Expert California Car Insurance Advice (Compare Costs & Companies)

California minimum car insurance requirements are 15/30/5 for bodily injury and property damage coverage. California car insurance rates average $82 per month while some of the cheapest auto insurance companies in California are USAA, Geico, and United Financial Casualty.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Feb 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

From the legendary Route 66 to the magnificent views offered by the famous Highway One, California really is a driver’s paradise.

This could explain why there are around 27 million registered vehicles sharing the nearly 226,000 miles of roadway that cut across the Golden State.

With so many cars on the road accidents are bound to happen from time to time. If one should happen involving you it will be a comfort to know that you have chosen the right California car insurance to protect you and the ones that you love.

There is a lot of information out there when it comes to car insurance though so choosing the right provider is not always easy. That’s where we come in.

We have collected all the information you need to make a wise investment in one convenient place. Just enter your information above and then keep reading to find out about all the ways that we are here to help.

- California car insurance laws require drivers to carry a minimum of 15/30/5 for bodily injury and property damage

- California car insurance rates average $82 per month

- Some of the cheapest auto insurance companies in California are USAA, Geico, and United Financial Casualty

| CALIFORNIA | STATISTICS |

|---|---|

| Miles of Roadway | 195,834 |

| Registered Vehicles | 28,595,129 |

| Population Estimate (2018) | 39,557,045 |

| Driving Deaths (2017) | Speeding-related: 1,070 Alcohol-related: 1,120 Total traffic fatalities: 3,602 |

| Vehicles | Registered: 27,872,875 Total Stolen: 151,852 |

| Most Popular Vehicle | Honda Civic |

| Average Premiums (Annual) | Liability: $489.66 Collision: $396.55 Comprehensive: $100.54 Combined Premiums: $986.75 |

| Percent of Motorists Uninsured | 15.20% State Rank: 12th |

| Cheapest Provider | USAA |

California Car Insurance Coverage and Rates

No matter which state you call home there are going to be car insurance requirements for registering your vehicle.

- Best Cheap Car Insurance Companies

- Affordable Car Insurance Rates in Chula Vista, CA

- Affordable Car Insurance Rates in Clovis, CA

- Affordable Car Insurance Rates in Corona, CA

- Affordable Car Insurance Rates in Costa Mesa, CA

- Affordable Car Insurance Rates in Lancaster, CA

- Affordable Car Insurance Rates in Long Beach, CA

- Affordable Car Insurance Rates in Menifee, CA

- Affordable Car Insurance Rates in Oxnard, CA

- Affordable Car Insurance Rates in Palmdale, CA

- Affordable Car Insurance Rates in Santa Maria, CA

- Affordable Car Insurance Rates in Thousand Oaks, CA

- Affordable Car Insurance Rates in Ventura, CA

- Affordable Car Insurance Rates in Torrance, CA (2025)

- Affordable Car Insurance Rates in Santa Monica, CA (2025)

- Affordable Car Insurance Rates in Santa Cruz, CA (2025)

- Affordable Car Insurance Rates in San Juan Capistrano, CA (2025)

- Affordable Car Insurance Rates in Rialto, CA (2025)

- Affordable Car Insurance Rates in Nevada City, CA (2025)

- Affordable Car Insurance Rates in Needles, CA (2025)

- Affordable Car Insurance Rates in Monterey, CA (2025)

- Affordable Car Insurance Rates in Madera, CA (2025)

- Affordable Car Insurance Rates in Lemoore, CA (2025)

- Affordable Car Insurance Rates in Gardena, CA (2025)

- Affordable Car Insurance Rates in Fillmore, CA (2025)

- Affordable Car Insurance Rates in East Hemet, CA (2025)

- Affordable Car Insurance Rates in Delano, CA (2025)

- Affordable Car Insurance Rates in Chino, CA (2025)

- Affordable Car Insurance Rates in Burbank, CA (2025)

- Affordable Car Insurance Rates in Brentwood, CA (2025)

- Affordable Car Insurance Rates in Bakersfield, CA (2025)

- Affordable Car Insurance Rates in Arcata, CA (2025)

- Affordable Car Insurance Rates in American Canyon, CA (2025)

- Los Angeles Car Insurance Advice (Compare Costs & Companies)

The sheer number of car insurance providers and coverage options can make shopping for car insurance a confusing and sometimes frustrating endeavor though.

Not to worry though. We are here to help you through the entire process by providing the information that you need to choose the right car insurance provider to handle all of your needs.

Keep scrolling to find out about the minimum car insurance requirements in the Golden State and how we can help you get the best deal possible on your car insurance policy.

California’s Car Culture

Part of California’s history and economy were built around its car culture.

In fact, by the turn of the 20th-Century “Southern California already had more cars per capita than just about anywhere else.”

California was also a major player in the car manufacturing industry between the 1920s to 1970s. This helps explain why, in the Golden State, a person’s car is more than just their mode of transportation.

In California, cars are also prized possesions which are shown off in annual car shows and in organized weekend car cruises all year long.

If you love your car as much as your fellow Californians do you will want to make sure that it is protected in case of loss or damage.

Having just the right amount of car insurance coverage with a provider that is best for you can help you cut through the red tape when filing a claim and help you get you and your prized possession back on the road fast after your repairs are complete.

California Minimum Coverage

Like almost all states in the Union, California has minimum state requirements when it comes to the minimum coverage amounts that drivers are required to carry on their vehicles.

Take a look at how state minimum car insurance rates vary from state to state.

According to the California DMV, the minimum requirements for car insurance coverage in the Golden State are:

- $15,000 for injury/death to one person

- $30,000 for injury/death to more than one person

- $5,000 for damage to property

California is also considered a “Fault” state which means that, according to NOLO, “drivers are financially responsible for the effects of any accident they cause.”

Knowing that you could be held financially responsible for any and all damage that you cause if you are ever involved in an accident is scary.

Having the right car insurance provider in your corner can help ease your fears though.

Forms of Financial Responsibility

In order to enforce the compulsory car insurance laws, California requires that all drivers have forms of financial responsibility in their car at all times.

These forms of financial responsibility are commonly referred to as proof of insurance and, these forms must be provided as follows:

- When requested by law enforcement

- When Renewing your vehicle registration

- When the vehicle is involved in a traffic collision.

Be aware that insurance companies in the Golden State are required by law to report car insurance information to the California DMV so if you have a lapse in coverage you might find your registration blocked the next time that you go to re-up.

It is also important to keep in mind that, according to Investopedia:

Lack of compliance with these laws can put other assets, such as a home, at risk if the vehicle owner does not have the financial resources to pay for damages that stem from accidents they are held liable for.

If you can’t present proof of insurance to law enforcement when requested to do so you could be fined between $100 to $200 dollars for the first infraction and between $200 to $500 for any infraction after that.

You may also be responsible for any additional assessment penalties.

California allows the following forms of financial responsibility:

- An e-insurance card which is accessible through your car insurance provider’s app on your smartphone, laptop, tablet, or other electronic devices.

- A printed paper insurance ID card which is usually presented to you when you by your car insurance provider by mail shortly after you have bought your policy.

It is also a good idea to keep your policy in the glove box just in case you can’t access your e-insurance card or locate your paper copy.

And it is nice to know that California law prevents law enforcement from scrolling through your phone without a warrant should you present them with your e-insurance card (unless you are placed under arrest).

Premiums as a Percentage of Coverage

Business Insider ranks California as one of the highest states in the nation when it comes to the annual cost of car insurance.

Even though California’s annual car insurance premiums rank among some of the highest in the United States residents of the Golden State actually dedicate less of their total income to car insurance premiums than the residents of neighboring states.

Californians may not dedicate as much of their annual income as residents of Arizona, Oregon, or Nevada do, but that doesn’t mean that residents of the Golden State don’t want to get the most for their money.

With a per capita disposable income of around $43,978 per year coming into the average household in California and almost $986.75 of that being spent on car insurance, this means that the average resident of the Golden State shells out approximately $82 of a $3,665 monthly budget just to maintain the minimum coverage required by the State of California in order to drive.

These numbers reflect a driver who has a clean driving record so the average cost for someone with a few marks on their driving record could be much higher.

The good news for all drivers in the Golden State is that between 2012 and 2014 car insurance rates in California did not increase all that much.

With an average expenditure of around $893 according to the Insurance Information Institute, California residents also pay less than the national average expenditure for car insurance which stands at $935.80 a year.

