Iowa Car Insurance 101 (Compare Costs & Companies)

One important Iowa car insurance 101 fact is that all Iowa drivers need to maintain 20/40/15 of liability car insurance. Iowa liability insurance is cheap, with an average rate of $23/mo, but it doesn't offer much protection. Instead, Iowa drivers should have full coverage, which averages $104/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Iowa drivers must meet Iowa car insurance requirements to drive legally

- Iowa requires all drivers to carry $20/40/15 of liability car insurance

- Minimum liability car insurance in Iowa is only an average of $23 per month

Car insurance in Iowa is generally affordable due to low average rates, making it easier for drivers to get full coverage insurance at an affordable price. Our Iowa car insurance 101 guide goes over everything drivers need to know about finding the best Iowa car insurance coverage, so read on.

If you want to look for affordable car insurance in Iowa right away, enter your ZIP code in our free quote comparison box. It compares Iowa car insurance quotes from local companies to help you find the best deal.

Iowa Car Insurance Rates

You may be wondering where to start when you’re looking for the right insurance policy. There’s a lot of information out there, and it can seem overwhelming at times.

You might be wondering where to even start. You may have questions like: how much car insurance do I really need? What type of car insurance do I need? Who is the cheapest provider?

We are going to get into minimum requirements and go from there, but first, let’s take a look at Iowa’s car culture.

How much coverage is required for Iowa minimum coverage?

So, what do we mean by minimum insurance coverage requirements?

Iowa follows a traditional at-fault system.

If you are found at fault for causing an accident, you are then liable for the damages caused by an accident. This is why it’s so important to have good coverage — so that you don’t have to pay out-of-pocket.

So, what are the minimum insurance requirements for the state of Iowa?

Iowa actually does not require car insurance by law. Instead, the Hawkeye State has something called the Motor Vehicle Financial and Safety Responsibility Act, which we will get into a little in the next section.

Iowa law requires the following minimum liability coverage if your license has been either suspended or revoked:

- $20,000 for bodily injury or death of one person in an accident caused by the at-fault owner/driver of the insured vehicle

- $40,000 for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $15,000 for property damage per accident caused by the at-fault owner/driver of the insured vehicle

This is sometimes referred to as the 20/40/15 rule for liability coverage.

Iowa ranks 38th in the US for uninsured motorists, with 8.7 percent of motorists driving around uninsured at any given time. Do you really want to take that chance? If you get into an accident and are found at-fault, you will be glad to have at least the minimum required insurance.

Trust us. Your wallet will thank you.

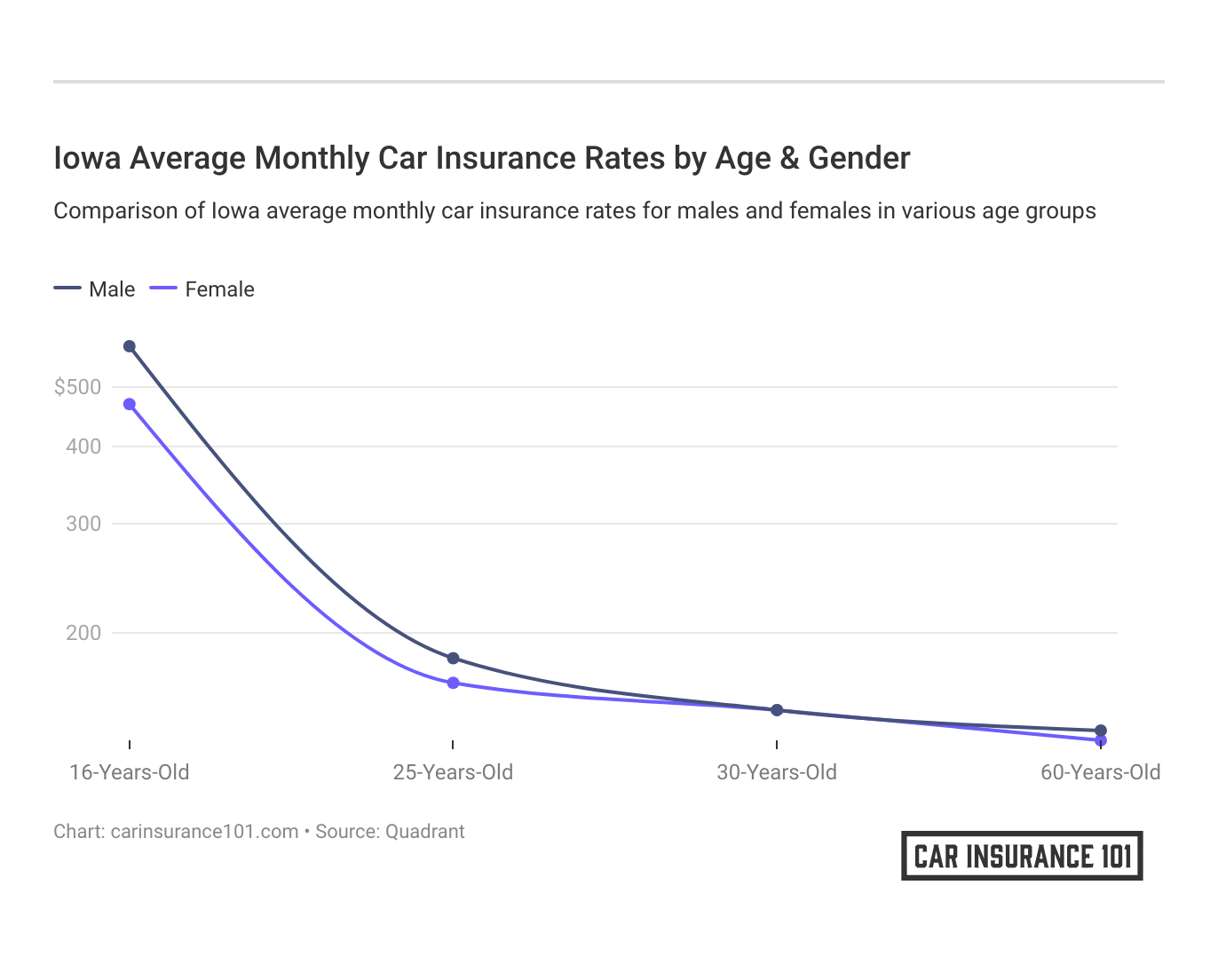

Average Monthly Car Insurance Rates by Age & Gender in IA

Why are we breaking down rates based on gender? Well, Iowa allows insurance providers to quote coverage based upon whether the driver is male or female. At this time, Iowa does not have a non-binary gender option.

Let’s take a look at how the average coverage breaks down based on age, gender, and marital status.

| Insurance Provider | Single 17-year-old Female | Single 17-year-old Male | Single 25-year-old Female | Single 25-year-old Male | Married 35-year-old Female | Married 35-year-old Male | Married 60-year-old Female | Married 60-year-old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $5,666.77 | $6,380.74 | $2,131.19 | $2,192.58 | $1,958.15 | $1,879.95 | $1,740.38 | $1,771.40 |

| American Family Mutual | $5,205.52 | $7,296.86 | $1,947.49 | $2,345.27 | $1,947.49 | $1,947.49 | $1,742.43 | $1,742.43 |

| Farmers Insurance | $4,551.35 | $4,851.93 | $2,038.46 | $2,181.07 | N/A | N/A | N/A | N/A |

| Geico | $4,252.86 | $3,954.88 | $1,767.80 | N/A | $1,871.32 | $1,677.39 | $1,676.90 | N/A |

| Nationwide | $4,078.71 | $5,280.35 | $2,007.84 | $2,184.45 | $1,773.80 | $1,821.30 | N/A | $1,687.66 |

| Progressive | $4,131.25 | $4,663.86 | $2,027.39 | $2,192.49 | $1,685.12 | N/A | N/A | N/A |

| Safeco Insurance | $10,248.60 | $11,534.94 | $2,390.92 | $2,636.91 | $2,110.02 | $2,290.23 | $1,856.34 | $2,255.89 |

| State Farm Auto | $3,914.70 | $4,964.07 | N/A | $1,851.50 | N/A | N/A | N/A | N/A |

| Travelers | $10,858.60 | $17,313.68 | $2,541.28 | $3,002.33 | $2,442.49 | $2,492.53 | $2,373.90 | $2,380.26 |

| USAA | $3,345.14 | $3,552.75 | N/A | N/A | N/A | N/A | N/A | N/A |

Check out the rates for your demographic. If you’re a young driver, it looks like you may want to stay away from State Farm and Travelers. If you’re an older driver, Geico and Nationwide may have the best rates.

These rates are based upon actually purchased coverage by the population of Iowa and include rates for high-risk drivers as well as those who choose to purchase more than the state minimum. It also includes other types of coverage that are not required, such as uninsured/underinsured motorist and MedPay.

If you’re a young driver looking at these rates and feeling down about it, keep in mind that your rates will go down across the board as you get older. Once you turn 25, most insurance companies consider you to be an “experienced driver” and modify their rates accordingly.

These factors certainly impact how much you’ll pay, but the most important thing that impacts your car insurance rates is your driving record.

Focus on being a safe and courteous driver, and you’ll find your rates going down.

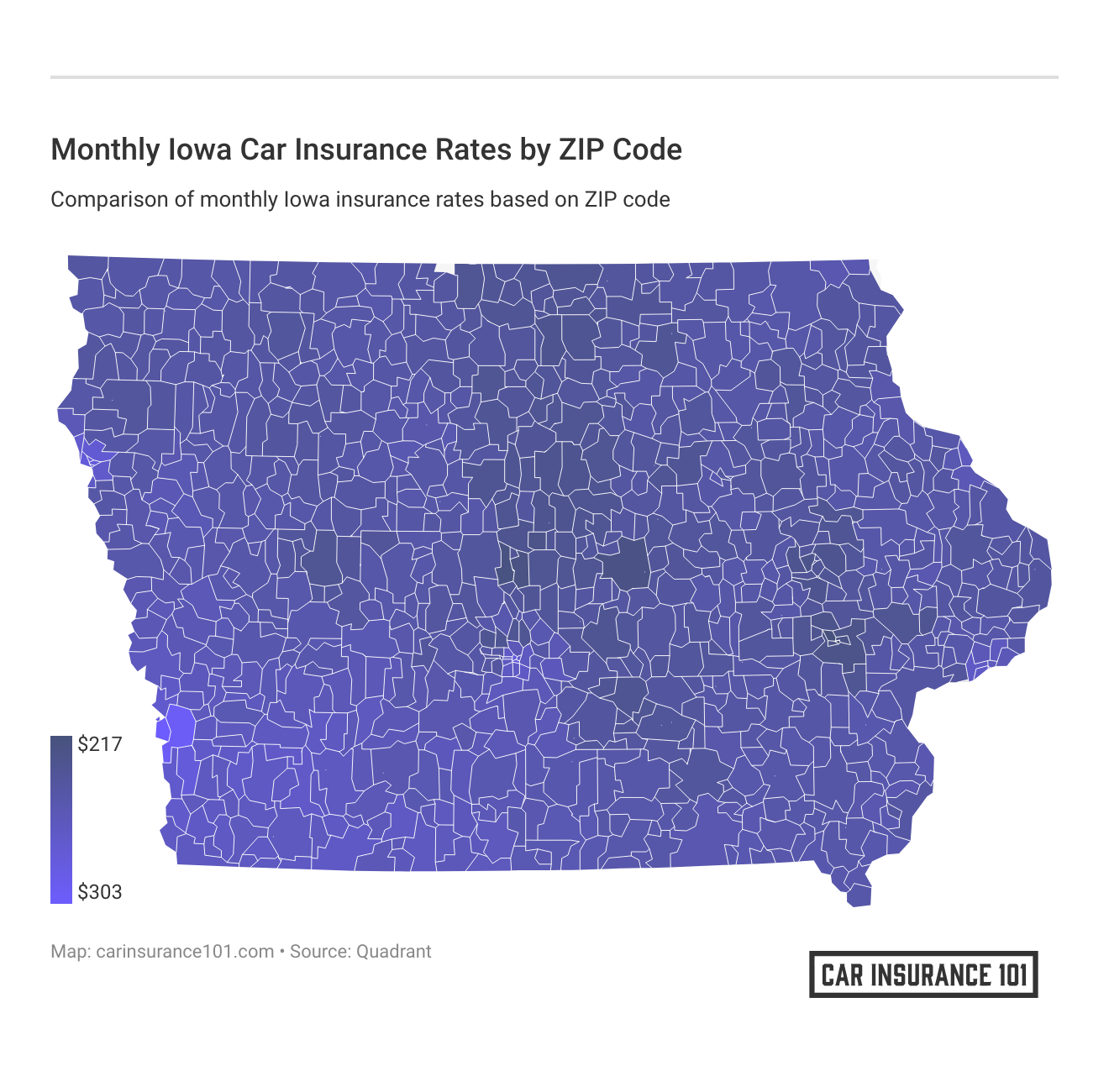

What are the cheapest rates by ZIP code in Iowa?

