Expert New Hampshire Car Insurance Advice (Compare Costs & Companies)

Unlike most states, car insurance in New Hampshire isn't required, but New Hampshire law requires drivers to show proof of financial responsibility if they're found liable for someone else's injuries or damages. For those who buy car insurance, New Hampshire minimum auto insurance requirements are 25/50/25 in bodily injury and property damage liability.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 20, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 20, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Car insurance in New Hampshire isn’t mandatory, but it’s still a good idea to carry at least the minimum coverage

- New Hampshire minimum auto insurance requirements are 25/50/25 in bodily injury and property damage liability

- New Hampshire car insurance rates average $68 per month

| New Hampshire Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 16,132 Vehicle Miles Driven: 12,970 million |

| Vehicles Registered | 1,234,098 |

| Population | 1,356,458 |

| Most Popular Vehicle | Chevrolet Silverado 1500 |

| Total Driving Related Deaths (2017) | 102 |

| Speeding-Related Fatalities (2017) | 58 |

| DUI-Related Fatalities (2017) | 27 |

| Average Premiums (Annual) | Liability: $400.56 Collision: $307.42 Comprehensive: $110.77 Combined Premium: $818.75 |

| Percentage of Motorists Uninsured | 9.9% State Rank: 35th |

| Cheapest Provider | Geico |

Whether you’re just passing through on a road trip with your buddies or you’re a New Hampshire native who loves to explore the backroads and winding highways in the mountains, one thing is for sure: you’re going to need New Hampshire car insurance.

Yes, we know that the state of New Hampshire doesn’t require drivers to carry a car insurance policy, but did you know you are still required to cover costs of bodily injury and property damage for any accident you cause? Of course, the best way to cover those costs is to carry insurance.

So if you’re stuck in the woods without a compass and can’t seem to find your way out the car insurance forest, you’ve come to the right place. Finding the right New Hampshire car insurance policy doesn’t have to be as difficult as it seems.

In this guide, we’ll go over the types of coverage you’ll want to consider if you live in New Hampshire, where and how to find the best rates, factors that can affect the cost of your car insurance, road statistics, and much more.

If you’d like to start comparing rates in your area right now, use our free comparison tool by entering your ZIP code in the box above to get started.

New Hampshire Car Insurance Coverage and Rates

You may or may not know this, but New Hampshire is one of the only states in the U.S. that does not require car insurance for all drivers. But, as we mentioned above, the state does require you to pay for costs of bodily injury or property damage resulting from a car accident you caused.

Wait, what? I don’t need insurance in New Hampshire?

Before you start jumping up and down at the thought of not having to pay for a policy, let us tell you why driving without insurance is a very unwise decision.

Over 90 percent of New Hampshire residents have auto insurance even though they’re not legally required to carry it.

If you get into an accident, are you prepared to cover the costs of medical bills and vehicle repairs out of your own pocket? Most people just don’t have the cash lying around, so if you’re one of those people, stick around and we’ll show you how to get the best car insurance policy at the best possible price.

But how?

We’ve partnered with leading car insurance sources and experts including Nolo, the Insurance Information Institute, the National Association of Insurance Commissioners, and the FBI, to give you all the information you could need.

What is New Hampshire’s car culture?

According to Hartford, the types of roads and the climate affect a state’s car culture, and -New Hampshire drivers love rugged vehicles that can handle hilly roads and bad weather. The most popular car in New Hampshire is a pickup truck — the Chevrolet Silverado 1500. There are also a lot of Subarus and Audis on the roads.

The Hartford also says that many drivers in New Hampshire seem like they’re in a hurry — the snow doesn’t slow these drivers down. The state also has a thriving classic car scene, where members of clubs like the Car Nutz in Newport, New Hampshire get together to compare notes on restoring old cars and cruise around in their classic rides.

How much coverage is required for New Hampshire minimum coverage?

Because it’s legal in New Hampshire to drive without car insurance, there aren’t really any true “minimum liability coverage” laws. But the New Hampshire DMV says that if you do decide to carry car insurance in New Hampshire, your policy must include the following:

- Liability coverage

- Medical payments coverage

- Uninsured motorist coverage

Liability coverage will help you pay for costs associated with bodily injury or property damage to others resulting from an accident you caused.

Your liability insurance must meet the following minimums:

- $25,000 for bodily injury, per person

- $50,000 for bodily injury, if multiple people are injured in an accident

- $25,000 for property damage

Your policy must also include medical payment coverage to help pay for your own medical costs in case of a car accident. You must have at least $1,000 in medical payment coverage.

Although New Hampshire has a relatively low rate of uninsured drivers, your insurance policy must also include uninsured motorist coverage to help pay for injuries and damage to your property that may result from being in an accident with an uninsured driver (or a driver whose insurance is not sufficient to cover your costs).

What are the forms of financial responsibility in New Hampshire?

Since car insurance isn’t required in New Hampshire, proof of financial responsibility isn’t required either. However, if you get into a car accident, you’re required to cover the costs of the damage you caused, including medical bills.

If you aren’t able to show that you can pay for the damage, you can have your license suspended.

How much percentage of income are premiums in New Hampshire?

New Hampshire’s annual per capita disposable income is $48,280. Disposable income is the amount of money that a person has to spend after they’ve paid their taxes.

According to our data from 2014, a full-coverage car insurance policy costs an average of $795.50 per year per driver. This means that drivers spend about 1.65 percent of their yearly income on car insurance alone. When we look at the three-year trend from 2012–2014, we see that the cost of car insurance has only increased by about $40, and the average yearly salary has also increased by almost $1,000.

The annual cost of car insurance in New Hampshire is about $180 cheaper than the average cost of car insurance in the U.S.

When we look at the cost of car insurance in surrounding states, we see that Maine has a cheaper average annual rate at $689.12, but also a lower annual income of $37,049, while Massachusetts has a more expensive average annual rate at $1,107.76 and a higher annual income of $50,366.

If you’re curious to know how much of your annual income is being spent on car insurance, use our free percentage calculator tool below.

CalculatorPro

Average Monthly Car Insurance Rates in NH (Liability, Collision, Comprehensive)

How much does car insurance cost in New Hampshire? The data in the table below is brought to you by the NAIC. Keep in mind that these are the average amounts for the following types of car insurance coverage in the Granite State.

| Coverage Type | National Average | New Hampshire Average |

|---|---|---|

| Full Coverage | $1,009.38 | $818.75 |

| Liability | $538.73 | $400.56 |

| Collision | $322.61 | $307.42 |

| Comprehensive | $148.04 | $110.77 |

Since this data is from 2016, you can expect costs to be slightly higher now.

What additional liability is available in New Hampshire?

Additional liability insurance is a type of insurance that normally isn’t required by law. It’s there to protect you even more than an average policy would in the event of an accident.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 73.39% | 68.59% | 66.34% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 54.43% | 62.79% | 49.57% |

Why is additional liability insurance such as medical payments and uninsured/underinsured important?

According to the New Hampshire DMV, although the state has a relatively low rate of uninsured drivers, your insurance policy must include uninsured motorist coverage to help cover your injuries and damage to your property that may result from being in an accident with an uninsured driver (or a driver whose insurance is not sufficient to cover your costs).

Your uninsured motorist coverage must match your liability coverage amounts.

Your policy must also include medical payment coverage to help pay for your own medical costs in case of a car accident. You must have at least $1,000 in medical payments coverage.

Did you know that almost 10 percent of New Hampshire drivers do not have car insurance? New Hampshire is ranked 35th in the U.S. for uninsured drivers.

When searching for a good car insurance company, make sure you check out their loss ratio percentage, as this will give you an idea of how the company is doing financially.

- A loss ratio under 40 percent is probably too low, and a loss ratio over 75 percent is too high.

- If a loss ratio is too low, then the company is collecting more in premiums than it needs for the number of claims it is paying out.

- If a loss ratio is too high, the carrier is not collecting enough in premiums for the claims it is receiving, which means they will likely be increasing their rates soon.

A high loss ratio doesn’t mean an insurance company is facing bankruptcy unless the loss ratio is high for several years in a row.

What add-ons, endorsements, and riders are available in New Hampshire?

Did you know there are even more ways to protect yourself and your vehicle if and when you’re involved in an accident?

You can build your policy from the ground up if you want to, or stack different coverage options on top of your already existing policy. You’re the boss — you decide exactly how you want to be covered.

Below is a list of extra coverage options. You can choose just one, or opt for all of them, depending on your needs and budget.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

Remember, the more coverage you have, the more secure you’ll be when you’re out on the road.