Residents of the Golden State also pay less than their neighbors in Arizona and Nevada who shell out about $962 and $1,083 respectively each year in car insurance premiums annually.

No matter what the national average expenditure is, all California residents like to save money whenever possible. This is why it is so important to shop around.

CalculatorPro

Average Monthly Car Insurance Rates in CA (Liability, Collision, Comprehensive)

Part of getting the best price on car insurance is understanding the types of coverages being offered to you as a consumer.

Let’s take a look at the average monthly car insurance rates.

The table below contains the three most purchased types of coverage and the annual price that your fellow Californians are paying for each.

| Core Coverage | Annual Costs (2015) |

|---|---|

| Liability | $489.66 |

| Collision | $396.55 |

| Comprehensive | $100.54 |

| Combined Total | $986.75 |

Liability coverage is the type of coverage that the state requires as part of its minimums. This type of coverage will cover any damage that you do to another part’s person or property if you are ever involved in an accident.

Liability will not pay for your injuries or damages though. That is where collision and/or comprehensive come in.

Generally speaking, collision insurance will pay for your damages and injuries if you hit another object and comprehensive will pay out if your car is vandalized stolen, or is the victim of an act of nature such as flood or mudslide.

When liability, comprehensive, and collision are combined on one policy you are considered to have full coverage.

If you take time to understand both the types of coverage that you are buying and just how much of each type of coverage you need before you decide on something as important as your car insurance policy you can save yourself a lot of frustration later.

Additional Liability

Even though California has a compulsory insurance law that sets state requirements for the minimum amount of car insurance that each driver must carry sometimes the basics just aren’t enough.

Medical bills add up quickly, and property damage totals can rise faster than you can say car insurance in some cases.

So how much coverage do you need?

You should carry as much liability coverage as you can comfortably afford because damage claims today are sometimes settled for millions.

It may surprise you to know that you and your car are not the only things at risk when you are behind the wheel.

You could be risking your home, retirement plan, and any other assets that you have if you were to cause an accident because anything of financial value that you own could become part of a settlement if you were to cause an accident. This is why it is good to consider purchasing as much coverage as you can comfortably afford.

Some of the additional types of coverage available to you are:

- MedPay-This covers the medical bills of all of the passengers in your car that are injured in an accident. These bills can include medical treatments and ambulance rides.

- Personal Injury Protection (PIP)-This can help you recoup lost wages, and pay medical expenses regardless of who caused the accident.

- and Uninsured/Underinsured Motorist-If you have this type of coverage it will protect you if you are in a car accident with an at-fault driver who isn’t carrying liability insurance. It will also cover you if the at-fault driver’s limits are not high enough to cover all of the damages and medical expenses that he or she has inflicted on others during an accident.

Knowing that almost 16 percent of all drivers on California roadways are uninsured is quite a motivator for going above and beyond purchasing just the state minimum requirements for car insurance coverage.

As you consider the types of coverages available to you and how much of each type you might need it is also a good idea to look at the percentage of voluntary business done in California for MedPay and Uninsured motorists.

According to the National Association of Insurance Commissioners (NAIC) those total are as follows.

| Coverage Type | 2013 | 2014 | 2015 |

|---|---|---|---|

| MedPay | 69% | 62% | 60% |

| Uninsured/Underinsured Motorist | 60% | 58% | 69% |

The numbers for MedPay and Uninsured/Underinsured motorists are good news for consumers because they indicate that the car insurance market in the Golden State s strong and a strong car insurance market translates to lower prices.

Looking at the loss ratio for car insurance companies can also help you get the best deal on your car insurance policy because this ratio tells you how likely a company is to pay out on a claim should you ever need to file one.

So what is the loss ratio exactly? Broken down, the loss ratio works like this:

- A High loss Ratio (over 100 percent) is indicative of a market where companies are losing money because they are paying out to many claims which might cause them to face bankruptcy.

- A Low Loss Ratio indicates that companies in the market are paying to few claims which might result in you having your claim rejected by such a company should ever need to file one with them.

The loss ratios for the major car insurance companies nationally indicate that these companies are pretty willing to give you a hassle-free experience when it comes to filing a claim and paying out for the damages.

Add-ons, Endorsements, and Riders

Purchasing additional liability coverage is not the only way to protect your assets if you are ever involved in a car accident in California.

Many car insurance providers also offer a variety of add-ons, endorsements, and riders to help you protect yourself. Some of the options available to you are:

- Guaranteed Auto Protection (GAP)-If your car is ever totaled or stolen GAP will pay any money that is remains owed on the lease or loan. .

- Personal Umbrella Policy (PUP)-When your liability limits have been reached PUP kicks in to help protect you from lawsuits which may result from an auto accident.

- Rental Reimbursement-If your car is in the shop due to a traffic incident rental reimbursement will help you pay the costs of renting a car until your repairs are finished.

- Emergency Roadside Assistance– If your car breaks down or you have a flat this addition to your policy will help you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance-Need repairs that were not due to an accident then this type of coverage is for you.

- Non-Owner Car Insurance-This type of coverage is perfect for you if you don’t own a car but still drive on occasion because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage-This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance-Specially designed for classic cars, this type of coverage helps ensure that if something happens to prized possession you will both be well protected.

- Pay-As-You-Drive Insurance or Usage-Based Insurance-This type of coverage is based on the way you drive based on information collected by your car insurance provider regarding your speed, distance traveled, and other such factors and issues discounts based on that information.

You should be aware that GAP insurance can come with limitations so be sure to ask your agent about this before signing on the dotted line.

Another thing to keep in mind is that not all modifications are legal in the Golden State so check your local laws before souping up your ride.

The age of your vehicle and the modifications that you may have made to it are not the only things that can determine the rates that you will pay for car insurance. Sometimes there are hidden factors such as gender or your commute rate that can drive up your costs. Keep reading to find out more.

Average Monthly Car Insurance Rates by Age & Gender in CA

One of the best ways to save money on car insurance is to know which factors car insurance providers are looking at when they are setting your rates.

Some of these factors can include your age, gender, and marital status. Take a look.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate Northbrook Indemnity | $2,921.24 | $2,923.87 | $2,126.03 | $2,148.03 | $8,098.88 | $10,188.73 | $3,742.44 | $4,115.50 |

| Farmers Ins Exchange | $2,715.31 | $2,715.31 | $2,451.83 | $2,451.83 | $8,667.08 | $14,189.14 | $3,218.46 | $3,585.17 |

| Geico General | $1,786.81 | $1,787.80 | $1,680.52 | $1,680.52 | $5,433.56 | $5,529.48 | $2,566.22 | $2,624.98 |

| SAFECO Ins Co of America | $2,303.99 | $2,177.93 | $2,145.20 | $2,077.01 | $5,014.43 | $5,348.46 | $2,593.72 | $2,620.60 |

| AMCO Insurance | $3,272.83 | $3,124.42 | $2,863.68 | $2,699.52 | $8,318.27 | $9,186.72 | $3,904.76 | $3,858.43 |

| United Financial Casualty | $1,785.37 | $1,837.82 | $1,518.62 | $1,802.64 | $4,767.78 | $5,748.65 | $2,576.92 | $2,771.33 |

| State Farm Mutual Auto | $3,310.18 | $3,310.18 | $2,957.44 | $2,957.44 | $6,089.50 | $7,555.39 | $3,663.92 | $3,777.69 |

| Travelers Commercial Ins Co. | $2,497.45 | $2,417.86 | $2,206.26 | $2,182.92 | $5,165.60 | $5,906.73 | $3,249.64 | $3,179.78 |

| USAA CIC | $1,929.46 | $1,827.74 | $1,882.10 | $1,889.89 | $4,404.58 | $4,428.83 | $2,670.51 | $2,523.86 |

This data includes rates based on actual purchased coverage by the state population which means that it includes rates for high-risk drivers, drivers who have purchased full coverage and the like.

Even with all of this, the table reveals that the cost of car insurance for a married woman in her thirties is only slightly lower across the board in the Golden State when compared to the rates for a single woman in her twenties.

As you can see, the rates of men and women in the same age group also do not differ all that much even though the Consumer Federation of America (CFA) released an interesting study in 2017, and among its findings was the fact that:

Female motorists with perfect driving records often pay significantly more for auto insurance than male drivers with identical driving records.

