Louisiana Car Insurance 101 (Compare Costs & Companies)

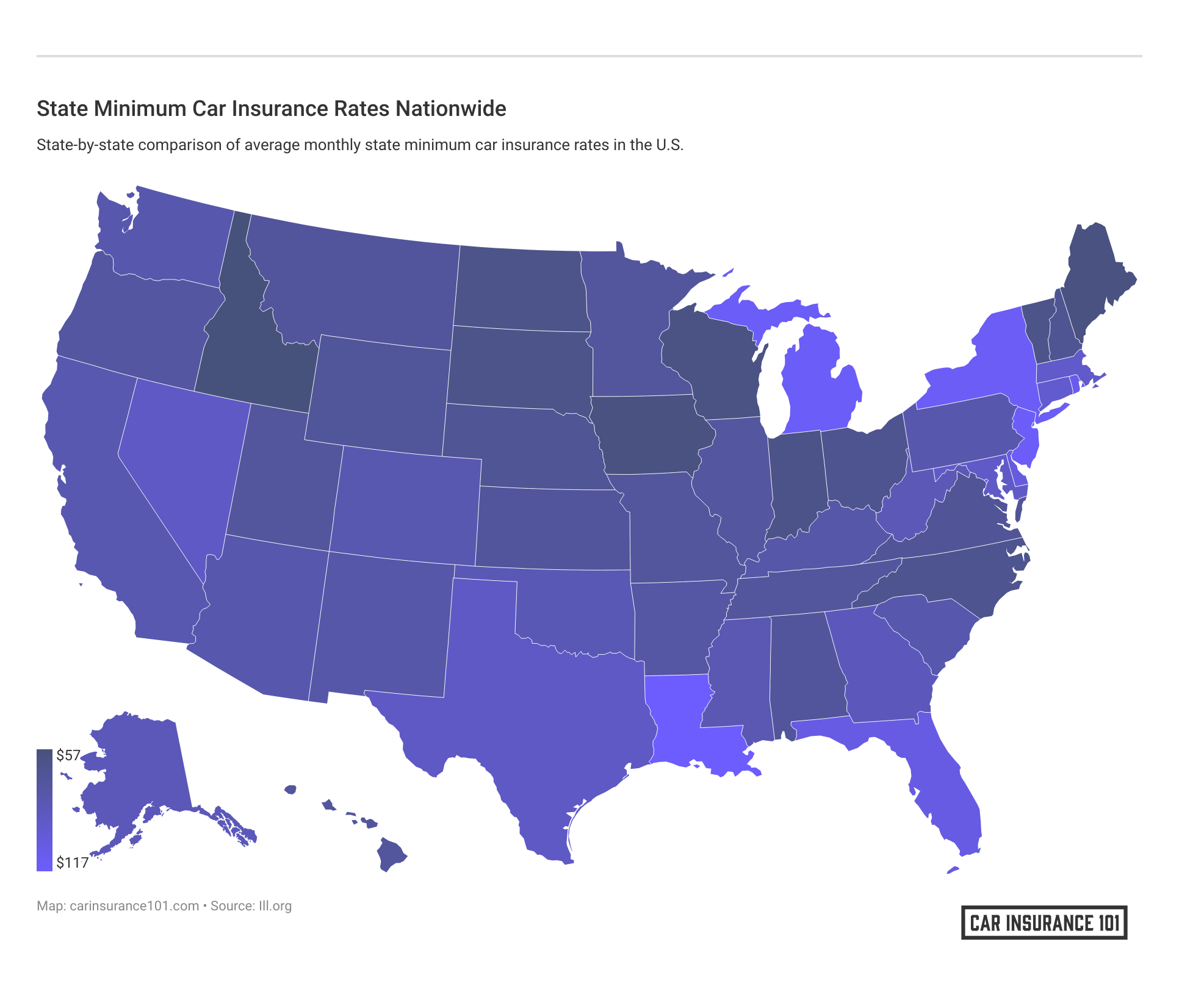

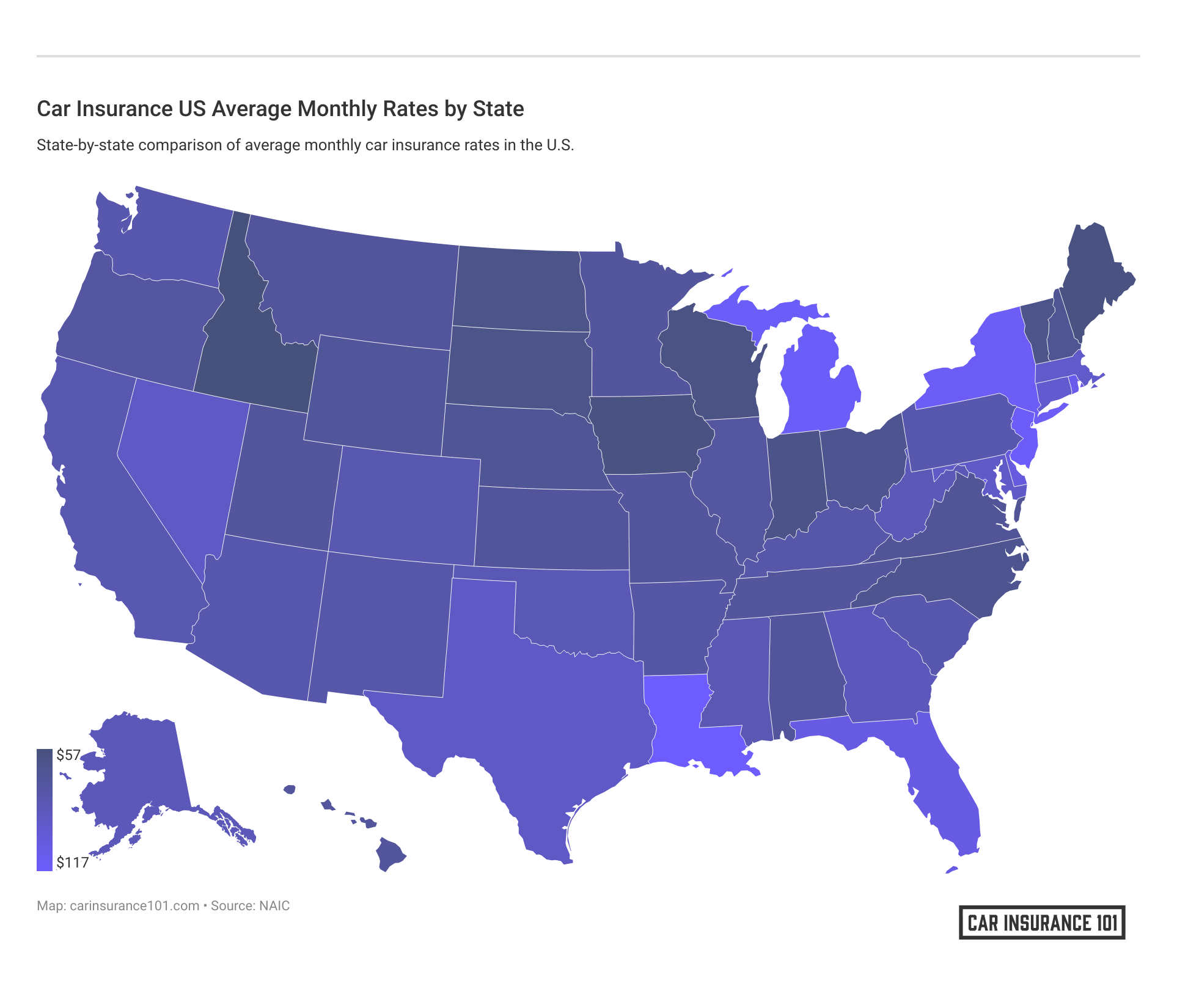

Louisiana car insurance 101 laws require all Louisiana drivers to carry minimum liability insurance, which costs an average of $66/mo in Louisiana. Full coverage car insurance in Louisiana is even more, costing an average of $275/mo, making it important to compare Louisiana car insurance quotes.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Louisiana drivers must carry minimum liability insurance to drive in the state

- Minimum liability insurance is an average of $66/mo in Louisiana

- Full coverage car insurance is an average of $275/mo in Louisiana

Louisiana car insurance is expensive, so drivers must take the time to familiarize themselves with Louisiana car insurance 101 tips and tricks on how to find savings. Our guide goes over everything Louisiana drivers should know about finding affordable Louisiana car insurance, from the best Louisiana car insurance discounts to the best Louisiana companies.

To find cheap Louisiana car insurance rates right away, use our free quote comparison tool above. It will compare car insurance rates from Louisiana companies to help you find the best rate possible.

Louisiana Car Insurance Coverage and Rates

There’s a lot of unique aspects to life in Louisiana. Louisiana is the only state in the United States that does not have counties. Its political subdivisions, or county-equivalents, are called parishes.

Did you know Baton, Rouge Louisiana is home to the tallest state capitol building in the United States, at 450 feet tall and 34 floors? Also, the New Orleans Superdome is the world’s largest fixed dome structure, and the Lake Pontchartrain Causeway is the longest bridge over water in the world.

Why do so many Cajuns live in Louisiana? Well, these descendants of the Acadians were driven out of Canada in the 18th century because they wouldn’t pledge allegiance to the King of England.

With lots of good times — the state is home to North America’s largest Mardi Gras, for instance — and hard workers, Louisiana is a beautiful state with a unique culture you can’t find anywhere else.

Are you a current Louisianan, or thinking about moving to the Pelican State? There will be car insurance requirements for registering your vehicle no matter which state you call home. And what state you call home can certainly affect your car insurance premiums. That’s especially true in the great state of Louisiana.

But don’t worry. We are here to help you through the entire process.

- Best Cheap Car Insurance Companies

- What is the Louisiana No Pay, No Play law?

- Affordable Car Insurance Rates in Waterproof, LA (2025)

- Affordable Car Insurance Rates in Ville Platte, LA (2025)

- Affordable Car Insurance Rates in Pineville, LA (2025)

- Affordable Car Insurance Rates in Natchitoches, LA (2025)

- Affordable Car Insurance Rates in Kinder, LA (2025)

- Affordable Car Insurance Rates in Jennings, LA (2025)

- Affordable Car Insurance Rates in Estherwood, LA (2025)

- Affordable Car Insurance Rates in Chatham, LA (2025)

- Affordable Car Insurance Rates in Bastrop, LA (2025)

In this guide, we’ll provide the information that you need to choose the right car insurance provider to handle all of you and your family’s needs in the Sugar State.

Keep reading to find out about the minimum car insurance requirements in Louisiana and how we can help you get the best deal possible.