Average Monthly Car Insurance Rates by Age & Gender in NH

Did you know that factors like your age and gender can affect your car insurance rate? Check out the data in the table below to see what we mean.

| Company | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $4,044.64 | $5,099.29 | $2,074.05 | $2,199.82 | $1,971.11 | $2,091.82 | $2,108.93 | $2,311.91 |

| Geico | $2,567.96 | $3,560.95 | $1,102.51 | $1,664.55 | $1,057.44 | $1,046.60 | $946.66 | $946.66 |

| Nationwide | $4,405.75 | $5,590.99 | $1,823.61 | $1,956.81 | $1,585.61 | $1,608.07 | $1,429.82 | $1,499.99 |

| Progressive | $6,320.20 | $6,980.91 | $1,610.65 | $1,618.31 | $1,366.59 | $1,244.66 | $1,188.47 | $1,199.26 |

| Safeco | $18,139.34 | $20,118.55 | $5,209.68 | $5,519.33 | $4,942.38 | $5,338.33 | $4,025.54 | $4,521.69 |

| State Farm | $4,066.25 | $5,031.12 | $1,508.29 | $1,721.50 | $1,352.09 | $1,352.09 | $1,231.58 | $1,231.58 |

| USAA | $4,269.45 | $4,673.07 | $1,246.20 | $1,361.16 | $992.31 | $973.40 | $926.28 | $927.55 |

As you probably noticed, the older you get, the less you pay for car insurance. As for gender, usually, females end up paying less for car insurance than males do.

Keep in mind that the data shown above is based on actual purchased coverage by the state population and includes rates for high-risk drivers and drivers who chose to purchase more than the state minimum as well as other types of coverage not required such as uninsured/underinsured motorist, PIP, and MedPay.

What are the cheapest rates by ZIP code in New Hampshire?

Did you know that where you live can affect your car insurance rate?

If your city or neighborhood is more prone to crime or natural disaster, you might be paying a little more than average for your car insurance policy. The table below shows the top 25 most expensive ZIP codes for car insurance in the state of New Hampshire.

| ZIP Code | City | Average | Allstate | Geico | Safeco | Nationwide | Progressive | State Farm | USAA |

|---|---|---|---|---|---|---|---|---|---|

| 03104 | Manchester | $3,845.88 | $3,137.78 | $1,929.49 | $10,234.44 | $3,322.91 | $3,081.80 | $2,949.61 | $2,265.12 |

| 03101 | Manchester | $3,835.72 | $3,133.15 | $1,929.49 | $10,234.44 | $3,322.91 | $3,081.80 | $2,883.13 | $2,265.12 |

| 03102 | Manchester | $3,825.66 | $3,002.18 | $1,878.72 | $10,234.44 | $3,322.91 | $3,081.80 | $2,994.46 | $2,265.12 |

| 03103 | Manchester | $3,762.33 | $2,762.47 | $1,878.72 | $10,234.44 | $3,322.91 | $3,081.80 | $2,790.88 | $2,265.12 |

| 03841 | Hampstead | $3,735.99 | $3,212.02 | $1,731.34 | $9,804.60 | $2,827.31 | $3,434.34 | $2,863.76 | $2,278.55 |

| 03811 | Atkinson | $3,725.58 | $3,212.02 | $1,798.02 | $9,804.60 | $2,827.31 | $3,434.34 | $2,724.21 | $2,278.55 |

| 03109 | Manchester | $3,720.88 | $2,787.74 | $1,747.47 | $10,234.44 | $3,322.91 | $3,081.80 | $2,606.71 | $2,265.12 |

| 03826 | East Hampstead | $3,695.88 | $3,456.72 | $1,798.02 | $9,804.60 | $2,827.31 | $2,790.16 | $2,915.78 | $2,278.55 |

| 03858 | Newton | $3,694.35 | $3,163.14 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,747.63 | $2,278.55 |

| 03848 | Kingston | $3,689.28 | $3,163.14 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,712.14 | $2,278.55 |

| 03079 | Salem | $3,678.46 | $3,132.62 | $1,762.82 | $9,646.10 | $3,153.58 | $3,289.60 | $2,363.39 | $2,401.14 |

| 03865 | Plaistow | $3,653.43 | $2,918.41 | $1,798.02 | $9,804.60 | $2,827.31 | $3,241.23 | $2,705.88 | $2,278.55 |

| 03087 | Windham | $3,648.72 | $3,132.62 | $1,747.47 | $9,646.10 | $3,153.58 | $2,946.89 | $2,513.28 | $2,401.14 |

| 03827 | East Kingston | $3,640.47 | $3,060.96 | $1,650.93 | $9,804.60 | $2,827.31 | $3,241.23 | $2,619.70 | $2,278.55 |

| 03076 | Pelham | $3,611.18 | $3,103.08 | $1,747.47 | $9,646.10 | $2,528.63 | $3,289.60 | $2,562.23 | $2,401.14 |

| 03874 | Seabrook | $3,610.79 | $2,904.06 | $1,650.93 | $9,804.60 | $2,827.31 | $3,241.23 | $2,568.83 | $2,278.55 |

| 03859 | Newton Junction | $3,512.48 | $3,163.14 | $1,798.02 | $9,804.60 | $2,421.57 | $2,790.16 | $2,689.18 | $1,920.69 |

| 03060 | Nashua | $3,451.59 | $2,959.49 | $1,847.27 | $9,141.45 | $2,842.24 | $2,848.25 | $2,637.91 | $1,884.55 |

| 03819 | Danville | $3,424.28 | $2,918.41 | $1,650.93 | $9,804.60 | $2,421.57 | $2,790.16 | $2,463.63 | $1,920.69 |

| 03064 | Nashua | $3,405.94 | $2,960.04 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,514.48 | $1,884.55 |

| 03032 | Auburn | $3,404.93 | $3,132.62 | $1,747.47 | $8,513.56 | $3,153.58 | $2,923.20 | $2,403.01 | $1,961.04 |

| 03062 | Nashua | $3,400.72 | $2,959.49 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,478.49 | $1,884.55 |

| 03038 | Derry | $3,394.58 | $2,863.36 | $1,886.80 | $8,483.24 | $3,153.58 | $2,749.60 | $2,664.42 | $1,961.04 |

| 03063 | Nashua | $3,389.41 | $2,959.49 | $1,650.60 | $9,141.45 | $2,842.24 | $2,848.25 | $2,399.32 | $1,884.55 |

| 03049 | Hollis | $3,331.53 | $2,936.83 | $1,689.50 | $9,141.45 | $2,469.60 | $2,785.35 | $2,336.95 | $1,961.04 |

As you can see, Manchester, New Hampshire has the most expensive car insurance rate.

This next table shows the 25 least expensive ZIP codes for car insurance in the state of New Hampshire.

| ZIP Code | Average | Allstate | Geico | Safeco | Nationwide | Progressive | State Farm | USAA |

|---|---|---|---|---|---|---|---|---|

| 03748 | $3,039.66 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,958.34 | $1,920.69 |

| 03272 | $3,038.38 | $2,799.15 | $1,497.18 | $7,713.25 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03446 | $3,037.08 | $2,799.15 | $1,533.97 | $8,476.40 | $2,340.52 | $2,587.81 | $1,909.36 | $1,612.39 |

| 03284 | $3,033.79 | $2,503.17 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,872.95 | $1,920.69 |

| 03755 | $3,032.36 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,907.21 | $1,920.69 |

| 03766 | $3,030.03 | $2,458.89 | $1,497.18 | $8,476.40 | $2,387.99 | $2,578.15 | $1,890.89 | $1,920.69 |

| 03245 | $3,029.02 | $2,467.84 | $1,667.83 | $7,986.70 | $2,398.41 | $2,695.12 | $2,068.34 | $1,918.91 |

| 03869 | $3,028.86 | $2,649.28 | $1,533.81 | $7,743.08 | $2,682.03 | $2,836.64 | $2,112.63 | $1,644.58 |

| 03753 | $3,023.42 | $2,503.17 | $1,497.18 | $8,382.59 | $2,387.99 | $2,578.15 | $1,894.16 | $1,920.69 |

| 03291 | $3,013.06 | $2,657.49 | $1,583.08 | $7,669.32 | $2,421.57 | $2,621.90 | $2,217.39 | $1,920.69 |

| 03264 | $2,994.72 | $2,461.29 | $1,667.83 | $7,986.70 | $2,398.41 | $2,444.07 | $2,085.85 | $1,918.91 |

| 03258 | $2,993.83 | $2,631.15 | $1,731.34 | $7,713.25 | $2,469.60 | $2,210.05 | $2,280.73 | $1,920.69 |

| 03273 | $2,991.56 | $2,471.42 | $1,497.18 | $7,713.25 | $2,469.60 | $2,578.15 | $2,290.65 | $1,920.69 |