This is shocking to a lot of people considering that common wisdom has always dictated that men are more likely to engage in risky behavior behind the wheel which is why their rates are usually higher.

Forbes agrees with CFA though when it comes to the fact that women often pay more and even goes so far as to say that:

The insurance companies’ use of sex as a rating factor does not seem to reveal much in the way of a consistent risk assessment.

If you live in California you are lucky though because California has enacted legislation to protect consumers against the use of gender as a means for setting car insurance rates.

Cheapest Rates By ZIP Code

While Proposition 103 is supposed to remove the ability of car insurance providers to use your ZIP code against you when determining your rates that isn’t always translating to real-world experiences. Take a look.

| Most Expensive Zip Codes in California | City | Average by Zip Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 90210 | BEVERLY HILLS | $6,324.83 | Nationwide | $8,533.47 | Allstate | $8,190.66 | Liberty Mutual | $4,414.40 | USAA | $4,692.62 |

| 91606 | NORTH HOLLYWOOD | $6,219.57 | Allstate | $8,174.05 | Farmers | $8,102.32 | USAA | $3,931.76 | Liberty Mutual | $4,611.35 |

| 90010 | LOS ANGELES | $6,201.00 | Nationwide | $8,610.21 | Allstate | $8,225.60 | USAA | $4,226.92 | Liberty Mutual | $4,883.02 |

| 90211 | BEVERLY HILLS | $6,199.34 | Nationwide | $8,922.36 | Allstate | $8,190.66 | USAA | $4,245.23 | Liberty Mutual | $4,439.85 |

| 91405 | VAN NUYS | $6,198.55 | Nationwide | $8,789.36 | Allstate | $8,155.64 | USAA | $3,931.76 | Liberty Mutual | $4,683.16 |

| 90020 | LOS ANGELES | $6,132.45 | Nationwide | $8,382.09 | Allstate | $8,360.06 | USAA | $4,004.33 | Geico | $4,512.30 |

| 91203 | GLENDALE | $6,086.66 | Nationwide | $9,116.47 | Allstate | $7,952.29 | USAA | $4,004.56 | Liberty Mutual | $4,116.05 |

| 91401 | VAN NUYS | $6,073.88 | Nationwide | $8,651.65 | Allstate | $8,335.75 | USAA | $3,828.03 | Liberty Mutual | $4,506.46 |

| 90028 | LOS ANGELES | $6,063.25 | Allstate | $8,360.06 | Farmers | $8,208.73 | USAA | $4,004.33 | Geico | $4,393.74 |

| 90038 | LOS ANGELES | $6,048.15 | Nationwide | $8,518.96 | Allstate | $8,360.06 | USAA | $3,693.78 | Geico | $4,309.89 |

| 90046 | LOS ANGELES | $6,045.78 | Allstate | $8,225.60 | Nationwide | $8,193.23 | USAA | $3,966.93 | Geico | $4,399.92 |

| 90212 | BEVERLY HILLS | $6,041.05 | Allstate | $8,190.66 | Farmers | $7,792.29 | USAA | $4,245.23 | Liberty Mutual | $4,539.22 |

| 90005 | LOS ANGELES | $6,040.60 | Allstate | $8,065.54 | Nationwide | $8,057.13 | USAA | $4,004.33 | Progressive | $4,592.87 |

| 91605 | NORTH HOLLYWOOD | $6,034.64 | Nationwide | $8,737.86 | Farmers | $7,959.34 | USAA | $3,808.95 | Liberty Mutual | $4,383.46 |

| 91204 | GLENDALE | $6,015.40 | Nationwide | $8,721.88 | Allstate | $7,952.29 | USAA | $4,004.56 | Liberty Mutual | $4,268.49 |

| 91205 | GLENDALE | $5,990.19 | Nationwide | $8,439.18 | Farmers | $7,685.36 | USAA | $4,004.56 | Liberty Mutual | $4,296.53 |

| 90029 | LOS ANGELES | $5,934.84 | Farmers | $8,227.86 | Allstate | $8,197.40 | USAA | $3,735.84 | Geico | $4,161.04 |

| 90004 | LOS ANGELES | $5,928.00 | Allstate | $8,189.47 | Nationwide | $8,127.33 | USAA | $3,847.79 | Progressive | $4,373.15 |

| 90017 | LOS ANGELES | $5,898.73 | Allstate | $8,014.89 | Nationwide | $8,005.94 | USAA | $3,945.10 | Liberty Mutual | $4,632.60 |

| 90027 | LOS ANGELES | $5,897.67 | Nationwide | $8,413.29 | Allstate | $8,189.47 | Progressive | $4,012.84 | USAA | $4,015.30 |

| 90057 | LOS ANGELES | $5,894.37 | Allstate | $8,016.78 | Nationwide | $8,012.71 | USAA | $3,847.79 | Progressive | $4,225.65 |

| 90077 | LOS ANGELES | $5,878.05 | Allstate | $8,190.66 | Farmers | $7,517.86 | Liberty Mutual | $3,925.51 | USAA | $4,125.06 |

| 90048 | LOS ANGELES | $5,877.67 | Allstate | $8,276.46 | Nationwide | $8,189.87 | USAA | $3,719.43 | Geico | $4,058.38 |

| 91201 | GLENDALE | $5,847.26 | Nationwide | $8,736.98 | Allstate | $7,952.29 | USAA | $3,808.95 | Liberty Mutual | $4,011.77 |

| 90069 | WEST HOLLYWOOD | $5,844.28 | Allstate | $8,276.46 | Farmers | $8,037.83 | USAA | $3,671.99 | Liberty Mutual | $4,191.86 |

The most expensive ZIP code is in Beverly Hills.

| Least Expensive Zip Codes in California | City | Average by Zip Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 93401 | SAN LUIS OBISPO | $2,731.32 | Allstate | $3,488.65 | Nationwide | $3,336.13 | Progressive | $2,177.96 | Liberty Mutual | $2,285.77 |

| 96094 | WEED | $2,752.73 | Farmers | $4,037.15 | Nationwide | $3,166.19 | Progressive | $2,000.62 | Geico | $2,061.72 |

| 93428 | CAMBRIA | $2,774.88 | Nationwide | $3,395.32 | Allstate | $3,380.26 | Progressive | $2,234.71 | Geico | $2,242.78 |

| 96067 | MOUNT SHASTA | $2,777.89 | Farmers | $4,029.52 | Nationwide | $3,347.10 | Progressive | $1,989.83 | Geico | $2,080.16 |

| 93437 | LOMPOC | $2,804.27 | Nationwide | $3,512.04 | Allstate | $3,460.07 | Progressive | $2,098.30 | USAA | $2,428.11 |

| 93427 | BUELLTON | $2,807.43 | Allstate | $3,442.05 | Nationwide | $3,437.39 | Progressive | $2,244.68 | USAA | $2,289.13 |

| 93442 | MORRO BAY | $2,807.97 | Allstate | $3,396.50 | Nationwide | $3,358.53 | Progressive | $2,126.82 | Liberty Mutual | $2,400.87 |

| 93402 | LOS OSOS | $2,821.16 | Nationwide | $3,411.51 | Allstate | $3,392.02 | Liberty Mutual | $2,324.69 | Progressive | $2,336.39 |

| 93420 | ARROYO GRANDE | $2,824.43 | Nationwide | $3,543.40 | Farmers | $3,404.34 | Progressive | $1,980.83 | Liberty Mutual | $2,298.66 |

| 93449 | PISMO BEACH | $2,829.93 | Nationwide | $3,707.40 | Allstate | $3,450.72 | Liberty Mutual | $2,283.28 | USAA | $2,449.96 |

| 93433 | GROVER BEACH | $2,834.19 | Nationwide | $3,752.44 | Allstate | $3,468.52 | Liberty Mutual | $2,282.99 | Progressive | $2,297.06 |

| 93514 | BISHOP | $2,837.87 | Allstate | $3,721.11 | Farmers | $3,446.65 | Progressive | $1,942.71 | Geico | $2,292.34 |

| 93441 | LOS OLIVOS | $2,840.56 | Nationwide | $3,594.51 | Allstate | $3,442.05 | Progressive | $2,327.04 | USAA | $2,426.99 |

| 96064 | MONTAGUE | $2,840.77 | Farmers | $4,019.73 | Nationwide | $3,532.73 | Progressive | $1,971.09 | Geico | $2,250.66 |

