Florida Car Insurance 101 (Compare Costs & Companies)

Familiarizing yourself with the ins and outs of Florida car insurance 101 requirements and coverages will ensure you get the best car insurance in Florida. All Florida drivers must have liability insurance, which costs an average of $63/mo, but full coverage provides more protection for drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Jan 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Average Florida car insurance rates are above the national average rates

- Florida minimum liability insurance is an average of $63 per month

- Florida full coverage insurance is an average of $209 per month

Florida car insurance rates are expensive, making it important to learn how to find cheap car insurance in Florida. Our Florida car insurance 101 guide goes over all the important Florida auto insurance details, from the best coverages to the best rates, to help you find affordable Florida car insurance.

If you want to get started right away on finding cheap Florida car insurance, enter your ZIP code into our free quote tool to get the best Florida car insurance quotes from companies in Florida.

Florida Car Insurance Coverage and Rates

According to the Insurance Information Institute, almost all states have some type of compulsory insurance law which requires that drivers carry a minimum amount of car insurance in order to operate their motor vehicle legally on state roadways.

Knowing how much coverage you are required to have versus how much you actually need can sometimes be confusing though which is where we come in.

We are here to help you make sense of everything from policy options to coverage types and discounts that you might qualify for. Keep reading to find all of the ways that we can help.

Florida Car Culture

As a top tourist destination, Florida hosts a lot of visitors each year.

In fact, Florida residents and tourists combined put approximately 588,062,806 miles behind them each yearin the Sunshine State, and they do it all on the approximately 123,000 miles of roadway that the Sunshine State maintains.

Whether you are traveling for business or pleasure there is always a chance that you could end up being involved in a car accident.

- Best Cheap Car Insurance Companies

- Affordable Car Insurance Rates in Palm Bay, FL

- Affordable Car Insurance Rates in Westville, FL (2025)

- Affordable Car Insurance Rates in Wesley Chapel, FL (2025)

- Affordable Car Insurance Rates in Tampa, FL (2025)

- Affordable Car Insurance Rates in St. Cloud, FL (2025)

- Affordable Car Insurance Rates in Ruskin, FL (2025)

- Affordable Car Insurance Rates in Riverview, FL (2025)

- Affordable Car Insurance Rates in Port St. Lucie, FL (2025)

- Affordable Car Insurance Rates in Parrish, FL (2025)

- Affordable Car Insurance Rates in Panama City, FL (2025)

- Affordable Car Insurance Rates in Palm Coast, FL (2025)

- Affordable Car Insurance Rates in Orange City, FL (2025)

- Affordable Car Insurance Rates in Ocklawaha, FL (2025)

- Affordable Car Insurance Rates in Navarre, FL (2025)

- Affordable Car Insurance Rates in Mount Dora, FL (2025)

- Affordable Car Insurance Rates in Longboat Key, FL (2025)

- Affordable Car Insurance Rates in Lake Alfred, FL (2025)

- Affordable Car Insurance Rates in Jupiter, FL (2025)

- Affordable Car Insurance Rates in Homosassa, FL (2025)

- Affordable Car Insurance Rates in Gulf Hammock, FL (2025)

- Affordable Car Insurance Rates in Eustis, FL (2025)

- Affordable Car Insurance Rates in Davenport, FL (2025)

- Affordable Car Insurance Rates in Dania, FL (2025)

- Affordable Car Insurance Rates in Auburndale, FL (2025)

When this happens it will be a comfort to know that you have done your homework and chosen the perfect car insurance provider to take care of all of your needs.

You can also add to this comfort level by understanding just what is covered according to the laws in Florida that govern car insurance.

Florida Minimum Coverage

The Florida Highway Safety and Motor Vehicle Department asserts that any resident of the state who registers their vehicle within the state must have the following amount of minimum coverage:

- $10,000 in Personal Injury Protection (PIP)

- AND $10,000 in Property Damage Liability (PDL)

These coverage amounts are required to be continuously maintained for as long as the vehicle has a valid Florida license plate.

AAA also notes that:

All drivers are required to have insurance policies of at least $10,000 for an individual’s bodily injury; $20,000 for injury to multiple persons; $10,000 for property damage; and a $30,000 minimum per accident.

Experts such as Kiplinger also agree that:

You should carry as much liability coverage as you can comfortably afford because damage claims today are sometimes settled for millions.

If you are ever involved in one of these claims and you are forced to pay out to settle it your house, boat, investments, or other personal assets could be in danger.

If you fail to comply with the state minimum requirements in Florida you could also have your driving privileges suspended, your vehicle registration blocked, and you could lose your license tag for up to three years.

Why take the risk when we are here to help you sort out all of the facts on car insurance and make sure that you get the best deal?

Forms of Financial Responsibility

If you are ever on the road in the Sunshine State and you find blue lights in your rear-view mirror you should know that, according to AAMVA, you are required to present proof of insurance to all law enforcement officers in the State of Florida upon their request.

If you are requested to do so then there are two acceptable forms of financial responsibility that you can present.

- An e-insurance card accessible through your car insurance provider’s app on your smartphone, laptop, tablet or electronic other devices

- A printed paper insurance ID card presented to you by your car insurance provider when you open an insurance policy with them

The Florida Financial Responsibility Law also states that any vehicle registered in the Sunshine State:

- Be insured with PIP and PDL insurance at the time of vehicle registration.

- Meet the minimum state requirements of $10,000 in PIP AND a minimum of $10,000 in PDL.

- Maintain continuous coverage even if the vehicle is not being driven or is inoperable.

- Has a policy that was purchased from an insurance carrier licensed to do business in Florida.

Military members and college students who maintain a permanent residence outside of Florida, and who have registered their vehicle within their own state of residence are exempt.

Vehicles registered as taxis are not though. This vehicle must carry bodily injury liability (BIL) coverage of $125,000 per person, $250,000 per occurrence and $50,000 for (PDL) coverage.

You must also surrender your plate before you cancel your insurance policy in the State of Florida.

If you fail to comply with Florida’s Finacial Responsibility Law you could face a suspension of your driver’s license and/or your license tag as well as a fee of up to $500 for reinstatement.

Premiums as a Percentage of Income

According to Business Insider and the Insurance Information Institute, Florida has some of the highest average car insurance premiums nationwide.

On average 3.15 percent of every Floridians’ annual disposable income is spent on car insurance.

With a per capita disposable income of $38,350 per year earned by each Floridian, and $1,257 of that being spent to maintain insurance on your vehicle, this means that on average $100 is spent on car insurance from a monthly budget of $3,195.

The good news is that Florida’s average annual car insurance premiums have remained relatively over the past few years.

The bad news is that they are still higher than those of its neighboring states of Georgia and Alabama whose residents pay $991 and $837 respectively on average per year for the same type of coverage.

Florida car insurance rates aren’t just higher than neighboring states. Florida is also on the high side of the national average as well which places the average expenditure for car insurance nationwide at $935.80 per year.

Compared to this national average expinditure then Floridians are paying about $322 more than the rest of the country just to drive in the Sunshine State which is why it is so important to shop around in order to get the best deal.

CalculatorPro

Core Coverage

Getting the most for every dollar that you spend on your car insurance policy begins by understanding what each type of coverage actually pays for in case of an accident.

With this information in hand, you can make a better decision about the types of coverage that you might need and the amount of each type of coverage that is best to have in order to protect you and your assets in case of an accident.

Generally speaking, the core coverage types of car insurance are as follows:

- Liability Coverage-This type of coverage helps to cover the cost of any damage that you do to another person’s property or any personal injuries that you might cause another person if you are found to be at-fault in an accident.