Where do you live in Iowa? Is it in a big city with more traffic, or are you in one of the state’s many rural towns?

Where you live affects how much you’ll pay.

But why?

Car insurance companies also look at factors that are out of your control for your ZIP code. This includes fraud rates, thefts, and stolen property. Even natural disasters may impact it, as that will drive up the number of claims.

Search for your ZIP code in the tables below to see what it’s like in your neck of the woods.

| Cheapest ZIP Codes in Iowa | City | Average by ZIP Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 52241 | CORALVILLE | $2,598.27 | Travelers | $4,479.87 | Liberty Mutual | $3,864.06 | USAA | $1,590.19 | Geico | $1,851.14 |

| 52242 | IOWA CITY | $2,605.98 | Travelers | $4,449.58 | Liberty Mutual | $3,864.06 | USAA | $1,590.19 | Geico | $1,851.14 |

| 52243 | IOWA CITY | $2,613.15 | Travelers | $4,449.58 | Liberty Mutual | $3,864.06 | USAA | $1,590.19 | Geico | $1,851.14 |

| 50012 | AMES | $2,643.57 | Travelers | $4,784.56 | Liberty Mutual | $4,251.53 | USAA | $1,535.20 | Geico | $1,798.80 |

| 50014 | AMES | $2,651.87 | Travelers | $4,839.57 | Liberty Mutual | $4,251.53 | USAA | $1,579.11 | Geico | $1,798.80 |

| 50010 | AMES | $2,661.70 | Travelers | $4,784.56 | Liberty Mutual | $4,251.53 | USAA | $1,535.20 | Geico | $1,798.80 |

| 50011 | AMES | $2,663.37 | Travelers | $4,784.56 | Liberty Mutual | $4,251.53 | USAA | $1,535.20 | Geico | $1,798.80 |

| 50013 | AMES | $2,676.23 | Travelers | $4,784.56 | Liberty Mutual | $4,251.53 | USAA | $1,535.20 | Geico | $1,798.80 |

| 50158 | MARSHALLTOWN | $2,686.15 | Liberty Mutual | $4,374.49 | Travelers | $4,015.99 | USAA | $1,684.35 | Geico | $2,042.95 |

| 52246 | IOWA CITY | $2,697.81 | Travelers | $5,430.13 | Liberty Mutual | $3,864.06 | USAA | $1,590.19 | Geico | $1,851.14 |

| 52245 | IOWA CITY | $2,699.88 | Travelers | $5,260.01 | Liberty Mutual | $3,864.06 | USAA | $1,670.79 | Geico | $1,851.14 |

| 52240 | IOWA CITY | $2,719.12 | Travelers | $5,366.21 | Liberty Mutual | $3,864.06 | USAA | $1,670.79 | Geico | $1,851.14 |

| 50078 | FERGUSON | $2,721.11 | Liberty Mutual | $4,374.49 | Travelers | $4,015.99 | USAA | $1,684.35 | State Farm | $2,217.05 |

| 50236 | ROLAND | $2,725.56 | Travelers | $4,513.96 | Liberty Mutual | $4,251.53 | USAA | $1,579.11 | Progressive | $2,085.94 |

| 50142 | LE GRAND | $2,734.13 | Liberty Mutual | $4,374.49 | Travelers | $4,015.99 | USAA | $1,684.35 | Progressive | $2,216.35 |

| 52317 | NORTH LIBERTY | $2,734.77 | Travelers | $5,005.02 | Liberty Mutual | $3,864.06 | USAA | $1,590.19 | State Farm | $2,061.78 |

| 52411 | CEDAR RAPIDS | $2,735.38 | Travelers | $4,504.33 | Liberty Mutual | $4,113.26 | USAA | $1,761.37 | Progressive | $2,157.17 |

| 50248 | STORY CITY | $2,759.69 | Travelers | $4,513.96 | Liberty Mutual | $4,251.53 | USAA | $1,754.52 | State Farm | $2,043.40 |

| 50122 | HUBBARD | $2,762.30 | Travelers | $4,520.50 | Liberty Mutual | $4,429.01 | USAA | $1,751.64 | State Farm | $2,009.74 |

| 52233 | HIAWATHA | $2,762.69 | Travelers | $4,381.76 | Liberty Mutual | $4,113.26 | USAA | $1,807.01 | Progressive | $2,279.17 |

| 50006 | ALDEN | $2,764.18 | Travelers | $4,686.98 | Liberty Mutual | $4,429.01 | USAA | $1,751.64 | State Farm | $1,978.63 |

| 52324 | PALO | $2,766.77 | Travelers | $4,504.33 | Liberty Mutual | $4,213.61 | USAA | $1,761.37 | Progressive | $2,211.78 |

| 52404 | CEDAR RAPIDS | $2,768.58 | Travelers | $4,276.17 | Liberty Mutual | $4,158.02 | USAA | $1,752.39 | Nationwide | $2,334.04 |

| 50126 | IOWA FALLS | $2,769.51 | Travelers | $4,686.98 | Liberty Mutual | $4,429.01 | USAA | $1,751.64 | State Farm | $2,009.15 |

| 52302 | MARION | $2,771.54 | Travelers | $4,672.31 | Liberty Mutual | $4,113.26 | USAA | $1,851.84 | Progressive | $2,249.67 |

There’s a pretty big difference between 51501 Council Bluffs and 52241 Coralville, the most and least expensive ZIP codes, respectively. That’s a difference of roughly 40 percent just because of where you live.

| Most Expensive ZIP Codes in Iowa | City | Average by ZIP Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company |

|---|---|---|---|---|---|---|---|---|---|

| 51501 | COUNCIL BLUFFS | $3,633.75 | Travelers | $7,990.77 | Liberty Mutual | $5,155.43 | USAA | $2,229.60 | State Farm |

| 51503 | COUNCIL BLUFFS | $3,575.94 | Travelers | $7,747.16 | Liberty Mutual | $4,734.09 | USAA | $2,229.60 | State Farm |

| 51510 | CARTER LAKE | $3,421.92 | Travelers | $6,296.97 | Liberty Mutual | $5,155.43 | USAA | $2,229.60 | State Farm |

| 50314 | DES MOINES | $3,379.73 | Travelers | $6,692.29 | Liberty Mutual | $5,242.10 | USAA | $1,979.28 | Geico |

| 50309 | DES MOINES | $3,367.30 | Travelers | $6,929.28 | Liberty Mutual | $5,242.10 | USAA | $1,979.28 | Geico |

| 51534 | GLENWOOD | $3,356.48 | Travelers | $6,838.58 | Liberty Mutual | $4,383.42 | USAA | $2,129.38 | Geico |

| 51103 | SIOUX CITY | $3,355.94 | Travelers | $6,493.88 | Liberty Mutual | $5,096.93 | USAA | $2,230.78 | Progressive |

| 50307 | DES MOINES | $3,350.71 | Travelers | $6,929.28 | Liberty Mutual | $5,242.10 | USAA | $1,979.28 | Geico |

| 51105 | SIOUX CITY | $3,350.44 | Travelers | $6,490.50 | Liberty Mutual | $5,096.93 | USAA | $2,230.78 | Farmers |

| 51104 | SIOUX CITY | $3,342.31 | Travelers | $6,466.89 | Liberty Mutual | $5,096.93 | USAA | $2,230.78 | Progressive |

| 51101 | SIOUX CITY | $3,333.89 | Travelers | $6,490.50 | Liberty Mutual | $5,096.93 | USAA | $2,230.78 | Progressive |

| 50308 | DES MOINES | $3,327.01 | Travelers | $6,692.29 | Liberty Mutual | $5,242.10 | USAA | $1,979.28 | Geico |

| 51108 | SIOUX CITY | $3,296.59 | Travelers | $6,635.30 | Liberty Mutual | $4,724.97 | USAA | $2,230.78 | Progressive |

| 52801 | DAVENPORT | $3,285.41 | Travelers | $6,442.62 | Liberty Mutual | $5,001.11 | USAA | $1,999.55 | Geico |

| 50319 | DES MOINES | $3,262.33 | Travelers | $7,228.33 | Liberty Mutual | $4,963.74 | USAA | $1,979.28 | Geico |

| 51109 | SIOUX CITY | $3,260.62 | Travelers | $6,237.19 | Liberty Mutual | $4,724.97 | USAA | $2,230.78 | Progressive |

| 51526 | CRESCENT | $3,259.16 | Travelers | $5,669.44 | Liberty Mutual | $4,734.09 | USAA | $2,040.42 | Geico |

| 51561 | PACIFIC JUNCTION | $3,249.84 | Travelers | $6,023.81 | Liberty Mutual | $4,383.42 | USAA | $2,129.38 | Geico |

| 51106 | SIOUX CITY | $3,242.81 | Travelers | $6,422.45 | Liberty Mutual | $4,724.97 | USAA | $2,028.09 | Progressive |

| 51654 | THURMAN | $3,239.93 | Travelers | $6,098.15 | Liberty Mutual | $4,551.50 | USAA | $1,892.30 | Geico |

| 50316 | DES MOINES | $3,230.43 | Travelers | $5,675.29 | Liberty Mutual | $5,242.10 | USAA | $1,979.28 | Geico |

| 51571 | SILVER CITY | $3,228.19 | Travelers | $5,947.51 | Liberty Mutual | $4,383.42 | USAA | $2,129.38 | Geico |

| 51533 | EMERSON | $3,223.48 | Travelers | $6,100.16 | Liberty Mutual | $4,383.42 | USAA | $1,892.30 | Geico |

| 50864 | VILLISCA | $3,217.00 | Travelers | $6,100.16 | Liberty Mutual | $4,383.42 | USAA | $1,892.30 | Geico |

| 51532 | ELLIOTT | $3,212.72 | Travelers | $6,100.16 | Liberty Mutual | $4,383.42 | USAA | $1,923.57 | Geico |

Let’s see about the rate by city next.

What are the cheapest rates by city in Iowa?

Search for your city in the tables below to see average grand totals for where you live.

| Cheapest Cities in Iowa | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Coralville | $2,598.27 | Travelers | $4,479.87 | Liberty Mutual | $3,864.06 | USAA | $1,590.19 | Geico | $1,851.14 |

| Ames | $2,659.35 | Travelers | $4,795.56 | Liberty Mutual | $4,251.53 | USAA | $1,543.98 | Geico | $1,798.80 |

| Iowa City | $2,667.19 | Travelers | $4,991.10 | Liberty Mutual | $3,864.06 | USAA | $1,622.43 | Geico | $1,851.14 |

| Marshalltown | $2,686.15 | Liberty Mutual | $4,374.49 | Travelers | $4,015.99 | USAA | $1,684.35 | Geico | $2,042.95 |

| Ferguson | $2,721.11 | Liberty Mutual | $4,374.49 | Travelers | $4,015.99 | USAA | $1,684.35 | State Farm | $2,217.05 |

| Roland | $2,725.56 | Travelers | $4,513.96 | Liberty Mutual | $4,251.53 | USAA | $1,579.11 | Progressive | $2,085.94 |

| Le Grand | $2,734.13 | Liberty Mutual | $4,374.49 | Travelers | $4,015.99 | USAA | $1,684.35 | Progressive | $2,216.35 |

| North Liberty | $2,734.77 | Travelers | $5,005.02 | Liberty Mutual | $3,864.06 | USAA | $1,590.19 | State Farm | $2,061.78 |

| Story City | $2,759.69 | Travelers | $4,513.96 | Liberty Mutual | $4,251.53 | USAA | $1,754.52 | State Farm | $2,043.40 |

| Hubbard | $2,762.30 | Travelers | $4,520.50 | Liberty Mutual | $4,429.01 | USAA | $1,751.64 | State Farm | $2,009.74 |

| Hiawatha | $2,762.69 | Travelers | $4,381.76 | Liberty Mutual | $4,113.26 | USAA | $1,807.01 | Progressive | $2,279.17 |

| Palo | $2,766.77 | Travelers | $4,504.33 | Liberty Mutual | $4,213.61 | USAA | $1,761.37 | Progressive | $2,211.78 |

| Iowa Falls | $2,769.51 | Travelers | $4,686.98 | Liberty Mutual | $4,429.01 | USAA | $1,751.64 | State Farm | $2,009.15 |

| Marion | $2,771.54 | Travelers | $4,672.31 | Liberty Mutual | $4,113.26 | USAA | $1,851.84 | Progressive | $2,249.67 |

| Tiffin | $2,772.01 | Travelers | $5,035.58 | Liberty Mutual | $3,864.06 | USAA | $1,590.19 | State Farm | $2,072.10 |

| Radcliffe | $2,772.23 | Travelers | $4,673.04 | Liberty Mutual | $4,429.01 | USAA | $1,751.64 | State Farm | $1,982.05 |

| Clear Lake | $2,774.04 | Travelers | $5,026.25 | Liberty Mutual | $4,305.70 | USAA | $1,788.41 | Progressive | $1,907.60 |

| Popejoy | $2,775.99 | Travelers | $4,686.98 | Liberty Mutual | $4,429.01 | USAA | $1,751.64 | Progressive | $1,928.11 |

| Pella | $2,778.49 | Travelers | $4,834.88 | Liberty Mutual | $4,210.79 | USAA | $1,707.12 | Progressive | $2,188.38 |

| Mason City | $2,782.99 | Travelers | $5,242.68 | Liberty Mutual | $4,305.70 | USAA | $1,788.41 | Progressive | $1,986.83 |

| Zearing | $2,785.76 | Travelers | $4,715.69 | Liberty Mutual | $4,251.53 | USAA | $1,751.64 | State Farm | $2,145.17 |

| Bennett | $2,786.21 | Travelers | $4,245.67 | Liberty Mutual | $4,178.92 | USAA | $1,797.08 | State Farm | $2,198.03 |

| Eldora | $2,787.19 | Travelers | $4,520.50 | Liberty Mutual | $4,429.01 | USAA | $1,751.64 | State Farm | $2,157.04 |

| Jewell | $2,787.93 | Travelers | $4,634.85 | Liberty Mutual | $4,426.94 | USAA | $1,754.52 | State Farm | $2,064.86 |

| Johnston | $2,788.69 | Travelers | $4,870.38 | Liberty Mutual | $4,342.51 | USAA | $1,641.11 | State Farm | $2,066.79 |

