Best AMAC Car Insurance Discounts in 2026 (Save up to 25% With These Companies)

USAA, Nationwide, and Progressive offer the best AMAC car insurance discounts, with savings up to 25% for bundling, good driver, defensive driving, and membership perks. USAA leads with low full coverage rates, Nationwide gives up to 40% for safe drivers, and Progressive rewards defensive driving for AMAC members.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: May 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: May 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

USAA, Nationwide, and Progressive offer the best AMAC car insurance discounts, offering top savings and strong coverage options for mature drivers. Our Top 10 Picks: Best AMAC Car Insurance Discounts

| Company | Rank | A.M. Best | Member Discount | Who Qualifies? |

|---|---|---|---|---|

| #1 | A++ | 25% | Military, Veterans, Organizations & Clubs | |

| #2 | A+ | 15% | Alumni, Professionals, Organizations & Clubs |

| #3 | A+ | 15% | Affinity Groups, Organizations & Clubs | |

| #4 | A++ | 10% | Work Programs, Organizations & Clubs | |

| #5 | A+ | 10% | Employers, Groups, Organizations & Clubs | |

| #6 | A | 10% | Alumni, Work Groups, Organizations & Clubs | |

| #7 | A | 10% | Employers, Members, Organizations & Clubs | |

| #8 | A | 10% | Employers, Alumni, Organizations & Clubs |

| #9 | A++ | 8% | Military, Alumni, Organizations & Clubs | |

| #10 | A++ | 5% | Employer Plans, Organizations & Clubs |

USAA stands out with the lowest post-discount rates, while Nationwide offers up to 40% off for good drivers, and Progressive rewards defensive driving.

- Get the best AMAC car insurance discounts with savings up to 25% on coverage

- Exclusive perks include bundling, safe driver, and defensive driving discounts

- USAA offers the lowest full coverage rates and top value for AMAC members

Top Car Insurance Discounts for AMAC Members

AMAC (Association of Mature American Citizens) members enjoy exclusive access to substantial car insurance discounts through partnerships with leading U.S. insurance companies. Car Insurance Discounts for AMAC Members by Provider

| Insurance Company | Bundling | Defensive Driving | Good Driver | Membership |

|---|---|---|---|---|

| 25% | 10% | 25% | 10% | |

| 25% | 5% | 25% | 10% | |

| 20% | 10% | 30% | 10% | |

| 25% | 15% | 26% | 8% | |

| 25% | 10% | 20% | 10% |

| 20% | 10% | 40% | 15% |

| 10% | 30% | 30% | 15% | |

| 17% | 15% | 25% | 5% | |

| 13% | 20% | 10% | 10% | |

| 10% | 5% | 30% | 25% |

These savings are tailored to reward responsible driving habits, loyalty through bundling, and membership affiliation. As part of car insurance 101, it’s essential to understand how these partnerships work to help members maximize benefits while maintaining quality coverage.

Clean driving records mean lower rates and better discounts, avoiding accidents and tickets. For example, three safe years can unlock top savings.Michelle Robbins Licensed Insurance Agent

Bundling Discount

AMAC members can unlock the best-multi policy car insurance discounts by bundling auto and home insurance with the same provider. Through partnerships with top insurers like State Farm, Liberty Mutual, and American Family, members can save up to 25% on premiums.

Defensive Driving Discount

Completing a certified safe driving course is a proven way for AMAC members to reduce their car insurance premiums while enhancing road safety. These courses provide methods for predicting and avoiding hazards, handling hazardous road conditions, and avoiding distractions, which help drivers make unsafely driving behavior.

Good Driver Discount

Maintaining a clean driving record is one of the best ways for AMAC members to earn significant car insurance discounts. A good driver has no recent accidents or traffic violations, showing insurers they are low-risk. AMAC partners like Nationwide, USAA, and Farmers offer discounts of up to 40% for qualifying drivers.

