Michigan Car Insurance 101 (Compare Costs & Companies)

Drivers looking for information on Michigan car insurance 101 should know that all Michigan drivers need Michigan liability insurance to drive legally. Liability car insurance in Michigan is an average of $99/mo, while drivers who chose Michigan full coverage insurance pay an average of $229/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Average Michigan car insurance rates are much higher than the national average

- Minimum liability car insurance in Michigan is an average of $99 per month

- Full coverage car insurance in Michigan is an average of $229 per month

Because Michigan car insurance rates are so expensive, Michigan drivers need to take the time to shop around to find affordable car insurance in Michigan. Our Michigan car insurance 101 guide goes over how to save on Michigan auto insurance, from the best companies to the best discounts, so read on.

If you want to find cheap Michigan car insurance today, use our free quote comparison tool. It will compare Michigan car insurance quotes from companies in your area, helping you quickly find affordable Michigan car insurance.

Michigan Car Insurance Coverage and Rates

You probably know that Michigan is a leading producer of American cars. But did you know that the Great Lakes State is also a manufacturing powerhouse in the production of cereals, machine tools, airplane parts, and many other goods? Or that it’s home to some of the finest universities in the United States?

As the state is fond of saying about itself now, that’s all Pure Michigan.

There will be car insurance requirements no matter what state you call home, and insurance companies charge different premiums depending on what state you live in, as we’ll soon see.

But don’t worry. We’re here to help you through the entire process by providing the information you need to choose the right car insurance provider for you.

Keep reading to find out about the minimum car insurance requirements in Michigan and how we can help you get the best deal possible.

Michigan’s Car Culture

Michiganders have a lot of reasons to drive. Just check out the video below to see one of the state’s most scenic routes.

- Best Cheap Car Insurance Companies

- Affordable Car Insurance Rates in Ypsilanti, MI (2025)

- Affordable Car Insurance Rates in Warren, MI (2025)

- Affordable Car Insurance Rates in Troy, MI (2025)

- Affordable Car Insurance Rates in Standish, MI (2025)

- Affordable Car Insurance Rates in Southfield, MI (2025)

- Affordable Car Insurance Rates in Norway, MI (2025)

- Affordable Car Insurance Rates in Muskegon, MI (2025)

- Affordable Car Insurance Rates in Monroe, MI (2025)

- Affordable Car Insurance Rates in Melvindale, MI (2025)

- Affordable Car Insurance Rates in Ludington, MI (2025)

- Affordable Car Insurance Rates in Lambertville, MI (2025)

- Affordable Car Insurance Rates in Kentwood, MI (2025)

- Affordable Car Insurance Rates in Hudsonville, MI (2025)

- Affordable Car Insurance Rates in Farmington Hills, MI (2025)

- Affordable Car Insurance Rates in Escanaba, MI (2025)

- Affordable Car Insurance Rates in Cadillac, MI (2025)

- Affordable Car Insurance Rates in Ann Arbor, MI (2025)

- Affordable Car Insurance Rates in Alma, MI (2025)

https://www.youtube.com/watch?v=WKZZr0BqDqk

According to The Hartford, “Detroit is synonymous with the U.S. auto industry – and the state of Michigan as a whole owes a great deal of its modern culture and infrastructure to the automakers who call the state home.

But as much as Michiganders are justly proud of the long history of automotive innovation and development in their state, driving in the Wolverine State presents certain unique challenges.”

The state’s car culture also includes the popular Detroit Auto Show (also known as the North American International Auto Show), Ann Arbor’s annual vintage car festival, and the beloved Henry Ford Museum.

Let’s take a look at the minimum car insurance you need in the great state of Michigan.

Michigan Minimum Coverage

Like almost all states, Michigan has minimum state requirements when it comes to the coverage that drivers are required to carry on their vehicles. In the Wolverine State, you need to have at least the following coverage as part of your car insurance policy:

- $20,000 for bodily injury or death of one person in an accident caused by the owner of the insured vehicle

- $40,000 for total bodily injury or death in an accident caused by the owner of the insured vehicle

- $10,000 for property damage per accident caused by the owner of the insured vehicle

Michigan is one of 12 no-fault states. According to The Hartford, this means “that a driver must carry insurance for their own protection, and that driver is limited in terms of whether they can sue another driver in the event of an accident. With the no-fault system, if you are involved in a car accident, even if it is clearly not your fault, you will file a claim with your insurance company for damages.”

“Unfortunately,” The Hartford goes on to explain, being a no-fault state also “means that good drivers with bad luck may be facing higher premiums if another car causes a crash.”

Knowing that you could be held financially responsible for any and all damage that you cause if you are ever involved in an accident might scare you. But having the right car insurance provider in your corner can help ease these fears.

Forms of Financial Responsibility

What is financial responsibility? Basically, financial responsibility is proof that you have Michigan’s minimum liability coverage.

Michigan law requires every driver to have proof of financial responsibility with them at all times.

In Michigan, the only acceptable form of financial responsibility is car insurance.

Except for people who happen to own a fleet of 25 vehicles or more – when you can apply for self-insurance – every driver must buy an insurance policy. In case of an accident or a traffic stop, present a paper copy of your proof of insurance — usually your company-issued insurance ID card — or prepare to show it electronically.

You can buy a policy with a limited term of at least six months, however, bear in mind that driving without insurance can lead to penalties, which we’ll cover later.

