelers | $4,341.67 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89883 | WEST WENDOVER | $3,504.32 | Liberty Mutual | $4,682.79 | State Farm | $4,251.31 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| 89414 | GOLCONDA | $3,507.02 | Liberty Mutual | $4,460.46 | American Family | $4,247.71 | Nationwide | $2,535.31 | USAA | $2,741.06 |

Not surprisingly, the more rural a ZIP code is the cheaper the rates will be. This is because fewer people means a lower rate of incidents.

This is why car insurance rates near downtown Las Vegas are noticeably higher those which are closer to Paradise.

Your ZIP code is only part of the overall story of your car insurance rates though.

Cheapest Rates by City

The city that you love could also be costing you big bucks on car insurance. Take a look.

| Most Expensive Cities in Nevada | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Paradise | $7,017.72 | Farmers | $9,217.08 | State Farm | $8,762.37 | USAA | $3,890.98 | Geico | $4,787.65 |

| Spring Valley | $6,898.71 | Farmers | $9,160.06 | State Farm | $8,392.48 | USAA | $3,895.68 | Nationwide | $4,959.82 |

| Sunrise Manor | $6,870.53 | Farmers | $9,318.62 | State Farm | $9,242.92 | USAA | $3,795.37 | Geico | $4,685.71 |

| Las Vegas | $6,548.55 | Liberty Mutual | $8,605.19 | Farmers | $8,520.35 | USAA | $3,678.43 | Geico | $4,486.84 |

| Enterprise | $6,540.38 | Farmers | $8,822.78 | Liberty Mutual | $8,077.31 | USAA | $3,826.49 | Nationwide | $4,597.71 |

| Nellis AFB | $6,489.55 | Farmers | $9,318.62 | Liberty Mutual | $8,923.23 | USAA | $2,788.04 | Geico | $3,835.08 |

| Summerlin South | $6,310.96 | Liberty Mutual | $8,092.19 | Farmers | $7,819.91 | USAA | $3,806.38 | Nationwide | $4,362.11 |

| North Las Vegas | $6,310.63 | Liberty Mutual | $7,936.62 | Farmers | $7,926.43 | USAA | $3,417.33 | Geico | $4,325.54 |

| Henderson | $5,803.78 | Liberty Mutual | $7,445.46 | Farmers | $7,189.41 | USAA | $3,635.37 | Geico | $4,139.28 |

| Blue Diamond | $5,596.93 | Liberty Mutual | $8,446.02 | Allstate | $7,347.57 | USAA | $3,106.95 | Geico | $3,477.01 |

As you can see, Las Vegas rates are way more expensive than the rates paid by residents of Fallon.

| Least Expensive Cities in Nevada | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Fallon | $3,411.08 | Liberty Mutual | $4,391.57 | American Family | $4,247.71 | USAA | $2,160.12 | Nationwide | $2,572.09 |

| Owyhee | $3,411.87 | Liberty Mutual | $4,505.15 | State Farm | $4,254.77 | Progressive | $2,522.37 | Nationwide | $2,535.31 |

| Winnemucca | $3,413.48 | Liberty Mutual | $4,359.85 | American Family | $4,247.71 | Nationwide | $2,453.46 | Progressive | $2,521.14 |

| Lovelock | $3,428.28 | Liberty Mutual | $4,386.51 | American Family | $4,247.71 | Nationwide | $2,535.31 | Progressive | $2,586.28 |

| Wells | $3,430.06 | Liberty Mutual | $4,682.79 | American Family | $4,060.71 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| Mountain City | $3,431.30 | Liberty Mutual | $4,505.15 | State Farm | $4,285.73 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| Tuscarora | $3,434.38 | Liberty Mutual | $4,564.00 | State Farm | $4,285.73 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| Spring Creek | $3,434.84 | Liberty Mutual | $4,684.24 | State Farm | $4,334.73 | USAA | $2,573.74 | Nationwide | $2,631.58 |

| Ruby Valley | $3,437.66 | Liberty Mutual | $4,602.12 | State Farm | $4,285.73 | Nationwide | $2,535.31 | USAA | $2,573.74 |

| Elko | $3,451.43 | Liberty Mutual | $4,684.24 | State Farm | $4,230.11 | USAA | $2,573.74 | Nationwide | $2,631.58 |

Once again this price difference has a lot to do with population density and the way that incidents’ rates rise or fall as a result.

More incidents result in more insurance claims which force car insurance companies in high-incident areas to raise their prices to cover the costs.

[360_quote-_box]

How Much Car Insurance Rates in Nevada

Compare and contrast the fluctuating car insurance rates across various cities in Nevada, from the tranquil landscapes of Battle Mountain to the bustling streets of Las Vegas.

| Find Affordable Car Insurance Rates in Nevada | |

|---|---|

| Battle Mountain, NV | North Las Vegas, NV |

| Henderson, NV | Reno, NV |

| Las Vegas, NV | Sparks, NV |

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Nevada Car Insurance Companies

Now that you have an idea about some of the factors that car insurance use to set your rates you are probably wondering just which companies in your area are the best.

Being the best isn’t just about having the lowest prices as you have probably figured out by looking at the loss ratios above.

So how do you know who are the best car insurance providers in your area? You should start by looking at their financial ratings. Keep reading to find out why.

The Largest Companies Financial Ratings

Looking at a car insurance company’s financial health can give you some indication about their ability to pay out any claim that you might need to file.

One of the best ways to see how financially sound a company is would be to consider how they rank according to AM Best because AM Best is one of the only worldwide credit agencies to have its eye solely on the insurance industry.

This singular focus is why AM Best is used by the National Association of Insurance Commionsers to determine a car insurance company’s overall health and viability in the car insurance market.

Take a look at how AM Best has rated the ten largest car insurance providers in the Silver State.

| BEST RATED COMPANIES | RATING | OUTLOOK |

|---|---|---|

| State Farm Group | A++ | Stable |

| Geico | A++ | Stable |

| Progressive Group | A+ | Stable |

| Allstate Insurance Group | A+ | Stable |

| Farmers Insurance Group | A | Stable |

| USAA Group | A++ | Stable |

| Liberty Mutual Group | A | Stable |

| CSAA Insurance Group | A | Stable |

| American Family Insurance Group | A | Stable |

| Hartford Fire & Casualty Group | A+ | Stable |

Companies with an A++ rating from AM Best have a more stable outlook for their future. This stability for them translates into consumer confidence for you because you can trust that the company that you choose won’t go bankrupt.

When you choose a company with a strong financial future you are also choosing one who is more likely to pay out your claim should you ever need to file one.

Companies with Best Ratings

AM Best is just one of a select few companies which are looking out for you when it comes to determining who the best car insurance providers in your area are.

