Arizona Car Insurance 101 (Compare Costs & Companies)

Drivers looking for Arizona car insurance 101 advice should know that all Arizona drivers need 25/50/15 of liability insurance. This required Arizona liability insurance costs an average of $46/mo. Drivers who choose to carry full coverage car insurance in Arizona will pay an average of $136/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Not sure what Arizona car insurance coverages you should be carrying or how much you should be paying? Our Arizona car insurance 101 guide goes over everything you need to know about finding the best Arizona car insurance, from what coverages you need to Arizona car insurance discounts.

Read on to learn everything you need to know about Arizona auto insurance. And if you want to jump right into comparing Arizona car insurance rates from companies in your area, use our free quote comparison tool at any time to find affordable Arizona car insurance.

- Arizona drivers must carry 25/50/15 of liability insurance to drive legally

- Liability insurance is an average of $46 per month in Arizona

- Full coverage insurance is an average of $136 per month in Arizona

Arizona Car Insurance Coverage and Rates

Arizona. The Grand Canyon State. The Copper State. The state of major cities like Phoenix and Tuscon, and small towns with Old West charm. Arizona was part of Mexico until 1848, the blend of Native American, Mexican, and Spanish cultures is still alive and well in the state.

Arizona is home to rockstar Stevie Nicks, Wonder Woman Lynda Carter, writer Jeannette Walls, hero John McCain and actress Emma Stone.

Its capital, Phoenix, is one of the few cities in the United States with franchises in all four major professional sports leagues, including the Phoenix Suns (NBA), Arizona Diamondbacks (MLB), Arizona Cardinals (NFL) and Arizona Coyotes (NHL).

And despite images of them on billboards everywhere, Arizona’s Sonoran Desert is the only place on earth where the saguaro cactus grows.

Arizona is also a place of innovation: a true technological, medical, educational and financial hub.

- Arizona Car Insurance

- Affordable Car Insurance Rates in Glendale, AZ

- Affordable Car Insurance Rates in Tempe, AZ

- Affordable Car Insurance Rates in Tonopah, AZ (2025)

- Affordable Car Insurance Rates in Oro Valley, AZ (2025)

- Affordable Car Insurance Rates in Kingman, AZ (2025)

- Expert Phoenix Car Insurance, AZ Car Insurance Advice (Compare Costs & Companies)

- Who are the biggest car insurance companies in Phoenix?

No wonder so many people are moving to The Grand Canyon State. The United States Cenus Bureau reports that Arizona is currently the fourth-quickest growing state in the country.

Are you a current Arizonan, or thinking about moving to The Copper State?

There will be car insurance requirements for registering your vehicle no matter which state you call home. And what state you call home can certainly affect your car insurance premiums.

But don’t worry. We are here to help you through the entire process.

In this guide, we’ll provide the information that you need to choose the right car insurance provider to handle all of your needs in the great state of Arizona

Keep reading to find out about the minimum car insurance requirements in Arizona and how we can help you get the best deal possible.

Arizona Car Culture

Arizonans have a lot of reasons to drive.

According to The Hartford, “From the iconic Route 66 winding through ghost towns and historic districts, to the zigzags and hairpin turns of the Apache Trail Historic Road, Arizona is home to a number of roads that will convince you that driving in this state is as much about the journey as the destination.”

Let’s take a look at the minimum car insurance you need in the great state of Arizona.

Arizona Minimum Coverage

Like almost all states, Arizona has minimum state requirements when it comes to the coverage amounts that drivers are required to carry on their vehicles.

Arizona requires drivers to have car insurance that meets or exceeds the following minimum coverage levels:

- Bodily injury liability coverage: Minimum $15,000 per person / $30,000 per accident

- Property damage liability coverage: Minimum $10,000

- Uninsured motorist bodily injury coverage: Minimum $15,000 per person / $30,000 per accident

- Underinsured motorist bodily injury coverage: Minimum $15,000 per person / $30,000 per accident

Arizona is what’s called a FAULT state, which means that, according to NOLO, “drivers are financially responsible for the effects of any accident they cause.”

Knowing that you could be held financially responsible for any and all damage that you cause if you are ever involved in an accident might scare you.

But having the right car insurance provider in your corner can help ease these fears. And we’re here to help you find the perfect one.

Forms of Financial Responsibility

You might be wondering: what is financial responsibility when it comes to car insurance?

Basically, financial responsibility is proof that you have Arizona’s minimum liability coverage.

Arizona law, like the law in most states, requires every driver to have proof of financial responsibility at all times.

Here are a few of the acceptable forms of proof of financial responsibility The Grand Canyon State recognizes:

- Valid Insurance ID Card

- Electronic proof on a smartphone

- A letter from an insurance agent or insurer on company letterhead

But how much of your income can you expect to spend on car insurance in Arizona?

Premiums as Percentage of Income in Arizona

Our research shows that Arizonans spend about half a percent above the national average of their annual income on car insurance premiums.

The table below offers Arizonans’ premiums as a percentage of average income for 2012 – 2014.

| Year | Insurance as % of Income |

|---|---|

| 2014 | 2.80% |

| 2013 | 2.81% |

| 2012 | 2.75% |

In 2014, Arizona residents had an average disposable income of $34,321.00, of which they spent $961.88, or 2.80 percent, on car insurance.

Arizonans like a good deal, however, and that’s why it’s important to shop around for the best car insurance provider.

Use the handy calculator below to figure out what percent of your income might go to car insurance premiums.

CalculatorPro

So what kind of coverage do you really need when it comes to car insurance?

Core Coverage

Do you know what your options are as a car insurance consumer?

Part of getting the best deal on car insurance is understanding the types of coverages various companies offer.

The table below contains the four most purchased types of coverage and the average annual price that you and your fellow Arizonans can expect to pay for each.

| Type of Coverage | Average Annual Cost |

|---|---|

| Liability | $508.76 |

| Collision | $277.96 |

| Comprehensive | $186.12 |

| Full Coverage | $972.85 |

Liability coverage is the type of coverage that the state requires as part of its minimums. This type of coverage will cover any damage that you do to another part’s person or property if you are ever involved in an accident.

Liability will not pay for your injuries or damages though. That is where collision and/or comprehensive come in.

Generally speaking, collision will pay for your damages and injuries if you hit another object and comprehensive will pay out if your car is vandalized stolen, or is the victim of an act of nature such as flood or mudslide.

When liability, comprehensive, and collision are combined on one policy you are considered to have full coverage.

If you take time to understand both the types of coverage that you are buying and just how much of each type of coverage you need before you decide on something as important as your car insurance policy you can save yourself a lot of frustration later.

Additional Liability

It’s important to know that anything above the insurance minimums offered above is optional in Arizona.

Remember, however, more comprehensive coverage can help you avoid financial hardship should bills stack up after an auto accident on one of Arizona’s highways.

So how do you know if a car insurance company is good for you? Knowing a company’s loss ratio can help you determine if they can provide you the car insurance you need.

But wait, you’re probably wondering unless you have an MBA, what the heck is a loss ratio to begin with?

A loss ratio simply shows how much an insurer spends on claims compared to how much they receive in premiums.

Here’s an example: if a company spends $65 in payouts for claims for every $100 they receive in premiums, they have a loss ratio of 65 percent. Loss ratios over 100 percent mean an insurer is losing money. But note: abnormally low loss ratios mean a company isn’t paying out much in claims, which could mean they don’t have the best customer service.

If that still doesn’t make sense, this short video provides a good overview of loss ratios.

For 2017, the National Association of Insurance Commissioners (NAIC) found the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is a bit lower than this 2017 average, between 60 and 70 percent.

What else can you do to protect yourself and your assets if you are involved in a car accident? In the following section, we’ll cover some great extras you can usually easily add to your existing or new car insurance policy.

Add-ons, Endorsements, and Riders

Many car insurance providers offer a variety of add-ons, endorsements, and riders to help you protect you and your vehicle in the case of an accident or another vehicular incident.

Some of the options available to you are:

- Guaranteed Auto Protection (GAP)-If your car is ever totaled or stolen GAP will pay any money that is remains owed on the lease or loan.

- Personal Umbrella Policy (PUP)-When your liability limits have been reached PUP kicks in to help protect you from lawsuits which may result from an auto accident.

- Rental Reimbursement-If your car is in the shop due to a traffic incident rental reimbursement will help you pay the costs of renting a car until your repairs are finished.

- Emergency Roadside Assistance– If your car breaks down or you have a flat this addition to your policy will help you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance-Need repairs that were not due to an accident then this type of coverage is for you.

- Non-Owner Car Insurance-This type of coverage is perfect for you if you don’t own a car but still drive on occasion because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage-This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance-Specially designed for classic cars, this type of coverage helps ensure that if something happens to prized possession you will both be well protected.

- Pay-As-You-Drive or Usage-Based Insurance-This type of coverage is based on the way you drive based on information collected by your car insurance provider regarding your speed, distance traveled, and other such factors and issues discounts based on that information.

Personal injury protection, or PIP, might be a good option for you, too. PIP, often referred to as “no-fault insurance,” covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

Male vs. Female Rates

Though Arizona is not one of the six states to ban gender discrimination in car insurance premiums, gender is less of a factor than age and marital status.

As you can see in the table below — which offers average premiums for Arizonans of various demographics — teenagers almost always pay more than older drivers. And: getting married can help save money on your car insurance premiums.

| Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $7,562.62 | $9,796.63 | $3,890.24 | $4,230.29 | $3,475.85 | $3,475.85 | $3,384.12 | $3,384.12 |

| American Family | $7,241.04 | $9,439.65 | $2,748.94 | $3,227.56 | $2,748.94 | $2,748.94 | $2,524.19 | $2,524.19 |

| Farmers | $11,538.29 | $11,976.04 | $3,034.99 | $3,144.34 | $2,679.47 | $2,677.67 | $2,381.02 | $2,534.04 |

| Geico | $4,418.49 | $4,657.44 | $1,408.73 | $1,388.68 | $1,544.04 | $1,721.95 | $1,303.63 | $1,659.36 |

| NICOA | $5,791.09 | $7,418.71 | $2,714.31 | $2,934.32 | $2,354.06 | $2,397.60 | $2,105.21 | $2,230.55 |

| Progressive | $8,119.66 | $9,061.45 | $2,128.03 | $2,116.05 | $1,977.89 | $1,731.84 | $1,776.60 | $1,687.27 |

| State Farm | $8,933.99 | $11,220.20 | $3,098.04 | $3,919.15 | $2,878.25 | $2,878.25 | $2,538.55 | $2,538.55 |

| Travelers | $5,643.46 | $7,078.41 | $2,057.04 | $2,162.23 | $1,942.75 | $2,042.96 | $1,800.08 | $1,912.79 |

| USAA | $6,306.70 | $7,232.99 | $2,216.43 | $2,377.31 | $1,682.06 | $1,686.88 | $1,569.71 | $1,589.18 |

But what cities and towns in Arizona have the cheapest car Insurance rates?