Premiums as Percentage of Income in Michigan

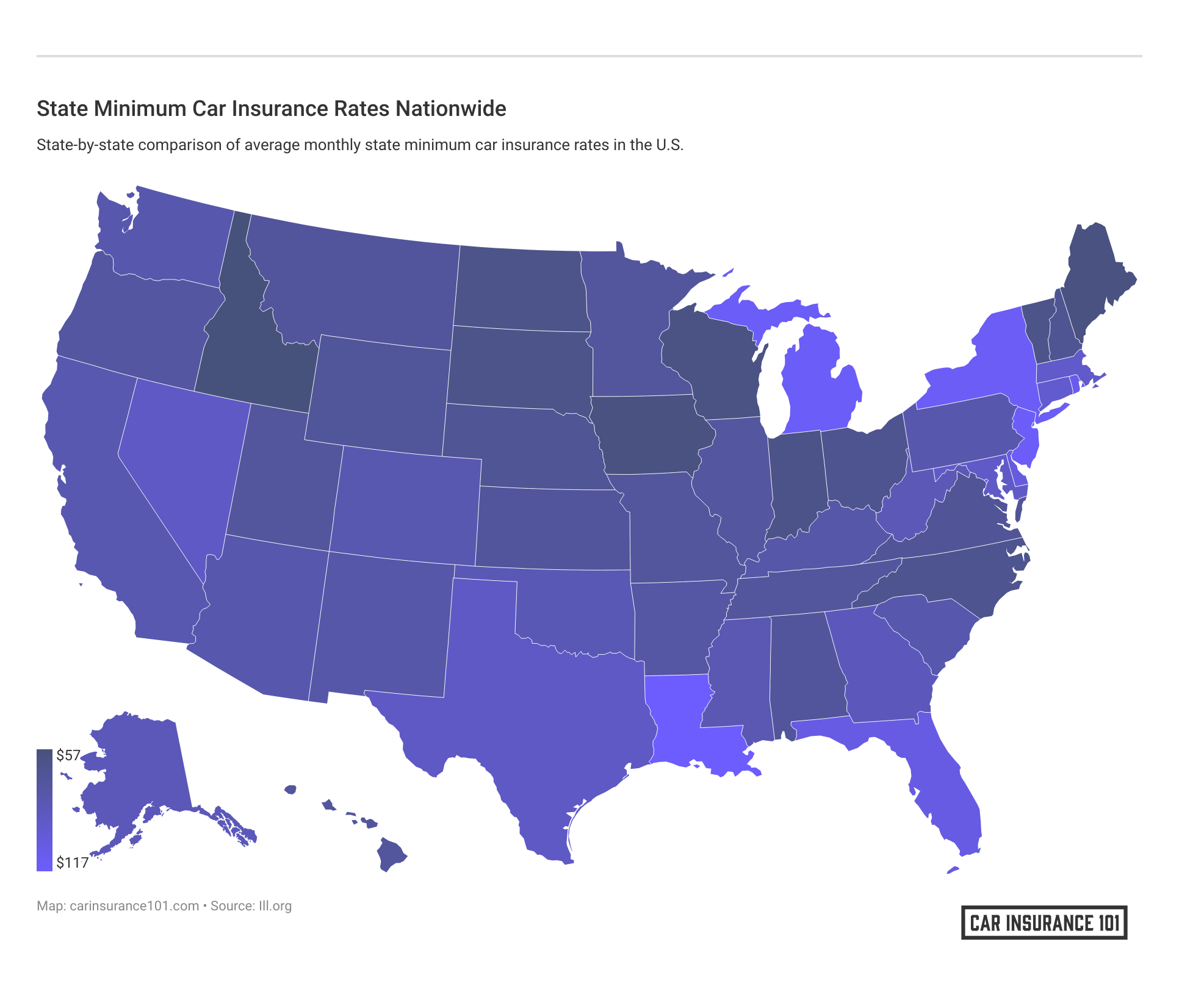

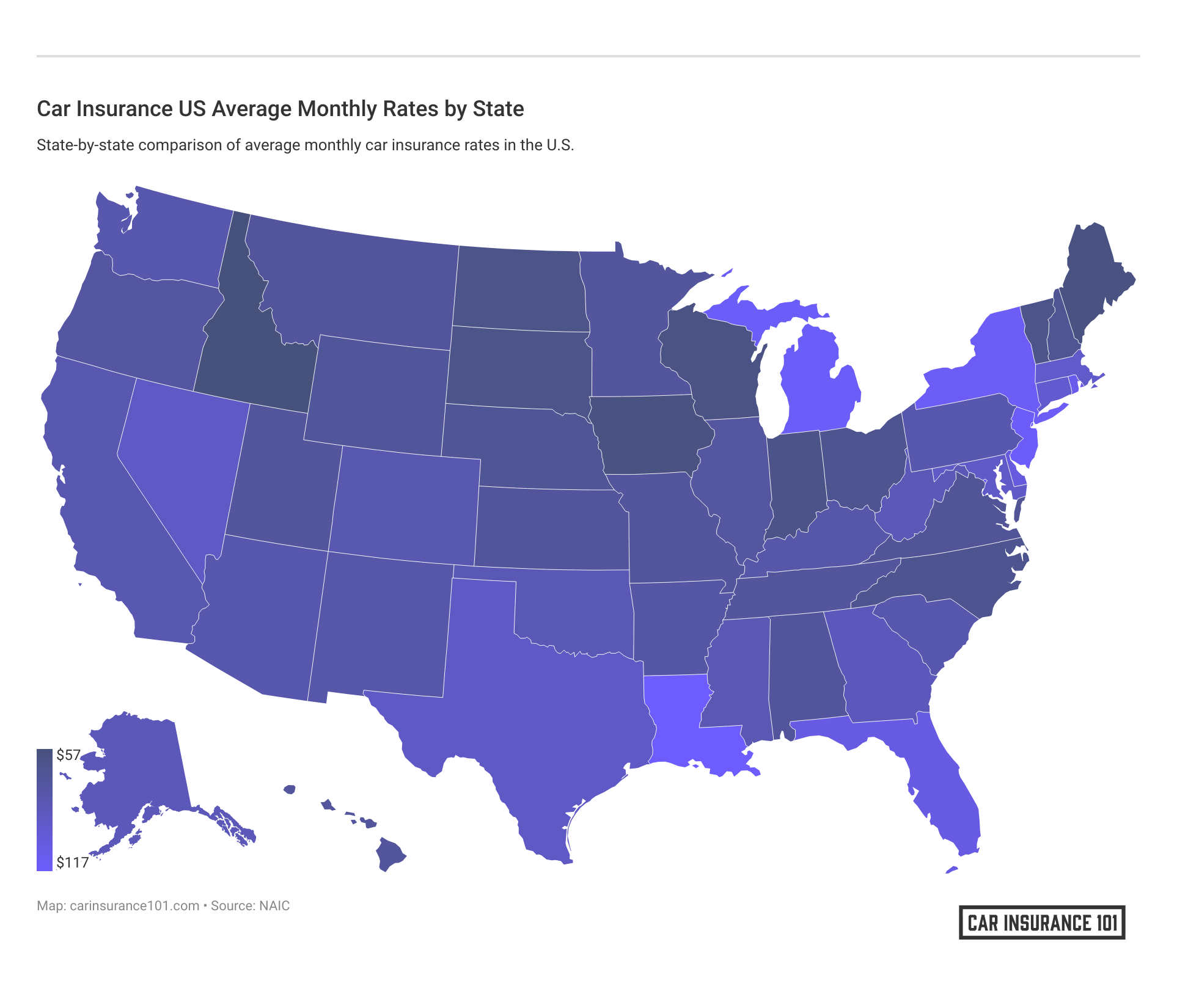

Our research shows that Michiganders pay more than their neighbors and the national average for insurance. The table below shows how much of their disposable income they paid for car insurance in 2012 and 2013. And you should note: premiums have risen since then.

| Year | Average Full Coverage Premium | Insurance as a Percent of Income |

|---|---|---|

| 2013 | $1,264.20 | 3.63% |

| 2012 | $1,171.94 | 3.37% |

The annual per capita disposable income in Michigan — the money individuals have available to spend after taxes — is $36,419, which works out to roughly $3,034.92 a month. The average annual car insurance premium is $1,350.58, or $112.55 a month. Michiganders currently spend an average of 3.71 percent of their disposable income on car insurance.

These rates are higher than the national average of 2.37 percent, and the averages of border states Ohio, Indiana, and Wisconsin. Residents in those three states also pay roughly $600 less in annual insurance premiums than the average Michigan driver.

But no matter what the national average expenditure is, all Michigan residents like to save money whenever possible. This is why it is so important to shop around and to come to your shopping armed with the best information on car insurance. Use the handy calculator below to figure out what percent of your income might go to car insurance premiums.

CalculatorPro

Average Monthly Car Insurance Rates in MI (Liability, Collision, Comprehensive)

Do you know what your options are as a car insurance consumer? Part of getting the best deal on car insurance is understanding the types of coverage being offered.

The table below contains the three most purchased types of coverage and the average annual price that your fellow Michiganders pay for each, plus the total cost for all three compared to the national average.

| Coverage | Average Annual Premium in Michigan | National Average |

|---|---|---|

| Liability | $795.32 | $538.73 |

| Collision | $413.83 | $322.61 |

| Comprehensive | $154.85 | $148.04 |

| Total | $1,364.00 | $1,009.38 |

Liability coverage is the type of coverage that the state requires as part of its minimums. This type of coverage will cover any damage that you do to another party’s person or property if you are ever involved in an accident.

Liability will not pay for your injuries or damages, though. That’s where collision and/or comprehensive come in.

Generally speaking, collision will pay for your damages and injuries if you hit another object, and comprehensive will pay out if your car is vandalized, stolen, or damaged by an act of nature, such as flood or mudslide.

When liability, comprehensive, and collision are combined in one policy you are considered to have full coverage.

If you take time to understand the types of coverage, and just how much of each type you need before you go shopping for your car insurance policy, you can save yourself a lot of frustration later.

Additional Liability

Anything above the insurance minimums explained above is optional in Michigan. But remember, stronger coverage can help you avoid financial hardship should bills stack up after an accident on one of Michigan’s many miles of roadways.

Sure, with so much required minimum liability coverage, you might wonder why you still need to protect yourself from an uninsured motorist.

But note: Michigan has the fourth highest number of uninsured motorists in the United States.

So how do you know if a car insurance company is good for you? Knowing a company’s loss ratio can help you determine if they can provide the car insurance you need.

But wait, you’re probably wondering, what the heck is a loss ratio?

A loss ratio simply shows how much an insurer spends on claims compared to how much they receive in premiums.

Here’s an example: if a company spends $700 in payouts for claims for every $1,000 they receive in premiums, they have a loss ratio of 70 percent.

Loss ratios over 100 percent mean an insurer is losing money. But it’s also important to note that abnormally low loss ratios mean a company isn’t paying out much in claims, which could mean they don’t have the best customer service.

If that still doesn’t make sense, this short video provides a good overview of loss ratios.

For 2017, the National Association of Insurance Commissioners (NAIC) found the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is a bit lower than this 2017 average, between 60 and 70 percent.

What else can you do to protect yourself and your assets if you’re involved in a car accident? In the following section, we’ll cover some great extras you can usually easily add to your existing or new car insurance policy.

Add-Ons, Endorsements, and Riders

Many car insurance providers offer a variety of add-ons, endorsements, and riders to help protect you and your vehicle in the case of an accident or another vehicular incident.

Some of the options available to you are:

- Guaranteed Auto Protection (GAP) – If your car is ever totaled or stolen, GAP will pay any money that remains owed on the lease or loan.

- Personal Umbrella Policy (PUP) – When your liability limits have been reached, PUP kicks in to help protect you from lawsuits that may result from an auto accident.

- Rental Reimbursement – If your car is in the shop due to a traffic incident, rental reimbursement will help you pay the costs of renting a car until your repairs are finished.

- Emergency Roadside Assistance – If your car breaks down or you have a flat, this addition to your policy will help you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance – If you need repairs that were not caused by an accident, then this type of coverage is for you.

- Non-Owner Car Insurance – This type of coverage is perfect for you if you don’t own a car but still drive on occasion; it provides you with limited liability coverage even if the car you’re driving isn’t registered to you.

- Modified Car Insurance Coverage – This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance – Specially designed for classic cars, this type of coverage helps ensure that if something happens to your prized possession, you will both be well protected.

- Pay-As-You-Drive or Usage-Based Insurance – This type of coverage is specially designed for you based on information collected by your car insurance provider regarding your speed, distance traveled, and other such factors.