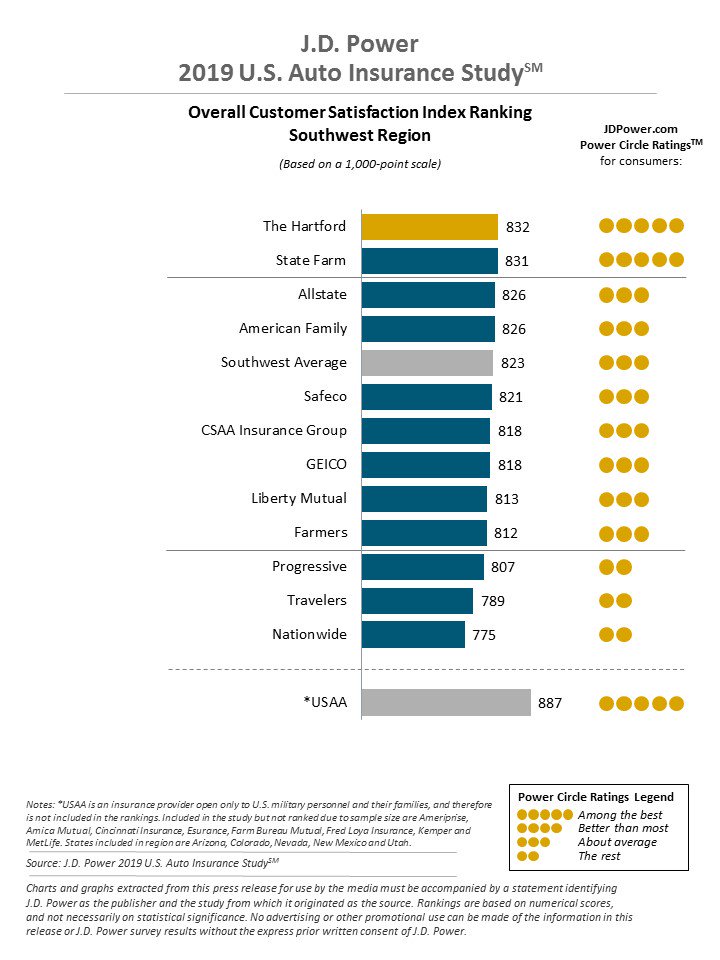

Another trusted agency is JD Power who conducted a study in 2018 which revealed that customer satisfaction with the car insurance market overall was at an all-time high.

Anyone who has bought car insurance in the Silver State recently knows that the experience is not always a pleasant one though.

That is why we are here to help. Making sure that your car insurance shopping experience is as smooth as it can be is as simple as scrolling down.

Companies with Most Complaints in Nevada

If you know which companies that customers complain about the most it can really help you lower your frustration level down the road.

This starts by understanding what the complaint ratio is and how it applies to each company that you are considering doing business with.

As a consumer, the complaint ratio tells you just where the providers in your area stand in relation to their competitors when it comes to the number of complaints filed against them.

The baseline for the complaint ratio is 1.0. This means that a company with a complaint ratio of 1.0 has an average number of complaints.

The higher the complaint ratio the higher the number of complaints lodged against the company then.

Below is a list of the best car insurance companies in Nevada along with their complaint ratios so that you can see how each one compares.

| COMPANY | DIRECT PREMIUMS WRITTEN | COMPLAINT RATIO | LOSS RATIO | MARKET SHARE |

|---|---|---|---|---|

| State Farm Group | $451,330 | 0.44 | 80.27% | 19.06% |

| Geico | $333,584 | 0.68 | 80.44% | 14.09% |

| Progressive Group | $236,952 | 0.75 | 64.05% | 10.01% |

| Allstate Insurance Group | $214,394 | 0.50 | 59.62% | 9.05% |

| Farmers Insurance Group | $207,969 | 0.59 | 63.14% | 8.78% |

| USAA Group | $140,660 | 0.74 | 79.65% | 5.94% |

| Liberty Mutual Group | $128,200 | 5.95 | 80.86% | 5.41% |

| CSAA Insurance Group | $117,964 | 3.97 | 66.05% | 4.98% |

| American Family Insurance Group | $69,913 | 0.79 | 74.88% | 2.95% |

| Hartford Fire & Casualty Group | $53,168 | 4.68 | 79.29% | 2.24% |

There is a lot more that goes into the complaint ratio than just how many consumer complaints have been lodged against a company.

When looking at the complaint ratio you also need to consider the size of the market share that a company has in relation.

For example, Liberty Mutual has a high complaint ratio but it also has a smaller share of the market.

This relation makes any complaints lodged against Liberty Mutual seem huge in comparison to a company like State Farm who can spread out their complaints across a larger customer base.

If you ever need to file a complaint against your car insurance provider in the Silver State you can do so by contacting the Nevada Division of Insurance:

Now that you know what the loss ratio and complaint ratio mean to you it is time to start comparing the rates.

Cheapest Car Insurance Companies in Nevada

Most savvy shoppers know that when looking for a good deal it pays to arrange your search prices from low to high.

These same shoppers also understand that this is only part of how you get a good deal.

As a smart shopper, you will want to purchase a product that will provide the most return on your investment. Shopping for car insurance is no different.

The table below can help get you started with this process by providing you with the top 10 cheapest car insurance providers in the Silver State.

