Expert North Carolina Car Insurance Advice (Compare Costs & Companies)

Reading expert North Carolina car insurance advice will ensure you choose the best coverage for your needs. For example, while liability insurance is only an average of $35/mo in North Carolina, it won't pay your accident bills if you cause an accident. Instead, you will need full coverage insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- North Carolina drivers need liability insurance to drive legally

- The cost of liability car insurance in North Carolina is an average of $35/mo

- The cost of full coverage insurance in North Carolina is an average of $92/mo

Following expert North Carolina car insurance advice will ensure you get the best North Carolina car insurance possible. If you aren’t sure where to start, we’ve created this comprehensive guide on coverages, rates, and more to help you and your family find the best affordable car insurance in North Carolina.

Read on to learn everything you need to know about North Carolina auto insurance. If you want to search for affordable North Carolina car insurance right away, enter your ZIP code in our free quote comparison tool.

North Carolina Car Insurance Coverage and Rates

One of the 10 fastest growing states in the nation, more people means more cars in the Old North State. We’ve created this guide to help you navigate car insurance, rules of the road, and other vehicular safety information in North Carolina.

North Carolina’s Car Culture

It’s true: North Carolinians love their cars.

According to theAuto Alliance, almost 9 million vehicles are registered with the state of North Carolina. With just over ten million residents, that’s a lot.

Given that Charlotte is home to the NASCAR Hall of Fame, perhaps North Carolina’s love affair with cars shouldn’t surprise us.

- Best Cheap Car Insurance Companies

- Affordable Car Insurance Rates in Winston-Salem, NC

- Affordable Car Insurance Rates in Wilson, NC (2025)

- Affordable Car Insurance Rates in Vanceboro, NC (2025)

- Affordable Car Insurance Rates in Southern Pines, NC (2025)

- Affordable Car Insurance Rates in Shallotte, NC (2025)

- Affordable Car Insurance Rates in Lincolnton, NC (2025)

- Affordable Car Insurance Rates in Hickory, NC (2025)

- Affordable Car Insurance Rates in Henderson, NC (2025)

- Affordable Car Insurance Rates in Goldsboro, NC (2025)

- Affordable Car Insurance Rates in Columbia, NC (2025)

- Affordable Car Insurance Rates in Boone, NC (2025)

So you know North Carolinians love to drive. But do you know the state’s minimum requirements for car insurance?

North Carolina Minimum Coverage

When it comes to car insurance, North Carolina has fairly straight-forward minimum coverage requirements. These requirements seem to be working. The state is the fourth-lowest in the nation for uninsured motorists.

The table below offers the Old North State’s minimum coverage levels for car insurance.

| Minimum Requirements | Cost |

|---|---|

| Body Injury Liability - One Person | $30,000 |

| Body Injury Liability - Two or More People | $60,000 |

| Property Damage | $25,000 |

But how do you prove you have minimum coverage?

Forms of Financial Responsibility

North Carolina law G.S. 20-309 is pretty standard. Carry an insurance card to prove you have financial responsibility or have:

- A surety bond in the amount of $85,000 or more.

- Certificate of deposit of money or securities of $85,000 or more.

- Self-insurance (if you own/lease 26 cars or more).

Additionally, it’s important to know that North Carolina takes insurance lapse more seriously than a lot of states.

There is no grace period, and insurers are required, by law, to inform the state if your insurance lapses.

If your insurance lapses, the state will then begin issuing fines:

- First time: $50 fine.

- Second time: $100 fine.

- Subsequent times: $150 fine.

- Restoration fee for license plate: $50 fee.

So if you need to change or cancel your North Carolina auto insurance, check out the state’s rules carefully.

Premiums as a Percentage of Income

In 2014, North Carolina had an average household disposable income of $35,099, of which they spent about $768.28 on car insurance premiums.

Our research shows that North Carolinians spend slightly below the national average of their income on car insurance at only 2.19 percent per year.

CBS News “attribute[s] the relatively low cost of insurance in North Carolina to the fact that the state is more rural than most and to its court system discouraging auto accident claims, which can drive up the cost of coverage.”

Core Coverage

More and more folks are calling North Carolina home.

And as North Carolina grows, so grows the cost of car insurance in the state.

It’s always good to remember that experts agree: the better insured you are, the better prepared you will be to deal with an accident, whether or not you are at fault.

The table below provides the most recent data on average core car insurance costs in North Carolina provided by the National Association of Insurance Commissioners (NAIC). Note that this data is as of 2015, so rates will likely be a bit higher for 2019 and beyond.

| Core Car Insurance Coverage Costs in North Carolina | Cost |

|---|---|

| Liability | $359.42 |

| Collision | $293.59 |

| Comprehensive | $136.08 |

| Combined | $789.09 |

Additional Liability

North Carolina’s minimum requirements are pretty good, but having more additional liability insurance might be best for you and your family. And how do you know if a company is right for you?

We’ll cover more on choosing a company below, but right now we want to discuss researching a company’s loss ratio.

Knowing a company’s loss ratio is important in determining if they can provide you the car insurance you need.

In essence, a company’s loss ratio is how much the insurer pays out in claims compared to how much money they receive in premiums. That might sound confusing.

Check out this example: if a company spends $60 in claims for every $100 they receive in premiums, they have a loss ratio of 60 percent. Thus, loss ratios over 100 percent show an insurer is losing money. Conversely, however, abnormally low loss ratios mean a company isn’t paying out much in claims.

The National Association of Insurance Commissioners (NAIC) reports that in 2017, the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is between 60 and 70 percent.

North Carolina has an oddly high loss ratio for medical payment claims.

Here’s the state’s average loss ratios between 2012 and 2014:

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 81% | 81% | 79% |

| Uninsured/Underinsured Motorist | 53% | 56% | 53% |

Though anything above minimum insurance coverage is optional in North Carolina, having stronger coverage may help you avoid financial hardship or even bankruptcy should medical or property damage bills stack up. Remember, about 9 percent of North Carolina drivers are uninsured.

Add-ons, Endorsements, and Riders

What is your biggest goal in shopping for car insurance? We’re going to guess it’s great coverage at an affordable premium. And who can blame you?

Did you know there are a lot of cheap but powerful extras you can add to your policy to ensure you are better-covered in case of an accident or other unfortunates events?

Some good add-ons you might consider in North Carolina are:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

There’s one other add-on we recommend you think about: personal injury protection (PIP). PIP, or “no-fault insurance,” covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

Male vs. Female Rates

North Carolina is only one of SIX states — alongside Hawaii, Massachusetts, Pennsylvania, California, and Montana — that bans companies from using gender as a factor in determining car insurance premiums.

And despite the perseverance of the idea of the gender gap in car insurance, the difference between car insurance premiums for men and women is insignificant for drivers over the age of 25, studies consistently show.

As the table below shows, however, your car insurance premium can be greatly affected by your age and marital status.

| Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $5,499.72 | $5,499.72 | $4,516.40 | $4,516.40 | $13,137.37 | $13,137.37 | $5,608.24 | $5,608.24 |

| Geico Govt Employees | $2,521.28 | $2,474.28 | $2,482.19 | $2,437.32 | $4,603.65 | $4,563.43 | $2,212.08 | $2,199.26 |

| Liberty Mutual | $1,823.22 | $1,823.22 | $1,886.88 | $1,886.88 | $3,197.53 | $3,197.53 | $1,823.22 | $1,823.22 |

| Nationwide Mutual | $2,431.91 | $2,431.91 | $2,431.91 | $2,431.91 | $4,096.41 | $4,096.41 | $2,431.91 | $2,431.91 |

| Progressive Premier | $1,785.15 | $1,785.15 | $1,623.93 | $1,623.93 | $4,132.18 | $4,132.18 | $1,989.17 | $1,989.17 |

| State Farm Mutual Auto | $2,692.15 | $2,692.15 | $2,327.42 | $2,327.42 | $3,966.45 | $3,966.45 | $3,328.58 | $3,328.58 |

| Standard Fire Ins Co | $2,665.43 | $2,665.43 | $2,644.05 | $2,644.05 | $4,485.32 | $4,485.32 | $2,735.84 | $2,735.84 |

Cheapest NC Car Insurance Rates by ZIP Code and City

North Carolina is a diverse state. The state’s urban areas — especially Charlotte, Raleigh, and the cities of the Research Triangle — are densely populated, and becoming denser. Much of the state, however, is still rural, full of mountains and family farms.

Where you live is a key factor in determining your car insurance premium.