Personal injury protection, or PIP, might be a good option for you, too. PIP, often referred to as “no-fault insurance,” covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

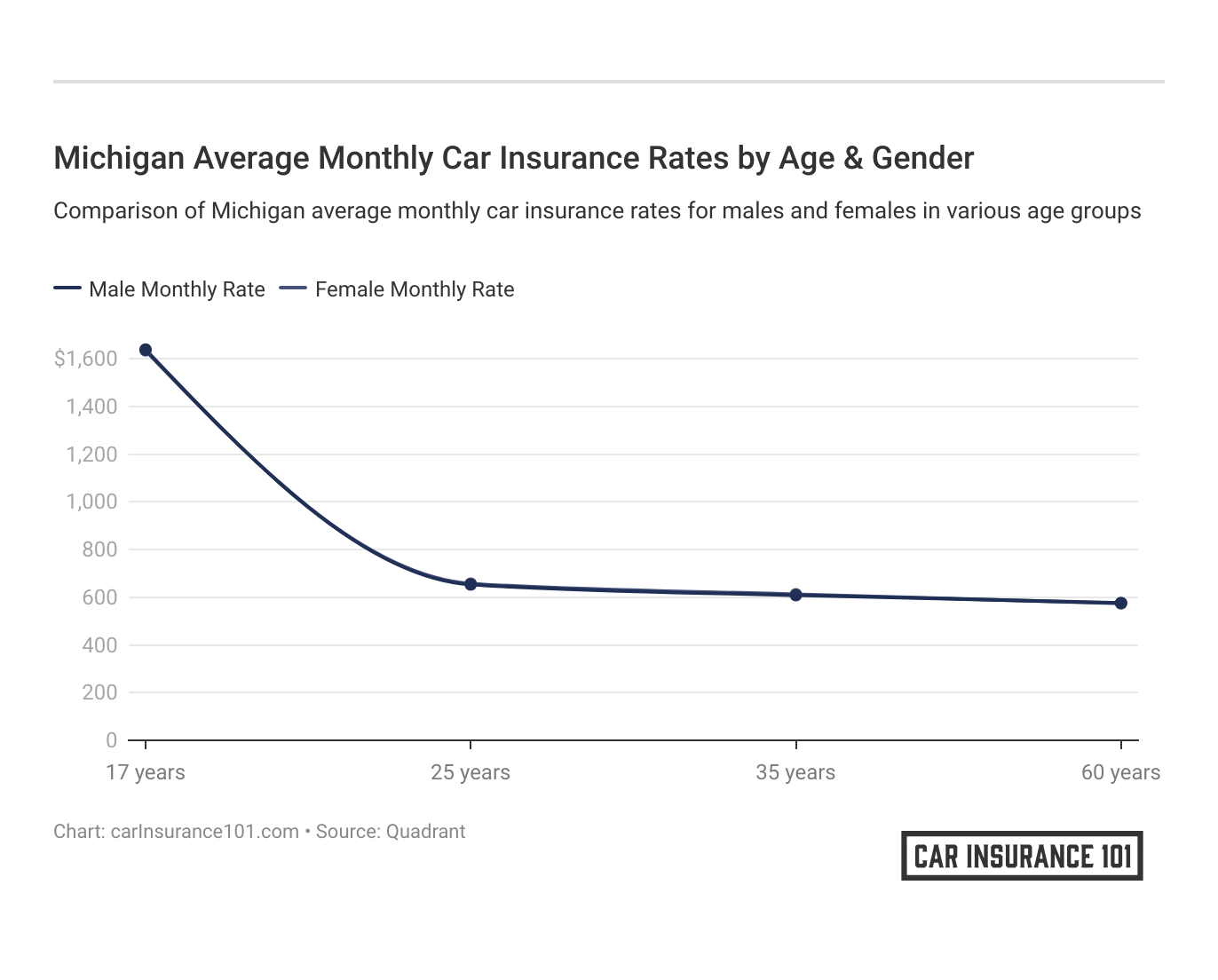

Male vs. Female Rates

Though Michigan is not one of the six states to ban gender discrimination in car insurance premiums, gender is less of a factor than age and marital status.

As you can see in the table below — which offers average premiums for Michiganders of various demographics — teenagers almost always pay more than older drivers.

| Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $41,309.06 | $41,309.06 | $17,646.81 | $17,646.81 | $16,754.82 | $16,754.82 | $15,575.00 | $15,575.00 |

| Farmers | $13,831.87 | $13,831.87 | $7,104.64 | $7,104.64 | $6,307.90 | $6,307.90 | $5,856.52 | $5,856.52 |

| Geico | $12,291.51 | $12,291.51 | $4,252.21 | $4,252.21 | $4,453.35 | $4,453.35 | $4,533.10 | $4,533.10 |

| Liberty Mutual | $35,157.81 | $35,157.81 | $14,880.96 | $14,880.96 | $14,880.96 | $14,880.96 | $14,732.64 | $14,732.64 |

| Nationwide | $11,785.55 | $11,785.55 | $4,907.85 | $4,907.85 | $4,477.30 | $4,477.30 | $3,979.03 | $3,979.03 |

| Progressive | $11,516.82 | $12,259.07 | $3,676.55 | $3,393.23 | $3,156.54 | $2,932.15 | $2,785.12 | $3,113.99 |

| State Farm | $26,491.15 | $26,491.15 | $8,869.85 | $8,869.85 | $7,556.15 | $7,556.15 | $7,010.11 | $7,010.11 |

| Travelers | $17,631.16 | $17,631.16 | $6,344.88 | $6,344.88 | $5,839.83 | $5,839.83 | $5,012.52 | $5,012.52 |

| USAA | $6,472.15 | $6,145.20 | $3,229.01 | $3,095.85 | $2,649.82 | $2,508.37 | $2,491.74 | $2,352.36 |

Cheapest Rates By ZIP Code

Did you know that car insurance rates vary not only by what state you live in but also by where you live in your state?

It’s true, especially in a state like Michigan with such a wide urban-rural divide.

The cheapest car insurance rates in Michigan can be found in ZIP code 48880, which encompasses the city of St. Louis, Michigan, a small town directly north of the state capital of Lansing. Residents of 48880 pay an annual average of $7,916.29 for their car insurance.

Where are the state’s most expensive annual premiums? Those can be found in 48201, or Midtown Detroit. Residents there pay a whopping $30,350.09 on average for their car insurance each year.

How Much Car Insurance Rates in Michigan

Explore the diversity in car insurance rates across various cities in Michigan. Choose your city from the options provided to grasp the intricacies of insurance costs in your locality.

Best Michigan Car Insurance Companies

How do you find the best car insurance company for your needs?

From company financial ratings to rates for drivers of various histories, you’ll want to consider the pros and cons of each insurer.

In the sections below, we’ve compiled the best car insurance companies in Michigan by key factors you need to know.

The Largest Companies’ Financial Ratings

A good insurance company has the ability to financially cover its customers. That’s why considering financial ratings is important.

AM Best ranks America’s insurance companies by financial solvency. What does it mean for a company to receive a high grade? This video explains their methodology and meaning well.

The table below provides AM Best’s financial ratings for Michigan’s ten highest-rated car insurance providers.

| Company | Financial Rating |

|---|---|

| Allstate | A+ |

| Auto-Owners | A++ |

| Automobile Club Michigan | A+ |

| Geico | A++ |

| Hanover | A |

| Liberty Mutual | A |

| Michigan Farm Bureau | A+ |

| Progressive | A+ |

But AM Best is not the only financial advising company that is keeping its eye on the car insurance market. Read on to see how J.D. Power ranks Michigan insurers.

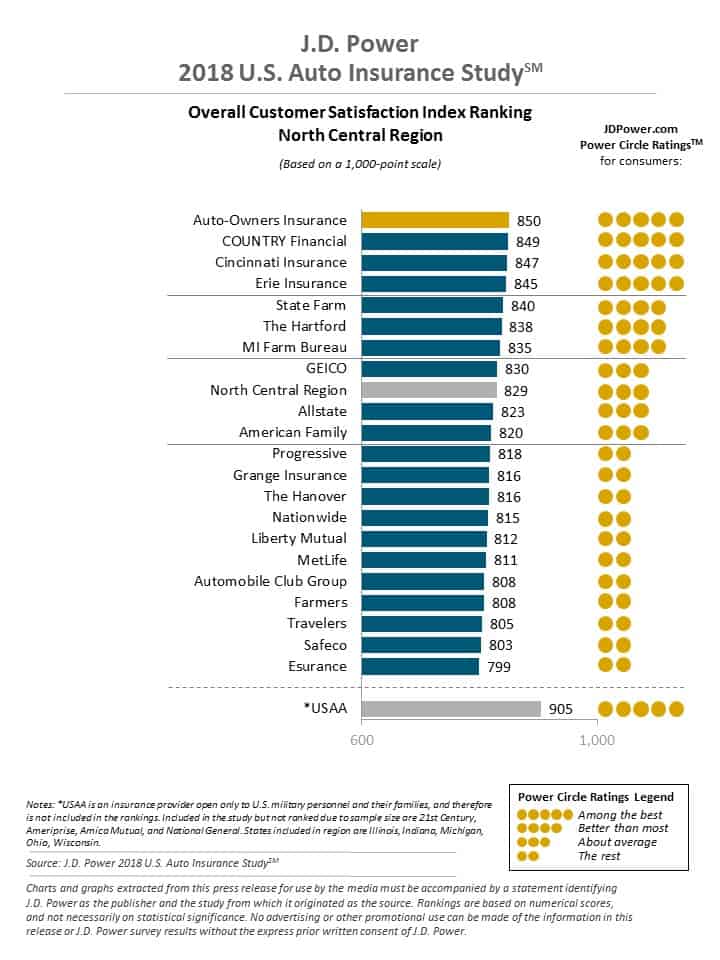

Companies With the Best Ratings

J.D. Power is also looking out for you, and what it has discovered is that customer satisfaction with the overall car insurance market is at an all-time high.

Here are their ratings for Michigan — part of the North Central Region — for 2018.

In Michigan, Auto-Owners Insurance ranks at the top of J.D. Power’s list. Let’s check out their record of official complaints.