| 96097 | YREKA | $2,843.29 | Farmers | $4,020.91 | Nationwide | $3,291.50 | Geico | $2,197.64 | Progressive | $2,200.87 |

| 93436 | LOMPOC | $2,843.64 | Nationwide | $3,536.94 | Allstate | $3,462.90 | Geico | $2,325.67 | USAA | $2,371.77 |

| 93444 | NIPOMO | $2,843.90 | Nationwide | $3,495.01 | Farmers | $3,445.56 | USAA | $2,299.41 | Liberty Mutual | $2,337.28 |

| 93430 | CAYUCOS | $2,850.58 | Nationwide | $3,460.36 | Allstate | $3,361.53 | Liberty Mutual | $2,344.53 | USAA | $2,423.24 |

| 93452 | SAN SIMEON | $2,858.30 | Nationwide | $3,497.26 | Allstate | $3,487.46 | Progressive | $2,305.34 | USAA | $2,330.63 |

| 93463 | SOLVANG | $2,861.18 | Allstate | $3,888.44 | Nationwide | $3,531.47 | Progressive | $2,112.72 | USAA | $2,362.05 |

| 93432 | CRESTON | $2,862.60 | Farmers | $3,526.64 | Allstate | $3,487.46 | Progressive | $2,239.41 | USAA | $2,324.62 |

| 93422 | ATASCADERO | $2,865.26 | Nationwide | $3,610.36 | Farmers | $3,438.02 | Progressive | $2,058.51 | USAA | $2,391.21 |

| 93455 | SANTA MARIA | $2,877.52 | Nationwide | $3,554.69 | Allstate | $3,453.85 | Geico | $2,325.67 | USAA | $2,363.73 |

| 96027 | ETNA | $2,882.83 | Farmers | $4,075.76 | Nationwide | $3,501.68 | Progressive | $2,071.13 | USAA | $2,309.58 |

| 96032 | FORT JONES | $2,885.83 | Farmers | $4,329.09 | Nationwide | $3,547.47 | Progressive | $2,122.70 | USAA | $2,266.86 |

The data reveals that the 2012 report by CBS still holds true. In this report, CBS asserted that:

Even in California, where the decades-old Proposition 103 mandated that insurers weigh driving experience more heavily than ZIP codes, the five-digit number that tells the post office where you live can cost — or save — you thousands of dollars.

So why are car insurance providers in California still using your ZIP code to set your car insurance rates? Because car insurance rates are set based on determined risk.

The map below reveals how California as a whole compares to other states when it comes to car insurance rates. As you can see, the Golden State is a bit on the high side.

Add in your ZIP code as a factor and your rates could climb even higher than your neighbors just because of the neighborhood that you love.

If you live in a neighborhood that is considered a high-crime area then the risk that your car will be damaged or stolen increases. This perceived risk that the car insurance company might be more likely to have to pay out a claim if you live in one of these areas is what causes your rates to be more expensive in these areas then.

Knowing your neighborhood’s crime statistics before you begin to shop around for car insurance could go a long way towards helping you save money. Check out the counties with the highest crime rates according to the Public Policy Institute of California.

If you live in one of these countiues it might be a good idea to purchase comprehensive insurance to protect your automobile against theft, vandalism, or other property crimes.

Cheapest Rates By City

Your ZIP code isn’t the only geographic factor that car insurance companies use to determine your rates.

The tables below reveal that the city that you love could also be causing you to pay higher prices.

| Most Expensive Cities in California | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Beverly Hills | $6,188.41 | Nationwide | $8,410.69 | Allstate | $8,190.66 | USAA | $4,394.36 | Liberty Mutual | $4,464.49 |

| Van Nuys | $5,897.85 | Nationwide | $8,039.20 | Farmers | $7,861.74 | USAA | $3,761.84 | Progressive | $4,503.60 |

| Tarzana | $5,798.47 | Farmers | $7,945.28 | Nationwide | $7,943.26 | USAA | $3,843.04 | Liberty Mutual | $4,034.36 |

| North Hollywood | $5,769.35 | Allstate | $7,921.82 | Farmers | $7,855.52 | USAA | $3,629.33 | Geico | $4,203.12 |

| Encino | $5,744.64 | Nationwide | $8,168.10 | Farmers | $7,766.47 | USAA | $3,757.52 | Geico | $3,997.59 |

| Valley Village | $5,718.12 | Allstate | $8,335.75 | Farmers | $7,716.75 | USAA | $3,752.84 | Progressive | $4,038.01 |

| Panorama City | $5,701.66 | Farmers | $7,975.17 | Nationwide | $7,804.98 | USAA | $3,411.65 | Progressive | $4,107.44 |

| Studio City | $5,649.18 | Allstate | $8,225.60 | Farmers | $7,795.23 | USAA | $3,438.90 | Liberty Mutual | $4,095.81 |

| Reseda | $5,593.76 | Farmers | $7,828.71 | Allstate | $7,329.09 | USAA | $3,593.77 | Progressive | $4,014.63 |

| Sherman Oaks | $5,562.19 | Allstate | $7,945.09 | Farmers | $7,897.13 | USAA | $3,463.15 | Geico | $4,052.60 |

Looking at the table reveals that drivers in Beverly Hills pay a pretty good price for their car insurance. The reason for this could be that residents in this city tend to drive more expensive cars.

The more expensive your replacement parts are for the car that you love the higher the repair bills could be if you are ever in an accident.

| Least Expensive Cities in California | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Los Ranchos | $2,731.32 | Allstate | $3,488.65 | Nationwide | $3,336.13 | Progressive | $2,177.96 | Liberty Mutual | $2,285.77 |

| Weed | $2,752.73 | Farmers | $4,037.15 | Nationwide | $3,166.19 | Progressive | $2,000.62 | Geico | $2,061.72 |

| Cambria | $2,774.88 | Nationwide | $3,395.32 | Allstate | $3,380.26 | Progressive | $2,234.71 | Geico | $2,242.78 |

| Mount Shasta | $2,777.89 | Farmers | $4,029.52 | Nationwide | $3,347.10 | Progressive | $1,989.83 | Geico | $2,080.16 |

| Vandenberg AFB | $2,804.27 | Nationwide | $3,512.04 | Allstate | $3,460.07 | Progressive | $2,098.30 | USAA | $2,428.11 |

| Buellton | $2,807.43 | Allstate | $3,442.05 | Nationwide | $3,437.39 | Progressive | $2,244.68 | USAA | $2,289.13 |

| Morro Bay | $2,807.96 | Allstate | $3,396.50 | Nationwide | $3,358.53 | Progressive | $2,126.82 | Liberty Mutual | $2,400.87 |

| Los Osos | $2,821.16 | Nationwide | $3,411.51 | Allstate | $3,392.02 | Liberty Mutual | $2,324.69 | Progressive | $2,336.39 |

| Arroyo Grande | $2,824.43 | Nationwide | $3,543.40 | Farmers | $3,404.34 | Progressive | $1,980.83 | Liberty Mutual | $2,298.66 |

| Pismo Beach | $2,829.93 | Nationwide | $3,707.40 | Allstate | $3,450.72 | Liberty Mutual | $2,283.28 | USAA | $2,449.96 |

Should you ever need to file a claim it will be a comfort to know that you have the right car insurance provider in your corner. That is where we come in. Keep scrolling to find out who some of the best car insurance companies in the Golden State are.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best California Car Insurance Companies

Being the best means staying ahead of the competition. Car insurance companies do this in a variety of ways.

Some of these ways include keeping their overhead down and their customers happy. In the car insurance industry, these milestones are known as the companies financial rating and complaint ratio.

We have collected a list of the top-rated insurance companies in California according to AM Best and gathered the information about their complaint ratio for you in one convenient place.

Keep reading to find out how these things can help you make an educated decision when purchasing your car insurance policy.

The Largest Companies Financial Ratings

AM Best has a singular focus on the car insurance market which makes its ratings one of the best indicators of a car insurance provider’s financial strength.

In fact, it is so good at what it does that the National Association of Insurance Commissioners, and other leaders in the field, rely on data from AM Best when determining the overall health and viability of insurers around the world.