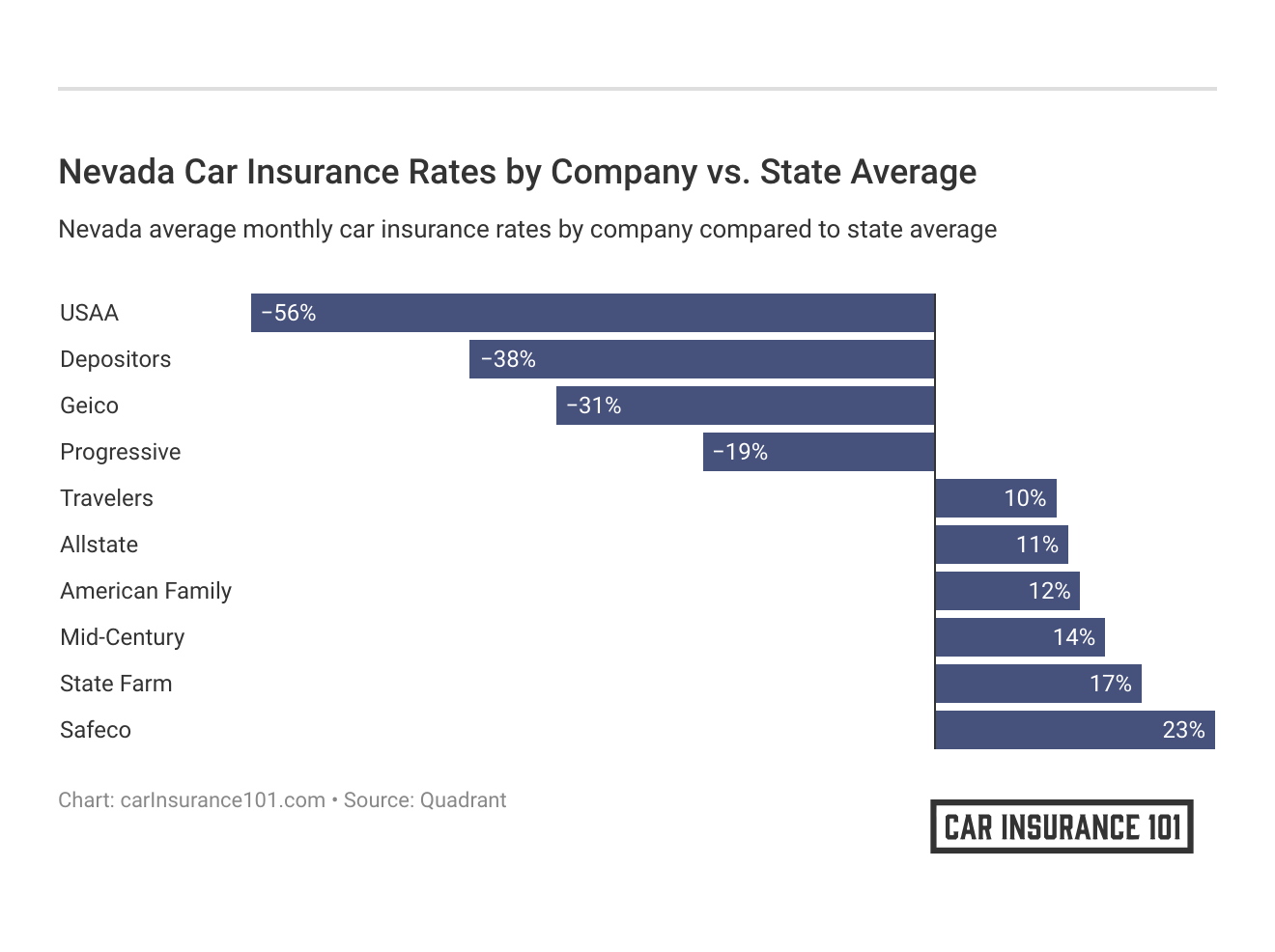

| COMPANY | AVERAGE | +/- COMPARED TO STATE AVERAGE (Rate) | +/- COMPARED TO STATE AVERAGE (%) |

|---|---|---|---|

| Allstate F&C | $5,372.21 | $571.17 | 10.63% |

| American Family Mutual | $5,439.95 | $638.92 | 11.74% |

| Mid-Century Ins Co | $5,589.91 | $788.87 | 14.11% |

| Geico Cas | $3,660.03 | -$1,141.00 | -31.17% |

| Safeco Ins Co of IL | $6,209.68 | $1,408.64 | 22.68% |

| Depositors Insurance | $3,474.93 | -$1,326.10 | -38.16% |

| Progressive Direct | $4,048.92 | -$752.12 | -18.58% |

| State Farm Mutual Auto | $5,792.85 | $991.81 | 17.12% |

| Travelers Home & Marine Ins Co | $5,349.64 | $548.60 | 10.25% |

| USAA | $3,072.26 | -$1,728.78 | -56.27% |

Cheap doesn’t mean best remember? As you look at the average prices for each of these providers you should also consider their complaint ratios, market share, and loss ratios in order to get a fuller picture of the company that you will be trusting with your safety and security while you are out on the road.

Commute Rate by Companies

As you are no doubt beginning to notice, there is a lot more to shopping for a car insurance policy than getting the lowest price.

As you look around at what each company has to offer you should also consider how far you commute each day.

The reality is that your rates could shift up or down by over $2,000 in some cases just by choosing the wrong company or driving a few extra miles. Take a look.

| COMPANY | 10 MILES COMMUTE. 6000 ANNUAL MILEAGE. | 25 MILES COMMUTE. 12000 ANNUAL MILEAGE. |

|---|---|---|

| Allstate | $5,372.21 | $5,372.21 |

| American Family | $5,365.30 | $5,514.60 |

| Farmers | $5,589.91 | $5,589.91 |

| Geico | $3,595.74 | $3,724.32 |

| Liberty Mutual | $6,209.68 | $6,209.68 |

| Nationwide | $3,474.93 | $3,474.93 |

| Progressive | $4,048.92 | $4,048.92 |

| State Farm | $5,620.99 | $5,964.71 |

| Travelers | $5,349.64 | $5,349.64 |

| USAA | $3,031.47 | $3,113.04 |

If you have a long commute each day then choosing a company like USAA could be right for you. If your commute is shorter though then a larger company like Nationwide might be better because it might offer a better loss ratio or lower complaints ratio.

Coverage Level Rate by Companies

Like any other purchase, the more car insurance coverage that you purchase the higher that your rates might be. Take a look at how much purchasing extra amounts of coverage might cost you in the Silver State.

| COMPANY | LOW COVERAGE | MEDIUM COVERAGE | HIGH COVERAGE |

|---|---|---|---|

| Allstate | $4,661.25 | $5,459.03 | $5,996.34 |

| American Family | $5,164.99 | $5,761.62 | $5,393.25 |

| Farmers | $5,020.70 | $5,520.67 | $6,228.36 |

| Geico | $3,252.50 | $3,569.08 | $4,158.52 |

| Liberty Mutual | $5,637.73 | $6,130.66 | $6,860.63 |

| Nationwide | $3,396.47 | $3,472.59 | $3,555.75 |

| Progressive | $3,507.46 | $3,891.68 | $4,747.61 |

| State Farm | $5,272.40 | $5,770.83 | $6,335.31 |

| Travelers | $4,810.46 | $5,367.41 | $5,871.04 |

| USAA | $2,723.24 | $3,040.54 | $3,452.99 |

Paying for more coverage could come in handy if you are ever struck by an uninsured or underinsured driver. Having additional coverage such as comprehensive could also be worth the money if your car is ever stolen or damaged by a weather event.

Of course, there are times when less coverage is also a good idea such as in the case of owning an older car with a lot of miles on it.

In this instance, a fender bender could result in a total loss which all the additional coverage in the world can’t really do to much about.