Louisiana Car Culture

Louisiana is a gorgeous state with some beautiful roadways. But there are some potential pitfalls for drivers there that you should know about.

According to The Hartford, “While it’s full of charm and excitement, there are reasons Louisiana isn’t always the best place to be behind the wheel. The state has some of the highest insurance rates in the nation, and it tops many lists of highway dangers from distracted driving to crash rates.”

Let’s take a look at the minimum car insurance you need in the great state of Louisiana.

Louisiana Minimum Coverage

Like almost all other states across the nation, Louisiana has minimum state requirements when it comes to the insurance coverage that drivers are required to carry.

Louisiana requires drivers to have car insurance that meets or exceeds the following minimum coverage levels:

- $15,000 bodily injury per person per accident

- $30,000 bodily injury for all persons per accident

- $25,000 property damage liability

- $1,000 medical payment coverage

- $15,000/$30,000 uninsured/underinsured motorist coverage

Louisiana is what’s called a FAULT state, which means that, according to NOLO, “drivers are financially responsible for the effects of any accident they cause.”

Knowing that you could be held financially responsible for any and all damage that you cause if you are ever involved in an accident might scare you. But having the right car insurance provider in your corner can help ease these fears. And we’re here to help you find the perfect one.

Forms of Financial Responsibility

How do you prove financial responsibility when it comes to car insurance? It’s a good question.

Basically, financial responsibility is proof that you have Louisiana’s minimum liability coverage.

Louisiana law, like the law in most states, requires every driver to have proof of financial responsibility at all times.

According to the Louisiana Department of Public Safety’s Office of Motor Vehicles, “Proof of future financial responsibility shall be demonstrated as a certificate of insurance (SR-22) filed by an insurance company authorized to do business in the state of Louisiana, as cash or unencumbered negotiable securities posted with the State Treasurer in the amount of $30,000.00, or as a surety bond posted with this agency in the amount of $30,000.00.”

So, how much of your income can you expect to spend on car insurance in Louisiana?

Premiums as Percentage of Income in Louisiana

As we’ve already discussed, Louisianans pay more, if not the most, for car insurance compared to the rest of Americans.

Our research shows that folks in the Sportsman’s Paradise spent about 3.61 percent of their income on car insurance in 2014, compared to the national average of 2.29 percent. The table below offers Louisianans’ premiums as a percentage of average income for 2012-2014.

| Year | Average Disposable Income | Insurance as % of Income |

|---|---|---|

| 2012 | $36,448.00 | 3.50% |

| 2013 | $36,244.00 | 3.61% |

| 2014 | $37,787.00 | 3.61% |

Since car insurance is pretty expensive in the state of Louisiana, it’s important to shop around for the best car insurance provider. Use the handy calculator below to figure out what percent of your income might go to car insurance premiums.

CalculatorPro

So what kind of coverage do you really need when it comes to car insurance?

Average Monthly Car Insurance Rates in LA (Liability, Collision, Comprehensive)

A big part of getting the best deal on car insurance, especially in a state with high premiums like Louisiana, is understanding the types of coverages various companies offer.

The table below contains the four most purchased types of coverage and the average annual price that folks in Louisiana can expect to pay for each.

| Type of Coverage | Average Annual Cost |

|---|---|

| Liability | $775.83 |

| Collision | $414.36 |

| Comprehensive | $215.17 |

| Full Coverage | $1,405.36 |

Liability coverage is required by the state. This type of coverage will cover any damage that you do to another party’s person or property if you are ever involved in an accident. It’s important to know, however, that liability insurance alone will not pay for your injuries or damages. That is where collision and/or comprehensive coverage come in.

Generally speaking, collision will pay for your damages and injuries if you hit another object and comprehensive will pay out if your car is vandalized, stolen, or damaged by an act of nature, such as a flood or a mudslide.

When liability, comprehensive, and collision are combined in one policy, you are considered to have what we call full coverage.

Additional Liability

Anything above the insurance minimums outlined above is optional in Louisiana.

But remember: more comprehensive coverage can help you avoid financial hardship should bills stack up after an auto accident on one of Louisiana’s highways.

But how do you know if a car insurance company is good for you in the first place? Knowing a company’s loss ratio can help you determine if they can provide you with the car insurance you need.

But wait, you’re probably wondering (unless you have an MBA or are a total insurance nerd like us), what is a loss ratio?

A loss ratio simply shows how much an insurer spends on claims compared to how much they receive in premiums.

But what does that mean?

Here’s an example: if a company spends $50 in payouts for claims for every $100 they receive in premiums, they have a loss ratio of 50 percent. Loss ratios over 100 percent mean an insurer is losing money. But also note: abnormally low loss ratios mean a company isn’t paying out much in claims, which could indicate they don’t have the best customer service.

This short video provides a good overview of loss ratios.

For 2017, the National Association of Insurance Commissioners (NAIC) found the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is a bit lower than this average, between 60 and 70 percent.

But what else can you do to protect yourself — and your assets — if you are involved in a car accident?

In the following section, we’ll cover some great extras you can usually easily add to your existing or new car insurance policy.

Add-Ons, Endorsements, and Riders

Most car insurance companies offer a wide array of add-ons, endorsements, and riders to supplement your standard insurance coverage. These items can help you protect you and your vehicle in the case of an accident or another vehicular incident.

Some of the options available to you are:

- Guaranteed Auto Protection (GAP): If your car is ever totaled or stolen, GAP will pay any money that remains owed on the lease or loan.

- Personal Umbrella Policy (PUP): When your liability limits have been reached, PUP kicks in to help protect you from lawsuits that may result from an auto accident.

- Rental Reimbursement: If your car is in the shop due to a traffic incident, rental reimbursement will help you pay the costs of renting a car until your repairs are finished.

- Emergency Roadside Assistance: If your car breaks down or you have a flat tire, this addition to your policy will help you to pay for the cost of roadside repairs or a tow, if need be.

- Mechanical Breakdown Insurance: Need repairs that were not caused by an accident? Then this type of coverage is for you.

- Non-Owner Car Insurance: This type of coverage is perfect for you if you don’t own a car but still drive on occasion, because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage: This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Classic Car Insurance: Specially designed for classic cars, this type of coverage helps ensure that if something happens to your prized possession, you will both be well protected.

- Pay-As-You-Drive or Usage-Based Insurance: This type of coverage is based on the way you drive; your rate is determined by information collected by your car insurance provider regarding your speed, distance traveled, and other similar factors.

Personal injury protection, or PIP, might be a good option for you, too. PIP, often referred to as “no-fault insurance,” covers medical bills incurred from an accident regardless of who is at fault, who is driving, or who owns the vehicle.

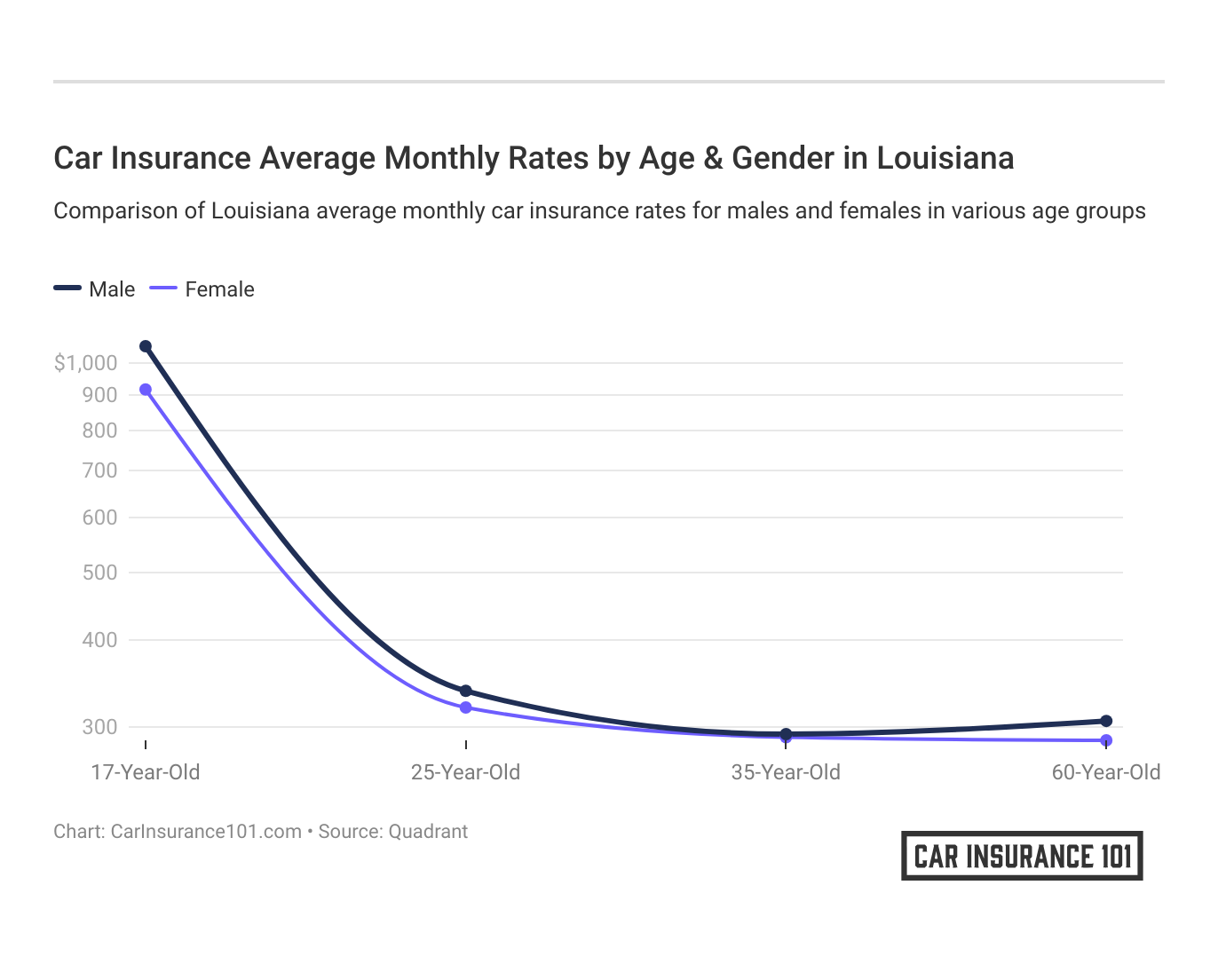

Average Monthly Car Insurance Rates by Age & Gender in LA

Louisiana is not one of the six states (California, Hawaii, Massachusetts, Montana, Pennsylvania, and North Carolina) that have banned gender discrimination in car insurance premiums.

Though it’s important to know that gender is less of a factor compared to age and marital status when it comes to increasing your car insurance premium.