Take a look at how AM Best has rated the top 10 auto insurers in the Golden State.

| Best Rated Companies | Rating | Outlook |

|---|---|---|

| State Farm | A++ | Stable |

| Farmers Insurance | A | Stable |

| Geico | A++ | Stable |

| Allstate Insurance | A+ | Stable |

| Auto Club Enterprises Insurance | A- | Stable |

| Mercury General | A- | Stable |

| CSAA Insurance | A | Stable |

| USAA Insurance | A++ | Stable |

| Progressive | A+ | Stable |

| Liberty Mutual | A | Stable |

Choosing a company with an A- or greater rating from AM Best ensures that you are choosing a car insurance provider that has a good loss ratio and is in great financial health.

The financial health of a company combined with the loss ratio indicates the willingness of a car insurance provider to pay out claims after an accident.

The better the financial rating and the higher the loss ration the better the chances are that if you choose that car insurance provider they will settle your claim fast.

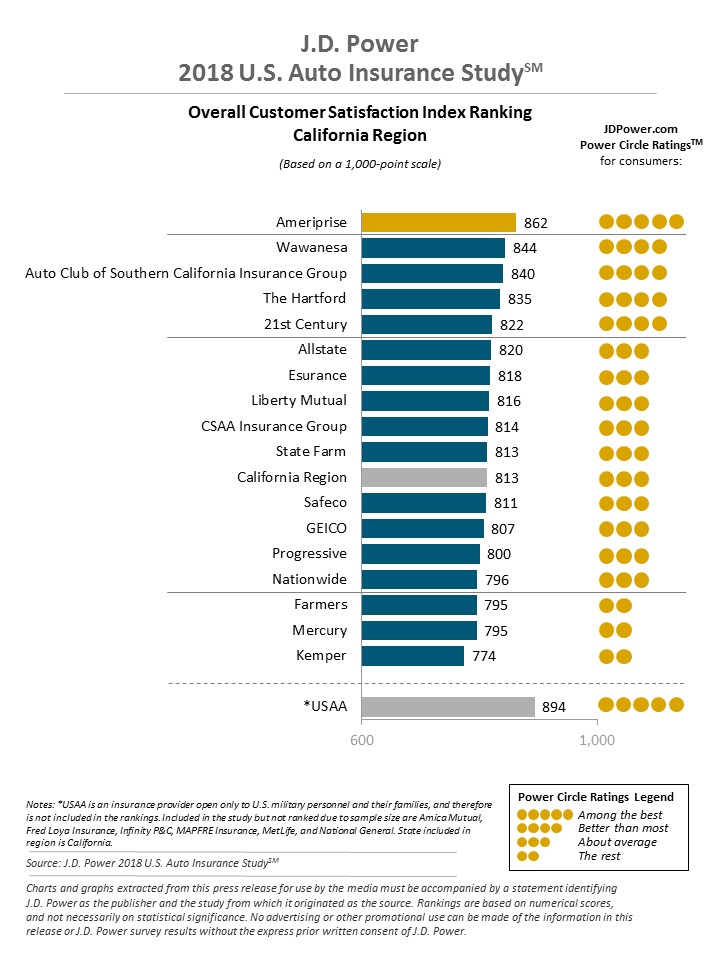

Companies With Best Ratings

AM Best is not the only financial advising company that is keeping its eye on the car insurance market.

JD Power is also looking out for you, and what it has discovered is that customer satisfaction with the overall car insurance market is at an all-time high.

Anyone who has ever bought car insurance in California knows that the experience is not without its hiccups though. Making sure that you have an easier time with the decision process is as simple as scrolling down to find out who customers complain about the most.

Companies With Most Complaints in California

So how do you know which companies in the Golden State have the most complaints? A good way to tell is to look at their complaint ratio in comparison to their market share.

The baseline for the complaint ratio is 1.0. This means that a company with a complaint ratio of 1.0 has an average number of complaints.

The higher the complaint ratio the higher the number of complaints lodged against the company then.

Below is a list of the top 10 best car insurance companies in California along with their complaint ratios so that you can see how each one compares.

| Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm | $3,910,351 | 0.44 | 75.94% | 14.34% |

| Farmers Insurance | $3,158,814 | 0.00 | 68.26% | 11.59% |

| Geico | $2,502,854 | 0.68 | 84.78% | 9.18% |

| Allstate Insurance | $2,446,564 | 0.50 | 64.73% | 8.97% |

| Auto Cub Enterprises | $2,312,230 | 0.69 | 65.03% | 8.48% |

| Mercury General | $2,095,531 | 0.56 | 61.91% | 7.69% |

| CSAA Insurance | $1,950,257 | 3.97 | 64.30% | 7.15% |

| USAA Insurance | $1,218,792 | 0.74 | 72.98% | 4.47% |

| Progressive | $1,147,186 | 0.75 | 62.78% | 4.21% |

| Liberty Mutual | $929,058 | 5.95 | 77.26% | 3.41% |

The raw numbers can be deceiving. For instance, looking at them out of context might make you think that you should avoid Liberty Mutual because it has a 5.95 complaint ratio.

When you look at Liberty Mutual’s complaint ratio in contrast with the small percentage of the market share that this company holds it makes a bit more sense though because Liberty Mutual only holds around 3.5 percent of the overall market share which means that it services fewer customers.

This means that the total of complaints filed against Liberty Mutual becomes amplified in the complaint ratio because it is not spread out across a bigger share of the overall car insurance market.

This also helps to explain why State Farm, which holds about 15 percent of the overall California car insurance market has such a small complaint ratio in comparison.

If you ever need to file a complaint against your car insurance provider the Golden State has several ways that you can do it.

- Online at:https://cdiapps.insurance.ca.gov/CP/login/

- By regular mail at: Department of Insurance, Consumer Services and Market Conduct Branch, Consumer Services Division, 300 South Spring Street, South Tower, Los Angeles, CA 90013

Be sure to include all of the relevant information such as your name, address, and phone number, as well as the car insurance provider that you are lodging the complaint against.

You will also need to include your Request for Assistance form when lodging your complaint by mail.

Now that you know how the loss ratio works, what the market share means to you, and how to file a complaint if you ever have to it is time to start com[aring rates.

Cheapest Car Insurance Companies in California

Savvy shoppers know that when you sopping for anything it is always best to sort your prices from low to high.

Smart shoppers also know that selecting the product with the cheapest price doesn’t always mean that you will get the best deal.

The table below can help you get started with your car insurance shopping experience by showing you just how far you could stretch your car insurance dollar.

| Company | Average | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Allstate Northbrook Indemnity | $4,533.09 | $843.47 | 18.61% |

| Farmers Insurance Exchange | $4,999.27 | $1,309.64 | 26.20% |

| Geico | $2,886.24 | -$803.38 | -27.84% |

| SAFECO Ins Co of America | $3,035.17 | -$654.45 | -21.56% |

| AMCO Insurance | $4,653.58 | $963.96 | 20.71% |

| United Financial Casualty | $2,851.14 | -$838.48 | -29.41% |

| State Farm Mutual Auto | $4,202.72 | $513.10 | 12.21% |

| Travelers Commercial Ins Co. | $3,350.78 | -$338.84 | -10.11% |

| USAA CIC | $2,694.62 | -$995.00 | -36.93% |

How far you can stretch your car insurance dollar is not the only thing you should know. It is also important to understand how each car insurance provider determines your rates.

One of the things that your car insurance company might consider when setting the price for your policy is long your annual commute is.

Commute Rate By Company

The more time you spend behind the wheel the greater your chances of being in an accident are. This is why car insurance companies consider the length of your commute when setting your rates.

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

Take a look at the table below to see what your annual commute rate could end up costing you.

| COMPANY | 10 MILES COMMUTE. 6000 ANNUAL MILEAGE. | 25 MILES COMMUTE. 12000 ANNUAL MILEAGE. |

|---|---|---|

| Allstate | $4,086.25 | $4,979.93 |

| Farmers | $4,535.69 | $5,462.84 |

| Geico | $2,621.93 | $3,150.55 |

| Liberty Mutual | $2,786.10 | $3,284.23 |

| Nationwide | $4,108.79 | $5,198.37 |

| Progressive | $2,587.19 | $3,115.09 |

| State Farm | $4,049.89 | $4,355.54 |

| Travelers | $3,014.07 | $3,687.49 |

| USAA | $2,482.96 | $2,906.28 |

The data demonstrates how having a shorter commute rate could save you money on car insurance no matter which provider you choose.

How far you drive is not the only thing that can have an impact on your car insurance rates.

The amount of coverage that you choose to purchase will also help in determining how much your car insurance policy will cost you in California.