Cheapest NC Car Insurance Rates by ZIP Code

Here are average insurance premiums for North Carolina cities by zip code and population in 2017:

| 25 Least Expensive Zip Codes in North Carolina | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 28701 | ALEXANDER | $2,860.59 | Allstate | $6,059.88 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $1,995.50 |

| 28715 | CANDLER | $2,862.25 | Allstate | $6,136.08 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,034.90 |

| 28748 | LEICESTER | $2,863.37 | Allstate | $6,059.88 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,021.11 |

| 28787 | WEAVERVILLE | $2,872.11 | Allstate | $6,136.08 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,018.45 |

| 28778 | SWANNANOA | $2,878.07 | Allstate | $6,148.91 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,028.10 |

| 28709 | BARNARDSVILLE | $2,882.94 | Allstate | $6,148.91 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,072.41 |

| 27265 | HIGH POINT | $2,883.83 | Allstate | $6,076.76 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $1,993.83 |

| 28801 | ASHEVILLE | $2,884.67 | Allstate | $6,385.53 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $1,981.45 |

| 28730 | FAIRVIEW | $2,886.16 | Allstate | $6,148.91 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,033.99 |

| 28711 | BLACK MOUNTAIN | $2,891.80 | Allstate | $6,227.12 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,054.26 |

| 28804 | ASHEVILLE | $2,892.21 | Allstate | $6,385.53 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $1,984.65 |

| 27516 | CHAPEL HILL | $2,894.00 | Allstate | $6,543.38 | Travelers | $2,628.40 | Liberty Mutual | $1,833.71 | Progressive | $1,926.80 |

| 28704 | ARDEN | $2,896.41 | Allstate | $6,385.53 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $1,988.16 |

| 28806 | ASHEVILLE | $2,901.40 | Allstate | $6,478.07 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $1,972.48 |

| 27284 | KERNERSVILLE | $2,904.11 | Allstate | $6,076.76 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $1,978.14 |

| 27103 | WINSTON SALEM | $2,906.04 | Allstate | $6,155.71 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $2,038.99 |

| 27023 | LEWISVILLE | $2,906.14 | Allstate | $6,090.04 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $2,017.16 |

| 27105 | WINSTON SALEM | $2,906.78 | Allstate | $6,155.71 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $2,027.48 |

| 28805 | ASHEVILLE | $2,907.32 | Allstate | $6,478.07 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,023.06 |

| 27410 | GREENSBORO | $2,908.91 | Allstate | $6,076.76 | Travelers | $2,732.86 | Liberty Mutual | $1,918.26 | Progressive | $2,041.66 |

| 27510 | CARRBORO | $2,908.96 | Allstate | $6,703.95 | Travelers | $2,628.40 | Liberty Mutual | $1,833.71 | Progressive | $1,870.94 |

| 28803 | ASHEVILLE | $2,909.29 | Allstate | $6,478.07 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,026.58 |

| 27050 | TOBACCOVILLE | $2,910.16 | Allstate | $6,039.60 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $2,059.56 |

| 27045 | RURAL HALL | $2,911.84 | Allstate | $6,076.76 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $2,035.22 |

| 27101 | WINSTON SALEM | $2,913.24 | Allstate | $6,155.71 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $2,025.74 |

It’s easy to find the cheapest car insurance rates for you. Just enter your zip code to get started.

Here are the most expensive NC car insurance rates by ZIP Code:

| 25 Most Expensive Zip Codes in North Carolina | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 28205 | CHARLOTTE | $4,803.84 | Allstate | $10,255.09 | State Farm | $4,754.10 | Liberty Mutual | $3,198.09 | Progressive | $3,600.76 |

| 28206 | CHARLOTTE | $4,801.37 | Allstate | $10,255.09 | State Farm | $4,730.74 | Liberty Mutual | $3,198.09 | Progressive | $3,606.80 |

| 28212 | CHARLOTTE | $4,795.85 | Allstate | $10,255.09 | State Farm | $4,752.72 | Liberty Mutual | $3,198.09 | Progressive | $3,546.16 |

| 28208 | CHARLOTTE | $4,786.44 | Allstate | $10,176.40 | State Farm | $4,724.45 | Liberty Mutual | $3,198.09 | Progressive | $3,587.28 |

| 28217 | CHARLOTTE | $4,746.83 | Allstate | $9,909.55 | State Farm | $4,710.84 | Liberty Mutual | $3,198.09 | Progressive | $3,590.48 |

| 28262 | CHARLOTTE | $4,649.95 | Allstate | $9,496.84 | State Farm | $4,569.67 | Liberty Mutual | $3,198.09 | Progressive | $3,466.15 |

| 28215 | CHARLOTTE | $4,639.07 | Allstate | $9,084.42 | State Farm | $4,766.92 | Liberty Mutual | $3,198.09 | Progressive | $3,605.20 |

| 28213 | CHARLOTTE | $4,633.71 | Allstate | $9,102.08 | State Farm | $4,674.82 | Liberty Mutual | $3,198.09 | Geico | $3,621.01 |

| 28126 | NEWELL | $4,563.72 | Allstate | $9,568.77 | Travelers | $4,474.57 | Liberty Mutual | $3,198.09 | Geico | $3,621.01 |

| 28216 | CHARLOTTE | $4,530.13 | Allstate | $8,427.84 | State Farm | $4,764.99 | Liberty Mutual | $3,198.09 | Progressive | $3,501.10 |

| 28254 | CHARLOTTE | $4,465.78 | Allstate | $10,255.09 | Nationwide | $3,723.29 | Travelers | $3,157.47 | Liberty Mutual | $3,198.09 |

| 28310 | FORT BRAGG | $4,347.17 | Allstate | $9,218.95 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,204.08 |

| 28308 | POPE A F B | $4,330.29 | Allstate | $9,205.54 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,149.93 |

| 28307 | FORT BRAGG | $4,328.13 | Allstate | $9,218.95 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,108.69 |

| 28314 | FAYETTEVILLE | $4,303.63 | Allstate | $9,039.66 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,128.85 |

| 28303 | FAYETTEVILLE | $4,298.91 | Allstate | $9,039.66 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,141.24 |

| 28311 | FAYETTEVILLE | $4,285.87 | Allstate | $9,039.66 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,104.17 |

| 28305 | FAYETTEVILLE | $4,281.21 | Allstate | $8,991.16 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,120.02 |

| 28301 | FAYETTEVILLE | $4,278.95 | Allstate | $8,991.16 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,108.85 |

| 28390 | SPRING LAKE | $4,274.80 | Allstate | $8,991.91 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,113.76 |

| 28304 | FAYETTEVILLE | $4,270.53 | Allstate | $8,867.89 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,105.32 |

| 28348 | HOPE MILLS | $4,256.98 | Allstate | $8,867.89 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,092.61 |

| 28306 | FAYETTEVILLE | $4,254.96 | Allstate | $8,867.89 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,064.54 |

| 28376 | RAEFORD | $4,234.90 | Allstate | $8,828.60 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,075.19 |

| 28323 | BUNNLEVEL | $4,231.45 | Allstate | $8,632.88 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,194.30 |

Cheapest NC Car Insurance Rates by City

Here are the cheapest NC car insurance rates by ZIP Code:

| 10 Most Expensive Cities in North Carolina | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Newell | $4,563.71 | Allstate | $9,568.77 | Travelers | $4,474.57 | Liberty Mutual | $3,198.09 | Geico | $3,621.01 |

| Pope Army Airfield | $4,330.29 | Allstate | $9,205.54 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,149.93 |

| Fort Bragg | $4,328.13 | Allstate | $9,218.95 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,108.69 |

| Fayetteville | $4,290.15 | Allstate | $9,007.01 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,122.13 |

| Spring Lake | $4,274.80 | Allstate | $8,991.91 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,113.76 |

| Bowmore | $4,234.90 | Allstate | $8,828.60 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,075.19 |

| Bunnlevel | $4,231.45 | Allstate | $8,632.88 | Travelers | $4,040.19 | Liberty Mutual | $2,815.72 | Progressive | $3,194.30 |

| Cumberland | $4,153.61 | Allstate | $8,977.75 | Nationwide | $3,754.57 | Liberty Mutual | $2,815.72 | Progressive | $3,064.54 |

| Hope Mills | $4,135.67 | Allstate | $8,944.64 | Travelers | $3,802.86 | Liberty Mutual | $2,670.66 | Progressive | $2,928.48 |

| Rex | $4,043.21 | Allstate | $9,021.39 | State Farm | $3,678.16 | Liberty Mutual | $2,525.61 | Progressive | $2,824.28 |

Here are the most expensive NC car insurance rates by ZIP Code:

| 10 Least Expensive Cities in North Carolina | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Alexander | $2,860.59 | Allstate | $6,059.88 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $1,995.50 |

| Candler | $2,862.25 | Allstate | $6,136.08 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,034.90 |

| Leicester | $2,863.37 | Allstate | $6,059.88 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,021.11 |

| Weaverville | $2,872.11 | Allstate | $6,136.08 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,018.45 |

| Swannanoa | $2,878.06 | Allstate | $6,148.91 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,028.10 |

| Barnardsville | $2,882.94 | Allstate | $6,148.91 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,072.41 |

| Black Mountain | $2,891.80 | Allstate | $6,227.12 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $2,054.26 |

| Arden | $2,896.41 | Allstate | $6,385.53 | Travelers | $2,681.73 | Liberty Mutual | $1,865.73 | Progressive | $1,988.16 |

| Carrboro | $2,901.48 | Allstate | $6,623.66 | Travelers | $2,628.40 | Liberty Mutual | $1,833.71 | Progressive | $1,898.87 |

| Kernersville | $2,904.11 | Allstate | $6,076.76 | Travelers | $2,750.53 | Liberty Mutual | $1,918.26 | Progressive | $1,978.14 |

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Best North Carolina Car Insurance Companies

From company financial ratings to rates for drivers of various histories, you’ll want to consider the pros and cons of each insurer because the best car insurance company for you depends on a number of factors.