As you can see in the table below — which offers average premiums for Louisianans of various demographics — teenagers almost always pay more than older drivers. Also, getting married can help you save money on your car insurance premiums.

| Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $9,256.33 | $11,657.16 | $4,694.46 | $5,083.73 | $4,254.40 | $4,254.40 | $4,394.91 | $4,394.91 |

| Geico | $12,767.36 | $13,458.88 | $3,309.53 | $3,204.45 | $3,430.68 | $3,952.72 | $4,103.66 | $5,009.51 |

| Progressive | $16,529.91 | $18,373.77 | $4,746.19 | $4,834.20 | $4,158.02 | $3,880.90 | $3,483.46 | $3,762.32 |

| State Farm | $8,404.12 | $10,538.72 | $3,180.57 | $3,569.11 | $2,851.05 | $2,851.05 | $2,619.17 | $2,619.17 |

| USAA | $8,021.04 | $9,403.41 | $3,286.33 | $3,597.39 | $2,678.38 | $2,634.64 | $2,612.63 | $2,591.11 |

But what cities and towns in the Pelican State have the cheapest car Insurance rates?

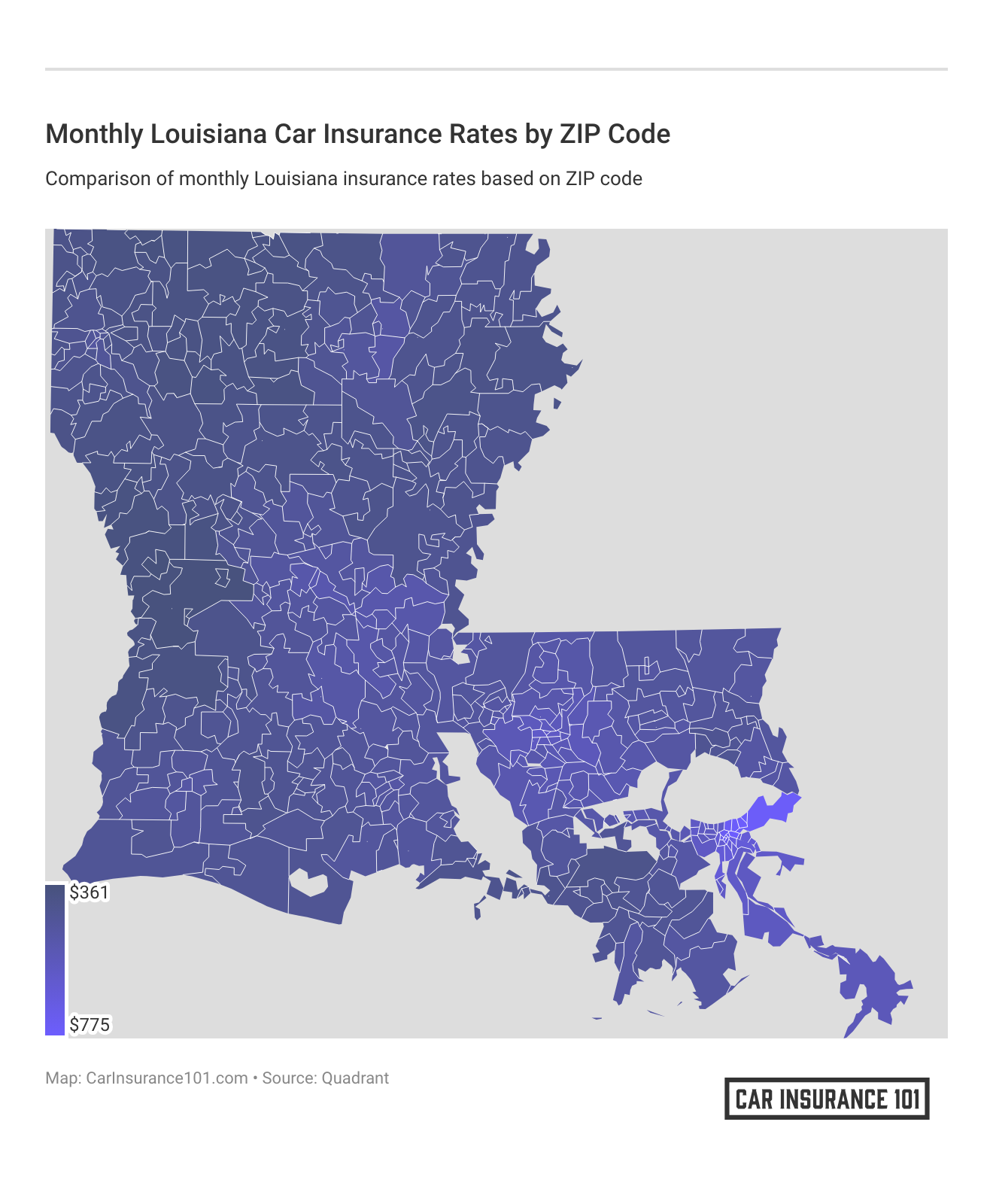

Cheapest Rates By ZIP Code

Did you know that car insurance rates vary not only by what state you call home but also by where you live in that state?

That’s especially true in a state like Louisiana with a wide urban-rural divide.

Of Louisiana’s 558 ZIP codes, the cheapest average car insurance premiums can be found in 71486. 71486 encompasses the small town of Zwolle in Sabine Parish, a rural area south of Shreveport on the Texas border. Residents of Zwolle pay an average of $4,580.26 in annual car insurance premiums.

Where are Louisiana’s most expensive premiums? Those can be found in ZIP code 70001, the Metairie neighborhood west of downtown New Orleans and just east of Louis Armstrong New Orleans International Airport.

But who do Louisianans say is the best car insurance company In the Sugar State?

How Much Car Insurance Rates in Louisiana

Explore the spectrum of car insurance premiums across various cities in Louisiana. Choose your city from the provided options to gain a comprehensive understanding of insurance costs specific to your locality.

| Find Affordable Car Insurance Rates in Louisiana | ||

|---|---|---|

| Bastrop, LA | Kinder, LA | Shreveport, LA |

| Baton Rouge, LA | Lafayette, LA | Ville Platte, LA |

| Chatham, LA | Natchitoches, LA | Waterproof, LA |

| Estherwood, LA | New Orleans, LA | |

| Jennings, LA | Pineville, LA |

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Louisiana Car Insurance Companies

At this point you might be wondering: how do you find the best car insurance company to meet you and your family’s needs?

Well, that depends in large part on what you want and need from your insurer, and what kind of company you want to do business with.

When shopping for car insurance, the key issues you need to prioritize include:

- The level of insurance coverage you need,

- The amount of money you can afford to pay for your car insurance premium, and

- The type of insurance company you want to do business with.

In the sections below, we’ll cover some of the factors that can help you figure out the best car insurance company in Louisiana for you and your family.

The Largest Companies’ Financial Ratings

Stop and think about it: do you want to do business with a company that has a good financial rating or a bad one? A company’s financial rating is a good indicator of their ability to provide for you when you call on them.

That’s why considering financial ratings is important: they represent how well a car insurance provider can service you and your family.

A.M. Best ranks America’s insurance companies by financial solvency. What does it mean for a company to receive a high grade? This video explains their methodology and meaning well.

The table below provides A.M. Best’s financial ratings for Louisiana’s biggest car insurance providers.

| Company | AM Best Rating |

|---|---|

| Allstate | A+ |

| Geico | A++ |

| Progressive | A+ |

| State Farm | A++ |

| USAA | A++ |

Lucky for Louisianans, Geico, State Farm and USAA all receive the top ranking AM Best provides.

But A.M. Best is not the only financial advising company that is keeping its eye on the car insurance market. Read on to see how J.D. Power ranks Louisiana’s insurers.

Companies With Best Ratings

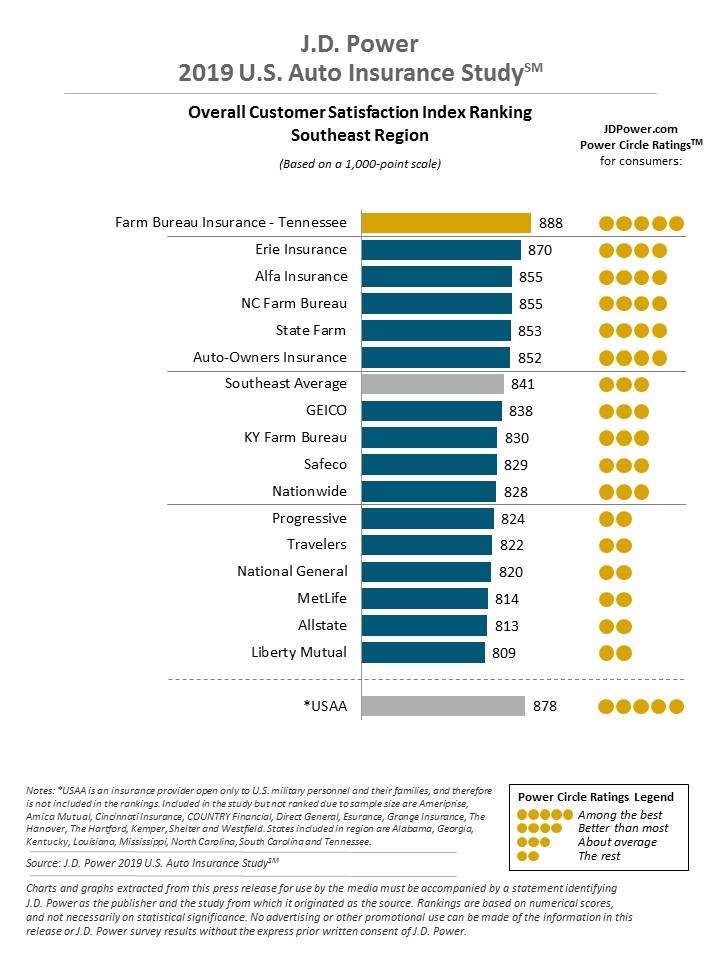

J.D. Power is also looking out for you. You might be surprised to find out that their research shows that customer satisfaction with the overall car insurance market is at an all-time high.

In 2019, they found Farm Bureau Insurance – Tennessee to be the best-rated car insurance provider in Louisiana. Here are their ratings for the Sugar State — part of the Southeast Region — for 2019.

Let’s take a look at who the cheapest car insurance providers are in Louisiana.