- Collision Coverage-This coverage type pays for damage to the policyholder’s car which has resulted from a collision with another car, object or as a result of flipping over

- Comprehensive Coverage-This coverage type can reimburse you for losses that result from theft or for damage caused by something other than a collision with another car or object, such as a natural disaster, animal strike, or vandalism.

Florida is a no-fault state which means that after an accident each person is responsible for paying for their own injuries or damages through their PIP of PDL.

Just because the Sunshine State operates under the no-fault system does not mean that car insurance claims don’t end up in court.

If you hit someone in the State of Florida and they choose to pursue legal action against you havingliability coverage could help protect you against any additional financial losses that might be incurred as a result of the accident.

Florida is also notorious for its hurricane seasons which bring with them torrential rains, high winds, and flooding. Having comprehensive car insurance could help protect you from any losses that occur as a result.

Take a look at what each of these types of coverage cost on average in the Sunshine State.

| COVERAGE TYPE | ANNUAL COSTS (2015) |

|---|---|

| Liability | $857.64 |

| Collision | $282.96 |

| Comprehensive | $116.53 |

| Combined Total | $1,257.13 |

The rates above reflect the fiscal year of 2015 so premiums for 2019 could be a bit higher.

Educating yourself on the car insurance requirements for Florida, the insurance providers available in your area, and then shopping around for the best rates from each of them can help keep your costs down though.

Additional Liability

Having liability, comprehensive, or collision coverage is not the only way to insulate yourself from the financial losses that can hit you as a result of a car accident.

There are also other types of liability coverage that can help. Some of the coverage types include:

- MedPay insurance will cover the medical payments of all passengers in a vehicle that are injured during an accident; including the ambulance ride and treatment.

- Uninsured/Underinsured insurance protects you if you are in an accident with an at-fault driver who isn’t carrying liability insurance or whose limits are to low to cover the damages and medical expenses incurred by you or others during an accident.

- Property Damage Liability which pays for damage policyholders–or anyone driving the car with their permission of the policyholder– might cause to someone else’s property.

When deciding on whether or not to invest in additional types of liability coverage it can be helpful to consider the loss ratios of these coverage types. Take a look at these ratios by coverage type according to the data collected by the National Association of Insurance Commissioners.

| LOSS RATIO | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection | 75% | 62% | 76% |

| Medical Payments (MedPay) | 74% | 73% | 81% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 73% | 80% | 86% |

These loss ratio numbers for PIP, MedPay, and Uninsured/Underinsured motorist sections are good news to you as a Florida consumer since loss ratios indicate a company’s willingness to pay out a claim after an accident.

Specifically the loss ratio works as follow:

- A High Loss Ratio (over 100 percent) indicates that the companies are losing money because they are paying out to many claims which might cause them to face bankruptcy.

- A Low Loss Ratio indicates that companies are paying to few claims which might result in you having your claim rejected by such a company should ever need to file one with them.

Florida’s car insurance loss ratios are relatively good then even if the premiums in the Sunshine State are generally higher than the national average.

When you consider that that around 27 percent of Florida drivers are uninsured/underinsured (ranking Florida number one in this area according to the Insurance Information Institute) it could be a major benefit to you to invest in additional types of liability coverage.

There are also other ways to protect yourself against financial losses after a car accident or traffic incident. Keep scrolling to find out how add-ons, endorsements, and/or riders can help lower the costs of owning, repairing, and/or maintaining your vehicle.

Add-ons, Endorsements, and Riders

Having specific types of add-ons, endorsements, or riders included in your insurance policy can help you pay some of the unforeseen costs of owning a car or having a car accident.

Some of these unforeseen costs can include, towing, renting a car while yours is being repaired, or paying for expensive replacement parts for special types of vehicles.

Take a look at a few of your options:

- Guaranteed Auto Protection (GAP)–If your car is ever totaled or stolen GAP will pay any money that is remains owed on the lease or loan.

- Rental Reimbursement-This type of coverage will help you pay the costs of renting a car until your repairs are finished.

- Emergency Roadside Assistance-If your car breaks down or you have a flat emergency roadside assistance will be there for you to pay for the cost of roadside repairs or a tow if need be.

- Mechanical Breakdown Insurance–This type of coverage helps to pay for the cost of repairs to your car which did not result from an accident.

- Non-Owner Car Insurance–This type of coverage is perfect for you then because it provides you with limited liability coverage even if the car you are driving isn’t registered to you.

- Modified Car Insurance Coverage–If a basic model just isn’t your style then modified car insurance should be. This type of insurance covers most modifications made to your vehicle that may not be covered by your general policy should you be involved in an accident.

- Collector Car Insurance–If you own a collector or classic car you will probably want to have additional protection for your prized possession which is where this type of coverage in. This type of insurance typically costs less as well since these types of cars are generally not driven as much.

- Pay-As-You-Drive or Usage-Based Insurance–With this type of coverage the insurance provider provides you with some type of onboard device and then takes into account your speed, distance traveled, and other such factors and issues discounts based on that information.

The type of car you drive or how and when you drive are not the only things that can determine the type of coverage you may need or the price that you will pay for it.

Sometimes just who you are can impact the rate that you receive. Keep reading to find out how.

Male Vs. Female Rates

In 2017, the Consumer Federation of America released a study that came as a shock to a lot of people.

This study revealed that:

Most large auto insurers charge 40 and 60-year-old women higher rates than men, often more than $100 per year.

This flies in the face of conventional wisdom which had previously asserted that men pay more for car insurance regardless of age.

Gender and age are not the only factors that can drive your car insurance costs up or down though. Take a look at how your rates could be impacted if your marital status is added in.

| COMPANY | MARRIED 35-YEAR OLD FEMALE | MARRIED 35-YEAR OLD MALE | MARRIED 60-YEAR OLD FEMALE` | MARRIED 60-YEAR OLD MALE | SINGLE 17-YEAR OLD FEMALE | SINGLE 17-YEAR OLD MALE | SINGLE 25-YEAR OLD FEMALE | SINGLE 25-YEAR OLD MALE |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $4,653.38 | $4,423.29 | $4,040.00 | $4,089.70 | $15,905.72 | $17,179.33 | $4,592.92 | $4,639.32 |

| Geico General | $2,986.89 | $3,001.17 | $2,793.99 | $2,793.99 | $5,342.74 | $6,713.47 | $3,292.51 | $3,344.27 |

| Liberty Mutual Ins. Co. | $3,711.14 | $3,711.14 | $3,398.94 | $3,398.94 | $7,859.88 | $12,116.72 | $3,711.14 | $5,037.27 |

| Allied P&C | $3,039.80 | $3,000.81 | $2,710.48 | $2,806.30 | $7,314.60 | $9,013.69 | $3,347.30 | $3,483.83 |

| Progressive Select | $3,736.10 | $3,523.35 | $3,200.74 | $3,428.17 | $10,512.83 | $11,453.56 | $4,508.82 | $4,302.83 |

| State Farm Mutual Auto | $2,158.99 | $2,158.99 | $1,954.51 | $1,954.51 | $6,166.09 | $7,832.79 | $2,399.41 | $2,556.07 |

| USAA | $1,646.31 | $1,619.33 | $1,536.18 | $1,525.12 | $5,638.10 | $6,551.72 | $2,060.09 | $2,226.40 |

As you can see, a 25-year-old single female is paying almost the same price for her car insurance policy as a female who is 60-years-old and married.

This is different than the rates for men who tend to pay less for their car insurance policies as they age.

Your age, gender, and marital status are not the only factors that car insurance companies look at when setting your rates. Keep reading to find out what we mean.

Cheapest Rates by Zip Code

Most people have no idea that just moving a few blocks can have a significant impact on the price that they pay for their car insurance policy.