For our compilation of the best car insurance companies in North Carolina, check out the sections below.

The Largest Companies Financial Rating

A.M. Best Financial Rating informs consumers of the financial strength of a particular insurance company.

Here are their financial ratings for the biggest insurers in North Carolina:

| Company | Rating |

|---|---|

| State Farm | A++ |

| Nationwide | A+ |

| Geico | A++ |

| North Carolina Farm Bureau Group | A |

| Amtrust NGH Group | Not Rated |

| Allstate | A+ |

| USAA | A++ |

| Progressive | A+ |

| Erie Insurance Group | A+ |

| Liberty Mutual | A |

Companies with Best Ratings

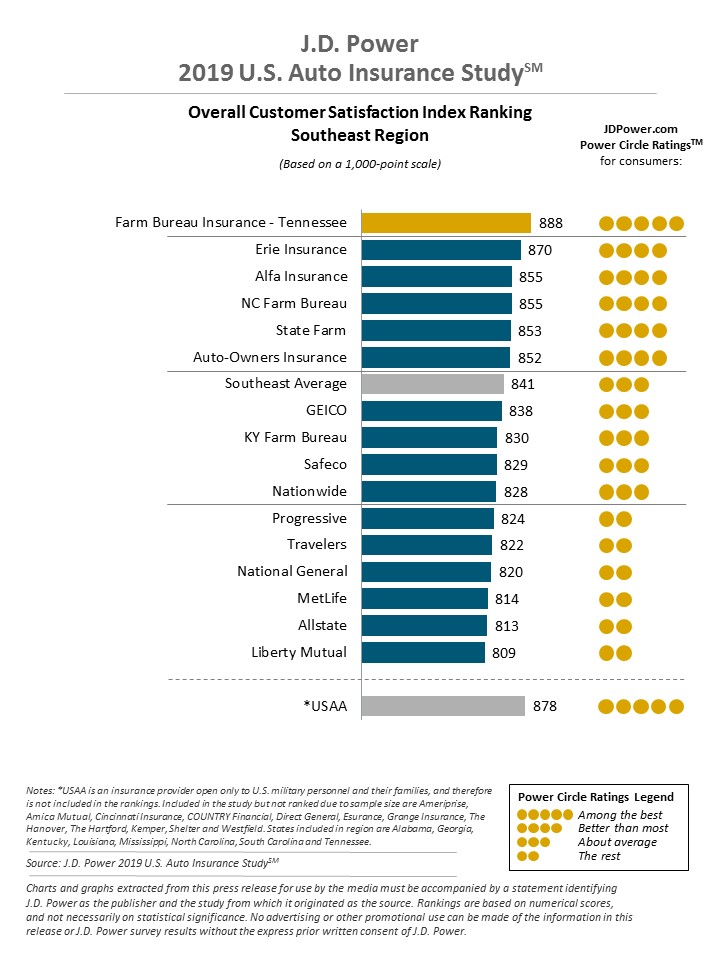

When you think of the best-ranked car insurance companies, do you think of zippy commercials with geckos or cashiers named Flo? If you do, you might be surprised to learn that J.D. Power and Associates recently ranked Farm Bureau Insurance – Tennessee the best auto insurer in North Carolina.

Here are their 2019 rankings for the Southeast region, including the Tarheel State:

Companies with Most Complaints in North Carolina

Knowing who gets the most complaints can help you determine who is the best car insurer for you and your family.

Our research shows these are the auto insurers with the most complaints in the Old North State:

- MAPFRE North America

- MetLife

- Mercury General

- Progressive

- Liberty Mutual

- Nationwide

- Allstate

- Farmers Insurance

- Berkshire Hathaway

- State Farm

Cheapest Companies in North Carolina

We understand that cost might be your bottom dollar when it comes to choosing a car insurance company.

Just remember that the cheapest isn’t always best (though most expensive might not be either).

All things considered, Liberty Mutual is the cheapest on average car insurance provider in North Carolina. They also don’t have a high number of customer complaints and have an average financial rating.

The table below provides the cheapest companies in North Carolina as of 2019.

| Company | Annual Average |

|---|---|

| Allstate P&C | $7,190.43 |

| Geico Govt Employees | $2,936.69 |

| Liberty Mutual | $2,182.71 |

| Nationwide Mutual | $2,848.04 |

| Progressive Premier | $2,382.61 |

| State Farm Mutual Auto | $3,078.65 |

| Standard Fire Ins Co | $3,132.66 |

Commute Rates by Companies

At 24.1 minutes each way, North Carolinians have a quicker commute than the national average of 26.1 minutes. In urban metros like Charlotte, that time increases, not surprisingly.

Again, Liberty Mutual holds steady as the cheapest company despite your commute. Your commute time can be a factor your auto insurer considers in determining your premium, and here is some information on various company car insurance premiums with average commutes in North Carolina:

| Company | Commute and Annual Mileage (in miles) | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $7,190.43 |

| Allstate | 25 miles commute. 12000 annual mileage. | $7,190.43 |

| Travelers | 10 miles commute. 6000 annual mileage. | $3,132.66 |

| Travelers | 25 miles commute. 12000 annual mileage. | $3,132.66 |

| State Farm | 25 miles commute. 12000 annual mileage. | $3,093.71 |

| State Farm | 10 miles commute. 6000 annual mileage. | $3,063.59 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,936.69 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,936.69 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,848.03 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,848.03 |

| Progressive | 10 miles commute. 6000 annual mileage. | $2,382.61 |

| Progressive | 25 miles commute. 12000 annual mileage. | $2,382.61 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $2,182.71 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $2,182.71 |

Credit History Rates by Companies

North Carolina’s average Vantage credit score is 666, just below the national average of 675 for 2017.

Your credit history can be a huge factor for companies in determining your car insurance premium. Before getting insurance, you’ll want to know if you have good, fair, or poor credit. If you find you have a low credit score, Liberty Mutual is likely to be the cheapest car insurance provider for you in North Carolina.

Here’s the average premiums by credit rating for North Carolina’s top car insurance companies:

| Company | Credit History | Annual Average |

|---|---|---|

| Allstate | Poor | $9,736.64 |

| Allstate | Fair | $6,309.79 |

| Allstate | Good | $5,524.87 |

| State Farm | Poor | $4,327.76 |

| Travelers | Poor | $3,352.92 |

| Geico | Poor | $3,177.49 |

| Travelers | Fair | $3,043.96 |

| Travelers | Good | $3,001.11 |

| Geico | Fair | $2,922.17 |

| Nationwide | Fair | $2,848.03 |

| Nationwide | Good | $2,848.03 |

| Nationwide | Poor | $2,848.03 |

| State Farm | Fair | $2,763.43 |

| Geico | Good | $2,710.39 |

| Progressive | Poor | $2,689.33 |

| Progressive | Fair | $2,325.80 |

| Liberty Mutual | Fair | $2,182.71 |

| Liberty Mutual | Good | $2,182.71 |

| Liberty Mutual | Poor | $2,182.71 |

| State Farm | Good | $2,144.76 |

| Progressive | Good | $2,132.70 |

But what’s even more important than credit history to car insurance providers in determining what you have to pay them? Your driving record.

Driving Record Rates by Companies

North Carolina, home of the NASCAR Museum, does not always shy away from its need for speed. But remember, your driving record certainly affects your premium, perhaps more than anything else.

If you’ve had a speeding violation, Progressive is likely the cheapest company for car insurance in North Carolina. A DUI in your past? Look into Liberty Mutual.