Coverage Level Rate By Company

It goes without saying that the more coverage that you purchase the higher the price you will pay for your car insurance policy. Take a look to see what we mean.

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $4,287.09 | $4,572.72 | $4,739.46 |

| Farmers | $4,651.83 | $5,038.58 | $5,307.39 |

| Geico | $2,612.92 | $2,918.49 | $3,127.30 |

| Liberty Mutual | $2,824.01 | $3,061.95 | $3,219.54 |

| Nationwide | $4,179.52 | $4,734.55 | $5,046.66 |

| Progressive | $2,555.04 | $2,936.65 | $3,061.73 |

| State Farm | $3,793.44 | $4,273.41 | $4,541.30 |

| Travelers | $2,924.52 | $3,440.36 | $3,687.46 |

| USAA | $2,445.05 | $2,746.50 | $2,892.32 |

A higher price shouldn’t be the only deciding factor when it comes to choosing how much car insurance coverage you will need.

You should also consider the age of your car, the cost of replacement parts, and how many assets you are trying to protect outside of your person and your automobile.

Credit History Rates By Company

Consumer Reports released a report in 2015 which came as a shock to a lot of people.

The report revealed that:

Your credit score could have more of an impact on your premium price than any other factor.

That is true of most states except California anyways because, in California, the law prohibits the use of your credit score as a factor for determining your car insurance rates.

If U.S. Representative Rashida Tlaib gets her way then all Americans might enjoy this luxury as well.

Just because it is illegal to use your credit score as a factor in setting your car insurance rates within the state of California doesn’t mean that there aren’t some benefits to keeping your eye on your credit report.

This is especially true in California where, according to Experian, the average credit score is 680.

You have the right to one free credit report from each of the three major reporting agencies every 12 months.

These credit reporting agencies are:

- Experian

- Equifax

- TransUnion

Having a good credit score could save you money on everything from the interest rates that you pay on your credit cards to the total cost of that new home that you have had your eye on for a while.

Driving Record Rates By Company

While your credit score may or may not impact your car insurance rate, your driving record definitely does.

Take a look at the table below to see just how much jus a slight bit of carelessness behind the wheel could end up costing you.

| Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| Allstate | $2,728.84 | $3,582.21 | $7,223.45 | $4,597.86 |

| Farmers | $3,697.25 | $4,998.06 | $6,268.29 | $5,033.47 |

| Geico | $2,018.18 | $2,503.62 | $3,908.23 | $3,114.92 |

| Liberty Mutual | $2,634.50 | $2,791.65 | $3,185.41 | $3,529.11 |

| Nationwide | $3,246.63 | $4,162.31 | $7,043.06 | $4,162.31 |

| Progressive | $1,865.51 | $2,687.54 | $3,680.03 | $3,171.49 |

| State Farm | $2,998.34 | $3,480.06 | $6,756.08 | $3,576.40 |

| Travelers | $2,234.04 | $3,290.14 | $4,234.85 | $3,644.10 |

| USAA | $1,790.02 | $1,960.95 | $4,363.10 | $2,664.41 |

As you can see from the data you can see that if you have a tendency to have a lead foot then USAA might be the best company for you.

If you find yourself involved in a car accident though then Liberty Mutual might be the better option.

Driving records are like credit scores as well which means that you should check your driving record for discrepancies from time to time to make sure that you won’t be overcharged for car insurance based on past mishaps.

The Golden State provides you with an easy way to request a copy of your driving record through its online portal.

Largest Car Insurance Companies in California

Monitoring your driving record is just one way to ensure that you are getting the best price on car insurance.

Knowing who the largest car insurance companies in your area are, and understanding what that means to you is another.

The data collected below can help you get started by showing you just how much of the market each of the ten largest companies in the Golden State holds.

| Largest Company | Direct Premiums Written | Market Share |

|---|---|---|

| Allstate Insurance | $2,446,564 | 8.97% |

| Auto Club Enterprises Insurance | $2,312,230 | 8.48% |

| CSAA Insurance | $1,950,257 | 7.15% |

| Farmers Insurance | $3,158,814 | 11.59% |

| Geico | $2,502,854 | 9.18% |

| Liberty Mutual | $929,058 | 3.41% |

| Mercury General | $2,095,531 | 7.69% |

| Progressive | $1,147,186 | 4.21% |

| State Farm | $3,910,351 | 14.34% |

| USAA | $1,218,792 | 4.47% |

As you can see, State Farm holds the largest portion of the market share in California.

According to Investopedia, “market share represents the percentage of an industry, or a market’s total sales, that is earned by a particular company over a specified time period.”

The more sales that a car insurance company makes the more financially stable it is and financially stable car insurance companies are more likely to settle claims in a hurry.

Number of Insurers by State

The Golden State has 99 domestic insurance providers and 671 foreign ones. This means that you have 770 car insurance providers to choose from when shopping for your car insurance policy in the great state of California.

The difference between a foreign or domestic insurer, simply stated, is that:

- A Domestic Insurer is one that has been formed under the laws of the state of California

- A Foreign Insurer is one that has been formed under the laws of any state, district, territory, or commonwealth of the United States other than the state of California.

Both of these types of insurers must follow all of the laws that govern the car insurance industry in the Golden State

Whether you choose to go with a domestic or foreign insurer you will still need to understand the laws that these insurers must follow. We are here to help you with that by providing you with a brief overview of these laws in the next section.

California Laws

The first thing that mist drivers become concerned with once the dust settles after an accident is how the laws that govern car insurance will pertain to them.

For example, understanding things such as whether or not you are required to fix a cracked windshield that resulted from the accident and how much of that repair will be covered by your car insurance policy can go a long way towards lowering your frustration levels when filing a claim.

Understanding how fixing that cracked windshield might impact your rates can also help prevent any nasty billing surprises after the repair has been made.

Cracked windshields are just one of the many things that might an extra effort on your part. If you get a DUI you might also be required to get a SR-22.

All of this sounds confusing, right? Not to worry. We are here to help you sort through all of the red tape and make repairs, filing extra forms, or getting that cracked windshield a bit easier n you. Keep reading to find out more.

California Car Insurance Laws

We told you in a previous section that there are minimum state requirements when it comes to the least amount of coverage that you must carry in order to be in compliance with California’s compulsory insurance law.

California doesn’t just stop at requiring that all licensed drivers carry a minimum amount of liability coverage on their registered vehicle though.

The Golden State also has a good deal of safety and licensing laws that are meant to keep every resident of California safer when on the roadways.

You can do your part as a responsible driver by being aware of what these laws are and following them at all times when you are behind the wheel. That starts by understanding how state laws are determined.

How State Laws For Insurance Are Determined

Whether they are state or federal, all laws begin their life as a bill that has been introduced by a member of the legislating body.

These bills then pass through several committees and sub-committees and undergo a variety of studies as lawmakers seek to understand just how beneficial the proposed law might be to protecting the common good.

One of the most misunderstood aspects of California car insurance law concerns the grace period for notifying the DMV regarding any changes that you might make to your car insurance policy.

Simply put, there is a 30-day grace period for submitting your insurance information to the California DMV after you purchase a vehicle in the Golden State.

The California DMV also asserts that you must notify them before you cancel your policy in order to prevent your registration from being suspended.

If your vehicle is left disabled on the side of the road in the Golden State you must submit an affidavit of non-use to the California DVM as well.

Knowing when to notify the California DMV, and what you must notify them if, and what to notify the DMV of, are just two of the things that you should be aware of as a licensed driver in the Golden State.

There are also various safety laws that determine what is allowable on roads in California, and ignorance of the law will not get you out of the fines or penalties that you might be assessed f you violate one of them.

Windshield Coverage

Some of the safety laws that the California Legislature has passed a mandate that a driver’s field of vision remain unobstructed.

One such law is California Vehicle Code 26710 which makes it illegal to drive a car if it has a crack that prevents you from seeing down the road clearly.

The California Legislature recognizes that an immediate repair may not be possible for some people though which is why according to their website:

In the event any windshield or rear window fails to comply with this code the officer making the inspection shall direct the driver to make the windshield and rear window conform to the requirements of this code within 48 hours.

This means that you have 48 hours to have the repair done once you have been cited for it.

There is an exception to the laws that govern the requirement to have a windshield on your car at all. Pursuant to Section 5004, if the vehicle in question did not require a windshield at the time that it was first sold or purchased then it is exempt from the laws that govern proper windshield maintenance.