Cheapest Rates By ZIP Code

Did you know that car insurance rates vary not only by what state you call home but also by where you live in that state?

It’s true: car insurance rates can vary by ZIP code.

Of Arizona’s 421 ZIP codes, the cheapest average car insurance premiums can be found in 86403. 86403 is primarily made up of the city of Lake Havasu, Arizona, a small, picturesque town on the border with California. Residents of 86403 can expect to pay an average yearly car insurance premium of $2,883.46.

The table below offers average premiums for Arizona’s biggest insurers by ZIP code.

| Zipcode | Average Premium |

|---|---|

| 85009 | $5,479.07 |

| 85017 | $5,440.43 |

| 85019 | $5,367.13 |

| 85031 | $5,339.76 |

| 85035 | $5,223.71 |

| 85033 | $5,221.61 |

| 85015 | $5,175.99 |

| 85051 | $5,127.30 |

| 85040 | $5,115.68 |

| 85041 | $5,101.83 |

| 85021 | $5,092.07 |

| 85006 | $5,079.52 |

| 85034 | $5,069.47 |

| 85013 | $5,037.15 |

| 85043 | $5,027.59 |

| 85004 | $5,011.05 |

| 85012 | $5,006.68 |

| 85007 | $5,005.43 |

| 85003 | $4,990.72 |

| 85301 | $4,990.47 |

| 85303 | $4,986.06 |

| 85029 | $4,978.32 |

| 85025 | $4,976.47 |

| 85042 | $4,882.91 |

| 85020 | $4,842.66 |

| 85014 | $4,828.12 |

| 85304 | $4,822.54 |

| 85302 | $4,815.47 |

| 85008 | $4,811.38 |

| 85037 | $4,789.84 |

| 85073 | $4,784.43 |

| 85023 | $4,773.40 |

| 85026 | $4,761.38 |

| 85016 | $4,724.98 |

| 85053 | $4,710.51 |

| 85065 | $4,687.34 |

| 85306 | $4,665.88 |

| 85353 | $4,640.27 |

| 85018 | $4,633.03 |

| 85339 | $4,582.09 |

| 85032 | $4,577.50 |

| 85022 | $4,570.10 |

| 85039 | $4,545.78 |

| 85305 | $4,542.50 |

| 85024 | $4,514.91 |

| 85028 | $4,493.67 |

| 85097 | $4,465.79 |

| 85307 | $4,438.79 |

| 85204 | $4,436.03 |

| 85027 | $4,430.41 |

| 85054 | $4,428.40 |

| 85345 | $4,412.01 |

| 85381 | $4,401.49 |

| 85254 | $4,397.37 |

| 85256 | $4,390.03 |

| 85050 | $4,372.54 |

| 85335 | $4,371.02 |

| 85308 | $4,358.47 |

| 85283 | $4,348.51 |

| 85259 | $4,341.31 |

| 85392 | $4,327.13 |

| 85253 | $4,326.68 |

| 85282 | $4,322.90 |

| 85213 | $4,321.40 |

| 85083 | $4,319.39 |

| 85251 | $4,312.62 |

| 85383 | $4,308.86 |

| 85201 | $4,304.78 |

| 85323 | $4,298.64 |

| 85309 | $4,294.56 |

| 85210 | $4,287.22 |

| 85250 | $4,284.61 |

| 85142 | $4,280.17 |

| 85281 | $4,264.20 |

| 85203 | $4,259.86 |

| 85260 | $4,250.29 |

| 85202 | $4,247.66 |

| 85355 | $4,243.07 |

| 85310 | $4,227.35 |

| 85045 | $4,222.94 |

| 85257 | $4,215.78 |

| 85382 | $4,213.83 |

| 85224 | $4,204.05 |

| 85044 | $4,197.17 |

| 85233 | $4,196.13 |

| 85709 | $4,182.37 |

| 85236 | $4,177.21 |

| 85363 | $4,176.27 |

| 85205 | $4,155.89 |

| 85048 | $4,155.67 |

| 85085 | $4,155.28 |

| 85140 | $4,154.32 |

| 85225 | $4,147.54 |

| 85331 | $4,145.70 |

| 85705 | $4,143.15 |

| 85379 | $4,138.72 |

| 85378 | $4,134.78 |

| 85258 | $4,126.62 |

| 85208 | $4,125.77 |

| 85143 | $4,122.39 |

| 85340 | $4,118.30 |

| 85284 | $4,117.19 |

| 85234 | $4,110.61 |

| 85087 | $4,110.13 |

| 85287 | $4,109.34 |

| 85721 | $4,107.98 |

| 85701 | $4,104.27 |

| 85706 | $4,101.80 |

| 85206 | $4,100.51 |

| 85746 | $4,099.26 |

| 85326 | $4,095.34 |

| 85296 | $4,094.36 |

| 85713 | $4,093.28 |

| 85249 | $4,092.89 |

| 85190 | $4,092.31 |

| 85295 | $4,091.16 |

| 85634 | $4,088.89 |

| 85297 | $4,088.49 |

| 85209 | $4,088.34 |

| 85264 | $4,086.90 |

| 85388 | $4,086.12 |

| 85266 | $4,082.91 |

| 85329 | $4,082.69 |

| 85086 | $4,077.70 |

| 85255 | $4,077.48 |

| 85716 | $4,072.70 |

| 85212 | $4,071.47 |

| 85215 | $4,071.12 |

| 85749 | $4,070.09 |

| 85286 | $4,068.77 |

| 85715 | $4,064.47 |

| 85735 | $4,059.79 |

| 85756 | $4,059.22 |

| 85226 | $4,057.95 |

| 85619 | $4,051.58 |

| 85396 | $4,046.68 |

| 85750 | $4,040.40 |

| 85268 | $4,038.21 |

| 85374 | $4,034.49 |

| 85719 | $4,029.02 |

| 85298 | $4,026.05 |

| 85712 | $4,024.04 |

| 85711 | $4,023.08 |

| 85714 | $4,018.98 |

| 85343 | $4,007.86 |

| 85207 | $4,006.69 |

| 85377 | $4,001.55 |

| 85322 | $4,001.45 |

| 85639 | $3,998.67 |

| 85718 | $3,998.52 |

| 85745 | $3,998.37 |

| 85354 | $3,997.86 |

| 85127 | $3,995.29 |

| 85117 | $3,987.17 |

| 85338 | $3,985.25 |

| 85710 | $3,982.43 |

| 85730 | $3,968.90 |

| 85263 | $3,967.18 |

| 85119 | $3,965.91 |

| 85704 | $3,960.21 |

| 85652 | $3,948.95 |

| 85337 | $3,939.71 |

| 85145 | $3,939.04 |

| 85748 | $3,938.35 |

| 85757 | $3,934.67 |

| 85128 | $3,923.76 |

| 85262 | $3,922.59 |

| 85351 | $3,922.28 |

| 85708 | $3,920.98 |

| 85118 | $3,919.71 |

| 86545 | $3,914.86 |

| 85120 | $3,913.33 |

| 85141 | $3,913.19 |

| 85743 | $3,910.56 |

| 85736 | $3,905.43 |

| 85741 | $3,900.23 |

| 85138 | $3,896.63 |

| 85747 | $3,890.96 |

| 85178 | $3,882.59 |

| 85248 | $3,874.66 |

| 85373 | $3,874.30 |

| 85173 | $3,873.95 |

| 85139 | $3,868.51 |

| 86042 | $3,867.09 |

| 85172 | $3,861.28 |

| 85737 | $3,858.54 |

| 85352 | $3,858.52 |

| 86514 | $3,856.93 |

| 85395 | $3,853.17 |

| 85654 | $3,852.42 |

| 85121 | $3,851.96 |

| 86054 | $3,847.65 |

| 86507 | $3,847.54 |

| 85361 | $3,840.91 |

| 85742 | $3,837.29 |

| 86520 | $3,837.21 |

| 85147 | $3,834.21 |

| 86540 | $3,833.85 |

| 85387 | $3,815.58 |

| 85191 | $3,814.67 |

| 85342 | $3,811.03 |

| 85193 | $3,810.93 |

| 86538 | $3,803.83 |

| 86544 | $3,796.43 |