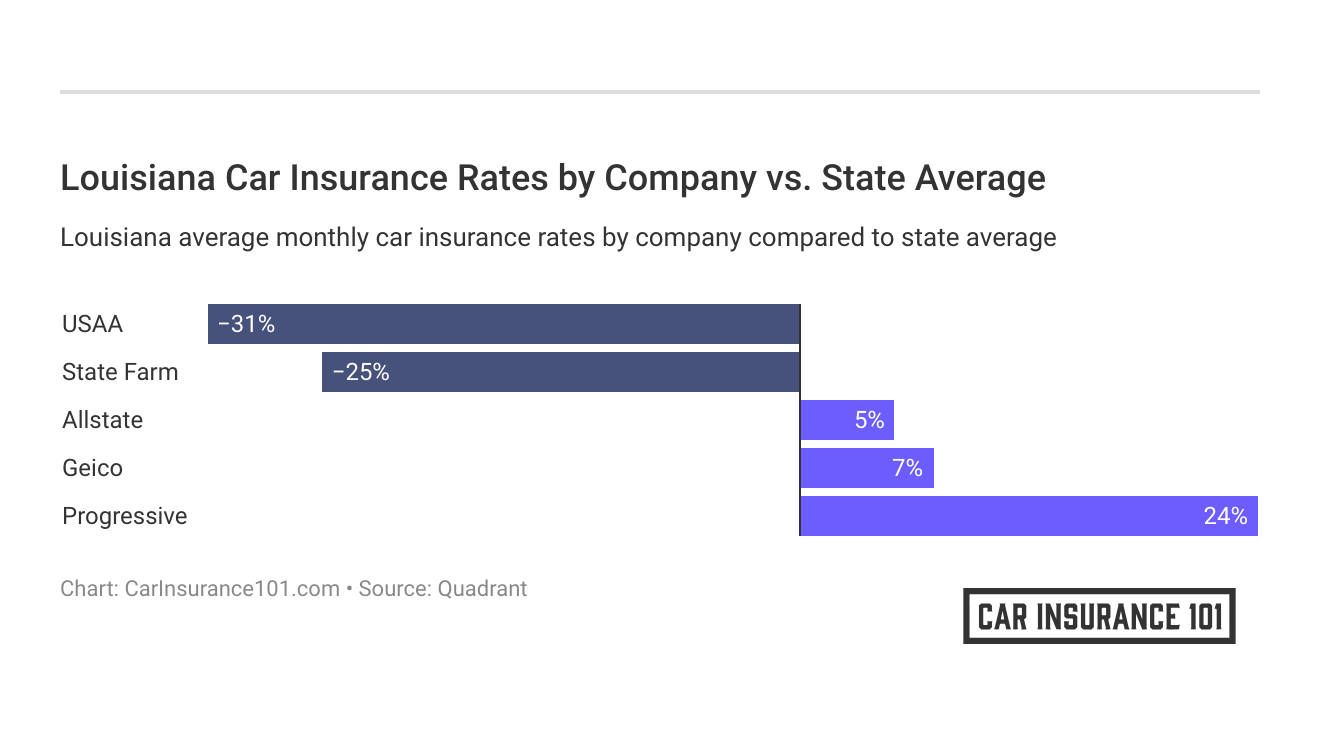

Cheapest Companies in Louisiana

We’ve already discussed how car insurance in Louisiana will cost you more than most, if not all, other places in the United States.

So you might be wondering: is the cheapest car insurance company the best car insurance company? Not always, but that doesn’t mean a cheaper provider is a bad provider either.

In Louisiana, State Farm is likely to be your cheapest auto insurance provider.

That is, unless you qualify for USAA, a top-ranked insurance company that only services military personnel, past or present, and their families. The table below shows the average premiums for Louisiana’s biggest car insurance providers.

| Company | Average |

|---|---|

| Allstate | $5,998.79 |

| Geico | $6,154.60 |

| Progressive | $7,471.10 |

| State Farm | $4,579.12 |

| USAA | $4,353.12 |

Did you know that your average commute can affect the amount you pay for car insurance?

Commute Rate By Company

According to DataUSA, Louisianans have an average commute of 24.4 minutes each way, just below the national average of 25.5 minutes. It’s important to know how much you drive because your insurance company will most likely use this to help calculate the amount of money you owe them for car insurance.

But whether you drive a little or a lot, State Farm is likely your cheapest insurance provider in the Child of the Mississippi.

The following table illustrates Louisiana’s biggest car insurance providers and their corresponding average rates for both a 10- and 25-mile average commute distance.

| Company | Commute & Annual Mileage | Annual Average Premium |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $5,998.79 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,998.79 |

| Geico | 10 miles commute. 6000 annual mileage. | $6,034.79 |

| Geico | 25 miles commute. 12000 annual mileage. | $6,274.40 |

| Progressive | 10 miles commute. 6000 annual mileage. | $7,471.10 |

| Progressive | 25 miles commute. 12000 annual mileage. | $7,471.10 |

| State Farm | 10 miles commute. 6000 annual mileage. | $4,461.13 |

| State Farm | 25 miles commute. 12000 annual mileage. | $4,697.11 |

| USAA | 10 miles commute. 6000 annual mileage. | $4,218.32 |

| USAA | 25 miles commute. 12000 annual mileage. | $4,487.91 |

The amount of coverage that you choose to purchase will also help determine how much your car insurance policy will cost you.

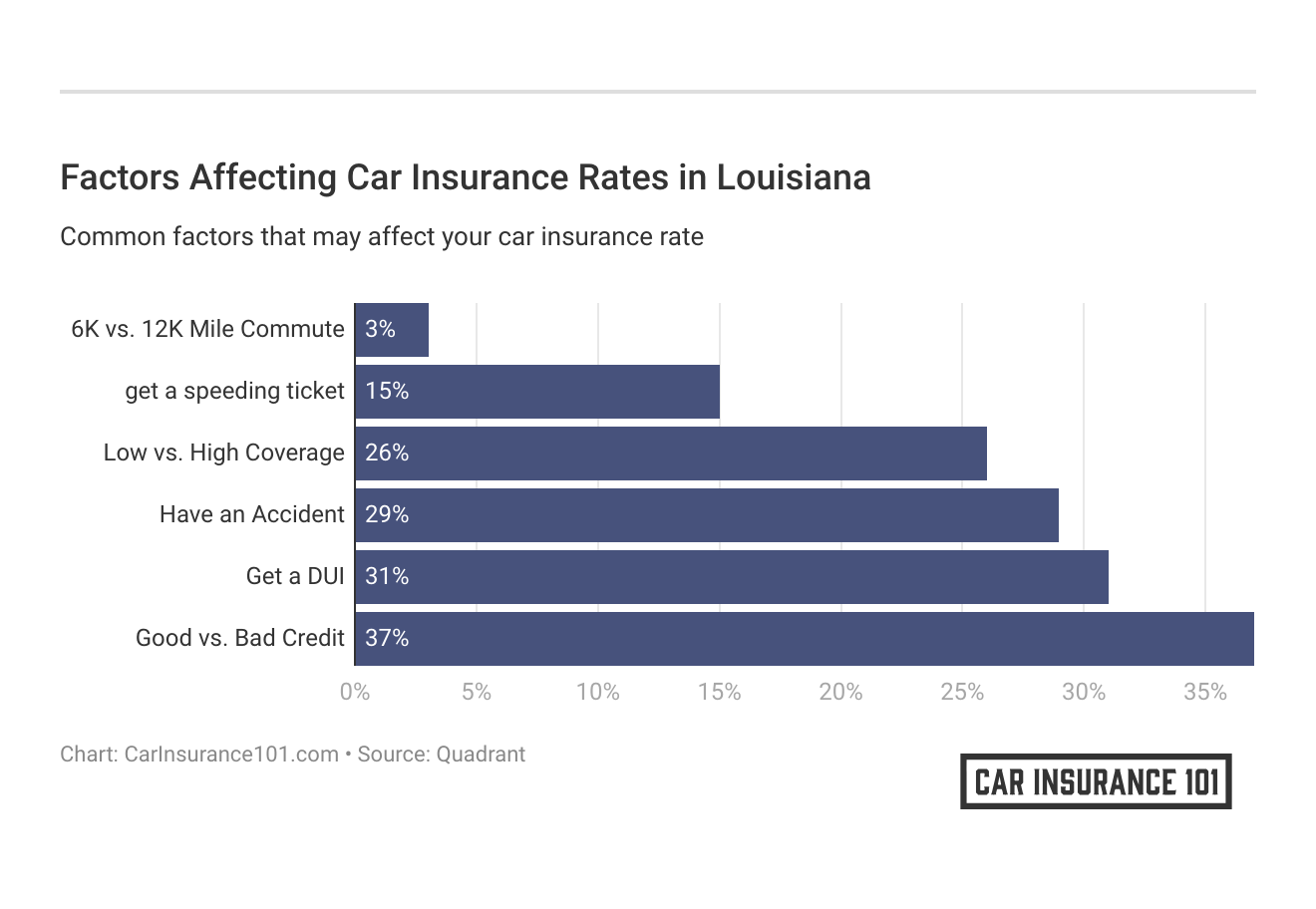

Six major factors affect auto insurance rates in LA. Which car insurance factors will affect your rates the most? Find out below:

Coverage Level Rate By Company

Not surprisingly, the more car insurance you need, the higher your premium will usually be.

That’s just a basic rule of capitalism.

Following these principles, the more extensive the coverage, the more expensive car insurance usually becomes. The less coverage, the cheaper your insurance will likely be.

Below is a table that illustrates the different types of insurance coverage levels and their average yearly rates for Louisiana’s biggest insurance providers.

| Company | Coverage Type | Annual Average Premium |

|---|---|---|

| Allstate | High | $6,702.00 |

| Allstate | Medium | $6,109.21 |

| Allstate | Low | $5,185.16 |

| Geico | High | $7,200.21 |

| Geico | Medium | $6,176.92 |

| Geico | Low | $5,086.66 |

| Progressive | High | $8,813.16 |

| Progressive | Medium | $7,406.27 |

| Progressive | Low | $6,193.86 |

| State Farm | High | $5,206.86 |

| State Farm | Medium | $4,568.03 |

| State Farm | Low | $3,962.47 |

| USAA | High | $4,862.64 |

| USAA | Medium | $4,420.47 |

| USAA | Low | $3,776.25 |

So what’s your credit score?

Credit History Rates By Company

Why are you asking about my credit score, you might be wondering. Well, credit scores are often used to determine your car insurance premiums.

U.S. Representative Rashida Tlaib has introduced a bill that would ban credit history discrimination in car insurance premiums from coast to coast, much like the state of California has already done for Golden State citizens.

But until this legislation gets off the ground, your credit history is a big factor for insurance companies when they are calculating your insurance premium.

On average, Louisianans have some of the lowest credit scores In the United States. With an average Experian score of 650, Louisianans’ credit history is well below the national average of 675.