Here’s what you can expect based on different driving histories in North Carolina:

| Company | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $12,757.11 |

| Allstate | With 1 accident | $6,855.02 |

| State Farm | With 1 DUI | $5,926.55 |

| Travelers | With 1 DUI | $5,836.08 |

| Geico | With 1 DUI | $5,666.30 |

| Nationwide | With 1 DUI | $5,390.16 |

| Allstate | With 1 speeding violation | $5,262.09 |

| Progressive | With 1 DUI | $5,173.29 |

| Liberty Mutual | With 1 DUI | $4,095.53 |

| Allstate | Clean record | $3,887.51 |

| Travelers | With 1 accident | $2,448.95 |

| Travelers | With 1 speeding violation | $2,400.64 |

| State Farm | With 1 accident | $2,371.17 |

| State Farm | With 1 speeding violation | $2,371.17 |

| Geico | With 1 accident | $2,336.01 |

| Geico | With 1 speeding violation | $2,167.56 |

| Nationwide | With 1 accident | $2,164.71 |

| Nationwide | With 1 speeding violation | $2,164.71 |

| Travelers | Clean record | $1,844.98 |

| Nationwide | Clean record | $1,672.56 |

| Liberty Mutual | With 1 accident | $1,668.53 |

| Liberty Mutual | With 1 speeding violation | $1,668.53 |

| State Farm | Clean record | $1,645.72 |

| Progressive | With 1 accident | $1,642.22 |

| Progressive | With 1 speeding violation | $1,590.55 |

| Geico | Clean record | $1,576.88 |

| Liberty Mutual | Clean record | $1,298.25 |

| Progressive | Clean record | $1,124.37 |

Largest Car Insurance Companies in North Carolina

Bigger can sometimes mean better and cheaper. Here are the biggest auto insurers in North Carolina:

| Company | Premiums Written | Market Share |

|---|---|---|

| State Farm | $915,686 | 15.30% |

| Nationwide | $760,136 | 12.70% |

| Geico | $670,830 | 11.21% |

| North Carolina Farm Bureau Group | $558,355 | 9.46% |

| Amtrust NGH Group | $558,355 | 9.33% |

| Allstate | $503,501 | 8.41% |

| USAA | $449,687 | 7.51% |

| Progressive | $338,265 | 5.65% |

| Erie Insurance Group | $226,829 | 3.79% |

| Liberty Mutual | $175,250 | 2.93% |

Number of Foreign vs. Domestic Insurers in North Carolina

Both domestic and foreign insurers are operating in the state of North Carolina. Those terms might be misleading, but the difference is simple.

- Domestic means that the insurer is in-state, or it may be an insurance company only available in the state of North Carolina.

- Foreign means out of state, or a company such as Geico that is available in multiple states.

In North Carolina, there are 56 domestic insurers and 855 foreign insurers.

How Much Car Insurance Rates in North Carolina

Explore the fluctuation of car insurance premiums among various cities in North Carolina. Choose your city from the options provided below to gain insights into insurance expenses specific to your locale.

North Carolina Laws

It’s always important to know the laws where you’re driving.

The National Motorists Association offers a top-notch summary of North Carolina’s driving laws, some of which we’ll talk about below.

Car Insurance Laws

Remember, North Carolina requires liability insurance with the following minimums:

- Injury to one person: $30,000

- All injuries: $60,000

- Property Damage: $25,000

Also remember, these are minimums. What is best for you and your family might be coverage above liability.

How State Laws for Insurance are Determined

Insurance laws can seem like a mystery, but they don’t just arise from the fog of the Blue Ridge Mountains.

The standard setting and regulatory support organization for the United States is the National Association of Insurance Commissioners (NAIC). Created and governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories they offer this great guide to understanding how insurance laws get made.

Windshield Coverage

Rats! You’ve cracked your windshield, and that crack is spreading.

Are insurers required by North Carolina law to replace windshield glass? Yes.

And good news: you can choose where the repairs are done, and the insurance company must use aftermarket parts that are equal to the original parts they are replacing.

By North Carolina law G.S. 58-3-180, “it is a violation for an automobile repair facility or parts person to place a nonoriginal crash repair part, nonoriginal windshield, or nonoriginal auto glass on a motor vehicle and to submit an invoice for an original repair part.”

Glass repair is the number one insurance claim across the nation, and North Carolina premiums are cheaper, in part, because the state has strict regulations for windshield coverage.

High-Risk Insurance

Like many states, North Carolina uses a points system. That is, the higher the number of points you have — as in, moving infractions on your driving record — the higher your car insurance premiums are likely to be.

Some examples of moving violations and the points associated with them include:

- Speeding 10 MPH or less over a speed limit that’s lower than 55 MPH: one point

- Following too closely: two points

- Causing an accident that results in death or total bodily injury of over $1,800: three points

- Reckless driving: four points

- Driving while your license or registration is revoked/suspended: eight points

- Speeding to elude arrest: 10 points

- Hit-and-run that results in bodily injury or death: 12 points

But even if you’re not a spotless driver, North Carolina has a Safe Driver Incentive Plan in place to allow folks to reduce the number of violative points on their record.

Automobile Insurance Fraud in North Carolina

Insurance fraud can come from two directions: from companies to consumers, and from consumers to companies.

Avoiding frauding your insurance company is fairly simple: don’t file false claims. And remember, insurance fraud can be a felony in the state of North Carolina.

The North Carolina Department of Insurance warns you to be on the lookout for the most common types of insurance schemes in North Carolina:

- Automobile repair fraud

- Staged automobile accidents

- Fraudulent billing of customers for medical services

- Property claims adjusting

- Property repair

Statute of Limitations

The Business Dictionary defines statute of limitations as the “legislation that sets a timeframe (limitations period) within which affected parties must take action to enforce their rights or to seek redress after a damage or injury.” Basically, a statute of limitations is the time you have to file a lawsuit in court following an automobile incident.

In North Carolina, the statute of limitations is three years for both personal injury and property damage cases.

North Carolina Specific Laws

We recommend you check out The National Motorists Association’s summary of North Carolina-specific driving laws.

For now though, here is some interesting (and important) information for driving in North Carolina:

- North Carolina is notorious for citing nonresidents who then receive offers from attorneys in the locale of the violation who “guarantee” a “no point” or reduced point violation for a specified amount of money.

- Left turns on red from a one-way street to another one-way street are illegal in North Carolina.

- North Carolina requires that you have your headlights on whenever you are using your windshield wipers.

Also, whether your ticket is for parking, speeding, equipment, or a DUI, you have the right to a trial by jury in North Carolina.

Vehicle Licensing Laws

Who doesn’t love getting their picture taken at the DMV?

Like almost everywhere, North Carolina requires a valid driver’s license to operate a vehicle. Want to test your luck? Unlicensed driving is a class 3 misdemeanor carrying a fine of up to $200. A convicted person may also be sentenced to up to 20 days in jail, depending on his or her criminal history.

Real ID

Even though you don’t need a REAL ID to drive in North Carolina, the state’s Department of Transportation makes it pretty easy to obtain one. Just visit the DMV with the required acceptable documentation.

Having a REAL ID can save you the hassle of bringing other forms of identification with you to conduct official state or federal government business.

Penalties for Driving Without Insurance

Trust us: it’s never a good idea to drive without insurance.

Here are the penalties for driving without insurance in the Old North State:

- First offense: $50 civil penalty; license/registration suspended for 30 days and $50 reinstatement fee; 45-day probation.

- Second offense: $100 civil penalty; license/registration suspended for 30 days and $50 reinstatement fee; 45-day probation.

- Third and subsequent offenses: $150 civil penalty; license/registration suspended for 30 days and $50 reinstatement fee; 45-day probation.

Teen Driver Laws

If you’re new to North Carolina, it’s best to read up before your teen gets on the road, as teen driving laws vary from state to state.

Here’s some info on driving as a teen in the Tarheel State:

| Teen Driving Laws in North Carolina | Requirements #1 | Requirements #2 | Requirements #3 |

|---|---|---|---|

| To get a learners license you must: | Have a minimum age of 15. | Pass a driver's education course. | Receive a driver's eligibility and a driver's education certificate. |

| Before getting a license or restricted license you must: | Have a minimum age of 16. | Have a mandatory holding period of 12 months | Have 60 hours of supervised driving time. 10 hours must be at night;. |

| Restrictions | Nighttime restrictions from 9 p.m. to 5 a.m. | No more than one passenger younger than 21. | - |

Older Driver License Renewal Procedures

The rules for older drivers in North Carolina are pretty straightforward, differing little from the rules for other adult drivers. Here’s some helpful information:

- Older Population License Renewal: every five years for people 66 years and older.

- Proof of vision required: every renewal.

- Mail or online renewal permitted: yes, for every other renewal.

New Residents

So you’re planning a move to North Carolina, one of the fastest-growing states in the nation? Don’t forget to include plans for your auto insurance and registration in your moving details.

The most important thing to know: you must register and title your vehicle, as well as get a North Carolina license, within 60 days of moving to the state.

That’s two months to get your car registered and your official North Carolina (or Duke!) basketball gear.

License Renewal Procedures

We all look forward to a trip to the license office. Well, not really, but come prepared and you’ll have a much smoother experience.

In North Carolina, you must have a current or expired license with you at the time of renewal. If you do not have one of these, you must present two forms of identification.

Please note: the North Carolina DMV will mail you a renewal card 60 days before your license expires. But, get ahead of the game by renewing your license up to 180 days before its expiration date.

And more good news. If you don’t have a restriction on your driver’s license and if you carry a standard Class C driver’s license, you can renew online.

Negligent Operator Treatment System (NOTS)

Remember, North Carolina is a “points” state, meaning the more moving infractions you have on your driving record, the more points you have. The more points you have, the more expensive your car insurance premium is likely to be.

The North Carolina Department of Transportation offers these key facts about the points system:

- An individual’s license may be suspended if they accumulate as many as 12 points within a three-year period.

- Eight points within three years following the reinstatement of a license can result in an additional suspension.

- When a driving privilege is reinstated, all previous points on an individual’s record are canceled.

Rules of the Road

Whether you’re a North Carolinian by birth or by choice, or even if you’re just passing through the Tarheel State, you’ll need to know rules for driving in North Carolina.

Below we offer some helpful advice we’ve compiled to make sure you’re in the know.