Council Bluffs is easily the most expensive city in Iowa in regard to insurance premiums. The premiums there are more than $1,000 pricier than Coralville — which is the cheapest city in the state.

| Most Expensive Cities in Iowa | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Council Bluffs | $3,604.85 | Travelers | $7,868.96 | Liberty Mutual | $4,944.76 | USAA | $2,229.60 | State Farm | $2,418.02 |

| Carter Lake | $3,421.91 | Travelers | $6,296.97 | Liberty Mutual | $5,155.43 | USAA | $2,229.60 | State Farm | $2,465.00 |

| Glenwood | $3,356.47 | Travelers | $6,838.58 | Liberty Mutual | $4,383.42 | USAA | $2,129.38 | Geico | $2,457.85 |

| Sioux City | $3,295.84 | Travelers | $6,371.96 | Liberty Mutual | $4,910.95 | USAA | $2,180.11 | Progressive | $2,443.48 |

| Crescent | $3,259.16 | Travelers | $5,669.44 | Liberty Mutual | $4,734.09 | USAA | $2,040.42 | Geico | $2,457.85 |

| Pacific Junction | $3,249.84 | Travelers | $6,023.81 | Liberty Mutual | $4,383.42 | USAA | $2,129.38 | Geico | $2,239.78 |

| Thurman | $3,239.93 | Travelers | $6,098.15 | Liberty Mutual | $4,551.50 | USAA | $1,892.30 | Geico | $2,239.78 |

| Silver City | $3,228.18 | Travelers | $5,947.51 | Liberty Mutual | $4,383.42 | USAA | $2,129.38 | Geico | $2,239.78 |

| Emerson | $3,223.48 | Travelers | $6,100.16 | Liberty Mutual | $4,383.42 | USAA | $1,892.30 | Geico | $2,239.78 |

| Villisca | $3,216.99 | Travelers | $6,100.16 | Liberty Mutual | $4,383.42 | USAA | $1,892.30 | Geico | $2,239.78 |

| Elliott | $3,212.72 | Travelers | $6,100.16 | Liberty Mutual | $4,383.42 | USAA | $1,923.57 | Geico | $2,239.78 |

| Des Moines | $3,210.88 | Travelers | $6,254.09 | Liberty Mutual | $4,957.66 | USAA | $1,920.73 | Geico | $2,110.32 |

| Honey Creek | $3,209.76 | Travelers | $5,732.04 | Liberty Mutual | $4,734.09 | USAA | $2,040.42 | Geico | $2,239.78 |

| Bedford | $3,204.32 | Travelers | $6,023.81 | Liberty Mutual | $4,415.43 | USAA | $1,892.30 | Geico | $2,239.78 |

| Sidney | $3,202.45 | Travelers | $5,958.23 | Liberty Mutual | $4,551.50 | USAA | $1,892.30 | Geico | $2,239.78 |

| Henderson | $3,201.16 | Travelers | $6,020.79 | Liberty Mutual | $4,383.42 | USAA | $2,129.38 | Geico | $2,239.78 |

| Randolph | $3,197.04 | Travelers | $5,958.23 | Liberty Mutual | $4,551.50 | USAA | $1,892.30 | Geico | $2,239.78 |

| Percival | $3,193.43 | Travelers | $6,098.15 | Liberty Mutual | $4,551.50 | USAA | $1,892.30 | State Farm | $2,217.05 |

| Stanton | $3,192.82 | Travelers | $6,100.16 | Liberty Mutual | $4,383.42 | USAA | $1,892.30 | Geico | $2,239.78 |

| Braddyville | $3,185.36 | Travelers | $6,023.81 | Liberty Mutual | $4,551.50 | USAA | $1,892.30 | Geico | $2,239.78 |

| Cumberland | $3,180.65 | Travelers | $5,855.94 | Liberty Mutual | $4,383.42 | USAA | $1,923.57 | Geico | $2,239.78 |

| Coin | $3,180.34 | Travelers | $6,023.81 | Liberty Mutual | $4,551.50 | USAA | $1,892.30 | Geico | $2,239.78 |

| Red Oak | $3,178.98 | Travelers | $6,100.16 | Liberty Mutual | $4,383.42 | USAA | $1,892.30 | Geico | $2,239.78 |

| Davenport | $3,178.04 | Travelers | $5,569.37 | Liberty Mutual | $5,001.11 | USAA | $1,970.79 | Geico | $2,166.09 |

| Gravity | $3,177.95 | Travelers | $6,023.81 | Liberty Mutual | $4,415.43 | USAA | $1,892.30 | Geico | $2,239.78 |

What are forms of financial responsibility in Iowa?

According to NOLO, there are other ways to comply with Iowa’s Motor Vehicle Financial and Safety Responsibility Act if you are not carrying insurance and are found at-fault in a car accident.

- Posting a bond with Driver and Identification Services

- Obtaining a legal release of liability from all parties involved in the accident

- If you are found completely not liable in a civil suit

- If you file an agreement to pay all damages on an installment plan

- Completing a warrant for confession of judgment where you promise to pay tall damages on an installment plan

- Filing evidence of complete damage settlement

If you do not meet the requirements mentioned in the Motor Vehicle Financial and Safety Responsibility Act, you may be subject to penalties, including fines and driver’s license suspension.

While these are options, you really don’t want to rely on this in the event you are found at fault in an accident. It’s much smarter to carry adequate insurance coverage and keep the minimum required liability insurance.

You don’t want to be stuck with a huge bill that could have been easily avoided.

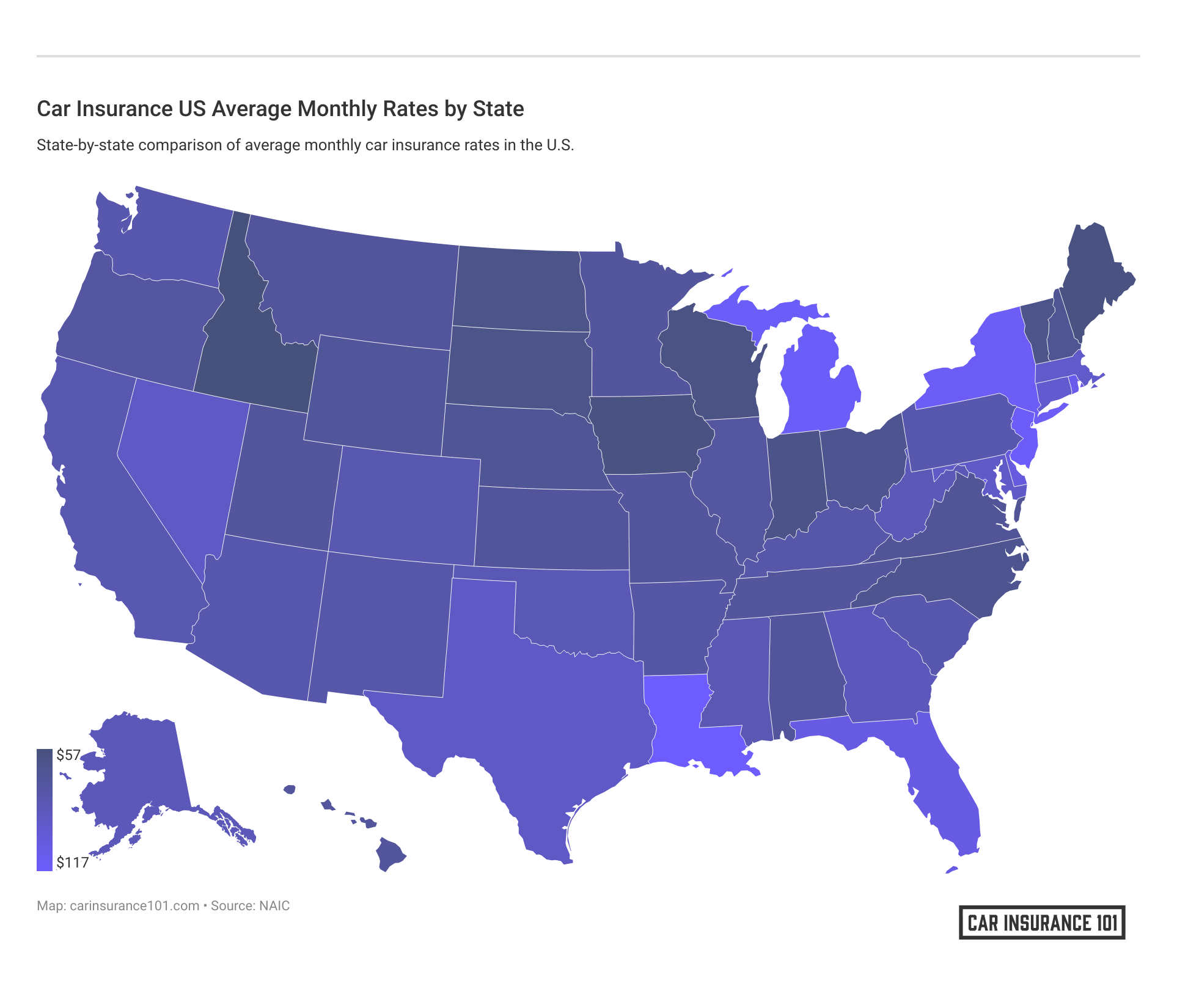

How much percentage of income are premiums in Iowa?

In 2014, the average disposable income for Iowa residents was $39,820. That’s the amount the average Iowan took home from their paychecks after paying taxes. The national average was only 2.28 percent higher at $40,726.30.

So, why is this relevant?

Well, it’s important to know how high rates are in the state relative to take-home income. According to NAIC, Iowans spent 1.72 percent of their disposable income on insurance in 2014. That’s 33 percent less of their total take-home pay than the national average of 2.29 percent.

But what does that mean? Well, insurance is relatively cheap in Iowa. Great news!

Look below to see how Iowa stacks up to the national average for premiums as percentage of income.

| Insurance as % of Income | 2014 | 2013 | 2012 |

|---|---|---|---|

| Iowa | 1.72% | 1.73% | 1.71% |

| National Average | 2.29% | 2.39% | 2.32% |

Iowa’s Insurance as percentage of income has stayed pretty steady at about 1.72 percent. That’s much cheaper than the national average of around 2.33 percent. The last available data was from 2014, so expect this to be slightly higher now.

Check out the calculator below to see what percentage you spend on your car insurance.

CalculatorPro

Now, let’s go over some coverage options.

Average Monthly Car Insurance Rates in IA (Liability, Collision, Comprehensive)

Let’s go ahead and take a look at some core coverage information that’s pulled directly from The National Association of Insurance Commissioners.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $299.18 |

| Collision | $219.75 |

| Comprehensive | $183.53 |

| Combined | $702.46 |

Iowans spent an average of $702.46 for full coverage car insurance, which was nearly $300 less than the national average of $1009.38. These numbers were taken in 2015, so they’ll be a little higher now.

Also, these numbers are based on the state minimum. It’s smart to carry more than the minimum required by law, as this will help keep you and your wallet safe and unburdened by an unexpected bill caused by a car accident.

What additional liability is available in Iowa?

Why would you want to purchase more than the legally required minimum liability insurance?

8.7 percent of Iowa’s drivers are driving around uninsured, which ranks 38th in the U.S. Additional liability will help protect you in case you get involved in an accident with one of these drivers.