Take a look at the tables below to see how much you and your neighbors are paying for your car insurance just because of your zip code.

| Most Expensive Zip Codes in Florida | City | Average by Zip Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 33142 | MIAMI | $7,631.16 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33147 | MIAMI | $7,626.18 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33125 | MIAMI | $7,606.64 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33135 | MIAMI | $7,606.64 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33130 | MIAMI | $7,592.83 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33136 | MIAMI | $7,592.83 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33127 | MIAMI | $7,517.24 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33010 | HIALEAH | $7,448.04 | Allstate | $12,185.02 | Progressive | $8,805.26 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33150 | MIAMI | $7,428.69 | Allstate | $12,124.19 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33128 | MIAMI | $7,404.00 | Allstate | $12,185.02 | Progressive | $8,497.04 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33012 | HIALEAH | $7,304.68 | Allstate | $11,716.92 | Progressive | $8,805.26 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33126 | MIAMI | $7,297.22 | Allstate | $12,367.26 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33013 | HIALEAH | $7,275.81 | Allstate | $11,715.10 | Progressive | $8,604.99 | USAA | $4,202.34 | Geico | $4,603.44 |

| 33168 | MIAMI | $7,240.81 | Allstate | $11,827.36 | Progressive | $8,466.37 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33167 | MIAMI | $7,216.08 | Allstate | $11,654.27 | Progressive | $8,466.37 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33145 | MIAMI | $7,199.47 | Allstate | $10,732.87 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33144 | MIAMI | $7,197.53 | Allstate | $12,367.26 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33174 | MIAMI | $7,178.70 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33199 | MIAMI | $7,178.70 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33122 | MIAMI | $7,163.83 | Allstate | $11,836.51 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | Geico | $4,603.44 |

| 33054 | OPA LOCKA | $7,162.08 | Allstate | $11,656.10 | Progressive | $8,533.79 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33184 | MIAMI | $7,153.94 | Allstate | $12,193.91 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33016 | HIALEAH | $7,146.88 | Allstate | $11,656.10 | Progressive | $8,805.26 | USAA | $4,505.83 | Geico | $4,603.44 |

| 33175 | MIAMI | $7,127.61 | Allstate | $12,009.61 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| 33162 | MIAMI | $7,110.30 | Allstate | $11,684.61 | Liberty Mutual | $8,135.30 | USAA | $4,505.83 | Geico | $4,603.44 |

Now for the least expensive zip codes.

| Least Expensive Zip Codes in Florida | City | Average by Zip Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 32694 | WALDO | $3,481.35 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32643 | HIGH SPRINGS | $3,486.23 | Allstate | $5,672.94 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32618 | ARCHER | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32667 | MICANOPY | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32669 | NEWBERRY | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32601 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32609 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32641 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32615 | ALACHUA | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32658 | LA CROSSE | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32612 | GAINESVILLE | $3,492.52 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32603 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32605 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32606 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32607 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32608 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32611 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32653 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32610 | GAINESVILLE | $3,504.58 | Allstate | $5,675.46 | Progressive | $3,951.64 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32631 | EARLETON | $3,523.03 | Allstate | $5,930.57 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32550 | MIRAMAR BEACH | $3,597.34 | Allstate | $5,996.61 | Progressive | $4,267.71 | USAA | $1,983.74 | State Farm | $2,555.76 |

| 32664 | MC INTOSH | $3,610.75 | Allstate | $5,675.46 | Liberty Mutual | $3,954.28 | USAA | $2,456.82 | State Farm | $2,656.82 |

| 32681 | ORANGE LAKE | $3,610.75 | Allstate | $5,675.46 | Liberty Mutual | $3,954.28 | USAA | $2,456.82 | State Farm | $2,656.82 |

| 32633 | EVINSTON | $3,646.11 | Allstate | $5,638.78 | Progressive | $5,035.52 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32640 | HAWTHORNE | $3,646.11 | Allstate | $5,638.78 | Progressive | $5,035.52 | USAA | $2,129.02 | State Farm | $2,685.17 |

As you can see, living further away from city centers can help you lower the cost of your car insurance.

Just looking at the areas in and around Tampa show by just how much if you look at the rates for drivers who reside in South Tampa with a zip code of 33611 versus drivers who live in the up and coming area of Ybor City with a zip code of 33603 which is closer to the city center’s zip code of 33603.

These rates reveal that South Tampa residents pay almost $1,000 less on average in insurance premiums than their neighbors north of Kennedy Blvd. do.

It is not just your zip code that can have an influence on what you pay for your car insurance coverage. The city you love can also determine how much you will spend.

Enter your ZIP code below to view companies that have cheap auto insurance rates. Secured with SHA-256 Encryption

Cheapest Rates by City

Florida cities are as beautiful as they are diverse. Navigating the city streets is not always easy though, and neither is negotiating the best price for car insurance.

We have done the work for you. Take a look at the tables below to see how the city that you love plays a role in determining just what you will pay for your car insurance.

| Most Expensive Cities in Florida | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Brownsville | $7,631.16 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | Geico | $4,603.44 |

| Gladeview | $7,527.43 | Allstate | $12,154.60 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | Geico | $4,603.44 |

| Fountainebleau | $7,237.96 | Allstate | $12,367.26 | Liberty Mutual | $8,191.19 | USAA | $4,037.71 | Geico | $4,603.44 |

| Hialeah | $7,178.98 | Allstate | $11,504.33 | Progressive | $8,630.10 | USAA | $4,248.38 | Geico | $4,603.44 |

| Golden Glades | $7,161.53 | Allstate | $11,695.48 | Liberty Mutual | $8,135.30 | USAA | $4,505.83 | Geico | $4,603.44 |

| Coral Terrace | $7,081.53 | Allstate | $12,367.26 | Liberty Mutual | $8,191.19 | USAA | $4,045.62 | Geico | $4,603.44 |

| Olympia Heights | $7,078.68 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | Geico | $4,603.44 |

| Miami | $7,078.48 | Allstate | $11,539.59 | Liberty Mutual | $8,684.52 | USAA | $4,077.32 | Geico | $4,603.44 |

| Biscayne Park | $6,983.18 | Allstate | $11,896.30 | Progressive | $8,392.79 | USAA | $4,505.83 | Geico | $4,603.44 |

| Miami Gardens | $6,972.48 | Allstate | $10,667.38 | Liberty Mutual | $8,209.82 | USAA | $4,505.83 | Geico | $4,603.44 |

Given the size of its population, it comes as no surprise that Miami ranks in the top 10 cities for the most expensive car insurance rates.

After all, more cars on the road usually translate into more traffic incidents which inevitably results in more claims.

| Least Expensive Cities in Florida | Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Waldo | $3,481.35 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| High Springs | $3,486.23 | Allstate | $5,672.94 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Archer | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Micanopy | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Newberry | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Alachua | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| La Crosse | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Gainesville | $3,494.00 | Allstate | $5,666.29 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Earleton | $3,523.03 | Allstate | $5,930.57 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Miramar Beach | $3,597.34 | Allstate | $5,996.61 | Progressive | $4,267.71 | USAA | $1,983.74 | State Farm | $2,555.76 |

If you ever need to file a claim then it will be nice to know where your car insurance provider stacks up among the others operating in the Sunshine State.

Best Florida Car Insurance Companies

A lot of things go into being the best when it comes to car insurance providers and as a savvy shopper, you will want to be looking at most of them.

Some of the things that you should consider first are the company’s financial rating, their complaint ratio, and the amount of the market share that each company holds by comparison. Keep scrolling to find out why.

Largest Companies Finacial Ratings

Looking at a car insurance company’s financial health is important because it can give you some indication about their ability to pay out a claim should you ever need to file one.

One of the best ways to see how financially sound the company you are looking at is would be to consider how they rank according to AM Best.

AM Best is one of the only worldwide credit agencies to have its eye solely on the insurance industry.