Be aware that if you get a ticket for a cracked or broken windshield, or you file a claim to have one repaired, your rates could be negatively impacted.

High-Risk Insurance

A ticket for a cracked or broken windshield is not the only thing that can raise your rates. Tickets for accidents, speeding, and DUIs can also end up costing you more for your car insurance policy.

The more tickets or accidents you have the better your chance of being labeled a high-risk driver becomes as well.

Getting a DUI in the Golden State could also mean that you will be required to obtain an SR-22.

This form is provided by your insurance company and it verifies you have met this state’s requirement with respect to auto liability insurance.

Once you obtain an SR-22 your car insurance provider will forward a copy of it to the DMV.

Residents of California who end up in the high-risk pool have a reprieve of sorts when it comes to purchasing car insurance. This reprieve is the California Automobile Assigned Risk Plan (CAARP)and this program makes it easier for high-risk drivers to find a policy that they can afford.

Residents of the Golden State who are having financial difficulty preventing them from finding a policy that they can afford can also find help from the State of California.

Low-Cost Insurance

The Golden State has a program called California’s Low-Cost Auto insurance policy (CLCA), and it can help low-income individuals find a plan that they can afford.

The requirements for qualification are:

- You must be 19 years old or older.

- Your gross household income cannot exceed 250 percent of the poverty level.

- You cannot have had had an at-fault accident with bodily injury or death within the past three years.

- You can have no more than one property damage only accident or moving violation in the past three years.

- The value of your vehicle cannot exceed $25,000.

According to NAIC the low-cost policy offered by the state of Califonia has the following limits:

- $10,000 in bodily injury protection for the injury/death of one person

- $20,000 in bodily injury protection for the injury/death of more than one person

- $3,000 in property damage coverage

The low-cost auto insurance program also offers the following additions to your policy for a charge of between $19-68 per person:

- $10,000 uninsured motorist bodily injury per person

- $20,000 uninsured motorist bodily injury per accident

- $1,000 medical payments per person

If you do not qualify for CLCA don’t panic. There are also a variety of discounts offered by various car insurance providers that could help you save a few dollars on your car insurance policy.

Some of these include safe-driver, good student, and military discounts so be sure to ask your agent about ones that you might qualify for.

Automobile Insurance Fraud in California

Part of shopping for your car insurance policy is being aware of your rights and responsibilities as a car insurance consumer.

You have the right to fair treatment under the law which is protected by things such as Proposition 103. You also have the responsibility to report honestly when filing a claim with your insurance provider.

Failure to make an honest report in an effort to receive a higher settlement award could result in a charge of fraud.

According to the California Department of Insurance (CDI):

Fraud occurs when someone knowingly lies to obtain a benifit or advantage to which they arenot otherwise entitled or someone knowingly denies a benifit that is due and to which someoe is entitled.

CDI handles cases of automobile fraud such as:

- Swoop and Squat-This is when one vehicle swerves in front of another vehicle so as to intentionally cause an accident.

- Backing-This occurs when one vehicle intentionally backs out in front of another causing an accident.

- Sudden Stop-When the car in front of you suddenly jams on its breaks so as to intentionally cause you to hit them as a means for collecting damages it is handled under this type of fraud.

- Phantom Vehicle-This occurs when a person crashes their vehicle and then claims it was the result f a second vehicle that fled the scene.

- And Medical Provider-This is what the CDI calls fraud perpetrated by a medical professional who intentionally inflates your bill.

This agency is also responsible for handling cases of automobile property damage fraud such as:

- Faked Damages-When you or a repair shop report exaggerates vehicle damages and/or pre-existing or non-existent ones the CDI pursues this type of fraud.

- Vehicle Theft-False claims of a vehicle or motor-home theft are considered vehicle theft fraud.

- Inflated Damages-This type of fraud occurs when the repair shop participates in excessive billing.

- Agent/Broker-If the agent or broker withholds payments that should be rightfully yours by means of backdating your policy ect. it falls under this type of fraud.

Anyone from your agent to the mechanic you entrust your repairs to after an accident can commit insurance fraud which is why it pays to keep track of all of your expenses and transactions.

Be aware that insurance fraud is a felony in the Golden State.

If you feel that you have been a victim of fraud you can file a Complaint of Suspected Insurance Fraud on the CDI’s website or by mail.

Just download the proper form fill it out, and mail it to the California Department of Insurance, Enforcement Branch Headquarters, Intake Unit, 9342 Tech Center Drive, Suite 100, Sacramento, CA 95826.

Statute of Limitations

Almost all laws have statutes of limitations. The laws that govern the proper time to file an insurance claim in California are no different.

The statutes of limitations on filing car insurance claims after an accident in the Golden State are as follows:

- For Personal Injury there is a two-year statute of limitations

- For Property Damage the statute of limitations is three years.

These time limits start on the day that the injury, loss, or damage was incurred.

State Specific Laws

Not all driving or safety laws in the Golden State seem to make sense. Case in point, the law that prohibits the hunt for wild game from a moving car. There is an exception to this law though.

Apparently it is perfectly legal to the hunt whales from your moving car if you can manage it.

In Eureka, CA it is illegal to use the road as a bed as well. Things aren’t all fun and games in the California State House though.

The California Court of Appeal upheld key components of the California Fair Claims Settlement Practices Regulations on September 20, 2018, and with its ruling, it “affirmed that the California Insurance Commissioner has the authority to penalize insurers for engaging in improper claim settlement practices based upon even a single act of misconduct.”

This ruling protects consumers like you when it comes time to settle out your car insurance claim.

Vehicle Licensing Laws

Now that you are starting to understand some of the more confusing aspects of car insurance and safety laws in the Golden State you are probably wondering about some of the more common ones.

Most of these laws revolve around registering your vehicle. In order to do so in the state of California you must adhere to the following rules:

- You must complete the Application for Title or Registration.

- If the vehicle is from out-of-state then the out-of-state title must be presented.

- You must also provide the vehicle’s out-of-state registration.

- Proof of insurance is also required.

- A valid Smog Certificate must be presented as proof that the vehicle meets with California’s vehicle emissions standards.

- You must also pay a $46 registration fee and a $23 California Highway Patrol fee.

Once a vehicle is registered you might be able to renew your registration online thereafter.

California has requirements for getting your driver’s license as well. To apply for one you must present the following to the California DMV:

- Proof of Identity

- Proof of true full name (such as marriage license or adoption documents)

- Social Security Number

- and two Residency Documents

Once you have provided the DMV with all of the proper paperwork you must then pass the road and vision test.

Real ID

The State of California also participates in the Real ID program.

Passed by Congress in 2005, the REAL ID Act established minimum security standards for state-issued driver’s licenses and identification cards and prohibits Federal agencies from accepting for official purposes licenses and identification cards from states that do not meet these standards.

The State of California has put together a video walkthrough of the process to make it easier for residents of the Golden State to obtain a Real ID.

https://www.youtube.com/watch?v=eIMqo2hghSE&feature=youtu.be

The California DMV has a Real ID Checklist tool on its website that can help you make sure that you have everything that you need when you come to apply for your Real ID.

Penalties For Driving Without Insurance

While the choice to obtain a Real Id is entirely up to you, the choice to maintain your car insurance in the state of California is completely out of your hands.

If you register a vehicle in the Golden State then you must maintain continuous coverage on that vehicle or you will be penalized.

If you are caught driving without car insurance you could face a fine of between $100 to $200 for your first offense.

Getting into an accident without car insurance could also result in the loss of your license for up to four years and you could also be required to obtain an SR22 Proof of Financial Responsibility.

Why take the risk when purchasing the right amount of car insurance coverage at a good price is as easy as finishing this article and getting a few quotes to find the best deal?

Teen Driving Laws

Just like the laws that govern the amount of coverage you have, how to register your vehicle, and how to obtain your regular driver’s license there is also a specific set of laws aimed at teenaged drivers in California.

These laws begin by setting age requirements for each stage of the graduated licensing program in the Golden State.

At age 15 1/2, teenagers in California become eligible to apply for their Provisional Permit. In order to do so the teenager must come to the DMV with the following:

- A parent or legal guardian

- Their birth certificate

- Their social Security Card

- And proof of residency

The teenager will then take their traffic law, road sign, and vision tests and complete a one-hour training session with an instructor.