What other kinds of liability insurance are available to you?

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Medical Payments | 79.28% | 68.90% | 67.43% |

| Uninsured/ Underinsured Motorist Coverage | 71.88% | 68.39% | 49.89% |

This table shows the total loss ratios for medical payments and uninsured/ underinsured coverage from 2013 to 2015. They’ve both increased dramatically, and medical payments in 2015 were over the ideal loss ratio.

Loss ratios show the financial strength of an insurance provider.

If the number is too high, the company is not collecting enough premiums to cover the claims it is paying out. If the number is too low, the company is collecting more in premiums than it needs to and may not be paying as many claims as it should.

If you’re seeing a loss ratio under 40 percent, that is probably too low, and the company is collecting too much in premium. If the loss ratio is over about 75 percent, that is probably too high. In this instance, the company is not collecting enough compared to the claims it is paying.

In 2015, the average uninsured/underinsured driver loss ratio for the entire country was 75.11 percent, while Iowa’s was 71.88 percent. This may indicate that Iowan insurance companies don’t pay out at a comparable rate to the rest of the country.

A company with a loss ratio over 100 percent for several years in a row may have a rate increase in the near future.

What should you be looking for when shopping for insurance? When choosing a provider, it’s smart to choose a company with a loss ratio within the 45 percent to 75 percent range.

Well, now that we’ve covered core coverage in Iowa, what else is there?

Let’s go over some add-on insurance policies you can have.

What add-ons, endorsements, and riders are available in Iowa?

Are you looking for even more car insurance? Well, you have options. These are a few of the add-ons that you can get for your vehicle.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-you-drive or Usage-based Insurance

The choice is up to you, but more insurance always equals better insurance.

Now, let’s dive a little deeper into insurance providers in Iowa.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Iowa Car Insurance Companies

So, how are you supposed to pick the right insurance company for you? With hundreds of options out there, the decision can seem overwhelming. Since Iowans spend an average of 1.72 percent of their take-home pay on car insurance alone, it’s an important financial decision.

We’re going to help you out with some information on Iowa’s biggest insurance companies so that you’ll be able to make an informed decision. Let’s go over the financial ratings, company complaints, A.M. ratings, and some more important topics you should know about.

What are the financial ratings of the largest car insurance companies in Iowa?

Where do you even start to pick the right company for you? The first factor you should consider is the financial strength of the company.

Most of us don’t have the time or training to properly analyze the finances of each insurer. That’s where A.M. Ratings come into the picture. A good financial rating indicates the company has the financial strength to settle future claims.

Let’s take a look at the table below. You can see all of the top insurance providers in Iowa and what their individual A.M. Best Rating is.

| Company Name | AM Rating |

|---|---|

| Allstate | A+ |

| American Family Insurance Group | A |

| Geico | A++ |

| Grinnell Mutual Group | A |

| IMT Mutual Holding Group | A |

| Iowa Farm Bureau | n/a |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | A++ |

| West Bend Mutual Insurance Group | A |

State Farm and Geico have the best AM Ratings in Iowa. Progressive, Nationwide, and Allstate aren’t far behind.

Take a minute to watch the video below and learn more about what an A.M. Rating is.

Now, let’s see which companies have the best J.D. Power Ratings.

Which car insurance companies have the best ratings in Iowa?

How important would you say customer service is to you?

Have you ever called a company for help but the person on the other end is rude and unhelpful? It can make a stressful situation worse. On the other hand, great customer service can truly make your day go better.

J.D. Power conducts a study every year that ranks car insurance companies based on customer satisfaction grades.

The 2019 U.S. Auto Insurance Study — now in its 20th year — examines customer satisfaction in five factors (in order of importance): interaction, policy offerings, price, billing process and policy information, and claims.

The study is based on responses from 42,759 auto insurance customers and was fielded from February through April 2019.

In the table below, the J.D. Power Circle Ratings are based on a five circle scale.

- Five circles – among the best

- Four circles – better than most

- Three circles – about average

- Two circles – the rest

Take a look below to see how these companies rank.

| Company Name | J.D. Power Circle Rating |

|---|---|

| Allstate | 4 |

| American Family | 3 |

| Auto Club of Southern California Insurance Group | 3 |

| Auto-Owners Insurance | 5 |

| Central Average | 3 |

| Farm Bureau Mutual | 3 |

| Farmers | 2 |

| Geico | 4 |

| Liberty Mutual | 2 |

| Nationwide | 2 |

| Progressive | 3 |

| Safeco | 2 |

| Shelter | 5 |

| State Farm | 3 |

| Travelers | 3 |

| USAA | 5 |

With the exception of USAA (which again, is only available to U.S. military personnel and their families), it looks like Shelter and Auto-Owners Insurance are the top-rated companies for customer service in the Central Region.

*Note: USAA is an insurance provider that is only open to U.S. military personnel and their families. Therefore, it is not included in the rankings.

Which car insurance companies have the most complaints in Iowa?

Another factor you should consider is how many complaints were filed against an insurer. Take a look at the complaint data from The National Association of Insurance Commissioners.

| Company Name | Complaint Ratio |

|---|---|

| Allstate | 0.5 |

| American Family Insurance Group | 0.79 |

| Geico | 0.68 |

| Grinnell Mutual Group | 0.07 |

| IMT Mutual Holding | 3.45 |

| Iowa Farm Bureau | 0.77 |

| Nationwide | 0.28 |

| Progressive | 0.75 |

| State Farm | 0.44 |

| West Bend Mutual Insurance Group | 0.33 |

The complaint ratio measures how many complaints were filed against the company per 100,000 policies written.

IMT Mutual Holding has a comparatively high complaint ratio with 3.45 out of every 100,000 written policies.

For reference, the national average complaint ratio is one.

A number less than the average means there were fewer complaints filed against that company. More than one means the complaints were high in relation to the size of the company.

It looks like Grinnell — a company based in Iowa with a 4.49 percent market share — has the best complaint ratio, at only 0.07. After that, Nationwide and West Bend Mutual have the lowest complaint ratios in the state.

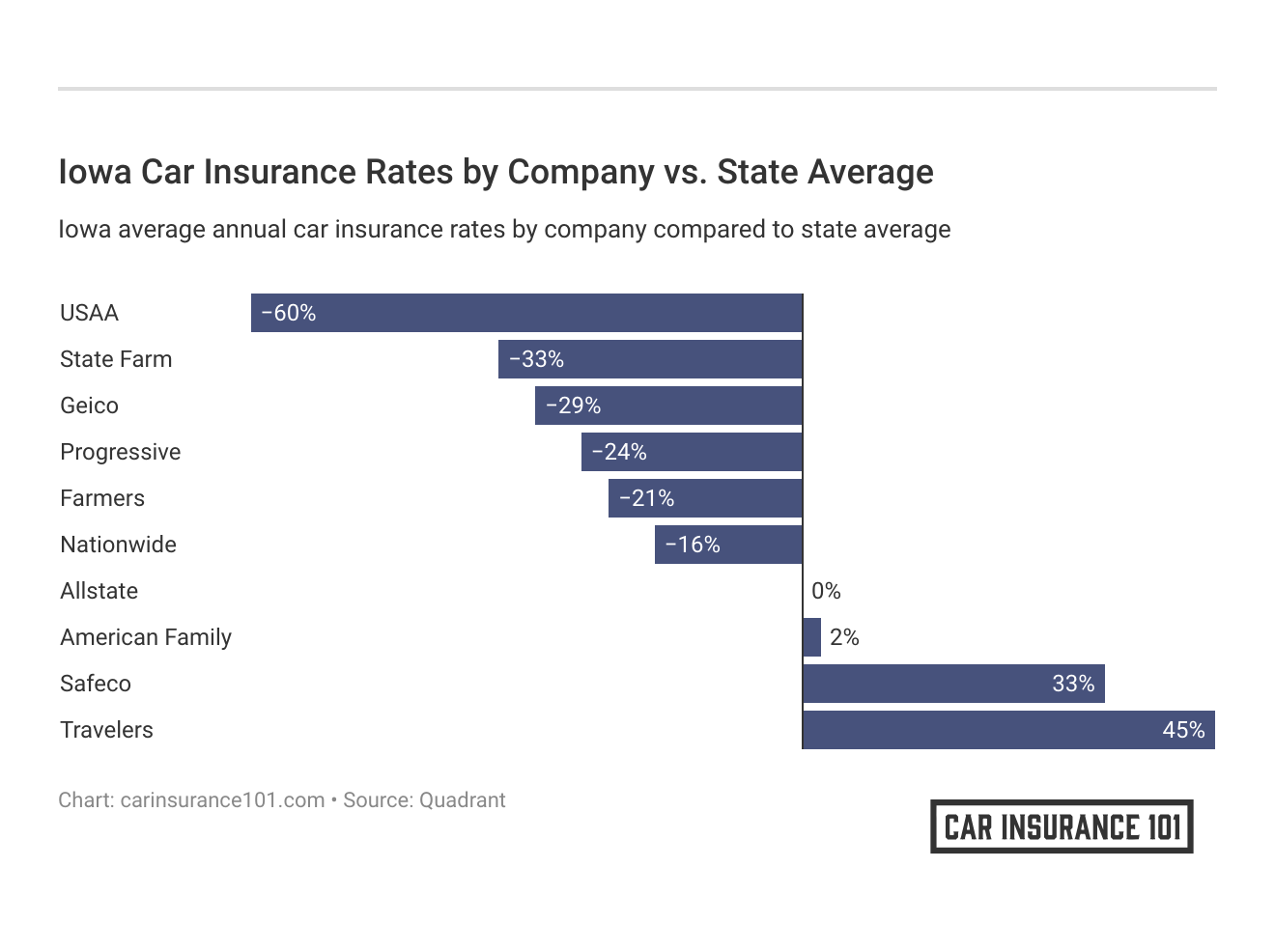

What are the cheapest car insurance companies in Iowa?

The chart below comes from information gathered from Quadrant Information Services.

| Company | Average | Amount Compared to State Average | % Compared to State Average |

|---|---|---|---|

| Allstate | $3,979.74 | $661.62 | 16.62% |

| American Family Mutual | $3,679.03 | $360.91 | 9.81% |

| First Liberty Ins Corp | $5,781.77 | $2,463.65 | 42.61% |

| Geico Cas | $2,260.74 | -$1,057.38 | -46.77% |

| Illinois Farmers Ins 2.0 | $3,437.24 | $119.11 | 3.47% |

| Nationwide Mutual | $2,712.47 | -$605.66 | -22.33% |

| Progressive | $3,898.01 | $579.89 | 14.88% |

| State Farm Mutual Auto | $2,408.63 | -$909.49 | -37.76% |

| Travco Ins Co | $3,393.54 | $75.42 | 2.22% |

| USAA | $1,630.06 | -$1,688.06 | -103.56% |

According to this, Geico and USAA — a company only available to military personnel and their families — are the cheapest in the state of Iowa. First Liberty is easily the most expensive, at 42.61 percent over the state average.