| 86535 | $3,796.36 |

| 85341 | $3,785.13 |

| 86030 | $3,783.66 |

| 85320 | $3,783.33 |

| 86547 | $3,783.24 |

| 86503 | $3,782.50 |

| 85135 | $3,778.59 |

| 86556 | $3,776.95 |

| 86043 | $3,776.32 |

| 86034 | $3,766.79 |

| 86510 | $3,763.28 |

| 86028 | $3,760.37 |

| 85658 | $3,751.63 |

| 86033 | $3,750.71 |

| 85641 | $3,744.23 |

| 85132 | $3,742.07 |

| 85653 | $3,739.64 |

| 86039 | $3,737.81 |

| 85130 | $3,731.01 |

| 86045 | $3,728.73 |

| 85194 | $3,728.32 |

| 85123 | $3,726.25 |

| 86506 | $3,722.89 |

| 86011 | $3,721.68 |

| 85122 | $3,719.09 |

| 86044 | $3,718.25 |

| 85633 | $3,704.13 |

| 86512 | $3,700.49 |

| 86053 | $3,699.78 |

| 85631 | $3,694.45 |

| 85755 | $3,688.49 |

| 85131 | $3,679.69 |

| 86029 | $3,678.65 |

| 85375 | $3,677.92 |

| 86511 | $3,668.22 |

| 86502 | $3,665.74 |

| 85623 | $3,663.96 |

| 85321 | $3,663.61 |

| 85324 | $3,658.23 |

| 86504 | $3,654.99 |

| 85601 | $3,652.75 |

| 86515 | $3,646.33 |

| 86020 | $3,632.29 |

| 85739 | $3,619.28 |

| 86508 | $3,615.14 |

| 85371 | $3,608.46 |

| 86342 | $3,602.74 |

| 86505 | $3,601.82 |

| 85618 | $3,601.62 |

| 85192 | $3,599.16 |

| 85545 | $3,594.35 |

| 85629 | $3,576.57 |

| 86333 | $3,575.09 |

| 86035 | $3,572.33 |

| 85542 | $3,556.80 |

| 85554 | $3,552.79 |

| 85357 | $3,550.17 |

| 86017 | $3,549.75 |

| 85333 | $3,545.31 |

| 85541 | $3,542.69 |

| 86052 | $3,541.15 |

| 85137 | $3,539.95 |

| 85648 | $3,517.07 |

| 85539 | $3,514.98 |

| 86016 | $3,505.09 |

| 85637 | $3,502.45 |

| 85553 | $3,501.75 |

| 85550 | $3,499.88 |

| 85941 | $3,498.58 |

| 86329 | $3,497.62 |

| 85640 | $3,496.80 |

| 85551 | $3,491.50 |

| 85621 | $3,485.34 |

| 86031 | $3,483.49 |

| 85336 | $3,480.34 |

| 85332 | $3,478.45 |

| 85356 | $3,471.60 |

| 85364 | $3,471.33 |

| 86038 | $3,468.41 |

| 86336 | $3,461.76 |

| 85942 | $3,459.02 |

| 85646 | $3,458.82 |

| 86032 | $3,454.29 |

| 85347 | $3,447.64 |

| 85501 | $3,442.58 |

| 85645 | $3,438.93 |

| 86024 | $3,437.97 |

| 85350 | $3,437.31 |

| 86343 | $3,435.10 |

| 85923 | $3,434.67 |

| 85911 | $3,428.57 |

| 85926 | $3,427.85 |

| 85929 | $3,427.23 |

| 85544 | $3,419.60 |

| 85390 | $3,417.77 |

| 86435 | $3,414.68 |

| 85939 | $3,411.93 |

| 85937 | $3,409.59 |

| 85936 | $3,403.85 |

| 85930 | $3,398.10 |

| 85933 | $3,395.09 |

| 85931 | $3,391.50 |

| 85349 | $3,388.99 |

| 85611 | $3,388.48 |

| 86322 | $3,383.71 |

| 85365 | $3,379.90 |

| 85925 | $3,378.33 |

| 85924 | $3,376.75 |

| 85901 | $3,375.43 |

| 85348 | $3,375.09 |

| 86331 | $3,370.85 |

| 85928 | $3,365.60 |

| 86025 | $3,365.50 |

| 85934 | $3,363.95 |

| 86335 | $3,359.64 |

| 85932 | $3,355.92 |

| 85362 | $3,355.88 |

| 85935 | $3,345.96 |

| 86036 | $3,344.54 |

| 85624 | $3,336.54 |

| 86040 | $3,334.36 |

| 86047 | $3,326.05 |

| 86351 | $3,325.88 |

| 86303 | $3,325.79 |

| 86023 | $3,321.65 |

| 85620 | $3,314.68 |

| 85367 | $3,312.32 |

| 86001 | $3,311.29 |

| 85622 | $3,311.04 |

| 86338 | $3,305.64 |

| 86305 | $3,297.11 |

| 86015 | $3,295.68 |

| 85938 | $3,294.82 |

| 86327 | $3,292.79 |

| 86004 | $3,281.82 |

| 86412 | $3,281.51 |

| 85927 | $3,280.38 |

| 86046 | $3,277.84 |

| 85606 | $3,276.63 |

| 85530 | $3,274.95 |

| 86332 | $3,274.94 |

| 85626 | $3,274.81 |

| 86005 | $3,270.90 |

| 86320 | $3,270.76 |

| 86018 | $3,269.84 |

| 85328 | $3,268.41 |

| 85940 | $3,262.34 |

| 85334 | $3,259.55 |

| 86325 | $3,250.42 |

| 85630 | $3,248.06 |

| 86326 | $3,245.38 |

| 86021 | $3,237.46 |

| 86301 | $3,237.46 |

| 85325 | $3,235.03 |

| 86337 | $3,230.71 |

| 85346 | $3,229.17 |

| 86324 | $3,226.21 |

| 85603 | $3,224.92 |

| 86321 | $3,215.77 |

| 85344 | $3,215.70 |

| 85614 | $3,207.92 |

| 86323 | $3,203.10 |

| 85602 | $3,189.32 |

| 86314 | $3,189.06 |

| 85920 | $3,184.68 |

| 85922 | $3,172.97 |

| 86334 | $3,163.32 |

| 86315 | $3,162.06 |

| 85531 | $3,159.24 |

| 85535 | $3,150.21 |

| 86434 | $3,148.39 |

| 85627 | $3,144.53 |

| 85613 | $3,140.67 |

| 85546 | $3,139.80 |

| 86432 | $3,127.87 |

| 85609 | $3,127.23 |

| 86022 | $3,123.68 |

| 86440 | $3,116.16 |

| 86433 | $3,113.95 |

| 85360 | $3,111.59 |

| 85605 | $3,107.00 |

| 85536 | $3,104.83 |

| 86441 | $3,104.40 |

| 85617 | $3,097.49 |

| 86445 | $3,093.35 |

| 85543 | $3,092.48 |

| 85638 | $3,090.81 |

| 85632 | $3,073.06 |

| 85650 | $3,069.53 |

| 86426 | $3,066.87 |

| 85625 | $3,064.05 |

| 85643 | $3,059.48 |

| 86413 | $3,059.25 |

| 85615 | $3,057.81 |

| 85616 | $3,055.06 |

| 85552 | $3,053.07 |

| 86411 | $3,049.80 |

| 86443 | $3,049.56 |

| 85534 | $3,049.17 |

| 85635 | $3,048.77 |

| 86437 | $3,039.01 |

| 85540 | $3,031.96 |

| 86442 | $3,031.71 |

| 86406 | $3,027.97 |

| 86429 | $3,025.22 |

| 85533 | $3,017.43 |

| 86444 | $3,013.06 |

| 85610 | $3,009.40 |

| 86401 | $2,996.32 |

| 85607 | $2,984.01 |

| 86438 | $2,982.40 |

| 86431 | $2,977.28 |

| 86436 | $2,951.90 |

| 86409 | $2,949.61 |

| 86404 | $2,896.40 |

| 86403 | $2,883.46 |

What is the cheapest city for car insurance in Arizona, you might be questioning?

Cheapest Rates By City

Your zip code isn’t the only geographic factor that car insurance companies use to determine your rates.

The table below reveals how the city that you call home could also be causing you to pay higher, or lower, prices for car insurance in Arizona.