This is why it is one of the most trusted agencies to use by the National Association of Insurance Commionsers for determining a car insurance company’s overall health and viability in the car insurance market.

Take a look at how AM Best has rated the ten largest car insurance providers in the Sunshine State.

| BEST RATED COMPANIES | RATING | OUTLOOK |

|---|---|---|

| ACE American Insurance Company | A++ | Stable |

| Agri General Insurance Company | A++ | Stable |

| Auto-Owners Insurance Company | A++ | Stable |

| Automobile Ins Co of Hartford, CT | A++ | Stable |

| Chubb Insurance Company | A++ | Stable |

| Columbia Insurance Company | A++ | Stable |

| Continental Divide Insurance Company | A++ | Stable |

| Geico | A++ | Stable |

| Great Northern Insurance Company | A++ | Stable |

| Owners Insurance Company | A++ | Stable |

Choosing a company with an A++ rating from AM Best means that you are choosing one that has a stable financial outlook.

This is important to you are a car insurance consumer because when you choose a company with a strong financial future you are also choosing one who is more likely to pay out your claim should you ever need to file one.

Companies with Best Ratings

AM Best is not the only agency looking out for you when it comes to determining who the best car insurance providers in your area are.

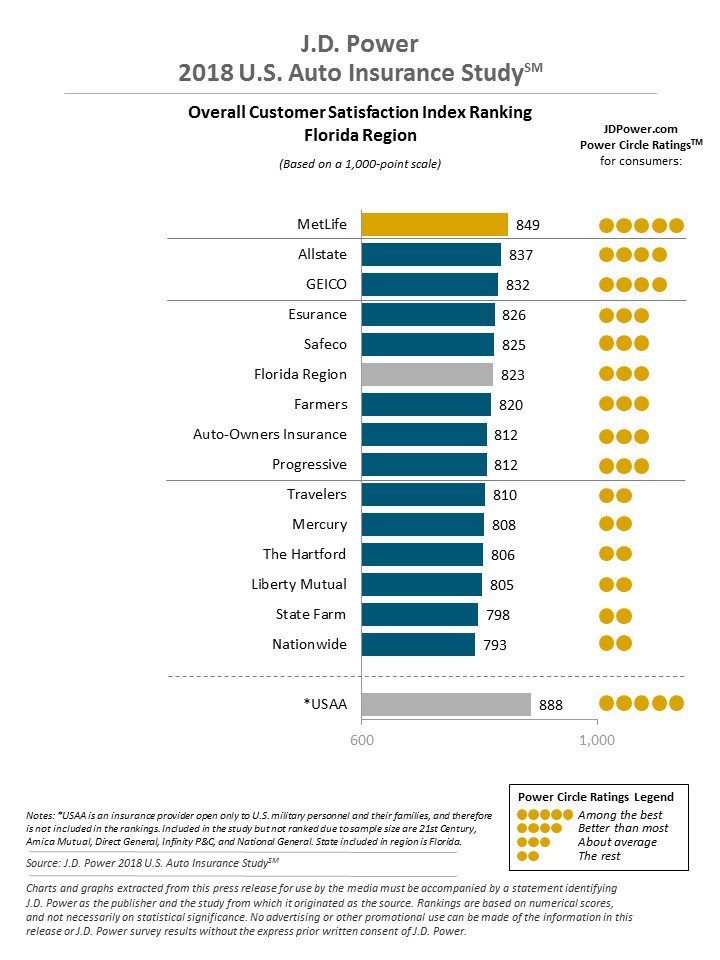

JD Power is also watching out for you, and what they have noted is that customer satisfaction among customers of automobile insurance is at a record high.

Shopping for car insurance in the Sunshine State isn’t always a pleasant experience even if JD Power has discovered that most people are satisfied overall.

Making sure that your car insurance shopping experience is as smooth as it can be is as simple as scrolling down.

Companies with Most Complaints in Florida

Knowing which car insurance provider that customers complain about the most can really help lower your frustration level down the road.

This starts by understanding what the complaint ratio is and how it applies to each company that you are looking at as a potential car insurance provider for you and your family.

The complaint ratio tells you as a consumer just where the providers in your area stand in relation to their competitors when it comes to the number of complaints filed against them.

The baseline for the complaint ratio is 1.0. This means that a company with a complaint ratio of 1.0 has an average number of complaints.

The higher the complaint ratio the higher the number of complaints lodged against the company then.

Below is a list of the best car insurance companies in Florida along with their complaint ratios so that you can see how each one compares.

| COMPANY | DIRECT PREMIUMS WRITTEN | COMPLAINT RATIO | LOSS RATIO | MARKET SHARE |

|---|---|---|---|---|

| Amtrust NGH Group | $413,351 | 0 | 61.98% | 2.16% |

| Travelers Group | $444,623 | 0.09 | 67.79% | 2.32% |

| State Farm Group | $3,042,871 | 0.44 | 79.80% | 15.89% |

| Allstate Insurance Group | $1,842,800 | 0.5 | 55.45% | 9.63% |

| Geico | $4,678,326 | 0.68 | 78.78% | 24.44% |

| USAA Group | $1,357,367 | 0.74 | 82.20% | 7.09% |

| Progressive Group | $3,031,444 | 0.75 | 66.17% | 15.84% |

| InFinanciality Prop & Casualty Insurance Group | $357,011 | 2.03 | 67.06% | 1.86% |

| Liberty Mutual Group | $617,089 | 5.95 | 68.42% | 3.22% |

| J. Whited Group (Windhaven) | $385,885 | 7.43 | 56.59% | 2.02% |

As you look at the table above you should keep in mind that there is a lot more that goes into the complaint ratio than just how many consumer complaints have been lodged against a company.

For instance, glancing briefly at the numbers could make it seem as if Amtrust NGH Group is the best choice overall,

You should consider that this company only holds 2.16 percent of the market share though. This means that NGH Group has fewer customers, and fewer customers translate into fewer possibilities for complaints.

Looking at the numbers again then you can see that Geico who holds almost 25 percent of Florida’s overall market share.

This means that their complaint ratio of 0.68 is actually better than NGH Group’s given the company size and the number of customers that Geico services.

Should you ever need to file a complaint against your car insurance provider in Florida there are several points of contact for you to choose from including the following:

- The Statewide toll-Free number: 1-877-My-FL-CFO

- Out-of-State callers can contact: (850) 413-3089

- There is also a TDD Line for the hearing impaired: 1-800-640-0886

- Or you can send an Email: [email protected]

The office of Florida’s Chief Financial Officer also offers Floridians a way to check the number of complaints against insurance providers for a given year through their Complaint Comparison Database search tool.

Now that you know what the loss ratio and complaint ratio mean to you it is time to start comparing the rates.

Cheapest Companies in Florida

Every good shopper knows that you always arrange the prices of your selections from low to high when you first begin your search.

The table below helps you do just that by showing you the cheapest car insurance providers in the Sunshine State.

| COMPANY | AVERAGE | +/- COMPARED TO STATE AVERAGE (RATE) | +/- COMPARED TO STATE AVERAGE (%) |

|---|---|---|---|

| Allstate F&C | $7,440.46 | $2,760.00 | 37.09% |

| Geico General | $3,783.63 | -$896.83 | -23.70% |

| Liberty Mutual Ins Co | $5,368.15 | $687.69 | 12.81% |

| Allied P&C | $4,339.60 | -$340.86 | -7.85% |

| Progressive Select | $5,583.30 | $902.84 | 16.17% |

| State Farm Mutual Auto | $3,397.67 | -$1,282.79 | -37.75% |

| USAA | $2,850.41 | -$1,830.05 | -64.20% |

Knowing how far you can stretch your car insurance dollar is important.