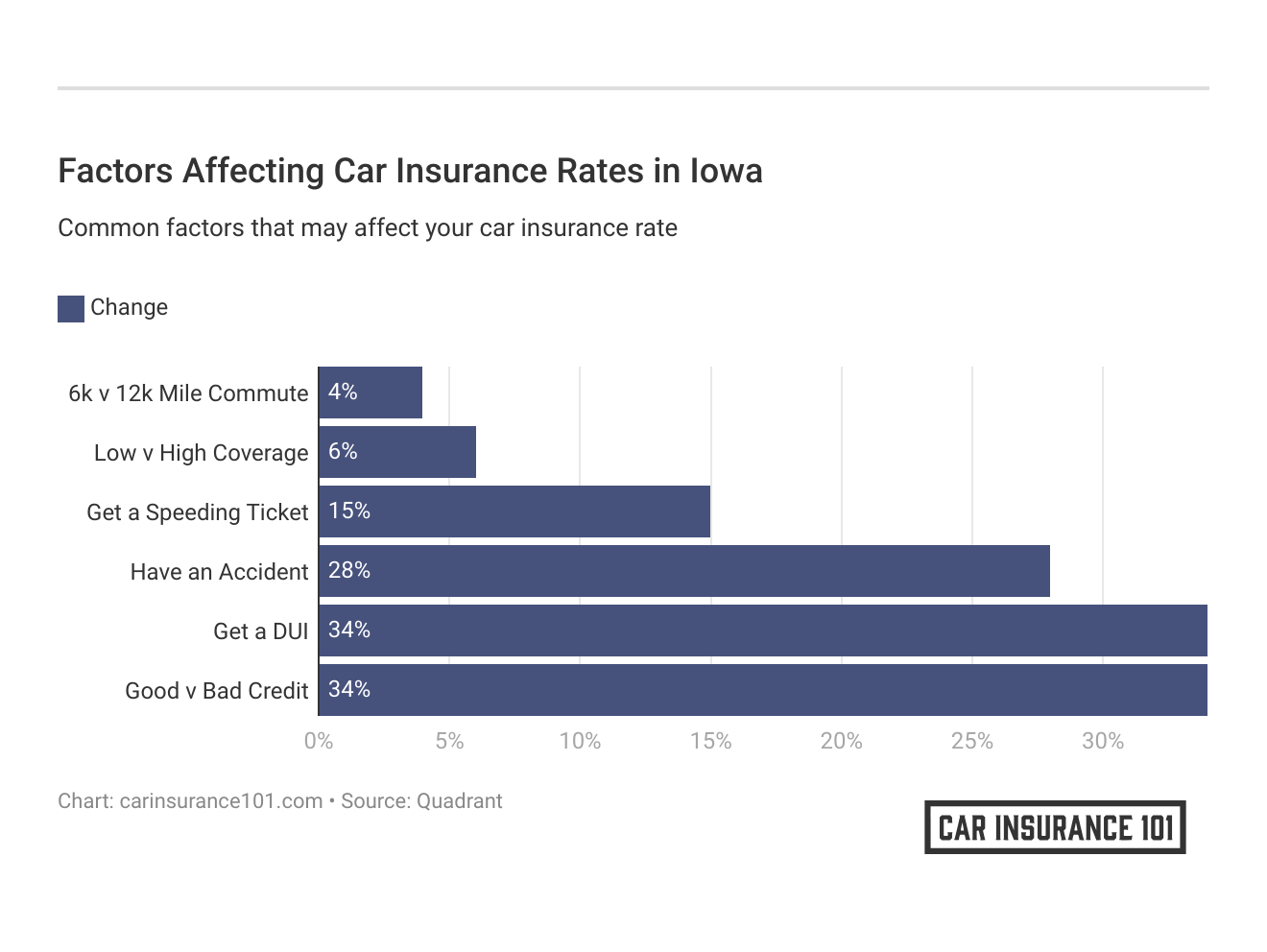

Does my commute affect my car insurance rate in Iowa?

Did you know that some companies charge more if you have a longer commute? If you find yourself queuing up an audiobook for your drive, you may be paying more for your insurance.

| Company Name | 10-mile Commute, 6,000 Annual Mileage | 25-mile Commute, 12,000 Annual Mileage |

|---|---|---|

| Allstate | $2,894.65 | $3,035.64 |

| American Family | $2,986.61 | $3,057.13 |

| Farmers | $2,435.45 | $2,435.45 |

| Geico | $2,251.26 | $2,341.77 |

| Liberty Mutual | $4,415.48 | $4,415.48 |

| Nationwide | $2,551.81 | $2,551.81 |

| Progressive | $2,394.23 | $2,394.23 |

| State Farm | $2,169.94 | $2,277.01 |

| Travelers | $5,425.63 | $5,425.63 |

| USAA | $1,784.77 | $1,919.94 |

Many of these companies do not charge any more based on commute. American Family and Geico charge less than $100 more. State Farm, Allstate, and USAA all charge more than $100 if you have a commute longer than 10 miles.

Can coverage level change my car insurance rate with companies in Iowa?

Sometimes, a company will give you a break if you elect to get more insurance coverage than is required. Take a look below for rates based on coverage level.

| Company Name | Low | Medium | High |

|---|---|---|---|

| Allstate | $2,853.70 | $2,968.91 | $3,072.83 |

| American Family | $3,035.16 | $3,189.92 | $2,840.53 |

| Farmers | $2,332.54 | $2,443.15 | $2,530.66 |

| Geico | $2,180.55 | $2,297.14 | $2,411.84 |

| Liberty Mutual | $4,237.62 | $4,407.47 | $4,601.36 |

| Nationwide | $2,660.79 | $2,539.43 | $2,455.20 |

| Progressive | $2,258.89 | $2,402.19 | $2,521.62 |

| State Farm | $2,115.69 | $2,236.04 | $2,318.68 |

| Travelers | $5,103.05 | $5,507.84 | $5,666.01 |

| USAA | $1,757.16 | $1,858.31 | $1,941.61 |

Most of these companies have an increase of between 7.5 percent and 11.6 percent from low to high coverage levels, but American Family and Nationwide have a decrease and charge approximately $200 less for the higher level of coverage.

Having more coverage is always a smart decision. A few hundred dollars more now may save you thousands down the line.

How does my credit history affect my car insurance rate with companies in Iowa?

Most people know their credit history will affect how much they’re going to pay for quite a few things. Car insurance is one of those. The company wants to make sure you are a good investment and will pay your premiums on time.

| Company Name | Good Credit History | Fair Credit History | Poor Credit History |

|---|---|---|---|

| Allstate | $2,533.59 | $2,817.56 | $3,544.28 |

| American Family | $2,380.74 | $2,831.65 | $3,853.23 |

| Farmers | $2,195.20 | $2,317.58 | $2,793.56 |

| Geico | $1,833.13 | $2,296.52 | $2,759.89 |

| Liberty Mutual | $3,061.08 | $3,889.40 | $6,295.97 |

| Nationwide | $2,127.45 | $2,427.31 | $3,100.67 |

| Progressive | $2,069.08 | $2,284.84 | $2,828.78 |

| State Farm | $1,544.99 | $1,958.88 | $3,166.55 |

| Travelers | $4,964.86 | $5,210.35 | $6,101.70 |

| USAA | $1,449.06 | $1,673.05 | $2,434.97 |

The rate of a driver with poor credit history increases anywhere from 23 percent to 106 percent compared to a driver with good credit. Liberty Mutual and State Farm penalize drivers heavily for bad credit history.

According to Experian, the nation’s average credit score is 675. That is the highest national average credit score since 2012, so consumer’s credit scores are on the rise.

Iowa’s average credit score is 695.

Here are the average premiums based on credit score for Iowa.

- Good Credit (670+) – $2,415.92

- Fair Credit (580–669) – $2,770.71

- Poor Credit (300–579) – $3,687.96

If you’re working to improve your credit but still have a way to go, you may want to look into Travelers, which charges just 23 percent more for drivers with poor credit, or Farmers, which charges just 27 percent more.

How does my driving record affect my rates with car insurance companies in Iowa?

Credit’s a big deal, but there’s something even more impactful.

Your driving record is the biggest factor that impacts how much you will pay for car insurance.

Take a look below to see just how important it is.

| Company Name | Clean Record | With One Accident | With One Speeding Violation | With One DUI |

|---|---|---|---|---|

| Allstate | $2,520.15 | $3,051.76 | $2,818.27 | $3,470.40 |

| American Family | $2,181.69 | $3,194.70 | $2,564.80 | $4,146.29 |

| Farmers | $2,075.02 | $2,574.18 | $2,479.99 | $2,612.59 |

| Geico | $1,739.14 | $2,430.59 | $1,865.34 | $3,150.98 |

| Liberty Mutual | $3,813.55 | $4,718.68 | $4,318.32 | $4,811.37 |

| Nationwide | $1,845.32 | $2,653.56 | $2,088.61 | $3,619.74 |

| Progressive | $1,925.00 | $3,153.79 | $2,409.88 | $2,088.27 |

| State Farm | $2,058.27 | $2,388.67 | $2,223.47 | $2,223.47 |

| Travelers | $3,954.60 | $5,272.67 | $5,414.68 | $7,060.59 |

| USAA | $1,414.93 | $1,899.66 | $1,624.60 | $2,470.24 |

Here are the average annual rates based upon these driving record factors:

- Clean Record – $2,352.77

- One Speeding Violation – $2,780.80

- One Accident – $3,133.83

- One DUI – $3,565.39

One speeding violation will increase premiums by an average of 17 percent, while one accident will increase it by an average of 35 percent. One DUI will increase your premiums by an average of 53 percent across these insurers.

Nationwide and American Family are the strictest on DUI violations, increasing over 90 percent. Travelers and Progressive increase most for speeding, and Progressive is the harshest for one accident premium increases.

Focus on being a safe and courteous driver, and your bank account will be happy with you.

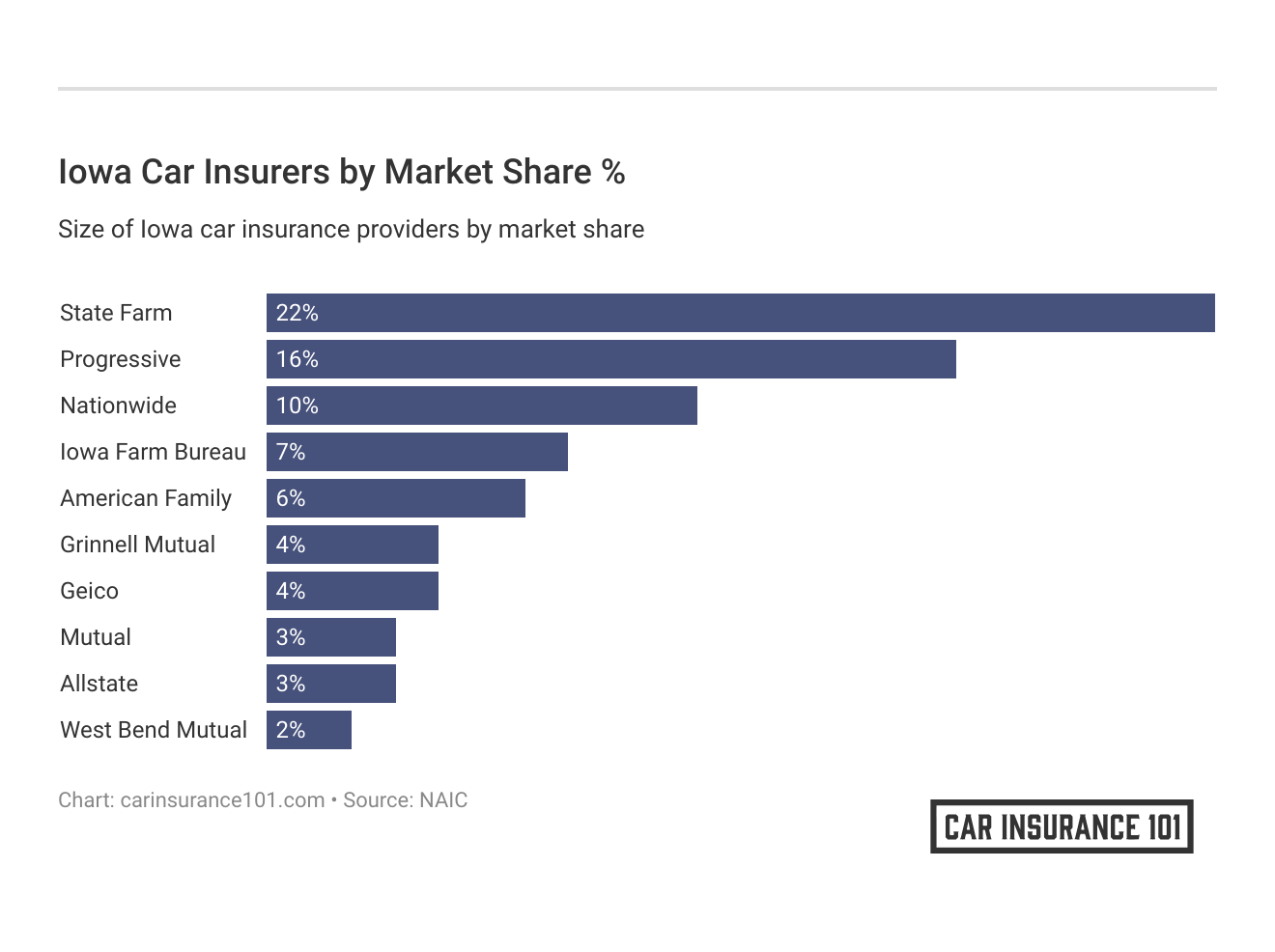

Which car insurance companies are the largest in Iowa?

Here are the largest insurers in Iowa by market share. Look at their rank by market share, premiums written, and loss ratio.

| Name of Insurance Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate | $56,702 | 60.70% | 3.23% |

| American Family Insurance | $111,227 | 69.86% | 6.33% |

| Geico | $64,044 | 78.07% | 3.65% |

| Grinnell Mutual Group | $78,945 | 71.86% | 4.49% |

| IMT Mutual Holding | $57,498 | 70.27% | 3.27% |

| Iowa Farm Bureau Group | $119,308 | 67.98% | 6.79% |

| Nationwide | $180,621 | 51.49% | 10.28% |

| Progressive | $285,107 | 63.34% | 16.23% |

| State Farm | $389,032 | 63.96% | 22.14% |

| West Bend Mutual Insurance Group | $38,498 | 58.38% | 2.19% |

State Farm is the largest car insurer in the state of Iowa, with 22 percent of the market share and $389,032 in direct premiums written. This is 36 percent more in premiums than the next highest, Progressive, which has a 16.23 percent market share and $285,307 written.