| City | Zipcode | Average |

|---|---|---|

| PHOENIX | 85003 | $4,990.72 |

| PHOENIX | 85004 | $5,011.05 |

| PHOENIX | 85006 | $5,079.52 |

| PHOENIX | 85007 | $5,005.43 |

| PHOENIX | 85008 | $4,811.38 |

| PHOENIX | 85009 | $5,479.07 |

| PHOENIX | 85012 | $5,006.68 |

| PHOENIX | 85013 | $5,037.15 |

| PHOENIX | 85014 | $4,828.12 |

| PHOENIX | 85015 | $5,175.99 |

| PHOENIX | 85016 | $4,724.98 |

| PHOENIX | 85017 | $5,440.43 |

| PHOENIX | 85018 | $4,633.03 |

| PHOENIX | 85019 | $5,367.13 |

| PHOENIX | 85020 | $4,842.66 |

| PHOENIX | 85021 | $5,092.07 |

| PHOENIX | 85022 | $4,570.10 |

| PHOENIX | 85023 | $4,773.40 |

| PHOENIX | 85024 | $4,514.91 |

| GLENDALE | 85025 | $4,976.47 |

| GLENDALE | 85026 | $4,761.38 |

| PHOENIX | 85027 | $4,430.41 |

| PHOENIX | 85028 | $4,493.67 |

| PHOENIX | 85029 | $4,978.32 |

| PHOENIX | 85031 | $5,339.76 |

| PHOENIX | 85032 | $4,577.50 |

| GLENDALE | 85033 | $5,221.61 |

| GLENDALE | 85034 | $5,069.47 |

| PHOENIX | 85035 | $5,223.71 |

| PHOENIX | 85037 | $4,789.84 |

| PHOENIX | 85039 | $4,545.78 |

| PHOENIX | 85040 | $5,115.68 |

| PHOENIX | 85041 | $5,101.83 |

| PHOENIX | 85042 | $4,882.91 |

| PHOENIX | 85043 | $5,027.59 |

| PHOENIX | 85044 | $4,197.17 |

| GLENDALE | 85045 | $4,222.94 |

| TOLLESON | 85048 | $4,155.67 |

| PHOENIX | 85050 | $4,372.54 |

| LAVEEN | 85051 | $5,127.30 |

| PHOENIX | 85053 | $4,710.51 |

| PHOENIX | 85054 | $4,428.40 |

| PHOENIX | 85065 | $4,687.34 |

| GLENDALE | 85073 | $4,784.43 |

| PHOENIX | 85083 | $4,319.39 |

| PHOENIX | 85085 | $4,155.28 |

| PHOENIX | 85086 | $4,077.70 |

| GLENDALE | 85087 | $4,110.13 |

| MESA | 85097 | $4,465.79 |

| PHOENIX | 85117 | $3,987.17 |

| PHOENIX | 85118 | $3,919.71 |

| PEORIA | 85119 | $3,965.91 |

| PEORIA | 85120 | $3,913.33 |

| SCOTTSDALE | 85121 | $3,851.96 |

| SCOTTSDALE | 85122 | $3,719.09 |

| PHOENIX | 85123 | $3,726.25 |

| EL MIRAGE | 85127 | $3,995.29 |

| GLENDALE | 85128 | $3,923.76 |

| TEMPE | 85130 | $3,731.01 |

| SCOTTSDALE | 85131 | $3,679.69 |

| AVONDALE | 85132 | $3,742.07 |

| PARADISE VALLEY | 85135 | $3,778.59 |

| TEMPE | 85137 | $3,539.95 |

| MESA | 85138 | $3,896.63 |

| PHOENIX | 85139 | $3,868.51 |

| SCOTTSDALE | 85140 | $4,154.32 |

| PEORIA | 85141 | $3,913.19 |

| MESA | 85142 | $4,280.17 |

| AVONDALE | 85143 | $4,122.39 |

| GLENDALE LUKE AFB | 85145 | $3,939.04 |

| MESA | 85147 | $3,834.21 |

| SCOTTSDALE | 85172 | $3,861.28 |

| QUEEN CREEK | 85173 | $3,873.95 |

| TEMPE | 85178 | $3,882.59 |

| MESA | 85190 | $4,092.31 |

| SCOTTSDALE | 85191 | $3,814.67 |

| MESA | 85192 | $3,599.16 |

| WADDELL | 85193 | $3,810.93 |

| GLENDALE | 85194 | $3,728.32 |

| PHOENIX | 85201 | $4,304.78 |

| SCOTTSDALE | 85202 | $4,247.66 |

| PEORIA | 85203 | $4,259.86 |

| CHANDLER | 85204 | $4,436.03 |

| PHOENIX | 85205 | $4,155.89 |

| GILBERT | 85206 | $4,100.51 |

| TUCSON | 85207 | $4,006.69 |

| HIGLEY | 85208 | $4,125.77 |

| YOUNGTOWN | 85209 | $4,088.34 |

| MESA | 85210 | $4,287.22 |

| PHOENIX | 85212 | $4,071.47 |

| PHOENIX | 85213 | $4,321.40 |

| SAN TAN VALLEY | 85215 | $4,071.12 |

| CHANDLER | 85224 | $4,204.05 |

| CAVE CREEK | 85225 | $4,147.54 |

| TUCSON | 85226 | $4,057.95 |

| SURPRISE | 85233 | $4,196.13 |

| SURPRISE | 85234 | $4,110.61 |

| SCOTTSDALE | 85236 | $4,177.21 |

| MESA | 85248 | $3,874.66 |

| SAN TAN VALLEY | 85249 | $4,092.89 |

| LITCHFIELD PARK | 85250 | $4,284.61 |

| TEMPE | 85251 | $4,312.62 |

| GILBERT | 85253 | $4,326.68 |

| NEW RIVER | 85254 | $4,397.37 |

| TEMPE | 85255 | $4,077.48 |

| TUCSON | 85256 | $4,390.03 |

| TUCSON | 85257 | $4,215.78 |

| TUCSON | 85258 | $4,126.62 |

| MESA | 85259 | $4,341.31 |

| TUCSON | 85260 | $4,250.29 |

| BUCKEYE | 85262 | $3,922.59 |

| GILBERT | 85263 | $3,967.18 |

| TUCSON | 85264 | $4,086.90 |

| CHANDLER | 85266 | $4,082.91 |

| TORTILLA FLAT | 85268 | $4,038.21 |

| GILBERT | 85281 | $4,264.20 |

| SELLS | 85282 | $4,322.90 |

| GILBERT | 85283 | $4,348.51 |

| MESA | 85284 | $4,117.19 |

| FORT MCDOWELL | 85286 | $4,068.77 |

| SURPRISE | 85287 | $4,109.34 |

| SCOTTSDALE | 85295 | $4,091.16 |

| CASHION | 85296 | $4,094.36 |

| PHOENIX | 85297 | $4,088.49 |

| SCOTTSDALE | 85298 | $4,026.05 |

| TUCSON | 85301 | $4,990.47 |

| MESA | 85302 | $4,815.47 |

| MESA | 85303 | $4,986.06 |

| TUCSON | 85304 | $4,822.54 |

| CHANDLER | 85305 | $4,542.50 |

| TUCSON | 85306 | $4,665.88 |

| TUCSON | 85307 | $4,438.79 |

| TUCSON | 85308 | $4,358.47 |

| CHANDLER | 85309 | $4,294.56 |

| MOUNT LEMMON | 85310 | $4,227.35 |

| BUCKEYE | 85320 | $3,783.33 |

| TUCSON | 85321 | $3,663.61 |

| FOUNTAIN HILLS | 85322 | $4,001.45 |

| SURPRISE | 85323 | $4,298.64 |

| TUCSON | 85324 | $3,658.23 |

| GILBERT | 85325 | $3,235.03 |

| TUCSON | 85326 | $4,095.34 |

| TUCSON | 85328 | $3,268.41 |

| TUCSON | 85329 | $4,082.69 |

| PALO VERDE | 85331 | $4,145.70 |

| MESA | 85332 | $3,478.45 |

| CAREFREE | 85333 | $3,545.31 |

| ARLINGTON | 85334 | $3,259.55 |

| TOPAWA | 85335 | $4,371.02 |

| TUCSON | 85336 | $3,480.34 |

| TUCSON | 85337 | $3,939.71 |

| TONOPAH | 85338 | $3,985.25 |

| CHANDLER HEIGHTS | 85339 | $4,582.09 |

| APACHE JUNCTION | 85340 | $4,118.30 |

| GOODYEAR | 85341 | $3,785.13 |

| TUCSON | 85342 | $3,811.03 |

| TUCSON | 85343 | $4,007.86 |

| RIO VERDE | 85344 | $3,215.70 |

| APACHE JUNCTION | 85345 | $4,412.01 |

| TUCSON | 85346 | $3,229.17 |

| CORTARO | 85347 | $3,447.64 |

| GILA BEND | 85348 | $3,375.09 |

| RED ROCK | 85349 | $3,388.99 |

| TUCSON | 85350 | $3,437.31 |

| TUCSON | 85351 | $3,922.28 |

| COOLIDGE | 85352 | $3,858.52 |

| SCOTTSDALE | 85353 | $4,640.27 |

| SUN CITY | 85354 | $3,997.86 |

| TUCSON | 85355 | $4,243.07 |

| GOLD CANYON | 85356 | $3,471.60 |

| ROCK POINT | 85357 | $3,550.17 |

| APACHE JUNCTION | 85360 | $3,111.59 |

| PICACHO | 85361 | $3,840.91 |

| TUCSON | 85362 | $3,355.88 |

| TUCSON | 85363 | $4,176.27 |

| TUCSON | 85364 | $3,471.33 |

| MARICOPA | 85365 | $3,379.90 |

| TUCSON | 85367 | $3,312.32 |

| APACHE JUNCTION | 85371 | $3,608.46 |

| CHANDLER | 85373 | $3,874.30 |

| SUN CITY | 85374 | $4,034.49 |

| SUPERIOR | 85375 | $3,677.92 |

| MARICOPA | 85377 | $4,001.55 |

| POLACCA | 85378 | $4,134.78 |

| STANFIELD | 85379 | $4,138.72 |

| TUCSON | 85381 | $4,401.49 |

| TACNA | 85382 | $4,213.83 |

| TEEC NOS POS | 85383 | $4,308.86 |

| GOODYEAR | 85387 | $3,815.58 |

| RILLITO | 85388 | $4,086.12 |

| BAPCHULE | 85390 | $3,417.77 |

| SHONTO | 85392 | $4,327.13 |

| LUKACHUKAI | 85395 | $3,853.17 |

| WITTMANN | 85396 | $4,046.68 |

| TUCSON | 85501 | $3,442.58 |

| BLUE GAP | 85530 | $3,274.95 |

| SACATON | 85531 | $3,159.24 |

| NAZLINI | 85533 | $3,017.43 |

| SURPRISE | 85534 | $3,049.17 |

| VALLEY FARMS | 85535 | $3,150.21 |

| MORRISTOWN | 85536 | $3,104.83 |

| CASA GRANDE | 85539 | $3,514.98 |

| MANY FARMS | 85540 | $3,031.96 |

| RED VALLEY | 85541 | $3,542.69 |

| DENNEHOTSO | 85542 | $3,556.80 |

| LUKEVILLE | 85543 | $3,092.48 |

| HOTEVILLA | 85544 | $3,419.60 |

| AGUILA | 85545 | $3,594.35 |

| ROUND ROCK | 85546 | $3,139.80 |

| CHINLE | 85550 | $3,499.88 |

| HAYDEN | 85551 | $3,491.50 |

| TSAILE | 85552 | $3,053.07 |

| SECOND MESA | 85553 | $3,501.75 |

| KEAMS CANYON | 85554 | $3,552.79 |

| PINON | 85601 | $3,652.75 |

| PETRIFIED FOREST NATL PK | 85602 | $3,189.32 |

| MARANA | 85603 | $3,224.92 |

| KAYENTA | 85605 | $3,107.00 |

| VAIL | 85606 | $3,276.63 |

| FLORENCE | 85607 | $2,984.01 |

| MARANA | 85609 | $3,127.23 |

| KYKOTSMOVI VILLAGE | 85610 | $3,009.40 |

| CASA GRANDE | 85611 | $3,388.48 |

| TUBA CITY | 85613 | $3,140.67 |