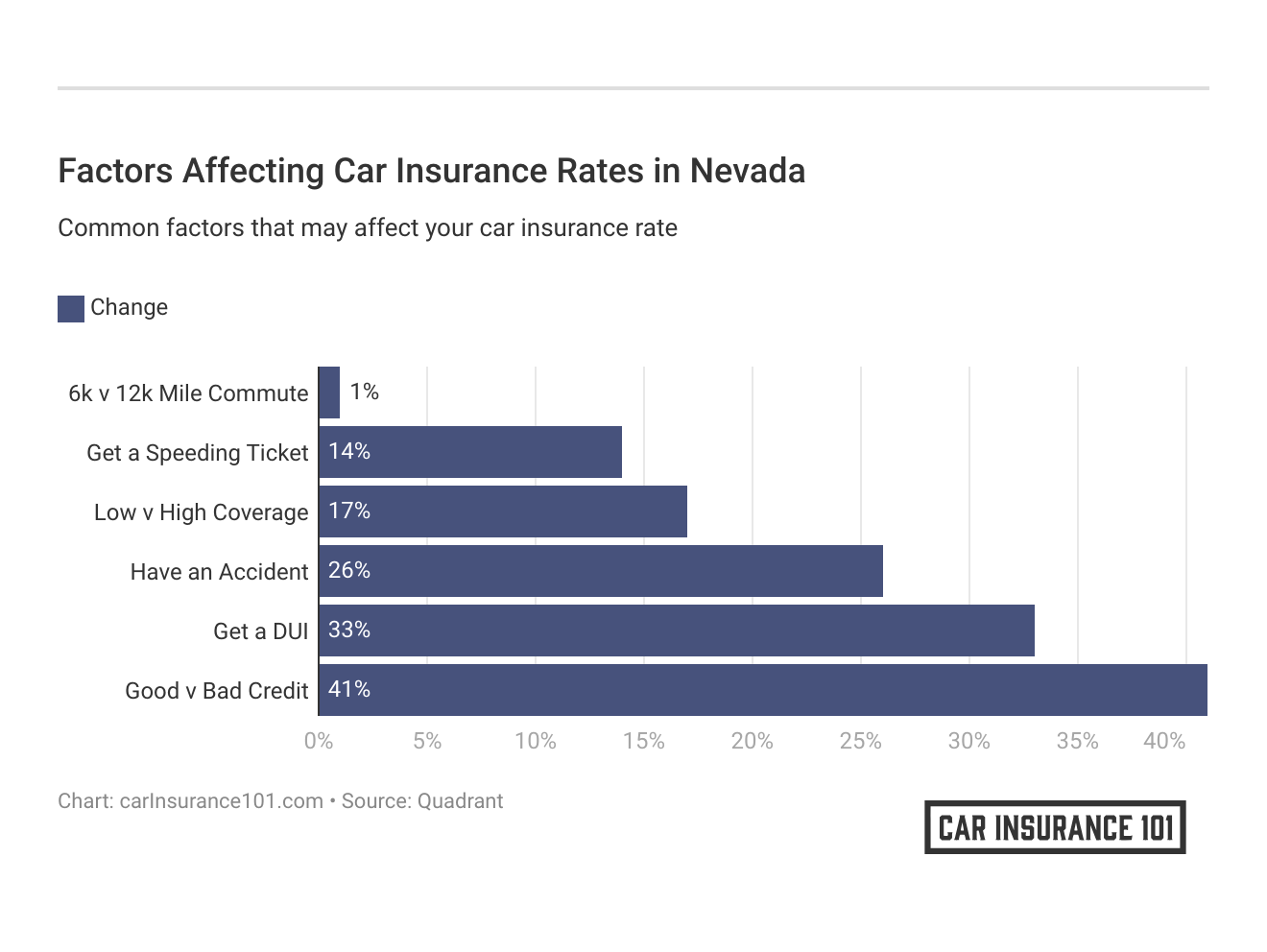

Credit History Rates by Companies

Just like your age, gender, and commute rate, your credit history also becomes a point of consideration by car insurance providers as they set your rates.

According to a 2015 article released by Consumer Reports, car insurance companies use your credit report to predict the odds that you might file a claim.

This could end up costing you a good deal of money on your car insurance purchase. Take a look.

| COMPANY | GOOD CREDIT | FAIR CREDIT | POOR CREDIT |

|---|---|---|---|

| Allstate | $4,203.10 | $4,948.32 | $6,965.19 |

| American Family | $4,447.03 | $5,149.36 | $6,723.48 |

| Farmers | $4,947.61 | $5,259.25 | $6,562.87 |

| Geico | $2,906.32 | $3,660.03 | $4,413.75 |

| Liberty Mutual | $4,254.31 | $5,442.36 | $8,932.36 |

| Nationwide | $2,935.04 | $3,385.24 | $4,104.51 |

| Progressive | $3,721.17 | $3,982.49 | $4,443.10 |

| State Farm | $2,650.28 | $4,161.60 | $10,566.65 |

| Travelers | $4,952.60 | $5,245.45 | $5,850.87 |

| USAA | $2,169.22 | $2,650.41 | $4,397.10 |

Consumer Reports asserted that:

Single drivers who had merely good scores paid $68 to $526 more per year, on average, than similar drivers with the best scores, depending on the state they called home.

Keeping an eye on your credit score could help you prevent this from happening.

Making sure that your driving record is accurate and free from errors can also help save you some money.

Driving Record Rates by Companies

What you do behind the wheel in the Silver State could cost or save you a lot of money depending on the action.

| COMPANY | CLEAN RECORD | WITH 1 SPEEDING VIOLATION | WITH 1 DUI | WITH 1 ACCIDENT |

|---|---|---|---|---|

| Allstate | $4,551.49 | $5,142.85 | $6,436.49 | $5,357.99 |

| American Family | $4,374.55 | $4,801.28 | $6,522.19 | $6,061.79 |

| Farmers | $4,654.50 | $5,599.97 | $6,162.80 | $5,942.38 |

| Geico | $2,524.40 | $3,104.75 | $4,929.65 | $4,081.33 |

| Liberty Mutual | $4,533.69 | $5,751.46 | $7,295.91 | $7,257.65 |

| Nationwide | $2,788.60 | $3,048.57 | $4,476.45 | $3,586.11 |

| Progressive | $3,373.82 | $3,929.54 | $4,249.70 | $4,642.62 |

| State Farm | $5,262.04 | $5,792.84 | $5,792.84 | $6,323.66 |

| Travelers | $3,826.30 | $4,604.96 | $7,262.46 | $5,704.83 |

| USAA | $2,342.56 | $2,646.40 | $4,348.40 | $2,951.67 |

Looking at the data above reveals how having just one accident can cost you as much as $2,500 if you have the wrong insurance company at the time.

Speeding and DUIs can also end up costing you more than just money so you should always drive defensively and designate a driver.

If you would like to check the accuracy of your driving record in the Silver State you can visit the NVDMV website and request a copy.

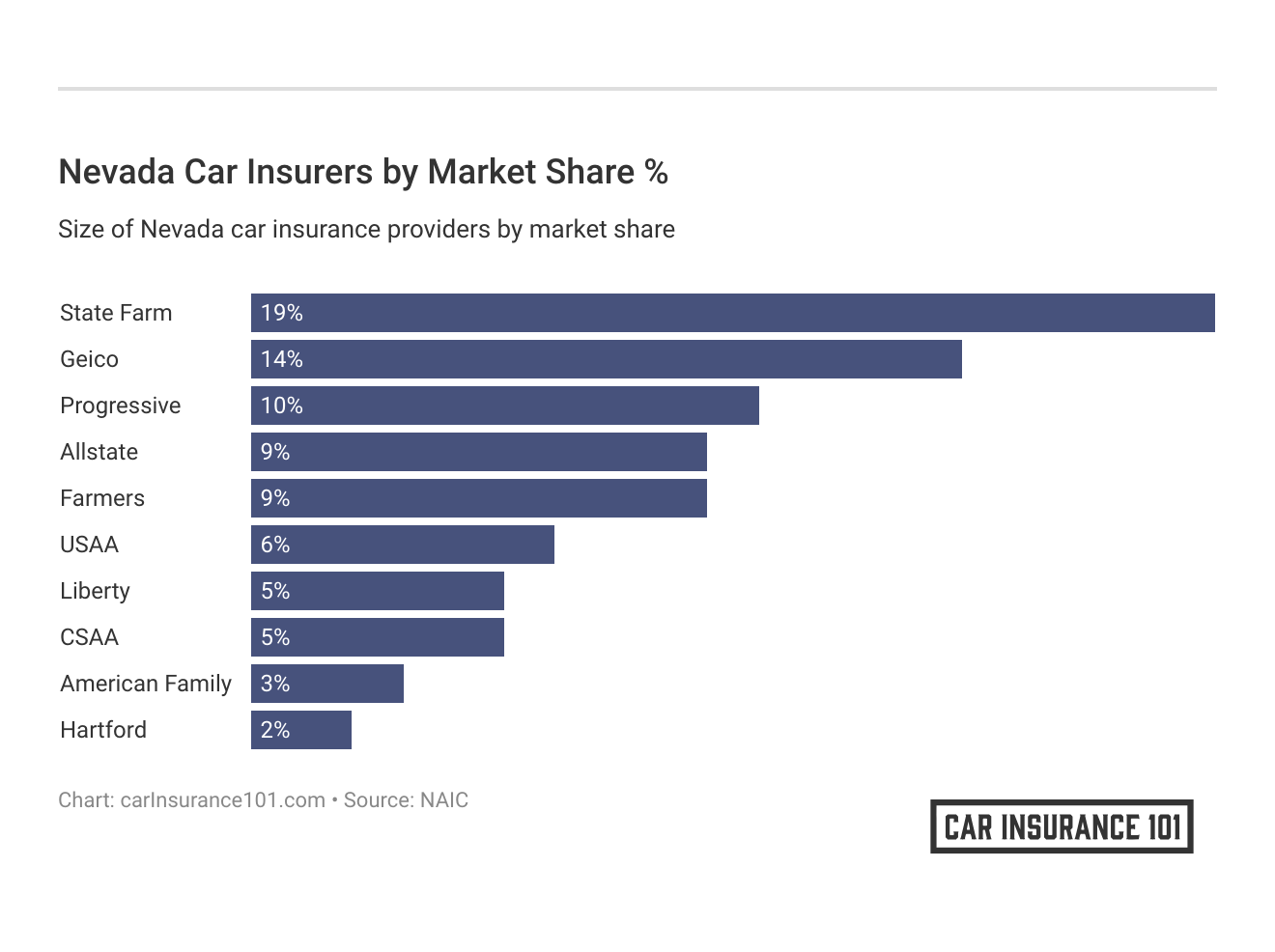

Largest Car Insurance Companies in Nevada

We’ve talked a little about how the market share interacts with the loss ratio and complaint ratio, and about how understanding all of these interactions could help save you money on car insurance.