| 03839 | $2,986.51 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,215.18 | $1,644.58 |

| 03867 | $2,980.81 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,175.29 | $1,644.58 |

| 03868 | $2,980.81 | $2,569.88 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,175.29 | $1,644.58 |

| 03878 | $2,978.65 | $2,649.28 | $1,510.82 | $7,743.08 | $2,682.03 | $2,540.02 | $2,080.76 | $1,644.58 |

| 03274 | $2,977.73 | $2,503.17 | $1,497.18 | $7,713.25 | $2,398.41 | $2,695.12 | $2,118.06 | $1,918.91 |

| 03221 | $2,967.97 | $2,799.15 | $1,497.18 | $7,713.25 | $2,469.60 | $2,210.05 | $2,165.89 | $1,920.69 |

| 03275 | $2,962.53 | $2,658.84 | $1,626.68 | $7,713.25 | $2,367.40 | $2,396.82 | $2,265.95 | $1,708.76 |

| 03304 | $2,960.07 | $2,572.77 | $1,731.34 | $7,713.25 | $2,367.40 | $2,324.36 | $2,302.61 | $1,708.76 |

| 03301 | $2,935.65 | $2,577.37 | $1,626.68 | $7,713.25 | $2,367.40 | $2,324.36 | $2,231.73 | $1,708.76 |

| 03303 | $2,919.52 | $2,469.86 | $1,626.68 | $7,713.25 | $2,367.40 | $2,324.36 | $2,226.33 | $1,708.76 |

| 03229 | $2,913.60 | $2,509.52 | $1,497.18 | $7,713.25 | $2,367.40 | $2,324.36 | $2,274.75 | $1,708.76 |

| 03435 | $2,901.99 | $2,799.15 | $1,533.97 | $7,369.92 | $2,340.52 | $2,722.03 | $1,935.95 | $1,612.39 |

ZIP codes in the city of Keene had the least expensive car insurance rate.

What are the cheapest rates by city in New Hampshire?

We have also collected data on the most and least expensive cities in New Hampshire. This next table shows the cities in New Hampshire with the least expensive car insurance rates.

| City | Average Grand Total |

|---|---|

| Bow | $2,960.07 |

| Bradford | $2,967.97 |

| Chichester | $2,993.83 |

| Concord | $2,927.59 |

| Contoocook | $2,913.60 |

| Enfield | $3,039.66 |

| Grantham | $3,023.42 |

| Hanover | $3,032.36 |

| Holderness | $3,029.02 |

| Keene | $2,894.88 |

| Lebanon | $3,030.03 |

| New Castle | $3,049.39 |

| North Sutton | $3,052.95 |

| Plymouth | $2,994.72 |

| Portsmouth | $3,046.47 |

| Rochester | $2,982.71 |

| Rollinsford | $3,028.86 |

| Somersworth | $2,978.65 |

| South Newbury | $3,038.38 |

| South Sutton | $2,991.56 |

| Springfield | $3,033.79 |

| Stinson Lake | $2,977.73 |

| Suncook | $2,962.53 |

| Swanzey | $3,037.08 |

| West Nottingham | $3,013.06 |

Just like we saw in the ZIP code table, the city of Keene has the cheapest average car insurance rate.

And here are the New Hampshire cities with the most expensive car insurance rates. Is your city on the list?

| City | Average Grand Total |

|---|---|

| Amherst | $3,277.35 |

| Atkinson | $3,725.58 |

| Auburn | $3,404.93 |

| Bedford | $3,272.93 |

| Danville | $3,424.29 |

| Derry | $3,394.58 |

| East Hampstead | $3,695.88 |

| East Kingston | $3,640.47 |

| Goffstown | $3,294.84 |

| Hampstead | $3,735.99 |

| Hollis | $3,331.53 |

| Hooksett | $3,268.15 |

| Kingston | $3,689.28 |

| Londonderry | $3,324.24 |

| Manchester | $3,798.09 |

| Nashua | $3,411.92 |

| Newton | $3,694.35 |

| Newton Junction | $3,512.48 |

| North Salem | $3,314.36 |

| Pelham | $3,611.18 |

| Plaistow | $3,653.43 |

| Salem | $3,678.46 |

| Sandown | $3,269.18 |

| Seabrook | $3,610.79 |

| Windham | $3,648.72 |

Manchester is the city with the most expensive average car insurance rate.

| Find Affordable Car Insurance Rates in New Hampshire |

|---|

| Franklin, NH |

| Manchester, NH |

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Car Insurance Companies in New Hampshire

With so many providers out there, it can be difficult to choose the right one for you and your family. After all, who has time to sift through policies, fine print, and reviews?

But guess what?

We’ve already done all of the hard work for you. In this next section, we’ll go over financial ratings, complaints, customer service rankings and much more. Stay tuned as we clue you in on this exclusive information.

What are the financial ratings of the largest car insurance companies in New Hampshire?

Ratings from A.M. Best show us a company’s financial strength. In the table below you’ll see the ratings for the top 10 insurance companies in New Hampshire.

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| Allstate | A+ | $84,945 | 54.95% | 10.04% |

| Amica Mutual | A+ | $29,976 | 65.49% | 3.54% |

| Auto-Owners | A++ | $27,987 | 60.58% | 3.31% |

| Geico | A++ | $114,977 | 72.49% | 13.59% |

| Liberty Mutual | A | $97,114 | 58.48% | 11.48% |

| Metropolitan | A | $25,318 | 54.20% | 2.99% |

| Progressive | A+ | $103,823 | 61.53% | 12.28% |

| State Farm | A++ | $106,434 | 52.06% | 12.58% |

| Travelers | A++ | $20,099 | 59.55% | 2.38% |

| USAA | A++ | $44,555 | 72.58% | 5.27% |

It’s no surprise that widely known companies like these would rank extremely high. They all appear to be very stable and committed to carrying out their financial obligations.

Which car insurance companies have the best ratings in New Hampshire?

The 2019 U.S. Auto Insurance Study conducted by J.D. Power, now in its 20th year, examines customer satisfaction using five factors (in order of importance): interaction, policy offerings, price, billing process and policy information, and claims. The study is based on responses from 42,759 auto insurance customers and was conducted from February through April 2019.

Take a look at some of the highest-ranked companies in the table below.

| Company | Points (based on a 1,000-point scale) | Power Circle Ratings |

|---|---|---|

| Allstate | 830 | 4 |

| Amica Mutual | 852 | 5 |

| Arbella | 802 | 2 |

| Geico | 836 | 4 |

| Liberty Mutual | 808 | 2 |

| MAPFRE Insurance | 807 | 2 |

| Metlife | 794 | 2 |

| Nationwide | 822 | 3 |

| New England Average | 822 | 3 |

| Plymouth Rock Assurance | 801 | 2 |

| Progressive | 825 | 3 |

| Safeco | 801 | 2 |

| Safety Insurance | 797 | 2 |

| State Farm | 844 | 4 |

| The Hanover | 817 | 3 |

| Travelers | 810 | 2 |

| USAA | 898 | 5 |

With the exception of USAA (a company that only services military members and their families), Amica Mutual was ranked as the number one car insurance company in the entire New England region.

Which car insurance companies have the most complaints in New Hampshire?

The following table shows complaint data for the top 10 companies in New Hampshire. This data was collected by the NAIC.

| Company | National Median Complaint Ratio | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|---|

| Allstate | 1 | 0.5 | 163 |

| Amica Mutual | 1 | 0.46 | 52 |

| Auto-Owners | 1 | 0.53 | 31 |

| Geico | N/A | 0.007 | 6 |

| Liberty Mutual | 1 | 5.95 | 222 |

| Metropolitan | 1 | 1.3 | 70 |

| Progressive | 1 | 0.75 | 120 |

| State Farm | 1 | 0.44 | 1,482 |

| Travelers | 1 | 0.09 | 2 |

| USAA | N/A | 0 | 2 |

Even though it seems like many of these companies have a high number of complaints, you shouldn’t be alarmed. Every company receives complaints — how a company chooses to handle a complaint is what really matters.

What are the cheapest car insurance companies in New Hampshire?

The data in the table below shows companies with the cheapest car insurance rates in the state of New Hampshire.

| Company | Average | Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Allstate | $2,737.70 | -$421.29 | -15.39% |

| Geico | $1,611.67 | -$1,547.32 | -96.01% |

| Nationwide | $2,487.58 | -$671.41 | -26.99% |

| Progressive | $2,691.13 | -$467.86 | -17.39% |

| Safeco | $8,476.85 | $5,317.87 | 62.73% |

| State Farm | $2,186.81 | -$972.18 | -44.46% |

| USAA | $1,921.18 | -$1,237.81 | -64.43% |

As you can see, Geico has the cheapest average car insurance rate in this state, followed by State Farm (if you’re not eligible for USAA).