| CASA GRANDE | 85614 | $3,207.92 |

| ARIZONA CITY | 85615 | $3,057.81 |

| HOUCK | 85616 | $3,055.06 |

| FLAGSTAFF | 85617 | $3,097.49 |

| CASA GRANDE | 85618 | $3,601.62 |

| TONALEA | 85619 | $4,051.58 |

| SASABE | 85620 | $3,314.68 |

| SANDERS | 85621 | $3,485.34 |

| KAIBETO | 85622 | $3,311.04 |

| SAN MANUEL | 85623 | $3,663.96 |

| TUCSON | 85624 | $3,336.54 |

| ELOY | 85625 | $3,064.05 |

| SUN VALLEY | 85626 | $3,274.81 |

| SUN CITY WEST | 85627 | $3,144.53 |

| SAINT MICHAELS | 85629 | $3,576.57 |

| CHAMBERS | 85630 | $3,248.06 |

| ORACLE | 85631 | $3,694.45 |

| AJO | 85632 | $3,073.06 |

| BLACK CANYON CITY | 85633 | $3,704.13 |

| FORT DEFIANCE | 85634 | $4,088.89 |

| ARIVACA | 85635 | $3,048.77 |

| WINDOW ROCK | 85637 | $3,502.45 |

| CAMERON | 85638 | $3,090.81 |

| TUCSON | 85639 | $3,998.67 |

| LUPTON | 85640 | $3,496.80 |

| POSTON | 85641 | $3,744.23 |

| LAKE MONTEZUMA | 85643 | $3,059.48 |

| GANADO | 85645 | $3,438.93 |

| MAMMOTH | 85646 | $3,458.82 |

| WINKELMAN | 85648 | $3,517.07 |

| ROOSEVELT | 85650 | $3,069.53 |

| SAHUARITA | 85652 | $3,948.95 |

| MAYER | 85653 | $3,739.64 |

| LEUPP | 85654 | $3,852.42 |

| PERIDOT | 85658 | $3,751.63 |

| YOUNG | 85701 | $4,104.27 |

| WENDEN | 85704 | $3,960.21 |

| MUNDS PARK | 85705 | $4,143.15 |

| DATELAND | 85706 | $4,101.80 |

| PAYSON | 85708 | $3,920.98 |

| NORTH RIM | 85709 | $4,182.37 |

| KEARNY | 85710 | $3,982.43 |

| RIO RICO | 85711 | $4,023.08 |

| MIAMI | 85712 | $4,024.04 |

| GRAY MOUNTAIN | 85713 | $4,093.28 |

| SONOITA | 85714 | $4,018.98 |

| TONTO BASIN | 85715 | $4,064.47 |

| SAN CARLOS | 85716 | $4,072.70 |

| WHITERIVER | 85718 | $3,998.52 |

| HUMBOLDT | 85719 | $4,029.02 |

| TUMACACORI | 85721 | $4,107.98 |

| SOLOMON | 85730 | $3,968.90 |

| NOGALES | 85735 | $4,059.79 |

| INDIAN WELLS | 85736 | $3,905.43 |

| GADSDEN | 85737 | $3,858.54 |

| CONGRESS | 85739 | $3,619.28 |

| WELLTON | 85741 | $3,900.23 |

| YUMA | 85742 | $3,837.29 |

| MORMON LAKE | 85743 | $3,910.56 |

| SEDONA | 85745 | $3,998.37 |

| WOODRUFF | 85746 | $4,099.26 |

| TUBAC | 85747 | $3,890.96 |

| JOSEPH CITY | 85748 | $3,938.35 |

| ROLL | 85749 | $4,070.09 |

| GLOBE | 85750 | $4,040.40 |

| AMADO | 85755 | $3,688.49 |

| HAPPY JACK | 85756 | $4,059.22 |

| SOMERTON | 85757 | $3,934.67 |

| CROWN KING | 85901 | $3,375.43 |

| CLAY SPRINGS | 85911 | $3,428.57 |

| CIBECUE | 85920 | $3,184.68 |

| FORT APACHE | 85922 | $3,172.97 |

| LAKESIDE | 85923 | $3,434.67 |

| PINE | 85924 | $3,376.75 |

| WICKENBURG | 85925 | $3,378.33 |

| SUPAI | 85926 | $3,427.85 |

| TAYLOR | 85927 | $3,280.38 |

| SNOWFLAKE | 85928 | $3,365.60 |

| SAINT JOHNS | 85929 | $3,427.23 |

| MCNARY | 85930 | $3,398.10 |

| OVERGAARD | 85931 | $3,391.50 |

| FOREST LAKES | 85932 | $3,355.92 |

| SAN LUIS | 85933 | $3,395.09 |

| ELGIN | 85934 | $3,363.95 |

| CAMP VERDE | 85935 | $3,345.96 |

| YUMA | 85936 | $3,403.85 |

| EAGAR | 85937 | $3,409.59 |

| CONCHO | 85938 | $3,294.82 |

| SHOW LOW | 85939 | $3,411.93 |

| SALOME | 85940 | $3,262.34 |

| JEROME | 85941 | $3,498.58 |

| HEBER | 85942 | $3,459.02 |

| HOLBROOK | 86001 | $3,311.29 |

| PINEDALE | 86004 | $3,281.82 |

| RIMROCK | 86005 | $3,270.90 |

| NUTRIOSO | 86011 | $3,721.68 |

| YARNELL | 86015 | $3,295.68 |

| PINETOP | 86016 | $3,505.09 |

| MARBLE CANYON | 86017 | $3,549.75 |

| PATAGONIA | 86018 | $3,269.84 |

| PAGE | 86020 | $3,632.29 |

| WINSLOW | 86021 | $3,237.46 |

| SEDONA | 86022 | $3,123.68 |

| PRESCOTT | 86023 | $3,321.65 |

| GRAND CANYON | 86024 | $3,437.97 |

| NACO | 86025 | $3,365.50 |

| YUMA | 86028 | $3,760.37 |

| FLAGSTAFF | 86029 | $3,678.65 |

| GREEN VALLEY | 86030 | $3,783.66 |

| SKULL VALLEY | 86031 | $3,483.49 |

| PRESCOTT | 86032 | $3,454.29 |

| BELLEMONT | 86033 | $3,750.71 |

| SPRINGERVILLE | 86034 | $3,766.79 |

| DEWEY | 86035 | $3,572.33 |

| FLAGSTAFF | 86036 | $3,344.54 |

| HUALAPAI | 86038 | $3,468.41 |

| GREER | 86039 | $3,737.81 |

| WILLIAMS | 86040 | $3,334.36 |

| COCHISE | 86042 | $3,867.09 |

| BYLAS | 86043 | $3,776.32 |

| KIRKLAND | 86044 | $3,718.25 |

| PIRTLEVILLE | 86045 | $3,728.73 |

| #N/A | 86046 | $3,277.84 |

| ASH FORK | 86047 | $3,326.05 |

| PARKS | 86052 | $3,541.15 |

| CIBOLA | 86053 | $3,699.78 |

| VERNON | 86054 | $3,847.65 |

| EHRENBERG | 86301 | $3,237.46 |

| CORNVILLE | 86303 | $3,325.79 |

| SAINT DAVID | 86305 | $3,297.11 |

| COTTONWOOD | 86314 | $3,189.06 |

| COLORADO CITY | 86315 | $3,162.06 |

| PRESCOTT | 86320 | $3,270.76 |

| BOUSE | 86321 | $3,215.77 |

| SELIGMAN | 86322 | $3,383.71 |

| QUARTZSITE | 86323 | $3,203.10 |

| CLARKDALE | 86324 | $3,226.21 |

| BISBEE | 86325 | $3,250.42 |

| BAGDAD | 86326 | $3,245.38 |

| PARKER | 86327 | $3,292.79 |

| GREEN VALLEY | 86329 | $3,497.62 |

| CHINO VALLEY | 86331 | $3,370.85 |

| BENSON | 86332 | $3,274.94 |

| PRESCOTT VALLEY | 86333 | $3,575.09 |

| ALPINE | 86334 | $3,163.32 |

| BLUE | 86335 | $3,359.64 |

| PAULDEN | 86336 | $3,461.76 |

| PRESCOTT VALLEY | 86337 | $3,230.71 |

| CENTRAL | 86338 | $3,305.64 |

| EDEN | 86342 | $3,602.74 |

| PEACH SPRINGS | 86343 | $3,435.10 |

| POMERENE | 86351 | $3,325.88 |

| FORT HUACHUCA | 86401 | $2,996.32 |

| SAFFORD | 86403 | $2,883.46 |

| LITTLEFIELD | 86404 | $2,896.40 |

| DRAGOON | 86406 | $3,027.97 |

| FREDONIA | 86409 | $2,949.61 |

| MOHAVE VALLEY | 86411 | $3,049.80 |

| OATMAN | 86412 | $3,281.51 |

| WIKIEUP | 86413 | $3,059.25 |

| BOWIE | 86426 | $3,066.87 |

| FORT THOMAS | 86429 | $3,025.22 |

| DOLAN SPRINGS | 86431 | $2,977.28 |

| MC NEAL | 86432 | $3,127.87 |

| WILLOW BEACH | 86433 | $3,113.95 |

| PIMA | 86434 | $3,148.39 |

| TOMBSTONE | 86435 | $3,414.68 |

| SAN SIMON | 86436 | $2,951.90 |

| SIERRA VISTA | 86437 | $3,039.01 |

| FORT MOHAVE | 86438 | $2,982.40 |

| PEARCE | 86440 | $3,116.16 |

| WILLCOX | 86441 | $3,104.40 |

| GOLDEN VALLEY | 86442 | $3,031.71 |

| HEREFORD | 86443 | $3,049.56 |

| HUACHUCA CITY | 86444 | $3,013.06 |

| THATCHER | 86445 | $3,093.35 |

| HACKBERRY | 86502 | $3,665.74 |

| TEMPLE BAR MARINA | 86503 | $3,782.50 |

| DUNCAN | 86504 | $3,654.99 |

| SIERRA VISTA | 86505 | $3,601.82 |

| VALENTINE | 86506 | $3,722.89 |

| MORENCI | 86507 | $3,847.54 |

| BULLHEAD CITY | 86508 | $3,615.14 |

| LAKE HAVASU CITY | 86510 | $3,763.28 |

| BULLHEAD CITY | 86511 | $3,668.22 |

| CLIFTON | 86512 | $3,700.49 |

| MEADVIEW | 86514 | $3,856.93 |

| ELFRIDA | 86515 | $3,646.33 |

| KINGMAN | 86520 | $3,837.21 |

| DOUGLAS | 86535 | $3,796.36 |

| YUCCA | 86538 | $3,803.83 |

| CHLORIDE | 86540 | $3,833.85 |

| TOPOCK | 86544 | $3,796.43 |

| KINGMAN | 86545 | $3,914.86 |

| LAKE HAVASU CITY | 86547 | $3,783.24 |

| LAKE HAVASU CITY | 86556 | $3,776.95 |

But who do Arizonans say is the best car insurance company In The Copper State?

How Much Car Insurance Rates in Arizona

Delve into the variations in car insurance costs across different cities in Arizona. Select your city from the available choices to understand the nuances of insurance expenses in your area.

| Find Affordable Car Insurance Rates in Arizona | ||

|---|---|---|

| Buckeye, AZ | Kingman, AZ | Scottsdale, AZ |

| Chandler, AZ | Mesa, AZ | Surprise, AZ |

| Gilbert, AZ | Oro Valley, AZ | Tempe, AZ |

| Glendale, AZ | Peoria, AZ | Tonopah, AZ |

| Goodyear, AZ | Phoenix, AZ | Tucson, AZ |

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Arizona Car Insurance Companies

How do you find the best car insurance company for meeting you and your family’s needs?

That depends in large part on what you want and need from your insurer, and what kind of company you want to do business with.