Understanding what factors these car insurance companies are using to determine your rates is critical though. Keep reading to find out what we mean.

Commute Rates by Companies

Did you know that the more time that you spend behind the wheel each year the higher your car insurance rates might be?

It’s true. In fact, your rates could shift up or down by over $2,000 in some cases just by choosing the wrong company or driving a few extra miles. Take a look.

| COMPANY | 10 MILES COMMUTE. 6000 ANNUAL MILEAGE. | 25 MILES COMMUTE. 12000 ANNUAL MILEAGE. |

|---|---|---|

| Allstate | $7,227.85 | $7,653.06 |

| Progressive | $5,583.30 | $5,583.30 |

| Liberty Mutual | $5,193.97 | $5,542.32 |

| Nationwide | $4,339.60 | $4,339.60 |

| Geico | $3,765.00 | $3,802.25 |

| State Farm | $3,278.22 | $3,517.12 |

| USAA | $2,818.01 | $2,882.80 |

If you have a short commute then it seems as if USAA might be your best choice.

There is a bit more to it than that though since car insurance companies aren’t just looking at how far you do or don’t drive.

Because Florida ranks as one of the most expensive states in the nation when it comes to car insurance prices you will definitely want to squeeze every penny per mile that you can out of your car insurance policy.

Coverage Level Rates by Companies

Its common knowledge that the more you buy of something the higher the price that you will pay for it.

Car insurance coverage is no different. Take a look at how much the price you pay for your car insurance policy can differ depending on the provider that you choose and how much coverage you purchase with them.

| COMPANY | LOW COVERAGE | MEDIUM COVERAGE | HIGH COVERAGE |

|---|---|---|---|

| Allstate | $5,762.84 | $7,820.73 | $8,737.79 |

| Geico | $3,105.08 | $3,915.19 | $4,330.61 |

| Liberty Mutual | $4,921.70 | $5,456.65 | $5,726.09 |

| Nationwide | $3,427.69 | $4,511.14 | $5,079.97 |

| Progressive | $4,681.36 | $5,712.27 | $6,356.27 |

| State Farm | $2,915.85 | $3,477.29 | $3,799.88 |

| USAA | $2,450.79 | $2,954.56 | $3,145.87 |

While it might seem like a good idea to skimp on coverage to save a few buck the lack of coverage could come back to haunt you later if you are ever in an accident.

This is especially true if you are hit by an uninsured motorist.

Of course, there are times when less coverage is your best option such as if you own an older car with a lot of miles on it which might be totaled out just by backing into a shopping cart.

Credit History Rates by Companies

As you are finding out, the amount of coverage that you decide to purchase is only one of the many things that determine the price that you pay for your car insurance policy.

According to a 2015 article released by Consumer Reports, your credit score is being used by many major car insurance providers when it comes time to set your rates.

Take a look at the table below to see how your credit history might be impacting your car insurance price in the Sunshine State.

| COMPANY | GOOD CREDIT | FAIR CREDIT | POOR CREDIT |

|---|---|---|---|

| Allstate | $5,314.82 | $6,574.17 | $10,432.38 |

| Geico | $2,505.51 | $3,335.60 | $5,509.78 |

| Liberty Mutual | $4,109.70 | $5,073.66 | $6,921.08 |

| Nationwide | $3,596.12 | $3,981.62 | $5,441.06 |

| Progressive | $4,302.18 | $5,169.65 | $7,278.07 |

| State Farm | $2,495.39 | $3,045.80 | $4,651.82 |

| USAA | $1,645.31 | $2,266.46 | $4,639.45 |

People with good credit scores get better car insurance rates because car insurance companies believe that these people are less likely to submit a claim.

This notion which is held by car insurance providers isn’t exactly baseless either.

In fact, the higher the credit rating the more likely it is that the person will pay out of pocket to have repairs done or to settle damages after an accident.

Just because car insurance providers are looking at your credit rating doesn’t mean that your driving record doesn’t matter though.

Driving Record Rates by Companies

What you do when you are behind the wheel really matters in the Sunshine State. In fact, just one speeding ticket could cost you over $1,000 if you have the wrong car insurance provider. Take a look.

| COMPANY | CLEAN RECORD | WITH 1 SPEEDING VIOLATION | WITH 1 DUI | WITH 1 ACCIDENT |

|---|---|---|---|---|

| Allstate | $6,417.39 | $7,119.64 | $8,524.13 | $7,700.66 |

| Geico | $2,636.72 | $4,116.12 | $5,012.72 | $3,368.94 |

| Liberty Mutual | $3,869.33 | $5,285.32 | $7,291.64 | $5,026.31 |

| Nationwide | $3,705.32 | $4,114.99 | $5,472.37 | $4,065.71 |

| Progressive | $4,407.95 | $5,915.72 | $5,490.35 | $6,519.19 |

| State Farm | $3,105.11 | $3,397.66 | $3,397.66 | $3,690.25 |

| USAA | $2,233.94 | $2,341.64 | $4,070.81 | $2,755.24 |

That speeding ticket could also cost you driving points in Florida. These points also stay on your driving record for three years and are used by car insurance providers to help set your rates.

It is as important to monitor your driving record as it is to monitor your credit score.

Making sure that your driving record is up to date and free from errors can help you save a lot of money and frustration when it comes time to purchase your car insurance policy.

You can obtain a copy of your driving record by contacting the Florida Highway Safety and Motor Vehicle Department.

Largest Car Insurance Companies in Florida

Monitoring your credit and driving records is not the only way to keep your car insurance rates down.

Understanding how the market share works alongside the loss ratio can also help you make an informed decision when it comes time to purchase your car insurance policy.

| COMPANY | DIRECT PREMIUMS WRITTEN | MARKET SHARE |

|---|---|---|

| Geico | $4,678,326 | 24.44% |

| State Farm Group | $3,042,871 | 15.89% |

| Progressive Group | $3,031,444 | 15.84% |

| Allstate Insurance Group | $1,842,800 | 9.63% |

| USAA Group | $1,357,367 | 7.09% |

| Liberty Mutual Group | $617,089 | 3.22% |

| Travelers Group | $444,623 | 2.32% |

| Amtrust NGH Group | $413,351 | 2.16% |

| J. Whited Group (Windhaven) | $385,885 | 2.02% |

| InFinanciality Prop & Casualty Insurance Group | $357,011 | 1.86% |

So what is market share exactly? Marketshare is the percentage of the overall market that is controlled by a single company.

As you can see from the table above, Geico controls approximately 25 percent of the overall car insurance market in the Sunshine State.

Bigger doesn’t always mean better though remember?

Even though Geico also has $4,678,326 in Direct Premiums Written which indicates that Geico is financially sound if you have a speeding ticket or accident on your driving record choosing Geico might actually cost you more money.

Things like this are why it pays to shop around.

Number of Insurers in Florida

There are 14 domestic insurance providers in the state of Florida and 953 foreign ones. This means that you have 967 to choose from as you shop for the best rates and coverage in the Sunshine State.

What’s the difference you ask? Take a look.

- Domestic insurer means that the insurer is one which has been formed under the laws of the state of Florida.

- Foreign insurer means that the insurer is one which has been formed under the laws of any state, district, territory, or commonwealth of the United States other than the state of Florida.

Both foreign and domestic car insurance providers have to follow the same laws that govern car insurance in the Sunshine State so the choice really just comes down to which one you feel most comfortable doing business with.

Florida State Laws

Figuring out just which laws apply to who and when after a car accident can be confusing, but having a general understanding of what these laws are before you find yourself involved in a traffic incident can go a long way towards lowering your anxiety.

This is where we come in. We are here to help you gain a good grasp of the laws that govern both driving and car insurance in the Sunshine State.

Keep scrolling to find out all of the basic information you need to help you keep your rates down and your family safe while on the road in Florida.