So what if you have poor credit? Who are the best car insurers in Louisiana for you? State Farm, or, if you qualify, USAA will likely be your most affordable options. The table below shows average rates for those with a good, fair, or poor credit rating for Louisiana’s top car insurance providers.

| Company | Credit History | Annual Average Premium |

|---|---|---|

| Allstate | Poor | $7,859.57 |

| Allstate | Fair | $5,410.52 |

| Allstate | Good | $4,726.27 |

| Geico | Poor | $7,322.08 |

| Geico | Fair | $6,353.32 |

| Geico | Good | $4,788.40 |

| Progressive | Poor | $8,444.80 |

| Progressive | Fair | $7,236.85 |

| Progressive | Good | $6,731.64 |

| State Farm | Poor | $6,350.34 |

| State Farm | Fair | $4,086.69 |

| State Farm | Good | $3,300.33 |

| USAA | Poor | $6,010.39 |

| USAA | Fair | $3,841.14 |

| USAA | Good | $3,207.81 |

What affects your car insurance premium perhaps more than anything else? Your driving record.

Driving Record Rates By Company

Do you have a spotless driving record? Or are you like Seinfeld’s Newman, with an infamous speeding ticket in his past?

If you don’t have a spotless driving record, you’re not alone, as most of us don’t. You might have a speeding ticket, an accident, or even a DUI in your past.

But you should also know: not all violations affect your car insurance premium in the same way.

Our research shows that whether you have a DUI, an accident, or a speeding ticket in your past, State Farm or USAA are still likely to be your cheapest car insurance providers in the Bayou State.

The following table shows different insurance companies and their annual averages for people with varying driving records in the great state of Louisiana.

| Company | Driving Record | Annual Average Premium |

|---|---|---|

| Allstate | Clean record | $4,753.81 |

| Geico | Clean record | $4,180.19 |

| Progressive | Clean record | $6,223.20 |

| State Farm | Clean record | $4,196.97 |

| USAA | Clean record | $3,321.63 |

| Allstate | With 1 accident | $7,221.89 |

| Geico | With 1 accident | $6,755.09 |

| Progressive | With 1 accident | $8,352.66 |

| State Farm | With 1 accident | $4,961.27 |

| USAA | With 1 accident | $4,611.20 |

| Allstate | With 1 DUI | $6,443.95 |

| Geico | With 1 DUI | $8,315.63 |

| Progressive | With 1 DUI | $8,027.23 |

| State Farm | With 1 DUI | $4,579.12 |

| USAA | With 1 DUI | $5,514.32 |

| Allstate | With 1 speeding violation | $5,575.49 |

| Geico | With 1 speeding violation | $5,367.48 |

| Progressive | With 1 speeding violation | $7,281.29 |

| State Farm | With 1 speeding violation | $4,579.12 |

| USAA | With 1 speeding violation | $3,965.32 |

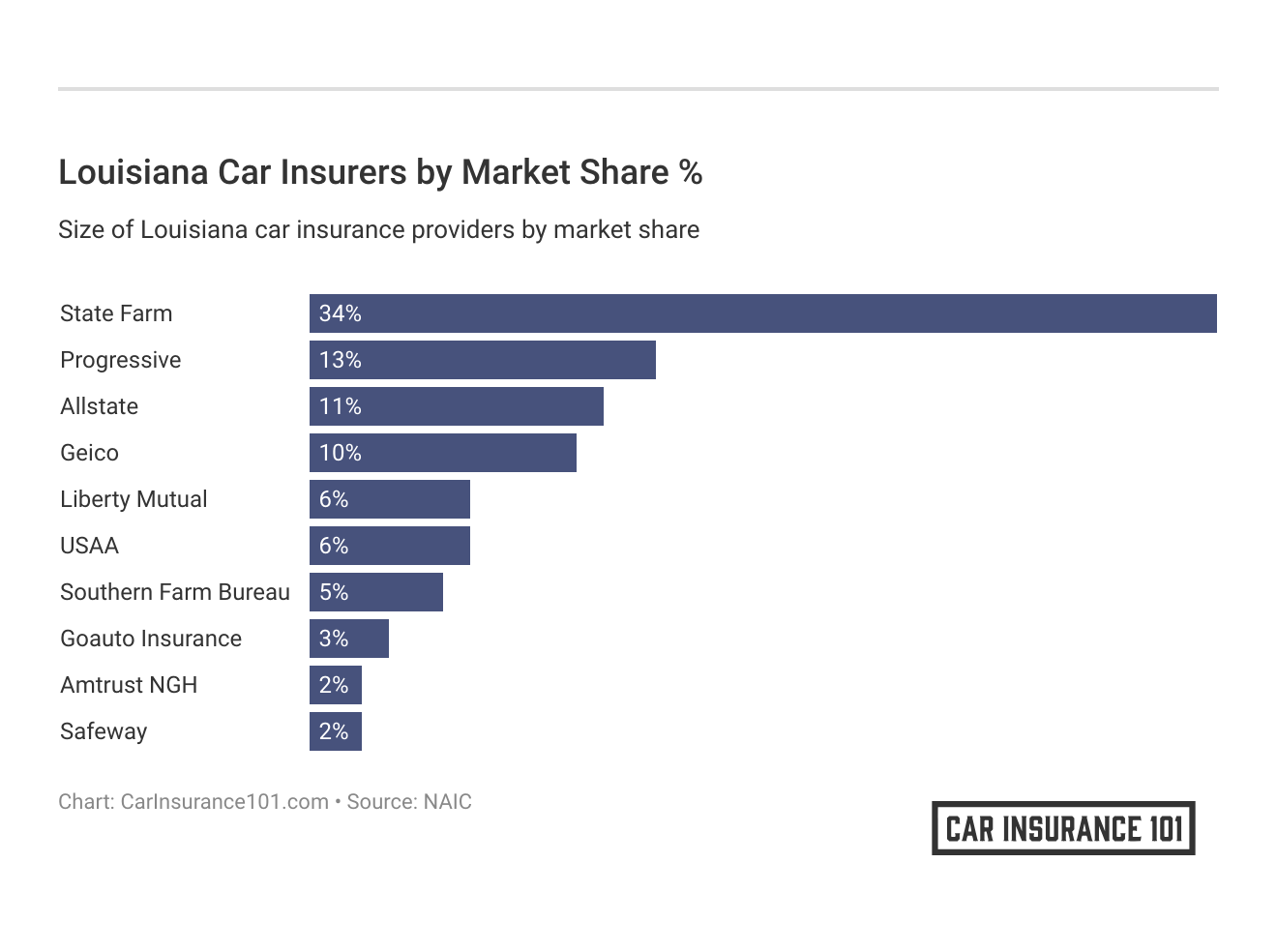

You might be wondering: who are the biggest car insurance companies in Louisiana anyway?

Largest Car Insurance Companies in Louisiana

So who are the biggest car insurance companies in the Sugar State? The table below provides Louisiana’s largest insurance companies by direct premiums written, loss ratio, and market share.

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm | $1,512,622.00 | 73.76% | 33.57% |

| Progressive | $602,564.00 | 65.32% | 13.37% |

| Allstate | $502,616.00 | 53.33% | 11.15% |

| Geico | $432,095.00 | 75.64% | 9.59% |

| Liberty Mutual | $253,836.00 | 68.10% | 5.63% |

| USAA | $248,894.00 | 86.36% | 5.52% |

| Southern Farm Bureau | $231,086.00 | 70.01% | 5.13% |

| Goauto Insurance | $144,626.00 | 74.36% | 3.21% |

| Amtrust NGH | $104,343.00 | 67.11% | 2.32% |

| Safeway | $72,940.00 | 67.02% | 1.62% |

Who are the largest car insurance companies in Louisiana?

Number of Foreign vs. Domestic Insurers in Louisiana

When you hear the phrase “foreign or domestic car insurance company,” what do you think that means?

When it comes to auto insurers, domestic simply means an in-state provider, and foreign an out-of-state provider.

According to the NAIC, Louisiana has 34 domestic car insurance companies and 819 foreign car insurance providers.

Louisiana Laws

So you want to drive in the Bayou State? Who can blame you? Louisiana, despite some roadway issues, offers some of the most scenic and interesting drives anywhere in the United States.

Like the one featured in the video below along Highway 90, also known as Cajun Highway.

But as you probably know, state laws can be odd, and they often vary from state to state. And trust us: Louisiana is known for having some strange ones.

In order to keep your car insurance rates low, you need to know the laws in your state so you don’t get a hefty fine. But don’t worry! We’re here to help.

Keep reading to learn about the laws specific to the state of Louisiana.

Car Insurance Laws

As we’ve seen above, Louisiana requires liability insurance with the following minimums:

- $15,000 bodily injury per person per accident

- $30,000 bodily injury for all persons per accident

- $25,000 property damage liability

- $1,000 medical payment coverage

- $15,000/$30,000 uninsured/underinsured motorist coverage

Also remember, these are minimums. What is best for you and your family might be coverage above liability, like the add-ons we explored earlier.

How State Laws For Insurance Are Determined

You might remember that jingle about how laws get made from Schoolhouse Rock.

But what about state-specific insurance laws? Well, do you know about the National Association of Insurance Commissioners (NAIC)? Unless you’re an insurance nerd like us, you probably haven’t heard of them before. But that’s okay.

The NAIC is the U.S. standard-setting and regulatory support organization for the insurance industry, including car insurance. They were created and are governed by the chief insurance regulators from all 50 states, the District of Columbia, and five U.S. territories.

And in case you’re curious how insurance laws actually get made, they offer this great white paper to help you understand.

Windshield Coverage

Here’s an important question you might not have thought to ask: is it required for insurers in Louisiana to pay for windshield repairs? Simply put: no.

While some states have strict laws regarding insurance benefits for full glass replacement services, Louisiana has no specific laws to this end.

With one exception: if you have comprehensive car insurance coverage, the state of Louisiana mandates that your maximum deductible is $250 for glass repair.

Remember, windshield and glass coverage may be an easy add-on to your car insurance. Make sure to check with your provider. After all, glass claims are the top insurance claims filed across the country.

Automobile Insurance Fraud in Louisiana

According to the Louisiana Insurance Fraud Task Force, “insurance fraud is any fraudulent act, knowingly and willfully committed by any person in an attempt to injure, defraud, or deceive an insurance company. In Louisiana, insurance fraud is a felony, and when convicted, penalties could include jail time, fines, community service, probation and/or restitution.”

Insurance fraud in Louisiana should be reported to:

Attention: Fraud Division

Louisiana Department

of Insurance

Post Office Box 3096

Baton Rouge, LA 70821

The fraud division can be reached by phone at 225-342-4956 or online.

Statute of Limitations

If you are in a car accident in Louisiana, there is a statute of limitations.