Membership Discount

AMAC members enjoy exclusive savings up to 25% on car insurance through partners like USAA, Nationwide, and Progressive. These are considerable savings, but your ultimate rate can also be influenced by other factors that impact your premiums, like your driving history and the type of vehicle you drive.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

AMAC Car Insurance Rates

AMAC members enjoy substantial savings on full coverage auto insurance through exclusive partnerships with top insurers, offering some of the best full coverage car insurance rates available. As shown by the monthly rate comparisons before and after discounts, these savings typically range from $15 to $25 per month, depending on the provider. AMAC Car Insurance Full Coverage Monthly Rates Before & After Discount

| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $230 | $210 | |

| $215 | $195 | |

| $250 | $230 | |

| $210 | $190 | |

| $275 | $255 |

| $240 | $225 |

| $260 | $245 | |

| $220 | $200 | |

| $235 | $215 | |

| $205 | $185 |

For example, USAA has the lowest post-discount rate at $185, down from $205, while Allstate and State Farm drop from $230 to $210 and $220 to $200, respectively. Other insurers, including Farmers, Geico, and Travelers also feature hefty reductions to make full coverage available without discounting protection.

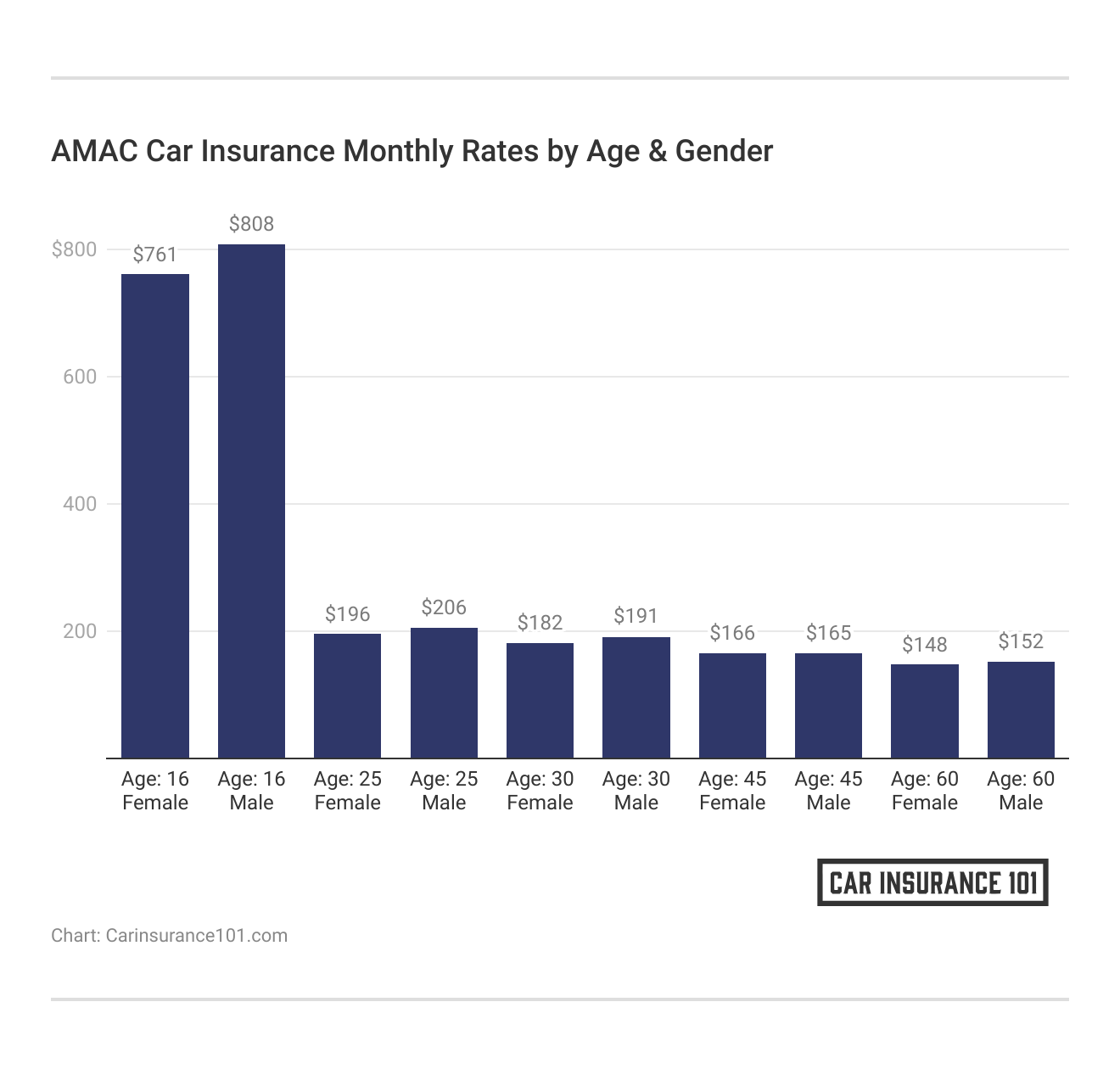

Monthly premiums are the lowest, at $148 for women and $152 for men, for 60-year-olds. This trend relates to the fact that older AMAC members are less risky drivers and with years of experience driving, insurers reduce rates due to that.

Monthly premiums are the lowest, at $148 for women and $152 for men, for 60-year-olds. This trend relates to the fact that older AMAC members are less risky drivers and with years of experience driving, insurers reduce rates due to that.

Other Ways to Save on Car Insurance for AMAC Members

AMAC members already get exclusive insurance discounts, but there are more ways to save. Smart financial and vehicle choices can lower premiums further. Here are five practical tips to cut costs beyond standard discounts.

- Pay-in-Full: Paying your annual premium in one lump sum can help you avoid installment fees and qualify for a paid-in-full discount.

- Maintain Good Credit: A good credit score can help you get lower insurance premiums, since many insurance companies see it as a sign of financial responsibility.

- Drive a Low-Risk Vehicle: The safer your car is, and the cheaper it is to repair, the lower your premium is likely to be.

- Install Anti-Theft Devices: Installing alarms or tracking systems can earn you an anti theft car insurance discount by lowering the theft risk.

- Review Your Policy Annually: Regularly updating your policy helps ensure you’re only paying for coverage you need and can uncover new discount opportunities.

Incorporating these simple yet effective steps into your insurance planning can lead to meaningful savings.

