Colorado Car Insurance 101 (Compare Costs & Companies)

Our best piece of Colorado car insurance 101 advice is to carry more than Colorado's required liability insurance coverage, which costs an average of only $42/mo but doesn't provide protection for you and your car if you cause an accident. Instead, look for full coverage car insurance in Colorado.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Looking for Colorado car insurance 101 advice? All drivers in Colorado must carry the required liability insurance minimum, but we recommend drivers carry full coverage car insurance in Colorado. While full coverage costs more, there are plenty of ways to still get cheap car insurance in Colorado even when buying full coverage.

Read on to learn how to get affordable Colorado auto insurance. You can also use our free quote comparison tool to search for the best Colorado car insurance rates from Colorado car insurance companies in your area.

- Drivers in Colorado need to carry Colorado’s required liability insurance coverage

- The required liability car insurance in Colorado averages $42/mo

- Optional full coverage car insurance in Colorado averages $155/mo

Colorado Car Insurance Coverage and Rates

Colorado lays claim to a lot of firsts. The first cheeseburger, the first rodeo, and the first movie theater. It’s certainly got a lot of purple mountain majesties, and despite national economic recessions over the last two decades, Colorado’s economy is growing fast.

No wonder so many people are moving to The Centennial State.

There will be car insurance requirements for registering your vehicle no matter which state you call home. And what state you call home can certainly affect your car insurance premiums.

But don’t worry. We are here to help you through the entire process by providing the information that you need to choose the right car insurance provider to handle all of your needs.

Keep reading to find out about the minimum car insurance requirements in Colorado and how we can help you get the best deal possible.

Colorado’s Car Culture

Coloradans have a lot of reasons to drive.

- Best Cheap Car Insurance Companies

- Affordable Car Insurance Rates in Aurora, CO

- Affordable Car Insurance Rates in Pueblo, CO (2025)

- Affordable Car Insurance Rates in Maybell, CO (2025)

- Affordable Car Insurance Rates in Fort Collins, CO (2025)

- Affordable Car Insurance Rates in Durango, CO (2025)

- Affordable Car Insurance Rates in Commerce City, CO (2025)

- Affordable Car Insurance Rates in Cimarron, CO (2025)

According to The Hartford, “Living in one of the country’s biggest states, with over 100,000 square miles of land, residents can have a long way to travel between the towns scattered throughout the state. They also have a choice of many attractions, from state forests to national monuments, spread out across mountains, deserts, and plains.”

Let’s take a look at the minimum car insurance you need in the great state of Colorado.

Colorado Minimum Coverage

Like almost all states, Colorado has minimum state requirements when it comes to the coverage amounts that drivers are required to carry on their vehicles. The table below shows these minimums for Colorado’s drivers.

State minimum auto insurance rates and requirements vary from state to state. Compare state to state below:

Colorado is what’s called a FAULT state, which means that, according to NOLO, “drivers are financially responsible for the effects of any accident they cause.”

Knowing that you could be held financially responsible for any and all damage that you cause if you are ever involved in an accident might scare you. But having the right car insurance provider in your corner can help ease these fears.

Forms of Financial Responsibility

What is financial responsibility?

Basically, financial responsibility is proof that you have Colorado’s minimum liability coverage.

Colorado law requires every driver to have proof of financial responsibility at all times.

Here are a few acceptable forms of proof of financial responsibility in Colorado:

- Valid Insurance ID Card

- Electronic proof on a smartphone

- A letter from an insurance agent or insurer on company letterhead

How much of your income can you expect to spend on car insurance in Colorado?

Premiums as Percentage of Income in Colorado

Our research shows that Coloradans spend just below the national average of their annual income on car insurance premiums. The table below offers Coloradans’ premiums as a percentage of average income vs. national averages for 2012 – 2014.

| Year | Colorado Averages | National Averages |

|---|---|---|

| 2014 | 2.15% | 2.29% |

| 2013 | 2.16% | 2.39% |

| 2012 | 2.13% | 2.32% |

As you can see, in 2014 Colorado residents had an average disposable income of $49,756, of which they spent $1,050.09, or 2.11 percent, on car insurance.

No matter what the national average expenditure is, all Colorado residents like to save money whenever possible. This is why it is so important to shop around.

Use the handy calculator below to figure out what percent of your income might go to car insurance premiums.

CalculatorPro

Average Monthly Car Insurance Rates in CO (Liability, Collision, Comprehensive)

Do you know what your options are as a car insurance consumer? Part of getting the best deal on car insurance is understanding the types of coverages being offered.