Car Insurance Laws

According to the NAIC, the Sunshine State requires that you file the proper forms before your insurance can be used.

If you have one too many tickets or accidents on your driving record one of these forms could be an SR-22 or FR-44.

In fact, the car insurance laws in the Sunshine State govern everything from how much car insurance coverage you need to requirements for your behavior when you are behind the wheel. Keep reading to find out more.

How State Laws for Car Insurance are Determined

In the State of Florida, the laws that govern car insurance are determined by the state legislature.

Florida State legislators look at various safety studies alongside financial reports and stacks of various other types of data and then they write and introduce bills on the floor.

These bills are then studied by committees and/or are put through public hearings before finally being voted on.

If the bill is debated and determined to be in the best interest of the public it then becomes a law. This is how the Sunshine State became a no-fault state.

This can make understanding Florida car insurance law a bit confusing to most residents, but financial responsibility after an accident generally breaks down as follows:

- No-Fault coverage is meant to protect the insured by paying for their expenses in an accident.

- After No-Fault coverage benefits are exhausted the insured can then turn to MedPay

- When MedPay benefits have reached their limits, and if the insured is not at fault, the insured can then look towards the other party’s insurance to seek reimbursement.

- Uninsured Motorist can cover the rest is the other party’s benefits reach their limits, but only within the limits of the uninsured motorist policy limits.

Because Florida is a no-fault state you should know that if you file an insurance claim you risk having your rates increase for up to three years after the date of the accident or incident.

This applies to everything from filing a claim for major accidents and/or being hit by a car as a pedestrian to filing a claim to have your windshield repaired for cracks or chips.

Windshield Coverage

Florida law does have a few stipulations when it comes to keeping a driver’s view unobstructed.

One of these laws is that all vehicles operating in the Sunshine State must have functioning windshield wipers.

The State of Florida also mandates that no coverings, stickers, or signs on windshields are allowed. The only exceptions are as follows:

- Stickers which are mandatory by law

- GPS devices

- And/or toll payment devices, such as Florida’s Sun Pass device

These stickers or devices cannot obstruct the driver’s view though. This is also true of damage such as cracks or chips which have the potential to interfere with the driver’s view.

Although Florida laws do not mention cracked or damaged windshields, the Sunshine State does adhere to the federal regulation that any cracks or chips smaller than ¾-inch in diameter are permitted.

This damage cannot be located within three inches of another crack though and it must also be located out of the driver’s field of vision.

If you need to have your windshield repaired or replaced then comprehensive coverage will generally cover the costs.

Be aware that filing of all other types of claims could increase your rates the next time that you rewrite your policy.

High-Risk Insurance

Filing one too many claims within a given period can be almost as costly as one too many tickets or accidents.

In fact, the more claims you file, or the more driving points you have, the higher a risk you are considered for car insurers to take you on.

Being a high-risk driver comes with its own set of issues. One of these might be that you are forced to get an FR-44. An FR-44 is a form of financial responsibility that all high-risk drivers in Florida are required to have.

The coverage limits under an FR-44 are significantly higher than they would be for a traditional policy because the risk that car insurance providers are taking by insuring a high-risk driver is higher as well.

Typically speaking, you are required to have an FR-44 if you incur a DUI or you are caught driving with a suspended license.

IF you find yourself in the high-risk pool and unable to get insurance through traditional means there is an option for you in the Sunshine State.

This option is to purchase your car insurance policy through the Florida Automobile Joint Underwriting Association.

Known as FAJUA, this association “is available to licensed drivers and vehicle owners who have been unable to purchase insurance from other companies.”

Low-Cost Insurance

All of this talk of high-risk drivers and increased rates seem intimidating, but there are low-cost options to be had in the state of Florida.

Some of the low-cost options are available through traditional auto insurance companies by way of discounts or other safe driver programs. Taking a defensive driving course can also lower your rates with certain car insurance companies if you have the time and money to invest.

Even with all of these discount and recovery options some people still feel compelled to file false claims. Be forewarned though that the State of Florida takes insurance fraud seriously.

Automobile Insurance Fraud in Florida

Living in a no-fault state can have its advantages for Florida residents in need of quick reimbursement after an accident.

Unfortunately, the no-fault system also lends itself to higher incidents of car insurance fraud.

The Insurance Information Institute even notes that:

In many no-fault states, unscrupulous medical providers, attorneys and others perpetrate fraud by padding costs associated with a legitimate claim, for example by billing an insurer for a medical procedure that was not performed.

This is why if you are ever injured in an accident or sustain damage to your vehicle, it is best to pay close attention to the billing practices of all of the service providers that you employ.

Florida law dictates that any person or business that submits a claim based on deliberate falsehood, exaggerations, or loss and/or injury that is the result of deliberate action on the part of the claimant has committed insurance fraud.

It is also against Florida law to submit false or misleading information to an insurer on a claim or an application for an insurance policy.

A person caught committing insurance fraud in the Sunshine State can be subject to:

- The loss of license as well as charges of criminal liability and/or civil fines, if the perpetrator is a lawyer, doctor and other professional.

- Fines and/or imprisonment in the case of those not so professionally inclined.

The severity of the punishment also increases with the value of the fraudulent claim, and can even result in first, second, or third-degree felony charges as well.

If you think that you have been the victim of car insurance fraud, or you would like to report an incident of it, you can contact the Bureau of Insurance Fraud for the State of Florida.

In 2012 Florida also enacted the No-Fault Insurance Reform Law which has helped to reduce fraud within the state resulting in lower rates for Floridians overall.

If current lawmakers have their way then no-fault could be a thing of the past in Florida all together as well.

At the moment a bill known as SB 1052 is just one hearing away from the Senate floor which means that according to The Center Square:

Under SB 1052, motorists would have to carry $25,000 in bodily injury coverage, $50,000 for any two or more persons, and $10,000 in property damage coverage as “minimum security requirements.”

This would put Florida in-line with most of the other states in the nation that are at-fault (or tort) states.

Statute of Limitations

If you should ever need to file a car insurance claim you should be aware that you have a limited time to do so.

According to the Florida State Legislature, claims for personal injury and property damage have the following statutes of limitations in Florida:

- Four Years from the date of the incident for Personal Injury claims

- Four Years from the date of the incident for Property Damage claims

The only way to stop the statute of limitations is to file a lawsuit.

Florida Specific Laws

Did you know that in the Sunshine State you must feed the parking meter if you tie an elephant, goat or alligator to it according to Florida law?

On a more serious note, in 2013, the State of Florida overturned a previous law that had allowed foreign tourists to drive with their licenses which had been issued in their home countries.

Florida also has a Move-Over law that requires drivers to slow their car down to 20 miles per hour below the posted speed limit when passing emergency vehicles and law enforcement officers on the side of Florida roadways.

Violating this law makes you subject to fines.

Vehicle Licensing Laws

Violating the various vehicle licensing laws in the State of Florida could also result in penalties or fines if you aren’t careful.

This is especially true if you have a lapse in your compulsory insurance obligations.

As mentioned in the previous section on minimum coverage requirements in Florida all car owners in the Sunshine State are also required to maintain minimum coverage of:

- $10,000 in Personal Injury Protection (PIP)

- AND $10,000 in Property Damage Liability (PDL)

Drivers must maintain this coverage for as long as they have a valid Florida license plate.

According to the Florida Highway Safety and Motor Vehicles, in order to obtain a license plate issued by the State of Florida you must present the following to your local licensing office in person:

- Proof of identity (required for all owners)

- Proof of Florida Insurance

- A completed Application for Certificate of Title With/Without Registration (HSMV form 82040)

The FLHSMV also asserts that:

A vehicle must have a valid registration to operate on Florida roads, and vehicle with out-of-state registrations are required by law to be registered within 10 days of the owner either becoming employed, placing children in public school, or establishing residency.