That means you have a specific amount of time to file a claim in a court of law.

According to the law firm of Simien & Simien, “in Louisiana, car accidents are governed by the statute of limitations for personal injury claims (Louisiana Civil Code (CC) Article 3492). Under this statute, lawsuits must be filed within one year of the date of the accident. This applies to claims for personal injuries and property damage.”

Vehicle Licensing Laws

You’re probably not surprised to learn that the Bayou State requires a valid driver’s license to operate a vehicle, just like every other state in the U.S.

And be honest: who doesn’t love getting their picture taken at the DMV?

Okay, maybe that’s not the case. But you should know: licensing yourself and your vehicle in Louisiana may be easier than you think.

REAL ID

Passed by Congress in 2005, the REAL ID Act establishes minimum security standards for state-issued driver’s licenses and identification cards and prohibits federal agencies from accepting for official purposes licenses and identification cards from states that do not meet these standards.

Luckily, Louisiana is in full compliance with the REAL ID Act passed by Congress and enforced by Homeland Security. This means that a driver’s license or state ID issued by Louisiana is an acceptable form of identification at federal facilities, airports, and nuclear power plants.

As of October 1, 2020, anyone wishing to fly on a commercial flight or to enter a federal facility must have a REAL ID-compliant form of identification, usually noted by that black star in the upper right corner of your driver’s license.

Penalties For Driving Without Insurance

Louisianans are known for caring about their neighbors.

And part of being a good neighbor is having good insurance to protect not only you, but also the drivers and passengers around you.

Also, driving without car insurance is against the law in the state of Louisiana, and if you do so, you will be facing some serious penalties and hefty fines. Anytime a law enforcement officer pulls you over and requests to see your license, proof of insurance, and registration, you must hand it over to him or her.

Here are the penalties for the first time you’re caught driving without valid car insurance in the Sugar State:

- Fine: $500-$1000

- If in a car accident, fine plus registration revoked and driving privileges suspended for 180 days

As you can see, purchasing car insurance is usually a much cheaper option than not having car insurance, especially in Louisiana.

Teen Driving Laws

Most states have some form of graduated licensing laws for teens, and Louisiana is no exception.

In the Pelican State, you must be at least 15 years old to start driver’s education classes. However, there are requirements that must be met before turning 16 years old and getting a restricted driver’s license.

In Louisiana, teen drivers have the following requirements:

- Mandatory Holding Period: 6 months

- Minimum Supervised Driving Time: 50 hours, 15 of which must be at night

- Minimum Age: 16

Additionally, Louisiana’s teen drivers have the following restrictions on their driving.

| Teen Driver Restrictions | Details |

|---|---|

| Nighttime restrictions | 11 p.m. - 5 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | no more than one passenger younger than 21 between the hours of 6 pm-5 am; no passenger restriction from 5 am-6 pm |

| Minimum age at which restrictions may be lifted | |

| Nighttime restrictions | until age 17 (min. age: 17) |

| Passenger restrictions | until age 17 (min. age: 17) |

Teenaged drivers are not the only ones who have a specific set of laws that pertain to their licensing requirements. In most states, older drivers also have restrictions when it comes to renewing their licenses.

Older Driver License Renewal Procedures

In the state of Louisiana, every driver must renew his or her license every six years regardless of age.

But you might be wondering: is proof of adequate vision required at every renewal?

- Drivers under the age of 70 years old must provide proof of adequate vision when renewing a license in person

- Drivers 70 years old and over must provide proof of adequate vision at every renewal

So, are drivers allowed to renew licenses online or by mail?

- Drivers under the age of 70 may renew a license online or by mail every other renewal

- Drivers 70 years old and older are not permitted to renew a license by mail or online

Now that we’ve covered driver’s license renewal procedures for current Louisiana residents, let’s take a look at what it takes to get a license for residents new to the Sugar State.

New Residents

According to the Louisiana Department of Public Safety’s Office of Motor Vehicles, you have 30 days once you move to Louisiana to obtain a Louisiana driver’s license. So basically, you’ve got a month to get yourself to the DMV. (Well, the OMV in Louisiana.)

When applying for a Louisiana driver’s license at the Office of Motor Vehicles, you will need the following documents:

- One primary document

- Social Security number

- Proof of residency

- Photo license from the last state of issuance

If the applicant does not have the photo license, an official driving record from the last licensing state listing the applicant’s personal information and driver’s license number is required.

Negligent Operator Treatment System (NOTS)

In Louisiana, negligent or “reckless operation” of a vehicle is taken very seriously. In the Bayou State, a person can be convicted of reckless operation for driving in a way that a reasonably careful person would know is dangerous.

In Louisiana, reckless operation is a misdemeanor. The possible penalties for a violation are:

- First offense: A first reckless operation conviction carries up to 90 days in jail and/or $200 in fines

- Repeat offense: For a second or subsequent reckless operation conviction, the driver faces ten days to six months in jail and/or $25-$500 in fines

Motorists who are convicted of three reckless operation offenses within a period of 12 months are looking at a 24-month license suspension. That’s two years of not driving.

So now let’s take a look at some specific driving rules for the beautiful state of Louisiana.

Rules of the Road

From New York to California, and certainly in Louisiana in between, every state has its own rules of the road.

Knowing what these laws are in the Child of the Mississippi could help you avoid receiving any negligent operator points on your license or tickets with hefty fines.

Keep reading to find out some of the information you need to know to save money on car insurance by following the laws of the great state of Louisiana.

Fault vs. No-Fault

As we’ve already discussed above, Louisiana is legally a fault state.

This legal designation means that, according to NOLO, “drivers are financially responsible for the effects of any accident they cause.”

Seatbelt and Car Seat Laws

For children and young adults ages 3-33, car crashes are the leading cause of death. Fortunately, the proper usage of seat belts, child restraints, and/or car seats can protect you and your children in the event of a car accident.

Since July 1, 1986, Louisiana has had strict seat belt laws stating that every passenger in a vehicle must be safely restrained either in a seat belt or car seat. And it’s important to note: these laws are primarily enforced, meaning a police officer can pull you over for not wearing a seat belt and nothing else.

A few exceptions to the seat belt law, according to Louisiana Legal Advisor:

- Rural letter carrier while on duty

- Certain utility workers while driving under 20 MPH

- Farm vehicle operated within 5 miles of its principal use

- Newspaper delivery person while delivering a regularly published newspaper

- A person with a medical or mental disability that prevents the use of a seatbelt

According to Louisiana’s Magic 101.9, in August 2019 Louisiana State Bill 76 strengthened the Pelican State’s child restraint laws.

Here are the new rules according to Louisiana State Bill 76:

- Children under the age of 2 years will be restrained in a rear-facing child safety seat.

- A child who is at least 2 years old and has outgrown the rear-facing seat will be restrained in a forward-facing restraint system with an internal harness.

- A 4-year-old child who has outgrown the forward-facing, internal harness system shall be restrained in a belt-positioning child booster seat.

- At nine years old, children who have outgrown the booster seat may use the adult safety belt fastened correctly.

- Children younger than 13 must be in the rear seat of a vehicle when available and properly restrained.

So keep yourself and your child safely buckled in the Sugar State.

Keep Right and Move Over Laws

So what about keep right and move over laws in the state of Louisiana?

Left lane driving is only allowed for passing or turning left. However, there are exceptions to this law. On multilane highways, keep right except to pass. Move right if blocking overtaking traffic.

According to AAA, state law requires drivers approaching any stationary emergency vehicle, including tow trucks, displaying flashing lights and traveling in the same direction, to vacate the lane closest if possible to do so, or slow to a reasonably safe speed.

Speed Limits

The table below provides Louisiana’s maximum speed limits according to the Insurance Institute for Highway Safety (IIHS).

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 65 mph |

Ridesharing

Most major rideshare services like Uber and Lyft mandate that their drivers carry personal car insurance that meets the minimum requirements of the state where they operate.

However, if drivers wish to purchase a commercial insurance policy, these are the companies that provide coverage:

- Allstate

- American Family

- Farmers

- Geico

- MetLife

- Safeco

- State Farm

- USAA

Automation on the Road

What the heck is automation?

The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task previously carried out by a human.

When it comes to automation, typically think radars, cameras, and other sensors used to gather information about a vehicle’s surroundings.

Louisiana doesn’t currently have any laws about automation, but this might change in the near future as technology advances.

Safety Laws

Let’s take a look at some important safety laws in Louisiana.

DUI Laws

As you probably already know, driving under the influence of alcohol often has disastrous results. That’s why strict laws are in place to prevent drunk driving fatalities, injuries, and property damage.

According to the Centers for Disease Control (CDC), between 2003-2012, 3,046 people died on Louisiana roads at the hands of a drunk driver. That’s way too many lives lost.

Keep in mind: Louisiana has a typical Blood Alcohol Content (BAC) limit of .08.

So what are the penalties for drunk driving in Louisiana?

Check out the table below for penalties you can expect for your first, second, and third DUI in the Child of the Mississippi.

| Number of Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 1 year/hBAC 2 years | 48 hours in jail + up to 6 months OR fine; up to 2 years probation | $300-$1000 +$100 reinstatement fee | 30 hours reeducation, 32+ hours community service, half must be street garbage pickup |

| 2nd Offense | 2 years / hBAC 4 years | 48 hours+ | $750-$1000 +$200 reinstatement fee | possible 30 days community service +reeducation requirements of 1st DWI |

| 3rd Offense | 3 years | 1-5 years w/ or w/o hard labor | $2000 +$300 reinstatement fee | 30 days community service, evaluation for addictive disorder, IID, probabtion and home incarceration for any part of suspended sentence |

These penalties aren’t inexpensive; don’t drink and drive. Every time you drink and drive, you risk your own life, as well as the lives of other drivers on the road.

So we’ve looked at drunk driving laws, but what about marijuana-impaired driving laws? Read on.

Marijuana Impaired Driving Laws

Driving impaired is driving impaired, and if you drive high, you face the same penalties as driving under the influence of alcohol outlined above.

Distracted Driving Laws

Texting is banned for all drivers in the great state of Louisiana, an active measure the state government has taken to increase roadway safety for all Louisianans.

Teen drivers in Louisiana face even more distracted driving restrictions.

All drivers younger than 18 are prohibited from using any cell phone.

And it’s important to note that all Louisiana learner’s permit holders, whatever their age, and all intermediate license holders, are prohibited from driving while using a hand-held cellphone.

AAA reports that Louisiana school bus drivers may not use cell phones while driving and that all drivers are banned from using a wireless telecommunications device to access, read, or post to a social networking site.

So wait to tweet until you pull over. All these laws are under primary enforcement in the state of Louisiana.

Driving in Louisiana

Driving safely is important wherever you are, as you probably already know.