Liability coverage is the type of coverage that the state requires as part of its minimums. This type of coverage will cover any damage that you do to another part’s person or property if you are ever involved in an accident.

Liability will not pay for your injuries or damages though. That is where collision and/or comprehensive come in.

Generally speaking, collision will pay for your damages and injuries if you hit another object and comprehensive will pay out if your car is vandalized stolen, or is the victim of an act of nature such as flood or mudslide.

When liability, comprehensive, and collision are combined on one policy you are considered to have full coverage.

If you take time to understand both the types of coverage that you are buying and just how much of each type of coverage you need before you decide on something as important as your car insurance policy you can save yourself a lot of frustration later.

Additional Liability

Anything above the insurance minimums offered above is optional in Colorado.

But remember, stronger coverage can help you avoid financial hardship should bills stack up after a run-in with a bear on one of Colorado’s many mountain roadways.

So how do you know if a car insurance company is good for you? Knowing a company’s loss ratio can help you determine if they can provide you the car insurance you need.

But wait, you’re probably wondering, unless you have an MBA, what the heck is a loss ratio?

A loss ratio simply shows how much an insurer spends on claims compared to how much they receive in premiums.

Here’s an example: if a company spends $60 in payouts for claims for every $100 they receive in premiums, they have a loss ratio of 60 percent. Loss ratios over 100 percent mean an insurer is losing money. But note: abnormally low loss ratios mean a company isn’t paying out much in claims, which could mean they don’t have the best customer service.

If that still doesn’t make sense, this short video provides a good overview of loss ratios.

For 2017, the National Association of Insurance Commissioners (NAIC) found the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is a bit lower than this 2017 average, between 60 and 70 percent.

What else can you do to protect yourself and your assets if you are involved in a car accident? In the following section, we’ll cover some great extras you can usually easily add to your existing or new car insurance policy.

Add-ons, Endorsements, and Riders

Many car insurance providers offer a variety of add-ons, endorsements, and riders to help you protect you and your vehicle in the case of an accident or another vehicular incident.

Some of the options available to you are:

- Guaranteed Auto Protection (GAP)-If your car is ever totaled or stolen GAP will pay any money that is remains owed on the lease or loan.

- Personal Umbrella Policy (PUP)-When your liability limits have been reached PUP kicks in to help protect you from lawsuits which may result from an auto accident.

- Rental Reimbursement-If your car is in the shop due to a traffic incident rental reimbursement will help you pay the costs of renting a car until your repairs are finished.

- Emergency Roadside Assistance– If your car breaks down or you have a flat this addition to your policy will help you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance-Need repairs that were not due to an accident then this type of coverage is for you.

- Non-Owner Car Insurance-This type of coverage is perfect for you if you don’t own a car but still drive on occasion because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage-This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance-Specially designed for classic cars, this type of coverage helps ensure that if something happens to prized possession you will both be well protected.

- Pay-As-You-Drive or Usage-Based Insurance-This type of coverage is based on the way you drive based on information collected by your car insurance provider regarding your speed, distance traveled, and other such factors and issues discounts based on that information.

Personal injury protection, or PIP, might be a good option for you, too. PIP, often referred to as “no-fault insurance,” covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

Average Monthly Car Insurance Rates by Age & Gender in CO

Though Colorado is not one of the six states to ban gender discrimination in car insurance premiums, gender is less of a factor than age and marital status. As you can see in the table below — which offers average premiums for Coloradans of various demographics — teenagers almost always pay more than older drivers.

| Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $11,732.84 | $12,322.40 | $3,748.22 | $3,771.84 | $3,397.34 | $3,180.33 | $3,056.13 | $3,088.23 |

| American Family | $6,182.18 | $8,292.20 | $2,552.17 | $3,128.70 | $2,552.17 | $2,552.17 | $2,302.28 | $2,302.28 |

| Farmers | $11,703.79 | $11,788.62 | $3,401.12 | $3,436.88 | $3,095.55 | $3,068.12 | $2,804.12 | $3,023.70 |

| Geico | $6,116.54 | $6,472.19 | $1,797.35 | $1,830.71 | $1,962.23 | $2,140.86 | $2,069.94 | $2,343.70 |

| Safeco | $5,559.53 | $6,061.99 | $1,877.93 | $1,897.98 | $1,859.15 | $1,810.08 | $1,578.98 | $1,736.25 |

| AMCO | $6,292.06 | $8,057.66 | $2,863.59 | $3,094.73 | $2,490.00 | $2,536.58 | $2,226.47 | $2,354.68 |

| Progressive | $8,765.26 | $9,802.10 | $2,926.11 | $2,846.92 | $2,593.20 | $2,426.75 | $2,250.01 | $2,245.05 |

| State Farm | $5,901.90 | $7,471.21 | $2,293.13 | $2,717.20 | $2,048.74 | $2,048.74 | $1,842.60 | $1,842.60 |

| USAA | $5,582.30 | $6,398.91 | $2,873.09 | $3,130.10 | $2,232.85 | $2,232.55 | $2,126.52 | $2,134.62 |

Age and gender will affect your car insurance. Younger drivers are often in a high risk class. See if the gender stereotype (males pay more) holds true in CO.