Does my commute affect my car insurance rate in New Hampshire?

How far you drive every day can also affect your car insurance rate. Car insurance companies know that the more you drive, the more likely you are to get into an accident. That’s why your rates might be a little higher if you spend a lot of time behind the wheel.

Take a look at the table below.

| Group | 10-Mile Commute/ 6,000 Annual Miles | 25-Mile Commute/ 12,000 Annual Miles |

|---|---|---|

| Allstate | $2,700.46 | $2,774.94 |

| Geico | $1,598.00 | $1,625.33 |

| Liberty Mutual | $8,476.86 | $8,476.86 |

| Nationwide | $2,487.58 | $2,487.58 |

| Progressive | $2,691.13 | $2,691.13 |

| State Farm | $2,137.31 | $2,236.31 |

| USAA | $1,901.80 | $1,940.56 |

While some companies charge the exact same rate no matter how many miles you rack up, other companies charge $20–$100 more per year to people who drive more than average.

If you know that you drive a lot, try looking at rates from Progressive or Nationwide.

Can coverage level change my car insurance rate with companies in New Hampshire?

The coverage level you choose can also affect your rate.

What do we mean by that? Sometimes your car insurance provider will give you a break on your rate if you purchase more insurance than what is required by law. Take a look at the table below.

| Group | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $2,661.29 | $2,734.45 | $2,817.35 |

| Geico | $1,537.03 | $1,602.39 | $1,695.58 |

| Liberty Mutual | $8,144.06 | $8,450.31 | $8,836.20 |

| Nationwide | $2,652.92 | $2,453.07 | $2,356.75 |

| Progressive | $2,584.38 | $2,691.20 | $2,797.82 |

| State Farm | $2,088.49 | $2,189.03 | $2,282.92 |

| USAA | $1,847.91 | $1,917.96 | $1,997.66 |

For just a few hundred dollars more per year (that’s less than $30–$40 per month), you could go from having minimum liability insurance to comprehensive coverage.

If you can afford to cut back on gourmet coffee and pay a few hundred dollars more per year, having a comprehensive car insurance policy could save you thousands of dollars more in the long run.

How does my credit history affect my car insurance rate with companies in New Hampshire?

Your credit history affects more than just your interest rates and your mortgage approvals. Car insurance companies can and will use your credit score to help them determine if you’re responsible with money. In other words, your credit history can heavily influence your car insurance rate.

Take a look at the next table.

| Group | Poor Credit History | Fair Credit History | Good Credit History |

|---|---|---|---|

| Allstate | $3,368.40 | $2,492.26 | $2,352.43 |

| Geico | $1,907.34 | $1,564.33 | $1,363.32 |

| Liberty Mutual | $12,168.83 | $7,441.23 | $5,820.50 |

| Nationwide | $2,896.14 | $2,374.92 | $2,191.67 |

| Progressive | $2,986.88 | $2,624.47 | $2,462.05 |

| State Farm | $3,096.59 | $1,927.69 | $1,536.16 |

| USAA | $2,606.19 | $1,714.14 | $1,443.21 |

As you can see, if you have poor credit, you’ll likely pay thousands of dollars more for your car insurance policy per year than the average driver.

The average person’s credit score in New Hampshire is 701, which is higher than the national average of 675. Only Vermont had a higher average, at 702.

So if you have good credit like the average New Hampshire resident, you shouldn’t have to worry about companies inflating your rates for this reason.

How does my driving record change my rates with car insurance companies in New Hampshire?

The most influential factor to affect your car insurance rate is likely going to be your driving record. Check out the driving record data in the table below.

| Group | Clean Record | With One Speeding Violation | With One Accident | With One DUI |

|---|---|---|---|---|

| Allstate | $2,276.40 | $2,655.21 | $3,095.98 | $2,923.20 |

| Geico | $1,437.50 | $1,437.50 | $1,590.83 | $1,980.83 |

| Liberty Mutual | $5,324.37 | $9,084.16 | $9,624.42 | $9,874.47 |

| Nationwide | $1,914.01 | $2,129.05 | $2,657.49 | $3,249.78 |

| Progressive | $2,312.48 | $2,711.71 | $3,190.12 | $2,550.23 |

| State Farm | $2,013.89 | $2,013.89 | $2,157.23 | $2,562.23 |

| USAA | $1,483.03 | $1,724.12 | $1,996.60 | $2,480.96 |

If you get one speeding ticket, your rate is likely to go up by a few hundred dollars. If you’re convicted of just one DUI, your car insurance rate could increase by thousands of dollars.

On the other hand, a clean driving record over time could lower your rate and help you save money on your car insurance policy.

Which car insurance companies are the largest in New Hampshire?

The 10 largest providers account for over 75 percent of the market share in New Hampshire.

These companies are:

- Geico

- State Farm

- Progressive

- Liberty Mutual

- Allstate

- USAA

- Amica Mutual

- Auto-Owners

- Metropolitan

- Travelers

How many car insurance companies are available in New Hampshire?

There are 50 domestic insurers, and 647 foreign insurers licensed in New Hampshire.

Domestic insurance is formed under the laws of New Hampshire, while foreign insurance is formed under the laws of any state in the U.S.

This means that there are almost 700 different insurance companies you can choose from if you’re a resident of New Hampshire. Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

New Hampshire Laws

Now that we’ve gone over insurance requirements, financial ratings, and factors that can affect your car insurance rate, it’s time to hone in on New Hampshire state laws.

In this next section, we’ll bring you information and data regarding state laws and insurance fraud from the NAIC, the IIHS, the New Hampshire DMV, Responsibility.org, and carwindshields.info. You’ll learn everything you need to know about insurance coverage, seatbelt laws, and much more.

What are New Hampshire car insurance laws like?

Every state has its own set of car insurance laws, but have you ever wondered how those laws are determined?

Up next we’ll discuss car insurance laws and how they’re formed in the state of New Hampshire, so don’t go anywhere.

How State Laws for Insurance Are Determined

The rules governing New Hampshire car insurance companies and rate-setting are as follows:

Regarding rate filings, file and use (30 days) in a competitive market. Prior approval (30 day deemer can be extended 30 days) in a non-competitive market.

In a competitive market, rates must be filed with the state insurance department but they do not need to be approved, whereas, in a non-competitive market, rates need to be filed and approved by the state insurance department.

Windshield Coverage

If your windshield is cracked or damaged, New Hampshire requires you to have the windshield replaced or repaired.

If you have comprehensive coverage, you may use that coverage to replace the windshield. There are no laws mandating deductible-free replacement, but some companies may offer that as a perk.

The windshield replacement may be with aftermarket parts unless the vehicle is two years old or newer and has fewer than 30,000 miles and the consumer requests original manufacturer parts.

Consumers have the right to choose a repair vendor.

High-Risk Insurance

We all know that car insurance isn’t generally required in the state of New Hampshire, but it could be a requirement for you if you’re considered to be a high-risk driver.

If you’ve been contacted by the New Hampshire Department of Motor Vehicles because you have a poor driving record, you may be required to file an SR-22 form.

The following offenses will require an SR-22 filing according to the New Hampshire Department of Public Safety.

- DWI – First offense, second offense, subsequent offense, and aggravated

- Underage DWI – First offense, second offense, subsequent offense, and aggravated

- Leaving Scene of Accident

- Conduct after Accident

- Subsequent (Second) Offense Reckless Operation

Keep in mind that if you have filed for an SR-22, insurance companies do have the right to refuse to cover you. If you have this problem, New Hampshire has an assigned risk pool from which people can purchase insurance when they’re unable to find it elsewhere.

Low-Cost Insurance

The state of New Hampshire does not have a government-aided car insurance program for families with low income — only Hawaii, New Jersey, and California offer programs like that.

But, if you’re still looking for more ways to save on your car insurance policy, check with your insurance provider to see if you qualify for any of the discounts listed below.

- Good driver discount

- Student discount

- Military discount

- Homeowners discount

- Multi-car discount

Automobile Insurance Fraud in New Hampshire

According to the IIHS, auto insurance fraud typically consists of things like misrepresenting facts on insurance applications and inflating insurance claims, staging accidents and submitting claim forms for injuries or damage that never occurred, or filing false reports of stolen vehicles.

Fraud accounted for 15–17 percent of total claims payments for bodily injury auto insurance in 2012, according to an Insurance Research Council (IRC) study.

Are you worried about committing insurance fraud? Don’t pad your claims and don’t fake an accident.

If you would like to get in contact with the New Hampshire Insurance Department, give them a call at (603) 271-2261, or visit their office at the address below:

21 S. Fruit St #14, Concord, NH 03301

Statute of Limitations

If you get into a car accident, it’s very important to file a claim with your insurance company as soon as possible.