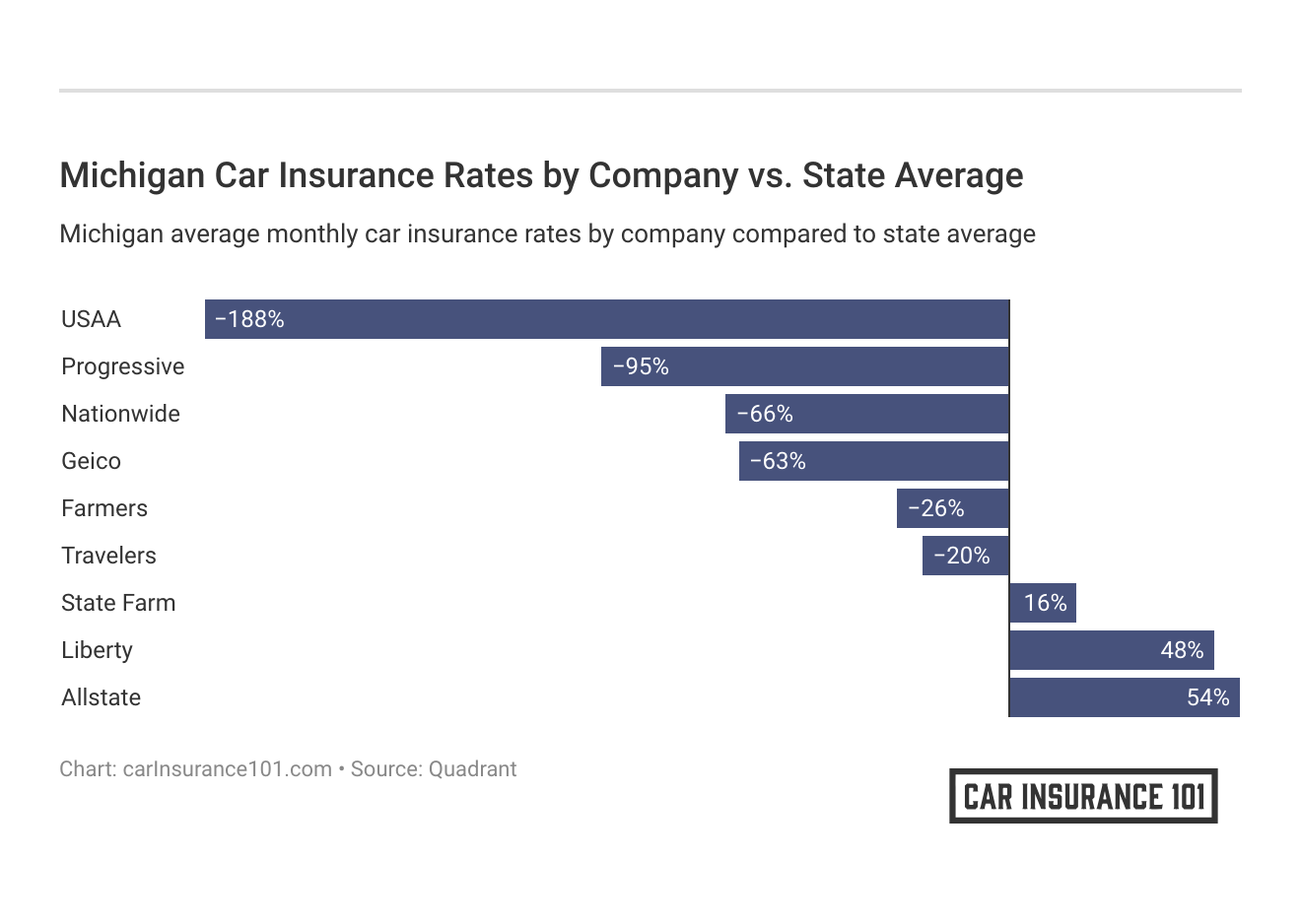

Cheapest Companies in Michigan

Is cheapest always best?

Of course not, but we also know that you want to find the most affordable and reliable car insurance for you and your family. The table below shows the average premiums for Michigan’s nine biggest car insurance providers.

| Company | Average | Compared to State Average (Rate) | Compared to State Average (%) |

|---|---|---|---|

| Allstate | $22,821.42 | $12,394.66 | 54.31% |

| Farmers | $8,275.23 | -$2,151.53 | -26.00% |

| Geico | $6,382.54 | -$4,044.22 | -63.36% |

| Liberty Mutual | $19,913.09 | $9,486.33 | 47.64% |

| Nationwide | $6,287.43 | -$4,139.33 | -65.84% |

| Progressive | $5,354.18 | -$5,072.58 | -94.74% |

| State Farm | $12,481.81 | $2,055.05 | 16.46% |

| Travelers | $8,707.10 | -$1,719.67 | -19.75% |

| USAA | $3,618.06 | -$6,808.70 | -188.19% |

Commute Rate By Company

As you might already know, how much you drive affects how much you pay for car insurance.

And whether you drive a little or a lot, Progressive, or, if you qualify, USAA, are likely to be your cheapest insurance providers in the Wolverine State.

The following table lists Michigan’s biggest car insurance providers and their corresponding average rates for both a 10- and 25-mile average commute distance.

| Company | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $22,821.42 |

| Allstate | 25 miles commute. 12000 annual mileage. | $22,821.42 |

| Farmers | 10 miles commute. 6000 annual mileage. | $8,275.23 |

| Farmers | 25 miles commute. 12000 annual mileage. | $8,275.23 |

| Geico | 10 miles commute. 6000 annual mileage. | $6,236.05 |

| Geico | 25 miles commute. 12000 annual mileage. | $6,529.03 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $19,223.85 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $20,602.33 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $6,287.43 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $6,287.43 |

| Progressive | 10 miles commute. 6000 annual mileage. | $5,354.18 |

| Progressive | 25 miles commute. 12000 annual mileage. | $5,354.18 |

| State Farm | 10 miles commute. 6000 annual mileage. | $12,142.23 |

| State Farm | 25 miles commute. 12000 annual mileage. | $12,821.40 |

| Travelers | 10 miles commute. 6000 annual mileage. | $8,657.15 |

| Travelers | 25 miles commute. 12000 annual mileage. | $8,757.05 |

| USAA | 10 miles commute. 6000 annual mileage. | $3,576.60 |

| USAA | 25 miles commute. 12000 annual mileage. | $3,659.52 |

The amount of coverage that you choose to purchase will also determine how much your car insurance policy will cost you.

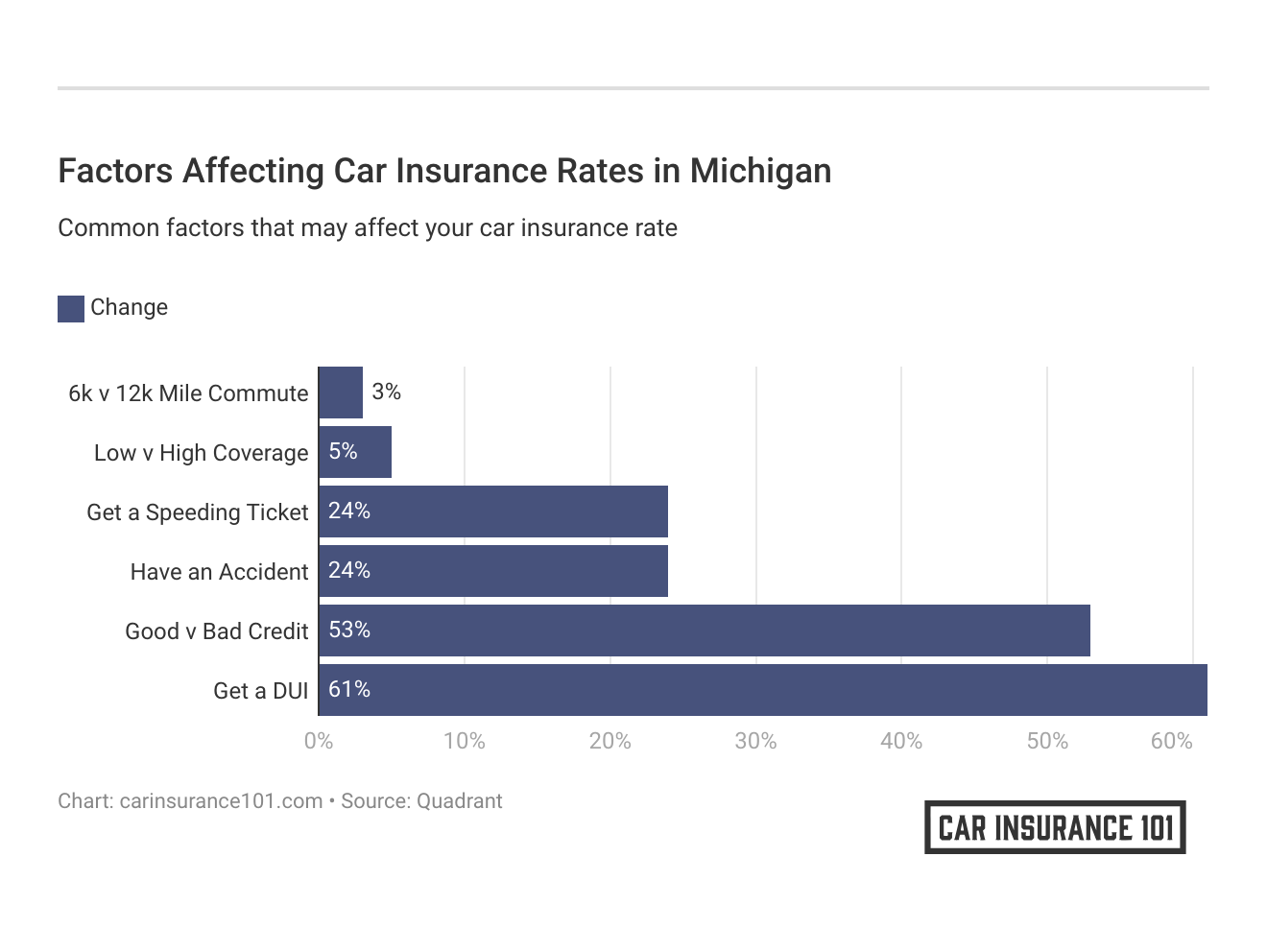

Take a look at these 6 major factors affecting auto insurance rates in Michigan.

Coverage Level Rate By Company

Did you know that what coverage level you request affects how much money you’ll pay in car insurance premiums?

Generally speaking, the more extensive the coverage, the more expensive your premiums will be. That’s just common sense.