And especially if you’re driving through beautiful, but busy New Orleans, you need to be on the lookout for safety measures every day.

Read on for some important information about keeping you, your family, and your vehicles safe in the beautiful state of Louisiana so you can laissez les bons temps rouler (“let the good times roll,” an unofficial state motto).

Vehicle Theft in Louisiana

The Federal Bureau of Investigation (FBI) keeps track of vehicle thefts and other crimes city-by-city in all states. In Louisiana, this means they’re tracking vehicle theft from Abbeville to Zachary.

New Orleans — Louisiana’s largest metro area — led the state in vehicle thefts for 2016, the FBI reports, with 2,427 cars and trucks stolen from their owners.

But what’s the most stolen vehicle in Louisiana? Currently, 2006 Chevorlet full-size pickups are most vulnerable to theft.

The table below shows the top 10 most frequently stolen cars in Louisiana for 2018 by make, model, year, and number of thefts.

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2006 | 671 |

| Ford Pickup (Full Size) | 2006 | 584 |

| GMC Pickup (Full Size) | 2006 | 253 |

| Toyota Camry | 2007 | 224 |

| Dodge Pickup (Full Size) | 2003 | 222 |

| Nissan Altima | 2014 | 215 |

| Honda Accord | 2008 | 209 |

| Chevrolet Impala | 2008 | 177 |

Make sure to check with your car insurance provider, because if you’ve got the right kind of insurance and are the victim of car theft, your car should be replaced.

Road Fatalities in Louisiana

Despite their beauty, snaking through bayous and historic urban centers, Louisiana’s roadways are sadly often the site of fatalities. Read on to find out more specific information provided by the National Highway Transportation Safety Administration (NHTSA).

Most Fatal Highway in Louisiana

According to Geotab, United States Highway 90 is the most dangerous stretch of roadway in Louisiana. The highway sees an average of 27 fatal crashes every year and runs through the southernmost part of the state, from the Mississippi border to the east, to the Texas border to the west.

Fatal Crashes by Weather and Light Conditions

Louisiana is home to a variety of weather phenomena, particularly hurricanes. The video below shows ABC News coverage from Hurrican Barry in 2019.

Not surprisingly, crashes are highly affected by both weather and light conditions. The table below provides a breakdown of crash fatalities by weather and light conditions across Louisiana in 2017.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 276 | 93 | 219 | 32 | 1 | 621 |

| Rain | 20 | 15 | 16 | 4 | 0 | 55 |

| Snow/Sleet | 1 | 0 | 0 | 0 | 0 | 1 |

| Other | 2 | 4 | 8 | 0 | 0 | 14 |

| Unknown | 0 | 1 | 1 | 0 | 3 | 5 |

| TOTAL | 299 | 113 | 244 | 36 | 4 | 696 |

Fatalities in Top 10 Parishes (All Crashes)

East Baton Rouge Parish leads the state of Louisiana in crash fatalities. The parish is not only home to the state capital of Baton Rouge, but also the site of the convergence of several major highways, including Interstates 10, 20, and 110.

The table below provides fatalities for all crashes in Louisiana’s 10 biggest parishes from 2014-2018.

| Parish | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| East Baton Rouge Parish | 50 | 43 | 52 | 69 | 66 |

| Caddo Parish | 40 | 36 | 27 | 34 | 51 |

| Orleans Parish | 50 | 50 | 55 | 45 | 41 |

| Calcasieu Parish | 24 | 36 | 47 | 38 | 35 |

| Ascension Parish | 23 | 19 | 21 | 27 | 32 |

| Livingston Parish | 24 | 18 | 25 | 24 | 30 |

| Tangipahoa Parish | 22 | 36 | 40 | 33 | 30 |

| St. Tammany Parish | 22 | 26 | 23 | 30 | 29 |

| Jefferson Parish | 24 | 26 | 34 | 28 | 28 |

| Rapides Parish | 22 | 22 | 20 | 13 | 26 |

| Total All Parishes | 740 | 752 | 757 | 770 | 768 |

Fatalities By Vehicle Type

What kind of vehicles are Louisianans riding in or driving when they’re in a deadly car crash? The table below shows fatalities by vehicle type from 2013-2017.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 243 | 258 | 259 | 254 | 254 |

| Light Truck - Pickup | 137 | 150 | 145 | 138 | 144 |

| Light Truck - Utility | 86 | 87 | 72 | 74 | 76 |

| Light Truck - Van | 10 | 8 | 16 | 17 | 14 |

| Large Truck | 13 | 20 | 7 | 11 | 30 |

| Other/Unknown Occupants | 15 | 10 | 16 | 14 | 11 |

| Total Occupants | 504 | 533 | 519 | 512 | 529 |

Fatalities By Crash Type

The National Highway Transportation Safety Administration reports that accidents involving a single vehicle are at the top of the list of fatal crash types in the Pelican State. The table below offers their crash type fatality figures for Louisiana from 2013-2017.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 703 | 740 | 752 | 757 | 760 |

| Single Vehicle | 403 | 467 | 435 | 418 | 440 |

| Involving a Large Truck | 84 | 80 | 79 | 89 | 102 |

| Involving Speeding | 193 | 204 | 171 | 173 | 177 |

| Involving a Rollover | 197 | 227 | 204 | 177 | 204 |

| Involving a Roadway Departure | 435 | 467 | 411 | 415 | 421 |

| Involving an Intersection (or Intersection Related) | 119 | 153 | 151 | 138 | 141 |

Fatalities Involving Speeding by Parish

Again, East Baton Rouge Parish leads the state of Louisiana in fatalities involving speeding. The table below provides the 2014-2018 statistics for fatalities involving speeding in Louisiana by parish.

| Parish | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Acadia Parish | 8 | 5 | 0 | 2 | 5 |

| Allen Parish | 2 | 2 | 1 | 0 | 1 |

| Ascension Parish | 5 | 10 | 8 | 7 | 7 |

| Assumption Parish | 4 | 1 | 2 | 1 | 0 |

| Avoyelles Parish | 2 | 2 | 2 | 0 | 0 |

| Beauregard Parish | 2 | 0 | 1 | 0 | 0 |

| Bienville Parish | 0 | 1 | 0 | 0 | 1 |

| Bossier Parish | 3 | 1 | 0 | 4 | 2 |

| Caddo Parish | 17 | 12 | 5 | 9 | 4 |

| Calcasieu Parish | 10 | 8 | 10 | 6 | 8 |

| Caldwell Parish | 0 | 1 | 0 | 2 | 0 |

| Cameron Parish | 0 | 0 | 0 | 0 | 0 |

| Catahoula Parish | 0 | 0 | 0 | 0 | 2 |

| Claiborne Parish | 2 | 0 | 2 | 0 | 0 |

| Concordia Parish | 0 | 5 | 3 | 0 | 2 |

| De Soto Parish | 1 | 3 | 2 | 2 | 1 |

| East Baton Rouge Parish | 8 | 5 | 3 | 10 | 15 |

| East Carroll Parish | 0 | 0 | 0 | 0 | 0 |

| East Feliciana Parish | 1 | 1 | 4 | 3 | 0 |

| Evangeline Parish | 0 | 0 | 3 | 2 | 1 |

| Franklin Parish | 1 | 2 | 1 | 1 | 1 |

| Grant Parish | 2 | 4 | 1 | 1 | 3 |

| Iberia Parish | 2 | 4 | 3 | 2 | 6 |

| Iberville Parish | 10 | 3 | 4 | 1 | 2 |

| Jackson Parish | 1 | 0 | 0 | 0 | 1 |

| Jefferson Davis Parish | 1 | 1 | 2 | 1 | 1 |

| Jefferson Parish | 4 | 6 | 8 | 3 | 9 |

| La Salle Parish | 0 | 1 | 3 | 0 | 0 |

| Lafayette Parish | 8 | 4 | 2 | 5 | 3 |

| Lafourche Parish | 7 | 5 | 5 | 11 | 4 |

| Lincoln Parish | 3 | 0 | 1 | 2 | 1 |

| Livingston Parish | 8 | 4 | 3 | 8 | 5 |

| Madison Parish | 1 | 2 | 0 | 1 | 0 |

| Morehouse Parish | 3 | 0 | 1 | 0 | 0 |

| Natchitoches Parish | 1 | 3 | 2 | 0 | 1 |

| Orleans Parish | 6 | 9 | 12 | 7 | 3 |

| Ouachita Parish | 6 | 3 | 0 | 6 | 4 |

| Plaquemines Parish | 1 | 4 | 0 | 1 | 0 |

| Pointe Coupee Parish | 1 | 2 | 7 | 2 | 2 |

| Rapides Parish | 13 | 5 | 7 | 4 | 6 |

| Red River Parish | 2 | 1 | 1 | 2 | 0 |

| Richland Parish | 1 | 1 | 0 | 1 | 0 |

| Sabine Parish | 1 | 2 | 1 | 1 | 0 |

| St. Bernard Parish | 1 | 0 | 1 | 1 | 2 |

| St. Charles Parish | 4 | 2 | 3 | 4 | 3 |

| St. Helena Parish | 0 | 4 | 0 | 1 | 3 |

| St. James Parish | 2 | 0 | 0 | 0 | 0 |

| St. John The Baptist Parish | 3 | 2 | 5 | 1 | 3 |

| St. Landry Parish | 8 | 5 | 3 | 2 | 3 |

| St. Martin Parish | 7 | 2 | 3 | 7 | 0 |

| St. Mary Parish | 0 | 0 | 0 | 1 | 3 |

| St. Tammany Parish | 5 | 10 | 6 | 10 | 3 |

| Tangipahoa Parish | 6 | 8 | 14 | 16 | 4 |

| Tensas Parish | 0 | 0 | 1 | 0 | 1 |

| Terrebonne Parish | 9 | 4 | 7 | 11 | 4 |

| Union Parish | 2 | 1 | 1 | 0 | 1 |

| Vermilion Parish | 3 | 3 | 2 | 0 | 1 |

| Vernon Parish | 1 | 1 | 2 | 6 | 0 |

| Washington Parish | 2 | 2 | 4 | 5 | 0 |

| Webster Parish | 0 | 1 | 7 | 1 | 1 |

| West Baton Rouge Parish | 3 | 1 | 2 | 4 | 3 |

| West Carroll Parish | 0 | 0 | 0 | 1 | 0 |

| West Feliciana Parish | 0 | 1 | 0 | 0 | 0 |

| Winn Parish | 0 | 1 | 2 | 2 | 0 |

Fatalities for Crashes Involving an Alcohol-Impaired Driver

Caddo Parish, centered in the city of Shreveport, leads Louisiana in the number of fatalities from crashes involving an alcohol-impaired driver. The table below provides the 2014-2018 statistics for such fatalities in Louisiana’s 64 parishes.