There is also an initial registration fee of $225 which must be paid at the time of registration.

You can renew your plate annually online after the initial registration.

You can also renew your vehicle registration through the MyFlorida mobile app.

Real ID

If you are a resident of the Sunshine state who wishes to travel abroad or enter federal facilities you must have a Real ID in order to do so.

Florida began issuing REAL ID-compliant driver’s licenses after January 1, 2010.

Floridians can tell if their state-issued id-card or drivers license is REAL ID-compliant by looking for the star in the upper right corner of their cards,

In order to be issued a REAL ID you will need to bring at least one of the primary documents listed below:

U.S. Citizens should bring with them:

- Valid, unexpired U.S. passport

- Original or Certified copy of a birth certificate

- Consular Report of Birth Abroad

- Certificate of Naturalization issued by DHS

- Certificate of Citizenship

If your current name is different from what appears on any of these you will also need to bring one of the following:

- Court-ordered name change document

- Marriage certificate, issued by the courts and/or

- Divorce decree, issued by the courts

For Non-Citizens the following should be brought with you:

- Valid, unexpired Permanent Resident Card – I-551 for Lawful Permanent Residents

- Valid Passport for non-immigrants except for asylum applicants and refugees

- Other government-issued document showing your full name

- Department of Homeland Security document showing proof of lawful presence

- If your name has changed by marriage/divorce, you must have your name changed on your Citizen and Immigration Services (CIS) documents.

Both Citizens and Non-Citizens will need to bring:

- Their Social Security Card or proof of your social security number.

- Two documents that show their principal residence

For in-depth information on the identity documents required to obtain your REAL ID, you can visit the FLHSMV website.

Penalties for Driving Without Insurance

Driving without car insurance in the Sunshine State has its consequences.

The first offense carries with it a penalty of the suspension of your license and registration until you have paid the reinstatement fee of $150.00 and proof that you have secured non-cancelable coverage is given.

Should you find yourself driving without insurance coverage for a second time the second offense carries with it the penalty of the suspension of your license and registration until the reinstatement fee of $250.00 is paid proof that you have secured non-cancelable coverage is given.

The best idea is just to pay the money for your car insurance coverage and prevent the financial consequences of driving without it.

Given that Florida has one of the highest rates of uninsured drivers it might be a good idea to consider carrying uninsured/underinsured motorists coverage on your own policy as well in order to protect yourself against other types of uninsured motorist financial losses.

Teen Driver Laws

In order to get their driver’s license Florida laws mandates that teenage drivers follow through with a multi-stage licensing process which is determined by their age and has pre-determined requirements.

Some of these pre-determined requirements are as follows:

- At age 15, Florida teenagers can apply for a learner’s license. In order to do so through the teenager has to have completed a Traffic Law and Substance Abuse Course. They must also have passed the written, vision, and hearing tests and they must have a signed parent consent form.

- When a driver turns 16, if they had their learner’s license for at least one year without any traffic violations and had completed 50 hours of practice driving, they could apply for the intermediate license. The issuance of this type of license is also contingent on the teenager being able to pass a behind-the-wheel driving test and completing a vision test, and providing proof of practice driving time. A legal guardian must also accompany the teenager to the DMV in order to sign the application form unless their signature has been notarized on the form prior to the teenager presenting it to the DMV officer. At the intermediate stage are also driving privileges are based on age.

- At age 18 a teenager becomes eligible for a full unrestricted license.

All first-time drivers in Florida are required to take a Traffic Law and Substance Abuse Course and a written exam to receive a learner’s license as well.

Just as with teenage drivers, the general population of Floridians on the road, and older operators of motor vehicles the procedures and requirements an procedures for new drivers in the state of Florida is slightly different. Read on to discover how.

Older Driver License Renewal Procedures

With age comes wisdom, but age also brings with it deteriorating eyesight and slower reflexes.

Because of the physical impairments that often accompany aging the State of Florida has specific driver’s license renewal procedures just this age group.

For instance, while mail-in or online renewal is permitted for residents over the age of 80 every other renewal cycle.

If you are an older driver there are a few things that you can do to stay safe behind the wheel according to the Mayo Clinic. Some of these include:

- Staying physically active

- Scheduling regular vision and hearing tests

- Driving only when road conditions are good

- Updating your driving skills by taking a refresher course

- And knowing your limitations

If someone you love is getting older and it is time to have a talk with them about handing in their keys you should have that conversation sooner rather than later.

Driving certainly does allow older residents of the Sunshine State to maintain their independence, but at a certain point the risks can far outweigh the benefits.

New Residents

Like older drivers, there are also special requirements for new residents to the Sunshine State when it comes to getting your Florida driver’s license.

One of the requirements is that you change over your out-of-state driver’s license as soon as you have established residency.

Even if you have a residence outside of the state of Florida you can be considered a new resident if you have done any of the following in the Sunshine State:

- Enrolled your children in public school

- Registered to vote in the state of Florida

- Filed for a homestead exemption

- Accepted employment within the state

- OR resided in Florida for more than six consecutive months

A motor vehicle is also required by law in the State of Florida to be registered within 30 days of the owner either becoming employed, placing children in public school, or establishing residency.

All those seeking to obtain a driver’s license in Florida are also required to show proof of valid car insurance from a company that is licensed to do business in the Sunshine State.

Additionally, proof of identity will be required of anyone seeking to procure a Florida state driver’s license.

License Renewal Procedures

If you do not fall into the teenage driver category and you are under 80 years old you are only required to take the vision test if you apply for a renewal of your license in person. For all Florida residents over the age of 80, a vision test is required for every renewal.

According to the Florida Highway and Safety Motor Vehicles department:

- Customers must renew their Florida driver license or ID card every eight years.

- And Florida driver license and ID cardholders may renew their credentials up to 18 months in advance of the expiration date

You can renew your license in person or online depending on your cycle and/or age.

Negligent Operator Treatment System

The State of Florida the Florida Department of Highway Saftey and Motor Vehicles has set forth a set amount of driver points in order to deal with traffic law infractions.

The following infractions all carry a weight of three points:

- Running a stop sign

- Failure to yield

- Curfew violations

- Driving with an open container

- Child seatbelt violation

- Driving on the shoulder

Four points can be added to your driving record for traffic tickets that are written because you have endangered the lives of others with your actions. Some of these things include:

- Passing a stopped school bus

- Speeding in excess of 15 MPH over the speed limit

- Or running a red light

For more serious infractions such as the following, six points are added to your record:

- Leaving the scene of an accident

- Speeding resulting in an accident

- A moving violation resulting in bodily harm

More points mean higher car insurance rates and could result in the suspension or revocation of your driver’s license. It is best to drive safe then and obey all applicable traffic laws when traveling on Florida roadways.

Rules of the Road

Every state has its own rules of the road and a good way to keep your car insurance costs down is to abide by them.

Knowing what these rules are and that you are following them at all times can really help you out when it comes time to shop for your car insurance policy as well.

Keep scrolling to find out more.

Fault Vs. No-Fault

You already know that Florida is a no-fault state. You also know that this determination is what dictates who is financially responsible after a car accident as follows:

- No-Fault coverage is meant to protect the insured by paying for their expenses in an accident.

- After No-Fault coverage benefits are exhausted the insured can then turn to MedPay

- When MedPay benefits have reached their limits, and if the insured is not at fault, the insured can then look towards the other party’s insurance to seek reimbursement.

- Uninsured Motorist can cover the rest is the other party’s benefits reach their limits, but only within the limits of the uninsured motorist policy limits.

There is a little more to living in a no-fault state though. Living in a no-fault state also means that it literally is every man for himself after an accident.