Cheapest Rates By ZIP Code

Did you know that car insurance rates vary not only by what state you live in but also by where you live in your state?

It’s true.

In Colorado, the most expensive average car insurance premiums can be found in ZIP code 80219. 80219 is an area just southwest of downtown Denver, including the neighborhoods of Westwood, Mar Lee, and Harvey Park. Car insurance averages $4,762.40 in the zone. You can also compare the cheapest rates by cities.

How Much Car Insurance Rates in Colorado

Discover the range of car insurance rates across different cities in Colorado. Select your city from the available options to understand the detailed aspects of insurance expenses in your area.

| Find Affordable Car Insurance Rates in Colorado | ||

|---|---|---|

| Arvada, CO | Denver, CO | Maybell, CO |

| Aurora, CO | Durango, CO | Pueblo, CO |

| Cimarron, CO | Fort Collins, CO | Thornton, CO |

| Colorado Springs, CO | Greeley, CO | Westminster, CO |

| Commerce City, CO | Lakewood, CO |

Best Colorado Car Insurance Companies

How do you find the best car insurance company for meeting you and your family’s needs?

From company financial ratings to rates for drivers of various histories, you’ll want to consider the pros and cons of each insurer.

In the sections below, we’ve compiled the best car insurance companies in Colorado by key factors.

The Largest Companies Financial Ratings

A good insurance company has the ability to financially cover its customers. That’s why considering financial ratings is important.

AM Best ranks America’s insurance companies by financial solvency. What does it mean for a company to receive a high grade? This video explains their methodology and meaning well.

But AM Best is not the only financial advising company that is keeping its eye on the car insurance market. Read on to see how JD Power ranks Colorado insurers.

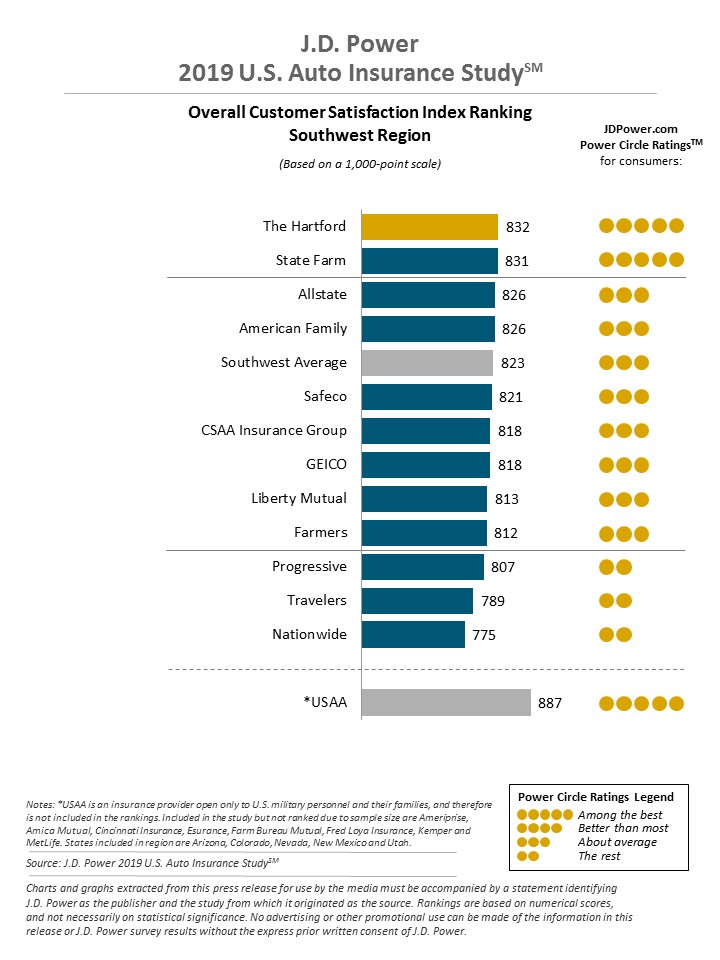

Companies With Best Ratings

JD Power is also looking out for you, and what it has discovered is that customer satisfaction with the overall car insurance market is at an all-time high. Here are their ratings for Colorado — part of the Southwest Region — for 2018.