Below is a table that illustrates the different types of insurance coverage levels and their average yearly rates for Michigan’s biggest insurance providers.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $23,352.73 |

| Allstate | Medium | $22,873.48 |

| Allstate | Low | $22,238.06 |

| Farmers | High | $8,523.10 |

| Farmers | Medium | $8,253.96 |

| Farmers | Low | $8,048.64 |

| Geico | High | $6,832.27 |

| Geico | Medium | $6,327.85 |

| Geico | Low | $5,987.51 |

| Liberty Mutual | High | $20,418.71 |

| Liberty Mutual | Medium | $19,868.02 |

| Liberty Mutual | Low | $19,452.55 |

| Nationwide | High | $6,101.40 |

| Nationwide | Medium | $6,181.29 |

| Nationwide | Low | $6,579.61 |

| Progressive | High | $5,512.79 |

| Progressive | Medium | $5,360.96 |

| Progressive | Low | $5,188.80 |

| State Farm | High | $13,040.02 |

| State Farm | Medium | $12,560.38 |

| State Farm | Low | $11,845.05 |

| Travelers | High | $8,788.45 |

| Travelers | Medium | $8,716.50 |

| Travelers | Low | $8,616.35 |

| USAA | High | $3,716.05 |

| USAA | Medium | $3,626.86 |

| USAA | Low | $3,511.28 |

But did you know that your credit history also affects your car insurance premiums?

Credit History Rates by Company

U.S. Representative Rashida Tlaib has introduced a federal bill that would ban credit history discrimination in car insurance premiums from coast to coast.

But until that happens, your credit history can affect your premiums a great deal in Michigan. Credit history is a big factor for insurance companies when they are calculating your premium.

On average, Michiganders have above-average credit scores. With an average Experian score of 677, the state’s residents’ credit is slightly above the national average of 675.

But what if you have poor credit? Who are the best car insurers in Michigan for you? Again, likely Progressive or, if you qualify, USAA will be your most affordable options.

The table below shows average rates for those with a good, fair, or poor credit rating for Michigan’s top car insurance providers.

| Company | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $34,695.69 |

| Allstate | Fair | $19,170.49 |

| Allstate | Good | $14,598.09 |

| Farmers | Poor | $11,579.33 |

| Farmers | Fair | $6,881.67 |

| Farmers | Good | $6,364.70 |

| Geico | Poor | $8,212.73 |

| Geico | Fair | $6,031.66 |

| Geico | Good | $4,903.24 |

| Liberty Mutual | Poor | $31,503.82 |

| Liberty Mutual | Fair | $18,192.56 |

| Liberty Mutual | Good | $10,042.90 |

| Nationwide | Poor | $7,888.82 |

| Nationwide | Fair | $5,932.40 |

| Nationwide | Good | $5,041.07 |

| Progressive | Poor | $6,184.82 |

| Progressive | Fair | $5,198.94 |

| Progressive | Good | $4,678.78 |

| State Farm | Poor | $20,256.29 |

| State Farm | Fair | $10,240.44 |

| State Farm | Good | $6,948.71 |

| Travelers | Poor | $8,923.51 |

| Travelers | Fair | $8,653.62 |

| Travelers | Good | $8,544.17 |

| USAA | Poor | $5,415.46 |

| USAA | Fair | $3,088.55 |

| USAA | Good | $2,350.18 |

What affects your car insurance premium perhaps more than anything else, though? It’s something that worries a lot of folks: your driving record.

Driving Record Rates by Company

Do you have a spotless driving record? Most of us don’t, but be prepared to see your record reflected in your premium.

If you live in Michigan and have a DUI in your past, again, Progressive or USAA will likely be your most cost-effective car insurance providers.

The following table shows different insurance companies and their annual averages for people with varying driving records in the Great Lakes State.

| Company | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $49,760.80 |

| Allstate | With 1 speeding violation | $15,547.99 |

| Allstate | With 1 accident | $14,863.20 |

| Allstate | Clean record | $11,113.69 |

| Farmers | With 1 accident | $8,878.82 |

| Farmers | With 1 DUI | $8,748.36 |

| Farmers | With 1 speeding violation | $8,539.80 |

| Farmers | Clean record | $6,933.96 |

| Geico | With 1 DUI | $14,384.88 |

| Geico | With 1 accident | $4,746.86 |

| Geico | With 1 speeding violation | $4,151.13 |

| Geico | Clean record | $2,247.29 |

| Liberty Mutual | With 1 DUI | $31,057.16 |

| Liberty Mutual | With 1 speeding violation | $17,841.37 |

| Liberty Mutual | With 1 accident | $16,814.63 |

| Liberty Mutual | Clean record | $13,939.21 |

| Nationwide | With 1 accident | $7,181.07 |

| Nationwide | With 1 DUI | $6,532.75 |

| Nationwide | With 1 speeding violation | $6,059.11 |

| Nationwide | Clean record | $5,376.80 |

| Progressive | With 1 accident | $5,964.06 |

| Progressive | With 1 speeding violation | $5,557.63 |

| Progressive | With 1 DUI | $5,361.42 |

| Progressive | Clean record | $4,533.62 |

| State Farm | With 1 DUI | $20,573.92 |

| State Farm | With 1 speeding violation | $11,889.70 |

| State Farm | With 1 accident | $9,521.29 |

| State Farm | Clean record | $7,942.35 |

| Travelers | With 1 DUI | $13,556.16 |

| Travelers | With 1 accident | $8,413.93 |

| Travelers | With 1 speeding violation | $6,966.74 |

| Travelers | Clean record | $5,891.56 |

| USAA | With 1 DUI | $4,758.07 |

| USAA | With 1 accident | $3,631.64 |

| USAA | With 1 speeding violation | $3,172.10 |

| USAA | Clean record | $2,910.44 |

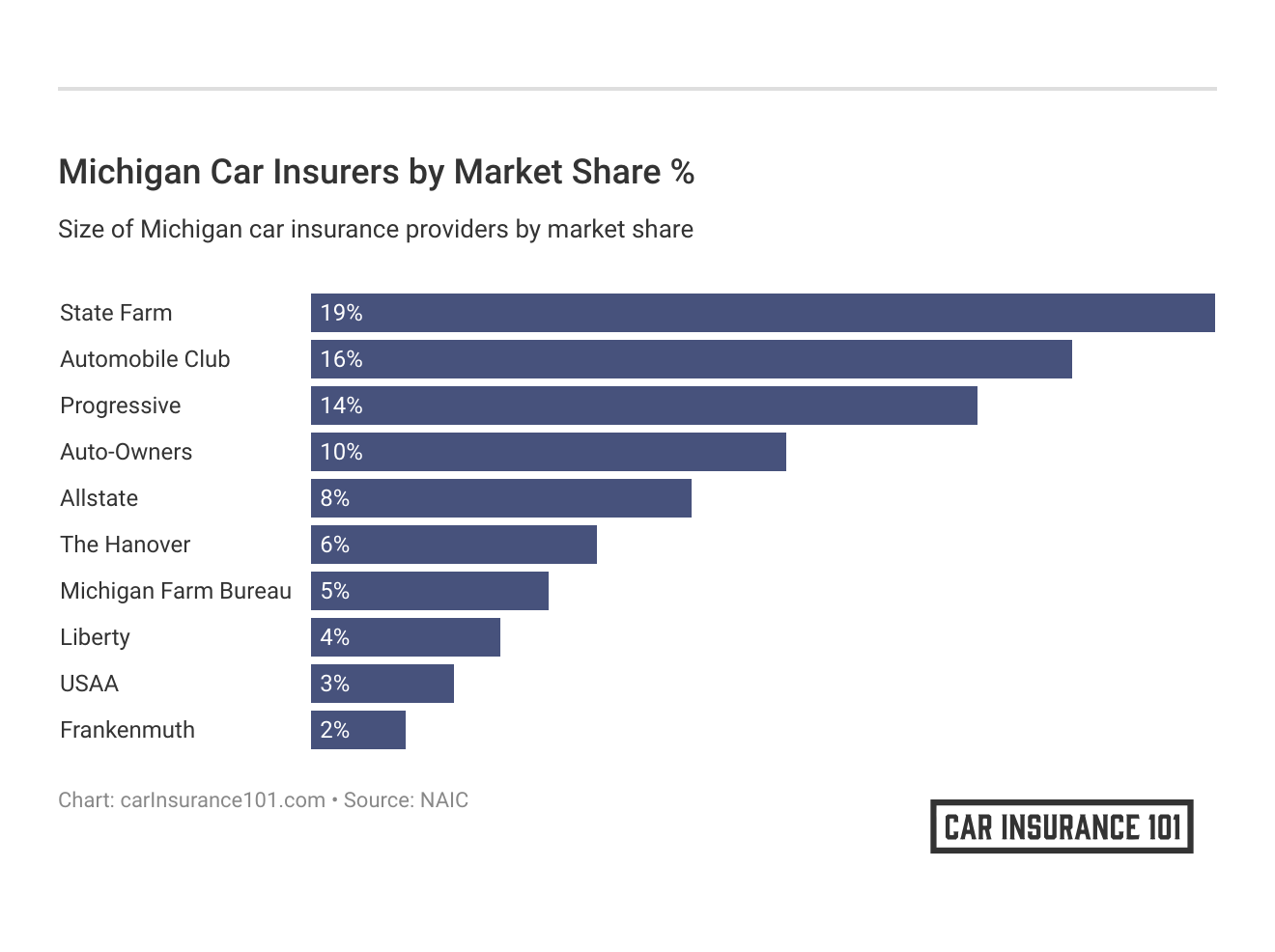

Largest Car Insurance Companies in Michigan

Knowing who the largest car insurance companies in your area are can help you find the best deal and the most reliable company, in many cases.