Living in a no-fault state means that if you have an accident you are responsible for paying for your own injuries and/or damages regardless of who was at fault.

What does it mean to be an at-fault state then? Well, unlike a no-fault state, in an at-fault state the person who was legally “at-fault” for the accident bears the liability for damages and injuries caused by the crash.

Whether you live in a no-fault state like Florida or an at-fault state like North Carolina, there are certain laws that cross all state lines. Seat belt laws are one of these, but the requirements for when and where a person in a motor vehicle must buckle up varies by state law.

Seatbelt and Car Seat Laws

The State of Florida has a mandatory seatbelt use law on the books.

This Florida safety belt law is also a primary enforcement law. This means that an officer can stop you and issue you a citation simply for your failure to observe safety belt and/or restraint laws.

Florida Law requires the use of safety belts for children as well.

Specifically, the law mandates that:

- Safety Belts are required to be used by drivers of motor vehicles, all front-seat passengers and all children riding in a vehicle under 18.

- Child Restraints – Car Seats and Booster Seats are required for use on children age 5 and under.

- Children ages 0 to 3 must be in child restraint devices of a separate carrier or a vehicle manufacturer’s integrated child seat.

- Children ages 4 and 5 must be in a separate carrier, an integrated child seat or a booster seat.

Florida Safety Belt Laws also require that the driver of a pick-up truck and his or her passengers under the age of 18 wear a seat belt. which means that riding in the bed is forbidden if you are under 18 years of age.

Keep Right and Move Over Laws

Florida also has Keep Right and Move Over laws just like many other states do.

According to Florida statute 316.081 Florida drivers must yield by moving right if blocking traffic is in the left lane.

Floridians must also move right to allow faster traffic to pass by them.

Florida also has a Move-Over law that requires drivers to slow their car down to at least 20 miles per hour below the posted speed limit so as to protect the lives of law enforcement or emergency personnel who are operating alongside the roadway.

Speed Limits

Like many other states, Florida also has speed limits which vary by location.

Generally speaking, these limits are as follows:

- Municipal Speed Areas……………..30 MPH

- Business or Residential Areas……30 MPH

- Rural Interstate Limited……………70 MPH

- Limited Access Highways………….70 MPH

- All other Riads and Highways….…55 MPH

- School Zones…………………………….20 MPH

Violation of these speeding restrictions can result in a traffic citation and between 3-4 driver points on your record depending on the situation.

Ridesharing

Anyone wishing to engage in driving for a rideshare company in the state of Florida should brush up on the car insurance requirements for this endeavor before taking on their first fare in the Sunshine State.

One of these requirements is that Rideshare drivers in Florida are required to carry the minimum amount of car insurance that all drivers in the Sunshine State must carry.

Florida also has an additional law that requires rideshare drivers to carry much more coverage.

Some of these additional coverage requirements include:

- At least $1 million in liability coverage for property damage, physical injury, and death.

- PIP insurance minimums that apply to all drivers.

- And even when an Uber or Lyft driver isn’t actively driving a passenger, they still must have $50,000 in physical injury or death liability coverage that applies anytime a driver has the app on to look for a customer.

Just like ridesharing has increased in popularity so too has the use of automation and crash avoidance devices. Read on to find out what this means to you.

Automation on the Road

The use of automation and crash avoidance devices technology is on the rise. This makes sense given the fact that they have been proven to can help reduce crashes.

What about full automation? Not too long ago, driverless cars seemed like a pipe dream. NOw they are being tested on America’s roads at an ever-increasing pace.

In an effort to stay at the forefront of this type of technology, Florida is currently working to expand the Self-Driving Car Law.

This means that driverless cars could be in the very near future for the Sunshine state.

If the law passes then more laws regulating its use are sure to follow; as are ones regarding the insurance required by the companies that operate them.

This could mean a boom for Florida’s economy, but it would also trigger massive shifts in car insurance laws as legislators struggle to determine who would be financially responsible for any damages or injuries that result from a collision with a driverless car.

Safety Laws

Florida has a number of safety laws on its books that are designed to keep residents of the Sunshine State safe while on the road.

Some of these include DUI laws and laws that regulate distracted driving. Partying and texting have their place, but not behind the wheel.

Scroll down to find out how the state of Florida deals with such bad decisions.

DUI Laws

There is a time and a place to celebrate, but behind the wheel is most definitely not it.

In fact, according to Responsibility.org Florida suffered 839 Alcohol-Impaired Driving fatalities in 2017 alone.

Statistics like this are why the penalties for driving while impaired are stiff in the Sunshine State.

Take a look at what it could cost you if you choose to take your party on the road.

- First Offense – up to six months in jail, $500-$2,000 fine/penalty, and between 180 days to a year of license suspension.

- Second Offense – up to nine months in jail, $1,00-$4,000 fine/penalty, and between 1-5 years of license suspension.

- Third Offense – 30 days to five years in jail, $2,000-$5,000 fine/penalty, and 2-10 years of license suspension.

It is just not worth the risk. As we say in Florida: Arrive Alive!

Marijuana-Impaired Laws

The penalties for driving under the influence of Marijuana are just as stiff as the ones for DUIs in Florida are.

In fact, penalties and fines for driving while under the influence of any drug in Florida are stiff. Take a look:

- First offense – a fine of $500 -$1,000, up to six months in jail, 180 days to one-year license suspension, 50 hours community service, and a 10-day vehicle impoundment/immobilization.

- Second offense –a fine of $1,000 -$2,000, up to nine months in jail, a mandatory ignition interlock,180 days to one-year license suspension, a mandatory one year of probation, a required psychosocial evaluation, 50 hours of community service, and a 10-day vehicle impoundment/immobilization.

- Third offense – a fine of $2,000 – $5,000, up to jail up to 12 months in jail, a mandatory ignition interlock; one-year license suspension, a mandatory year of probation; a required psychosocial evaluation, 50 hours community service, and a 90-day vehicle impoundment/immobilization.

- Third offense within 10 years of the second offense– this is a felony that carries with it a minimum fine of $2,000- $5,000, up to 30 days to five years in jail, a mandatory ignition interlock, a 10-year mandatory license suspension, a mandatory year of probation, a required psychosocial evaluation, 50 hours community service, and a 90-day vehicle impoundment/immobilization.

- Fourth offense-This is a 3rd-degree felony and penalties include up to $5,000 in fines, a five-year prison sentence, and the penalties imposed for the third offense.

Florida is not kidding around when it comes to keeping its citizens and visitors safe on its roadways so make sure that you choose not to get behind the wheel while under the influence of anything.

Distracted Driving Laws

As part of its initiative to keep its residents and visitors safe on Florida roadways, the Sunshine State has made distracted driving a primary offensive effective July 1, 2019.

This means that if you are suspected of doing any of the following things that are part of the ban on handheld devices then Florida law enforcement officers can pull you over.

Specifically, the ban includes things such as:

- When performing official duties as an operator of an authorized emergency vehicle as defined in s.322.01.

- If you are reporting an emergency or criminal or suspicious activity to law enforcement authorities.

- When you are receiving messages that are related to the operation or navigation of the motor vehicle or safety-related information

- When using the device or system for navigation purposes

- If you are conducting wireless interpersonal communications that do not require manual entry of multiple letters, numbers, or symbols

- When conducting wireless interpersonal communications that do not require reading text messages

- Or if you are operating an autonomous vehicle, as defined in s. 316.003

There is nothing that you need to do, say, or text when you are behind the wheel that is worth risking your life for. To stay safe always store electronics until you are safely parked.

Driving in Florida

As you can tell, driving in the Sunshine State doesn’t come without risk.

All of the risks to you and your car aren’t on the roadway either. Sometimes just parking your car in the wrong spot could end up costing you big time.