A statute of limitations is the period of time a claimant has to file and resolve their claim OR file a lawsuit after an accident.

New Hampshire’s statutes of limitations are as follows:

- Personal Injury – Three years

- Property Damage – Three years

At the very most, you have three years to file a claim in New Hampshire. Ideally, you should do so as soon as possible.

What are the vehicle licensing laws in New Hampshire?

In this next section, we’ll go over license renewal procedures, the REAL ID law, the penalties for driving without the correct type of insurance, teen driver laws, and much more.

REAL ID

What is a REAL ID? The video below will explain.

By October 2020, you must have a REAL ID in order to go through airport security, board a plane, or get into a federal building.

You will still be able to use your regular driver’s license to drive and vote, but it’s still a good idea to go ahead and get your REAL ID sooner rather than later.

Penalties for Driving Without Insurance

Since car insurance isn’t required in New Hampshire, there aren’t any penalties for driving without it.

If you are responsible for an accident and you don’t have insurance, your driver’s license can be suspended until you reach an agreement with the other party and pay for the damage you caused.

If you have an SR-22 requirement, you will be required to show proof of insurance. Your license will be suspended if you can’t show proof of insurance.

Teen Driver Laws

New Hampshire teens age 15 and a half and older may begin learning to drive with a licensed adult age 25 or older in the passenger seat. There is no permit required to begin this training as there is in many other states.

| Type of License | Minimum Age Requirement | Driving Requirement | Time Restriction | Passenger Restriction |

|---|---|---|---|---|

| Permit | 15 years 6 months | Must have a licensed adult over 25 years old supervising in the passenger seat | No restrictions | May not have more passengers than seat belts |

| Restricted License | 16 years | Must have completed 40 hours driving, 10 of which must be at night and passed an approved driver's education program | No driving between 1 a.m. and 4 a.m. | No more than one passenger younger than 25 (excluding family members) May not have more passengers than seat belts |

| Unrestricted License | Age after holding a restricted license six months (minimum 16 years 6 months) or 18 years, whichever occurs first | Must have held a restricted license six months or be 18 years old | No restrictions | No restrictions |

A teen driver must have a restricted license for a minimum of six months or be at least 18 years old before they can get an unrestricted license.

Driver’s License Renewal Procedures

Whether you’re 26 or 76, the state of New Hampshire has the same driver’s license renewal procedures for everyone.

See below:

- Renewal every five years

- Proof of adequate vision at every renewal

- May renew in person every renewal or online every other renewal

New Residents

If you just moved to the state of New Hampshire, you have 60 days to register your vehicle, get new tags, and obtain a New Hampshire license.

These things might sound like a chore, but they are easier to complete than you might think. Simply go to your local DMV office, bring two pieces of photo identification and a piece of mail that proves your new address, and complete the license application.

When you’re at the DMV, make sure you hand over the old license from your previous state.

Negligent Operator Treatment System (NOTS)

According to NOLO, in New Hampshire, a “reckless driving” conviction generally requires proof that the motorist:

- drove in a manner that posed a “substantial and unjustifiable” risk to others, and

- was aware of but disregarded the risk

There are lots of scenarios that could lead to a reckless driving conviction. But New Hampshire law specifically says that street racing and driving 100 miles per hour or faster are by definition reckless driving.

The possible penalties for a reckless driving violation are:

- First Offense – For a first reckless driving violation, the motorist is looking at a minimum of $500 in fines and a 60-day license suspension.

- Second or Subsequent Offense – A second reckless driving conviction carries $750 to $1,000 in fines and a 60-day to one-year license suspension.

A reckless driving conviction will also add six points to a motorist’s driving record. Accumulating too many points can lead to license suspension. Violations that lead to the death of another person can result in vehicular homicide or manslaughter charges and more severe penalties.

New Hampshire also has a less serious offense called “negligent driving.” Generally, a negligent driving conviction requires proof that the motorist:

- drove in a manner that endangered a person or property

- wasn’t — but should have been — aware of such danger

A negligent driving conviction carries $250 to $500 in fines for a first offense and $500 to $1,000 in fines for a second offense. A negligent driving violation will add four points to the motorist’s driving record.

What are the rules of the road in New Hampshire?

To help keep you safe while driving on New Hampshire roads, it’s important to know the rules of the road in New Hampshire.

This next section will touch on seat belt and car seat laws, speed limit laws, ridesharing laws, and much more, so keep reading.

Fault Versus No-Fault

According to Nolo, New Hampshire follows a traditional fault-based system when it comes to financial responsibility for losses stemming from a crash: that includes car accident injuries, lost income, vehicle damage, and so on.

Under the New Hampshire Motor Vehicle Financial Responsibility Law, the person who was at fault for causing the car accident is also responsible for any resulting harm (from a practical standpoint, if the driver has liability insurance, the insurance company will absorb these losses, up to policy limits).

In New Hampshire, a person who suffers any kind of injury or damage due to an auto accident usually can proceed in one of three ways:

- by filing a claim with his or her own insurance company, assuming that the loss is covered under the policy (in this situation, the injured person’s insurance company will likely turn around and pursue a subrogation claim against the at-fault driver’s carrier)

- by filing a third-party claim directly with the at-fault driver’s insurance carrier

- by filing a personal injury lawsuit in civil court against the at-fault driver

Seat Belt and Car Seat Laws

Check out New Hampshire’s car seat laws listed in the table below.

| Child Restraint Law | Details |

|---|---|

| Must be in child restraint | 6 years and younger who are less than 57 inches |

| Adult safety belt permissible | 7 through 17 years; younger than 7 who are at least 57 inches tall |

| Maximum fine first offense | $50 |

If you would like more information about how to keep your child safe while driving, please visit the American Academy of Pediatrics car seat recommendations.

According to the Governor’s Highway Safety Association, New Hampshire has enacted neither a primary nor a secondary seat belt law for adults, although the state does have a primary child passenger safety law that covers all drivers and passengers under 18.

Are you wondering if you can ride in the cargo area of a pickup truck? New Hampshire doesn’t have any laws about riding in the bed of a moving truck either.

Keep Right and Move Over Laws

New Hampshire’s keep right and move over laws are pretty self-explanatory. According to state law, you are to keep right if you are driving slower than the average speed of traffic around you.

State law also requires drivers approaching a crash or emergency area to slow to a safe speed and give wide berth to emergency vehicles displaying flashing lights, including towing, recovery, and highway maintenance vehicles.

Take note of two amendments effective January 2019:

- Motor vehicles shall not be operated continuously in the left lane of a multilane roadway whenever it impedes the flow of other traffic at or below the posted speed limit unless reasonable and prudent under the conditions having regard to the actual and potential hazards then existing.

- Any person who violates this section shall be guilty of a violation and shall be fined $50 plus penalty assessment.

Speed Limits

Make sure you know New Hampshire’s speed limit laws so you can avoid getting a speeding ticket.

| Type of Roadway | Speed Limit (mph) |

|---|---|

| Rural interstates | 65; 70 on specified segments of road |

| Urban interstates | 65 |

| Other limited access roads | 55 |

| Other roads | 55 |

As you can see, the highest speed you can drive in New Hampshire is 70 mph on some rural interstates.

Ridesharing

In many states in the U.S., you need rideshare insurance if you drive for Lyft, Uber, or another rideshare company. However, since New Hampshire does not require drivers to have car insurance, you do not need rideshare insurance either.

If you would like to purchase rideshare insurance in New Hampshire (and it’s a very good idea to do so), the following companies offer this type of coverage:

- Geico

- Liberty Mutual

- USAA

- State Farm

Automation on the Road

According to the IIHS, New Hampshire requires $5,000,000 in the form of an insurance policy, bond, or other financial instrument for a “testing entity.” Effective July 1, 2021, when New Hampshire authorizes the deployment of “driverless capable vehicles” without a “conventional human driver,” the state requires an amount of insurance equivalent to the minimum required under existing insurance law.

| Automation Laws | Details |

|---|---|

| What type of driving automation on public roads does the law/provision permit? | Deployment |

| Require an operator to be licensed? | Yes |

| Require an operator to be in the vehicle? | Yes, except for testing |

| Require liability insurance? | Yes; $5,000,000 |

New Hampshire does not require the operator to be in the “ADS-equipped vehicle” (Automated Driving Systems) if the vehicle is being operated as part of an “automated vehicle testing pilot program.” Effective July 1, 2021, New Hampshire will not require the operator to be in any “ADS-equipped vehicle.”

What are the safety laws in New Hampshire?

In this next section, we’ll go over New Hampshire’s safety laws. Knowing these laws can keep you safe while on the road and help you avoid a serious accident.