When shopping for car insurance, the key issues you need to prioritize include:

- The level of insurance coverage you need,

- The amount of money you can afford to pay for your car insurance premium, and

- The type of insurance company you want to do business with.

In the sections below, we’ll cover some of the factors that can help you figure out the best Arizona car insurance company for you and your family.

The Largest Companies Financial Ratings

It might not be obvious until you stop and think about it, but a good insurance company has the ability to financially cover its customers.

That’s why considering financial ratings is important.

AM Best ranks America’s insurance companies by financial solvency. What does it mean for a company to receive a high grade? This video explains their methodology and meaning well.

The table below provides AM Best’s financial ratings for Arizona’s ten biggest car insurance providers.

| Company | Rating |

|---|---|

| State Farm | A++ |

| Berkshire Hathaway | A++ |

| Progressive | A+ |

| Farmers | A |

| Allstate | A+ |

| USAA | A++ |

| Liberty Mutual | A |

| American Family | A |

| Hartford | A+ |

| CSAA | A |

But AM Best is not the only financial advising company that is keeping its eye on the car insurance market. Read on to see how JD Power ranks Arizona insurers.

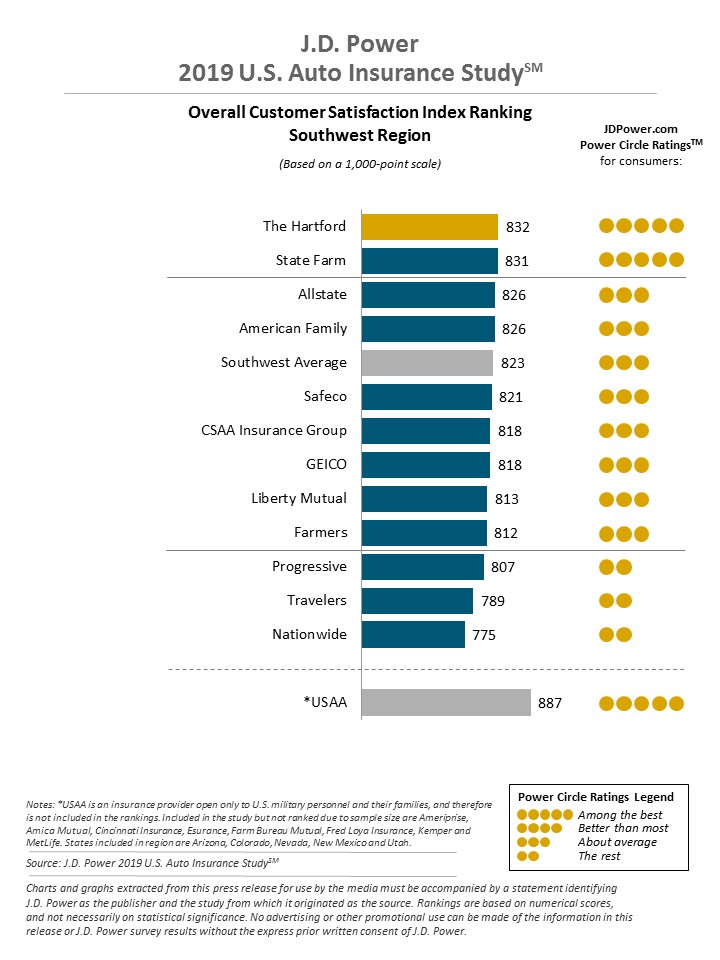

Companies With Best Ratings

JD Power is also looking out for you, and what it has discovered is that customer satisfaction with the overall car insurance market is at an all-time high.

In 2018, they found State Farm to be the best-rated car insurance provider in Arizona. Here are their ratings for Arizona — part of the Southwest Region — for 2018.

Let’s check out Arizona’s record of official complaints about the state’s biggest car insurance providers.

Companies With Most Complaints in Arizona

Knowing how many complaints a company receives is can be an indicator of its quality. But it shouldn’t be your sole decision-maker, of course.

Keep in mind that every company is going to get some complaints, and a bigger company will have more customers and will get more complaints.

What really matters is the complaint ratio.

The ratio is the number of complaints divided by the number of justified claims and then multiplied by 100. The higher the number, the higher the rate of complaints. In Arizona, Access Insurance has the highest complaint ratio.

But what are the overall cheapest car insurance companies in The Grand Canyon State?

Cheapest Companies in Arizona

You might be wondering: is the cheapest car insurance company the best car insurance company? Not always, but that doesn’t mean a cheaper provider is a bad provider either.

In Arizona, Geico is likely to be your cheapest auto insurance provider.

The table below shows the average premiums for Arizona’s biggest car insurance providers.

| Company | Average |

|---|---|

| Allstate | $4,899.96 |

| American Family | $4,150.43 |

| Farmers | $4,995.73 |

| Geico | $2,262.79 |

| NICOA | $3,493.23 |

| Progressive | $3,574.85 |

| State Farm | $4,750.62 |

| Travelers | $3,079.96 |

| USAA | $3,082.66 |

Commute Rate By Company

As you might already know, how much you drive affects how much you pay for car insurance.

And whether you drive a little or a lot, Geico is likely your cheapest insurance provider in Arizona.

The following table illustrates Arizona’s biggest car insurance providers and their corresponding average rates for both a 10- and 25-mile average commute distance.

| COMPANY | AVERAGE COMMUTE (IN MILES) | AVERAGE PREMIUM |

|---|---|---|

| Allstate | 10 | $4,899.96 |

| Allstate | 25 | $4,899.96 |

| American Family | 10 | $4,110.32 |

| American Family | 25 | $4,190.54 |

| Farmers | 10 | $4,995.73 |

| Farmers | 25 | $4,995.73 |

| Geico | 10 | $2,224.53 |

| Geico | 25 | $2,301.06 |

| Nationwide | 10 | $3,493.23 |

| Nationwide | 25 | $3,493.23 |

| Progressive | 10 | $3,574.85 |

| Progressive | 25 | $3,574.85 |

| State Farm | 10 | $4,631.04 |

| State Farm | 25 | $4,870.20 |

| Travelers | 10 | $3,079.97 |

| Travelers | 25 | $3,079.97 |

| USAA | 10 | $3,049.29 |

| USAA | 25 | $3,116.03 |

The amount of coverage that you choose to purchase will also help in determining how much your car insurance policy will cost you.

Coverage Level Rate By Company

Not surprisingly, the more car insurance you need, the higher your premium will almost always be.

Thus, the more extensive the coverage, the more expensive car insurance usually becomes. The less coverage, the cheaper your insurance will likely be.

Below is a table that illustrates the different types of insurance coverage levels and their average yearly rates for Arizona’s biggest insurance providers.

| COMPANY | COVERAGE TYPE | ANNUAL AVERAGE |

|---|---|---|

| American Family | High | $4,173.07 |

| American Family | Medium | $4,282.99 |

| American Family | Low | $3,995.23 |

| Geico | High | $2,757.50 |

| Geico | Medium | $2,295.09 |

| Geico | Low | $1,907.11 |

| Nationwide | High | $3,603.30 |

| Nationwide | Medium | $3,529.03 |

| Nationwide | Low | $3,347.36 |

| Progressive | High | $3,929.72 |

| Progressive | Medium | $3,639.87 |

| Progressive | Low | $3,154.96 |

| Travelers | High | $3,354.49 |

| Travelers | Medium | $3,127.90 |

| Travelers | Low | $2,757.50 |

| USAA | High | $3,282.03 |

| USAA | Medium | $3,125.01 |

| USAA | Low | $2,840.93 |

But did you also know: your credit history also affects your car insurance premiums?

Credit History Rates By Company

U.S. Representative Rashida Tlaib has introduced a bill that would ban credit history discrimination in car insurance premiums from coast to coast.

You might be surprised to learn that your credit history can affect your car insurance premiums.

But stop and think about it: our credit history affects so many parts of our lives, from buying a home to even, in some cases, getting a job.

This short video offers a great explanation as to how and why credit scores affect car insurance premiums.

Credit history is a big factor for insurance companies when they are calculating your insurance premium.

On average, Arizonans have a slightly-below-average credit score. With an average Experian score of 669, Arizonans’ credit is just below the national average of 675.

And what if you have poor credit? Who are the best car insurers in Arizona for you? Likely Geico or, if you qualify, USAA will your most affordable options.

The table below shows average rates for those with a good, fair, or poor credit rating for Arizona’s top car insurance providers.

| COMPANY | CREDIT HISTORY | ANNUAL AVERAGE |

|---|---|---|

| Allstate | Poor | $6,268.01 |

| Allstate | Fair | $4,462.15 |

| Allstate | Good | $3,969.73 |

| American Family | Poor | $5,217.99 |

| American Family | Fair | $3,885.37 |

| American Family | Good | $3,347.92 |

| Farmers | Poor | $5,691.27 |

| Farmers | Fair | $4,764.49 |

| Farmers | Good | $4,531.43 |

| Geico | Poor | $3,108.67 |

| Geico | Fair | $2,039.68 |

| Geico | Good | $1,640.02 |

| Nationwide | Poor | $4,203.65 |

| Nationwide | Fair | $3,345.92 |

| Nationwide | Good | $2,930.12 |

| Progressive | Poor | $3,988.93 |

| Progressive | Fair | $3,482.51 |

| Progressive | Good | $3,253.11 |

| State Farm | Poor | $8,740.46 |

| State Farm | Fair | $3,387.26 |

| State Farm | Good | $2,124.14 |

| Travelers | Poor | $3,750.98 |

| Travelers | Fair | $3,058.12 |

| Travelers | Good | $2,430.80 |

| USAA | Poor | $4,057.11 |

| USAA | Fair | $2,833.38 |

| USAA | Good | $2,357.49 |

What affects your car insurance premium perhaps more than anything else? Your driving record, and that’s something that can worry a lot of folks.

Driving Record Rates By Company

Do you have a spotless driving record? Most of us don’t. You might have a speeding ticket, an accident, or even a DUI in your past.

But you should know: not all violations affect your car insurance premium in the same way.

Our research shows that whether you have a DUI, an accident, or a speeding ticket in your past, Geico is still likely to be your cheapest car insurance provider in Arizona.