The table below provides Michigan’s largest insurance companies by direct premiums written, loss ratio, and market share.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm | $1,662,966.00 | 53.42% | 18.54% |

| Automobile Club Michigan | $1,421,253.00 | 109.36% | 15.84% |

| Progressive | $1,261,150.00 | 68.76% | 14.06% |

| Auto-Owners | $888,716.00 | 90.82% | 9.91% |

| Allstate | $731,916.00 | 109.93% | 8.16% |

| The Hanover | $535,020.00 | 67.97% | 5.96% |

| Michigan Farm Bureau | $410,895.00 | 65.71% | 4.58% |

| Liberty Mutual | $390,079.00 | 66.52% | 4.35% |

| USAA | $271,157.00 | 88.71% | 3.02% |

| Frankenmuth | $157,962.00 | 66.30% | 1.76% |

Number of Foreign vs. Domestic Insurers in Michigan

When you hear the phrase “foreign or domestic car insurance company,” what do you think that means?

When it comes to auto insurers, domestic simply means an in-state provider, and foreign, an out-of-state provider.

According to the NAIC, Michigan has 65 domestic car insurance companies and 786 foreign car insurance providers. Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michigan Laws

So you want to drive in Michigan? Who can blame you! The Great Lakes State is one of the most gorgeous places in the United States. Especially in the fall, as the video below shows.

But as you probably know, all states have their own distinct laws, and some of them can be a little odd.

In the sections below, we’ll cover a variety of legal topics related to driving and insuring your car in Michigan.

You might also want to check out the National Motorists Association’s guide to driving in Michigan.

Car Insurance Laws

As we’ve seen above, Michigan requires liability insurance with the following minimums:

- $20,000 for bodily injury or death of one person in an accident caused by the owner of the insured vehicle

- $40,000 for total bodily injury or death in an accident caused by the owner of the insured vehicle

- $10,000 for property damage per accident caused by the owner of the insured vehicle

Also remember, these are minimums. What is best for you and your family might be coverage above liability, like the add-ons we explored earlier.

How State Laws for Insurance Are Determined

Do you know about the National Association of Insurance Commissioners (NAIC)?

Well, unless you’re an insurance nerd like us, you probably haven’t heard of them before. But that’s okay.

The NAIC is the U.S. standard-setting and regulatory support organization for the insurance industry, including car insurance. They were created and are governed by the chief insurance regulators from all 50 states, the District of Columbia, and five U.S. territories.

And in case you’re curious how insurance laws actually get made, they offer this great white paper to help you understand.

Michigan’s state legislature has been making some moves recently to be more proactive about protecting the state’s car insurance consumers, as you can see in the video below.

Windshield Coverage

While some states have strict laws regarding insurance benefits for full glass replacement services, Michigan has no specific laws to this end. Companies can offer a windshield replacement and repair coverage option in their policies, but they don’t have to provide them. Comprehensive coverage generally includes this as part of the policies subject to a deductible.

So it’s important to note: windshield and glass coverage may be an easy add-on to your car insurance. Make sure to check with your provider. After all, glass claims are the top insurance claims filed across the country.

Also take note that Michigan law allows car owners to use aftermarket parts in windshield repair, but the shop must state that specifically in the estimate. Car owners can also choose their own repair shop, however, they may need to cover the cost of any price differences if they do so.

High-Risk Insurance

If you have a bad driving record, it may be difficult to find an insurance company that is willing to insure you as a driver. Luckily, in most states, insurance companies have made programs available to provide affordable coverage for those who are deemed high-risk drivers.

The Michigan Automobile Insurance Placement Facility (MAIPF) helps drivers who can’t get coverage on the open market, however, it’s the last resort for those who have been turned down before by private insurance providers.

Low-Cost Insurance

Some states have programs set up for those who receive benefits from government assistance programs, or those who have a combined family income that is below the poverty level.

Unfortunately, Michigan has no such plan in place.

In order to obey the law, you must carry the minimum liability coverage.

Automobile Insurance Fraud in Michigan

Michigan has a commission specifically charged with fighting insurance fraud in the state.

Insurance fraud, which includes lying about, concealing, or omitting information related to a claim, is illegal in Michigan. It carries a penalty of up to five years in jail and fines of up to $50,000. Those who commit this crime also face restitution and other civil penalties.

The Michigan Department of Insurance and Financial Services estimates that 15 percent of insurance claims in 2012 showed signs of possible fraud.

The easiest way to avoid committing insurance fraud? Be honest with your insurance provider at all times.

Statute of Limitations

A statute of limitations means you have a specific amount of time to file a claim in a court of law. In Michigan, you have three years to file both property damage and bodily injury claims following an automobile accident.

Vehicle Licensing Laws

Like all other states in America, Michigan has mandatory licensing laws in addition to the laws we have already covered. You’re probably not surprised to learn that a valid driver’s license is required to operate a vehicle in the great state of Michigan.

And be honest: who doesn’t love getting their picture taken at the DMV?

Okay, maybe that’s not the case. But you should know: licensing yourself and your vehicle in Michigan may be easier than you think.

Through their online ExpressSOS portal, residents can renew their registrations and driver’s licenses, update or change their addresses, and access their driving histories. They can also look up vehicle registration and insurance information.

REAL ID

Passed by Congress in 2005, the REAL ID Act establishes minimum security standards for state-issued driver’s licenses and identification cards and prohibits federal agencies from accepting for official purposes licenses and identification cards from states that do not meet these standards.

Michigan complies with the REAL ID Act Congress passed and Homeland Security enforces. This means a driver’s license or state ID is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

As of October 1, 2020, anyone wishing to fly on a commercial flight or enter a federal facility must have a REAL ID-compliant form of identification, usually noted by that black star in the upper right corner of your driver’s license.

Penalties for Driving Without Insurance

Driving without insurance is a misdemeanor crime in Michigan. And it can lead to both fines and prison time.

Under Michigan law, a police officer can fine a driver who doesn’t show proof of insurance — even if they have it. As we mentioned before, your proof of insurance is evidence that you can pay for damages from an accident. Nowadays, showing proof of insurance can be as easy as taking out your smartphone.

Potential penalties for driving without insurance include:

- $200 to $400 in fines

- Up to one year in jail

- License suspension of up to 30 days, or until you provide proof of insurance

- $25 to $125 reinstatement fee

On top of that, Michigan police can look up your license plate number to see if you have insurance before they pull you over.

Are you familiar with the teen driving laws in Michigan?

Teen Driving Laws

Most states have some form of graduated licensing laws for teens, and Michigan is no exception. This short video provides some helpful information about getting a teen license in the Great Lakes State.

The table below outlines the specifics of Michigan’s young driver graduated licensing system.

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 14 and 9 months; permit applicants younger than 18 must have completed the first segment of driver education | no more than 1 passenger younger than 21 (family members excepted) | 10 p.m.-5 a.m. |

| Provisional License | 6 months holding period, 50 hours, 10 of which must be at night | no more than 1 passenger younger than 21 (family members excepted) | 10 p.m.-5 a.m. |

| Full License | 16; Neither driver education nor an intermediate license is required for license applicants 18 and older. | Lifted after 6 months and age 17 or until age 18 (min. age 17). | Lifted after 6 months and age 17 or until age 18 (min. age 17). |

Teenaged drivers are not the only ones who have a specific set of laws that pertain to their licensing requirements. In most states, older drivers also have restrictions when it comes to renewing their licenses.

Older Driver License Renewal Procedures

All Michigan drivers must renew their driver’s license every four years, regardless of age. And every Michigander who’s also a United States citizen can renew online or by mail on every second renewal.

Michigan doesn’t have any renewal laws specific to older drivers. Keep in mind, though: every in-person renewal requires a vision test. You’ll need to bring any prescription eyewear and pay a fee.

The table below provides some specifics about Michigan’s renewal procedures.

| Renewal Procedures | General Population | Older Population |

|---|---|---|

| License renewal cycle | 4 years | 4 years |

| Mail or online renewal permitted | both, every other renewal | both, every other renewal |

| Proof of adequate vision required at renewal | when renewing in person | when renewing in person |

But what do you do if you’re new to Michigan?

New Residents

If you’re a new Michigan resident age 18 or older, you must register and title your vehicles and turn over the title from your former state of residence within 30 days.

That’s a month to get yourself to the Michigan DMV.

Those who apply for a license must show proof of residency and/or employment, bring their social security numbers, and pay a $25 fee. With a valid license from another state or one that has been expired for less than four years, the Secretary of State office may waive the required written and driving skills test. But you’ll still need to take a vision test.

Drivers from another country with temporary status in the United States can receive a temporary license at the DMV with proper documentation.

Negligent Operator Treatment System (NOTS)

Michigan uses a points system for violations. Points range between two and six depending on the offense, and include the following:

- Two points: minor moving violations such as speeding ten MPH or less over the limit, refusing a breathalyzer (under age 21), open alcohol containers

- Three points: careless driving, speeding 11-15 MPH over the limit, failure to obey traffic lights or stop signs, or to stop at a railroad crossing

- Four points: Drag racing, driving while visibly impaired, speeding 16 MPH or more over the limit, or any BAC while under age 21

- Six points: a felony involving the use of a motor vehicle (such as manslaughter), driving under the influence, reckless driving, fleeing a police officer

If you rack up 12 points, your license will be suspended.

Rules of the Road

From New York to California, and certainly in Michigan in between, every state has its own rules of the road.

Knowing what they are in the Great Lakes State will help you avoid the receipt of any negligent operator points on your license or hefty tickets.

Keep reading to find out all of the information you need to know to save money on car insurance by following the laws of the great state of Michigan.

Fault Vs. No-Fault

As we mentioned above, Michigan is one of 12 “no-fault” states. It’s also the only no-fault state where PIP injury benefits are unlimited, but that will change in July 2020 when the new insurance reform laws go into effect, which will also make lower PIP limit choices available.