In Colorado, State Farm ranks near the top of JD Power’s list.

Let’s check out their record of official complaints.

Companies With Most Complaints in Colorado

Knowing how many complaints a company receives is can be an indicator of its quality. But it shouldn’t be your sole decision-maker, of course.

In Colorado, Permanent General of Ohio has the highest number of complaints of any car insurer in the state.

But what are the cheapest car insurance companies in The Centennial State?

Cheapest Companies in Colorado

Is cheapest always best? Of course not, but we also know that you want to find the most affordable and reliable car insurance for you and your family.

The table below shows the average premiums for Colorado’s biggest car insurance providers.

| Company | Average | Compared to State Average (+/-) | Compared to State Average (%) |

|---|---|---|---|

| Allstate | $5,537.17 | $1,644.85 | 29.71% |

| American Family | $3,733.02 | -$159.30 | -4.27% |

| Farmers | $5,290.24 | $1,397.92 | 26.42% |

| Geico | $3,091.69 | -$800.63 | -25.90% |

| Safeco | $2,797.74 | -$1,094.58 | -39.12% |

| AMCO | $3,739.47 | -$152.85 | -4.09% |

| Progressive | $4,231.92 | $339.60 | 8.02% |

| State Farm | $3,270.76 | -$621.56 | -19.00% |

| USAA | $3,338.87 | -$553.45 | -16.58% |

Commute Rate By Company

As you might already know, how much you drive affects how much you pay for car insurance.

And whether you drive a little or a lot, Geico is likely your cheapest insurance provider in Colorado.

The following table lists Colorado’s biggest car insurance providers and their corresponding average rates for both a 10- and 25-mile average commute distance.

| Group | Daily Commute | Annual Mileage | Annual Average |

|---|---|---|---|

| Allstate | 10 miles | 6,000 | $5,537.17 |

| Allstate | 25 miles | 12,000 | $5,537.17 |

| American Family | 10 miles | 6,000 | $3,653.11 |

| American Family | 25 miles | 12,000 | $3,812.93 |

| Farmers | 10 miles | 6,000 | $5,290.24 |

| Farmers | 25 miles | 12,000 | $5,290.24 |

| Geico | 10 miles | 6,000 | $3,025.45 |

| Geico | 25 miles | 12,000 | $3,157.93 |

| Liberty Mutual | 10 miles | 6,000 | $2,797.74 |

| Liberty Mutual | 25 miles | 12,000 | $2,797.74 |

| Nationwide | 10 miles | 6,000 | $3,739.47 |

| Nationwide | 25 miles | 12,000 | $3,739.47 |

| Progressive | 10 miles | 6,000 | $4,231.92 |

| Progressive | 25 miles | 12,000 | $4,231.92 |

| State Farm | 10 miles | 6,000 | $3,190.31 |

| State Farm | 25 miles | 12,000 | $3,351.22 |

| USAA | 10 miles | 6,000 | $3,244.04 |

| USAA | 25 miles | 12,000 | $3,433.70 |

The amount of coverage that you choose to purchase will also help in determining how much your car insurance policy will cost you.

Coverage Level Rate By Company

Did you know that what coverage level you request affects how much money you will pay in car insurance premiums?

The more extensive the coverage, the more expensive car insurance usually becomes. The less coverage, the cheaper your insurance will likely be.

Below is a table that illustrates the different types of insurance coverage levels and their average yearly rates for Colorado’s biggest insurance providers.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $5,856.45 |

| Allstate | Medium | $5,518.14 |

| Allstate | Low | $5,236.91 |

| American Family | High | $3,842.92 |

| American Family | Medium | $3,809.91 |

| American Family | Low | $3,546.22 |

| Farmers | High | $6,013.62 |

| Farmers | Medium | $5,215.47 |

| Farmers | Low | $4,641.62 |

| Geico | High | $3,454.92 |

| Geico | Medium | $3,034.95 |

| Geico | Low | $2,785.20 |

| Liberty Mutual | High | $2,969.02 |

| Liberty Mutual | Medium | $2,787.15 |

| Liberty Mutual | Low | $2,637.04 |

| Nationwide | High | $3,729.76 |

| Nationwide | Medium | $3,740.53 |

| Nationwide | Low | $3,748.13 |

| Progressive | High | $4,535.53 |

| Progressive | Medium | $4,244.39 |

| Progressive | Low | $3,915.86 |

| State Farm | High | $3,487.06 |

| State Farm | Medium | $3,272.35 |

| State Farm | Low | $3,052.89 |

| USAA | High | $3,486.28 |

| USAA | Medium | $3,338.66 |

| USAA | Low | $3,191.66 |

But did you also know: your credit history also affects your car insurance premiums?