The following table shows different insurance companies and their annual averages for people with varying driving records in the great state of Arizona.

| COMPANY | DRIVING RECORD | ANNUAL AVERAGE |

|---|---|---|

| Allstate | Clean record | $3,924.91 |

| Allstate | With 1 accident | $4,964.56 |

| Allstate | With 1 DUI | $5,631.44 |

| Allstate | With 1 speeding violation | $5,078.95 |

| American Family | Clean record | $2,939.21 |

| American Family | With 1 accident | $4,574.11 |

| American Family | With 1 DUI | $5,673.56 |

| American Family | With 1 speeding violation | $3,414.84 |

| Farmers | Clean record | $4,219.77 |

| Farmers | With 1 accident | $5,444.19 |

| Farmers | With 1 DUI | $5,312.44 |

| Farmers | With 1 speeding violation | $5,006.52 |

| Geico | Clean record | $1,755.11 |

| Geico | With 1 accident | $2,370.73 |

| Geico | With 1 DUI | $3,170.22 |

| Geico | With 1 speeding violation | $1,755.11 |

| Nationwide | Clean record | $2,955.75 |

| Nationwide | With 1 accident | $3,107.91 |

| Nationwide | With 1 DUI | $4,602.36 |

| Nationwide | With 1 speeding violation | $3,306.90 |

| Progressive | Clean record | $3,153.69 |

| Progressive | With 1 accident | $4,152.77 |

| Progressive | With 1 DUI | $3,328.96 |

| Progressive | With 1 speeding violation | $3,663.97 |

| State Farm | Clean record | $4,321.08 |

| State Farm | With 1 accident | $5,180.16 |

| State Farm | With 1 DUI | $4,750.62 |

| State Farm | With 1 speeding violation | $4,750.62 |

| Travelers | Clean record | $2,464.33 |

| Travelers | With 1 accident | $3,210.80 |

| Travelers | With 1 DUI | $3,572.38 |

| Travelers | With 1 speeding violation | $3,072.34 |

| USAA | Clean record | $2,242.13 |

| USAA | With 1 accident | $3,212.15 |

| USAA | With 1 DUI | $4,237.25 |

| USAA | With 1 speeding violation | $2,639.09 |

You might be wondering: who are the biggest car insurance companies in Arizona anyway?

Largest Car Insurance Companies in Arizona

Knowing who the largest car insurance companies in your area are can help you find the best deal and, in many cases, most reliable service.

The table below provides Arizona’s largest insurance companies by market share.

| COMPANY | MARKET SHARE |

|---|---|

| State Farm | 16.87% |

| Geico | 14.91% |

| Progressive | 10.58% |

| Farmers | 8.10% |

| Allstate | 7.61% |

| USAA | 7.47% |

| Liberty Mutual | 5.76% |

| American Family | 5.70% |

| Hartford | 2.25% |

| CSAA | 2.06% |

Number of Foreign vs. Domestic Insurers in Arizona

When you hear the phrase “foreign or domestic car insurance company,” what do you think that means?

When it comes to auto insurers, domestic simply means an in-state provider, and foreign, an out-of-state provider.

According to the NAIC, Arizona has 40 domestic car insurance companies and 943 foreign car insurance providers.

Arizona Laws

So you want to drive in Arizona?

Who can blame you! The Grand Canyon State is one of the most gorgeous places in the United States, with some of the most scenic roadways anywhere.

Just follow these two fun guys as they drive in one of Arizona’s most underrated spots.

But as you probably know, state laws can be odd, and often vary from state to state.

In order to keep your car insurance rates low, you need to know the laws in your state so you don’t get a hefty fine. But don’t worry! We’re here to help.

Keep reading to learn about the laws specific to the state of Arizona.

Car Insurance Laws

As we’ve seen above, Arizona requires liability insurance with the following minimums:

- Bodily injury liability coverage: Minimum $15,000 per person / $30,000 per accident

- Property damage liability coverage: Minimum $10,000

- Uninsured motorist bodily injury coverage: Minimum $15,000 per person / $30,000 per accident

- Underinsured motorist bodily injury coverage: Minimum $15,000 per person / $30,000 per accident

Also remember, these are minimums. What is best for you and your family might be coverage above liability, like the add-ons we explored earlier.

How State Laws For Insurance Are Determined

Do you know about the National Association of Insurance Commissioners (NAIC)?

Well, unless you’re an insurance nerd like us, you probably haven’t heard of them before. But that’s okay.

The NAIC is the U.S. standard-setting and regulatory support organization for the insurance industry, including car insurance. They were created and are governed by the chief insurance regulators from all 50 states, the District of Columbia and five U.S. territories.

And in case you’re curious how insurance laws actually get made, they offer this great white paper to help you understand.

Windshield Coverage

You might be wondering: is it required for insurers in Arizona to pay for windshield repairs? Only if you purchase optional “full glass” or “safety equipment coverage.”

While some states have strict laws regarding insurance benefits for full glass replacement services, Arizona has no specific laws to this end.

In Arizona, insurance companies have the option of offering to repair your windshield with aftermarket and used parts — as long as you agree. If you decline, you then agree to pay the difference in the cost of repairs to your windshield.

But note: windshield and glass coverage may be an easy add-on to your car insurance. Make sure to check with your provider. After all, glass claims are the top insurance claims filed across the country.

High-Risk Insurance

Sometimes, bad things happen to you on the road and your driving record ends up being less-than-stellar. You may end up being deemed a high-risk driver if things get bad enough.

In Arizona, a high-risk driver must get a type of insurance called an SR-22.

Here are some reasons Arizona drivers need an SR-22 once they’re driving privileges are reinstated:

- Failing to have the minimum liability coverage required.

- An alcohol or drug violation, e.g., DUI.

If you’re a high-risk driver and unable to find coverage through the free market, Arizona has a provision for you called Arizona Automobile Insurance Plan.

Low-Cost Insurance

Some states have programs set up for those who receive benefits from government assistance programs, or those who have a combined family income that is below the poverty level.

Unfortunately, Arizona has no such plan in place.

And remember: in order to obey the law, you must carry the minimum liability coverage.

Automobile Insurance Fraud in Arizona

Arizona takes insurance fraud very seriously. So seriously, in fact, that they have an entire division devoted to it called the Arizona Department of Insurance Fraud Unit.

Insurance fraud, according to the Arizona Department of Insurance Fraud, is divided up into hard fraud and soft fraud.

- Hard Fraud: Someone deliberately fakes an accident, injury, theft, arson or other loss to collect money illegally from insurance companies. Crooks often act alone, but increasingly, organized crime rings stage large schemes that steal millions of dollars.

- Soft Fraud: Normally honest people often tell so-called “little white lies” to their insurance company. Many people think it’s just harmless fudging. But soft fraud is a crime, and raises everyone’s insurance costs.

In Arizona, insurance fraud classified as a crime, punishable by fines and possible prison time.

Statute of Limitations

If you are in a car accident in Arizona, there is a statute of limitations.

That means you have a specific amount of time to file a claim in a court of law.

In Arizona, you only have two years to file both property damage and bodily injury claims following an accident.

Vehicle Licensing Laws

Like all other states in America, Arizona has mandatory licensing laws in addition to the laws we have already covered.

You’re probably not surprised to learn that The Grand Canyon State requires a valid driver’s license to operate a vehicle.

And be honest: who doesn’t love getting their picture taken at the DMV?

Okay, maybe that’s not the case. But you should know: licensing yourself and your vehicle in Arizona may be easier than you think.

According to the Arizona Department of Transportation, state law requires that you obtain an Arizona vehicle registration and driver license, immediately if any of the following apply:

- You work in Arizona (other than for seasonal agricultural work).

- You are registered to vote in Arizona.

- You place children in school without paying the tuition rate of a nonresident.

- You have a business with an office in Arizona that bases and operates vehicles in this state.

- You obtain a state license or pay school tuition fees at the same rate as an Arizona resident.

- You have a business that operates vehicles to transport goods or passengers within Arizona.

- You remain in Arizona for a total of seven months or more during any calendar year, regardless of your permanent residence.

You have 60 days when you move to the state to get a valid Arizona license.

Real ID

Passed by Congress in 2005, the REAL ID Act establishes minimum security standards for state-issued driver’s licenses and identification cards and prohibits Federal agencies from accepting for official purposes licenses and identification cards from states that do not meet these standards.

Arizona is in full compliance with the REAL ID Act passed by Congress and enforced by Homeland Security. This means that a driver’s license or state ID issued by Arizona is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

As of October 1, 2020, anyone wishing to fly on a commercial flight or to enter a federal facility must have a REAL ID-compliant form of identification, usually noted by that black star in the upper right corner of your driver’s license.

Penalties For Driving Without Insurance

Arizonans are known for caring about their neighbors. And part of being a good neighbor is having good insurance to protect not only you, but also the drivers and passengers around you.

What happens if you get caught driving without valid insurance in The Copper State?

- First offense: Fine: $500 (or more); license/registration/license plate suspension for three months.

- Second offense:Fine: $750 (or more within 36 months); license/registration/license plate suspension for six months.

Are you familiar with the teen driving laws in Arizona?

Teen Driving Laws

Most states have some form of graduated licensing laws for teens, and Arizona is no exception.

The Insurance Institute for Highway Safety (IIHS) specifies that Arizona teens must meet the requirements outlined in the table below.

| TEEN DRIVING LAWS IN ARIZONA | REQUIREMENT #1 | REQUIREMENT #2 | REQUIREMENT #3 |

|---|---|---|---|

| To get a learners license you must: | Have a minimum age of 15 years, 6 months | - | - |

| Before getting a license or restricted license you must: | Have a mandatory holding period of 6 months | Have a minimum supervised driving time of 30 hours, 10 of which must be at night (none with driver education) | Have a minimum age of 16 |

| Nighttime restrictions midnight-5 a.m. secondary enforcement | Passenger restrictions: (family members excepted unless otherwise noted) | no more than 1 passenger younger than 18 secondary enforcement | - |

Teenaged drivers are not the only ones who have a specific set of laws that pertain to their licensing requirements. In most states, older drivers also have restrictions when it comes to renewing their licenses.

Older Driver License Renewal Procedures

Arizona’s license renewal procedures for the general population and older drivers are pretty straightforward:

- Older Population License Renewal: every five years for people 65 years and older

- Proof of vision required: every renewal

- Mail or online renewal permitted: no

New Residents

If you’re one of Arizona’s lucky new residents, remember that you must obtain an Arizona driver’s license within 60 days of moving to the state.

But how do you do that?

A great place to start is by checking out the Department of Transportation’s New to AZ Guide.