Fault vs. No-Fault

North Carolina is an at-fault state.

This means you’ll be held financially and legally liable if you are found at-fault in an auto accident.

Make sure you have the best liability insurance you can to protect you and your family.

Seat belt and car seat laws

Unlike many states, North Carolina primarily enforces seat belt and car seat laws. This means if a police officer sees you not wearing your seat belt or doesn’t see a child in a car seat, they can (and likely will) stop you without any other reason.

The North Carolina Department of Public Safety explains that “all drivers, front seat passengers and back seat passengers ages 16 and older must wear their seat belts. Children less than age 16 are covered by the NC child passenger safety law.”

The North Carolina Child Passenger Safety Law requires children less than age 16 to be properly restrained in an age, weight, and height appropriate restraint.

That means that a properly used car seat or booster seat is required for children less than age 8 and less than 80 pounds, and that only when a child reaches age 8 (regardless of weight) or 80 pounds (regardless of age), a properly fitted seat belt can be used in place of a car seat or booster seat.

Keep Right and Move Over Laws

The law firm Riddle & Brantley explains that “the ‘Move Over’ law in North Carolina requires motorists to move their vehicles away from the lane closest to a parked law enforcement or emergency vehicle.”

Also, if you are in the left lane on a multi-lane highway, slow driving is not allowed if you are traveling under the speed limit.

Speed Limits

Speed limits in North Carolina are absolute, meaning that exceeding the speed limit is illegal per se (regardless of whether it was safe under the specific conditions).

Absolute speed limits in the Old North State are the same for both cars and trucks:

- Rural Interstates: 70 mph

- Urban Interstates: 70 mph

- Other Limited Access Roads: 70 mph

Ridesharing

Ridesharing options like Uber and Lyft are becoming more and more common, especially in growing cities like Charlotte and Raleigh, North Carolina.

Fortunately, such companies require their drivers to carry insurance to cover them and their passengers in the case of an accident.

ABC 11 in Raleigh reports that North Carolina is going a step further in protecting rideshare passengers, explaining that the Passenger Protection Act (House Bill 391) will require Uber, Lyft and other rideshare company drivers to:

- Display a license plate number visible in front of the car.

- Have an illuminated sign displaying the rideshare logo that can be visible in darkness.

Automation on the Road

North Carolinians are likely to see more and more automation on their roadways. The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task that was previously carried out by a human.

North Carolina is one of 12 states that have authorized the full deployment of automated vehicles.

DUI Laws

Never drive while under the influence of alcohol. And remember, North Carolina’s DUI Laws are some of the strictest in the United States.

Absolute Advocacy explains that alcohol-impaired driving can be proven in one of two ways:

- By proving the driver’s physical or mental fitness are appreciably impaired by alcohol, drugs or a combination of both; or

- By proving the driver’s blood alcohol concentration is 0.08 percent or more.

With four levels of DUI offense, a person convicted of the lowest-level DUI for the first time faces a minimum $4,000 fine and up to a year of revoked licensure.

Marijuana-Impaired Driving Laws

There are no marijuana-specific laws in the state of North Carolina, but it doesn’t mean you won’t get in trouble for driving under the influence.

The state’s DUI laws extend to cover “alcohol, drugs or a combination of both” when it comes to determining impairment.

Distracted Driving Laws

AAA reports that in North Carolina, “text messaging and emailing while driving are prohibited for all drivers. Limited learner’s permit and provisional driver’s license holders, and drivers under 18, are prohibited from all cell phone use. School bus drivers are not permitted to use cell phones.”

And those laws may be becoming stricter. The Hands Free North Carolina Act is currently being debated in the state legislature.

Driving Safely in North Carolina

You probably know that driving safely is important wherever you are.

In the sections below, we’ve compiled some important information on keeping you, your family, and your vehicles safe in North Carolina.

Vehicle Theft in North Carolina

The FBI tracks vehicle theft and other crimes across the state of North Carolina, from Cape Carteret to Wrightsville Beach. In 2016, Charlotte led the state in vehicle thefts, with 2,761.

It’s important to check your insurance policy for coverage in the case of vehicle theft.

The table below offers the top-10 most-stolen cars in North Carolina for 2017 by make, model year, and the number of thefts.

| Vehicle | Year | Thefts |

|---|---|---|

| Honda Accord | 1997 | 609 |

| Ford Pickup (Full Size) | 2004 | 424 |

| Chevrolet Pickup (Full Size) | 2003 | 370 |

| Honda Civic | 2000 | 350 |

| Toyota Camry | 2014 | 291 |

| Nissan Altima | 2015 | 249 |

| Jeep Cherokee/Grand Cherokee | 1999 | 203 |

| Chevrolet Impala | 2006 | 194 |

| Toyota Corolla | 2014 | 190 |

| Ford Explorer | 2003 | 185 |

Road Fatalities in North Carolina

Fatalities are sadly on the rise in the growing state of North Carolina.

Here’s the 2017 breakdown of road fatalities by county:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alamance | 23 | 9 | 24 | 15 | 26 |