Under the new law, drivers will be able to sue for excess medical benefits rather than for specific circumstances that limit lawsuits.

Because insurance laws in Michigan are so different from other states, it’s important to understand how they work and how they apply to you and your vehicles. By understanding your insurance policy, you can be sure you get the best coverage to suit your needs.

How No-Fault Insurance Works

In every state, liability insurance is required by all drivers. This insurance generally pays for damage that a person may cause to another individual’s property. In most states, the person whose property was damaged can file a claim directly with the at-fault driver’s insurance. This enables them to have their vehicle repaired regardless of what coverage they carry.

Michigan does not allow this. Whether or not a person is at fault for damage, they must file the claim with their own insurance. This means that drivers with liability-only policies can never get their vehicles repaired following an accident. Although there are some exceptions, the only way to obtain coverage for an auto accident is to carry collision on the insured vehicle.

No-fault insurance only applies to collisions between two vehicles. If a person collides with a fixed object, such as a fence or mailbox, the person whose property was damaged will receive reimbursement for that damage whether or not the item was insured.

Three Types of Collision

Most states only offer a single type of collision coverage. This would provide coverage to any accident caused by a vehicle colliding with another person or property. Collision coverage comes with a deductible that must be paid in order to complete repairs. People not at fault in an accident can recover a reimbursement on that deductible from the at-fault driver.

Michigan handles collision differently. In Michigan, there are three types of collision coverage that can be purchased, and each functions differently:

Normal Collision

This coverage functions in the same way as collision coverage in other states. The insured will have a deductible that they are responsible for paying. If they are not at fault for an accident, they have a limited opportunity to get this deductible reimbursed, but that is the extent of payments they can seek from another person’s insurance company.

Broadform Collision

The most common type of insurance in Michigan, this coverage applies to both at-fault and not-at-fault accidents. If a driver is not at fault for an accident, the deductible is waived; otherwise, the insured must pay the deductible in order to seek repairs for the vehicle.

Limited Collision

The least common type of coverage in the state, limited collision is also the most affordable. Limited collision coverage only pays for damage if the driver is not at fault for the accident. If an insured causes the collision, the claim will be denied.

How Fault is Determined

In order to be considered at-fault for a collision, a driver in Michigan must be found to have been 51% or more responsible for causing the accident. Some accidents are clear liability claims. For example, if a person rear-ends another vehicle, they will automatically be found at fault. The same is true for a person who hits a parked vehicle or a fixed object.

All other cases require an adjuster to review the facts of the accident and make a liability determination based on these factors. In order to assess the liability, an adjuster will get statements from all members involved. They may also interview witnesses and order a police report.

What happens once a claim is filed?

After liability is addressed, the insured will have their vehicle inspected. The adjuster will assess the damage and offer settlement based on the cost of the repairs. If the insured qualifies for a deductible waiver, the full amount of repairs will be paid. Otherwise, the deductible amount will be subtracted from the overall cost of repairs and the insured will be issued a check for the difference.

If the insured is not at fault and carries regular collision coverage, he or she can still file a mini-tort claim. This enables the insured to recover up to $500 or the amount of their deductible, whichever is lower.

Additionally, if an insured is not at fault for an accident and without collision coverage, they can also file a mini-tort claim against the at-fault driver’s insurance. In this case, the individual will receive a settlement of $500 or the worth of the vehicle’s repairs, whichever is lower. This is the only damage settlement that an individual is entitled to if they do not have collision coverage.

What if I’m Visiting Michigan and Get Involved in an Accident?

All drivers visiting Michigan from another state are automatically granted broadform collision. This means that as long as you have any sort of collision coverage on your vehicle and you get into an accident that’s not your fault, your deductible will be waived.

Michigan insurance laws are complex, and it’s a driver’s responsibility to know what insurance they carry and how it will apply. If you have any questions about what coverage to get or how your insurance will work in any particular situation, you can contact your insurance company’s toll-free customer service number or discuss the matter with your local agent. By reviewing your needs and selecting the appropriate coverage, you can be ensured that you won’t be unpleasantly surprised by any situation that may arise.

Seat belt and Car Seat Laws

Michigan law requires drivers and passengers over the age of 16 to wear a seat belt or face fines starting at $25 for failure to do so.

These are the state’s child restraint laws, which apply to those 15 years of age and under:

- Children under four must be in the rear seat if available.

- All children eight and under and under 4’9″ tall must be in an appropriate car seat or booster seat.

- All children ages eight to 15 and at least 57 inches tall must wear a seat belt in the front and back seats.

The minimum fine for violating the child restraint law is $10.

Keep Right and Move Over Laws

In a lot of places, it’s just common courtesy, but Michigan traffic laws mandate that drivers must keep right to let faster vehicles pass. These are a few exceptions to the rule:

- When passing another vehicle on the left

- When making a left turn

- In heavy traffic

- On a freeway with more than three lanes

When it comes to “move over” laws, AAA reports that Michigan state law “requires drivers approaching a stationary emergency vehicle displaying flashing lights, including towing and recovery vehicles, traveling in the same direction, to vacate the lane closest if safe and possible to do so, or to slow to a speed safe for weather, road and traffic conditions. The law also includes stationary solid waste collection, utility service, or road maintenance vehicles.”

Speed Limits

Speeding is never a good idea, but in Michigan, you should know there are two types of speeding: absolute and presumed.

Absolute speeding means exceeding the speed limit is illegal per se, regardless of whether it was safe under the specific conditions. Absolutely speed limits apply to the state’s interstates and highways.

Presumed speeding means that you can drive faster than the speed limit if it’s reasonable to argue that your speed was perfectly safe and not reckless, given the conditions. This only applies to driving on roads other than interstates and highways.

In Michigan, absolute speed limits are:

- Rural Interstates: Cars 70 MPH (75 MPH on select segments), Trucks 65 MPH

- Urban Interstates: Cars 70 MPH, Trucks 60 MPH

- Other Limited Access Roads: Cars 70 MPH Trucks 60 MPH

And remember, a speeding ticket is one of the quickest ways to raise your car insurance premiums.

Ridesharing

Currently, Farmers and State Farm provide ridesharing insurance in the state of Michigan.

The state requires all drivers for Uber, Lyft, and similar services to pass background checks and have their vehicles inspected regularly. State law also places limits on the driving record of anyone who drives for a rideshare company.

Rideshare drivers must have $1 million in liability insurance when they carry a passenger and $50,000 in liability when not using their vehicles for ridesharing.

In keeping with Michigan’s no-fault laws, in case of an accident, the passenger’s PIP coverage will serve as the primary coverage. When the passenger doesn’t have coverage, the rideshare driver or company will be responsible for the coverage.

Automation on the Road

What the heck is automation?

The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task previously carried out by a human.

When it comes to automation, typically think radars, cameras, and other sensors used to gather information about a vehicle’s surroundings.

In Michigan, it’s legal to test and deploy autonomous vehicles, but the operator must have a license and liability insurance.

Safety Laws

Let’s take a look at some important safety laws in Michigan.

DUI Laws

As you probably already know, driving under the influence of alcohol has disastrous, often fatal, results.

That’s why strict laws are in place to prevent drunk driving fatalities, injuries, and property damage. In Michigan in 2017 alone, drunk driving caused 311 deaths.

In the table below, we’ve listed some important details about Michigan’s impaired driving laws.

| Offense Number | License Suspension | Fine | Incarceration | Other Penalties |

|---|---|---|---|---|

| First | 6 months - possible restricted license after 30 days | $100-$500 | 5 days to 1 year OR 30-90 hours community service | 6 points on record and possible interlock device |

| Second | 1 year minimum, 5 years if previous conviction within past 7 years | $200-$1,000 plus $1,000 driver responsibility fee | 30 days minimum up to 1 year and 48 hours must be served in jail/workhouse | License plate confiscated, vehicle immobilized 60-90 days or forfeited, and 6 points on license |

| Third | Minimum 1 year, 5 years if previous conviction within past 7 years | $500-$5,000 plus $1,000 driver responsibility fee | 1-5 years | License plate confiscated, vehicle immobilized 1-3 years or forfeited, possible registration denial or vehicle forfeiture, 6 points on record |

But what about driving under the influence of marijuana in Michigan?

Marijuana Impaired Driving Laws

Although marijuana is legal in Michigan, there is currently no allowable legal amount of THC, the chemical that causes a “high,” in a driver’s bloodstream.

Drive high and you’re subject to the same penalties for driving under the influence of alcohol outlined above.

Distracted Driving Laws

In Michigan, texting while driving is illegal for all drivers, regardless of age.

Michigan doesn’t have any statewide hand-held cell phone bans except for drivers with a learner’s permit or a Level 1 or Level 2 graduated license (integrated voice-operated systems excepted).

The cities of Detroit and Troy have enacted bans on handheld cell phone use while driving, and others are following suit. The video below examines Michigan’s distracted driving laws, including how they affect teen drivers specifically.

Driving in Michigan

You know driving safely is important wherever you are.

Read on for some important information about keeping you, your family, and your vehicles safe in the beautiful state of Michigan.

Vehicle Theft in Michigan

The Federal Bureau of Investigation (FBI) keeps track of vehicle thefts and other crimes city-by-city in all states. In Michigan, this means they’re tracking vehicle theft everywhere, from Addison Township to Zilwaukee.

In 2016, Detroit — Michigan’s largest city and capital of America’s car industry — led the state in vehicle thefts with a whopping 8,905 vehicles stolen.