Credit History Rates By Company

U.S. Representative Rashida Tlaib has introduced a bill that would ban credit history discrimination in car insurance premiums from coast to coast.

But until that happens, your credit history can affect your premiums a great deal in Colorado.

Credit history is a big factor for insurance companies when they are calculating your insurance premium.

On average, Coloradans have an above-average credit score. With an average Experian score of 688, Coloradans’ credit is well above the national average of 675.

But what if you have poor credit? Who are the best car insurers in Colorado for you? Likely Geico or, if you qualify, USAA will your most affordable options.

What affects your car insurance premium perhaps more than anything else? Your driving record.

Driving Record Rates By Company

Do you have a spotless driving record? Most of us don’t, and we need to be prepared for our car insurance premiums to be affected by our driving histories.

If you live in Colorado and have a DUI in your past, for example, Liberty Mutual will likely be your most cost-effective car insurance provider.

Largest Car Insurance Companies in Colorado

Knowing who the largest car insurance companies in your area are can help you find the best deal and most reliable company, in many cases.

The table below provides Colorado’s largest insurance companies by direct premiums written, loss ratio, and market share.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm | $906,918 | 77.60% | 19.81% |

| USAA | $467,079 | 86.16% | 10.20% |

| Geico | $452,585 | 98.99% | 9.89% |

| Progressive | $440,274 | 69.82% | 9.62% |

| Allstate Insurance | $388,445 | 78.44% | 8.49% |

| American Family | $384,892 | 100.38% | 8.41% |

| Farmers | $330,473 | 63.89% | 7.22% |

| Liberty Mutual | $319,166 | 86.69% | 6.97% |

| Travelers | $129,187 | 191.67% | 2.82% |

| Nationwide | $91,547 | 86.32% | 2.00% |

Number of Foreign vs. Domestic Insurers in Colorado

When you hear the phrase “foreign or domestic car insurance company,” what do you think that means?

When it comes to auto insurers, domestic simply means an in-state provider, and foreign, an out-of-state provider.

According to the NAIC, Colorado has 10 domestic car insurance companies and 848 foreign car insurance providers. Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Colorado Laws

So you want to drive in Colorado?

Who can blame you! The Centennial State is one of the most gorgeous places in the United States.

But as you probably know, state laws can be odd, and often vary from state to state.

In the sections below, we’ll cover a variety of legal topics related to driving and insuring your car in Colorado.

You might also want to check out the National Motorists Association guide to driving in Colorado.

Car Insurance Laws

As we’ve seen above, Colorado requires liability insurance with the following minimums:

- Injury to one person: $25,000

- All injuries: $50,000

- Property Damage: $15,000

Also remember, these are minimums. What is best for you and your family might be coverage above liability, like the add-ons we explored earlier.

How State Laws For Insurance Are Determined

Do you know about the National Association of Insurance Commissioners (NAIC)?

Well, unless you’re an insurance nerd like us, you probably haven’t heard of them before. But that’s okay.

The NAIC is the U.S. standard-setting and regulatory support organization for the insurance industry, including car insurance. They were created and are governed by the chief insurance regulators from all 50 states, the District of Columbia and five U.S. territories.

And in case you’re curious how insurance laws actually get made, they offer this great white paper to help you understand.

Windshield Coverage

While some states have strict laws regarding insurance benefits for full glass replacement services, Colorado has no specific laws to this end.

But note: windshield and glass coverage may be an easy add-on to your car insurance. Make sure to check with your provider. After all, glass claims are the top insurance claims filed across the country.

High-Risk Insurance

If you have a bad driving record, it may be difficult to find an insurance company that is willing to insure you as a driver.

Luckily, in most states, insurance companies have made programs available to provide affordable coverage for those who are deemed high-risk drivers.

In Colorado, this program is known as the Colorado Automobile Insurance Plan.

According to Colorado’s DMV: “The plan is a voluntary agreement between the state and all auto insurers licensed in Colorado. The deal is that if an insurer wants to do ANY auto insurance business in Colorado, then that insurer must agree to cover a share of high-risk drivers when they are assigned.”