The teen must also log 50 hours of practice driving with a parent, guardian, spouse, or any other driver who is over the age of 25 and licensed to drive in California.

The next stage for the Teenaged driver in the Golden State is the Provisional License which requires:

- The driver to be 16 years of age

- Have completed 50 hours of practice, including 10 hours at night

- And have completed driver education and formal behind-the-wheel training

The teenaged driver must also pass the road test administered by the DMV.

Once this is done the teen driver can drive alone with a few restrictions which include:

- No driving between 11 p.m. and 5 a.m. for the first six months

- No transporting passengers under the age of 20 unless accompanied by a licensed driver over 25 years of age

The teenaged driver must also maintain a clean driving record and is not allowed to use any hand-held devices while operating a motor vehicle.

At age 18 the teenager becomes eligible for a Full License so long as there are no suspensions of other court-ordered restrictions attached to their driving record.

Older Driver License Renewal Procedures

Teenaged drivers are not the only ones who have a specific set of laws that pertain to their licensing requirements.

Older drivers also have restrictions when it comes to renewing their licenses.

One of these restrictions pertains to the renewal process that older drivers must face.

In the Golden State, the general population is required to renew their license every five years and can do so by mail or online for up to two consecutive cycles according to the Insurance Institute for Highway Safety (IIHS).

While older drivers are also required to renew their driver’s license every five years they are not permitted to do so online or by mail if they are over the age of 70.

This age limit is meant to protect both the general population and the older drivers who may have a hard time letting go of the keys when it comes time.

New Residents

The California DMV has dedicated an entire page just to new resident information.

This page tells you how to apply for everything from a CDL to your disabled placard.

The California DMV also has an extensive section on how to obtain your California driver’s license.

As a new resident, you will be required to present all of the same credentials that you would if you were a life-long resident. Some of these credentials include:

- Your Social Security number

- Your full true name

- Residency documents

- And verification of your identity

You must also fill out the Driver License or Identification Card Application and pay the application fee.

After the proper paperwork is handled you can then take the road test along with the vision and road sign test.

The California DMV notes that:

If you have a DL from another country, you will be required to take a driving test. If you have a DL from another state, the driving test may be waived.

Once your paperwork and tests have been completed you will be issued a 90-day interim license while your official license is being processed and mailed to you.

License Renewal Procedures

If you are eligible you can renew your California driver’s license when the time comes.

To renew your California driver’s license simply visit the California DMV website.

If online isn’t your thing then you can opt into renewal by mail.

Just complete the California Driver’s License By Mail Eligibility Form and send it with a check for the renewal fee to: The Department of Motor Vehicles, ATTN: Renewal By Mail, PO Box 942890, Sacramento, CA 94290-0001

You can also renew your driver’s license in person by visiting your local California DMV office.

Negligent Operator Treatment System

In the Golden State, the Negligent Operator Treatment System is a point system.

These points, also known as ‘negligent operator points’, and they generate a series of warning letters and sanctions as points are added to your license.

The state of California considers you a negligent operator when your driving record reflects the point counts as follows:

- Four points in a 12 month period

- Six points in a 24 month period

- EIght points in a 36 month period

Points can be accrued for such infractions as:

- Speeding – one point

- Running a red light – one point

- Reckless driving – two points

- DUI – two points

Parking tickets, fix-it tickets, and talking or texting while driving does not put points on your license but it is still a good idea to keep your car in good working order, your hands on the wheel, and your eyes on the road.

Rules of the Road

From New York to California, every state has its own rules of the road and knowing what they are in the Golden State could help you avoid the receipt of any negligent operator points.

Understanding the driving laws in California can also make it easier for you when shopping for your car insurance policy.

Keep scrolling to find out all of the information you need to know to save money on car insurance.

Fault Vs. No-Fault

The first thing that any driver should know when it comes to car insurance is whether their state is a fault or no-fault state.

As a resident of California, you are living in a fault (or tort) state.

This means that after an accident the person who is deemed to be at fault is the one who bears the financial responsibility for all of the damages or injuries that were the result of the crash

This is why what you do and say at the scene of a car accident is very important.

Never admit fault to the other party or any officials who might be attending the scene.

You will also want to take pictures of the scene if you can and make sure that you collect as much information from witnesses and any others who are there before you leave.

The more you know and the less you say at an accident the better your chances become of have less trouble when it comes time to settle out your claim.

Seatbelt and Car Seat Laws

Whether you live in an at-fault state like California or a no-fault state like the residents of Florida, there are some laws that cross every state line. Seat belt and car seat laws are among these.

In the state of California, anyone over the age of 16 must wear a seat belt while riding in a motor vehicle no matter which position they are sitting in. Not doing so is considered a primary offense which means that law enforcement does not need another reason to pull you over and ticket you.

The maximum penalty for a first-time offense of an adult not wearing their seatbelt is $20.

California also mandates that if a child is younger than 2 years of age, less than 40 pounds and/or is under 40 inches they must be in a rear-facing infant car seat.

In the Golden State, children under 7 years of age who are less than 57 inches tall must also be seated in an appropriate child restraint system but children between the ages of 8-15 years of age or those who are over 57 inches tall may use an adult seat belt.

All children under 7 years of age who are under 57 inches in height must be in the back seat and failure to comply with child seat laws in the Golden State will result in a minimum of a $100 fine.

Riding in the cargo area of pickup trucks is against the law unless the person is restrained by a restraint system that has been federally approved.

Farm vehicles also have a few exceptions to this restriction such as if they are “used exclusively within farming land or one mile of highway between one part to another.”

Keep Right and Move Over Laws

According to the California Legislature, if you are driving below the speed limit or less than the normal speed of the moving traffic you must keep to the right.

Keeping right doesn’t just keep traffic flowing and prevent traffic jams, it also helps prevent traffic accidents since most incidents occur when people are changing lanes.

California also has Move Over/Slow Down Law which states that:

When approaching emergency vehicles, tow trucks, or Caltrans vehicles displaying emergency or amber flashing lights, motorists are to move over to a lane not adjacent to the emergency vehicles or vehicle.

If this can not be done safely by the driver then they must reduce their rate of speed to a reasonable rate given the weather or road conditions.

Moving over and slowing down when approaching emergency or state vehicles that are working on the side of the road could save a life.

Speed Limits

Currently there is a bill being proposed by California State Senator John Moorlach that would create two new lanes on two of the state’s major highways.

If the bill goes through it remove the speed restrictions from these two new lanes making it possible for drivers to go as fast as they wanted to when traveling in them.

Opponents of the bill fall on conventional wisdom that states that speed kills, but it may not be as simple as that.

Those who support the bill cite successes in Nevada and Montana which were the last hold-outs in the United States when it came to passing speed restrictions.

For the moment though there are speed limits in California, and they are generally as follows:

- On a multilane freeway-65 MPH with some exceptions of 70 MPH

- On two-lane highways-55 MPH

- On city streets-35 MPH

- In school zones-25 MPH

these speed limits are applicable to every driver on the California roadways no matter where they are from or what type of vehicle they are driving.

Ridesharing

As the first state to regulate Transportation Network Companies (TNC), California is carving the pathways of the future when it comes to rideshare laws.

Some of the regulations that California has placed on TNCs in the Golden State include:

- The requirement that the TNC obtain a license from the CPUC to operate in California

- A zero-tolerance policy for drug and alcohol infractions

- The establishment of driver training programs

Existing laws in the Golden State also prohibit TNCs from employing people who have been convicted of:

- Sex Offenses

- Violent felonies

- Acts of terror

- Or misdemeanor assault or battery, domestic violence or DUI/drugged driving offenses in the last 7 years

Both the roads and the passengers are safer thanks to California’s approach to TNCs.

According to NOLO:

Carriers can’t offer contingent liability insurance.

This means that California drivers who want to drive for rideshare companies must either purchase a commercial policy or a rideshare endorsement for their current personal policies.

California has also recently passed a new law that may negatively affect rideshare drivers.

This new law will classify most rideshare drivers as independent contractors

The new law will result in the majority of rideshare drivers being classified as employees rather than independent contractors. As such rideshare drivers would be required to have commercial coverage.

Automation on the Road

It is hard to buy a car without some type of automation or crash avoidance system these days.

The future is now and everything from back-up cameras to proximity warnings and even driverless cars are now a reality.

Since 2018 California’s DMV has had regulations on autonomous vehicles as a result.