When you go to the DMV, you’ll need to bring with you a primary identification document, a social security number document, and two pieces of proof of Arizona residency, all outlined in this helpful document provided by the state’s Department of Transportation.

Rules of the Road

From New York to California, and certainly in Arizona in between, every state has its own rules of the road.

Knowing what these laws are in The Grand Canyon State could help you avoid the receipt of any negligent operator points on your license or hefty tickets.

Keep reading to find out some of the information you need to know to save money on car insurance by following the laws of the great state of Arizona.

Fault Vs. No-Fault

As we’ve already learned, Arizona is what’s called a FAULT state.

This legal definition means that, according to NOLO, “drivers are financially responsible for the effects of any accident they cause.”

Seatbelt and Car Seat Laws

According to the lawyers at Jackson White, in Arizona, there are two main sections to the seat belt law.

1. Driver and passengers in the front seat must have the waist and chest strap properly fastened and in place if the vehicle is moving.

Note: Arizona does not require passengers in the back seat to wear a seat belt by law, but it is always recommended to wear a seat belt no matter where you are sitting in a car.

2. Anyone under the age of 16 must wear a seat belt while in a moving vehicle, no matter where they are seated.

Note: If you are driving with a minor in the car and their seat belt is not fastened, you are responsible and can receive a ticket. Any adult sitting in the front seat without a seat belt will be responsible for themselves and receive their own ticket.

When it comes to kiddos, be sure to restrain your children — their safety should be your first priority, but you should also be aware that Arizona imposes fines up to $50 for a first offense, with fines increasing on repeat offenses.

All children age 4 and under — or children ages 5-7 who are 57 inches tall or less — must be in a child restraint in the state of Arizona while riding in a moving vehicle. Eight years old and over 57 inches tall, they may wear an adult safety belt. There is no preference for the rear seat.

Keep Right and Move Over Laws

Arizona’s “Move Over” law requires motorists to move over one lane — or slow down if it is not safe to change lanes — when driving by any vehicle with flashing lights pulled to the side of a road or highway.

However, no “Keep Right” laws exist in the state of Arizona.

Speed Limits

Arizona keeps its speed limit laws pretty simple: the maximum speed limit on rural interstates is 75 mph. On all other roads, it is 65 mph.

Ridesharing

Most major rideshare services like Uber and Lyft mandate that their drivers carry personal car insurance that meets the minimum requirements of the state where they operate.

However, if drivers wish to purchase a commercial insurance policy, these are the companies that provide coverage:

- Allstate

- American Family

- Farmers

- Geico

- MetLife

- Safeco

- State Farm

- USAA

Automation on the Road

What the heck is automation?

The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task previously carried out by a human.

When it comes to automation, typically think radars, cameras, and other sensors used to gather information about a vehicle’s surroundings.

Currently, Arizona does allow the deployment of autonomous vehicles with no restrictions on having an operator in the vehicle.

Safety Laws

Let’s take a look at some important safety laws in Arizona.

DUI Laws

As you probably already know, driving under the influence of alcohol often has disastrous results.

That’s why strict laws are in place to prevent drunk driving fatalities, injuries, and property damage. Arizona has a typical Blood Alcohol Content (BAC) limit of .08. In 2017 alone, drunk driving caused 278 deaths in Arizona.

What are the penalties for drunk driving in Arizona?

For your first offense, it is a Class 1 misdemeanor, with your license taken away for a period between 90 to 360 days. In addition, you will be in prison for a minimum of one to ten days and will pay a fine of $250.

For your second offense, it is a Class 1 misdemeanor, with your license taken away for one year. In addition, you will be in prison for a minimum of 30 to 90 days, have your license revoked for one year, and will pay a fine of $500.

Marijuana Impaired Driving Laws

Driving impaired is driving impaired, and if you drive high, you face the same penalties as driving under the influence of alcohol outlined above.

Also note: there is a zero-tolerance law for marijuana use in Arizona. It is legal for medical use, but you have to have it prescribed by a doctor.

Distracted Driving Laws

Currently, there are no distracted driving laws or formal consequences in Arizona, but that’s about to change.

Effective as of January 1, 2021, it will be illegal to use a handheld phone while driving in the state of Arizona.

In the interim, however, several cities have taken action. For instance, Flagstaff, Phoenix, and Tucson have already made it illegal to text while driving before the state-wide ban goes into effect in 2021.

Driving in Arizona

Driving safely is important wherever you are, as you probably already know.

And please, don’t take your Arizona driving cues from Thelma and Louise, as cool as they are.

Read on for some important information about keeping you, your family, and your vehicles safe in the beautiful state of Arizona.

Vehicle Theft in Arizona

The Federal Bureau of Investigation (FBI) keeps track of vehicle thefts and other crimes city-by-city in all states.

In Arizona, this means they’re tracking vehicle theft from Apache Junction to Winslow.

In 2016, Phoenix — Arizona’s largest metro and capital city — led the state in vehicle thefts, with 7,960 cars and trucks stolen.

What’s the most stolen vehicle in Arizona? Currently, 1997 Honda Accords are most vulnerable to theft.

The table below shows the top 10 most-stolen cars in Arizona for 2018 by make, model, and model year.

| Model | Model Year |

|---|---|

| Honda Accord | 1997 |

| Honda Civic | 1998 |

| Chevrolet Pickup (Full Size) | 2004 |

| Ford Pickup (Full Size) | 2006 |

| Dodge Pickup (Full Size) | 2001 |

| Nissan Altima | 2015 |

| GMC Pickup (Full Size) | 2015 |

| Toyota Camry | 1999 |

| Jeep Cherokee/Grand Cherokee | 1994 |

| Nissan Sentra | 2014 |

Road Fatalities in Arizona

Despite their beauty, Arizona has some dangerous roadways, winding up steep mountains, through flood-prone valleys, and across congested metro areas.

Most Fatal Highway in Arizona

According to Geotab, Interstate 40 is the most dangerous highway in the state. I-40 cuts east-to-west across the top third of the state, and averages 25 fatal crashes a year.

Fatal Crashes by Weather and Light Conditions

Arizona has a variety of weather phenomenons, from snowy mountains to dry, arid deserts.

Not surprisingly, crashes are highly affected by both weather and light conditions.

The table below provides a breakdown of crash fatalities by weather and light conditions across Arizona in 2017.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 350 | 191 | 146 | 38 | 1 | 726 |

| Rain | 8 | 9 | 1 | 0 | 0 | 18 |

| Snow/Sleet | 2 | 0 | 1 | 0 | 0 | 3 |

| Other | 2 | 1 | 1 | 1 | 0 | 5 |

| Unknown | 45 | 2 | 68 | 0 | 52 | 167 |

| TOTAL | 407 | 203 | 217 | 39 | 53 | 919 |

Fatalities in Top 10 Counties (All Crashes)

Maricopa County, Arizona’s most populous county and home to the Phoenix metropolitan area, has more roadway fatalities than any other county in the state. In 2018, Maricopa County recorded 490 roadway fatalities.

The table below provides fatalities for all crashes in Arizona’s 10 biggest counties from 2014 to 2018.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Maricopa County | 367 | 405 | 478 | 462 | 490 |

| Pima County | 88 | 93 | 111 | 114 | 125 |

| Pinal County | 45 | 55 | 62 | 71 | 71 |

| Navajo County | 39 | 43 | 31 | 52 | 56 |

| Coconino County | 45 | 58 | 50 | 47 | 47 |

| Yavapai County | 42 | 47 | 41 | 55 | 44 |

| Mohave County | 29 | 49 | 53 | 43 | 43 |

| Yuma County | 33 | 16 | 18 | 26 | 31 |

| Gila County | 17 | 31 | 19 | 26 | 24 |

| Apache County | 26 | 49 | 35 | 47 | 23 |

Fatalities By Person Type

What kind of vehicles are Arizonans riding in or driving when they’re in a deadly car crash?

The table below shows fatalities by passenger type from 2014 to 2018.

| Person Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Passenger Car | 216 | 254 | 265 | 252 | 271 |

| Light Truck - Pickup | 74 | 103 | 101 | 111 | 104 |

| Light Truck - Utility | 81 | 105 | 113 | 106 | 105 |

| Light Truck - Van | 20 | 33 | 30 | 21 | 17 |

| Light Truck - Other | 1 | 0 | 2 | 1 | 4 |

| Large Truck | 9 | 17 | 16 | 19 | 18 |

| Bus | 1 | 0 | 0 | 2 | 0 |

| Other/Unknown Occupants | 56 | 56 | 55 | 65 | 73 |

| Total Occupants | 458 | 568 | 582 | 577 | 592 |

| Total Motorcyclists | 130 | 137 | 146 | 162 | 149 |

| Pedestrian | 142 | 155 | 186 | 213 | 237 |

| Bicyclist and Other Cyclist | 29 | 28 | 31 | 32 | 23 |

| Other/Unknown Nonoccupants | 14 | 9 | 7 | 14 | 9 |

| Total Nonoccupants | 185 | 192 | 224 | 259 | 269 |

| Total | 773 | 897 | 952 | 998 | 1,010 |

Fatalities By Crash Type

The National Highway Transportation Safety Administration (NHTSA) notes that accidents involving a single vehicle are at the top of the list of fatal crash types in Arizona.

The table below offers their crash type fatality figures for Arizona from 2014 to 2018.

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 773 | 897 | 952 | 998 | 1,010 |

| Single Vehicle | 462 | 499 | 542 | 565 | 588 |

| Involving a Large Truck | 67 | 91 | 84 | 95 | 90 |

| Involving Speeding | 255 | 315 | 325 | 313 | 285 |

| Involving a Rollover | 218 | 268 | 294 | 267 | 265 |

| Involving a Roadway Departure | 301 | 379 | 388 | 375 | 393 |

| Involving an Intersection (or Intersection Related) | 212 | 248 | 269 | 284 | 276 |

Fatalities Involving Speeding by County

Arizona’s uber populated Maricopa County leads the state in fatalities involving speeding.

The table below provides the 2014 to 2018 statistics for fatalities involving speeding in Arizona by county.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Apache County | 3 | 18 | 12 | 6 | 5 |

| Cochise County | 6 | 6 | 11 | 4 | 8 |

| Coconino County | 18 | 17 | 18 | 12 | 18 |

| Gila County | 7 | 13 | 8 | 8 | 9 |