Colorado is also one of several states that comprises an association of auto plans referred to as the Western Association of Automobile Insurance Plans (WAAIP). WAAIP is a processing center where people who have trouble buying automobile insurance are put in touch with an insurance company that will more likely insure them.

Low-Cost Insurance

Some states have programs set up for those who receive benefits from government assistance programs, or those who have a combined family income that is below the poverty level.

Unfortunately, Colorado has no such plan in place.

In order to obey the law, you must carry the minimum liability coverage.

Automobile Insurance Fraud in Colorado

Colorado has a commission specifically charged with fighting insurance fraud in the state.

But what is automobile insurance fraud? In Colorado, insurance fraud is:

- Creating a claim for damages or injuries that NEVER occurred (such as faking an accident)

- Adding “extra” costs onto a claim that is legitimate

Insurance fraud in Colorado is generally considered a Class 5 Felony, which means it’s punishable by up to three years in prison and $100,000 in fines.

Statute of Limitations

If you are in a car accident in Colorado, there is a statute of limitations. That means you have a specific amount of time to file a claim in a court of law. In Colorado, you have three years to file both property damage and bodily injury claims following an accident.

Vehicle Licensing Laws

Like all other states in America, Colorado has mandatory licensing laws in addition to the laws we have already covered.

You’re probably not surprised to learn that The Centennial State requires a valid driver’s license to operate a vehicle.

And be honest: who doesn’t love getting their picture taken at the DMV?

Okay, maybe that’s not the case. But you should know: licensing yourself and your vehicle in Colorado may be easier than you think.

The Colorado Department of Motor Vehicles requires that you get a license within 90 days of becoming a state resident. Their website is really helpful and explains that you will need documentation from this list provided on their website if you are a United States citizen or resident.

Real ID

Passed by Congress in 2005, the REAL ID Act establishes minimum security standards for state-issued driver’s licenses and identification cards and prohibits Federal agencies from accepting for official purposes licenses and identification cards from states that do not meet these standards.

Colorado is in full compliance with the REAL ID Act passed by Congress and enforced by Homeland Security. This means that a driver’s license or state ID issued by Colorado is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

As of October 1, 2020, anyone wishing to fly on a commercial flight or to enter a federal facility must have a REAL ID-compliant form of identification, usually noted by that black star in the upper right corner of your driver’s license.

Penalties For Driving Without Insurance

In Colorado, police and DMV officials have access to the state’s Motorist Insurance Information Database (MIIDB). Registration information is updated in the MIIDB daily and insurance information is updated weekly or more, so this is a great resource if you get pulled over without visual proof of your insurance available.

But what if you’re actually driving without insurance? That’s not good.

Teen Driving Laws

Most states have some form of graduated licensing laws for teens, and Colorado is no exception.

Colorado teens must be 15 an attending a driving class to apply for a learner’s permit. Before teens can apply for a regular license or a restricted license, the Insurance Institute for Highway Safety (IIHS) specifies that teens must meet the requirements.

Teenaged drivers are not the only ones who have a specific set of laws that pertain to their licensing requirements. In most states, older drivers also have restrictions when it comes to renewing their licenses.

Older Driver License Renewal Procedures

Although older drivers in Colorado must renew their license every five years, the same renewal period as the general population, they differ in their form of renewal.

Here are the differences:

- General population – limited to two consecutive renewals online before having to go in person or every other renewal by mail

- Over 66 years old – every other renewal may be by mail

But what do you do if you’re new to Colorado?

New Residents

If you’re one of Colorado’s lucky new residents, remember that you must obtain a Colorado driver license within 90 days of moving to the state.

But how do you do that?

According to the Colorado DMV, “if you have a valid driver license in your possession which was issued by another U.S. state, territory, or possession, you will normally not be required to take the written exam or drive skills test.” That’s great!

You will, however, need to bring the following documents with you to change over your driver license:

- Your valid out of state driver license. If it does not display your full legal name (i.e. middle name spelled out), please bring your certified original state or county issued birth certificate, U.S. passport (if applicable), or military ID (if applicable) to confirm your middle name – Identification documents. NOTE: Acceptance of a birth certificate is dependent on the certifying authority, which certifies the document by its seal. Birth certificates must have a seal from a state or county, not a city.

- If you are under the age of 18, an Affidavit of Liability or Guardianship (DR2460) must be signed by your parent/legal guardian in front of a driver license employee or notary

- Proof of your Social Security number

- Two proofs of current physical Colorado address documents

- Proof of lawful presence (if U.S. citizen or permanently lawfully present in the U.S.)