| Alexander | 8 | 6 | 6 | 4 | 1 |

| Alleghany | 4 | 0 | 2 | 1 | 2 |

| Anson | 7 | 8 | 2 | 1 | 6 |

| Ashe | 5 | 2 | 6 | 7 | 2 |

| Avery | 2 | 0 | 3 | 3 | 2 |

| Beaufort | 13 | 7 | 5 | 6 | 11 |

| Bertie | 5 | 11 | 6 | 7 | 8 |

| Bladen | 16 | 9 | 4 | 16 | 10 |

| Brunswick | 13 | 13 | 12 | 15 | 30 |

| Buncombe | 35 | 29 | 36 | 25 | 32 |

| Burke | 9 | 16 | 8 | 16 | 17 |

| Cabarrus | 19 | 17 | 24 | 23 | 17 |

| Caldwell | 8 | 9 | 12 | 10 | 6 |

| Camden | 1 | 4 | 0 | 0 | 2 |

| Carteret | 8 | 4 | 4 | 9 | 3 |

| Caswell | 2 | 4 | 6 | 7 | 6 |

| Catawba | 21 | 24 | 28 | 15 | 19 |

| Chatham | 12 | 12 | 12 | 15 | 13 |

| Cherokee | 6 | 5 | 5 | 6 | 11 |

| Chowan | 0 | 3 | 1 | 2 | 3 |

| Clay | 2 | 1 | 2 | 2 | 3 |

| Cleveland | 9 | 16 | 20 | 33 | 10 |

| Columbus | 22 | 18 | 14 | 26 | 30 |

| Craven | 17 | 10 | 16 | 19 | 9 |

| Cumberland | 53 | 40 | 43 | 43 | 43 |

| Currituck | 4 | 4 | 4 | 9 | 5 |

| Dare | 7 | 2 | 2 | 4 | 2 |

| Davidson | 31 | 24 | 28 | 34 | 23 |

| Davie | 4 | 7 | 6 | 7 | 9 |

| Duplin | 9 | 17 | 20 | 8 | 9 |

| Durham | 25 | 26 | 25 | 22 | 31 |

| Edgecombe | 8 | 9 | 11 | 7 | 14 |

| Forsyth | 27 | 34 | 40 | 42 | 42 |

| Franklin | 12 | 4 | 7 | 19 | 14 |

| Gaston | 23 | 31 | 40 | 29 | 23 |

| Gates | 3 | 5 | 4 | 3 | 2 |

| Graham | 5 | 3 | 3 | 5 | 2 |

| Granville | 8 | 18 | 12 | 12 | 12 |

| Greene | 3 | 3 | 5 | 1 | 5 |

| Guilford | 44 | 57 | 57 | 59 | 66 |

| Halifax | 12 | 9 | 12 | 10 | 12 |

| Harnett | 27 | 23 | 23 | 22 | 34 |

| Haywood | 7 | 6 | 8 | 14 | 10 |

| Henderson | 9 | 16 | 9 | 14 | 12 |

| Hertford | 3 | 1 | 4 | 7 | 8 |

| Hoke | 6 | 11 | 15 | 15 | 18 |

| Hyde | 0 | 1 | 1 | 0 | 1 |

| Iredell | 22 | 27 | 18 | 23 | 31 |

| Jackson | 5 | 7 | 6 | 10 | 4 |

| Johnston | 28 | 36 | 27 | 34 | 32 |

| Jones | 2 | 2 | 1 | 3 | 3 |

| Lee | 15 | 7 | 21 | 8 | 19 |

| Lenoir | 7 | 11 | 9 | 9 | 3 |

| Lincoln | 12 | 7 | 19 | 14 | 14 |

| Macon | 4 | 9 | 5 | 8 | 7 |

| Madison | 3 | 4 | 3 | 3 | 6 |

| Martin | 5 | 3 | 2 | 7 | 4 |

| Mcdowell | 10 | 9 | 5 | 8 | 5 |

| Mecklenburg | 67 | 69 | 80 | 103 | 114 |

| Mitchell | 4 | 0 | 2 | 2 | 0 |

| Montgomery | 4 | 10 | 3 | 8 | 13 |

| Moore | 9 | 26 | 16 | 19 | 19 |

| Nash | 21 | 24 | 24 | 27 | 17 |

| New Hanover | 18 | 18 | 22 | 20 | 18 |

| Northampton | 7 | 9 | 5 | 2 | 9 |

| Onslow | 25 | 23 | 24 | 20 | 18 |

| Orange | 15 | 10 | 12 | 12 | 10 |

| Pamlico | 2 | 3 | 5 | 3 | 0 |

| Pasquotank | 0 | 3 | 4 | 4 | 2 |

| Pender | 15 | 19 | 14 | 16 | 17 |

| Perquimans | 5 | 0 | 2 | 1 | 0 |

| Person | 6 | 7 | 6 | 3 | 9 |

| Pitt | 21 | 16 | 32 | 22 | 21 |

| Polk | 5 | 6 | 4 | 2 | 3 |

| Randolph | 22 | 23 | 26 | 17 | 25 |

| Richmond | 12 | 9 | 5 | 17 | 9 |

| Robeson | 42 | 32 | 53 | 38 | 53 |

| Rockingham | 13 | 11 | 15 | 20 | 8 |

| Rowan | 27 | 27 | 23 | 20 | 14 |

| Rutherford | 11 | 14 | 6 | 6 | 11 |

| Sampson | 13 | 10 | 25 | 24 | 18 |

| Scotland | 9 | 8 | 9 | 5 | 10 |

| Stanly | 10 | 8 | 11 | 13 | 12 |

| Stokes | 9 | 8 | 9 | 9 | 7 |

| Surry | 11 | 18 | 16 | 18 | 8 |

| Swain | 5 | 2 | 1 | 2 | 1 |

| Transylvania | 3 | 7 | 5 | 1 | 7 |

| Tyrrell | 0 | 0 | 0 | 0 | 0 |

| Union | 21 | 18 | 16 | 27 | 28 |

| Vance | 13 | 9 | 10 | 9 | 9 |

| Wake | 73 | 63 | 65 | 81 | 53 |

| Warren | 0 | 3 | 6 | 10 | 6 |

| Washington | 0 | 0 | 3 | 2 | 3 |

| Watauga | 4 | 3 | 12 | 5 | 4 |

| Wayne | 26 | 22 | 17 | 24 | 13 |

| Wilkes | 10 | 13 | 12 | 11 | 12 |

| Wilson | 13 | 14 | 15 | 18 | 20 |

| Yadkin | 6 | 6 | 8 | 8 | 6 |

| Yancey | 3 | 3 | 3 | 5 | 1 |

One key factor of road fatalities in North Carolina: the urban vs. rural divide.

Here’s the breakdown of fatalities, both urban and rural, from 2008 to 2017:

| Region Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 1,010 | 964 | 945 | 835 | 901 | 861 | 896 | 910 | 902 | 903 |

| Urban | 418 | 349 | 375 | 394 | 398 | 426 | 388 | 468 | 543 | 509 |

Most fatal highway in North Carolina

I-40, the busy cross-country interstate that traverses North Carolina, was named the state’s most deadly highway in a 2019 study.

Fatal Crashes by Weather Condition and Light Condition

Both the weather and the time of day are extremely determinative of fatality rates in automobile accidents.

Here are the most recent weather and light-condition fatality rates for the state of North Carolina:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 619 | 132 | 384 | 47 | 2 | 1,184 |

| Rain | 38 | 18 | 31 | 7 | 0 | 94 |

| Snow/Sleet | 4 | 1 | 2 | 2 | 0 | 9 |

Fatalities by Person Type

Not only motorists die on North Carolina’s roads.

Pedestrians, cyclists, and others are part of the state’s transportation system, too.

The following table shows fatalities by person type from 2013 to 2017:

| Person | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 533 | 517 | 605 | 582 | 581 |

| Light Truck - Pickup | 149 | 152 | 154 | 177 | 151 |

| Light Truck - Utility | 146 | 144 | 149 | 184 | 170 |

| Light Truck - Van | 43 | 52 | 39 | 55 | 51 |

| Light Truck - Other | 1 | 0 | 1 | 1 | 3 |

| Large Truck | 16 | 20 | 19 | 20 | 29 |

| Bus | 0 | 0 | 0 | 4 | 0 |

| Motorcyclists | 189 | 190 | 192 | 185 | 176 |

| Pedestrian | 174 | 172 | 182 | 200 | 198 |

| Bicyclist and Other Cyclist | 22 | 19 | 23 | 17 | 29 |

Fatalities by Crash Type

Crashes are caused by a variety of reasons, from speeding to drunk driving. The following table shows North Carolina fatalities by crash type from 2013 to 2017:

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 743 | 756 | 751 | 819 | 765 |

| Involving a Large Truck | 139 | 121 | 129 | 152 | 164 |

| Involving Speeding | 413 | 497 | 547 | 566 | 423 |

| Involving a Rollover | 311 | 336 | 332 | 361 | 360 |

| Involving a Roadway Departure | 775 | 771 | 803 | 889 | 798 |

| Involving an Intersection (or Intersection Related) | 239 | 230 | 256 | 245 | 268 |

Five-Year Trend For The Top 10 Counties

North Carolina is growing, and growing fast.

Here are the five-year road fatality trends for the state’s 10 biggest counties:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Mecklenburg County | 67 | 69 | 80 | 103 | 114 |

| Guilford County | 44 | 57 | 57 | 59 | 66 |

| Robeson County | 42 | 32 | 53 | 38 | 53 |

| Wake County | 73 | 63 | 65 | 81 | 53 |

| Cumberland County | 53 | 40 | 43 | 43 | 43 |

| Forsyth County | 27 | 34 | 40 | 42 | 42 |

| Harnett County | 27 | 23 | 23 | 22 | 34 |

| Buncombe County | 35 | 29 | 36 | 25 | 32 |

| Johnston County | 28 | 36 | 27 | 34 | 32 |

| Durham County | 25 | 26 | 25 | 22 | 31 |

Fatalities Involving Speeding by County

Speeding is a top cause of roadway death.

Here are the statistics on fatalities caused by speeding in North Carolina by county:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alamance | 11 | 2 | 6 | 4 | 8 |