How many car insurance companies are available in Iowa?

How many insurer options are there in Iowa?

| Domestic | Foreign | Total Number of Licensed Insurers |

|---|---|---|

| 73 | 860 | 933 |

Wow! There are 933 options for insurers in the Hawkeye State.

What exactly is the difference here between foreign and domestic casualty insurers? Domestic insurers are based out of Iowa, and foreign insurers are out-of-state but operating within Iowa.

Let’s move on and learn about state traffic laws.

Iowa State Laws

There’s so much information about state laws out there, and it can seem really overwhelming. But you really don’t need to know all of it. Most of it isn’t relevant to your day-to-day life.

However, some of this is important for you to know as a driver in this mostly rural state. Let’s dive right into it.

What are the car insurance laws in Iowa?

Let’s talk about the basics.

We are going to be going over stuff like insurance and licensing laws, safety laws, and rules of the road. Let’s get started by talking about how insurance laws are determined.

How State Laws for Insurance Are Determined

The state determines the type of tort law that will apply in the state and what the minimum liability requirements will be. The state also enacts seat belt laws, drunk driving laws, and speed limits.

According to the National Association of Insurance Commissioners, Iowa uses a system called use and file for how state laws for insurance are determined.

This refers to a system where rates and forms must be filed with the state insurance department within a previously specified time period after they have already been put into use.

The Iowa Insurance Division is the main regulator of auto insurance for the state of Iowa.

Windshield Coverage in Iowa

According to carwindshields.info, there is no specific legislation unique to windshields.

According to Chapter 15 of IAC 5/4/11, insurers are allowed to use aftermarket crash parts if they are equal in kind and quality to the original equipment manufacturer part. You can insist on OEM parts, but you’ll have to pay out of pocket for whatever the difference is.

There is nothing that specifies rules for windshield replacements, but you should check with your insurance provider. It’s usually covered by an insurer’s comprehensive coverage policy.

High-risk Insurance in Iowa

Remember when we said keeping a clean driving record is the most important factor for keeping your car insurance premiums low? If you don’t, you may be required to get SR-22 insurance.

What is SR-22 insurance? Check out the short video below for a quick overview.

Iowa has tough laws regarding driving under the influence of drugs or alcohol. You can have your license revoked if you fail a breath, urine, or blood test that proves you were driving while intoxicated.

If your license is revoked, do not continue to drive. This is considered a serious misdemeanor that can result in fines up to $1,000 and having your vehicle impounded.

The law requires you to show proof of financial responsibility before you can have your license reinstated. This is usually done through SR-22 special insurance.

Keep in mind that insurers reserve the right to refuse insurance to you.

Low-cost Insurance in Iowa

Iowa does not have a specific low-cost insurance plan. California, Hawaii, and New Jersey are the only U.S. states that do.

You can save on your premium by qualifying for additional discounts. Also, shop around. You’ll need to decide what the cheapest insurance is for you that also fits your requirements.

Automobile Insurance Fraud in Iowa

What are we talking about when we refer to automobile insurance fraud?

According to the Insurance Information Institute, insurance fraud is a deliberate deception committed by or against an insurance provider for the purpose of financial gain.

People who commit insurance fraud can be any of the following:

- ordinary people who try to make money from filing a false claim

- professionals or technicians who overcharge for services or add fees for services not rendered

- organized criminals who steal large sums of money through fraudulent business practices

Why should you care if you are committing fraud?

Fraud comes back to customers in the form of higher premiums.

If you are found guilty of committing insurance fraud, that is a Class D felony with a prison sentence of up to five years and a fine of between $750 and $7,500.

You can contact the Iowa Insurance Division to report insurance fraud at the following address:

Iowa Insurance Fraud Bureau

601 Locust, 4th Floor

Des Moines, IA 50309-3738

Phone: 515-242-5304

FAX: 515-242-5303

E-Mail: [email protected]

You can also submit a report online to the National Association of Insurance Commissioners.

Statute of Limitations in Iowa

What is the statute of limitations?

The statute of limitations is the period of time after a qualifying event that a claimant has to file and resolve their claim.

This is in place to protect the insurance company from people who decide to file a claim years after an accident. It also gives the driver ample time to file a claim.

In Iowa, drivers have:

- two years from the day of their accident to file a personal injury claim

- five years from the day of the event to file a property damage claim

That’s plenty of time, so make sure you file your claims within that time frame.

Iowa-specific Laws

In Iowa, insurers are required by law to respond to claims submitted by their customers. If they do not respond, these claims can be pursued in a court of law. While insurers are required to respond to claims, they may not disclose all benefits you may be entitled to.

You’ll want to familiarize yourself with the policy you choose so you receive all the benefits you’re due.

It’s best to always be prepared. Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What are the vehicle licensing laws in Iowa?

Do you want to learn more about vehicle licensing laws in Iowa? Do you want to know more about REAL ID and why you are required to have one? Are you a teenager or do you have one in the house who is about to start driving?

Let’s go over that and more in the section below.

REAL ID in Iowa

What is a REAL ID? You probably know by now — as Iowa is compliant with the act — but let’s take a look at the video below.

Congress passed the Real ID Act in 2005 to establish a federally acceptable I.D. for entering federal facilities and boarding domestic flights.

October 1, 2020 is the deadline to get a REAL ID in Iowa.

Make sure to have your REAL ID by then unless you have another acceptable identity document.

Penalties for Driving Without Insurance in Iowa

We went over Iowa’s Motor Vehicle Financial and Safety Responsibility Act earlier. If you are not carrying insurance and found at-fault in an accident, you have a few other options to comply with the act.

As a reminder your other options include:

- posting a bond with Driver and Identification Services

- obtaining a legal release of liability from all parties involved in the accident

- If you are found completely not liable in a civil suit

- If you file an agreement to pay all damages on an installment plan

- completing a warrant for confession of judgment where you promise to pay tall damages on an installment plan

- filing evidence of complete damage settlement

If you’re caught driving without insurance in Iowa and found at-fault in an accident, you may have to pay a $500 fine. You may also be subject to having your license and registration suspended and your vehicle impounded.

Teen Driver Laws in Iowa

Teens in Iowa can apply for a learner’s permit at 14 years old. To apply for a license or restricted license, teens must meet the requirements below during the learner stage.

| Requirements for a License or Restricted License | Time Limits |

|---|---|

| Mandatory Holding Period | 12 Months |

| Minimum Supervised Driving | 20 hours (two of which must be at night) |

| Minimum Age | 16 Years |

You will need a minimum of 20 hours of supervised driving before you can move on. Two of these must be at night, and more is better.

During the intermediate stage, teen drivers must meet these requirements:

| Restrictions for Intermediate License | Details | Removal Time Limits |

|---|---|---|

| Nighttime Restrictions | 12:30 am to 5:00 am | 12 months and age 17 or until age 18, whichever occurs first (minimum age: 17) |

| Passenger Restrictions | none/ parental discretion | Changed at parental discretion |

Teens with an intermediate license are not allowed to drive between the hours of 12:30 am and 5 am, but it’s up to parental discretion to decide what passengers are allowed in the vehicle while the teen is driving.

Now, let’s go look at another demographic and see what the renewal procedures are for older drivers.

Older Driver License Renewal Procedures in Iowa

How often do you need to renew your driver’s license in Iowa? Well, that depends on how old you are.

If you’re over 72 years old, you’ll have to renew your license every other year.

Proof of vision is required every time you renew, so online renewal is not allowed.

New Residents in Iowa

Are you moving to Iowa soon, or have you recently relocated? Welcome to Iowa!

According to the Iowa Department of Transportation, you can get a new Iowa driver’s license by paying applicable fees, passing a vision test, and presenting acceptable proof of residence and identity.

License Renewal Procedures in Iowa

What about renewal procedures for the general population? If you’re under the age of 72 years old, you must renew your license every eight years or prior to your 74th birthday, whichever occurs first.

Proof of vision is required every time you renew in person, but the good news is you can renew your license online every other time.

This means Iowans under the age of 72 can avoid going to the DMV for renewal for 16 years.

Make sure to keep your license current. You don’t want to get fined and go through the hassle that comes with driving without a valid license.

Negligent Operator Treatment System (NOTS) in Iowa

We all know that reckless or negligent driving is illegal. If you are caught engaging in reckless or negligent driving, you could face some serious consequences.

The difference between the two is the severity. Essentially, reckless driving is operating a vehicle in a way that is obviously dangerous, but negligent driving may be lesser instances of bad driving.

Usually, reckless driving is considered a simple misdemeanor in Iowa.

A conviction could mean:

- Up to 30 days in jail

- A fine between $25 and $625

A second offense could also mean a license suspension of five to 30 days.

Drivers who drive recklessly and cause the death of another person can be convicted of vehicular homicide, which is a class C felony. If you are convicted, you could face the following consequences:

| Cause of Homicide | Felony Class | Jail Time | License Revocation | Additional Penalties |

|---|---|---|---|---|

| Reckless driving while intoxicated | Class B Felony | Up to 25 years | Six years | Complete drinking and driving program; also may have to complete substance abuse program |

| Recklessness and/or fleeing from an officer | Class C Felony | Up to 10 years | Up to one year | $1,000 to $10,000 fines |

| Drag racing | Class D Felony | Up to five years | Up to one year | $750 to $7,000 fines |

If you cause the death of another person because you were driving recklessly while intoxicated, you can get up to 25 years in jail. Fleeing an officer an get you up to 10 years in jail and $10,000 in fines. You’ll also be facing up to five years if you cause the death of another person while drag racing.

Don’t be the cause of someone’s death on the road.

What are the rules of the road in Iowa?

Every driver needs to know the rules of the road. They help you stay safe and keep you from getting fines and points on your license. We are going to be going over various laws, ridesharing, and automated vehicles in Iowa.

First, let’s talk about fault versus no-fault.

Fault Versus No-fault in Iowa

Iowa follows an at-fault system for car accidents.

This means any driver who is found at fault in an accident is then responsible for all medical bills and property damages of all vehicles involved in the accident. This is why it is so important to have a sufficient level of coverage for your vehicle.

Although Iowa does not require minimum liability coverage in most cases, the state has a rate of 8.7 percent uninsured drivers. It’s smart to carry enough insurance to cover any damages you may incur if you’re in an accident.

You don’t want to go bankrupt because of a bad day, do you?

Seat Belt and Car Seat Laws in Iowa

Seat belts are required for drivers and front-seat passengers who are age 18 and older. Check out the information from The Insurance Institute for Highway Safety (IIHS) in the chart below.

| Seat Belt Laws in Iowa | Details |

|---|---|

| Effective Date | 07/01/1986 |

| Primary Enforcement | Yes; Effective 07/01/1986 |

| Age and Seats Applicable | 18+ Years in Front Seat |

| First Offense Maximum Fine | $25 |

All adults over the age of 18 must use a seat belt while in a vehicle that’s in operation.

It’s very important to keep your child safe by putting them into the correct car seat.

| Type of Car Seat Required | Age and Details |

|---|---|

| Must be in Child Safety Seat | Younger than 1 year and less than 20 pounds in a rear-facing child restraint; 1 through 5 years in a child restraint or a booster seat |

| Maximum Base Fine for 1st Offense | $25 |

| Preference for Rear Seat | Law states no preference |

| Adult Belt Permissable | 6 through 17 years old |

Kids less than one year of age or 20 pounds must be in a rear-facing child restraint. Years one through five must be in a child restraint or booster seat.

From six to 17 years old, an adult belt is permissible.

According to AAA, Iowa permits passengers riding in the beds of pickup trucks, except when prohibited by local ordinance.

Keep Right and Move Over Laws in Iowa

Have you ever been stuck behind a group of cars who are all going below the speed limit and won’t let you pass? Most states have laws about that, and Iowa is no exception.

If you’re driving slower than the traffic around you, state law requires that you keep right and let others pass on your left.

If you are approaching a stationary emergency vehicle flashing its lights, you must move out of the lane closest to it. If you are unable to vacate that lane, slow to a reasonable speed for road and traffic conditions.

Speed Limits in Iowa

Between 2009 and 2018, there were 633 speeding fatalities in Iowa. According to the Insurance Institute for Highway Safety, 26 percent of all crash fatalities were speed-related in 2017.

Research shows that raising speed limits also increases fatal crashes. So, keep your speedometer in check. It isn’t just to keep you from getting a ticket.

| Type of Road | Speed Limits |

|---|---|

| Urban Interstates | 55 mph |

| Rural Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 65 mph |

These are general rules, but please adhere to all posted speed limits.

Ridesharing in Iowa

Taxi services like Uber or Lyft are ridesharing services.

The following providers offer ridesharing insurance in Iowa:

- Farmers

- State Farm

- USAA

If you are working for a rideshare company, you will need to apply for ridesharing insurance.