- Applicable fee

Rules of the Road

From New York to California, and certainly in Colorado in between, every state has its own rules of the road.

Knowing what they are in The Centennial State could help you avoid the receipt of any negligent operator points on your license or hefty tickets.

Keep scrolling to find out all of the information you need to know to save money on car insurance by following the laws of the great state of Colorado.

Fault Vs. No-Fault

As we’ve already learned, Colorado is what’s called a FAULT state. This legal definition means that, according to NOLO, “drivers are financially responsible for the effects of any accident they cause.”

Seatbelt and Car Seat Laws

Put simply: All passengers in the front seat of a vehicle driven in Colorado must be wearing a seat belt. Additionally, children 16 years and younger are required to be properly restrained no matter where they are sitting.

According to the Colorado General Assembly, “a driver in violation of the seat belt law commits a Class B traffic infraction and is subject to a $65 fine and a $6 surcharge.”

The Colorado General Assembly also offers guidelines for car seat restrictions found in the table below.

| CHILD AGE/SIZE | STATUTORY REQUIREMENT |

|---|---|

| Less than 1 year and weighing less than 20 pounds | Properly secured in a rear‑facing child restraint system in a rear seat of the vehicle |

| 1 year to 4 years, and weighing 20 to 40 pounds | Properly secured in a rear‑facing or forward‑facing child restraint system |

| Children up to 8 years | Properly secured in a child restraint system, such as a booster seat, according to the manufacturer's instructions |

| 8 to 15 years | Properly restrained in a safety belt or child restraint system according to manufacturer's instructions |

Keep Right and Move Over Laws

In a lot of places, it’s just common courtesy, but Colorado traffic laws mandate that you must keep right when traveling slower than the average speed of traffic around you.

Generally, the left lane is reserved for faster-moving traffic and passing.

AAA reports that Colorado “state law requires drivers approaching stationary emergency vehicles that are displaying flashing lights, including tow trucks, traveling in the same direction, to vacate the lane closest, if safe and possible to do so, or to reduce to a speed safe for weather, road, and traffic conditions.

Also included in the law are utility vehicles and road maintenance vehicles.”

Speed Limits

Speeding is never a good idea, but in Colorado you should know there are two types of speeding: absolute and presumed.

Absolute speeding means exceeding the speed limit is illegal per se, regardless of whether it was safe under the specific conditions. Absolutely speed limits apply to the state’s Interstates and state highways.

Presumed speeding means driving faster than the speed limit is only evidence of unreasonable speed. Get caught on a non-interstate or state highway, and you can still argue that your speed was safe under the specific conditions of presumed speeding laws.

In Colorado, absolute speed limits are:

- Rural Interstates: 75 mph

- Urban Interstates: 65 mph

- Other Limited Access Roads: 65 mph

But remember, a speeding ticket is one of the quickest ways to raise your car insurance premiums.

Ridesharing

Most major rideshare services like Uber and Lyft mandate that their drivers carry personal car insurance that meets the minimum requirements of the state where they operate.

However, if drivers wish to purchase a commercial insurance policy, these are the companies that provide coverage:

- Allstate

- American Family

- Farmers

- Geico

- MetLife

- Safeco

- State Farm

- USAA

In 2014, the state of Colorado became the first to pass a regulatory bill for ridesharing companies.

Automation on the Road

What the heck is automation?

The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task previously carried out by a human.

When it comes to automation, typically think radars, cameras, and other sensors used to gather information about a vehicle’s surroundings.

Currently, Colorado does allow the deployment of autonomous vehicles with no restrictions on having an operator in the vehicle.

Safety Laws

Let’s take a look at some important safety laws in Colorado.

DUI Laws

Driving under the influence of alcohol has disastrous results, as you probably already know.

That’s why strict laws are in place to prevent drunk driving fatalities, injuries, and property damage. In Colorado in 2017 alone, drunk driving caused 177 deaths.

But isn’t marijuana legal in Colorado?

Marijuana Impaired Driving Laws

The legalization of recreational marijuana in Colorado has had many great benefits.

However, driving under the influence of any drug, including marijuana, is illegal and subject to the same penalties as driving under the influence of alcohol shown above.

Distracted Driving Laws

In Colorado, text messaging while driving is prohibited for all drivers, though talking on the telephone is still legal, even if the device is handheld. Generally, a texting ticket is a class 2 misdemeanor traffic offense and costs $300.