| Parish | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Acadia Parish | 5 | 3 | 2 | 4 | 4 |

| Allen Parish | 3 | 2 | 0 | 0 | 1 |

| Ascension Parish | 5 | 4 | 6 | 7 | 13 |

| Assumption Parish | 4 | 1 | 1 | 0 | 0 |

| Avoyelles Parish | 2 | 2 | 1 | 2 | 1 |

| Beauregard Parish | 4 | 1 | 0 | 1 | 1 |

| Bienville Parish | 0 | 0 | 0 | 0 | 0 |

| Bossier Parish | 4 | 3 | 0 | 2 | 3 |

| Caddo Parish | 16 | 17 | 7 | 13 | 20 |

| Calcasieu Parish | 8 | 13 | 17 | 13 | 13 |

| Caldwell Parish | 1 | 2 | 0 | 1 | 1 |

| Cameron Parish | 0 | 1 | 0 | 0 | 0 |

| Catahoula Parish | 0 | 1 | 0 | 0 | 1 |

| Claiborne Parish | 0 | 0 | 2 | 0 | 0 |

| Concordia Parish | 2 | 1 | 2 | 0 | 1 |

| De Soto Parish | 3 | 1 | 1 | 1 | 1 |

| East Baton Rouge Parish | 17 | 14 | 15 | 20 | 15 |

| East Carroll Parish | 1 | 1 | 0 | 0 | 0 |

| East Feliciana Parish | 2 | 1 | 8 | 2 | 3 |

| Evangeline Parish | 0 | 2 | 5 | 3 | 2 |

| Franklin Parish | 2 | 2 | 2 | 2 | 1 |

| Grant Parish | 5 | 1 | 1 | 2 | 4 |

| Iberia Parish | 3 | 14 | 6 | 2 | 4 |

| Iberville Parish | 7 | 1 | 5 | 2 | 1 |

| Jackson Parish | 1 | 1 | 0 | 1 | 2 |

| Jefferson Davis Parish | 3 | 4 | 2 | 3 | 1 |

| Jefferson Parish | 9 | 7 | 11 | 6 | 10 |

| La Salle Parish | 0 | 1 | 2 | 1 | 1 |

| Lafayette Parish | 12 | 10 | 5 | 6 | 6 |

| Lafourche Parish | 1 | 8 | 4 | 5 | 1 |

| Lincoln Parish | 2 | 0 | 1 | 2 | 0 |

| Livingston Parish | 11 | 6 | 9 | 5 | 9 |

| Madison Parish | 2 | 3 | 1 | 1 | 1 |

| Morehouse Parish | 1 | 3 | 1 | 1 | 0 |

| Natchitoches Parish | 2 | 2 | 3 | 0 | 2 |

| Orleans Parish | 13 | 18 | 21 | 17 | 14 |

| Ouachita Parish | 3 | 8 | 4 | 8 | 4 |

| Plaquemines Parish | 3 | 5 | 1 | 1 | 0 |

| Pointe Coupee Parish | 2 | 6 | 5 | 3 | 4 |

| Rapides Parish | 5 | 4 | 4 | 2 | 7 |

| Red River Parish | 2 | 2 | 1 | 2 | 0 |

| Richland Parish | 0 | 2 | 0 | 0 | 0 |

| Sabine Parish | 1 | 1 | 2 | 2 | 3 |

| St. Bernard Parish | 2 | 1 | 1 | 0 | 2 |

| St. Charles Parish | 2 | 4 | 3 | 2 | 1 |

| St. Helena Parish | 2 | 1 | 0 | 6 | 2 |

| St. James Parish | 4 | 1 | 1 | 1 | 4 |

| St. John The Baptist Parish | 3 | 0 | 1 | 0 | 7 |

| St. Landry Parish | 15 | 5 | 5 | 6 | 7 |

| St. Martin Parish | 6 | 3 | 4 | 5 | 2 |

| St. Mary Parish | 4 | 1 | 1 | 3 | 2 |

| St. Tammany Parish | 7 | 7 | 6 | 6 | 5 |

| Tangipahoa Parish | 10 | 20 | 8 | 8 | 5 |

| Tensas Parish | 0 | 0 | 1 | 0 | 0 |

| Terrebonne Parish | 8 | 8 | 11 | 14 | 4 |

| Union Parish | 0 | 1 | 3 | 0 | 2 |

| Vermilion Parish | 3 | 3 | 5 | 2 | 2 |

| Vernon Parish | 7 | 3 | 6 | 3 | 1 |

| Washington Parish | 3 | 1 | 5 | 2 | 4 |

| Webster Parish | 0 | 0 | 7 | 3 | 2 |

| West Baton Rouge Parish | 4 | 5 | 2 | 5 | 2 |

| West Carroll Parish | 0 | 1 | 0 | 0 | 0 |

| West Feliciana Parish | 1 | 0 | 0 | 1 | 2 |

| Winn Parish | 0 | 0 | 0 | 0 | 2 |

No matter where you live, you should never drink and drive.

Teen Drinking and Driving

Sadly, Louisiana’s average for teen drinking and driving fatalities is slightly above the national average at 1.3 alcohol-impaired fatalities per 100,000 people.

Louisiana is ranked 45th in the U.S. for under-18 DUI arrests.

EMS Response Time

Louisiana is a state with a big urban vs. rural divide. EMS response times to crashes are highly dependent upon where the crash happens, especially in the Pelican State.

For instance, if you have a crash in a rural area of Louisiana, it will take the EMS an average of 61.82 minutes to get you from the crash site to the hospital.

The table below breaks down the average EMS response time for urban and rural areas of Louisiana, from time of the crash, to EMS notification, to hospital arrival.

| Area | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to EMS Arrival at Hospital | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 6 mins | 14.32 mins | 46.13 mins | 61.82 mins | 325 |

| Urban | 4.19 mins | 8.92 mins | 32.77 mins | 44.29 mins | 370 |

Let’s look at some specific transportation issues for the Sugar State.

Transportation

DataUSA reports that if you call the great state of Louisiana home, you likely live in a two-car household and drive alone 24.4 minutes each way to work.

Car Ownership

According to DataUSA, 43.1 percent of Louisiana households own two vehicles, while 20.2 percent own three and 23.4 percent own one.

Commute Time

DataUSA also reports that “employees in Louisiana have a shorter commute time (24.4 minutes) than the normal U.S. worker (25.5 minutes). Additionally, 2.68 percent of the workforce in Louisiana have ‘super commutes’ in excess of 90 minutes.”

Commuter Transportation

“In 2017,” DataUSA reports, “the most common method of travel for workers in Louisiana was drove alone (82.7 percent), followed by those who carpooled (9.22 percent) and those who worked at home (3.34 percent).”

Traffic Congestion in Louisiana

Outside of New Orleans, congestion is rarely a problem in Louisiana.

Traffic monitoring agency Inrix reports that New Orleans is the 26th most traffic-congested city in the United States and the 137th most traffic-congested city in the world. The city’s residents lose an average of 73 hours and $1,023 a year due to traffic congestion.

But don’t let that deter you. We think Louisiana is a great place to call home. Just ask Southern Living, who created this cool video of the top 10 things to do in the Bayou State.

Did this guide help you think about all the factors that should go into your car insurance search?

What part of the guide was most helpful for you?

You can start your search today for the perfect car insurance fit for you and your family in Louisiana simply by entering your ZIP code below.

Frequently Asked Questions

What is a fault state?

Louisiana is a fault state, which means that drivers are financially responsible for the effects of any accident they cause. This means you could be held financially responsible for any damages you cause in an accident.

How do I prove financial responsibility for car insurance in Louisiana?

Financial responsibility can be demonstrated through a certificate of insurance (SR-22) filed by an authorized insurance company in Louisiana, cash or negotiable securities posted with the State Treasurer, or a surety bond posted with the Louisiana Department of Public Safety’s Office of Motor Vehicles.

What percentage of income do Louisianans spend on car insurance?

According to research, Louisianans spent about 3.61 percent of their income on car insurance in 2014, compared to the national average of 2.29 percent.

Do car insurance rates vary by ZIP code in Louisiana?

Yes, car insurance rates can vary by ZIP code in Louisiana. Factors such as urban or rural areas can impact the rates. Cheaper rates can be found in certain ZIP codes, such as 71486, which encompasses the town of Zwolle in Sabine Parish.

How do I find the best car insurance company in Louisiana?

Finding the best car insurance company depends on your needs and preferences. Consider factors such as the level of coverage you need, your budget for premiums, and the type of company you want to do business with. It’s also important to consider the financial ratings of insurance companies, which indicate their ability to provide service.

What are financial ratings for car insurance companies?

Financial ratings represent the financial solvency of car insurance companies and their ability to provide for policyholders. A.M. Best is an organization that ranks insurance companies based on financial solvency. Higher ratings indicate a better ability to serve policyholders.

Why are car insurance premiums in Louisiana higher compared to other states?

Louisiana has some of the highest car insurance premiums in the country due to various factors such as high accident rates, insurance fraud, and the frequency of severe weather events like hurricanes. Additionally, Louisiana’s legal system and unique insurance regulations contribute to higher costs for insurers, which are passed on to consumers.

What factors should I consider when choosing a car insurance company in Louisiana?

When choosing a car insurance company in Louisiana, consider factors such as the company’s financial stability, customer service reputation, coverage options, discounts available, and the overall cost of premiums. It’s also a good idea to compare quotes from multiple insurers to find the best deal.

Can I customize my car insurance policy in Louisiana?

Yes, many car insurance companies in Louisiana offer customizable policies to suit your specific needs. You can often choose from different coverage levels, deductibles, and additional coverage options to tailor your policy to your preferences and budget.

Are there any discounts available for car insurance in Louisiana?

Yes, car insurance companies in Louisiana offer various discounts that can help you save on your premiums. Common discounts include safe driver discounts, multi-policy discounts (for bundling multiple policies with the same insurer), good student discounts, and discounts for anti-theft devices or safety features in your vehicle. Be sure to inquire about available discounts when getting quotes.

What should I do if I’m involved in a car accident in Louisiana?

If you’re involved in a car accident in Louisiana, it’s important to first ensure everyone’s safety and seek medical attention if needed. Then, exchange information with the other parties involved, such as names, contact information, and insurance details. It’s crucial to report the accident to your insurance company as soon as possible to initiate the claims process.

Can I use digital proof of insurance in Louisiana?

Yes, Louisiana law allows drivers to provide digital proof of insurance on their mobile devices when requested by law enforcement or when registering a vehicle. However, it’s a good idea to also carry a physical copy of your insurance card as a backup.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.