Automation on the Road in Iowa

As technology keeps progressing faster and faster, automated vehicles are getting better and better. Could this finally be the answer to distracted driving?

But what about Iowa specifically?

| Rules | Details |

|---|---|

| What type of driving automation on public roads does the law or provision allow? | Deployment |

| Is an operator required to be licensed? | Yes |

| Is an operator required to be in the vehicle? | Depends on level of vehicle automation (If the vehicle can achieve a "minimal risk condition" in the event of a failure, the operator does not need to be in the vehicle) |

| Is liability insurance required? | Yes |

This data comes from iihs.org.

What are the safety laws in Iowa?

Safety is the single most important part of your driving experience. Anyone can have an accident because of an error in judgment or through no fault of their own. That’s one thing, and it’s forgivable.

Causing one because you’re checking a text message or under the influence is not.

Here we are going to go over some of the laws designed to keep you safe. We will be going over DUI, marijuana, and distracted driving laws.

DUI Laws in Iowa

Iowa has an Implied Consent Law. Under this law, a police officer can ask you to submit to a breath, urine, or blood test if they think you may be driving under the influence. If you refuse to take the test — or if you fail the test — the officer can take your license away on the spot.

If the tests show you have an alcohol concentration of 0.08 or more, you are considered legally intoxicated.

The table below shows how Iowa classifies drunk driving offenses.

| Impaired Driving Laws in Iowa | Details |

|---|---|

| Name of Offense | OWI (Operating While Intoxicated) |

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | First – serious misdemeanor Second – aggravated misdemeanor Third and subsequent – class D felony |

| Look Back Period/ Washout Period | 12 Years |

A look back period is the amount of time the offense will stay on your driving record. In Iowa, that’s 12 years. So, if you get convicted, you’ll have over a decade of paying high premiums because of one stupid decision.

If you get multiple offenses, the consequences get steadily worse.

| Offense | License revocation or suspension | IID Lock | Imprisonment | Fine | Other |

|---|---|---|---|---|---|

| First Offense | 180 days (may apply for temporary restricted license) | Must install IID if crash occurred or BAC was over 0.10 | 48 hours up to one year; min 48 hours may be served in OWI program with law enforcement security | $625 up to $1,250 OR community service | Complete substance abuse evaluation and treatment program Might be assigned a reality education substance abuse prevention program |

| Second Offense | Two years (not eligible for temporary restricted license for 45 days) | n/s | Seven days to two years | $1,875 to $6,250 | Same as first offense |

| Third Offense | Six years (not eligible for temporary restricted license for 45 days) | n/s | 30 days to five years | $3,125 to $9,375 | Same as first offense |

| Fourth Offense | Same as third offense | Same as third offense | Same as third offense | Same as third offense | Same as first offense |

Don’t drink and drive, and then you won’t have to worry about any of this.

Marijuana-impaired Driving Laws in Iowa

Iowa has a zero-tolerance policy for THC impaired driving. If you’re found to be driving under the influence of THC, you’ll be facing similar punishments as for a DUI.

This is important: marijuana can stay in your system long after you’ve used it. Police can book you for a DUI if a blood test results in your testing positive for marijuana you used days prior.

Even if you’re not driving while high, you can still be charged.

Distracted Driving Laws in Iowa

According to AAA, all drivers are prohibited from text messaging while driving. There is not a hand-held ban, so drivers with a general driver’s license can use a device if they are at a full stop off of the traveled portion of the roadway.

Young drivers with an intermediate license or learner’s permit are banned from using an electronic device in the car at all.

These laws are in place for good reason. Between 2010–2014, there were 1,419 crashes involving the use of a cell phone. Of these, 15 crashes resulted in fatalities, and 1,175 people were injured.

Driving in Iowa

Insurance rates are affected by more than just an individual’s demographics and history. There are other factors that affect the state as a whole that filter down to you. Let’s get into these and talk about vehicle theft, road fatalities, EMS response time, and more.

How many vehicle thefts occur in Iowa?

Is your vehicle on this most-stolen list? Check out the list below.

| Make/Model | Most Stolen Model Year | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2002 | 258 |

| Ford Pickup (Full Size) | 2001 | 198 |

| Chevrolet Impala | 2005 | 101 |

| Dodge Pickup (Full Size) | 2004 | 93 |

| Ford Taurus | 2003 | 77 |

| Jeep Cherokee/Grand Cherokee | 2005 | 65 |

| GMC Pickup (Full Size) | 2007 | 60 |

| Toyota Camry | 1997 | 59 |

| Dodge Caravan | 2005 | 56 |

| Pontiac Grand Prix | 1999 | 56 |

The year next to the vehicle is the most popular model year stolen. The number listed as stolen for that make and model includes all model years of it.

The FBI has compiled data from 2017 that details where thefts are happening by city.

| City | Motor Vehicle Thefts |

|---|---|

| Adel | 10 |

| Albia | 2 |

| Algona | 3 |

| Altoona | 23 |

| Ames | 57 |

| Anamosa | 3 |

| Ankeny | 38 |

| Atlantic | 9 |

| Audubon | 0 |

| Bettendorf | 46 |

| Blue Grass | 1 |

| Boone | 14 |

| Buffalo | 1 |

| Burlington | 74 |

| Carroll | 12 |

| Cedar Falls | 28 |

| Cedar Rapids | 342 |

| Centerville | 14 |

| Charles City | 4 |

| Cherokee | 0 |

| Clarinda | 13 |

| Clear Lake | 11 |

| Clinton | 104 |

| Clive | 23 |

| Colfax | 4 |

| Coralville | 14 |

| Council Bluffs | 429 |

| Cresco | 1 |

| Creston | 7 |

| Davenport | 555 |

| DeWitt | 2 |

| Decorah | 7 |

| Denison | 4 |

| Des Moines | 1,260 |

| Dubuque | 63 |

| Dyersville | 1 |

| Eldridge | 12 |

| Emmetsburg | 0 |

| Estherville | 0 |

| Evansdale | 8 |

| Fairfield | 16 |

| Forest City | 0 |

| Fort Dodge | 58 |

| Fort Madison | 33 |

| Glenwood | 5 |

| Grinnell | 12 |

| Grundy Center | 5 |

| Hampton | 2 |

| Harlan | 0 |

| Hawarden | 2 |

| Humboldt | 3 |

| Independence | 6 |

| Indianola | 26 |

| Iowa City | 81 |

| Jefferson | 3 |

| Johnston | 11 |

| Keokuk | 54 |

| Le Claire | 2 |

| Le Mars | 11 |

| Lisbon | 1 |

| Manchester | 6 |

| Maquoketa | 2 |

| Marion | 36 |

| Mason City | 37 |

| Monticello | 6 |

| Mount Pleasant | 9 |

| Mount Vernon | 1 |

| Muscatine | 37 |

| New Hampton | 3 |

| Newton | 18 |

| North Liberty | 3 |

| Norwalk | 8 |

| Oelwein | 7 |

| Ogden | 0 |

| Onawa | 6 |

| Orange City | 1 |

| Osage | 3 |

| Osceola | 5 |

| Oskaloosa | 9 |

| Ottumwa | 89 |

| Pella | 13 |

| Perry | 11 |

| Pleasant Hill | 38 |

| Polk City | 1 |

| Prairie City | 0 |

| Red Oak | 8 |

| Rock Valley | 1 |

| Sac City | 1 |

| Sergeant Bluff | 3 |

| Sheldon | 7 |

| Sigourney | 2 |

| Sioux Center | 0 |

| Sioux City | 289 |

| Spencer | 13 |

| Spirit Lake | 6 |

| Storm Lake | 6 |

| Story City | 2 |

| Tama | 2 |

| Tipton | 1 |

| Toledo | 3 |

| Urbandale | 47 |

| Vinton | 2 |

| Walcott | 3 |

| Washington | 4 |

| Waterloo | 142 |

| Waukee | 38 |

| Webster City | 9 |

| West Branch | 1 |

| West Burlington | 8 |

| Williamsburg | 3 |

| Windsor Heights | 1 |

| Winterset | 3 |

Some of these cities had zero reported thefts in 2017, but Des Moines was not one of those.

The city of Des Moines had 1,260 reported thefts in 2017. That makes sense, as it is the largest city in Iowa. With more people comes more opportunities for theft.

How Much Auto Insurance Costs in Iowa

Discover affordable rates in key cities like Des Moines and Cedar Rapids. Tailored coverage options await in Ames, Manchester, Sioux City, and Westside. Drive confidently with the right coverage at the right price in Iowa!

| Find Affordable Car Insurance Rates in Iowa | |

|---|---|

| Ames, IA | Manchester, IA |

| Cedar Rapids, IA | Sioux City, IA |

| Des Moines, IA | Westside, IA |

How many road fatalities occur in Iowa?

The National Highway Traffic Safety Administration (NHTSA) regularly publishes data about crashes, fatalities, and causes.

Let’s take a look at these facts.

Most Fatal Highway in Iowa

Every year, more than 30,000 people die in road crashes across the country. According to the National Highway Traffic Safety Administration, the fatal crash rate was calculated based on the annual number of road and crash fatalities.

Cutting across the entire state with about one-third of the population living nearby, Iowa’s most fatal highway is I-80. According to geotab.com, the highway sees about 15 fatalities every year.

Fatal Crashes by Weather Condition and Light Condition in Iowa

It will come as no surprise that weather conditions affect crash rates, right?

Let’s see what that looks like.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other/Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 146 | 21 | 85 | 14 | 1 | 267 |

| Rain | 4 | 3 | 4 | 0 | 0 | 11 |

| Snow/Sleet | 4 | 0 | 3 | 0 | 0 | 7 |

| Other | 3 | 2 | 3 | 1 | 0 | 9 |

| Unknown | 3 | 0 | 3 | 0 | 1 | 7 |

| TOTAL | 160 | 26 | 98 | 15 | 2 | 301 |

Most fatalities occur during normal daylight conditions, as that is when people are driving most.

Now, let’s look at the somber numbers for fatalities in Iowa.

Fatalities (All Crashes) by County in Iowa

You can search the following table which shows fatalities by county in Iowa.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities per 100k Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Adair | 5 | 0 | 5 | 2 | 4 | 67.87 | 0 | 71.45 | 28.36 | 56.63 |