The Market share doesn’t just determine how likely a company might be to payout after a claim has been filed or how many complaints might be one too many given a company’s size.

The market share is also a good predictor of a car insurance company’s growth and stability which can help you determine whether your rates might go up or down based on your provider’s overhead costs.

Take a look at how the largest companies in your area compare to one another.

| COMPANY | DIRECT PREMIUMS WRITTEN | MARKET SHARE |

|---|---|---|

| State Farm Group | $451,330 | 19.06% |

| Geico | $333,584 | 14.09% |

| Progressive Group | $236,952 | 10.01% |

| Allstate Insurance Group | $214,394 | 9.05% |

| Farmers Insurance Group | $207,969 | 8.78% |

| USAA Group | $140,660 | 5.94% |

| Liberty Mutual Group | $128,200 | 5.41% |

| CSAA Insurance Group | $117,964 | 4.98% |

| American Family Insurance Group | $69,913 | 2.95% |

| Hartford Fire & Casualty Group | $53,168 | 2.24% |

As you can see, State Farm holds the largest portion of the market share. You shouldn’t dismiss a company like USAA though just because it is smaller.

USAA offers a wealth of benefits to its client that might not be available to customers of larger companies, and give that USAA caters only to military members, veterans, and their families you should expect their market share to be small.

Number of Insurers in Nevada

There are nine domestic car insurance providers in the Silver State and 873 foreign ones. This means that you have 882 providers to choose from as you shop around for the best price.

What’s the difference you ask? Take a look.

- Domestic insurer means that the insurer is one which has been formed under the laws of the State of Nevada.

- Foreign insurer means that the insurer is one which has been formed under the laws of any state, district, territory, or commonwealth of the United States other than the State of Nevada.

Both foreign and domestic car insurance providers must follow the same laws that govern car insurance in the Silver State,

The choice comes down to which one you feel most comfortable doing business with then rather than who is better.

Nevada State Laws

Figuring out which laws apply to what after a car accident can be a confusing and frustrating endeavor.

Having a general understanding of what these laws are before you find yourself involved in a traffic incident can go a long way towards lowering your anxiety though.

This is where we come in. We are here to help you make sense of the laws that govern both driving and car insurance in the Silver State.

Keep scrolling to find out all of the basic information you need to help you keep your rates down and your family safe while on the road in Nevada.

Car Insurance Laws

While some of the car insurance laws in Nevada are as unique as the culture others are pretty typical.

Understanding things like what an SR-22 is, where you can get high-risk insurance, or what the laws that govern car insurance and traffic safety are can help you be a better driver and save money in the process.

Keep scrolling to find out how.

How State Laws for Insurance are Determined

The laws that govern car insurance and traffic safety in the Silver State start out in much the same way as all laws do: as bills introduced to the state legislature.

Once a bill has been introduced it is then sent to a committee to be debated and studied.

If the bill is determined to be in the public interest it is sent to the floor for a vote. If it carries the majority then that bill becomes a law.

This is how Nevada became an at-fault (or tort) state which means that:

The person who was at fault for causing the car accident is also responsible for any resulting harm (from a practical standpoint, the at-fault driver’s insurance carrier will absorb these losses, up to policy limits).

If you have suffered an injury or property damage as a result of a car accident that was due to someone else’s negligence you have three main options:

- You can file a claim with your own car insurance provider so long as the injuries/damages are something that would be covered by your policy.

- You can file a third-party claim against the other person’s car insurance policy

- Or you can file a lawsuit in civil court against the at-fault driver.

If you wish to file a claim or a lawsuit you should keep in mind that liability coverage only covers any damages or injuries that you might inflict on another person. It will not cover your own injuries or damages.

Windshield Coverage

One of the most frequently misunderstood claims to file on your car insurance policy often involves repairing or replacing your windshield.

Most people think that this is automatically covered by their full coverage policy but, like so many other things having to do with car insurance claims, the circumstances surrounding the damage determine the viability of the claim.

In the State of Nevada, your insurer may not require the use of a specific repair shop but you might end up paying the difference if you choose a specific one yourself as well.

Before you decide whether or not to repair your windshield it might be helpful to know that, according to Your Mechanic:

- All vehicles are required to have windshields in order to be driven in Nevada roadways.

- Working windshield wipers are also required on all vehicles except motorcycles and mopeds.

- The wipers must be capable of efficiently removing rain, snow and other moisture from the driver’s field of vision.

- And safety glazing material is required for the windshield and other windows.

If you do file a claim to have your windshield repaired and it is paid out you should also be aware that it could impact your car insurance rates.

You shouldn’t let the risk of raising your car insurance rates deter you from making the necessary repairs to your windshield to keep your file of view clear and you safer behind the wheel though.

High-Risk Insurance

Filing too many claims, having too many tickets or accidents, and getting a DUI can all land you in the high-risk pool for car insurance.

Once there it can become increasingly difficult to find a car insurance provider who is willing to take a risk in you.

If you live in Nevada though you can always opt into the Nevada Automobile Insurance Plan – NV AIP.

If you get a DUI in the Silver State you may also be required to obtain SR-22 insurance.

The NVDMV notes that:

“SR-22 Insurance” is a Certificate of Financial Responsibility that your insurance company will file with the DMV.

If you drop your coverage with an SR-22 then your car insurance company will notify the State of Nevada immediately.

Penalties for failure to maintain insurance under the SR-22 requirement can also include a driver’s license suspension.

Low-Cost Insurance

While many states have a low-cost auto insurance plan to help people with low incomes be able to afford their car insurance policies Nevada is not among them.

This is unfortunate since many low-income individuals also suffer from low credit scores that can hike their car insurance rates even if they are good drivers.

You overcome this financial difficulty in the Silver State though by asking for discounts from your car insurance provider.

There are discounts for just about anything you can imagine when it comes to purchasing car insurance. Some of the most popular ones include:

- Safe Driver Discounts

- Low Mileage DIscounts

- Good Studnet DIscounts

- and Multi-Car Discounts.

If you own your home you could also save a few dollars by bundling your home and auto insurance plans.

Automobile Insurance Fraud in Nevada

We all want to save money; especially on car insurance. This becomes increasingly harder though as the costs due to fraudulent insurance claims force prices upward.

Automobile fraud is a serious problem in the Silver State.

In fact, according to the Nevada Attorney General’s Office:

A recent study by Conning & Co. estimated that fraud cost the private insurance industry $96 billion dollars annually.

If you think that automobile insurance fraud is a victimless crime then you should think again.

All money lost by car insurance companies as a result of fraudulent claims is recouped by these insurance providers through rate increases inflicted on the rest of their customers.

In order to protect its citizens from high car insurance costs, the State of Nevada has severe punishments for those who submit false claims.