DUI Laws

In New Hampshire, the legal blood alcohol content (BAC) limit is 0.08 percent, while the high BAC limit is 0.16 percent. If you are convicted of Driving While Intoxicated (DWI), it will be considered a misdemeanor the first three times.

If you get caught driving while intoxicated a fourth time, you will be convicted of a felony. If you drive while intoxicated at any point and cause someone serious bodily injury, the DWI will automatically be considered a felony.

The lookback period where a previous DWI is considered in a subsequent charge is 10 years.

Check out the penalties for a DWI listed below.

| Type of Penalty | First Offense | Second Offense | Third Offense | Fourth and Subsequent Offenses |

|---|---|---|---|---|

| Driver's License Suspension | Nine months to six years. Six months of the sentence may be suspended for enrollment in 20-hour Impaired Driver Intervention Program | Three years minimum | Lifetime – may be reinstated after five years | Lifetime – may be reinstated after seven years |

| Imprisonment | No minimum | 30 days (mandatory minimum) to one year | 180 days to one year | 30 days to seven years, minimum six months deferred jail time |

| Fine | $500 minimum | $750 minimum | $750 minimum | $930 minimum |

| Other | N/A | IID required for one to two years after license reinstatement; Seven-day Multiple Offender Program (MOP) required | IID required one to two years after license reinstatement; 28-day MOP required | IID required one to two years after license reinstatement; 28-day MOP required |

If you are convicted of a DWI, you will pay hundreds of dollars in fines and you’re likely to spend a considerable amount of time in prison as well. Don’t drink and drive — every time you do it, you risk your life as well as the lives of others on the road.

Marijuana-Impaired Driving Laws

DWI laws apply to driving under the influence of marijuana and other drugs.

Individuals convicted of impaired driving under the influence of marijuana and other drugs must attend and participate in an Impaired Driver Care Management Program (IDCMP).

Distracted Driving Laws

Technology has come a long way over the last couple of decades. Just like any other tool, it can be used in a responsible way or in an irresponsible way. In the state of New Hampshire, it is illegal to use your phone at all while driving.

Check out the distracted driving laws listed in the table below.

| Cellphone and Texting Restrictions | Details |

|---|---|

| Hand-held ban | All drivers |

| Young drivers all cellphone ban | Drivers younger than 18 |

| Texting ban | All drivers |

| Enforcement | Primary |

The fines for violations are as follows:

- First Offense – $100

- Second Offense – $250

- Third and Subsequent Offenses – $500

In other words, if you text and drive and get caught just one time, you’re paying $100 in fines.

Driving in New Hampshire

Don’t go away — up next, we’ll share some critical New Hampshire facts.

You now know the rules of the road, but do you know the risks of owning and operating a vehicle in New Hampshire? From vehicle thefts to crash reports, we’ll cover everything you need to know.

The following information is brought to you by the NHTSA, Data USA, the FBI, and Inrix.

How many vehicle thefts occur in New Hampshire?

Here’s a list of the top 10 most frequently stolen vehicle models in 2016.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Honda Civic | 1997 | 34 |

| Honda Accord | 1996 | 20 |

| Chevrolet Pickup (Full Size) | 2002 | 19 |

| Ford Pickup (Full Size) | 2002 | 17 |

| Dodge Caravan | 2003 | 16 |

| Ford Focus | 2007 | 14 |

| Toyota Camry | 1999 | 13 |

| Jeep Cherokee/Grand Cherokee | 2000 | 11 |

| GMC Pickup (Full Size) | 2007 | 9 |

| Toyota Corolla | 1999 | 9 |

As you can see, the 1997 Honda Civic was stolen more than any other vehicle in New Hampshire.

You might also want to take a look at this next table, as it will show you data from the FBI on how many vehicle thefts occurred in each city in New Hampshire in 2017. As we discussed earlier, car insurance companies will take information like this into account when setting rates.

How many reported vehicle thefts happened in your city?

| City | Motor vehicle theft |

|---|---|

| Alexandria | 0 |

| Alstead | 0 |

| Alton | 2 |

| Amherst | 4 |

| Antrim | 2 |

| Ashland | 4 |

| Atkinson | 1 |

| Auburn | 1 |

| Barnstead | 7 |

| Barrington | 1 |

| Bartlett | 1 |

| Bedford | 7 |

| Belmont | 10 |

| Bennington | 1 |

| Berlin | 2 |

| Bethlehem | 1 |

| Boscawen | 2 |

| Bow | 3 |

| Bradford | 0 |

| Brentwood | 3 |

| Bristol | 3 |

| Brookline | 0 |

| Campton | 3 |

| Candia | 4 |

| Canterbury | 2 |

| Carroll | 1 |

| Center Harbor | 0 |

| Charlestown | 1 |

| Chester | 1 |

| Claremont | 7 |

| Colebrook | 2 |

| Concord | 34 |

| Conway | 9 |

| Cornish | 2 |

| Dalton | 0 |

| Danville | 1 |

| Deerfield | 6 |

| Deering | 2 |

| Derry | 19 |

| Dover | 10 |

| Dublin | 0 |

| Dunbarton | 2 |

| Durham | 4 |

| East Kingston | 2 |

| Effingham | 1 |

| Enfield | 1 |

| Epping | 8 |

| Epsom | 3 |

| Exeter | 8 |

| Farmington | 7 |

| Fitzwilliam | 0 |

| Franconia | 0 |

| Franklin | 5 |

| Freedom | 1 |

| Fremont | 1 |

| Gilford | 5 |

| Gilmanton | 4 |

| Goffstown | 13 |

| Gorham | 1 |

| Grantham | 0 |

| Greenland | 0 |

| Hampstead | 4 |

| Hampton | 13 |

| Hampton Falls | 0 |

| Hancock | 0 |

| Hanover | 1 |

| Haverhill | 5 |

| Henniker | 3 |

| Hillsborough | 2 |

| Hinsdale | 3 |

| Holderness | 1 |

| Hollis | 3 |

| Hooksett | 9 |

| Hopkinton | 2 |

| Hudson | 13 |

| Jackson | 0 |

| Jaffrey | 1 |

| Keene | 20 |

| Kensington | 0 |

| Kingston | 7 |

| Laconia | 21 |

| Lancaster | 0 |

| Lebanon | 14 |

| Lee | 0 |

| Lincoln | 6 |

| Lisbon | 0 |

| Litchfield | 2 |

| Littleton | 4 |

| Londonderry | 11 |

| Loudon | 3 |

| Lyndeborough | 1 |

| Madbury | 0 |

| Madison | 2 |

| Manchester | 185 |

| Marlborough | 0 |

| Meredith | 6 |

| Merrimack | 4 |

| Middleton | 2 |

| Milford | 5 |

| Milton | 3 |

| Mont Vernon | 0 |

| Moultonborough | 8 |

| Nashua | 72 |

| New Boston | 2 |

| New Durham | 0 |

| New Hampton | 4 |

| New Ipswich | 3 |

| New London | 0 |

| Newbury | 1 |

| Newfields | 1 |

| Newington | 1 |

| Newmarket | 1 |

| Newport | 4 |

| Newton | 1 |

| North Hampton | 2 |

| Northfield | 10 |

| Northumberland | 0 |

| Northwood | 3 |

| Nottingham | 1 |

| Ossipee | 7 |

| Pelham | 5 |

| Pembroke | 8 |

| Peterborough | 3 |

| Plaistow | 8 |

| Plymouth | 9 |

| Portsmouth | 17 |

| Raymond | 9 |

| Rindge | 2 |

| Rochester | 23 |

| Rollinsford | 0 |

| Rye | 1 |

| Salem | 11 |

| Sanbornton | 5 |

| Sandown | 1 |

| Sandwich | 0 |

| Seabrook | 11 |

| Somersworth | 17 |

| South Hampton | 0 |

| Springfield | 2 |

| Strafford | 0 |

| Stratham | 0 |

| Sugar Hill | 0 |

| Sunapee | 1 |

| Thornton | 0 |

| Tilton | 7 |

| Troy | 0 |

| Tuftonboro | 2 |

| Wakefield | 4 |

| Warner | 0 |

| Washington | 1 |

| Waterville Valley | 0 |

| Weare | 2 |

| Webster | 0 |

| Wilton | 2 |

| Winchester | 2 |

| Windham | 5 |

| Wolfeboro | 3 |

| Woodstock | 1 |

The highest number of vehicle thefts happened in Manchester, which makes sense, as it’s the biggest city in New Hampshire.

How many road fatalities occur in New Hampshire?

Traffic fatalities are always sad and they happen every day in the U.S. We’re going to go through the data about how, when, and where they happen the most, as this information could potentially save your or someone else’s life.