You might want to know what vehicles are stolen the most in the Wolverine State. The table below shows the top 10 most-stolen cars in Michigan for 2018 by make/model and number of vehicles stolen.

| Make/Model | Number of Thefts |

|---|---|

| Chevrolet Impala | 733 |

| Chevrolet Pickup (Full Size) | 585 |

| Ford Pickup (Full Size) | 530 |

| Dodge Caravan | 528 |

| Dodge Charger | 477 |

| Chevrolet Trailblazer | 462 |

| Chevrolet Malibu | 451 |

| Pontiac Grand Prix | 418 |

| Jeep Cherokee/Grand Cherokee | 407 |

| Ford Fusion | 355 |

Road Fatalities in Michigan

Michigan has some dangerous roadways, winding up snowy hills, through flood-prone valleys, and across congested metro areas.

Most Fatal Highway in Michigan

According to Geotab, US-31 is Michigan’s most fatal highway, with around 11 fatal crashes a year. US-31 follows Lake Michigan’s coastline from the border with Indiana in the south to the bridge that connects Michigan’s mainland with its Upper Peninsula.

Fatal Crashes by Weather and Light Conditions

Michigan, as you probably know, isn’t always a paradise of green forests. In fact, winters in this northern state can be quite harsh, with snowfalls measured in feet, not inches.

Not surprisingly, crashes are highly contingent on both weather and light conditions, especially in a winter wonderland like Michigan.

The table below provides a breakdown of fatal crashes by weather and light conditions across Michigan in 2017.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 413 | 140 | 195 | 30 | 2 | 780 |

| Rain | 29 | 27 | 27 | 3 | 0 | 86 |

| Snow/Sleet | 22 | 8 | 14 | 4 | 0 | 48 |

| Other | 7 | 6 | 7 | 1 | 0 | 21 |

| Unknown | 0 | 0 | 2 | 0 | 2 | 4 |

| TOTAL | 471 | 181 | 245 | 38 | 4 | 939 |

Fatalities in Top 10 Counties (All Crashes)

The table below provides fatalities for all crashes in Michigan’s 10 biggest counties from 2014 to 2018.

| County | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Wayne County | 174 | 190 | 201 | 161 | 164 |

| Kent County | 55 | 64 | 57 | 69 | 65 |

| Oakland County | 63 | 67 | 80 | 69 | 54 |

| Macomb County | 46 | 61 | 63 | 42 | 53 |

| Genesee County | 33 | 33 | 50 | 38 | 43 |

| Kalamazoo County | 16 | 27 | 35 | 38 | 30 |

| Monroe County | 27 | 13 | 18 | 23 | 29 |

| Washtenaw County | 30 | 27 | 26 | 39 | 27 |

| Ottawa County | 24 | 19 | 27 | 17 | 26 |

| Saginaw County | 10 | 23 | 14 | 22 | 26 |

Fatalities by Person Type

What kind of vehicles are Michiganders riding in or driving when they’re in a deadly car crash? The table below shows fatalities by passenger type from 2014 to 2018.

| Person Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Passenger Car | 335 | 342 | 377 | 388 | 367 |

| Light Truck - Pickup | 88 | 95 | 97 | 80 | 91 |

| Light Truck - Utility | 119 | 121 | 140 | 141 | 139 |

| Light Truck - Van | 42 | 30 | 49 | 49 | 43 |

| Light Truck - Other | 1 | 0 | 1 | 1 | 0 |

| Large Truck | 9 | 11 | 12 | 15 | 10 |

| Bus | 3 | 0 | 0 | 0 | 0 |

| Other/Unknown Occupants | 16 | 19 | 27 | 23 | 13 |

| Total Occupants | 613 | 618 | 703 | 697 | 663 |

Fatalities by Crash Type

The National Highway Transportation Safety Administration (NHTSA) notes that accidents involving a single vehicle or a roadway departure are at the top of the list of fatal crash types in Michigan.

The table below offers their crash type fatality figures for Michigan from 2014 to 2018.

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 901 | 967 | 1,065 | 1,031 | 974 |

| Single Vehicle | 469 | 536 | 543 | 519 | 472 |

| Involving a Large Truck | 98 | 75 | 113 | 90 | 105 |

| Involving Speeding | 235 | 264 | 245 | 241 | 245 |

| Involving a Rollover | 182 | 163 | 174 | 224 | 174 |

| Involving a Roadway Departure | 426 | 484 | 468 | 430 | 449 |

| Involving an Intersection (or Intersection Related) | 233 | 238 | 322 | 269 | 269 |

Fatalities Involving Speeding by County

Of Michigan’s 83 counties, Wayne County — which includes the city of Detroit — led the state for 2017 fatalities involving a speeding vehicle with 57 deaths.

The table below provides the county-by-county breakdown of fatalities involving speeding for Michigan’s eight biggest counties between 2013 and 2017.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Wayne County | 50 | 49 | 57 | 58 | 57 |

| Kent County | 9 | 12 | 13 | 13 | 16 |

| Oakland County | 12 | 10 | 8 | 10 | 12 |

| Kalamazoo County | 11 | 4 | 12 | 8 | 11 |

| Cass County | 4 | 4 | 3 | 1 | 8 |

| Ingham County | 5 | 6 | 3 | 7 | 8 |

| Macomb County | 15 | 3 | 15 | 10 | 8 |

| Livingston County | 5 | 6 | 2 | 5 | 7 |

Fatalities for Crashes Involving an Alcohol-Impaired Driver

Again, Wayne County, which includes the city of Detroit, leads the state in fatalities in crashes involving an alcohol-impaired driver. The table below provides the 2013 to 2017 statistics for such fatalities in Michigan’s eight biggest counties.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Wayne County | 47 | 34 | 48 | 61 | 54 |

| Oakland County | 9 | 14 | 17 | 22 | 18 |

| Kent County | 14 | 14 | 14 | 13 | 16 |

| Macomb County | 14 | 11 | 14 | 14 | 14 |

| Monroe County | 6 | 12 | 3 | 6 | 12 |

| Washtenaw County | 10 | 10 | 9 | 3 | 12 |

| Jackson County | 2 | 2 | 4 | 3 | 11 |

| Genesee County | 10 | 8 | 11 | 12 | 10 |

No matter where you live, you should never drink and drive.

Teen Drinking and Driving

Michigan sees an average of 1.2 fatalities every year for every 100,000 residents due to teen drinking and driving. Though this is exactly the same as the national average, it’s still a startling phenomenon. In 2017 alone, 194 underage Michiganders were arrested for drunk driving.

EMS Response Time

Michigan is a large state, with a big urban-rural divide. EMS response times to crashes are highly dependent upon where the crash happens.

The table below breaks down the average EMS response times for urban and rural areas of Michigan, from time of the crash to EMS notification, to time of crash to hospital arrival.

| Location | Time of Crash to Notification | Arrival | Arrival at Scene to Hospital | Time of Crash to Hospital |

|---|---|---|---|---|

| Rural | 2.67 minutes | 10.41 minutes | N/A | N/A |

| Urban | 2.01 minutes | 5.44 minutes | N/A | N/A |

Transportation

DataUSA reports that if you call Michigan home, you likely live in a two-car household and drive alone 23.3 minutes each way to work.

Car Ownership

Michiganders love their cars, and the data backs this claim up.

According to DataUSA, 43.7 percent of Michigan households owned two cars in 2017. 21.3 percent owned three cars, and 19.6 percent owned just one.

Commute Time

DataUSA also reports that “using averages, employees in Michigan have a shorter commute time (23.3 minutes) than the normal U.S. worker (25.5 minutes). Additionally, 1.75 percent of the workforce in Michigan have ‘super commutes’ in excess of 90 minutes.”

Commuter Transportation

Outside of the Detroit metropolitan area, public transportation is not much of an option in Michigan. Accordingly, DataUSA explains that “in 2017, the most common method of travel for workers in Michigan was Drove Alone (82.5 percent), followed by those who Carpooled (8.71 percent) and those who Worked At Home (4.19 percent).”

Traffic Congestion in Michigan

In Michigan, only Detroit residents face much of a congestion problem. The Motor City is the 27th most congested city in North America and ranks 146th worldwide, according to traffic monitoring agency INRIX. Detroit drivers spend an average of 66 minutes in congested traffic each day.

But we still think the Motor City is pretty great.

Did this guide help you think about all the factors that should go into your car insurance search? What part was the most helpful?

You can start your search for that perfect fit simply by entering your ZIP code below.

Frequently Asked Questions

What is financial responsibility in Michigan car insurance?

Financial responsibility is proof that you have Michigan’s minimum liability coverage, which is mandatory for all drivers in the state.

What is the minimum car insurance requirement in Michigan?

Michigan requires drivers to have liability insurance coverage that includes $20,000 for property damage, $40,000 for injuries or death to multiple people, and $10,000 for injuries or death to one person.

How much do Michiganders pay for car insurance on average?

On average, Michiganders pay $1,350.58 per year for car insurance, which is higher than the national average of $1,004.68.

What is a loss ratio in car insurance, and why is it important?

A loss ratio is the ratio of the amount an insurance company pays out in claims compared to the premiums it receives. It is important because it can help determine the financial stability and reliability of an insurance company.

What add-ons, endorsements, and riders are available in Michigan car insurance?

Michigan car insurance providers offer various add-ons, endorsements, and riders, such as guaranteed auto protection, personal umbrella policy, rental reimbursement, emergency roadside assistance, mechanical breakdown insurance, non-owner car insurance, modified car insurance coverage, classic car insurance, and pay-as-you-drive or usage-based insurance.

What is personal injury protection (PIP) in Michigan car insurance?

Personal injury protection, or PIP, is often referred to as “no-fault insurance” and covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

What is the vehicle theft rate in Michigan?

The vehicle theft rate in Michigan is higher than the national average, with Detroit leading the state in vehicle thefts with 8,905 stolen vehicles in 2016.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.