Some of the penalties for committing insurance fraud in the Silver State are:

- Up to four years in prison

- A requirement to pay restitution to the insurance company defrauded

- A court order to pay the Nevada law offices for the cost of their investigation and prosecution

- And you may be ordered to pay up to $5,000.00 in fines

You should be aware that insurance companies are required by the law to report suspicious insurance claims in the Silver State.

Private citizens in Nevada can also report suspicious claims by submitting a complaint form online or by calling the National Insurance Crime Bureau at (800) 835-6422.

Statute of Limitations

If you are ever in a car accident you have a limited amount of time to file your car insurance claim in order to ensure the possibility of being reimbursed for your injuries of damages.

This time frame is called a statute of limitations and in Nevada, this window of opportunity is as follows:

- Two years from the date of the accident for bodily injury

- Two years from the date of a person’s death in the event of a wrongful death suit

- And three years for property damage claims

Nevada is also a modified comparative negligence state which means that you can be recover damages if you are involved in a lawsuit related to a car accident.

Keep in mind though that those damages might be reduced according to how much of the negligence that caused the accident is deemed to be your fault.

Nevada Specific Laws

The minimum state requirements for car insurance are not the only thing that changed in July of 2018.

The Silver State also passed a law that protects pets against the heat in a locked car.

According to this new law:

Law enforcement, animal control, and other public safety workers are now allowed to use reasonable means to remove pets left unattended in vehicles in extreme weather conditions without fear of civil liability.

Drivers who drive to slow in the fast lane and impede traffic flow can also be ticked for it under the law in Nevada.

The Silver State also came in line with most of the country with its institution of the Move Over law that became effective July 1, 2018.

Vehicle Licensing Laws

If you intend to register a vehicle in the State of Nevada you must first obtain car insurance. You must then present Evidence of Insurance to the NVDMV.

This is a requirement for all registrations regardless of whether you purchased your vehicle from an in or out-of-state dealer, a private citizen, you are registering a vehicle for the first time, or you are a new resident.

The Silver State also requires that you present a Nevada Emissions Vehicle Inspection Report no matter where you obtained your vehicle from.

Some of the other things that may be required include:

- A bill of sale

- A current odometer reading

- A Manufacturer’s Certificate of Origin

- A VIN inspection

- And an Application for Vehicle Registration

The basic registration fee for a passenger car is $33.

Real ID

The Silver State has been issuing federally approved Real Ids since the passage or the Real ID Act in 2005.

As of October 1, 2020, if you want to be able to board a commercial aircraft for either a domestic or international flight you will need a Real ID.

You can tell if your Nevada driver’s license is Real ID compliant by looking for the gold circle and star cutout in the upper right corner.

In order to obtain a Real ID you must present the following forms to the NVDMV:

- One document that is proof of identity AND

- Proof of all name change(s) if applicable AND

- Proof of Social Security number AND

- Two documents that prove your Nevada residential address AND

- An Application for Driving Privileges or ID Card

Some acceptable proofs of identity for U.S. citizens who wish to obtain a Real ID include:

- A U.S. state-issued birth certificate

- A Valid ID or driver’s license from another state

- A valid or unexpired United State Passport or United States Passport Card

If you are not a U.S. citizen and you want to get your Real ID acceptable proof of identity includes:

- A Consular Report of Birth Abroad

- A Certificate of Naturalization

- A Certificate of Citizenship

- A Permanent Resident Card that is not expired

- A Valid, unexpired foreign passport with an I-94 stamped “Processed for I-551.”

- An Unexpired Employment Authorization Card

- A Valid, unexpired Foreign Passport with an unexpired U.S. Visa and an I-94 form

In order to prove a legal name change you can present:

- A marriage certificate

- A divorce decree

- Adoption records

- Or a court order

For more in-depth information on Real ID in the State in Nevada, you can visit the NVDMV Real ID website.

Penalties for Driving Without Insurance

Because Nevada has a compulsory insurance mandate there are penalties for lapses in coverage and/or driving without car insurance coverage.

These penalties come in a tiered system of fees and fines which are based on the length of time that coverage lapsed. Take a look.

| LENGTH OF LAPSE | 1-30 DAYS | 31-90 DAYS | 91-180 DAYS | 181 DAY OR MORE |

|---|---|---|---|---|

| FIRST OFFENSE | ||||

| Reinstatement Fee (Technology Fee Included) | $251 | $251 | $251 | $251 |

| Fine | $250 | $500 | $1,000 | |

| SR-22 Insurance | Yes | Yes | ||

| Totals | $251 | $501 | $751 | $1,251 |

| SECOND OFFENSE (Within Five Years) | ||||

| Reinstatement Fee (Technology Fee Included) | $501 | $501 | $501 | $501 |

| Fine | $500 | $500 | $1,000 | |

| SR-22 Insurance | Yes | Yes | ||

| Totals | $501 | $1,001 | $1,001 | $1,501 |

| THIRD OFFENSE (Within Five Years) | ||||

| Reinstatement Fee (Technology Fee Included) | $751 | $751 | $751 | $751 |

| Fine | $500 | $750 | $1,000 | |

| SR-22 Insurance | Yes | Yes | Yes | Yes |

| Driver License Suspension | Min. 30 days | Min. 30 days | Min. 30 days | Min. 30 days |

| TOTALS | $751 | $1,251 | $1,501 | $1,751 |

As you can see, the fines and penalties get more expensive with each offense and increase in the length of the lapse in coverage.

You can save yourself a lot of trouble though by simply purchasing a car insurance policy which includes at least what the state requires.

Teen Drivers

The State of Nevada also uses a multi-stage licensing process for teen drivers.

This system allows teenagers to gain driving experience over time rather than just handing them the keys and a full license and letting them hit the open road.

There are three stages of the graduated licensing program for teens:

- Learner’s Permit-You must be 15.5 years old, have proof of residency, pass the vision and the written test, and have your parent/guardian sign the financial responsibility section of your application.

- Minor License-You must be 16 years old, have had your learner’s permit for at least six months without incident, and pass a road test. You must also submit your driving log which demonstrates that you have completed the required hours.

- Full License-You must be at least 18 years old and have no court-ordered restrictions, suspensions, or revocations.

While in possession of your Learner’s Permit you must complete a drover’s education program with a public or private high school and log the required road hours before you can move onto the Minor License stage.

The Minor License stage also does not allow teen drivers to operate a motor vehicle between the hours of 10 pm to 5 am unless traveling to or from a scheduled event like work or a school event.

Older Drivers License Renewal Process

If you are planning on spending your Golden Years in the Silver State then you will need to know how to renew your driver’s license there.

If you are 65 years old or older this means going down to your local NVDMV office every four years.

You will also be required to take a vision test every time that you are seeking a renewal (or at the discretion of the DMV office).

Your medical history could also hamper your ability to renew driver’s licenses in the State of Nevada so be aware.

The NVDMV might also consider the following restrictions as necessary:

- No freeway driving

- Daylight driving only

- Restrictions on maximum allowable travel speed

- Additional right side mirrors on your vehicle

If you feel that your loved one is an unsafe driver but they are refusing to give up the keys you can always request an Unsafe Driver Investigation by completing Request for Re-Evaluation form.

This request must be notarized and/or witnessed by a member of the DMV and be accompanied by a medical affidavit.

New Residents

If you have recently relocated to the Silver State and want to get a Nevada issued driver’s license you must present proof of residency to the NVDMV when applying.

You might also need:

- Proof of identity

- Proof of legal name changes

- Your Social Security number

- And two proofs of address

Foreign nationals may not be eligible for a Nevada driver’s license depending on their immigration status.