But before we get into all of that, let’s talk about the most fatal highway in New Hampshire.

Most Fatal Highway in New Hampshire

To determine the most dangerous highway in each U.S. state, Geotab calculated a fatal crash rate that is based on the annual number of road fatalities and fatal crashes according to the National Highway Traffic Safety Administration, adjusted for the average daily traffic counts provided by the Federal Highway Administration.

According to Geotab, the most fatal highway in New Hampshire is Interstate 93.

Fatal Crashes by Weather Condition and Light Condition

Did the weather or light conditions have anything to do with the fatal crash rate in New Hampshire?

Check out the table below.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other/Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 50 | 6 | 20 | 5 | 0 | 81 |

| Snow/Sleet | 3 | 2 | 4 | 1 | 0 | 10 |

| Rain | 5 | 0 | 1 | 0 | 0 | 6 |

| Other | 0 | 0 | 1 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 58 | 8 | 26 | 6 | 0 | 98 |

According to the data, most of these fatal crashes happened in the daylight or in the dark under normal weather conditions.

Fatalities (All Crashes) by County

Let’s take a look at the total number of fatal crashes by county.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Belknap | 4 | 6 | 8 | 11 | 13 | 6.64 | 9.94 | 13.18 | 18.08 | 21.3 |

| Carroll | 6 | 6 | 10 | 6 | 9 | 12.65 | 12.66 | 21.06 | 12.47 | 18.45 |

| Cheshire | 7 | 2 | 11 | 10 | 8 | 9.16 | 2.62 | 14.48 | 13.13 | 10.46 |

| Coos | 3 | 7 | 6 | 7 | 6 | 9.15 | 21.65 | 18.81 | 22.16 | 18.99 |

| Grafton | 4 | 9 | 14 | 5 | 12 | 4.45 | 10.07 | 15.56 | 5.56 | 13.37 |

| Hillsborough | 27 | 24 | 27 | 20 | 27 | 6.63 | 5.87 | 6.57 | 4.84 | 6.5 |

| Merrimack | 13 | 16 | 13 | 12 | 24 | 8.78 | 10.76 | 8.72 | 7.99 | 15.88 |

| Rockingham | 18 | 29 | 28 | 16 | 29 | 5.97 | 9.57 | 9.19 | 5.21 | 9.38 |

| Strafford | 9 | 12 | 15 | 12 | 11 | 7.11 | 9.45 | 11.7 | 9.27 | 8.4 |

| Sullivan | 4 | 3 | 4 | 3 | 8 | 9.27 | 6.95 | 9.28 | 6.97 | 18.54 |

According to the table above, Rockingham County had the most fatal crashes in 2018.

Traffic Fatalities

Most people tend to think that fatal crashes happen more often in the city than they do in rural areas. Actually, it’s often the other way around, as emergency services may not be readily available when an accident happens on a rural road.

Check out the table below.

| Area | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 109 | 86 | 64 | 60 | 87 | 48 | 66 | 75 | 51 | 78 |

| Urban | 1 | 42 | 26 | 48 | 48 | 47 | 48 | 61 | 51 | 69 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 110 | 128 | 90 | 108 | 135 | 95 | 114 | 136 | 102 | 147 |

Although it’s not a huge difference, there were nine more rural fatal crashes than urban fatal crashes in the year 2018.

Fatalities by Person Type

Below you’ll see the 2018 fatal crashes broken down by person/vehicle type.

| Person Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Passenger Car | 42 | 49 | 57 | 46 | 54 |

| Light Truck – Pickup | 6 | 10 | 23 | 9 | 11 |

| Light Truck – Utility | 8 | 12 | 14 | 12 | 31 |

| Light Truck – Van | 2 | 3 | 1 | 3 | 2 |

| Large Truck | 2 | 0 | 0 | 1 | 7 |

| Light Truck – Other | 0 | 0 | 1 | 0 | 0 |

| Other/Unknown Occupants | 2 | 1 | 1 | 2 | 0 |

| Total Occupants | 62 | 75 | 97 | 73 | 105 |

| Total Motorcyclists | 17 | 26 | 19 | 15 | 28 |

| Pedestrian | 12 | 8 | 17 | 11 | 9 |

| Bicyclist and Other Cyclist | 3 | 3 | 2 | 2 | 2 |

| Other/Unknown Nonoccupants | 1 | 2 | 1 | 1 | 3 |

| Total Nonoccupants | 16 | 13 | 20 | 14 | 14 |

| Total | 95 | 114 | 136 | 102 | 147 |

According to the data, there were more traffic fatalities that involved passenger car occupants than any other person type this year.

Fatalities by Crash Type

Next, you’ll see the breakdown of different types of crashes involving fatalities.

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 95 | 114 | 136 | 102 | 147 |

| Involving a Roadway Departure | 66 | 79 | 95 | 70 | 106 |

| Single Vehicle | 60 | 70 | 100 | 64 | 89 |

| Involving Speeding | 47 | 56 | 77 | 58 | 71 |

| Involving a Rollover | 18 | 23 | 39 | 25 | 27 |

| Involving a Large Truck | 12 | 6 | 9 | 13 | 22 |

| Involving an Intersection (or Intersection Related) | 21 | 15 | 15 | 14 | 19 |

Single-vehicle crashes, crashes involving a roadway departure, and crashes involving speeding were the top three categories that had the highest number of fatal crashes in 2018.

Five-Year Trend for the Top 10 Counties

Below is the five-year fatality trend for the top 10 largest counties in New Hampshire.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Belknap | 4 | 6 | 8 | 11 | 13 |

| Carroll | 6 | 6 | 10 | 6 | 9 |

| Cheshire | 7 | 2 | 11 | 10 | 8 |

| Coos | 3 | 7 | 6 | 7 | 6 |

| Grafton | 4 | 9 | 14 | 5 | 12 |

| Hillsborough | 27 | 24 | 27 | 20 | 27 |

| Merrimack | 13 | 16 | 13 | 12 | 24 |

| Rockingham | 18 | 29 | 28 | 16 | 29 |

| Strafford | 9 | 12 | 15 | 12 | 11 |

| Sullivan | 4 | 3 | 4 | 3 | 8 |

Again, Rockingham County had the highest number of traffic fatalities in 2018.

Fatalities Involving Speeding by County

Speeding is another major cause of traffic fatalities in New Hampshire. See the table below.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Belknap | 3 | 5 | 6 | 7 | 5 | 4.98 | 8.29 | 9.88 | 11.5 | 8.19 |

| Carroll | 1 | 2 | 6 | 4 | 0 | 2.11 | 4.22 | 12.63 | 8.31 | 0 |

| Cheshire | 3 | 0 | 9 | 7 | 3 | 3.93 | 0 | 11.85 | 9.19 | 3.92 |

| Coos | 0 | 3 | 3 | 4 | 4 | 0 | 9.28 | 9.4 | 12.66 | 12.66 |

| Grafton | 3 | 3 | 8 | 4 | 5 | 3.34 | 3.36 | 8.89 | 4.45 | 5.57 |

| Hillsborough | 11 | 12 | 13 | 6 | 16 | 2.7 | 2.94 | 3.16 | 1.45 | 3.85 |

| Merrimack | 7 | 8 | 4 | 8 | 12 | 4.73 | 5.38 | 2.68 | 5.33 | 7.94 |

| Rockingham | 11 | 17 | 18 | 9 | 17 | 3.65 | 5.61 | 5.91 | 2.93 | 5.5 |

| Strafford | 4 | 4 | 7 | 7 | 6 | 3.16 | 3.15 | 5.46 | 5.41 | 4.61 |

| Sullivan | 4 | 2 | 3 | 2 | 3 | 9.27 | 4.63 | 6.96 | 4.64 | 6.95 |

Rockingham County had the highest number of traffic fatalities resulting from speeding, while Carroll County had the lowest number (zero) of traffic fatalities in New Hampshire in 2018.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Drinking and driving is obviously very dangerous — here’s a look at traffic fatality statistics in New Hampshire involving alcohol-impaired drivers.

| County | Fatalities 2014 | 2015 | 2016 | 2017 | 2018 | Fatalities per 100,000 Population 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Belknap | 3 | 3 | 1 | 3 | 5 | 4.98 | 4.97 | 1.65 | 4.93 | 8.19 |

| Carroll | 1 | 1 | 3 | 4 | 0 | 2.11 | 2.11 | 6.32 | 8.31 | 0 |

| Cheshire | 2 | 0 | 4 | 6 | 3 | 2.62 | 0 | 5.27 | 7.88 | 3.92 |

| Coos | 0 | 3 | 2 | 2 | 0 | 0 | 9.28 | 6.27 | 6.33 | 0 |

| Grafton | 1 | 2 | 6 | 0 | 2 | 1.11 | 2.24 | 6.67 | 0 | 2.23 |

| Hillsborough | 8 | 9 | 5 | 3 | 11 | 1.97 | 2.2 | 1.22 | 0.73 | 2.65 |

| Merrimack | 1 | 3 | 3 | 1 | 8 | 0.68 | 2.02 | 2.01 | 0.67 | 5.29 |

| Rockingham | 10 | 9 | 12 | 3 | 15 | 3.32 | 2.97 | 3.94 | 0.98 | 4.85 |

| Strafford | 3 | 2 | 3 | 2 | 4 | 2.37 | 1.58 | 2.34 | 1.55 | 3.07 |

| Sullivan | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 4.64 | 0 |

Rockingham County had the highest number of alcohol-related fatal crashes in 2018.