Raising your deductible is a simple way to lower monthly premiums if you can afford more upfront in a claim.Tonya Sisler Content Team Lead

AMAC Insurance Coverage and Member Perks

AMAC members have access to auto insurance coverage levels from affiliated insurers. These options include liability for at-fault crashes, collision for vehicle damage, and comprehensive for incidents that are not collisions, like theft and vandalism.

Uninsured and underinsured motorists’ coverage is also provided, giving protection if a member has an accident with an uninsured driver. Other advantages include medical payment benefits for injury-related expenses and roadside assistance for emergency towing and battery jump-starts. Discover our car insurance requirements for further insights.

In addition to auto insurance discounts, AMAC members enjoy financial and lifestyle benefits such as discounted home financing, savings on phone plans, and exclusive offers from insurers like State Farm, USAA, and Travelers. Members also receive travel discounts on car rentals, hotels, and cruises, as well as savings on home, renters, and RV insurance.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Get Top Car Insurance Discounts for AMAC Members

The best AMAC car insurance discounts are offered by top providers like USAA, Nationwide, and Progressive, with savings of up to 25% on full coverage policies. These discounts can make a noticeable impact on monthly premiums, such as USAA’s reduction from $205 to $185 and Nationwide’s good driver discount of up to 40%.

Rates also tend to drop with age, with the most affordable premiums available around age 60. With competitive pricing, valuable coverage options, and exclusive member benefits, AMAC continues to provide seniors an effective way to save on affordable car insurance without compromising quality.

Ready to find the best car insurance company? Enter your ZIP code to see who provides the coverage you accept.

Frequently Asked Questions

How do I get AMAC auto insurance discounts?

To access AMAC auto insurance discounts, you must be a registered AMAC member and request a quote through one of AMAC’s affiliated insurance partners. The discounts are applied by the insurer, not AMAC, and depend on eligibility criteria like driving history and location.

Are AMAC insurance discounts guaranteed for all members?

No, insurance discounts available through AMAC partnerships are not guaranteed for every member. Savings depend on individual factors such as age, location, driving history, and insurance needs. Eligibility is determined by the insurance provider, not AMAC.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool.

Is AMAC worth joining for car insurance discounts?

Yes, AMAC is worth joining if you want access to exclusive car insurance discounts through top providers like USAA, Nationwide, and Progressive. While AMAC doesn’t offer the discounts directly, membership unlocks special rates and benefits. Learn more in our USAA car insurance review.