| Alexander | 5 | 2 | 2 | 0 | 1 |

| Alleghany | 0 | 0 | 1 | 0 | 1 |

| Anson | 1 | 4 | 0 | 1 | 0 |

| Ashe | 0 | 0 | 1 | 1 | 0 |

| Avery | 1 | 0 | 0 | 2 | 0 |

| Beaufort | 0 | 1 | 1 | 2 | 1 |

| Bertie | 3 | 4 | 3 | 2 | 4 |

| Bladen | 3 | 1 | 1 | 6 | 3 |

| Brunswick | 4 | 4 | 4 | 5 | 8 |

| Buncombe | 9 | 8 | 15 | 8 | 9 |

| Burke | 2 | 6 | 2 | 5 | 2 |

| Cabarrus | 8 | 4 | 13 | 12 | 5 |

| Caldwell | 2 | 5 | 5 | 6 | 2 |

| Camden | 0 | 0 | 0 | 0 | 0 |

| Carteret | 2 | 2 | 2 | 4 | 1 |

| Caswell | 1 | 2 | 4 | 4 | 3 |

| Catawba | 3 | 11 | 5 | 5 | 4 |

| Chatham | 3 | 2 | 3 | 8 | 3 |

| Cherokee | 1 | 1 | 5 | 1 | 1 |

| Chowan | 0 | 1 | 0 | 2 | 3 |

| Clay | 1 | 0 | 1 | 0 | 1 |

| Cleveland | 1 | 9 | 8 | 18 | 2 |

| Columbus | 6 | 5 | 2 | 7 | 6 |

| Craven | 3 | 6 | 6 | 8 | 2 |

| Cumberland | 15 | 14 | 14 | 25 | 13 |

| Currituck | 2 | 1 | 0 | 1 | 1 |

| Dare | 1 | 1 | 1 | 0 | 0 |

| Davidson | 13 | 12 | 14 | 17 | 12 |

| Davie | 1 | 3 | 2 | 5 | 5 |

| Duplin | 2 | 9 | 4 | 3 | 0 |

| Durham | 6 | 11 | 11 | 10 | 17 |

| Edgecombe | 1 | 6 | 7 | 5 | 2 |

| Forsyth | 11 | 12 | 10 | 14 | 11 |

| Franklin | 3 | 2 | 1 | 5 | 5 |

| Gaston | 6 | 15 | 12 | 14 | 10 |

| Gates | 2 | 2 | 3 | 1 | 1 |

| Graham | 2 | 2 | 2 | 2 | 0 |

| Granville | 3 | 5 | 2 | 4 | 7 |

| Greene | 1 | 1 | 4 | 0 | 1 |

| Guilford | 13 | 27 | 25 | 26 | 19 |

| Halifax | 4 | 5 | 6 | 2 | 8 |

| Harnett | 13 | 11 | 13 | 9 | 14 |

| Haywood | 1 | 3 | 3 | 4 | 2 |

| Henderson | 2 | 9 | 3 | 4 | 2 |

| Hertford | 1 | 0 | 3 | 5 | 1 |

| Hoke | 2 | 2 | 12 | 6 | 9 |

| Hyde | 0 | 0 | 1 | 0 | 1 |

| Iredell | 4 | 6 | 8 | 7 | 3 |

| Jackson | 1 | 4 | 3 | 5 | 3 |

| Johnston | 10 | 11 | 17 | 14 | 9 |

| Jones | 0 | 0 | 0 | 2 | 1 |

| Lee | 8 | 2 | 7 | 2 | 10 |

| Lenoir | 0 | 2 | 2 | 2 | 1 |

| Lincoln | 4 | 1 | 9 | 6 | 4 |

| Macon | 1 | 5 | 3 | 2 | 2 |

| Madison | 0 | 4 | 2 | 3 | 3 |

| Martin | 0 | 2 | 2 | 3 | 2 |

| Mcdowell | 2 | 4 | 3 | 1 | 3 |

| Mecklenburg | 28 | 19 | 44 | 49 | 41 |

| Mitchell | 1 | 0 | 1 | 0 | 0 |

| Montgomery | 2 | 3 | 1 | 4 | 2 |

| Moore | 3 | 13 | 5 | 9 | 3 |

| Nash | 4 | 13 | 9 | 9 | 5 |

| New Hanover | 5 | 8 | 8 | 6 | 4 |

| Northampton | 0 | 1 | 1 | 1 | 1 |

| Onslow | 10 | 12 | 16 | 6 | 5 |

| Orange | 11 | 5 | 7 | 3 | 4 |

| Pamlico | 2 | 2 | 3 | 1 | 0 |

| Pasquotank | 0 | 2 | 1 | 1 | 0 |

| Pender | 7 | 8 | 6 | 0 | 5 |

| Perquimans | 0 | 0 | 1 | 0 | 0 |

| Person | 2 | 4 | 2 | 1 | 2 |

| Pitt | 7 | 5 | 7 | 4 | 2 |

| Polk | 2 | 4 | 2 | 1 | 0 |

| Randolph | 8 | 10 | 14 | 9 | 7 |

| Richmond | 4 | 0 | 1 | 7 | 3 |

| Robeson | 19 | 20 | 18 | 20 | 20 |

| Rockingham | 2 | 5 | 6 | 9 | 2 |

| Rowan | 11 | 8 | 6 | 7 | 3 |

| Rutherford | 4 | 6 | 2 | 3 | 2 |

| Sampson | 5 | 0 | 7 | 7 | 2 |

| Scotland | 3 | 3 | 6 | 1 | 3 |

| Stanly | 5 | 5 | 3 | 5 | 3 |

| Stokes | 2 | 3 | 3 | 4 | 2 |

| Surry | 4 | 6 | 5 | 2 | 2 |

| Swain | 2 | 0 | 0 | 2 | 0 |

| Transylvania | 1 | 4 | 2 | 0 | 6 |

| Tyrrell | 0 | 0 | 0 | 0 | 0 |

| Union | 1 | 5 | 8 | 7 | 11 |

| Vance | 6 | 4 | 2 | 4 | 2 |

| Wake | 29 | 21 | 24 | 33 | 6 |

| Warren | 0 | 1 | 0 | 3 | 3 |

| Washington | 0 | 0 | 0 | 1 | 1 |

| Watauga | 2 | 1 | 6 | 4 | 1 |

| Wayne | 5 | 7 | 6 | 11 | 5 |

| Wilkes | 1 | 5 | 5 | 3 | 3 |

| Wilson | 5 | 4 | 4 | 4 | 8 |

| Yadkin | 4 | 5 | 4 | 1 | 1 |

| Yancey | 1 | 1 | 2 | 4 | 1 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Drunk driving is one of the most notorious causes of road fatalities. (And remember: North Carolina has some of the strictest DUI laws in the nation!)

Here are statistics on fatalities in crashes involving an alcohol-impaired driver in North Carolina by county:

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Alamance | 6 | 3 | 6 | 4 | 10 |