| Adams | 2 | 1 | 0 | 0 | 0 | 51.59 | 26.65 | 0 | 0 | 0 |

| Allamakee | 3 | 3 | 3 | 2 | 1 | 21.34 | 21.65 | 21.66 | 14.49 | 7.23 |

| Appanoose | 2 | 2 | 5 | 2 | 2 | 15.78 | 15.91 | 39.98 | 16.18 | 16.08 |

| Audubon | 1 | 1 | 1 | 4 | 0 | 17.33 | 17.5 | 17.77 | 71.86 | 0 |

| Benton | 6 | 11 | 9 | 5 | 7 | 23.42 | 42.97 | 35.11 | 19.51 | 27.3 |

| Black Hawk | 5 | 10 | 11 | 8 | 10 | 3.75 | 7.48 | 8.26 | 6.04 | 7.55 |

| Boone | 6 | 4 | 2 | 1 | 4 | 22.82 | 15.12 | 7.57 | 3.78 | 15.18 |

| Bremer | 3 | 1 | 1 | 0 | 3 | 12.16 | 4.04 | 4.04 | 0 | 12.03 |

| Buchanan | 1 | 4 | 2 | 3 | 1 | 4.73 | 18.94 | 9.52 | 14.18 | 4.72 |

| Buena Vista | 6 | 3 | 2 | 1 | 1 | 29.1 | 14.72 | 9.84 | 4.97 | 5.03 |

| Butler | 1 | 1 | 4 | 2 | 0 | 6.68 | 6.72 | 27.2 | 13.72 | 0 |

| Calhoun | 3 | 1 | 1 | 4 | 2 | 30.47 | 10.2 | 10.2 | 41.03 | 20.62 |

| Carroll | 6 | 0 | 4 | 3 | 1 | 29.27 | 0 | 19.63 | 14.8 | 4.96 |

| Cass | 6 | 5 | 14 | 1 | 5 | 44.8 | 37.47 | 106.37 | 7.62 | 38.67 |

| Cedar | 2 | 5 | 2 | 2 | 4 | 10.91 | 27.31 | 10.86 | 10.78 | 21.47 |

| Cerro Gordo | 6 | 7 | 6 | 12 | 5 | 13.89 | 16.29 | 13.92 | 27.91 | 11.72 |

| Cherokee | 2 | 2 | 1 | 1 | 2 | 16.95 | 17.41 | 8.77 | 8.83 | 17.67 |

| Chickasaw | 2 | 1 | 5 | 0 | 2 | 16.33 | 8.23 | 41.34 | 0 | 16.72 |

| Clarke | 0 | 0 | 6 | 3 | 4 | 0 | 0 | 64.86 | 32.15 | 42.45 |

| Clay | 5 | 1 | 1 | 1 | 0 | 30.33 | 6.06 | 6.14 | 6.19 | 0 |

| Clayton | 2 | 3 | 4 | 1 | 5 | 11.25 | 16.92 | 22.65 | 5.67 | 28.48 |

| Clinton | 4 | 3 | 2 | 1 | 6 | 8.35 | 6.31 | 4.23 | 2.13 | 12.9 |

| Crawford | 2 | 4 | 3 | 0 | 3 | 11.65 | 23.4 | 17.53 | 0 | 17.48 |

| Dallas | 6 | 4 | 6 | 2 | 5 | 7.72 | 4.96 | 7.12 | 2.29 | 5.54 |

| Davis | 1 | 2 | 3 | 0 | 3 | 11.42 | 22.79 | 33.77 | 0 | 33.27 |

| Decatur | 3 | 0 | 1 | 7 | 4 | 36.55 | 0 | 12.43 | 88.13 | 50.7 |

| Delaware | 1 | 2 | 4 | 2 | 4 | 5.75 | 11.5 | 23.15 | 11.66 | 23.43 |

| Des Moines | 2 | 4 | 5 | 3 | 2 | 4.99 | 10.04 | 12.63 | 7.63 | 5.11 |

| Dickinson | 2 | 4 | 2 | 1 | 3 | 11.88 | 23.52 | 11.69 | 5.82 | 17.49 |

| Dubuque | 9 | 4 | 4 | 10 | 6 | 9.33 | 4.13 | 4.13 | 10.31 | 6.19 |

| Emmet | 1 | 1 | 0 | 0 | 0 | 10.18 | 10.31 | 0 | 0 | 0 |

| Fayette | 5 | 2 | 2 | 3 | 3 | 24.64 | 9.93 | 10.08 | 15.22 | 15.26 |

| Floyd | 3 | 1 | 6 | 5 | 5 | 18.75 | 6.29 | 37.84 | 31.72 | 31.72 |

| Franklin | 0 | 3 | 1 | 1 | 0 | 0 | 29.05 | 9.82 | 9.84 | 0 |

| Fremont | 3 | 0 | 3 | 3 | 2 | 42.67 | 0 | 43.16 | 43.15 | 28.6 |

| Greene | 2 | 2 | 3 | 1 | 2 | 21.92 | 22.37 | 33.33 | 11.15 | 22.27 |

| Grundy | 2 | 0 | 2 | 1 | 1 | 16.14 | 0 | 16.28 | 8.12 | 8.13 |

| Guthrie | 1 | 2 | 0 | 2 | 0 | 9.36 | 18.78 | 0 | 18.75 | 0 |

| Hamilton | 2 | 5 | 5 | 1 | 4 | 13.14 | 32.85 | 33.13 | 6.64 | 26.75 |

| Hancock | 3 | 2 | 0 | 2 | 2 | 27.17 | 18.14 | 0 | 18.56 | 18.67 |

| Hardin | 2 | 3 | 4 | 0 | 4 | 11.54 | 17.39 | 23.29 | 0 | 23.71 |

| Harrison | 3 | 2 | 1 | 5 | 5 | 21.03 | 14.14 | 7.12 | 35.39 | 35.38 |

| Henry | 2 | 3 | 5 | 2 | 4 | 10.08 | 15.12 | 25.22 | 9.97 | 19.93 |

| Howard | 0 | 2 | 1 | 0 | 0 | 0 | 21.48 | 10.81 | 0 | 0 |

| Humboldt | 2 | 0 | 3 | 1 | 4 | 20.76 | 0 | 31.52 | 10.44 | 41.9 |

| Ida | 0 | 1 | 1 | 1 | 2 | 0 | 14.37 | 14.38 | 14.59 | 29.24 |

| Iowa | 1 | 5 | 8 | 9 | 2 | 6.13 | 30.72 | 49.43 | 55.84 | 12.39 |

| Jackson | 3 | 4 | 4 | 4 | 2 | 15.44 | 20.66 | 20.63 | 20.65 | 10.29 |

| Jasper | 5 | 5 | 4 | 4 | 4 | 13.56 | 13.61 | 10.9 | 10.82 | 10.77 |

| Jefferson | 1 | 1 | 1 | 3 | 4 | 5.62 | 5.58 | 5.54 | 16.45 | 21.76 |

| Johnson | 8 | 5 | 16 | 8 | 7 | 5.6 | 3.45 | 10.89 | 5.36 | 4.63 |

| Jones | 4 | 4 | 3 | 1 | 1 | 19.47 | 19.57 | 14.69 | 4.83 | 4.82 |

| Keokuk | 4 | 2 | 1 | 1 | 1 | 38.89 | 19.66 | 9.83 | 9.85 | 9.78 |

| Kossuth | 3 | 2 | 2 | 2 | 0 | 19.7 | 13.19 | 13.24 | 13.36 | 0 |

| Lee | 3 | 11 | 11 | 4 | 4 | 8.56 | 31.52 | 31.92 | 11.68 | 11.75 |

| Linn | 14 | 5 | 20 | 16 | 13 | 6.42 | 2.27 | 9.01 | 7.13 | 5.75 |

| Louisa | 5 | 1 | 2 | 2 | 2 | 44.43 | 8.87 | 17.84 | 17.85 | 17.91 |

| Lucas | 1 | 0 | 1 | 2 | 0 | 11.58 | 0 | 11.69 | 23.39 | 0 |

| Lyon | 1 | 0 | 2 | 2 | 1 | 8.54 | 0 | 16.98 | 16.95 | 8.47 |

| Madison | 2 | 4 | 5 | 3 | 0 | 12.81 | 25.43 | 31.6 | 18.71 | 0 |

| Mahaska | 2 | 7 | 5 | 1 | 0 | 8.94 | 31.38 | 22.55 | 4.51 | 0 |

| Marion | 1 | 2 | 3 | 1 | 5 | 3.01 | 6.04 | 9.05 | 3.02 | 14.97 |

| Marshall | 5 | 4 | 4 | 12 | 4 | 12.27 | 9.91 | 9.97 | 29.89 | 10 |

| Mills | 3 | 2 | 5 | 3 | 6 | 20.32 | 13.45 | 33.26 | 19.93 | 39.83 |

| Mitchell | 3 | 1 | 1 | 0 | 2 | 28.04 | 9.37 | 9.4 | 0 | 18.92 |

| Monona | 1 | 3 | 5 | 7 | 4 | 11.24 | 33.83 | 56.88 | 80.04 | 46.09 |

| Monroe | 1 | 2 | 2 | 0 | 2 | 12.57 | 25.25 | 25.54 | 0 | 25.67 |

| Montgomery | 0 | 1 | 0 | 3 | 0 | 0 | 9.85 | 0 | 29.67 | 0 |

| Muscatine | 1 | 1 | 5 | 4 | 3 | 2.33 | 2.32 | 11.65 | 9.33 | 6.99 |

| O'Brien | 0 | 4 | 1 | 0 | 2 | 0 | 28.72 | 7.18 | 0 | 14.45 |

| Osceola | 3 | 2 | 1 | 4 | 0 | 48.15 | 32.45 | 16.39 | 66.24 | 0 |

| Page | 2 | 1 | 1 | 0 | 3 | 12.92 | 6.46 | 6.52 | 0 | 19.67 |

| Palo Alto | 3 | 0 | 0 | 4 | 2 | 32.89 | 0 | 0 | 44.15 | 22.4 |

| Plymouth | 1 | 4 | 3 | 4 | 3 | 4.01 | 16.06 | 11.91 | 15.94 | 11.95 |

| Pocahontas | 1 | 0 | 0 | 2 | 6 | 14.09 | 0 | 0 | 29.24 | 89.02 |

| Polk | 19 | 20 | 28 | 26 | 27 | 4.12 | 4.28 | 5.9 | 5.4 | 5.54 |

| Pottawattamie | 16 | 13 | 13 | 12 | 11 | 17.15 | 13.89 | 13.89 | 12.83 | 11.76 |

| Poweshiek | 5 | 2 | 2 | 6 | 3 | 26.87 | 10.74 | 10.79 | 32.32 | 16.04 |

| Ringgold | 0 | 0 | 6 | 2 | 1 | 0 | 0 | 120.36 | 39.77 | 20.13 |

| Sac | 3 | 1 | 4 | 3 | 3 | 29.86 | 10.04 | 40.77 | 30.62 | 30.87 |

| Scott | 13 | 21 | 19 | 8 | 13 | 7.59 | 12.21 | 11.03 | 4.63 | 7.5 |

| Shelby | 1 | 3 | 2 | 3 | 0 | 8.42 | 25.45 | 17.16 | 25.91 | 0 |

| Sioux | 1 | 3 | 4 | 3 | 2 | 2.89 | 8.63 | 11.44 | 8.61 | 5.73 |

| Story | 5 | 5 | 4 | 5 | 2 | 5.22 | 5.18 | 4.13 | 5.14 | 2.04 |

| Tama | 3 | 4 | 2 | 6 | 4 | 17.33 | 23.23 | 11.63 | 35.18 | 23.66 |

| Taylor | 0 | 0 | 2 | 2 | 0 | 0 | 0 | 32.06 | 32.53 | 0 |

| Union | 0 | 1 | 2 | 1 | 1 | 0 | 8.04 | 16.17 | 8.01 | 8.09 |

| Van Buren | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 27.62 | 13.96 | 0 |

| Wapello | 2 | 2 | 6 | 4 | 4 | 5.64 | 5.63 | 16.98 | 11.39 | 11.36 |

| Warren | 6 | 11 | 8 | 5 | 6 | 12.54 | 22.7 | 16.21 | 9.98 | 11.75 |

| Washington | 4 | 3 | 3 | 3 | 1 | 18.16 | 13.55 | 13.55 | 13.48 | 4.52 |

| Wayne | 0 | 1 | 0 | 4 | 0 | 0 | 15.73 | 0 | 61.67 | 0 |

| Webster | 2 | 7 | 6 | 5 | 9 | 5.4 | 18.89 | 16.33 | 13.65 | 24.81 |

| Winnebago | 1 | 0 | 0 | 2 | 1 | 9.48 | 0 | 0 | 18.89 | 9.51 |

| Winneshiek | 2 | 2 | 4 | 2 | 2 | 9.66 | 9.65 | 19.6 | 9.93 | 9.99 |

| Woodbury | 14 | 13 | 10 | 8 | 5 | 13.68 | 12.68 | 9.75 | 7.84 | 4.88 |

| Worth | 1 | 2 | 3 | 0 | 2 | 13.23 | 26.66 | 40.16 | 0 | 26.83 |

| Wright | 4 | 1 | 0 | 1 | 1 | 31 | 7.79 | 0 | 7.84 | 7.88 |

According to this data from nhtsa.gov, Polk County had the most fatalities in 2018. It is the most populous county in Iowa.

Traffic Fatalities in Iowa

Most traffic fatalities happen in rural areas rather than urban areas because there are fewer EMS service locations, so response time is generally slower.

| Type of Fatality | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 305 | 303 | 300 | 286 | 256 | 255 | 230 | 306 | 254 | 254 |

| Urban | 66 | 87 | 60 | 79 | 61 | 67 | 90 | 96 | 76 | 64 |

| Total Traffic Fatalities | 371 | 390 | 360 | 365 | 317 | 322 | 320 | 402 | 330 | 318 |

From 2009 to 2018, there were 3,495 total traffic fatalities in Iowa. On average, that’s about 350 a year.

There were 270 percent more car crash-related fatalities in rural areas than in urban areas over the 10-year period of 2009 to 2018.

In life-threatening situations, location can make the difference between life and death.

Fatalities by Person Type in Iowa

Below are the statistics for fatalities by vehicle type, motorcyclist, or pedestrian.

| Person Type | Number – 2014 | Percent – 2014 | Number – 2015 | Percent – 2015 | Number – 2016 | Percent – 2016 | Number- 2017 | Percent- 2017 | Number- 2018 | Percent- 2018 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 117 | 36 | 111 | 35 | 152 | 38 | 108 | 33 | 116 | 36 |

| Occupants | Light Truck – Pickup | 53 | 16 | 71 | 22 | 52 | 13 | 53 | 16 | 48 | 15 |

| Occupants | Light Truck – Utility | 32 | 10 | 42 | 13 | 54 | 13 | 42 | 13 | 38 | 12 |

| Occupants | Light Truck – Van | 17 | 5 | 12 | 4 | 32 | 8 | 17 | 5 | 19 | 6 |

| Occupants | Light Truck – Other | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 1 |

| Occupants | Large Truck | 11 | 3 | 6 | 2 | 12 | 3 | 19 | 6 | 8 | 3 |

| Occupants | Other/Unknown Occupants | 15 | 5 | 4 | 1 | 8 | 2 | 10 | 3 | 14 | 4 |