Teen Drinking and Driving

New Hampshire ranks ninth in the U.S. for under-18 DUI arrests. Forty-two teen arrests in 2016 put the arrest rate at 161 per million residents.

The high arrest rate appears to be paying off, though, as the death rate for people under 21 years old in alcohol-related fatalities is 0.6 per 100,000 population, which is half the national average.

EMS Response Time

EMS response time could mean the difference between life and death. Normally, it takes longer for an emergency team to reach a crash site in a rural area compared to an urban area.

| Crash Location | Time of Crash to EMS Notification (minutes) | EMS Notification to EMS Arrival (minutes) | EMS Arrival at Scene to Hospital Arrival (minutes) | Time of Crash to Hospital Arrival (minutes) |

|---|---|---|---|---|

| Rural | 1.27 | 12 | 31 | 45.58 |

| Urban | 0.71 | 10 | 24 | 35.05 |

As you can see from the table above, it takes 10 more minutes on average to reach a victim in a rural area than it does in an urban area. Nevertheless, an EMS response team is likely going to have an accident victim at the hospital in 45 minutes or less.

What is transportation like in New Hampshire?

Let’s talk about transportation statistics in New Hampshire next. How many cars does the average New Hampshire family own? What is their average commute time? What is traffic congestion like here?

We answer all these questions and more in the next section.

Car Ownership

Have you ever wondered how many vehicles your neighbors own?

According to Data USA, the average number of cars owned per household in New Hampshire is two. There is also a fairly large number of households in New Hampshire that own three cars.

Commute Time

How much time does the average New Hampshire driver spend on their daily commute?

Data USA also says that the length of the average employee’s commute in New Hampshire is consistent with the national average for U.S. workers (25.7 minutes). Additionally, 3.67 percent of the workforce in New Hampshire have a “super commute” in excess of 90 minutes.

Commuter Transportation

In 2018, the most common method of travel for workers in New Hampshire was to drive alone (80.8 percent), followed by those who carpooled (7.44 percent).

Nearly seven percent of New Hampshire drivers work from home and do not commute to an office.

Traffic Congestion in New Hampshire

Good news for New Hampshire drivers: None of the state’s cities made it onto Inrix’s Traffic Scorecard. However, just because New Hampshire doesn’t have any cities with major congestion problems doesn’t mean you’ll never encounter traffic.

That’s all folks! Now that you’ve read our complete guide to car insurance in New Hampshire, you’re ready to start comparing insurance rates on your own. Use our free comparison tool by entering your ZIP code in the box below to get started.

Good luck and happy shopping.

Frequently Asked Questions

How can I compare car insurance costs and companies in New Hampshire?

You can compare car insurance costs and companies in New Hampshire by using online comparison tools or by contacting insurance agents or brokers. It’s important to compare quotes from multiple insurers and consider factors such as coverage options, deductibles, discounts, and customer reviews.

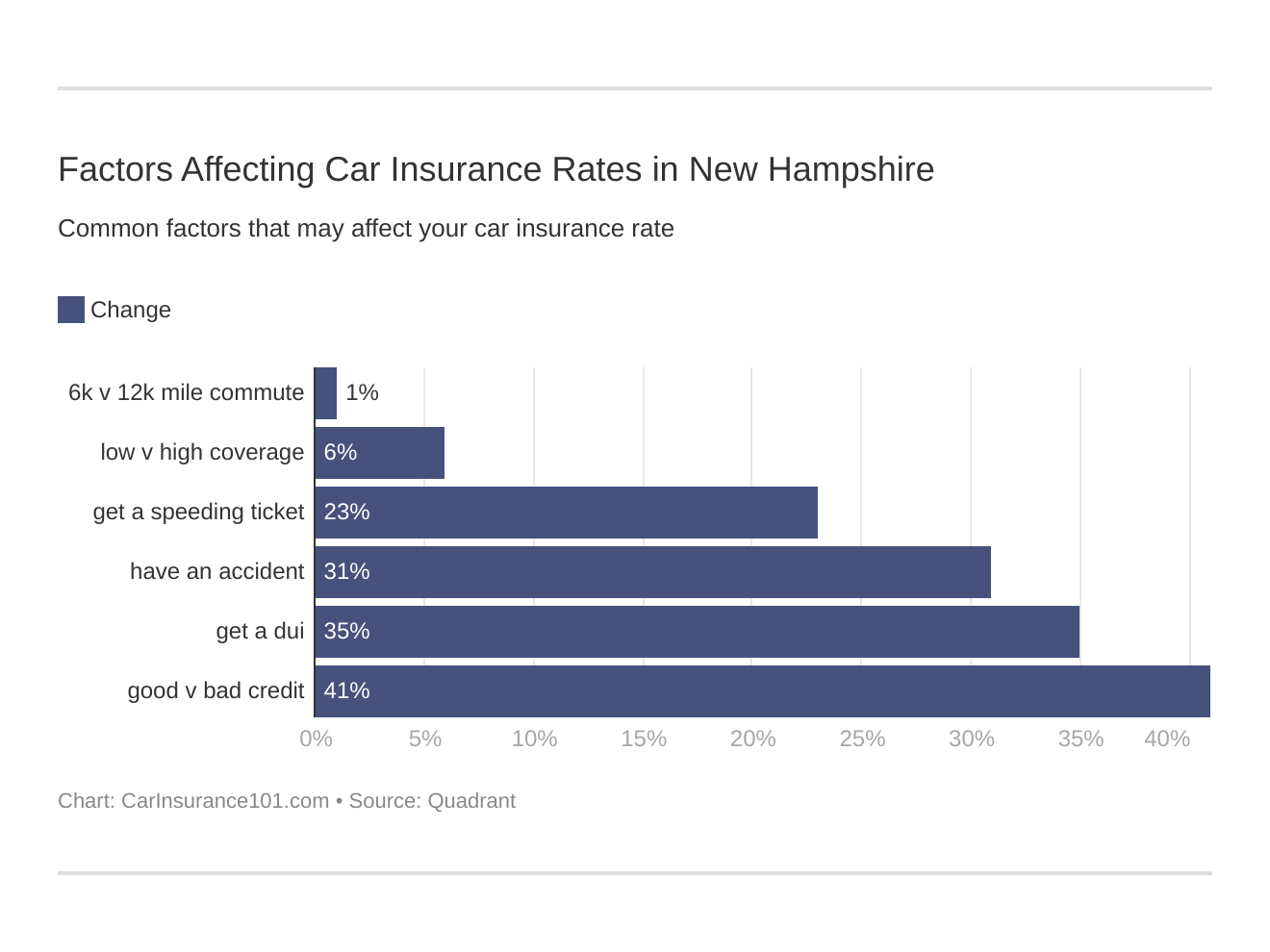

What factors affect my car insurance rates in New Hampshire?

Several factors affect your car insurance rates in New Hampshire, including your age, gender, marital status, driving history, credit score, vehicle make and model, annual mileage, and coverage options. Additionally, some insurers may also consider factors such as your occupation, education level, and location.

How can I compare car insurance costs and companies in New Hampshire?

You can compare car insurance costs and companies in New Hampshire by using online comparison tools or by contacting insurance agents or brokers. It’s important to compare quotes from multiple insurers and consider factors such as coverage options, deductibles, discounts, and customer reviews.

What factors affect my car insurance rates in New Hampshire?

Several factors affect your car insurance rates in New Hampshire, including your age, gender, marital status, driving history, credit score, vehicle make and model, annual mileage, and coverage options. Additionally, some insurers may also consider factors such as your occupation, education level, and location.

How can I lower my car insurance rates in New Hampshire?

You can lower your car insurance rates in New Hampshire by maintaining a good driving record, improving your credit score, choosing a higher deductible, bundling your insurance policies, and taking advantage of discounts offered by insurers, such as safe driver, good student, and multi-car discounts.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.