| Alexander | 2 | 2 | 2 | 1 | 0 |

| Alleghany | 1 | 0 | 0 | 0 | 0 |

| Anson | 1 | 3 | 0 | 0 | 2 |

| Ashe | 1 | 0 | 0 | 3 | 1 |

| Avery | 1 | 0 | 1 | 0 | 0 |

| Beaufort | 3 | 2 | 0 | 1 | 1 |

| Bertie | 0 | 2 | 3 | 3 | 3 |

| Bladen | 5 | 0 | 0 | 6 | 4 |

| Brunswick | 5 | 5 | 4 | 5 | 11 |

| Buncombe | 4 | 9 | 5 | 9 | 7 |

| Burke | 3 | 3 | 1 | 3 | 4 |

| Cabarrus | 3 | 5 | 8 | 9 | 3 |

| Caldwell | 1 | 5 | 6 | 5 | 3 |

| Camden | 0 | 0 | 0 | 0 | 1 |

| Carteret | 1 | 2 | 1 | 0 | 1 |

| Caswell | 1 | 2 | 2 | 3 | 2 |

| Catawba | 6 | 10 | 8 | 5 | 6 |

| Chatham | 5 | 1 | 2 | 3 | 5 |

| Cherokee | 3 | 1 | 3 | 1 | 3 |

| Chowan | 0 | 1 | 0 | 1 | 1 |

| Clay | 0 | 0 | 1 | 1 | 0 |

| Cleveland | 3 | 6 | 5 | 13 | 4 |

| Columbus | 8 | 5 | 2 | 7 | 4 |

| Craven | 5 | 3 | 3 | 6 | 1 |

| Cumberland | 15 | 11 | 12 | 17 | 11 |

| Currituck | 0 | 2 | 1 | 0 | 1 |

| Dare | 0 | 1 | 0 | 0 | 1 |

| Davidson | 6 | 8 | 9 | 10 | 8 |

| Davie | 0 | 2 | 1 | 2 | 2 |

| Duplin | 3 | 5 | 3 | 2 | 1 |

| Durham | 4 | 11 | 6 | 7 | 12 |

| Edgecombe | 3 | 2 | 3 | 4 | 5 |

| Forsyth | 8 | 12 | 10 | 18 | 12 |

| Franklin | 2 | 1 | 3 | 5 | 6 |

| Gaston | 3 | 10 | 10 | 8 | 5 |

| Gates | 0 | 1 | 1 | 0 | 1 |

| Graham | 0 | 0 | 1 | 0 | 0 |

| Granville | 3 | 4 | 3 | 3 | 3 |

| Greene | 2 | 0 | 2 | 0 | 1 |

| Guilford | 14 | 14 | 19 | 20 | 26 |

| Halifax | 5 | 4 | 5 | 1 | 5 |

| Harnett | 9 | 6 | 8 | 7 | 7 |

| Haywood | 0 | 2 | 0 | 3 | 2 |

| Henderson | 1 | 3 | 0 | 2 | 3 |

| Hertford | 1 | 0 | 1 | 4 | 4 |

| Hoke | 1 | 3 | 8 | 5 | 6 |

| Hyde | 0 | 0 | 1 | 0 | 0 |

| Iredell | 7 | 8 | 4 | 8 | 8 |

| Jackson | 2 | 2 | 1 | 2 | 2 |

| Johnston | 6 | 5 | 6 | 12 | 12 |

| Jones | 0 | 0 | 0 | 1 | 0 |

| Lee | 7 | 1 | 7 | 2 | 4 |

| Lenoir | 4 | 1 | 2 | 3 | 1 |

| Lincoln | 6 | 2 | 7 | 4 | 5 |

| Macon | 1 | 3 | 0 | 2 | 1 |

| Madison | 1 | 1 | 1 | 2 | 2 |

| Martin | 1 | 1 | 2 | 1 | 0 |

| Mcdowell | 1 | 2 | 1 | 0 | 0 |

| Mecklenburg | 26 | 25 | 29 | 39 | 40 |

| Mitchell | 0 | 0 | 0 | 0 | 0 |

| Montgomery | 1 | 2 | 1 | 2 | 3 |

| Moore | 2 | 9 | 7 | 7 | 5 |

| Nash | 7 | 8 | 4 | 9 | 4 |

| New Hanover | 5 | 8 | 6 | 6 | 5 |

| Northampton | 1 | 2 | 1 | 1 | 3 |

| Onslow | 9 | 6 | 12 | 4 | 7 |

| Orange | 6 | 3 | 7 | 4 | 3 |

| Pamlico | 0 | 0 | 2 | 1 | 0 |

| Pasquotank | 0 | 1 | 0 | 2 | 0 |

| Pender | 7 | 6 | 5 | 3 | 3 |

| Perquimans | 1 | 0 | 1 | 0 | 0 |

| Person | 2 | 4 | 2 | 1 | 1 |

| Pitt | 4 | 4 | 10 | 4 | 4 |

| Polk | 0 | 0 | 1 | 1 | 0 |

| Randolph | 4 | 9 | 7 | 5 | 6 |

| Richmond | 4 | 4 | 0 | 2 | 1 |

| Robeson | 13 | 9 | 16 | 9 | 16 |

| Rockingham | 3 | 1 | 2 | 5 | 4 |

| Rowan | 9 | 5 | 4 | 7 | 3 |

| Rutherford | 2 | 5 | 1 | 0 | 2 |

| Sampson | 4 | 4 | 8 | 3 | 5 |

| Scotland | 1 | 3 | 2 | 3 | 4 |

| Stanly | 5 | 1 | 2 | 5 | 1 |

| Stokes | 4 | 1 | 2 | 4 | 2 |

| Surry | 2 | 4 | 5 | 5 | 1 |

| Swain | 0 | 1 | 0 | 0 | 0 |

| Transylvania | 1 | 0 | 1 | 0 | 2 |

| Tyrrell | 0 | 0 | 0 | 0 | 0 |

| Union | 5 | 6 | 5 | 8 | 8 |

| Vance | 5 | 4 | 5 | 4 | 2 |

| Wake | 29 | 19 | 18 | 27 | 19 |

| Warren | 0 | 1 | 1 | 3 | 2 |

| Washington | 0 | 0 | 0 | 0 | 0 |

| Watauga | 2 | 2 | 5 | 2 | 2 |

| Wayne | 8 | 4 | 5 | 6 | 5 |

| Wilkes | 2 | 3 | 3 | 3 | 3 |

| Wilson | 6 | 3 | 5 | 7 | 8 |

| Yadkin | 0 | 1 | 3 | 4 | 2 |

| Yancey | 0 | 0 | 2 | 0 | 0 |

Teen Drinking and Driving

Teenage drunk driving is a tragic statistic we must discuss, unfortunately.

Here are some key stats on teens and driving under the influence in North Carolina:

| Teens and Drunk Driving | Details |

|---|---|

| Alcohol-Impaired Driving Fatalities Per one million people | 1.5 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrests (Under 18 years old) | 201 |

| DUI Arrests (Under 18 years old) Total Per Million People | 87.44 |

EMS Response Time

Given the large urban-rural divide in North Carolina, EMS response times can vary greatly by where you live and how populated your city or county is.

Some comfort: EMS response times in North Carolina are well below the national average, no matter where you live.

Here are some recent statistics on EMS response time to crashes in North Carolina:

| Region Types | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural | 6 minutes | 10 minutes | 41 minutes | 48 minutes |

| Urban | 3 minutes | 8 minutes | 29 minutes | 37 minutes |

Transportation in North Carolina

North Carolinians love to own cars, love to drive those cars alone to work, and by-and-large eschew public transportation.

Car Ownership

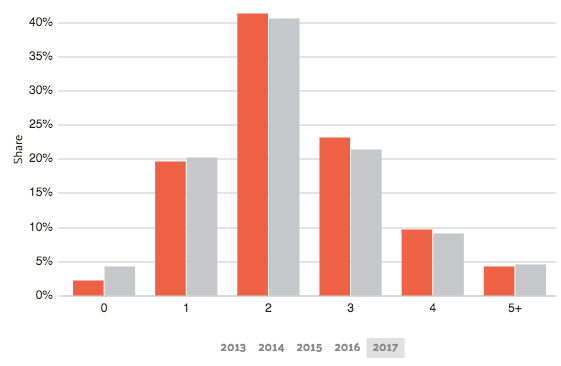

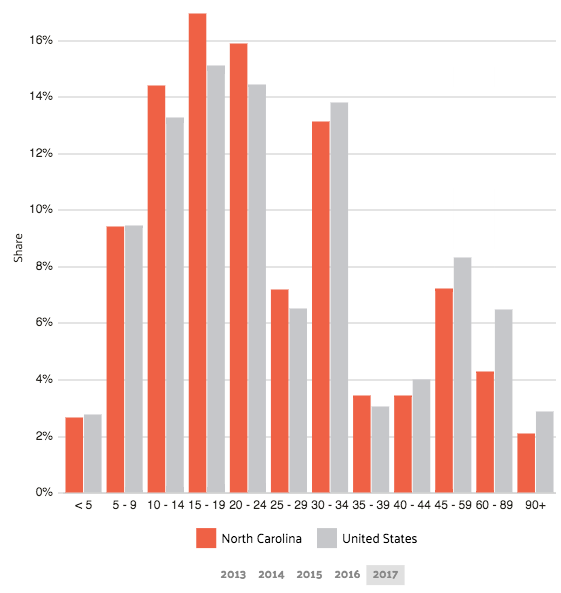

On average, North Carolina households own at least two cars. DataUSA offers this telling graph of how much Tarheelers loved to own vehicles in 2017:

Commute Time

Remember that, at 24.1 minutes each way, North Carolinians have a quicker commute than the national average of 26.1 minutes. In urban metros like Charlotte, that time increases, not surprisingly.

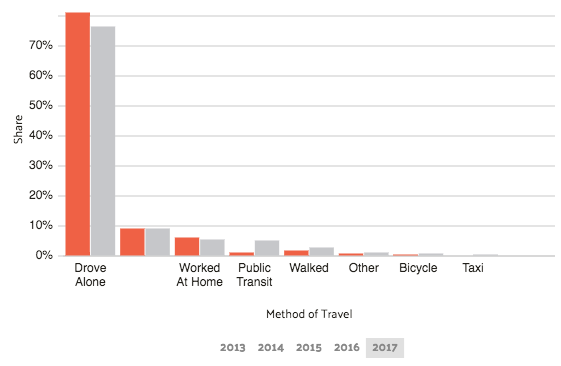

Commuter Transportation

DataUSA reports that a whopping 86.1 percent of North Carolinians drive to work alone.

Traffic Congestion

When it comes to traffic, only two North Carolina cities are the worst: Greensboro and Charlotte rank 209th and 91st, respectively, for the worst traffic in the world, according to the INRIX Global Traffic scorecard.

Has this guide helped you learn more about your liabilities as a driver in North Carolina? What part was the most helpful?

Take the next step by getting the best auto insurance quotes for North Carolina by entering your zip code below.

Frequently Asked Questions

What are North Carolina’s minimum car insurance requirements?

North Carolina requires drivers to have liability coverage of at least $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage per accident.

What happens if my car insurance lapses in North Carolina?

North Carolina takes insurance lapses seriously, and there is no grace period. If your insurance lapses, you will be fined $50 for the first time, $100 for the second time, and $150 for subsequent times. Additionally, you will have to pay a $50 fee to restore your license plate.

How much do North Carolinians spend on car insurance premiums as a percentage of their income?

According to 2014 data, North Carolinians spend about 2.19% of their average household disposable income of $35,099 on car insurance premiums.

What add-ons or endorsements can I consider for my North Carolina car insurance policy?

Some good add-ons or endorsements to consider include Guaranteed Auto Protection (GAP), Personal Umbrella Policy (PUP), Rental Reimbursement, Emergency Roadside Assistance, Mechanical Breakdown Insurance, Non-Owner Car Insurance, Modified Car Insurance Coverage, Classic Car Insurance, and Pay-as-You-Drive or Usage-Based Insurance. Personal injury protection (PIP) is another add-on to consider, as it covers medical bills incurred from an accident, regardless of who is at fault.

Which car insurance companies are the best in North Carolina?

A: The best car insurance company for you depends on a number of factors, including your driving history and financial situation. However, according to J.D. Power and Associates’ 2019 rankings for the Southeast region, including North Carolina, Farm Bureau Insurance – Tennessee is the best auto insurer in North Carolina.

What is a loss ratio in car insurance, and why is it important?

A loss ratio in car insurance is the amount of money an insurer pays out in claims compared to the premiums they receive. It is an important factor to consider when choosing a car insurance company because it gives an idea of how much money the insurer is paying out in claims versus how much they are collecting in premiums. A high loss ratio indicates that the company is paying out a lot in claims, which could lead to higher premiums, while a low loss ratio may indicate that the company is not paying out as much in claims as they should be.

What are some additional forms of financial responsibility that North Carolina accepts?

In addition to carrying an insurance card to prove financial responsibility, North Carolina also accepts a surety bond of $85,000 or more, a certificate of deposit of money or securities of $85,000 or more, or self-insurance if you own or lease 26 cars or more.

Why is North Carolina’s loss ratio for medical payment claims higher than in other states?

North Carolina’s loss ratio for medical payment claims is higher than other states due to a state law that requires insurers to pay medical providers directly for services rendered, rather than reimbursing the policyholder for medical expenses. This direct payment system can lead to higher medical costs and therefore higher loss ratios for medical payment claims.

How can I find the cheapest car insurance rates in North Carolina?

Car insurance rates vary based on factors such as your age, driving record, location, and the type of car you drive. To find the cheapest car insurance rates in North Carolina, you can compare quotes from different insurance companies, taking into account any discounts or special offers they may be offering. You can also adjust your coverage options to find a policy that meets your needs and budget.

What is the average cost of North Carolina car insurance?

North Carolina auto insurance is an average of $35/mo for liability insurance and an average of $92/mo for full coverage insurance.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.