What is AMAC and what does it offer to its members?

AMAC (Association of Mature American Citizens) is a membership organization for Americans 50+, offering benefits like advocacy, financial tools, travel deals, and exclusive partner offers. While AMAC doesn’t directly provide services like insurance, it connects members with trusted providers offering special discounts.

Are AMAC car rental discounts available to all ages?

Car rental offers through AMAC’s partners are typically geared toward seniors, as AMAC is a senior-focused membership organization. However, eligibility for discounts and rental terms ultimately depends on the policies of the rental car company providing the offer.

Where can I find reviews of the Association of Mature American Citizens?

You can find Association of Mature American Citizens reviews online or visit their website, where members share their experiences with the organization’s benefits, including insurance savings and advocacy for seniors. For more insights, dive into our guide on buying a car and getting it insured.

Are AMAC rental car discounts available at all locations?

Discount availability depends on the rental company and the location. Most AMAC partner discounts are honored at participating U.S. rental locations, but it’s best to check the terms and conditions of the offer when booking.

How does AMAC help seniors save on car insurance?

AMAC connects members to leading insurers that may offer savings up to 25% for things like bundling policies, safe driving, or completing a defensive driving course. AMAC does not apply the discounts itself but facilitates access to insurers that may provide these benefits.

Does AMAC directly offer roadside assistance coverage?

No, AMAC doesn’t directly provide roadside assistance. Instead, it partners with trusted providers offering discounts to members. If you’re seeking the best car insurance for towing and roadside assistance, AMAC’s network can help you find the right plan based on your needs and budget.

What do AMAC roadside assistance reviews typically say about the service quality?

AMAC roadside assistance reviews generally praise the speed of service, the friendly staff, and the value of emergency coverage. They like the convenience and the safety, especially if they’re on the road. But it’s important to point out that, like several others, AMAC actually contracts with third party providers for its roadside services, so the experience can vary by location.

Are AMAC travel discounts better than public travel deals?

Many of AMAC’s travel discounts are better than what you can find publicly. But savings could be slightly different based on provider, time of purchase, and time of booking. Members should compare AMAC’s prices with offers from other travel sites, however, to make sure they’re getting the best value.

Does AMAC offer a student discount on car insurance?

No, AMAC does not offer a student discount on car insurance. It mainly caters to those aged 50 and older, offering some of the best car insurance discounts for seniors. However, students may still save if added to a family policy held by an AMAC member.

What are AMAC senior discounts and how do they work?

AMAC senior discounts are special savings and offers that AMAC (Association of Mature American Citizens) members can access through the organization’s partnerships with trusted companies. While AMAC itself does not directly provide the discounts, it negotiates exclusive deals on behalf of members with providers in insurance, travel, healthcare, and more. Members simply use their AMAC affiliation to qualify for these offers.

Do I need to be a certain age to qualify for AMAC benefits?

AMAC primarily serves Americans aged 50 and older, focusing on providing benefits and advocacy tailored to the needs of older adults. However, anyone can join AMAC and access its benefits, including insurance referral programs and partnerships with service providers.

Does AMAC offer car insurance directly to members?

No, AMAC doesn’t sell or underwrite car insurance directly. Instead, it partners with top providers like USAA, Nationwide, and Progressive to offer members exclusive deals, helping them find the best car insurance for comprehensive coverage.

Are AMAC deals available to all members?

Yes, all AMAC members have access to the full range of available deals. These include offers on auto and home insurance, vision and dental plans, travel packages, phone services, and more. Eligibility for specific discounts may depend on provider criteria, such as age, location, or driving history, but membership itself grants access to the deal opportunities.

Can I call the AMAC phone number to get a car insurance quote?

While you can call 1-888-262-2006 for general questions about AMAC membership benefits, AMAC does not provide car insurance quotes directly. Instead, they connect members with partner insurance providers who offer potential discounts.

Are AMAC insurance reviews generally positive?

Most AMAC insurance reviews are positive, especially from seniors who value discounted rates through AMAC’s partnerships with trusted insurers. Members often highlight strong customer service and perks like the government mandated car insurance discount for seniors. While AMAC doesn’t sell insurance directly, it connects members with providers that do.

Searching for more affordable premiums? Insert your ZIP code to get started on finding the right provider for you and your budget.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.