License Renewal Procedures

If you are not a teen or older driver, and you are not a new resident, then you only need to renew your driver’s license every four years in Nevada.

This four-year renewal is based on the date of your birth through which means that “current driver’s licenses expire on the 4th anniversary of the licensee’s birthday nearest the date of issuance or renewal” according to AAA.

The Silver State is in the process of transitioning to an eight-year cycle though.

You may be required to pass a vision test each time that you are up for renewal depending on your circumstance.

The NVDMV will also mail an expiration notice within 30 days of the date that your driver’s license is set to expire.

If you let your driver’s license expire you might e required to complete the entire process of issuing an initial license as well.

Negligent Operator Treatment System

Before you even think about getting into a ticket or an accident you should be aware that Nevada has a Demerit Point System to penalize drivers who break traffic laws.

Each violation has its own code and each code is assigned its own amount of points. Take a look at the points attached to some of the more common offenses.

| OFFENSE | POINTS |

|---|---|

| Reckless Driving | 8 |

| Careless Driving | 6 |

| Failure to give information or render aid at the scene of an accident | 6 |

| Following too closely | 4 |

| Failure to yield right-of-way | 4 |

| Passing a school bus when signals are flashing | 4 |

| Hand-held cellphone use or texting (2nd and subsequent offenses) | 4 |

| Disobeying a traffic signal or stop sign | 4 |

| Impeding traffic, driving too slowly | 2 |

| Failure to dim headlights | 2 |

| Speeding: | |

| 1 - 10 mph over posted limit | 1 |

| 11 - 20 mph over posted limit | 2 |

| 21 - 30 mph over posted limit | 3 |

| 31 - 40 mph over posted limit | 4 |

| 41 mph or more over posted limit | 5 |

Reckless and careless driving are some ambiguous terms. Rather than finding out how the Stet of Nevada defines them by getting a ticket for them, you should probably just drive responsibly.

Rules of the Road

No matter where you live there will always be rules of the road. Nevada is no different.

Understanding the rules and obeying them can go a long way towards helping you pay less for car insurance. Keep scrolling to find out how.

Fault Vs. No-fault

One of the most basic things that every driver should know is whether or not their state is a no-fault or at-fault state.

You already know from the sections above that Nevada is the latter.

As an at-fault state, when you file a claim it will be up to law enforcement and the car insurance experts to decide to what degree each party involved was negligent.

Once the degree of negligence is assigned a settlement is reached whereby each party becomes financially responsible for their degree of contributory negligence.

This is different than a no-fault state where each party is responsible for their own injuries and damages.

Whether you live in an at-fault state like Nevada or a no-fault state like Florida, there are certain laws that almost always cross all state lines.

Seat belt laws are one of these, but the requirements for when and where a person in a motor vehicle must buckle up vary by state law.

Seatbelt and Car Seat Laws

The seatbelt law in Nevada is not a primary enforcement law which means that you must be stopped for another infraction in order to be ticked for lack of seatbelt use.

That doesn’t mean that you shouldn’t buckle up though.

Statistics have consistently demonstrated that if you are wearing a seatbelt in a car accident your chances for injury or death are significantly lowered.

In fact, according to the CDC:

Most drivers and passengers killed in crashes are unrestrained [and] 53% of drivers and passengers killed in car crashes in 2009 were not wearing restraints.

Nevada law also requires that all vehicle occupants over the age of six be buckled in no matter where they are sitting and that any occupant that is 5 years or younger (or who weighs less than 60 lbs) be in a child safety seat.

Failure to comply with the law could result in a $500 fine.

Keep Right and Move Over Laws

As of October 1, 2019, it is required that you move over to the adjacent lane or reduce your speed when you are approaching any vehicle with flashing blue lights conducting business on the side of Nevada roadways.

The Silver State also requires slower drivers to keep right so as not to impede traffic flow.

Fender benders are also supposed to be moved to the shoulder if there are no significant injuries or damages involved and the vehicle can be moved safely.

Speed Limits

Although Nevada residents recently enjoyed a speed limit hike on the state’s highways from 75 MPH to 80 MPH it doesn’t mean that it is a speeding free for all.

In fact, it is quite the opposite according to the Las Vegas Sun which reported in February of 2019 that the Nevada Highway Patrol was cracking down.

This is just one of the ways that the Silver State is looking to keep its residents safe. Another way is through fines based on the amount of speed at which you are traveling.

According to the NVDMV:

The maximum fine for speeding is capped at $20 for each mile per hour above the speed limit or proper rate of speed.

This is not surprising given that speeding ranks among the top five reasons for traffic accidents.

Getting a speeding ticket can also raise your car insurance rates so why take the risk?

Ridesharing

Sometimes its best to just let someone else do the driving and why not considering that ridesharing is all the rage nowadays?

Ridesharing has also become a convenient way for many people to make a few extra bucks.

Whether you are riding in or driving a rideshare vehicle you will want to know about the types of car insurance that rideshare drivers in Nevada are required to have.

Major companies like Uber and Lyft offer rideshare drivers and passengers a limited amount of coverage.

If you are set on becoming a rideshare driver in Nevada though you should be aware that you must inform your car insurance provider first and purchase additional liability coverage to protect your passengers.

You should also note that who pays out in the event of an accident is entirely dependant upon who was at fault as well as whether your mobile app was on or off.

Automation on the Road

Ridesharing is not the only thing that has become wildly popular in recent days.

Autonomous vehicles and various autonomous safety features such as lane assist have also become almost commonplace on Nevada highways.

As a means for keeping its citizens safe while remaining on the cutting edge of technology, the Nevada State Legislature has passed Assembly Bill 69.

This bill has revised language that modifies out-date testing and operational requirements for manufactures.

Manufacturers and developers wishing to test their vehicles in Nevada must submit their completed “Autonomous Vehicle Testing Registry Application”.

Safety Laws

LAws mandating minimum coverage amounts for car insurance and mandatory seatbelt use are not the only ones on the books in Nevada.

The Silver State also has various safety laws regarding drunk driving and drug use which are meant to keep Nevada residents safe. Keep reading to find out more.

DUI Laws

In the State of Nevada, it is illegal to operate a motor vehicle if your blood-alcohol level is .08 percent or higher.

You can also get a DUI even if your car is not in motion and getting a DUI will definitely drive up your car insurance rates.

Penalties for DUI offenses in the State of Nevada can include jail time and fines.

Take a look.

| PENALTIES | 1st OFFENSE | 2nd OFFENSE | 3rd OFFENSE |

|---|---|---|---|

| Jail | 180-day maximum (mandatory 2 days in jail or 48 to 96 hours community service) | 180-day maximum (mandatory 2 days in jail or home confinement) | 1 to 6 years in prison |

| Fines | $400 minimum | $750 minimum or equivalent number of community service hours | $2,000 minimum |

| License Revocation | At least 185 days | 1 year | 3 years |

| Ignition Lock Device | 185 days if BAC is less than 0,18%, 1 to 3 years if BAC is 0.18% or more. | 185 days if BAC is less than 0,18% or 1 to 3 years if BAc is 0.18% or higher | 1 to 3 years |

Nevada also has an implied consent law which asserts that all drivers who are lawfully arrested for a DUI must consent to a blood, urine, or breath test.

Marijuana-Impaired Driving Laws

Although recreational use of marijuana is legal in Nevada now driving while under its effects is not.

If you get caught doing so then some of the penalties could include:

- Two days to six months in jail

- 24-96 hours of community service

- Nevada DUI School at your expense

- Fines ranging between $400 to $1,000 plus court costs

- You could face a Nevada Victim Impact Panel

- You might be subject to a 90-day drivers license suspension

- And you could be issued a stay-out-of-trouble order while the case is open

Getting a ticket or causing an accident while under the influence of marijuana can also raise your car insurance rate.