Persons under the age of 18 are prohibited from using a wireless telephone while driving.

https://www.youtube.com/watch?v=h3VnEduzH5U&feature=youtu.be

Driving in Colorado

You know driving safely is important wherever you are.

Read on for some important information about keeping you, your family, and your vehicles safe in the beautiful state of Colorado.

Vehicle Theft in Colorado

The Federal Bureau of Investigation (FBI) keeps track of vehicle thefts and other crimes city-by-city in all states. In Colorado, this means they’re tracking vehicle theft everywhere, from Aspen to Yuma.

In 2016, Denver — Colorado’s largest and capital city — led the state in vehicle thefts with 4,788.

Road Fatalities in Colorado

Despite their beauty, Colorado has some dangerous roadways, winding up snowy mountains, through flood-prone valleys, and across congested metro areas.

Most Fatal Highway in Colorado

According to Geotab, US-160 is Colorado’s deadliest highway. US-160 winds across the southern part of the state, from Kansas in the east to the four corners in the west, where Colorado, Utah, New Mexico, and Arizona meet.

Fatal Crashes by Weather and Light Conditions

Colorado, as you probably know, isn’t always a paradise of green forests. In fact, winters in this western state can be quite harsh, with snowfalls measured in feet, not inches.

Not surprisingly, crashes are highly affected by both weather and light conditions, especially in a winter wonderland like Colorado.

Teen Drinking and Driving

In 2016, Colorado law enforcement arrested 217 teenagers under the age of 18 for drunk driving.

This number places Colorado as the seventh worst state in the United States for underage drinking and driving.

Sadly, Colorado Is on-trend with national averages for underage (under 21 years old) drinking-related fatalities, with 1.2 fatalities per 100,000 people.

Transportation

DataUSA reports that if you call Colorado home, you likely live in a two-car household and drive alone 23.7 minutes each way to work.

Car Ownership

According to DataUSA, the average household in Colorado owned two cars in 2017.

Commute Time

Coloradans have an average commute to work of 23.7 minutes each way, below the national average of 25.1.

Commuter Transportation

Public transportation and other alternative forms of transit, such as bicycling, are popular in the Denver metro area, but in few other parts of the state.

Traffic Congestion in Colorado

In Colorado, only Denverites face many problems with traffic congestion. Traffic monitoring group TomTom recently found that drivers in Denver faced an overall congestion rate of 22 percent in 2018. This resulted in an extra 11 minutes for those commuting during morning rush hour stuck in congestion, and an extra 15 minutes for evening rush.

Did this guide help you think about all the factors that should go into your car insurance search?

You can start your search for that perfect fit simply by entering your ZIP code below.

Frequently Asked Questions

Why is car insurance required in Colorado

Car insurance is required in Colorado to ensure that drivers are able to cover the costs of damages and injuries resulting from car accidents they cause. This protects both drivers and other individuals on the road.

What are the minimum car insurance requirements in Colorado?

In Colorado, drivers are required to carry liability insurance with at least the following minimum coverage limits:

- $25,000 for bodily injury or death to one person in an accident

- $50,000 for bodily injury or death to two or more people in an accident

- $15,000 for property damage in an accident

Are there additional types of car insurance coverage I should consider in Colorado?

Yes, in addition to liability insurance, you may want to consider adding:

- Collision coverage: which pays for damages to your own vehicle in an accident.

- Comprehensive coverage: which covers non-collision events like theft or weather damage.

How do I choose the best car insurance company in Colorado?

The best car insurance company for you will depend on your individual needs and preferences. Consider factors like:

- cost

- customer service

- coverage options

- discounts when comparing companies

What factors can affect the cost of car insurance in Colorado?

Several factors can affect the cost of car insurance in Colorado, including:

- driving record

- age

- gender

- location

- vehicle type

- coverage needs

How can I save money on car insurance in Colorado?

There are several ways to save money on car insurance in Colorado, including:

- Bundling multiple policies with the same insurer

- Maintaining a clean driving record

- Taking a defensive driving course

- Choosing a higher deductible

- Inquiring about discounts for good driving, multiple vehicles, or safety features on your car.

How can I compare car insurance quotes in Colorado?

You can compare car insurance quotes in Colorado by gathering quotes from several different insurance companies and comparing the costs and coverage options side by side. Many insurance companies allow you to obtain quotes online or over the phone.

What should I do if I am involved in a car accident in Colorado?

If you are involved in a car accident in Colorado, take the following four steps:

- Check for injuries and seek medical attention if necessary.

- Exchange information with the other driver(s) involved in the accident.

- File a police report.

- Contact your insurance company to report the accident and file a claim.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.