Worst of all though; driving under the influence could cost a life so don’t do it.

Distracted Driving Laws

Nevada also has several laws regarding distracted driving which are meant to keep its motorists safe on the roadways.

The Silver State defines distracted driving as activities such as:

- Using a cell phone

- Eating and drinking

- Talking to passengers

- Grooming

- Reading, including maps

- Using a PDA or navigation system

- Watching a video

- Changing the radio station, CD, or Mp3 player

Or any other activity that takes your hands off of the wheel and your eyes off of the road.

Effective October 1, 2011, The penalties for distracted driving in Nevada include:

- A $50 for your first offense in seven ears

- A $100 fine for your second offense

- A $250 fine for your third offense

These fines could also be doubled if you are found distracted driving while in a work zone.

You should also keep in mind that:

In 2009, more than 5,000 people died and almost half a million injuries occurred in the U.S. simply because people were not paying attention to the road.

No text, email, or phone conversation is worth a life.

Driving in Nevada

Driving in the Silver State is not the only way to increase your risk of property damage or vehicle loss.

Sometimes just parking in the wrong spot, driving at the wrong time of the day, or living in the wrong area can increase your chances of this.

You can protect yourself from financial ruin in the event of one of these incidents though. Keep reading to find out how.

Vehicle Theft in Nevada

Anyone who has ever had their car stolen knows just what type of headache it can be.

Owning a particular make or model can increase your chances of this headache in the Silver State as well.

| MAKE/MODEL | RANK | VEHICLE YEAR | NUMBER OF THEFTS |

|---|---|---|---|

| Honda Accord | 1 | 1996 | 1,048 |

| Honda Civic | 2 | 1998 | 1,011 |

| Chevrolet Pickup (Full Size) | 3 | 2006 | 377 |

| Ford Pickup (Full Size) | 4 | 2006 | 279 |

| Toyota Camry | 5 | 2015 | 254 |

| Nissan Maxima | 6 | 1997 | 208 |

| Nissan Altima | 7 | 1997 | 207 |

| Nissan Sentra | 8 | 2014 | 200 |

| Toyota Corolla | 9 | 2014 | 151 |

| Dodge Pickup (Full Size) | 10 | 2005 | 148 |

Even if you don’t see your make or model on the list of top ten favorites among car thieves in the Silver State you still might be vulnerable to this type of loss.

Where you live could also have a lot to do in determining the probability that your car will be stolen. Take a look.

| CITY | MOTOR VEHICLE THEFTS |

|---|---|

| Boulder City | 20 |

| Carlin | 5 |

| Elko | 59 |

| Fallon | 13 |

| Henderson | 641 |

| Las Vegas Metropolitan Police Department | 8,186 |

| Lovelock | 3 |

| Mesquite | 40 |

| North Las Vegas | 1,321 |

| Reno | 1,432 |

| Sparks | 417 |

| West Wendover | 14 |

| Winnemucca | 15 |

| Yerington | 3 |

So how do you protect yourself in the event that your prized possession becomes someone else’s temporary unlawful property?

One way is to prevent the loss in the first place by being mindful about where you park, never leaving valuables in your car where thieves can see them, and by always locking your car.

Having a theft-deterrent system can also help prevent loss and might even lower your car insurance rates. Another way to protect yourself is to invest in comprehensive car insurance coverage before the worst happens.

This type of coverage can help you recover some of your losses if your vehicle is ever stolen or vandalized.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Road Fatalities in Nevada

There are several ways to prevent the worst from happening while behind the wheel.

In fact, designating a driver, reducing your speed, and keeping both eyes on the road as well as both hands on the wheel are always the best practices.

You can also help reduce the probability of becoming a statistic by understanding the places, situations, and things that can cause the most roadway fatalities and actively working to avoid them. Keep reading to find out more.

Most Fatal Highway in Nevada

According to Geo Tab, the most dangerous stretch of roadway in the Silver State is I-80.

This stretch of interstate that traces the paths of the Truckee and Humbolt RIvers sees an average if 15 fatalities a year in car accidents.

If your daily travels take you along this route then it is a good idea to give yourself extra time and refrain from speeding or distracted driving.

Fatal Crashes by Weather Condition and Light Condition

Everyone knows that certain weather conditions or times of the day can make driving a more dangerous endeavor.

Take a look at how these things impact the state of driving in Nevada.

| WEATHER CONDITION | DAYLIGHT | DARK, BUT LIGHTED | DARK | DAWN OR DUSK | OTHER / UNKNOWN | TOTAL |

|---|---|---|---|---|---|---|

| Normal | 121 | 104 | 40 | 7 | 0 | 272 |

| Rain | 1 | 6 | 1 | 0 | 0 | 8 |

| Snow/Sleet | 3 | 0 | 1 | 0 | 0 | 4 |

| Other | 4 | 0 | 1 | 0 | 0 | 5 |

| Unknown | 0 | 0 | 1 | 0 | 0 | 1 |

| TOTAL | 129 | 110 | 44 | 7 | 0 | 290 |

As you can see, most accidents occur during daylight hours. This isn’t surprising given that more people are on the roadways during this time.

Rain, snow, dawn, and dusk can also make navigating Nevada roadways a challenge though so always give yourself enough time to get where you are going and always drive defensively.

Fatalities (All Crashes) by County

Each state has its own quirks. Each state also has its areas where driving conditions are more deadly.

Most of the time the amount of traffic fatalities is directly correlated to the number of people that live within a given area.

Take a look at where your county stands in relation to its neighbors.

| COUNTY | 2013 FATALITIES | 2014 FATALITIES | 2015 FATALITIES | 2016 FATALITIES | 2017 FATALITIES |

|---|---|---|---|---|---|

| Carson City | 5 | 5 | 2 | 7 | 4 |

| Churchill | 1 | 4 | 5 | 8 | 6 |

| Clark | 190 | 174 | 210 | 217 | 208 |

| Douglas | 6 | 3 | 7 | 5 | 11 |

| Elko | 7 | 13 | 12 | 8 | 9 |

| Esmeralda | 2 | 3 | 5 | 3 | 4 |

| Eureka | 3 | 5 | 4 | 1 | 0 |

| Humboldt | 3 | 10 | 8 | 5 | 3 |

| Lander | 0 | 3 | 5 | 3 | 2 |

| Lincoln | 5 | 3 | 4 | 1 | 0 |

| Lyon | 6 | 12 | 7 | 1 | 9 |

| Mineral | 3 | 0 | 2 | 4 | 1 |

| Nye | 11 | 12 | 11 | 6 | 9 |

| Pershing | 2 | 4 | 1 | 1 | 2 |

| Storey | 0 | 2 | 2 | 2 | 0 |

| Washoe | 19 | 38 | 37 | 50 | 39 |

| White Pine | 3 | 0 | 4 | 7 | 2 |

Home to Las Vegas, it comes as no surprise that Clark County has the most traffic fatalities overall.

You can reduce the possibility of being counted as a statistic if you live in Clark by behaving in a responsible manner behind the wheel.

Urban Vs. Rural Traffic Fatalities

The rate of fatalities in Clark County is a grim reminder that the more people there are in a given area the higher the risk is of having a deadly crash.

This idea is underscored by the data collected by the NHTSA in its crash report. Take a look.

| TRAFFIC FATALITIES | 2013 | 2014 | 2015 | 2016 | 2017 |